13 Best Stocks to Buy for the Next Stock Market Correction

The stock market has been shaken in recent days by an escalation of the trade battle with China, as well as a Federal Reserve move to lower benchmark interest rates for the first time since 2008 – but not by as much as some on Wall Street hoped.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The stock market has been shaken in recent days by an escalation of the trade battle with China, as well as a Federal Reserve move to lower benchmark interest rates for the first time since 2008 – but not by as much as some on Wall Street hoped. But even after heavy selling, Standard & Poor’s 500-stock index remains just a few percent off all-time highs.

Is this the start of a long-awaited stock market correction? Possibly. But rather than trying to gauge exactly when a correction is coming or what will spark it, a better plan is to simply prepare. That is, you can shift the composition of your portfolio so it can better weather a storm – but still profit as long as the bull keeps running.

A more defensive posture does have drawbacks; nothing is free. The biggest problem is being underweight the stocks that are still driving the market higher. But for investors who do think a correction is coming and don’t want to play the losing game of trying to time the market, we’ve asked a group of investment managers and other experts which stocks they expect to hold up should the market pull back.

Here are 13 of the best stocks to buy to ride out a stock market correction. Most of these revolve around the idea of investing in high-quality companies that have good cash flows and business health, boasting pricing power and stable customer demand. This includes consumer staples stocks that sell products and services that people cannot live without. A couple will help raise your exposure to gold, which is emerging from a multiyear slumber.

Data is as of Aug. 1.

Coca-Cola

- Market value: $222.5 billion

- Dividend yield: 3.0%

Market pundits often suggest consumer staples stocks when the market seems ready to pull back. Companies in this group enjoy stable demand in good times and bad and their stocks tend to pay good dividends, making them among the best stocks to help soften the blow of a market downturn.

However, just because a company is in this sector does not mean it can stave off the bears. It must offer solid financial health and good market share in its industry.

David Bickerton, president of MDH Investment Management in Ohio, says Coca-Cola (KO, $52.03) is well-positioned within the sector, has a “fortress” balance sheet and pays a strong dividend. That payout has increased without interruption for 57 consecutive years, too, putting KO among the ranks of the Dividend Aristocrats.

Coca-Cola cruised to new all-time highs in July thanks in part to organic growth through its Dasani brand of seltzer waters. Its acquisition of British international coffee chain Costa Coffee – which had nearly 3,900 locations by the end of 2018 – is proving to be a major contributor to growth through its stores and thousands of vending facilities.

Coca-Cola’s revenues still are growing outside of the United States, too, despite the generally slower global economy – again thanks in part to Dasani.

A strong U.S. dollar is a headwind for Coca-Cola, as it weakens the effect of the company’s overseas earnings. But should the dollar weaken, that would provide another lift to Coke’s business.

J.M. Smucker

- Market value: $12.7 billion

- Dividend yield: 3.0%

David Bickerton also ranks J.M. Smucker (SJM, $111.73) as a top candidate for safety and growth.

Most people are familiar with Smucker’s brands, from Folgers and Dunkin coffee to Jif peanut butter, Crisco shortening and the namesake Smucker’s jams. Pet owners likely will recognize Meow Mix, Milk-Bone, Kibbles ‘n Bits, 9Lives and the celebrity-branded Rachael Ray Nutrish.

These are traditional consumer staples products that people will still buy no matter what the economy does. That should give the company’s stock price natural support if and when we experience a stock market correction.

Bickerton says SJM’s balance sheet has the same “fortress” quality as Coca-Cola. Smucker doesn’t have as lengthy a payout history, but it has improved its dividend for 18 straight years. Over the past half-decade, Smucker increased its dividend five times for an average annual increase of 7.9%.

Target

- Market value: $42.3 billion

- Dividend yield: 3.1%

Danny Ray, founder of PinnacleQuote Life Insurance Specialists, recommends retailer Target (TGT, $82.62).

The most interesting aspect of this stock is off the balance sheet, Ray says. Target is not a specialty retailer – such as store that only deals in, say, furniture or clothing – and thus would not be hit as hard by an economic slowdown. Target, thanks to its grocery options, is a part of many Americans’ everyday life. That doesn’t make TGT immune to a pullback, but it and similar retailers should be among the best stocks in the industry if the market wanes.

