10 Stocks to Buy on Any Trade War Dip

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

How do you know in advance which stocks to watch for potential buyable declines sparked by fears about a China trade war?

For one, look for the ones that have a lot of sales in China. Several tech companies fit the bill. And given China’s fascination with American brands, big U.S. consumer-products companies pop up on the short list, too. The second option is to go with companies in industries singled out by China as targets.

If you are of the belief that tariff bluster between China and America is mostly just that – bluster – then the following are 10 stocks to buy on any dips sparked by trade war headlines.

Even without the added plus of a favorable entry price, these companies look attractive as long-term plays on rapid growth in China because they do such a large portion of their business there. They also benefit from synchronized global growth, popular consumer trends and big-picture themes like greater use of cloud computing by businesses.

Data is as of April 5, 2018. Data on China sales exposure comes from FactSet and company filings. Click on ticker-symbol links in each slide for current share prices and more. Michael Brush is the editor of the stock newsletter Brush Up on Stocks.

Micron Technology

- Market value: $57.2 billion

Chipmaker Micron Technology (MU, $49.84) generates more than half its sales in China. So when the trade warriors bluster, MU stock gets understandably weak. But that weakness is a good time to buy because the underlying trends at Micron look solid. The company just posted 58% year-over-year sales growth for its most recent quarter, and it expects continued solid demand ahead.

Like many chip companies, Micron is a play on robust demand for semiconductors for use in the cloud – or remote server farms for hire by companies. They increasingly use the cloud to store data and run software, because this brings down costs. Micron also supplies chips for smartphones and tablets, where growth is strong.

Behind the scenes, Micron also is converting to new chip production processes that will bring down costs.

Advanced Micro Devices

- Market value: $9.4 billion

Chipmaker Advanced Micro Devices’ (AMD, $10.02) – which gets about 33% of its sales in China – also will weaken on any saber rattling about a trade war. And similarly, that kind of weakness might be the time to pick up shares of AMD.

The brokerage Stifel just upped its rating on Advanced Micro Devices to “Buy,” in part because valuations look cheap – even without a China trade war scare pullback. Stifel thinks sellers are overreacting to the potential impact of a slowdown in demand for cryptocurrency mining hardware using AMD chips, as competing hardware rolls out and crypto mania fades. Crypto, in fact, is not a significant part of Advanced Micro’s business.

Meanwhile, the company should benefit from a ramp up this year in sales of its Epyc processors for servers. IDC projects global cloud-related hardware demand to increase 13.7% in 2018, and continue with solid growth for the next three years. AMD also should benefit from continued popularity of its relatively new Ryzen processors used in smartphones, tablets and PCs. The second generation (Ryzen 2) is expected to debut in April.

