10 Stocks That Could Replace GE in the Dow

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

General Electric Company (GE, $17.88) is the sole survivor of the original 1896 Dow Jones Industrial Average, but some market watchers are wondering if its century-long membership is coming to a close.

The keepers of the Dow over at S&P Dow Jones Indices reveal little about what it takes to get into the exclusive 30-stock club. It’s important that “the company has an excellent reputation, demonstrates sustained growth and is of interest to a large number of investors,” S&P Dow Jones Indices says.

Sadly, General Electric is not what it once was. “It is no longer a good representative of U.S. businesses,” says David Kass, professor of finance at the University of Maryland's Robert H. Smith School of Business. “Its poor stock and earnings performance over the past 17 years are indicative of the decline of the industries it is has chosen to invest in.” Since the start of 2000, GE’s stock price has fallen 60%; the Dow has gained 124% since then.

Another strike against General Electric is its vow to sell $20 billion in assets, which should reduce GE’s market value further. Dow stocks typically have some of the largest values on the market. Its low nominal stock price is problematic, too; the blue-chip average is price-weighted, which means lower-priced stocks have less effect on the index than pricier ones. And although GE is of interest to a large number of investors, its reputation took a serious hit after announcing a dividend cut in November.

General Electric losing its position in the Dow is pure speculation, and it could just as easily stay put. Still, analyzing what companies could replace it reveals some bullish (and bearish) arguments for each stock. If S&P DJI calls, we’re happy to share these 10 ideas with them.

Data is as of Nov. 27, 2017. Analyst ratings are from Zacks Investment Research. Stocks are listed in alphabetical order. Click on symbol links in each slide for current share prices and more.

Comcast

- Market value: $179.1 billion

- Sector: Consumer discretionary

- Analysts’ opinion: 20 strong buy, 1 buy, 1 hold, 0 sell, 0 strong sell

With a market value of nearly $180 billion, Comcast Corp. (CMCSA, $38.43) certainly is big enough to justify a place in the Dow 30. If the sprawling telecommunications and media giant were added to the average, it would be larger than 14 other members, including titans such as Boeing (BA) and Goldman Sachs (GS).

Comcast surely holds a central place in a key sector of the economy, too. It’s the second-largest pay-TV provider in the U.S., the largest internet provider and a top telephone service supplier. Customers might be cutting their cable cords, but Comcast’s focus on internet and content – it owns NBCUniversal and DreamWorks Animation, to name just two of its properties – has it positioned for growth.

The one flaw here is reputation. Comcast scores low on customer satisfaction and twice was named “The Worst Company in America” by The Consumerist.

Danaher

- Market value: $65.3 billion

- Sector: Industrials

- Analysts’ opinion: 9 strong buy, 4 buy, 1 hold, 0 sell, 0 strong sell

- Danaher Corp. (DHR, $93.82) is the kind of meat-and-potatoes company you would expect to see in the Dow – at least back when it really was an “industrial” average. The company operates businesses devoted to everything from industrial technologies to dental radiography to scientific sensors.

If the Dow Jones wants to replace General Electric with something similar, this industrial conglomerate fits nicely.

The flip side of the argument is that the Dow has been moving away from industrials for some time. None of the newer entrants to the exclusive average have come from the industrial sector because other parts of the economy have gained in prominence. The last five additions have been Apple (AAPL), Goldman Sachs, Nike (NKE), Visa (V) and UnitedHealth Group (UNH).

- Market value: $508.8 billion

- Sector: Technology

- Analysts’ opinion: 23 strong buy, 3 buy, 0 hold, 0 sell, 0 strong sell

Before we look at Facebook Inc. (FB, $175.10), let’s dispense with fellow internet behemoths Amazon.com (AMZN) and Google parent Alphabet (GOOGL). As dominant and fast-growing as the e-commerce and search companies are, respectively, their shares prices of around $1,000 a pop make them untenable candidates for the Dow Jones Industrial Average. They would have outsized sway on the price-weighted index. The priciest Dow stock these days, Boeing, tops out at around $280. Unless Amazon and Alphabet split their shares, they’re out.

