10 Top Stocks That Show Gender Diversity Counts

Data shows that if you want to generate alpha and outperform the major indexes, some of the top stocks to buy are companies that practice gender diversity.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Data shows that if you want to generate alpha and outperform the major indexes, some of the top stocks to buy are companies that practice gender diversity.

Catalyst, the global nonprofit dedicated to building workplaces for women that work, has done exhaustive research into why diversity and inclusion matter. Among its findings:

- Companies pay something of a self-imposed penalty for lack of diversity. That is, those companies that poorly practice gender and ethnic/cultural diversity were 29% less likely to experience profitability above the industry average.

- A study of U.S. companies in the MSCI World Index between 2011 and 2016 found that “companies beginning with at least three women on their boards produced median gains of 10% ROE and 37% Earnings Per Share” over the five-year period. Companies with fewer women on their boards delivered less growth in these two important metrics.

- A 2016 study by Intel and Dalberg Global Development Advisors found that tech companies that practiced diversity had higher revenues, profits, and market value than those that didn’t. According to the study, diversity was worth $320 billion-$390 billion in increased market value by closing the gender gap in leadership.

In short, investing in gender-diverse stocks isn’t just a moral stance – it’s financially rewarding. For investors looking for ways to get in, here are 10 top stocks that show gender diversity counts.

Data is as of Aug. 11. Five-year average annual total returns from Morningstar data. Companies listed in alphabetical order.

American Water Works

- Market value: $21.8 billion

- 5-year average annual total return: 21.8% (vs. 10.8% for the S&P 500)

- Percentage of women on board: 60%

- American Water Works (AWK, $120.55) not only has more women than men on its board of directors, but its CEO (Susan Story) and CFO (Susan Hardwick) are women too, making this utility company a shining practitioner of gender diversity.

Since taking the top job in May 2014, Story has delivered an impressive cumulative total return of 295%, versus just 72% for Standard & Poor’s 500-stock index. But how on earth has she been able to accomplish such market-smashing returns in the utility sector, which is known for steady dividends, not breakneck growth?

For one, she has focused on developing a corporate culture that’s better than the competition.

“I think that one of the biggest changes that we’ve made is that we’re trying to let our frontline employees dictate how we do our business, because they’re the ones interacting with our customers every day,” Story told Chief Executive magazine in November 2018.

“So when you look at permeating that culture through very different workforces, we have folks on the frontline,” she said. “And the one thing we all share is the commitment to the customer to provide safe water that’s healthy. Our employees live in these communities. These are their neighbors, and they feel that.”

As CEO, Story feels a sincere commitment to developing all 7,100 employees scattered around the country, and treating them with respect and dignity. The formula has proven very rewarding for employees, shareholders and American Water Works customers.

Ecolab

- Market value: $59.3 billion

- 5-year average annual total return: 14.4%

- Percentage of women on board: 38%

In September 2018, Ecolab (ECL, $205.97) was named to Forbes magazine’s inaugural list of the Best Employers for Women. To make the list, companies had to rank highly on diversity, parental leave and pay equality.

Douglas Baker – CEO of the world leader in water, hygiene and energy technologies – had a simple explanation of why the company is so focused on diversity.

“To deliver exceptional value to our customers, we need the world’s best talent. And half of that talent is female. That’s why we strive to create an inclusive environment where everyone can thrive,” Baker stated in a press release acknowledging the recognition.

Baker believes that diversity and inclusion are about doing the right thing, but there’s also a business case to be made for the practice.

“I hold my team responsible for their business results, and that includes how well they are managing the company’s talent resources. If we want to grow, we need strong, diverse talent pipelines. This begins with our leadership team and the decisions we make today,” Baker wrote in a June 2018 article in the Huffington Post.

Baker has been CEO of Ecolab since 2004. Back then, women accounted for just 8% of the board of directors. Today, it’s up to 38% and rising. Over the past 15 years, Ecolab’s stock has generated an annualized total return of more than 14%, significantly higher than the S&P 500’s 9% annualized total return.

Hershey

- Market value: $32.6 billion

- 5-year average annual total return: 13.2%

- Percentage of women on board: 42%

- Hershey (HSY, $155.48), one of the most iconic brands in America, is run by a woman.

CEO Michele Buck has worked at the chocolate company in Hershey, Pennsylvania, for more than 12 years. Across several promotions, the consumer goods veteran ascended from the global chief marketing officer in 2007 to chief executive in roughly a decade.

Not wanting to rest on her laurels, Buck is determined to move Hershey from its chocolate and candy core, to become a “snacking powerhouse.”

