13 Stock Picks Getting Hit by Coronavirus Fears

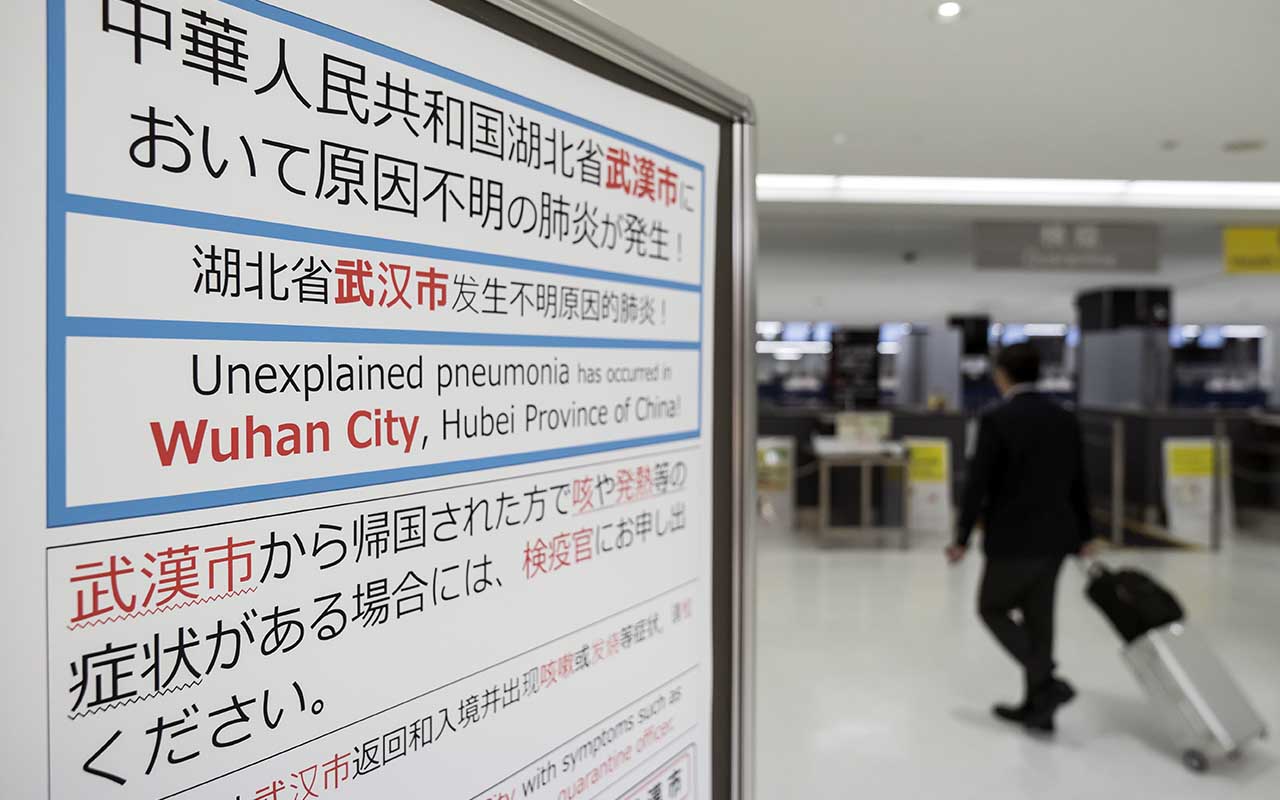

The COVID-19 coronavirus is making its way across the world.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The COVID-19 coronavirus is making its way across the world. The outbreak began at the end of 2019 in Wuhan, China; it has killed roughly 2,500 people, infected more than 83,000 people overall and spread to nearly 50 countries, including the U.S., since then.

The coronavirus has now passed the 2002-03 SARS and 2015 MERS outbreaks in scale, and that has triggered heavy selling: Stock indices around the world, including here at home, have been sent into correction territory. Numerous stock picks are already in bear markets.

It's no small worry. The SARS outbreak tallied 774 deaths across more than 8,000 cases over a six-month period, yet helped knock China's GDP down from 11.1% in the first quarter of 2003 to 9.1% in the second quarter. The coronavirus's ultimate potential to disrupt the global economy is far worse.