Strong net operating cash flow also gives the company the flexibility to sustain a longer period of a correction. In addition, its dividend – which currently yields more than 3% and has been growing continuously for almost half a century – will help investors bide their time by partially offsetting downside price movements.

Ray adds that dividend investors tend to be long-term holders, so selling pressure in income stocks such as Target would be mitigated. He also thinks larger institutional funds won’t exit their positions and instead are likely to accumulate more shares at lower prices.

Walmart

- Market value: $312.3 billion

- Dividend yield: 1.9%

For similar reasons, Danny Ray also likes Walmart (WMT, $109.38). It is an “everyday American” retailer. Many analysts agree that it also is one of the few traditional brick-and-mortar retailers that have built an online presence that’s truly competitive with Amazon.com (AMZN) – the 800-pound e-commerce gorilla.

Bickerton concurs, pointing out that during its most recent quarterly earnings report, Walmart announced e-commerce growth of 37% year-over-year – a huge number considering how much they’ve already grown the large platform. Grocery pickup and delivery through Walmart.com continue to add to the growth story.

Ray says the demographics of consumers using Amazon are middle class and above – essentially, people with money to spend. However, lower-income consumers tend not to shop on Amazon. Many rely on fixed incomes, including Social Security, and the majority of them still head to Walmart (and Target) in person.

A stock market correction in and of itself is unlikely to affect these consumers much. They would be unlikely to pull back on spending the way a more affluent consumer might when their portfolio shrinks.

“Even during the financial crisis in 2008, when many retailers were going under, parking lots at Walmart were not empty,” Ray says.

Consider that during the most recent correction during the fourth quarter of 2018, AMZN shares lost 31% peak-to-trough while WMT lost only 19%. Importantly, Walmart fared better across the entire downturn; Amazon lost a quarter of its value across all of Q4 and the S&P 500 lost 14% … while Walmart only gave up less than 1%.

Sherwin-Williams

- Market value: $47.3 billion

- Dividend yield: 0.8%

One of the least expensive home improvement projects is a fresh coat of paint. And with demand for home improvement proving to be less cyclical than in the past, Izet Elmazi – senior portfolio manager with Bristol Gate Capital Partners in Toronto – thinks Sherwin-Williams (SHW, $512.95) is the right stock for stability and growth.

Sherwin-Williams is a global leader in making and selling paints, coatings and other similar products. Elmazi believes the company is financially sound thanks to high free cash flow generation and an improving balance sheet. SHW has generated $17.7 billion in revenue over the past 12 months with 43% gross margins.

Remodeling and refurbishment drive the bulk of its demand, and the company has ample pricing power. Sherwin-Williams should be a survivor, then, even in a consolidating industry.

“If our thesis is right, this is just the beginning as gross margins trend back towards 50% over time and organic growth accelerates from here,” Elmazi says. “Demand for its products are still not at previous cycle highs. How many things can you say that for?”

American Tower

- Market value: $93.6 billion

- Dividend yield: 1.6%

The need for telecommunications infrastructure is clear as it is, but the advent of 5G communications is making that need more pressing. This is an example of an industry that is not beholden to the minor ups and downs of the economy or stock market, as it is central to a macro trend across the globe.

Emmet Savage – CEO of MyWallSt, an investing app and educational website – likes American Tower (AMT, $211.41) for exposure to this space, calling it “a great one to invest in when considering stocks that are recession-ready.”

American Tower is a real estate investment trust (REIT) that, despite what the name might imply, owns and operates wireless and broadcast infrastructure not just in the U.S., but also in 16 other countries. AMT owns more than 170,000 cellular towers and leases them to some of the biggest names in communication, including AT&T (T) and Verizon (VZ). And demand for American Tower’s infrastructure solutions should only expand once 5G reaches its mass-rollout stage.

“Today, they’re in a growth market,” Savage says. “And if there is a downturn, American Tower’s services will not be disturbed. No matter what happens, people will still need a phone signal and that means their towers will still be rented.”

American Tower, as a REIT, is required to pay out at least 90% of its taxable profits as dividends. The current yield below 2% isn’t impressive, but the company has improved its payout every quarter since early 2012.

General Parts

- Market value: $13.8 billion

- Dividend yield: 3.1%

Sometimes a good investment does not look that enticing on the surface. Take automotive parts and office supplies maker General Parts (GPC, $94.53). Since peaking April 5 at $115.20 per share, its stock price has mostly gone downhill, falling to current levels around $95. This isn’t a momentum story at the moment.