“Our largest focus for M&A is snacking and really on filling out the places that we don’t currently meet demand,” Buck told Food Dive at the February Consumer Analyst Group of New York conference in Florida. “We’re not there yet, but we’re on our journey. And I don’t think I would ever declare that we’re there.”

Since taking the top job, Buck has made two acquisitions in the snack category. Hershey paid $1.6 billion for Amplify Snack Brands, the people behind SkinnyPop; and $420 million to acquire Pirate Brands, a maker of healthier versions of cheese puffs and cheese sticks. At the time of the Amplify acquisition, SkinnyPop was thought to have almost 25% market share in the popcorn category in the U.S., as well as a significant presence in the U.K.

In 2019, Hershey expects to grow its adjusted earnings by at least 5% year-over-year to $5.63 per share.

Progressive

- Market value: $47.1 billion

- 5-year average annual total return: 29.6%

- Percentage of women on board: 50%

Fortune named Progressive (PGR, $80.60) CEO Tricia Griffith one of 2019’s World’s Greatest Leaders – putting her alongside the likes of Bill and Melinda Gates, Satya Nadella, José Andrés and Michael J. Fox.

That’s quite a list. And Griffith’s quite a CEO, which is why Fortune also named her the 2018 Businessperson of the Year.

Since taking the top job in 2016 – Griffith has worked at the country’s third-largest insurance company since joining Progressive as an entry-level claims representative 31 years ago – she has grown the company’s revenues by 36%. That’s a big reason why PGR has been among the top stocks in insurance, delivering an annualized total return of more than 35.7% over the past three years.

Griffith combines a natural interest in people with an eye to the future. Progressive, a big believer in artificial intelligence, launched Snapshot in 2017. This usage-based insurance program charges premiums based on a customer’s driving habits. Since launching the app, it has been able to gather more than 1.5 billion miles of driving data, which helps it stay ahead of the competition by offering lower premiums to safer drivers.

As for the people side of the business, Griffith enjoys meeting with employees in the company cafeteria.

“My favorite part, usually on Fridays, (is when I) walk down here and I grab a lunch, and I randomly sit with people I’ve never met,” Griffith told Cleveland TV station WKYC in February.

How many CEOs of multibillion-dollar companies regularly chow down with their employees? Likely not many.

S&P Global

- Market value: $63.1 billion

- 5-year average annual total return: 27.5%

- Percentage of women on board: 33%

Just squeaking into the list with four women out of a total board of 12, S&P Global (SPGI, $256.19) is an excellent investment despite the fact it can do better when it comes to gender diversity.

That said, Monique Leroux’s addition to the board in 2016 was a brilliant move. Leroux was the CEO of Desjardins Group, a Quebec-based financial cooperative, from 2008 to 2016. In those nine years as the chief executive, Leroux took the co-op from a broken financial services company to become Canada’s sixth-largest deposit-taking institution by revenue in the country.

Many boards have men and women well past their prime. Not so with Leroux – a very good thing if you own SPGI shares.

As for the company itself, S&P Dow Jones Indices, the company’s indexes unit, has been busy launching a global family of environmental, social and governance (ESG) indices. For example, the S&P 500 ESG Index replicates both the risk and reward found in the S&P 500 while adding ESG criteria to the mix.

Companies excluded from the new index include tobacco producers, makers of certain weapons, and companies that score poorly on the United Nations Global Compact’s universal principles of corporate sustainability.

SPGI has rocketed ahead by more than 50% through May 2, and it has generated a 10-year annualized total return of 24.7%.

Starbucks

- Market value: $115.3 billion

- 5-year average annual total return: 26.1%

- Percentage of women on board: 40%

It has been 19 months since Starbucks (SBUX, $96.30) elevated Rosalind Brewer to chief operating officer.

Brewer joined the company’s board in January 2017 after meeting former CEO and executive chairman Howard Schultz at a Walmart (WMT) panel discussion a couple of months earlier. At the time, Brewer was running Sam’s Club, the retailer’s warehouse club division, and wasn’t looking for another board seat. But Schultz persuaded her to accept his invitation. A month later, she resigned from her job at Sam’s Club to search for her next leadership adventure.

Current CEO Kevin Johnson took the helm at Starbucks in April 2017, providing him an opportunity to get to know Brewer at board meetings and other functions. By October 2017, Brewer was in the COO role, making her the company’s second-highest ranking officer. Since that time, SBUX stock is up nearly 75%, thanks in large part to its Chinese expansion.

Starbucks’ board also features the CEO of another company on this list of top stocks for gender diversity. (We’ll get to her in a minute.)