This health issue is weighing on most stocks, but it's cutting particularly deep into a few specific industries where the financial strain is already being felt. If there's any silver lining, it's that, like with SARS, this could end up being an opportunity to buy otherwise high-quality stocks at a discount for a potential snap-back.

Here, we look at 13 stock picks that are being hammered by the coronavirus outbreak. These stocks might be best avoided until a clearer picture of the coronavirus's eventual fallout develops. But they eventually might be extremely attractive buy-the-dip prospects.

Data is as of Feb. 27. Stocks listed alphabetically. Dividend yields are calculated by annualizing the most recent payout and dividing by the share price.

Analog Devices

- Market value: $39.7 billion

- Dividend yield: 2.1%

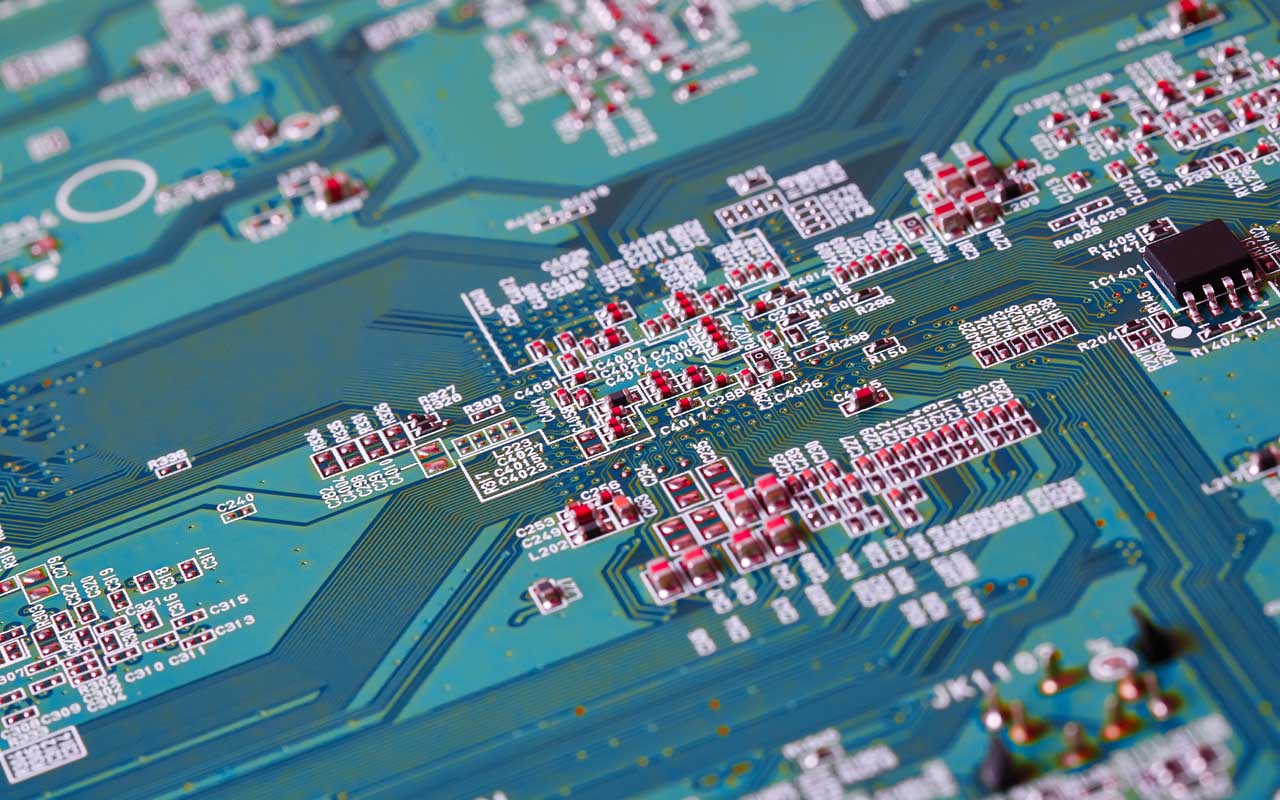

Technology is becoming a more important aspect in most facets of our lives. That includes everything from AI-powered supercomputers that monitor your search queries to determine what ads to serve you up … to, well, your toaster. And driving all of that is the humble semiconductor.

