12 Large-Cap Stocks With Must-Watch Earnings Reports

The third-quarter earnings season is upon us.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The third-quarter earnings season is upon us. Alcoa (AA), which used to be the unofficial harbinger of the season, will post its Q3 results on Oct. 17 … but a handful of big-name large-cap stocks will have dropped their earnings reports before that.

Earnings reports are highly scrutinized, not just because investors are looking for information about how well individual companies are doing, but because the reports paint a picture for how well corporations as a whole are doing.

This season, investors are particularly on edge because many think the red-hot pace of profit growth seen over the past few quarters will be all but impossible to sustain.

Here’s a closer look at 12 large-cap stocks that are about to present what may be the 12 most important earnings reports to watch during the Q3 season. This news may well set the tone for the overall market, and make or break the usual year-end bullishness.

Data is as of Oct. 8, 2018. Earnings calendar data provided by MarketWatch and company data. Stocks listed in chronological order of report date.

Wells Fargo

- Market value: $257.4 billion

- Earnings Report Date: Oct. 12, before market open

Give credit to Wells Fargo (WFC, $53.67): The mega-bank is growing its bottom line again, and should rekindle top line growth next year. Both bumped into a headwind following the 2016 realization that bank employees had opened more than 2 million unauthorized bank accounts and credit card accounts, setting off a firestorm of regulatory and public relations nightmares.

Still, even two years out, consumers don’t appear to have fully forgiven or forgotten. Wells Fargo has fallen short of each of its past four quarterly earnings estimates, and the bar is set uncomfortably high headed into its third-quarter report. Analysts are calling for per-share earnings of $1.17, which actually would set a new record for the bank.

A reminder: Wells Fargo’s Q2 interest income was up, as would be expected in an environment where interest rates are rising. Non-interest income and fee-based income, however, fell year-over-year as consumers and companies continued to steer clear of the tainted company. Costs also increased as Wells continued to spend heavily not just on attracting new customers, but attracting and retaining personnel. It remains to be seen whether the bank can keep those and other costs tamped down according to plan.

Bank of America

- Market value: $299.2 billion

- Earnings Report Date: Oct. 15, before market open

Rising interest rates are a double-edged sword. On the one hand, they make lending a more profitable function for banks. On the other hand, they can discourage would-be borrowers from taking out loans in the first place.

It’s not entirely clear where the fine line is right now for the country’s banking industry. But Bank of America (BAC, $30.27) may give us a good idea of how far is too far when it reports Q3 numbers after the Oct. 15 bell.

BofA also is a good proxy of how most other banks are faring right now. But it’s not just lending revenue and net interest income that should be scrutinized. Bank of America also operates trading and capital-markets arms that may serve as a barometer for other financial stocks.

Analysts are collectively calling for earnings of 62 cents per share on $22.8 billion in revenue for the quarter ending in September. In the year-ago quarter, BofA generated 48 cents per share in profits on $22.1 billion in sales. Just note that in Q2 of this year, revenues were down slightly, and while earnings were up, that primarily was because of newly lowered tax rates.