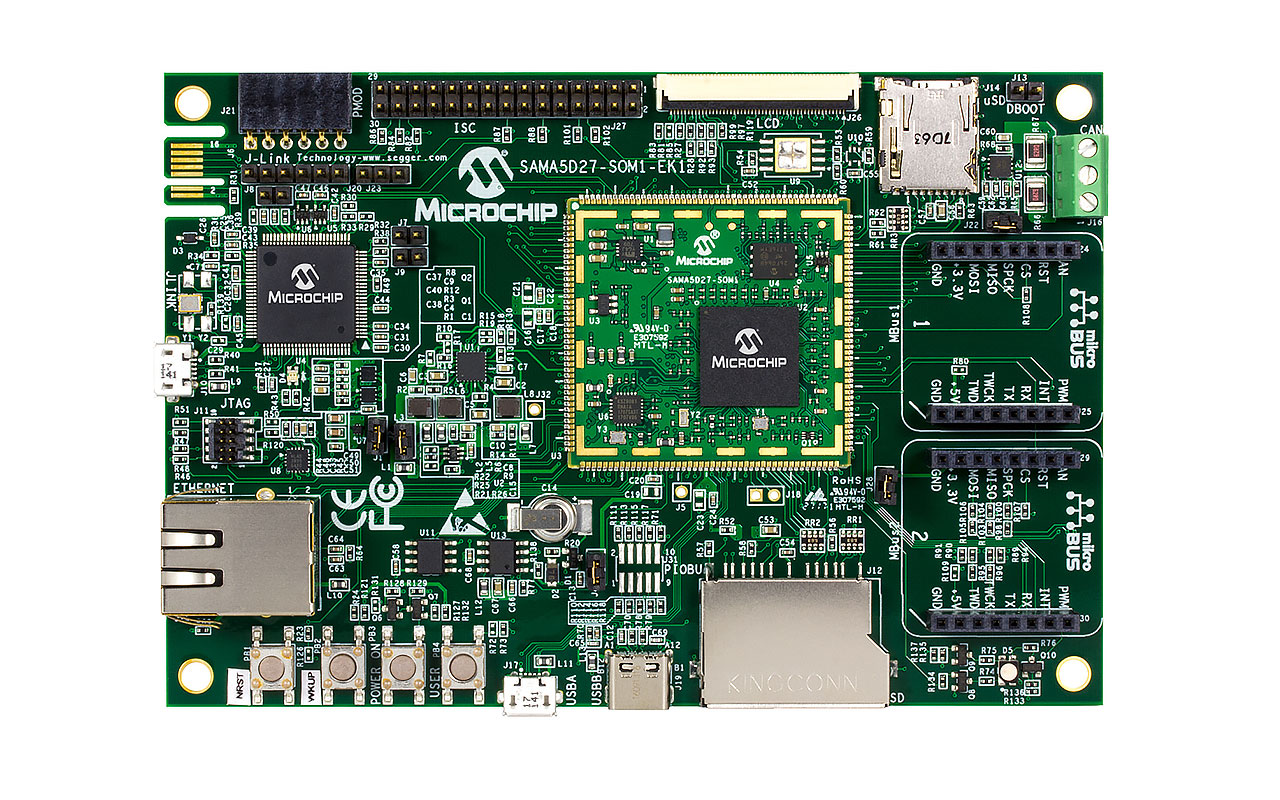

Microchip Technology

- Market value: $20.5 billion

- Microchip Technology (MCHP, $87.64) gets 32% of its revenue from China, so its stock will get caught in trade war crossfire too. But the long-term trends here look good, so again, you may want to buy on any weakness.

Microchip Technology sells microcontrollers (MCUs), or chips used in embedded controls in lots of consumer products from thermostats to garage doors. This makes Microchip Technology a “connected home” play.

Its chips make up a small percentage of the overall cost of the products they are used in. So its customers are reluctant to take on the headache of switching to a new supplier to save a few pennies. This gives Microchip Technology a protective moat around its business, and it helps explain the high profit margins here, Morningstar analyst Brian Colello says.

Qorvo

- Market value: $9.0 billion

- Qorvo (QRVO, $71.41) sells radio frequency (RF) chips used to manage and amplify wireless signals inside smartphones. This line of business accounts for 75% of sales, and its chips are used in lots of smartphones made by Chinese producers, so Qorvo gets 62% of its sales in China. This sets the company up as a direct hit in any further China trade war turmoil.

But smartphone demand should continue to be strong, and Qorvo recently scored a design win at Apple (AAPL) that will help with sales. Smartphones based on the 4G LTE standard use many more RF chips, and use of 4G LTE continues to spread globally.

Qorvo chips are also used by defense contractors, so it should benefit from the ramp-up in U.S. defense spending. The company has projected 20% year-over-year near-term sales growth in its defense and infrastructure business.

One risk here is that almost 40% of sales are linked to Apple products, so Qorvo shareholders would suffer if the smartphone giant switched suppliers.

Starbucks

- Market value: $82.6 billion

When investors such as Warren Buffett say they like “economic moats” around their companies, a top quality on their checklist is brand power. Starbucks (SBUX, $59.14) has that in spades. While the running joke about this coffee chain – there are so many stores they have to open new ones inside existing shops – suggests growth has tapped out, there’s actually plenty of room to expand.

China, where Starbucks is popular, offers fertile ground for growth. This potential, plus the fact that Starbucks already gets 20% of revenue there, explain why the shares of the ubiquitous coffee chain could stumble on any new China trade war noise.

Starbucks may be a good buy on any such weakness. Besides China potential, the chain has plenty of room to grow in India and Japan. At home, it’s expanding into packaged products sold in grocery stores. It’s rolling out premium stores like Roastery and Starbucks Reserve. It’s expanding its menu. And Starbucks is exploiting its powerful brand in partnerships with Keurig Green Mountain, JPMorgan Chase (JPM), Visa (V), Spotify (SPOT) and Lyft, among others.

Even though it might seem like there is “a Starbucks on every corner,” don’t count this coffee chain out.

Nike

- Market value: $110.8 billion

Just like Starbucks, Nike’s (NKE, $69.59) powerful brand plants a solid protective moat around its business. Since Nike is one of the best-known sports brands around the globe, it’s no surprise that the company’s athletic shoes, apparel and sports equipment are a big hit with Chinese consumers; Nike generates 12% of its revenue there. Robust international growth – thanks in part to Chinese demand – is one of the key drivers at Nike. All of this means a rerun of China trade war fears may have Nike investors trimming positions.

But any share weakness they create might present a good time to buy. Nike’s powerful brand gives it lots of stamina in a highly competitive market. The company keeps consumers coming back with innovative products. Meanwhile, Nike is wisely side stepping the brick-and-mortal retail Armageddon by ramping up its own direct sales to consumers at its website.