Facebook, however, carries a Dow-friendlier price of about $175 per share, so it has no problems there.

As the world’s dominant social-media company, it certainly represents an important part of the U.S. economy. It’s also growing at a fast pace and is (mostly) free of reputational black eyes.

But the big strike against Facebook is that it’s too young, having gone public just five years ago. Dow stocks typically must be leaders in their fields for much longer than that. Apple, for instance, wasn’t added until 2015 despite being a successful tech company for decades.

Honeywell

- Market value: $117.6 billion

- Sector: Industrials

- Analysts’ opinion: 11 strong buy, 2 buy, 1 hold, 0 sell, 0 strong sell

Like General Electric and Danaher, Honeywell International Inc. (HON, $154.40) is a massive industrial conglomerate with strong Dow credentials. Heck, from 1925 until 2008, it was a Dow stock.

A stagnant share price and decade of sluggish revenue growth prompted the stewards of the Dow to drop the stock from the index. But a lot has changed at Honeywell since then.

Analysts are optimistic about the company under new CEO Darius Adamczyk. Pockets of cash allow Honeywell to be both selective and aggressive in mergers and acquisitions. Deutsche Bank says Honeywell is heading toward faster growth, and its strong balance sheet could fuel billions of dollars in investments for future growth. A shrinking and less competitive General Electric helps matters, too.

If the Dow wants to keep its current balance of sectors, HON is a smooth replacement for GE.

Medtronic

- Market value: $109.7 billion

- Sector: Health care

- Analysts’ opinion: 9 strong buy, 2 buy, 8 hold, 0 sell, 0 strong sell

- Medtronic plc (MDT, $81.27) is one of the world’s largest players in the medical devices field. The company holds more than 4,600 patents, and produces everything from neurostimulators to defibrillators to bone grafts.

Medtronic has a stellar reputation that only gets better as its products are used more widely around the globe; at the moment, you can find Medtronic products in roughly 160 countries. It also has the size to qualify as a Dow stock, as well as longevity – the company has improved its dividend for a full four decades.

But the argument against Medtronic is the industrial average’s already heavy representation in health care. Johnson & Johnson (JNJ), Pfizer (PFE), Merck (MRK) and UnitedHealth already fill that role.

Nvidia

- Market value: $119.8 billion

- Sector: Technology

- Analysts’ opinion: 10 strong buy, 3 buy, 11 hold, 0 sell, 2 strong sell

Graphics chipmaker Nvidia Corp. (NVDA, $197.68) is on the cutting edge of the revolution in artificial intelligence and cloud-based computing. When a list of major customers reads like a who’s who of tech giants – Alphabet, Facebook, Microsoft (MSFT) and Amazon all rely on Nvidia hardware in their data centers – you can understand why the market is so high in the name. As a result, the stock has gained 530% in just the past two years.

Nvidia is hefty enough to be in the Dow, but it has been public since only 1999. That makes it older than Facebook, but it still would be the youngest stock in the average by far. Another knock against this less-than-venerable name that shares really only went ballistic in the past two years. The chipmaker still must prove that it can build on such momentum over the long haul and not be pushed off its industry perch.

Kraft Heinz

- Market value: $99.1 billion

- Sector: Consumer staples

- Analysts’ opinion: 8 strong buy, 1 buy, 4 hold, 0 sell, 0 strong sell

In another back-to-the-future idea for replacing General Electric in the Dow, why not have another go with the latest itineration of Kraft, now known as Kraft Heinz Co. (KHC, $81.21)?

It wouldn’t be the first time the blue-chip index contained some version of the Kraft company. Insurer American International Group (AIG) was dropped from the Dow during the financial crisis of 2008 and replaced by what was then Kraft Foods Inc. Three years later, Kraft split into the Mondelez (MDLZ) snacks business and a grocery business called Kraft Foods Group. That company, in turn, merged with Heinz in 2015 to form current international food giant Kraft Heinz.

Given its lineage, KHC certainly has the pedigree to be a Dow stock. And it has the imprimatur of Warren Buffett himself, whose Berkshire Hathaway (BRK.B) holds a 27% stake in the company.

