10 Stocks That Refuse to Die

Mr.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Mr. Market often takes investors for a wild ride that instills them with fear and drives them away from stocks. But giving in to your market-phobia means missing out on big wins and losing out to future inflation.

Instead, add a more-reliable brand of stock to your portfolio. Here are ten low-volatility stocks that will deliver consistent returns over the long haul without all the drama. They all have betas of less than 1, which suggests that their moves are less than the market's (beta is a measure of volatility compared with a particular market, in this case the U.S. stock market, as measured by Standard & Poor’s 500-stock index).

On top of having low volatility, the companies tend to pay generous dividends and increase them regularly. They usually boast pristine balance sheets, with loads of cash and little debt. Plus they are industry leaders and have been around for a long time, so you’ll no doubt find their products and services familiar. Take a look:

ExxonMobil (XOM)

Year company was founded: 1882 (ExxonMobil merger was in 1999)

52-week high: $86.42

52-week low: $66.80

Consecutive years of dividend increases: 13

Yield: 2.8%

Beta: 0.50

ExxonMobil may have ceded its claim as the world’s most valuable company to Apple (AAPL), but the energy giant has something Apple doesn’t: a corporate history spanning more than a century and a reputation for safety befitting a stock with a market value of $400 billion. Plus, it is one of just four companies with a perfect, AAA credit rating from Standard & Poor’s.

Exxon is not without some challenges. The company has cut back its refining business, for example, as demand for oil in developed countries shrinks. Another hurdle is a huge stake in North American natural gas production at a time when a glut has pushed gas prices to ten-year lows. And opportunities for energy production growth overall are limited.

But the company’s functional and geographical diversity, along with deep pockets and extensive expertise, give it unparalleled muscle to compete globally. Analysts at International Strategy & Investment call the company’s balance sheet a “fortress,” strengthened with $13 billion in cash. Exxon has a long policy of returning cash to investors via share buybacks and dividends, and analysts speculate that Exxon is poised to boost the dividend significantly.

General Mills (GIS)

Year company was founded: 1856 (as Minneapolis Milling Company)

52-week high: $40.73

52-week low: $34.15

Consecutive years of dividend increases: 29

Yield: 3.2%

Beta: 0.18

The brands of consumer food giant General Mills are strong enough to withstand competitive pressures from cheaper generic brands. Is there really any substitute for Cheerios? Other brands include Lucky Charms, Progresso soups, Green Giant vegetables and Betty Crocker baking mixes. A weak economy and high commodity prices are challenges. A slightly muted outlook for the fiscal year that ends May 2013 in part reflects increased spending to shore up the company’s recently acquired Yoplait yogurt division, a laggard in the trendy Greek yogurt category. But General Mills is cutting costs elsewhere and using its formidable cash position to expand in faster-growing emerging markets and to finance dividends, share buybacks and acquisitions -- most recently a Brazilian food maker that is expected to more than double the company’s annual sales in Latin America, to nearly $1 billion.

International Business Machines (IBM)

Year company was founded: 1911 (as Computing-Tabulating Recording Company)

52-week high: $208.63

52-week low: $155.65

Consecutive years of dividend increases: 17

Yield: 1.8%

Beta: 0.66

Big Blue has been around for a century and knows how to weather economic storms. The company offers a wide range of computer hardware, software and services, making it a one-stop shop for many corporate information-technology departments. Cloud computing could challenge IBM’s high-end hardware business. But the company continues to innovate. It spent $6.3 billion on research last year and won more U.S. patents (6,180) than any other company.

Johnson & Johnson (JNJ)

Year company was founded: 1886

52-week high: $65.48

52-week low: $58.04

Consecutive years of dividend increases: 45

Yield: 3.7%

Beta: 0.53

A slew of recent product recalls at Johnson & Johnson has given investors headaches lately. But it’s probably nothing that a couple of Tylenol tablets and a dividend check can’t cure. Both the medical-devices unit and the consumer segment are well on the road to recovery, says Cowen and Co. analyst Ian Sanderson.

The prognosis for the company’s pharmaceuticals franchise is strong, with promising drugs coming to treat cancer, schizophrenia and hepatitis C. Sanderson sees J&J’s sales and earnings growth reaccelerating in 2013.