However, there is something to be said for a company that sees relatively stable demand for its products and offers a decent dividend yield. These qualities are why Chris Matteson – who runs Integrated Planning Strategies, an Oklahoma-based fee-only registered investment advisor – likes GPC to shore up a portfolio ahead of any upcoming pullback.

“GPC has an adequate cashflow position,” he says. “Its current ratio and quick ratio (two measures of corporate liquidity) look good, and it sports an affordable payout ratio of about 51%. Although it has recently increased debt its debt burden to pay for acquisitions, it has a healthy balance sheet.”

Genuine Parts’ price drop, Matteson adds, were sparked by weak sales in a challenging European economy, but sales in the rest of the world are growing slowly. “I’d add to my existing position if the stock dips any further,” he says.

He’s not alone. As the stock fell from April through August, insiders held on to their shares. In fact, there was one 5,000-share purchase and zero sales from people with intimate knowledge of the company’s health.

The combination of solid fundamentals and a price that has already come down substantially puts GPC among the best stocks to buy to weather a market-wide correction.

Bristol-Myers Squibb

- Market value: $73.9 billion

- Dividend yield: 3.6%

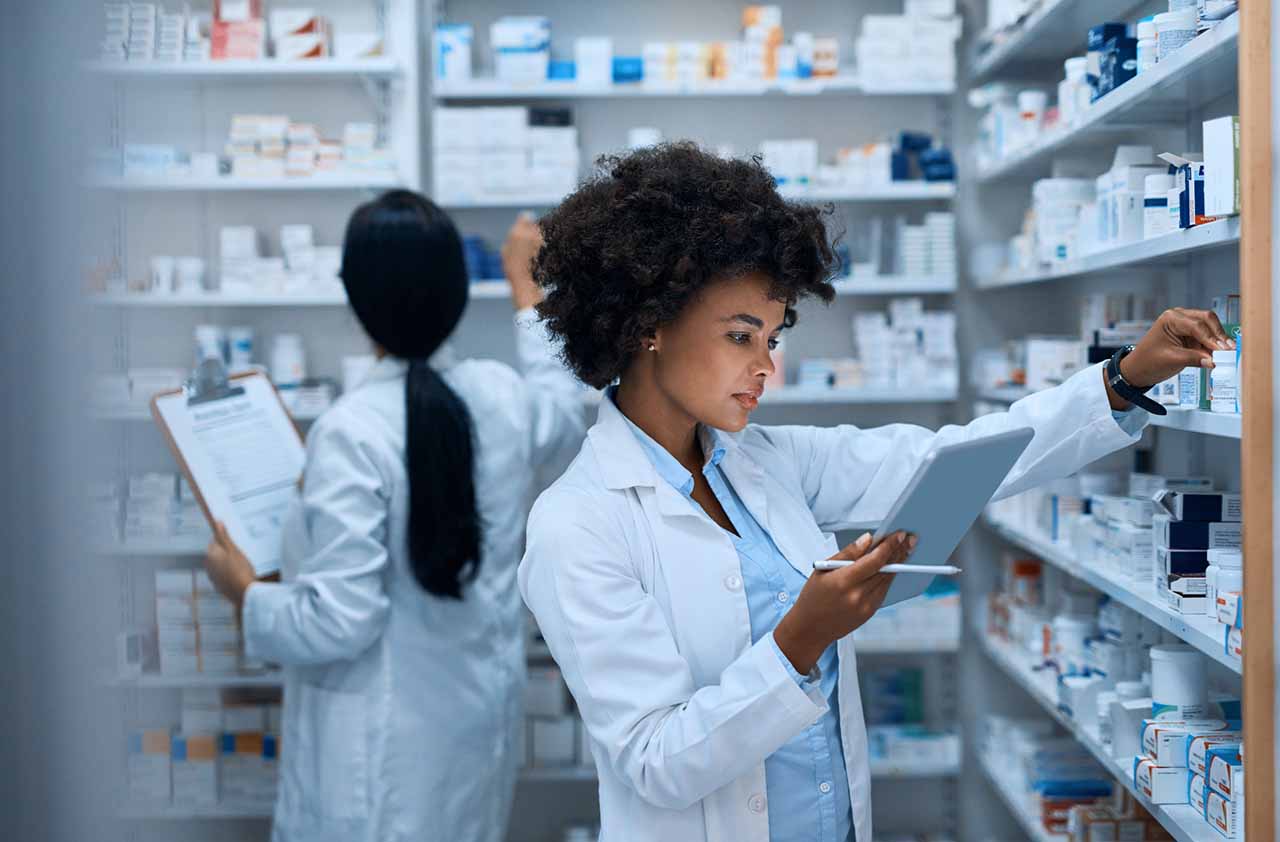

Pharmaceutical stocks are more defensive in nature, too. After all, people have to take their medicine regardless of what the market or economy do.