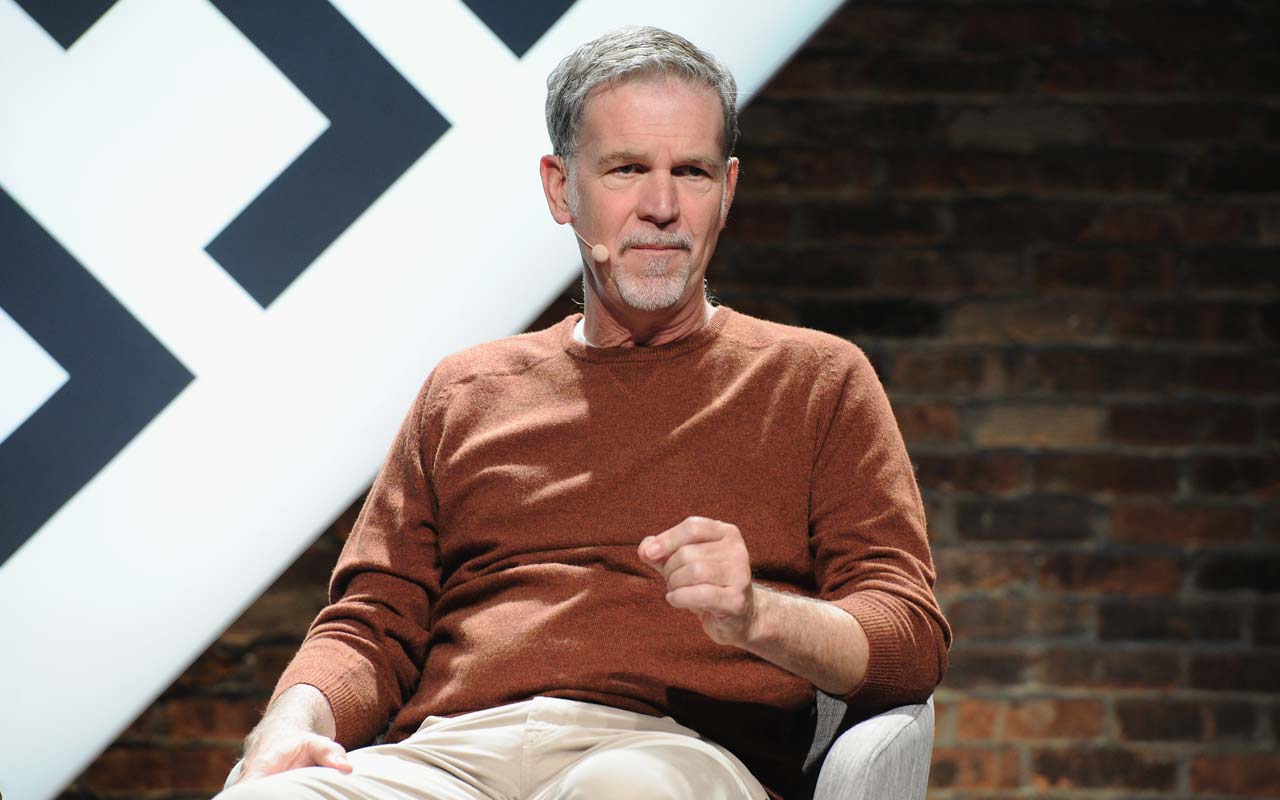

Netflix

- Market value: $154.2 billion

- Earnings Report Date: Oct. 16, after market close

- Netflix (NFLX, $349.10) is the leading name in streaming video, shaping and defining the industry as we know it. But it hasn’t been an especially profitable venture.

Buying or creating enough different video content to maintain an over-the-top television platform can be a very expensive undertaking. Even with a big chunk of this year’s $13 billion content budget already being deployed at the time, Netflix’s second-quarter net subscriber growth of 5.1 million fell more than a million people short of estimates.

Maybe it was just bad luck. Or perhaps it’s a clue that the streaming market is maturing and rivals are starting to figure out how to compete. The company’s second-quarter letter to shareholders explained, “HBO and Disney are evolving to focus on internet entertainment services. Amazon and Apple are investing in content as part of larger ecosystem subscriptions.” It added, “We anticipate more competition from the combined AT&T/Warner Media, from the combined Fox/Disney or Fox/Comcast as well as from international players.”

If improving competition is indeed taking shape, Q2’s subscriber-growth shortfall may well be the new norm. That’s a potential problem because Netflix has yet to reach enough scale to produce the kinds of profits that a company of its size should generate.

The Oct. 16 earnings release will reveal a great deal about Netflix’s true status and likely future.

Advanced Micro Devices

- Market value: $22.9 billion

- Earnings Report Date: Oct. 23, after market close*

Kudos to Advanced Micro Devices (AMD, $26.46) for digging its way out of trouble. Just a few years ago, many investors concluded that AMD would remain a distant second (maybe even third) in the GPU and CPU races.

Those doubters were wrong. AMD has turned heads again, leveraging its new Ryzen processors and new Vega technologies for its GPU business. Its second-quarter profit was its biggest in seven years, with the company turning $1.76 billion in revenues (+53% YoY) into income of $116 million.