Behind the scenes, Nike’s heft gives it lots of clout with suppliers. This keeps costs down. Moreover, founder Phil Knight remains on the board, which can be a plus for investors; several studies, including one by several Purdue Krannert School of Management professors, show that founder-run companies often outperform.

Boeing

- Market value: $192.6 billion

China’s list of U.S. products to slap tariffs on includes commercial jets made by Boeing (BA, $336.40).

On the surface, this looks bad for the aircraft maker. China demand growth was supposed to account for about 20% of Boeing’s annual deliveries over the next two decades, according to Morningstar analyst Chris Higgins. Boeing gets about 13% of its sales from China.

Look closer, though, and you see that Chinese tariffs might not cause that much damage. So far, China is targeting smaller aircraft – mainly older variations of the 737 which are nearing the end of production. Boeing’s newer 737 MAX planes wouldn’t get hit. Wide-body planes like the 787 and 777 are excluded too, Higgins says. “The tariff seems symbolic and likely a negotiating tactic,” he says.

Two trends may explain this. Chinese people who have money love to travel. And the middle class is growing rapidly. This means China has to expand airline capacity significantly. That makes it tougher for China to crack down on Boeing – though it could shift orders to Airbus (EADSY).

Besides commercial aircraft, Boeing supplies aircraft, missiles and other gear to the military, so it should be a big winner in Trump’s planned escalation in military spending. Higgins projects 6% overall average annual sales growth for Boeing over the next five years.

General Motors

- Market value: $53.1 billion

- General Motors (GM, $38.00) sold 9.6 million vehicles last year. About 42% of them changed hands in China. The company has a 14.3% market share there, it says in filings. Chinese sales growth is robust, recently clocking in at about 8% year-over-year, so any Chinese trade war noise may send investors running for the exits.

However, General Motors has a long-standing presence in China and deep relationships there with customers and distributors. So it will be tough for China to turn its back on this U.S. car giant.

Back home, General Motors continues to roll out cars with decent quality that consumers actually like – such as the Chevrolet Malibu. Labor union concessions on retirement health care have brought down costs. GM, which owns a stake in Lyft, also is a play on the future of autonomous taxis.

Caterpillar

- Market value: $85.6 billion

Given all of the construction that happens in a high-growth economy like China’s, it’s no surprise that building-equipment company Caterpillar (CAT, $148.13) does a lot of business there.

Caterpillar doesn’t actually break out China sales. However, 21% of its $45.5 billion 2017 revenue came from the “Asia Pacific,” according to its annual report. And we know that a lot of that was from China, since almost a third of Caterpillar’s workforce is there. Moreover, Asia Pacific sales advanced 23% last year, and the company says half of that growth happened in China. It expects even faster China growth this year.

In short, access to China is key for Caterpillar investors. So its stock is vulnerable to anything that makes a trade war more likely.

Caterpillar is such a key player in its industry – it’s the largest construction and mining equipment maker in the world, controlling almost a fifth of the overall market – it’ll be tough for China to turn its back on the company. Outside of China, Caterpillar’s sheer size makes it a good play on synchronized global growth. More than half of sales come from the energy and transport sectors, making it a play on the ongoing rise in oil prices, too.