Chris Matteson likes Bristol-Myers Squibb (BMY, $45.20) in this space because it is fundamentally strong yet currently out of favor on Wall Street; BMY shares are trading near six-year lows.

“It’s still a solid business with a full product line that includes strong-selling drugs such as Opdivo (cancer), Eliquis (anticoagulant) and Revlimid (cancer),” Matteson says. “Their recent acquisition of the pharmaceutical company Celgene (CELG), a cancer-focused biopharma company, spooked investors into selling the stock because they think Bristol-Myers Squibb overpaid for a drug with limited patent protection.”

BMY does appear to be “washed out.” This means that heavy selling pressure from fleeing investors have been exhausted, in turn suggesting limited downside price movement from here.

“Liquidity ratios look good, debt is low for a pharmaceutical company, and the dividend payout is about 51%, for little chance of seeing a dividend cut,” says Matteson, who says he owns the stock and, despite current sentiment, would consider accumulating more at current levels.

iShares MSCI Eurozone ETF

- Market value: $5.6 billion

- Dividend yield: 3.2%

In the model of Warren Buffett, buying undervalued assets has been a good way to grow capital in good environments and bad. The theory is that others are overlooking the asset’s potential.

While the U.S. economy still puts out great numbers in jobs, wages and confidence, we cannot say the same for much of the rest of the world. Europe in particular remains under extreme pressure and many countries have lowered interest rates to below zero in an attempt to stimulate the continental economies.

That’s what makes investing in Europe now so intriguing.

Tom Chapin, chief investment officer of Pennsylvania-based Mill Creek Capital Advisors, thinks an easy way to gain exposure to Europe is via the iShares MSCI Eurozone ETF (EZU, $38.38). This ETF holds shares of large- and mid-cap stocks from developed-market countries that use the euro as their official currency. It’s a concentrated fund, though; nearly three-quarters of its market value is derived from France, Germany and Netherlands.

Chapin believes European markets have already priced in their economic conditions and now trade at more conservative valuations. For example, the underlying MSCI Eurozone index trades at a price-to-earnings ratio of 13.9 based on forward-looking profit estimates. Compare that to the S&P 500, which trades at 17.7. And the EZU, at 3.2%, offers a far richer yield than the sub-2% S&P 500.

Toronto-Dominion Bank

- Market value: $105.2 billion

- Dividend yield: 3.7%

Daniel Kent, owner and researcher for StockTrades – a Calgary-based investment and personal finance website – thinks the major Canadian banks are some of the world’s best stocks, as far as reliability is concerned. That’s paramount when the market starts looking shaky. Reliable earnings will help them hold their value in most conditions, including market corrections.

“They have proven time and time again they can withstand market hardships,” Kent says. “During the 2008 financial crisis, they weathered the storm better than any banks in the world.” In fact, not a single Canadian institution failed.

His top stock pick is Toronto-Dominion Bank (TD, $57.51). The Canadian financial giant has operations spread across North America and also owns a portion of online broker TD Ameritrade (AMTD).

The dividend is quite attractive at current levels. Given the company’s recent payout growth – the distribution has expanded by nearly 10% annually over the past half-decade – and healthy payout coverage, future dividend hikes seem likely, too.

Royal Bank of Canada

- Market value: $111.6 billion

- Dividend yield: 3.9%

Daniel Kent also recommends the Royal Bank of Canada (RY, $77.77) for riding out any market pullbacks.

Royal Bank is a global enterprise, operating in 42 countries including Canada and the United States. The company posted more than C$3.2 billion in profits last quarter and is one of Canada’s most valuable brands. It also has raised dividends for eight consecutive years, at a clip of about 8% annually over the past five years.

RY, like many other Canadian banks, began its current dividend growth streak near the end of the financial crisis – just when markets were starting to recover. But the important takeaway is that Canadian banks’ dividends were starting from higher ground. None of the Canadian “Big Five” banks executed a dividend reduction, and in fact, none had to take a bailout. “I think this contributed heavily to the speed of their recovery,” Kent says.