Given both China's place a manufacturer and as an adopter of tech, the coronavirus has some pretty dire short-term implications for the broader semiconductor industry.

Getting hit on both fronts has been Analog Devices (ADI, $10.72).

Analog Devices cut its teeth on boring, low-margin analog chips, but it has since moved into higher-margin processors used in everything from 5G communications to self-driving cars. The problem? Sales of analog chips to original equipment manufacturers have trended down, while 5G and other advanced tech rollouts have stalled in China.

CFO Prashanth Mahendra-Rajah recently had this to say:

"Unsurprisingly, we have begun to see weaker demand in China related to the extended Chinese New Year and ongoing business disruption. As such, our outlook assumes that China demand for industrial, automotive and consumer is minimal for all of February before returning to a more normal level in the last 2 months of our second quarter. And we are assuming an impact on our communications business due to the high likelihood of a delay in the 5G rollout."

Mahendra-Rajah added that the firm will see a $70 million hit to second-quarter revenues.

That potential normalization might mean now is the opportunity for a relative bargain. Shares are off more than 12% over the past week, and ADI's forward P/E has been knocked down to 22 – not cheap, but decent compared to some of its industry rivals.

Moreover, Analog Devices has grown its payout for 16 consecutive years, including a 15% increase to the payout announced in mid-February. Doing so amid the coronavirus outbreak is a glimpse into management's longer-term confidence.

Booking Holdings

- Market value: $68.2 billion

- Dividend yield: N/A

China's government, in an attempt to contain the coronavirus, quickly ramped up quarantine efforts and put numerous travel restrictions in place. More governments are beginning to follow suit, and travel is being curtailed in other ways too. In the U.S., for instance, several universities are canceling or rerouting travel-abroad programs.

- Booking Holdings (BKNG, $1,659.85) – the parent of Booking.com and Priceline, among other travel sites – has understandably been hit hard.

Booking has made China, and its huge consumer base, a primary focus for growth. It has invested in leading Chinese travel sites including Trip.com (TCOM) and Meituan-Dianping to gain a foothold in this market. Booking doesn't break out China revenues specifically, but it has said that China is a major part of its International Other revenues, which accounted for 13% of revenues for the first nine months of 2019.

Its ties to China have weighed on the stock more recently – BKNG is down more than 15% over the past couple weeks. But this might be a case of short-term pain, long-term gain.

A strengthening Chinese consumer is bolstering travel spending in the country, both domestically and internationally. China's Outbound Tourism Research Institute pegs 170% growth in the number of annual overseas trips by Chinese residents, from 149.7 million in 2018 to 400 million in 2030.

How deep BKNG and similar stock picks fall is difficult to determine because COVID-19 hasn't been contained – the longer the outbreak lasts and the wider its spreads, the worse it could get for Booking. For context, though, the New York Times says that Chinese stocks as a whole "caught up" with their international peers about six months after first reporting SARS to the World Health Organization.

Delta Air Lines / United Airlines

- DAL Market value: $30.9 billion

- Dividend yield: 3.2%

- UAL Market value: $16.1 billion

- Dividend yield: N/A

Airline stocks such as Delta Air Lines (DAL, $48.19) and United Airlines (UAL, $64.94) have delivered mostly flat stock performance over the past few years. However, they were already in value territory to begin 2020, and their stocks are getting even cheaper as travel fears mount.

According to the Bureau of Transportation Statistics, only about 60,000 passengers flew from the U.S. to Wuhan last year. Delta and United don't even offer direct flights to Wuhan, though they do offer service via their OneWorld and Star Alliance partnerships. That said, their ties to China more broadly, as well as Hong Kong, are significantly stronger. For instance, Stifel analysts predict that United has about 5.5% of its capacity heading along U.S-to-China/Hong Kong routes.