But the turn for the better raised the bar quite a bit for future reports. AMD must reliably continue to grow the top and bottom lines just to justify its $26.8 billion market cap. It’s not clear Advanced Micro Devices can do it, and there’s certainly little room for error.

MKM Partners analyst Ruben Roy voiced this concern just a few days ago. He writes, “We’d agree with AMD bulls that it’s done a much better job of executing on its product road map but executing on products and gaining market share are different things.” He adds, “With valuations reflecting the best possible scenario, we think there could be better opportunities coming up if there are hiccups.”

Analysts are collectively calling for 12 cents of per-share profits, up 20% from the year-ago figure, on a 3.7% bump in revenues to $1.7 billion.

* Estimated time of day.

Caterpillar

- Market value: $88.8 billion

- Earnings Report Date: Oct. 23, before market open

The tariff war chatter has been circulating for months, but most of the tariffs have only been in place for a few weeks. Ergo, the political standoff wasn’t an issue for Caterpillar (CAT, $153.35) during its quarter that ended in June. Its third quarter ending in September, however, may be a different story.

Indeed, Caterpillar is a barometer of the impact of import tariffs for the entire industrial sector in many ways – though not necessarily all ways.

The company also cautioned in July that tariffs would reduce profits between $100 million and $200 million during the second half of 2018. That’s the bad news. The good news is, Caterpillar believes it can offset that added cost by raising prices and lowering its operating costs. So far, analysts agree. They expect Q3 revenues of $13.2 billion and per-share profits of $2.83, up from respective year-ago figures of $11.4 billion and $1.95, respectively.

That’s a risky game, however. Asia/Pacific customers, which buy about one-fifth of Caterpillar’s wares, are already suffering the intended fallout of a trade war. They may either be unwilling or unable to absorb the costs Caterpillar says it will be able to pass along.

Boeing

- Market value: $219.6 billion

- Earnings Report Date: Oct. 24, before market open

- Boeing (BA, $385.77) shares have impressively climbed a wall of worry.

Between geopolitical tensions, new tariffs, competition from Airbus (EADSY) and an apparent saturation of the air travel market, Boeing was fighting an uphill battle. But BA shares just hit record highs and are up a whopping 170% over the past couple years, in step with rekindled revenue and earnings growth that few believed would materialize so well, and so soon.

What gives? First and foremost, demand for air travel may ebb and flow, but in a bigger-picture sense it’s not slowing down. The company anticipates that as infrastructure is built and costs continue to fall, global demand for air travel will grow at an annualized pace of 4.7% over the course of the next 20 years. Second, Boeing makes the fuel-efficient and appropriately sized aircraft that airlines want. The 737 offers the perfect mix of capacity and performance for most carriers.

But aircraft buyers can be a fickle bunch. While they all see a bright future for air travel, cancelled orders aren’t uncommon, even if only in response to short-term headwinds. Boeing had a great run over the past several quarters, but now we must see whether it can maintain altitude. The Oct. 24 report will shed some light on the matter.

Intel

- Market value: $216.4 billion

- Earnings Report Date: Oct. 25, after market close

While 2018 has been a fruitful year for Advanced Micro Devices (AMD) shareholders, it largely has been at the expense of Intel (INTC, $47.03) investors. To a certain degree, that makes sense. AMD has spent the last several years regrouping and designing some amazing and affordable computer processors, and Intel looks like it was caught unaware. Worse, Intel’s production pace allegedly is not keeping up with demand.

The preferred narrative can be deceptive, though. Investors love stories about companies that rise and fall, but all too often those rises and falls are exaggerated for the purpose of drawing a crowd.

Morningstar analyst Abhinav Davuluri isn’t taking the bait – yet. He noted in late September, “We concede AMD is likely to capture some market share at the lower end of the performance spectrum in the PC market over subsequent quarters and server space in 2019. However, we continue to foresee Intel dominating the high end of these markets.” He continued, “As Intel ramps up its 10-nm process throughout 2019, we don’t foresee material share loss as implied by the current share prices of AMD and Intel.”

Intel’s actual status with corporate and consumer customers will become much clearer on Oct. 25. Analysts expect $18.1 billion in sales and $1.15 per share in profits.