As Royal Bank’s stock fell from roughly $49 to under $25 during the heat of the crisis, the stock recovered back to its original $49 price point in less than a year. Compare this to Bank of America (BAC), which currently trades at $29 per share but topped out above $54 in 2007.

“Canada’s extensive regulatory environment is what saved these banks from insolvency, and is one of the primary reasons they are such a valuable asset to any investors portfolio today,” he says.

Evolution Mining

- Market value: $8.4 billion

- Dividend yield: 2.1%

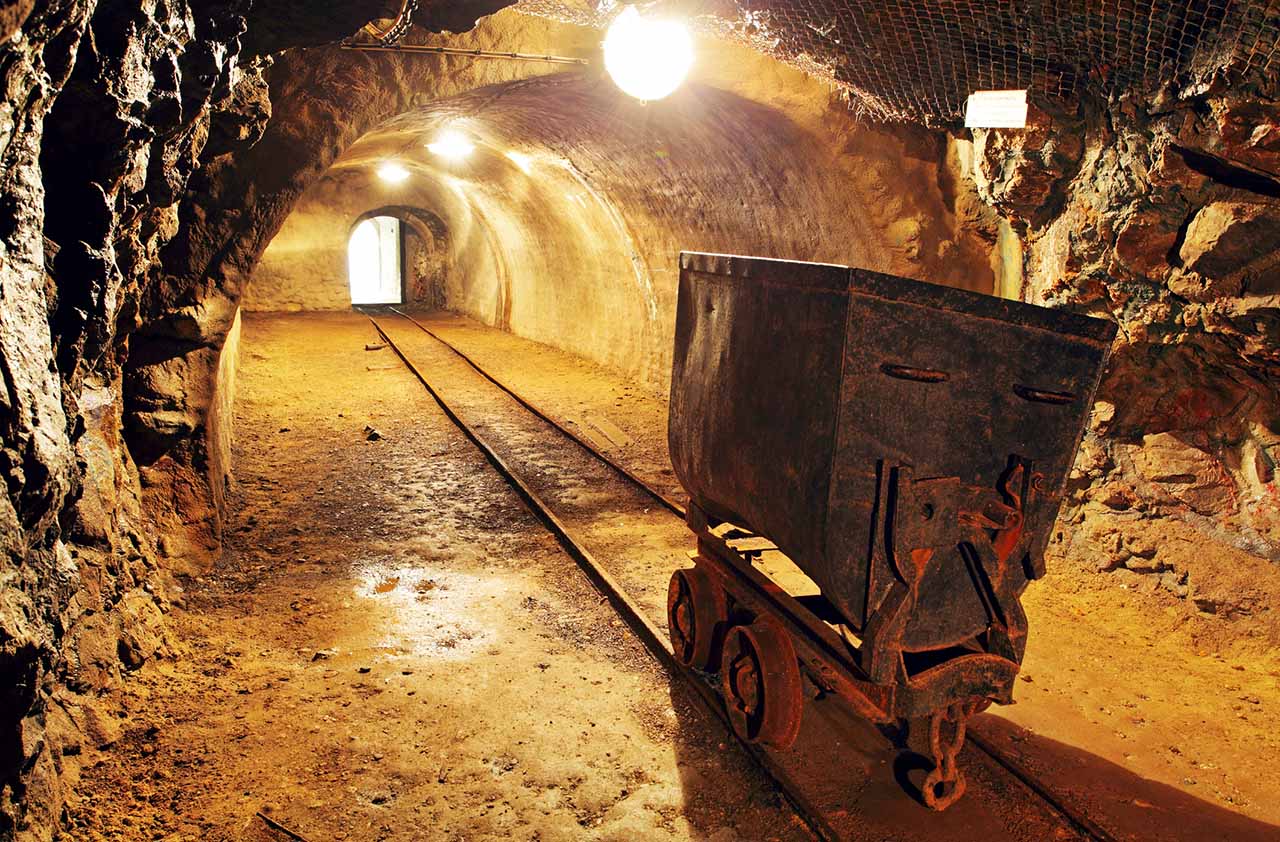

Gold mining stocks often are recommended when economic, or geopolitical, conditions start to sour. The idea is that gold as an asset is not correlated to movements in stocks, and that it provides a safe haven for money to hide when stocks do stumble. To wit, gold has fared well in a year of high uncertainty, and it recently closed at multiyear highs.