Both airlines have been forced to issue refunds, cancel flights and reroute people returning from China just to conduct screening measures. Now, the pain is spreading to U.S. travel. Research firm Vertical Research Partners recently said U.S. travel agency ticketing, by dollars transacted, plunged 9.4% year-over-year between Feb. 24-28. Their troubles likely will only get worse the longer the outbreak lasts – travel bans likely will become more restrictive, and people in general are likely to put off international and even domestic travel until the coronavirus situation has been contained.

Worry about these outcomes have already weighed on UAL (-26% in 2020) and DAL (-18%), and might continue to drag their shares down. But there are reasons to like airline stocks once the coronavirus danger has subsided. Lower fuel costs, rising fees and overall higher ticket prices have been improving many airlines' financial situations.

Analysts had been optimistically cautious at first. Bernstein analyst David Vernon, for one, predicted that the coronavirus would only affect United's earnings by 8 cents per share, writing that it would be "less severe" on load factors than SARS. Delta, which has less exposure to China than United, should feel an even smaller impact, he wrote. However, downgrades have been creeping into these and other U.S. airlines as they adjust for growing coronavirus concerns domestically.

Disney

- Market value: $213.11 billion

- Dividend yield: 1.5%

- Disney (DIS, $118.04) shares beat the market by more than 3 percentage points in 2019 on the strength of the company's Marvel and Star Wars franchises, as well as the launch of its streaming service, Disney+.

But while investors fawned over Disney's big-screen success, the House of Mouse also was scoring gains in the theme-park business. "Parks, Experiences and Products" revenues grew 6% year-over-year in its fiscal year ended September 2019, and operating income improved by 11%.

However, thanks to travel bans enacted by the Chinese government, Disney has been forced to close its Shanghai Disney Resort and Hong Kong Disneyland. Worse, it hasn't listed a reopening date. Worse still, this is coming during the critical Lunar New Year travel season. And on top of all that, its Chinese operations had been hurting already. Disney CFO Christine McCarthy mentioned during the fourth-quarter earnings release that the Hong Kong protests "have led to a significant decrease in tourism from China and other parts of Asia" and that the company expected a $275 million full-year revenue decline in those operations. That was before the outbreak.

Disney has continued to slide more recently amid growing coronavirus concerns, specifically the potential impact on its U.S. and other international parks. Further complicating matters is the recent sudden departure of CEO Robert Iger, who led a massive expansion for the entertainment giant since taking over for Michael Eisner in 2005. He will be replaced by parks chief Bob Chapek.

It's not all woes at Disney: Its new Disney+ service is a hit and racking up new subscribers at a rapid clip. Rosenblatt Securities analyst Bernie McTernan wrote ahead of Disney's most recently quarterly report that he expected the company to claim 25 million subscribers for its streaming service, versus a previous 21 million estimate. Disney exceeded his and other expectations by saying it had already reached 28.6 million.

Disney has its short-term work cut out for it, but the coronavirus selloff is at least knocking a lot of froth off the stock's valuation. It now trades at 22 times forward-looking estimates, which isn't a steal, but is considerably cheaper than what investors had been paying for months.

Exxon Mobil

- Market value: $210.9 billion

- Dividend yield: 7.0%

China became the world's largest importer of crude oil in 2016. You can thank not just China's growing internal demand, but also fracking and low-cost shale production in the U.S., for that.

But that kind of position can create some serious hiccups in the global energy market.

The coronavirus has already knocked about 3 million barrels per day off China's consumption. That, as well as worries about what will happen as the COVID-19 spreads across the world, is hammering oil prices, which have fallen into bear-market territory (a decline of at least 20% from a peak.) WTI currently trades at $44 per barrel – the lowest prices we've seen in more than a year.

For pure energy exploration-and-production companies, profits are simply a measure of the commodity's price minus their costs to produce it. At these low prices, not many can generate any sort of real value from crude. But Exxon Mobil (XOM, $49.82) can, and it's at 15-year-low prices. From a valuation perspective, it's trading at 14 times future earnings estimates, which is less than the market. XOM also has a more-than-generous 7.0% yield on a dividend it has grown for 37 consecutive years.

Exxon absolutely has issues. Indeed, lower oil prices will negatively impact Exxon's E&P business. Analysts are worried that the company is falling behind on its multiyear growth plan. And in turn, Wall Street has been lowering its price targets.