Synchrony Financial

- Market value: $23.4 billion

- 5-year average annual total return: 10.3%

- Percentage of women on board: 36%

Synchrony Financial (SYF, $35.26) doesn’t have an uber-high ratio of women to men on the board, but it’s at least more than a third – and a woman helms the company, too. CEO Margaret Keane has been chief executive since its initial public offering in July 2014 – part of a multiyear split from General Electric (GE) that was finalized in November 2015.

Before becoming CEO, Keane spent 18 years at GE Captial, where she held several senior positions for over a decade before getting the call to run the consumer finance business.

Synchrony shares have been a rollercoaster ride. It went public at $23 per share, then hit both $25 and $35 on four separate occasions. SYF has had a phenomenal run in 2019, up 50% before even including dividends, though that comes on the heels of a 37% decline in 2018.

Gender diversity has yet to hit U.S. banks and other financial stocks, with just three female CEOs amongst the 100 largest banks in the country; Keane is one of them. Ever since she took the top role, though, she has worked diligently to improve the company culture, making it a more diverse and welcoming financial institution.

“I can’t change the world,” Keane told the attendees of the 2018 Ellevate Action Summit. “But what I can change is how we treat employees inside the company; understanding what they’re going through when they walk outside of their house and come to our office.”

Synchrony’s CEO started her career in a finance call center, so she appreciates that its employees, who work the phones and are paid hourly, need a path to future development. To accomplish this, Synchrony’s created STEP: a two-year development program that gives call center employees training in other parts of its business.

Unlike the rest of the top stocks on this list, SYF shareholders have yet to be truly rewarded for Keane’s big-picture thinking. But Synchrony’s strong financials suggest that won’t be the case for much longer.

TJX Cos.

- Market value: $64.2 billion

- 5-year average annual total return: 15.2%

- Percentage of women on board: 45%

- TJX Cos. (TJX, $52.96) publicly lists a couple of stats that show it’s serious about board diversity: Five of its 11 board members are women, and seven of its 11 board members reflect gender or ethnic/racial diversity.

Executive Chairman Carol Meyrowitz was the multi-banner discount retailer’s chief executive for nine years from January 2007 to January 2016. In that time, TJX stock appreciated by 360%, or 19.5% annually. Since CEO Ernie Herrman entered the top job in January 2016, it still has done well, but averaged less, up 14.9% on an annualized basis.

While retail stores have blown hot and cold over the past decade, TJX has managed to keep the ball rolling up the hill by delivering top-name merchandise at discount prices. Brick-and-mortar store closings continue to be a problem in the retail industry, yet TJX keeps opening stores and growing its sales. TJX reported revenues of $39 billion in fiscal 2018, including same-store sales growth of 6% – three times its comps growth in 2017. Its adjusted earnings per share of $2.11 were 9% higher than the year-ago figure.

TJX also is a big generator of free cash flow, which it has used to repurchase $22.1 billion worth of stock over the past 20 years. The retailer has reduced its share count by more than a quarter over the past decade alone, enriching shareholders along the way.

Ulta Beauty

- Market value: $20.3 billion

- 5-year average annual total return: 29.6%

- Percentage of women on board: 56%

If there’s a business you would expect to have gender diversity figured out, it would have to be Ulta Beauty (ULTA, $346.70), the experiential beauty retailer that’s part cosmetics store and part hair salon.