J&J’s financial condition is the picture of health, with $32 billion of cash in the till and easy access to debt (it’s one of those four companies with a triple-A credit rating) to pursue opportunistic acquisitions, buy back shares or raise the dividend. The distribution rate has climbed by one third over the past four years.

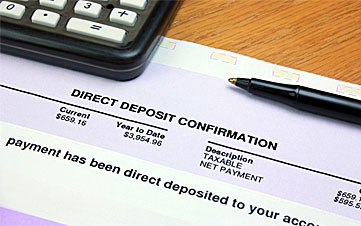

Automatic Data Processing (ADP)

Year company was founded: 1949

52-week high: $56.07

52-week low: $43.48

Consecutive years of dividend increases: 36

Yield: 2.9%

Beta: 0.70

ADP is a bet on an improving economy and a rosier employment picture. The world’s largest provider of outsourced payroll services, it's another of the four triple-A-rated companies left standing.The annual dividend has grown from $1.16 per share in 2008 to a rate of $1.58 this year.

A recessionary relapse would be bad news for ADP. But employment numbers in the U.S. are trending up. And untapped markets among small and midsize businesses, as well as overseas, provide plenty of running room for ADP.

Coca-Cola Co. (KO)

Year company was founded: 1886

52-week high: $76.94

52-week low: $62.19

Consecutive years of dividend increases: 23

Yield: 2.7%

Beta: 0.52

You can order a Coke almost anywhere. Coca-Cola Co. delivers its soft drinks, which also include Sprite, Fanta, Tab and Fresca, to thirsty consumers in some 200 countries. (Other brands include Minute Maid orange juice, Powerade energy drink and Dasani bottled water.) And the company is investing billions of dollars more in overseas markets (which account for 70% of sales), especially in China, Russia, Brazil and other big emerging markets.

Coke battled higher commodity prices last year but recently announced a plan to shave annual costs by $550 million to $650 million by the end of 2015. Analysts, on average, expect Coke to generate annualized earnings growth of nearly 8% over the next three to five years. Some, such as analyst Caroline Levy, at Credit Agricole Securities, think Coke can achieve a double-digit earnings growth rate over the long haul. The stock, at 18 times estimated earnings, isn’t cheap. But the bulls say that because of Coke’s steadiness, it deserves an even higher price-earnings ratio.

McDonald's (MCD)

Year company was founded: 1940

52-week high: $100.25

52-week low: $79.76

Consecutive years of dividend increases: 36

Yield: 3.2%

Beta: 0.42

The golden arches continue to rise in emerging markets. But McDonald’s continues to gain market share even in the developed world, where restaurant demand is muted. The world’s number-one chain in total sales, McDonald’s enjoys huge economies of scale and wields significant bargaining clout with suppliers. According to Morningstar, McDonald’s restaurants, on average, generate about $2.7 million per year, easily trumping the fast-food industry average of just over $1 million per location. Nobody does fast food better.

Since 2007, McDonald’s has returned more than $27 billion to shareholders via share buybacks and dividends, funded by strong profits and refranchising activity (the latter involves selling corporate-owned stores to franchisees). The stock has served up tasty gains over the past ten years, returning 14.7% annualized, an average of nearly ten percentage points per year ahead of the S&P 500.

Philip Morris International (PM)

Year company was founded: 1847 (went public in 1881)

52-week high: $89.50

52-week low: $60.06

Consecutive years of dividend increases: 4

Yield: 3.7%

Beta: 0.87

You’ll find the shares of Philip Morris International tempting if you have no concerns about investing in tobacco. Consider this telling prediction, from Morningstar: By 2020, there will be 1.4 billion smokers globally, up from 1.3 billion today, even if the percentage of the population that smokes declines 1% annually. Not counting China and the U.S., the market share of Marlboro, PMI’s best-selling brand, rose to 9% last year. And Parliament, a luxury brand with a high profit margin, saw sales volume increase 12%. Midprice L&M has been gaining market share in the European Union since 2009 and is the second-largest brand there.