But as an integrated energy super-major, XOM has its ladles in a variety of soups, from pipelines and production to refining chemicals and LNG exports. The firm has spent plenty of dollars expanding into low-cost shale regions like the Permian Basin. In fact, Exxon Mobil believes that its breakeven costs for the Permian will be around $15 per barrel in the near future. Meanwhile, the energy stock has turned its attention to toward exporting natural gas with new deals with India's IndianOil and Petronet. Moreover, natural gas demand in China continues to grow despite declines in crude oil.

The panic selling might be overdone. Don't try to "catch a falling knife" and buy the stock today. But once the price stabilizes for a few weeks to a month, XOM finally might be ready for new money.

Five Below

- Market value: $5.6 billion

- Dividend yield: N/A

China's presence as a low-cost manufacturing hub has long been a crutch for retailers, particularly dollar stores and discounters. But the coronavirus has forced numerous factory and warehouse closures, disrupting the supply chain and dinging retailers who are forced to contend with higher prices for goods.

Some have been able to navigate this better than others, however.

- Five Below (FIVE, $101.19) already warned about the trade war forcing higher prices back in June, but the firm has again had to guide lower for the rest of 2020 as a result of coronavirus-related factory closures and export issues. But long term, FIVE looks exceedingly attractive – and there's a small chance its guidance is too conservative.

That's because of Five Below's niche. While technically a dollar store, FIVE is targeting not adults, but their kids.

Five Below sells a variety of toys, candy, health & beauty items, fashion and gadgets. It's the kind of stuff that 7- to 14-year-old kids just can't get enough of. Moreover, the target demographic tends to be upper-middle to upper class, which has allowed it to raise prices and introduce "Ten Below" zones in several of its stores. Q3 net sales jumped by nearly 21% during its last reported quarter. Cost controls and higher prices managed to keep operating income at still high levels despite the tariff issues.

FIVE no doubt will deal with supply-chain issues as long as the coronavirus outbreak persists, but the company clearly is set for the long-term. It's also debt-free, which is a great trait for any holding during an economic disruption.

iShares MSCI China ETF

- Market value: $4.9 billion

- Dividend yield: 1.5%*

- Expenses: 0.59%, or $59 annually on a $10,000 investment

To say that Chinese stocks are cheap would be an understatement.

China's equities were already dinged up thanks to trade-war issues and slowing growth. But the coronavirus has crushed the country's stocks to valuations not seen in years. At the beginning of January (the most recent data available), the MSCI China Index was trading at less than 12 times estimates for next year's earnings – making China one of the cheapest markets in the world, and it's certainly cheaper now than it was then.

This might be a chance to buy one of the world's better long-term bets at a rare deep discount. Many of the drivers behind pre-coronavirus Chinese optimism, such as a growing and increasingly wealthier middle class, are still very much in place.

One of the best ways to gain exposure continues to be the iShares MSCI China ETF (MCHI, $61.81).

The exchange-traded fund tracks the aforementioned MSCI China Index, providing exposure to nearly 600 large- and mid-cap Chinese stocks. You get a "total picture" of the Chinese economy – large multinationals as well as smaller, regional players. Naturally, it's heaviest in the heavyweights, so you get considerable exposure to companies such as e-commerce giant Alibaba Group (BABA), internet conglomerate Tencent (TCEHY) and China Construction Bank (CICHY).

MCHI, at just 0.59% annually, is about half as expensive as the average Chinese-focused mutual fund.

* The trailing 12-month yield, which is a standard measure for equity funds.

LVMH

- Market value: $199.7 billion

- Dividend yield: 1.7%

The rise of the Chinese consumer isn't boosting only normal goods – it's quickly becoming a shopper's paradise for luxury products. Data from consultancy Bain & Company shows that Chinese shoppers account for 35% of all global luxury goods sales. Moreover, rising Chinese demand for high-end handbags, jewelry, shoes and other goods accounts for more than 90% of the growth in the luxury market. Those sales happen not just in mainland China and Hong Kong, but also on trips to Europe and major U.S. cities.