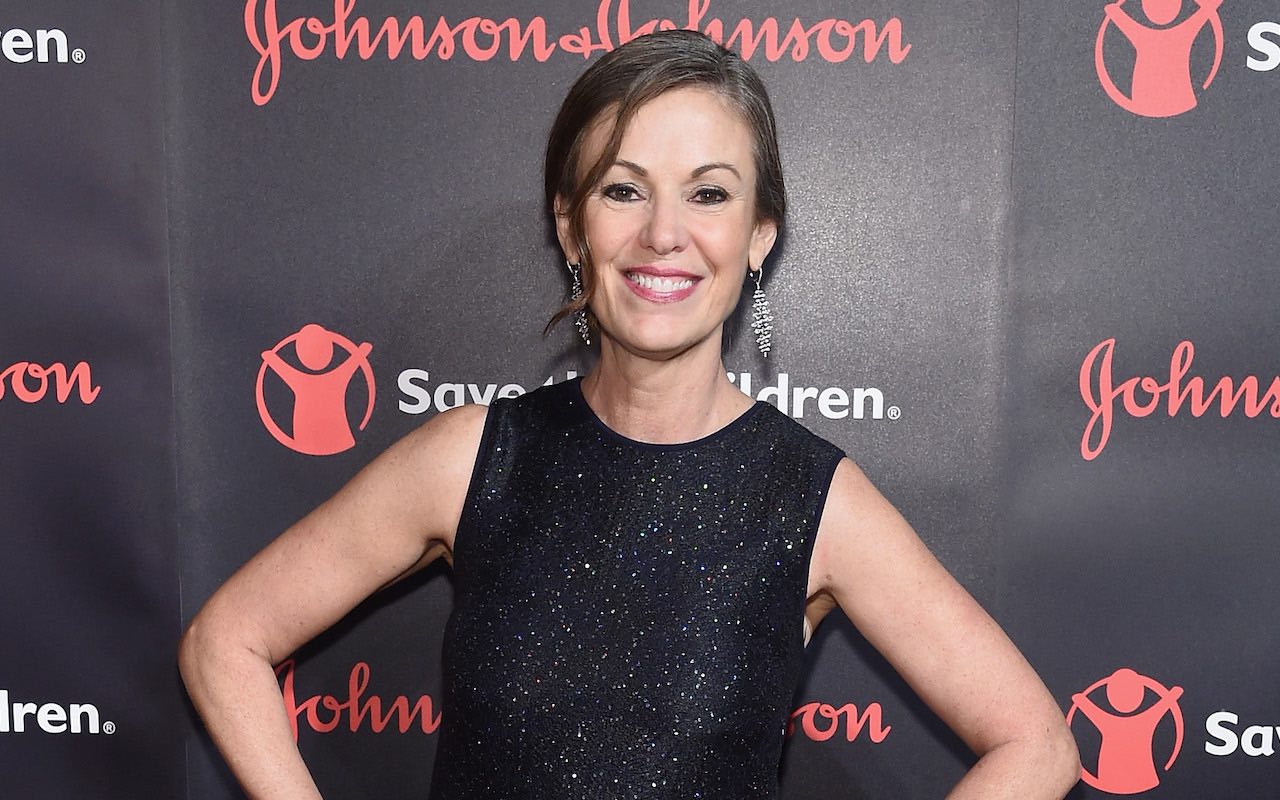

CEO Mary Dillon is one of the best chiefs in recent U.S. corporate history. She has assembled a board of directors and management team that reflects a diverse group of employees and customers – more than 50% of the board and top management is made up of women – and she has richly rewarded shareholders.

Fighting tooth and nail with Sephora, part of the massive LVMH (LVMUY) organization, Dillon has been able to carve out a significant piece of beauty retail in America. Soon, Ulta will be replicating its omnichannel success in Canada, opening stores from coast to coast starting in late 2020 or early 2021.

“Ulta has some significant advantages – it is an energetic, aggressive competitor with a lot to offer customers,” Pamela Danziger, president of retail consultancy Unity Marketing, told The Globe and Mail in April. “It creates an energy in the store which is what malls need desperately today to survive.”

Since Mary Dillon became CEO in June 2013, Ulta’s stock has gained 262% on a cumulative basis, or 23.1% compounded annually. She also has helped lift Starbucks since being appointed to its board in January 2016.

Who says gender diversity doesn’t pay?

Walt Disney

- Market value: $249.5 billion

- 5-year average annual total return: 11.1%

- Percentage of women on board: 44%

It has been a hectic year for Walt Disney (DIS, $138.52) CEO Bob Iger, who closed on his $71 billion acquisition of numerous 21st Century Fox assets in March and is launching a streaming competitor to Netflix (NFLX) and Amazon.com’s (AMZN) Prime service later this year.

Luckily, the four women serving on Disney’s board are all working CEOs or high-ranking executives. That gives Iger some excellent talent to lean on for feedback and advice for the myriad decisions he must make as the head of the world’s most iconic entertainment brand.

Later in 2019, Disney will launch Disney+: a streaming service that many are calling a Netflix killer. Priced at $6.99 – less than half the premium rate Netflix charges monthly – Disney+ is looking to steal Reed Hastings’ thunder.

“Disney+ has every possibility to get as big as Netflix,” CFRA Research analyst Tuna Amobi told BNN Bloomberg in April. “Reaching tens of millions of subscribers would be quite feasible, maybe even conservative. I would be surprised if the service does not reach 100 million subscribers over time.”

While Disney likely will gain millions of subscribers with its streaming service, many of those subscribers also will continue to use Netflix. That’s because 36% of U.S. households with broadband subscribe to two or more streaming services.

However, Disney can market its various products and services (including Disney+) across all of its multiple businesses – theme parks, cruise ships, retail stores, broadcast television, cable TV, ESPN – which should keep it among America’s top stocks overall in the years ahead.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Will has written professionally for investment and finance publications in both the U.S. and Canada since 2004. A native of Toronto, Canada, his sole objective is to help people become better and more informed investors. Fascinated by how companies make money, he's a keen student of business history. Married and now living in Halifax, Nova Scotia, he's also got an interest in equity and debt crowdfunding.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.