On the other hand, with Coca-Cola (KO), McDonald’s (MCD) and Procter & Gamble (PG), the Dow has plenty of slow-growth consumer stocks.

Netflix

- Market value: $80.8 billion

- Sector: Consumer discretionary

- Analysts’ opinion: 19 strong buy, 2 buy, 12 hold, 0 sell, 1 strong sell

Let’s be honest. Netflix Inc. (NFLX, $186.82) – despite its size, growth prospects and central role in the streaming media revolution – probably won’t be tapped for the august industrial average anytime soon. The company is too young and its stock is too volatile to be clubbable as a Dow Jones stock.

You just don’t say “blue chip” and think Netflix.

Besides, Netflix is competing with a murder’s row of companies including Amazon, Alphabet, Apple and Walt Disney (DIS), the last two of which are Dow stocks already.

But for all the checks against it, Netflix remains a juggernaut, setting the industry’s pace on a global scale. If the DJIA editors wanted to swing for the fences in swapping out an old-economy company for a 21st century digital media powerhouse, they could do worse than adding Netflix to the average.

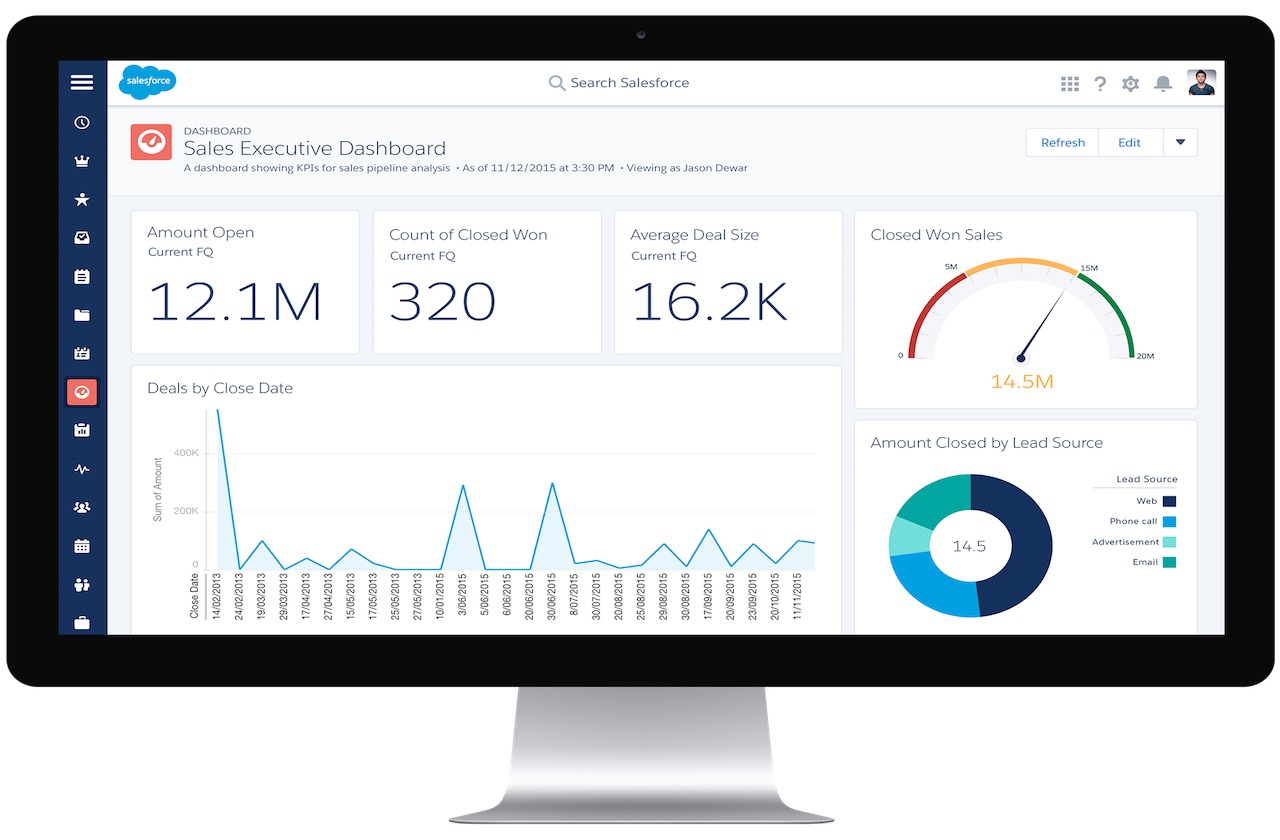

Salesforce.com

- Market value: $75.0 billion

- Sector: Technology

- Analysts’ opinion: 30 strong buy, 1 buy, 3 hold, 0 sell, 0 strong sell

Before Amazon, Microsoft and Alphabet jumped on the cloud-based computing bandwagon, there was Salesforce.com Inc. (CRM, $103.83). The company has become a subscription-software juggernaut worth nearly $75 billion thanks to its customer relationship products.

Analysts expect earnings growth to average 25% a year for the next five years, according to data from Thomson Reuters. Revenue is forecast to increase 25% this year and 20% next year. So the growth is there.

However, Microsoft, International Business Machines (IBM) and Intel (INTC) already give the DJIA exposure to cloud-based computing. It’s not clear whether Salesforce brings anything new to the blue-chip average.

Texas Instruments

- Market value: $95.8 billion

- Sector: Technology

- Analysts’ opinion: 10 strong buy, 1 buy, 14 hold, 0 sell, 0 strong sell

Chips don’t get much bluer than Texas Instruments Inc. (TXN, $97.18). The venerable chipmaker traces its lineage back to the 1930s and has been operating under its current name since 1951. The pedigree is there, as is the size and shareholder interest.