- Market value: $460.13

- Earnings Report Date: Oct. 30, after market close

- Facebook (FB, $157.25) shares plummeted 19% on July 15 in response to an alarmingly disappointing outlook that was dished out along with its Q2 results. That selling – made even more painful by the fact that FB shares were marching deep into record-high territory as of the day before – has been followed by even more exit orders.

The concern voiced by the company at the time wasn’t obscured or complicated. CFO David Wehner bluntly said, “We expect revenue growth rates to continue to decelerate in the second half,” adding “in addition, we’re continuing to focus our product development around putting privacy first, and that’s going to, we believe, have some impact on revenue growth.”

It’s ultimately the fallout from the Cambridge Analytica scandal that materialized last year, though a recent data-breach disclosure has added to Facebook’s woes. But the king of social networking may have been ready to run into a user-growth anyway. Facebook is more than 10 years old and has 2.2 billion regular users; most would-be members likely have signed up by now.

Facebook’s third-quarter numbers should clarify whether Wehner was sandbagging figure reports, or if he was legitimately sending a word of warning that shareholder expectations were too high. Like last time, though, the guidance and commentary may mean more than the numbers themselves.

Apple

- Market value: $1.1 trillion

- Earnings Report Date: Nov. 1, after market close

The world’s biggest and most profitable company probably is on every investor’s radar already. But even if Apple (AAPL, $223.77) weren’t at the top of the proverbial food chain, it still would be worth watching.

Of particular interest this time around will be a look at how well its flagship product, the iPhone, sold during the three-month stretch.

Smartphone saturation is a real thing, but the relatively recent unveilings of the iPhone 8 and the iPhone X have been met just as robustly as prior versions of the popular device have. Sales aren’t really growing, but they’re not shrinking either despite more and better competition. Its fiscal Q4 report slated for Thursday, Nov. 1, will speak volumes about how marketable its primary consumer technology still is.

Broadcom (AVGO) CEO Hock Tan recently implied, based on the number of components Apple ordered to manufacture iPhones, that the company’s fourth-quarter sales of iPhones would be roughly in line with the 46.7 million iPhones shipped in the same quarter a year earlier.

There’s more to Apple’s upcoming earnings report than iPhone sales, though. All eyes also will be on its Services revenue. That unit saw a 31% year-over-year improvement in sales for the company’s fiscal third quarter ending in June, validating the company’s bigger-picture plan to put more focus on sales of media and digital goods.

Tesla

- Market value: $44.8 billion

- Earnings Report Date: Nov. 7, after market close*

To say Tesla (TSLA, $250.56) needs to serve up impressive numbers when it posts third-quarter earnings on Nov. 7 would be a considerable understatement. It may well be a now-or-never event for the company and Elon Musk in particular, who alluded to profitability a quarter earlier by saying, “Our goal is to be profitable and cash-flow positive for every quarter going forward.”

The irony: He gave the profitability pep-talk immediately after the electric vehicle manufacturer reported its biggest-ever quarterly loss. Tesla was $717 million in the red for Q2.

The dynamic has left many investors understandably confused. The company’s production issues seem to be easing up, with Tesla meeting production goals for Q3 – but now delivery logistics have gotten in the way. Meanwhile, they also know Musk has a penchant for bold talk and exaggeration. Exacerbating investors’ tensions is sheer uncertainty as to whether Musk will even be around a year from now, or even a month from now. The SEC just sued him, alleging he falsely told investors he had funding lined up to take the company private; Musk lost his post as chairman as part of a settlement.

Already seen by some as a liability, one more misstep like an ill-advised comment during the conference call could drive an even bigger management shakeup.

* Expected date and time of day

Macy’s

- Market value: $10.3 billion

- Earnings Report Date: Nov. 8, before market open*

The so-called retail apocalypse has destroyed more than a few retailers, and it has come close to ending Macy’s (M, $33.18) as we know it. The iconic company has managed to hold on, though, working to emerge stronger, leaner and wiser. Macy’s finally experienced revenue growth a couple quarters ago, and profits have improved in each of the past five quarters.

Analysts expect more such progress (albeit erratic) for the foreseeable future, and are looking for Q3 income of 14 cents per share on $5.4 billion in sales.