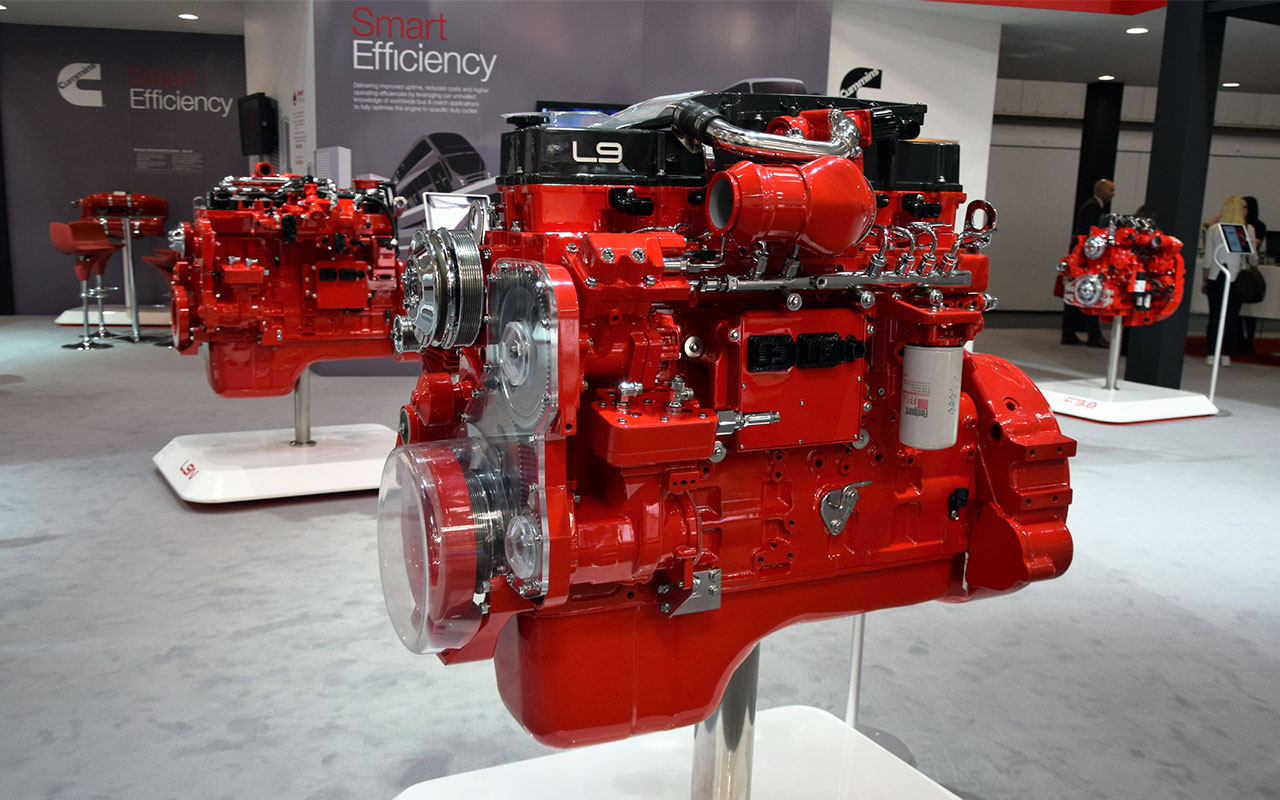

Cummins

- Market value: $26.2 billion

- Cummins (CMI, $162.42) is a major global producer of engines and parts used in heavy duty trucks and mining and construction equipment. This means it does a lot of business in China, where construction is booming. Cummings gets about 10.5% of sales from China. Its biggest manufacturing joint ventures in the world are in China – with partners like Beiqi Foton Motor, Dongfeng Automotive, and Chongqing Machinery and Electric.

This means Cummins could get hurt if any China trade tension boils over into outright trade wars. Investors are aware of this, so they grow cautious on Cummins and sell shares when tariff and trade-war headlines bubble up.

But like Caterpillar, Cummins sells key products that China needs to keep its economy growing at a rapid pace. So unless China’s economic policy officials want to shoot themselves in the foot, they’re not likely to shut down Cummins’ presence in the country – especially considering the company’s reputation for quality. Besides construction, Cummins sells engines used in defense and mining. That means it should benefit from rising defense spending in the U.S. and rising commodity prices.

Michael Brush had no positions in any stocks mentioned in this column as of this writing. Brush has suggested AMD, CAT, GM, MU, NKE, SBUX and WDC in his stock newsletter Brush Up on Stocks. Brush is a Manhattan-based financial writer who has covered business for the New York Times and The Economist group, and he attended Columbia Business School in the Knight-Bagehot program.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

5 Stocks to Sell or Avoid Now

5 Stocks to Sell or Avoid Nowstocks to sell In a difficult market like this, weak positions can get even weaker. Wall Street analysts believe these five stocks should be near the front of your sell list.

-

Best Stocks for Rising Interest Rates

Best Stocks for Rising Interest Ratesstocks The Federal Reserve has been aggressive in its rate hiking, and there's a chance it's not done yet. Here are eight of the best stocks for rising interest rates.

-

The Five Safest Vanguard Funds to Own in a Volatile Market

The Five Safest Vanguard Funds to Own in a Volatile Marketrecession The safest Vanguard funds can help prepare investors for market tumult but without high fees.

-

The 5 Best Inflation-Proof Stocks

The 5 Best Inflation-Proof Stocksstocks Higher prices have been a major headache for investors, but these best inflation-proof stocks could help ease the impact.

-

5 of the Best Preferred Stock ETFs for High and Stable Dividends

5 of the Best Preferred Stock ETFs for High and Stable DividendsETFs The best preferred stock ETFs allow you to reduce your risk by investing in baskets of preferred stocks.

-

What Happens When the Retirement Honeymoon Phase Is Over?

What Happens When the Retirement Honeymoon Phase Is Over?In the early days, all is fun and exciting, but after a while, it may seem to some like they’ve lost as much as they’ve gained. What then?

-

5 Top-Rated Housing Stocks With Long-Term Growth Potential

5 Top-Rated Housing Stocks With Long-Term Growth Potentialstocks Housing stocks have struggled as a red-hot market cools, but these Buy-rated picks could be worth a closer look.