So is growth. Texas Instruments isn’t exactly Nvidia, but it remains one of the top 10 semiconductor manufacturers worldwide based on sales volume and generates solid earnings growth. Analysts polled by Thomson Reuters expect earnings to rise at an average annual clip of 11% a year for the next five years.

On the other hand, with a market value of less than $100 billion, TXN would be one of the smaller Dow stocks. It’s also safe to say that semiconductor companies are adequately reflected in the Dow already thanks to Intel.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Markets Are Quiet Ahead of Fed Day: Stock Market Today

Markets Are Quiet Ahead of Fed Day: Stock Market TodayInvestors, traders and speculators appear to be on hold amid an unusually fraught Fed meeting.

-

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)State Taxes Living in one of these places could lower your 2025 investment taxes — especially if you invest in real estate.

-

DexCom, GE, SLB: Why Experts Rate These Stocks at Strong Buy

DexCom, GE, SLB: Why Experts Rate These Stocks at Strong BuyWall Street gives these three diverse names Strong Buy recommendations with high potential upside.

-

The Best Aerospace and Defense ETFs to Buy

The Best Aerospace and Defense ETFs to BuyThe best aerospace and defense ETFs can help investors capitalize on higher defense spending or hedge against the potential of a large-scale conflict.

-

AI vs the Stock Market: How Did Alphabet, Nike and Industrial Stocks Perform in June?

AI vs the Stock Market: How Did Alphabet, Nike and Industrial Stocks Perform in June?AI is a new tool to help investors analyze data, but can it beat the stock market? Here's how a chatbot's stock picks fared in June.

-

Stock Market Today: Stocks Rise on Less Deadly Concerns

Stock Market Today: Stocks Rise on Less Deadly ConcernsMarkets are forward-looking mechanisms, and it's good when price action shows there's a future to look forward to.

-

Stock Market Today: Stocks Soar on China Trade Talk Hopes

Stock Market Today: Stocks Soar on China Trade Talk HopesTreasury Secretary Bessent said current U.S.-China trade relations are unsustainable and signaled hopes for negotiations.

-

Is GE Aerospace Stock Still a Buy After Earnings?

Is GE Aerospace Stock Still a Buy After Earnings?GE Aerospace stock is higher Thursday after the industrial firm topped analysts' fourth-quarter expectations and issued a strong full-year outlook. Here's what you need to know.