This trend has been a boon for luxury powerhouse LVMH (LVMUY, $79.35), whose brands include Louis Vuitton, Christian Dior, Moët and Hennessy. Its revenues have grown by 11% annually over the past four years, and Asia ex-Japan sales accounted for roughly a third of 2018's total.

But LVMUY shares have been hit hard, off 12% in just about a month amid worries about the economic impact of the coronavirus.

Here again, though, the longer-term outlook is still rosy. The firm continues to strengthen its portfolio of brands, most recently with its $16.2 billion purchase of Tiffany, which is expected to add more than $4.4 billion in annual revenues – the bulk of that from North America. An eventual return to normalcy likely will include a return to Chinese luxury spending in many of LVMH's premier brands.

Royal Caribbean

- Market value: $16.1 billion

- Dividend yield: 3.8%

- Royal Caribbean (RCL, $77.00) is plenty exposed to China. RCL has built up its brand in the country over the past decade, and now offers several cruises throughout the region. The resulting brand familiarity has spurred Chinese travelers to also book Royal Caribbean cruises in other parts of the world. The company said Chinese guests with non-China itineraries spiked 75% between 2016 and 2019.

RCL is feeling the bite now, though. The company had to cancel a Shanghai-to-Japan sail, and it will turn away passengers either from Wuhan or who have recently traveled through the city. More broadly speaking, consumers increasingly are becoming wary of scenarios where they're trapped with others in close quarters for several days. And the spread of the coronavirus on Princess Cruises' Diamond Princess cruise ship has painted a disturbing image for would-be passengers. As of mid-February, Royal Caribbean had to cancel 18 cruises.

Shares have plunged by 40% in 2020, in part because while investors assume the COVID-19 outbreak will take a financial toll, there's little visibility into just how much. During the company's quarterly earnings call at the start of February, CEO Richard Fain said when asked about how many cruises the company would have to cancel: “We don’t yet know how many.”

Like these other stock picks, RCL's short-term plunge could be a buying opportunity. For Royal Caribbean, its brand is its pull. Cruises tend to rely heavily on brand loyalty; their booking perks keep consumers entrenched in a single cruise line. And RCL has a strong grip on the Chinese market. But investors should wait for the stock to stabilize before considering dipping in.

Starbucks

- Market value: $91.9 billion

- Dividend yield: 2.0%

Comedian Lewis Black has a famous bit about two Starbucks (SBUX, $78.29) coffee locations being directly across the street from each other. While it has more to do with the fickle nature of human beings and wait times, it does highlight how Starbucks is pretty saturated here in the U.S. That's why the Seattle coffee shop has set its sights on China as a source of new growth.

They're ambitious plans, too. Starbucks is in the midst of a multiyear plan to build nearly 3,000 new stores in mainland China between 2018 and 2022. That's basically double the number of locations it had previously and equates to a new store opening every 15 hours. Starbucks is also going heavy into digital operations with news apps and partnerships with China's Alibaba. Those efforts had been bearing fruit: Starbucks reported in late January that in its most recent quarter, Chinese revenues jumped 13% year-over-year, including comparable-store sales growth (revenues from stores open at least a year) improving by 3%.

Coronavirus fears have thrown all that for a loop. The coffee roaster was forced to close more than 2,000 of its current 4,300 stores in January. It remains to be seen what it will have to do in other areas of the world where it has exposure, including in the U.S.

But one thing to note: Roughly 85% of its Chinese stores are open now. While the coronavirus still is spreading in China, the official numbers say the spread there has begun to slow. Starbucks says the virus will "materially" affect its results for the current quarter and whole year, but the impact might be less than what people are pricing in.

As coronavirus goes, so does Starbucks. If China is stabilizing, SBUX could see a similar pattern of short interruptions across the world before returning to normalcy. Starbucks' forward P/E of 26 might be a decent price for the eventual rebound. If the outbreak worsens, however – especially if it rebounds in China – SBUX could get a lot cheaper.

Wynn Resorts

- Market value: $11.9 billion

- Dividend yield: 3.6%

- Wynn Resorts (WYNN, $111.16) will strike a chord with American consumers for its Las Vegas properties, but the company is very much a China play.