Investors can buy gold itself, either directly as coins or indirectly via gold-based exchange-traded funds (ETFs). However, if it takes longer for the economy and stock market to sour, investors in gold will miss out on the potential profits offered by stocks.

The ideal compromise is to shift some money into gold miners, which will benefit from rising gold prices but still can follow the broad market higher.

Simon Popple – editor of U.K.-based Brookville Capital Newsletter, which specializes in gold and silver investing – is most excited about Australian miner Evolution Mining (CAHPF, $3.38), especially if the market corrects. He says there are several reasons why Evolution is well-positioned, but the main one is that it’s such a low-cost producer. This has two key benefits in a market correction.

The first is that investors feel more comfortable with companies that are already generating a lot of cash. Evolution Mining would fall into that lower risk category because it’s the lowest-cost producer in the VanEck Vectors Gold Miners ETF (GDX) at $615 to $650 per ounce. Gold currently trades near $1,441 per ounce.

The second is that the company likely will remain profitable if gold falls in price when many other gold miners may not be. And if the gold price goes up, they become even more profitable.

Evolution’s home market is Australia, where it averages about 10 million shares traded daily. U.S. investors can most easily get exposure via the CAHPF shares, which trade over-the-counter (OTC). The caveat? The OTC shares trade an average of less than 9,000 shares daily, so interested investors will want to take precautions such as using limit orders and stop-losses.

Agnico Eagle Mines

- Market value: $12.9 billion

- Dividend yield: 0.9%

David McAlvany – CEO of Colorado-based gold brokerage and advisory firm McAlvany ICA, which is responsible for the gold investing app Vaulted – thinks gold and silver miner Agnico Eagle Mines (AEM, $54.39) checks all the right boxes. In fact, he owns shares in client, firm and personal accounts.

McAlvany likes that Agnico runs high-quality, profitable mines with superior returns on capital. It operates in the fairly stable geopolitical jurisdictions of Finland, Canada and Mexico.

The company has exceeded guidance for seven years running, McAlvany says, and its assets provide stability and visibility of cash flows.

Agnico has a policy of not hedging, which essentially means not selling any of its gold or silver production forward. This gives investors full exposure to gold and silver prices, for better or worse. Considering that gold itself has finally emerged from a six-year trading range, hedges would only create a drag on returns right now.

The company also has a long history of paying dividends, unlike many peers. With a sub-1% yield, AEM is far from an income play. But the extra padding contributes to Agnico Eagle Mines’ status as one of the best stocks for protection against a downturn.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

January Fed Meeting: Updates and Commentary

January Fed Meeting: Updates and CommentaryThe January Fed meeting marked the first central bank gathering of 2026, with Fed Chair Powell & Co. voting to keep interest rates unchanged.

-

The December CPI Report Is Out. Here's What It Means for the Fed's Next Move

The December CPI Report Is Out. Here's What It Means for the Fed's Next MoveThe December CPI report came in lighter than expected, but housing costs remain an overhang.

-

How Worried Should Investors Be About a Jerome Powell Investigation?

How Worried Should Investors Be About a Jerome Powell Investigation?The Justice Department served subpoenas on the Fed about a project to remodel the central bank's historic buildings.

-

The December Jobs Report Is Out. Here's What It Means for the Next Fed Meeting

The December Jobs Report Is Out. Here's What It Means for the Next Fed MeetingThe December jobs report signaled a sluggish labor market, but it's not weak enough for the Fed to cut rates later this month.

-

The November CPI Report Is Out. Here's What It Means for Rising Prices

The November CPI Report Is Out. Here's What It Means for Rising PricesThe November CPI report came in lighter than expected, but the delayed data give an incomplete picture of inflation, say economists.

-

The Delayed November Jobs Report Is Out. Here's What It Means for the Fed and Rate Cuts

The Delayed November Jobs Report Is Out. Here's What It Means for the Fed and Rate CutsThe November jobs report came in higher than expected, although it still shows plenty of signs of weakness in the labor market.

-

December Fed Meeting: Updates and Commentary

December Fed Meeting: Updates and CommentaryThe December Fed meeting is one of the last key economic events of 2025, with Wall Street closely watching what Chair Powell & Co. will do about interest rates.