Unfortunately for smokers, cigarette price hikes are a frequent fact of life. But that pricing power helps PMI offset pockets of declining sales in Europe. And it contributes to the large profits that fund an aggressive stock-repurchase program and regular dividend increases, including a 20% boost in the payout rate last year.

Procter & Gamble (PG)

Year company was founded: 1837

52-week high: $67.33

52-week low: $57.09

Consecutive years of dividend increases: 10

Yield: 3.8%

Beta: 0.45

Check your pantry or laundry room and you'll probably find this company's products lining the shelves. P&G has more brands generating at least $1 billion in annual sales -- including Tide, Duracell and Charmin -- than any other household-goods maker.

P&G hasn’t been immune to consumer belt-tightening in the U.S. and Europe and slower growth in emerging markets. As with many multinationals, currency swings have cut into revenues. The company recently warned that sales and profits for the fiscal year that ends in June 2013 would be less than previously expected. But P&G has responded with some belt-tightening of its own. The company is engineering a $10 billion, five-year cost-savings program aimed at plumping profit margins. And executives have vowed to focus on core markets and businesses, as well as on dreaming up the next game-changing product you don’t yet know you need.

Disappointing short-term projections have pushed the stock to bargain levels, say long-term bulls. If P&G’s plan works, shareholders could come out winners as earnings growth re-accelerates. Meanwhile, investors are paid to wait for progress with a generous dividend on a stock that is less than half as volatile as the overall market.

Wal-Mart Stores (WMT)

Year company was founded: 1962

52-week high: $68.58

52-week low: $47.47

Consecutive years of dividend increases: 15

Yield: 2.3%

Beta: 0.31

Behold the largest retailer in the world, posting annual sales of more than $400 billion. Every week, more than 100 million people walk into a Wal-Mart store. Its stock seems to have shaken off worries about any long-term effects of an investigation into the company’s Mexico operations. Look for Wal-Mart Express stores to penetrate urban and smaller rural markets, while the company’s Internet division readies itself to take on Amazon.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Anne Kates Smith brings Wall Street to Main Street, with decades of experience covering investments and personal finance for real people trying to navigate fast-changing markets, preserve financial security or plan for the future. She oversees the magazine's investing coverage, authors Kiplinger’s biannual stock-market outlooks and writes the "Your Mind and Your Money" column, a take on behavioral finance and how investors can get out of their own way. Smith began her journalism career as a writer and columnist for USA Today. Prior to joining Kiplinger, she was a senior editor at U.S. News & World Report and a contributing columnist for TheStreet. Smith is a graduate of St. John's College in Annapolis, Md., the third-oldest college in America.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

Bond Basics: How to Reduce the Risks

Bond Basics: How to Reduce the Risksinvesting Bonds have risks you won't find in other types of investments. Find out how to spot risky bonds and how to avoid them.

-

Bond Ratings and What They Mean

Bond Ratings and What They Meaninvesting Bond ratings measure the creditworthiness of your bond issuer. Understanding bond ratings can help you limit your risk and maximize your yield.

-

Stock Market Today: Stocks Struggle on Credit Suisse, First Republic Bank Concerns

Stock Market Today: Stocks Struggle on Credit Suisse, First Republic Bank ConcernsChaos in the financial sector stole the spotlight from this morning's inflation and retail sales updates.

-

5 Stocks to Sell or Avoid Now

5 Stocks to Sell or Avoid Nowstocks to sell In a difficult market like this, weak positions can get even weaker. Wall Street analysts believe these five stocks should be near the front of your sell list.

-

Stock Market Today: Stocks Gain Ahead of Fed Meeting

Stock Market Today: Stocks Gain Ahead of Fed MeetingExxon Mobil (XOM) and General Motors (GM) both popped after reporting solid earnings.

-

Q4 GDP Beats Expectations: What the Experts Say

Q4 GDP Beats Expectations: What the Experts SayGDP The latest GDP report shows that the economy avoided recession last year, but market pros say we might not be so lucky in 2023.

-

Best Stocks for Rising Interest Rates

Best Stocks for Rising Interest Ratesstocks The Federal Reserve has been aggressive in its rate hiking, and there's a chance it's not done yet. Here are eight of the best stocks for rising interest rates.