As one of the only places in China that gambling is legal, the special district of Macau has become a travel mecca for entertainment seekers – and Wynn was one of the first groups to be granted an operating license in the region. Today, Wynn pulls almost three-quarters of its adjusted property EBITDA (earnings before interest, taxes, depreciation and amortization) from the region – the highest among the major competitors there.

The problem for investors looking to history is that Wynn's presence in Macau began after the 2002-03 SARA breakout, so there's little to compare it to. However, Jefferies analyst David Katz says a worst-case scenario for WYNN would see a roughly 29% decline from its Jan. 20 closing price – and shares have already dropped 27% since then.

Interestingly, more recently, Bank of America analyst Shaun Kelley actually upgraded WYNN shares, from Neutral (equivalent of Hold) to Buy, amid stable and declining growth rates in China and abroad. While China continues to stabilize, growth rates are accelerating in other parts of the world, however.

The long-term upside for Wynn isn't in VIPs, but the so-called "mass-market gambler." Wynn has shifted its product mix in Macau to court the average Joe, and it's working. VIPs often demand opulent perks, cutting into their margins, but Wynn is finding that it can squeeze plenty of profit out of regular players. Thus, the company is executing several projects, including converting some luxury rooms into standards, to capture more of this market share.

The quick drop in WYNN shares has also brought its yield to well more than 3%, which is on the high end of its range for the past few years.

Yum! China

- Market value: $16.5 billion

- Dividend yield: 1.1%

Pure-play Chinese domestic-consumption stocks have taken a beating. The Global X MSCI China Consumer Discretionary ETF (CHIQ), for instance, has dropped by double digits in just a week's worth of trading in late January.

- Yum! China (YUMC, $43.75) was in the same boat, dropping 16% in five days.

With more than 8,750 restaurants in over 1,300 cities, Yum! China has been among the better stock picks leveraging the domestic Chinese economy and offered up torrid growth – both when it was part of Yum! Brands (YUM) as well as following its 2015 spinoff. Yum! China is responsible for Pizza Hut, KFC and Taco Bell operations in China.

But when Chinese consumers won't – or can't – spend any money, YUMC naturally will find itself in a difficult situation. Yum! China temporarily closed some of its KFC and Pizza Hut stores in Wuhan due to the outbreak. It's a tiny fraction of its base; the real fear is that overall traffic will decline throughout the company as fewer people venture out over virus fears.

But while YUMC shares could sustain even more losses the longer the coronavirus outbreak drags out, the stock has been stabilizing for several weeks amid an improving picture across most of China. A longer-term rebound seems likely given its longer-term growth drivers, such as coffee concept COFFii & JOY and its controlling interest in hot-pot chain Huang Ji Huang. And as China continues to modernize, Yum! China plans to expand its empire into more cities, targeting 20,000 potential locations in its network. In the future, you might not be able to go anywhere within the country without running into a KFC or Pizza Hut – and that would be music to investors' ears.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

What Fed Rate Cuts Mean For Fixed-Income Investors

What Fed Rate Cuts Mean For Fixed-Income InvestorsThe Fed's rate-cutting campaign has the fixed-income market set for an encore of Q4 2024.

-

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)State Taxes Living in one of these places could lower your 2025 investment taxes — especially if you invest in real estate.

-

The Final Countdown for Retirees with Investment Income

The Final Countdown for Retirees with Investment IncomeRetirement Tax Don’t assume Social Security withholding is enough. Some retirement income may require a quarterly estimated tax payment by the September 15 deadline.

-

What to Do With Your Tax Refund: 6 Ways to Bring Growth

What to Do With Your Tax Refund: 6 Ways to Bring GrowthUse your 2024 tax refund to boost short-term or long-term financial goals by putting it in one of these six places.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

15 Reasons You'll Regret an RV in Retirement

15 Reasons You'll Regret an RV in RetirementMaking Your Money Last Here's why you might regret an RV in retirement. RV-savvy retirees talk about the downsides of spending retirement in a motorhome, travel trailer, fifth wheel, or other recreational vehicle.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

Why Analysts Say Five Below Is a Buy After Earnings

Why Analysts Say Five Below Is a Buy After EarningsFive Below stock is higher Thursday after the value retailer beat earnings expectations and raised its full-year outlook. Here's what Wall Street has to say.