This – one year removed from relatively low expectations when most everyone feared the worst – is where it gets hard. If Macy’s wants to move forward, it has to play offense now, not just defense.

To that end, the Nov. 8 earnings report may be less about Macy’s third quarter and more about its plausible future. CEO Jeff Gennette conceded last month that the “recipe for success is healthy stores, a robust e-commerce business, and a powerful mobile app. Our customer wants a great experience anytime and anywhere she shops with us.” The question is, can Gannette and his management team convince investors he has a viable growth plan that will successfully address those areas?

Even more than that, Macy’s earnings report may serve as a proxy for how other department stores are performing.

* Expected date and time of day.

Walmart

- Market value: $283.3 billion

- Earnings Report Date: Nov. 15, before market open*

- Walmart (WMT, $94.69) stood back for years and let rival Amazon.com (AMZN) grow into the dominant name it has become. It paid the price, too. But the world’s biggest retailer finally put its foot down a few years ago and pieced together a real turnaround.

Evidence of that turnaround materialized in the latter part of 2016, when year-over-year sales growth not only was positive, but once again accelerated. Income still is dwindling, but there’s light at the end of the tunnel. Walmart’s online sales are particularly encouraging: They were up 40% in Q2, marking the fifth straight quarter of strong double-digit e-commerce growth.

Turning sales around is relatively easy, though. It’s much tougher to maintain sales growth, and it’s tougher still to grow the bottom and top lines at the same time in a highly competitive environment like the one we’re in now. Investors have been patient thus far, but that patience may be wearing thin.

The recently completed quarter may be the turning point. Analysts are looking for revenue growth of 1.6%, but profits are finally expected to improve from $1 per share a year ago to $1.03 per share this time around.

Walmart’s report also may offer another glimpse at the impact of relatively new tariffs on consumers.

* Expected date and time of day.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Look Out for These Gold Bar Scams as Prices Surge

Look Out for These Gold Bar Scams as Prices SurgeFraudsters impersonating government agents are convincing victims to convert savings into gold — and handing it over in courier scams costing Americans millions.

-

How to Turn Your 401(k) Into A Real Estate Empire

How to Turn Your 401(k) Into A Real Estate EmpireTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

My First $1 Million: Retired Nuclear Plant Supervisor, 68

My First $1 Million: Retired Nuclear Plant Supervisor, 68Ever wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

Stocks See First Back-to-Back Losses of 2026: Stock Market Today

Stocks See First Back-to-Back Losses of 2026: Stock Market TodayRising geopolitical worries and a continued sell off in financial stocks kept pressure on the main indexes on Wednesday.

-

Stocks Swing in Volatile Session: Stock Market Today

Stocks Swing in Volatile Session: Stock Market TodayThe main indexes fell sharply in early trading on rising China tensions, but rebounded thanks to encouraging bank earnings.

-

The Best Bank Stocks to Buy

The Best Bank Stocks to BuyBank stocks are part of the financial services sector and are a way to gain exposure to the broader economy. Here, we look at how you can find the best ones.

-

Stock Market Today: Nasdaq Hits a New High as Nvidia Soars

Stock Market Today: Nasdaq Hits a New High as Nvidia SoarsA big day for Nvidia boosted the Nasdaq, but bank stocks created headwinds for the S&P 500.

-

Stock Market Today: A Historic Quarter Closes on High Notes

Stock Market Today: A Historic Quarter Closes on High Notes"All's well that ends well" is one way to describe the second quarter of 2025, at least from a pure price-action perspective.

-

We Are Peter Lynch: How to Invest in What You Know

We Are Peter Lynch: How to Invest in What You KnowTake a look around, go to a free stock market data website, and get to work.

-

Stock Market Today: Uncertainty Proliferates: Dow Loses 1,014 Points

Stock Market Today: Uncertainty Proliferates: Dow Loses 1,014 PointsWeaker-than-expected consumer inflation data wasn't enough to stabilize sentiment during another volatile day for financial markets.

-

Stock Market Today: Dow Rises 854 Points From Its Intraday Low

Stock Market Today: Dow Rises 854 Points From Its Intraday LowIf there's one thing markets hate, it's uncertainty. But uncertainty is all they're getting these days.