14 Blue-Chip Dividend Stocks Yielding 4% or More

While the markets have rebounded from last year’s late plunge somewhat in 2019, there’s still one positive remnant from the selloff.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

While the markets have rebounded from last year’s late plunge somewhat in 2019, there’s still one positive remnant from the selloff. Dozens of high-quality blue-chip stocks have been cut in price enough to lift their dividend yields above 4%.

At present, familiar names from the consumer staples sector are combining decades of steady dividend growth with near-record yields and bargain-priced valuations.

Energy stocks – which already were depressed due to weakened energy prices – were hacked even deeper. But these companies have already responded to market adversity over the past few years by shedding poorly performing assets, trimming costs, repurchasing stock and paying down debt. Some of those same companies were able to keep raising dividends, too, and now are positioned to survive in lean times and thrive as energy prices recover.

Even some international stocks’ yields are ballooning thanks to Brexit fears and a slowdown in several countries’ growth.

As a result, each of these 14 blue-chip dividend stocks currently off yields of 4% or better – with the highest payers delivering more than 6%.

Data is as of Feb. 21. Dividend yields are calculated by annualizing the most recent quarterly payout and dividing by the share price.

AT&T

- Market value: $224.6 billion

- Dividend yield: 6.6%

Already well-known for its TV, mobile and broadband businesses that serve nearly 160 million subscribers, AT&T (T, $30.83) recently closed on an impressive portfolio of entertainment assets. Through the 2018 acquisition of Time Warner – which includes the Turner, HBO and Warner Brothers businesses – AT&T gained one of the world’s largest TV and film studios and a world-class library of entertainment content.

During the final quarter of 2018, AT&T reported profits of 78 cents per share to easily beat expectations of 65 cents, and revenues of $41.7 billion beat estimates of $41.2 billion. The company also beat the mark on U.S. wireless net additions, adding 2.7 million customers versus 2.2 million expected.

Future growth will come from rolling out 5G service in additional markets and launching a new direct-to-consumer bundled entertainment package. AT&T’s entertainment business began 2019 with the top-grossing movie of the holiday season (Aquaman), which has earned more than $1.1 billion worldwide.

While AT&T’s sizable debt load is a concern for investors, the company plans to use 2019 free cash flow (estimated at more than $26 billion) to trim $12 billion from debt and end next year with a debt ratio reduced to just 2.5 times EBITDA.

AT&T has delivered 35 consecutive years of dividend growth, putting it in the ranks of the Dividend Aristocrats … though growth has been relatively modest at 2.2% annually.

General Mills

- Market value: $28.0 billion

- Dividend yield: 4.2%

Shares of General Mills (GIS, $46.95) were hit particularly hard by the 2018 market selloff, dropping more than 30% due to fears of slowed top-line growth and a significant debt load. General Mills owns iconic food brands such as Cheerios, Haagen-Dazs, Betty Crocker, Pillsbury, Old El Paso and Nature Valley and generated $15.7 billion of revenues last year.

The company plans to re-vitalize its top-line by launching new products next year that leverage its powerful brand names and strengthening brand management by increased investments in point-of-sale, packaging and sponsorship.

General Mills’ purchase of Blue Buffalo pet food has been a game-changer for its e-commerce business, which grew 50% last year and could hit $1 billion in sales by 2020. Blue Buffalo is the No. 1 pet food brand in specialty and e-commerce channels.

The company is committed to maximizing growth opportunities for the Blue Buffalo brand and extending its track record of double-digit growth. Divestitures are another aspect of General Mills’ portfolio strategy, with plans to sell assets representing roughly 5% of company revenues.

General Mills targets 9%-10% sales growth and 6%-9% operating profit growth this year. Cash flow will be used for capital expenditures (estimated at 4% of revenues), dividends and debt repayment. Over the next two years, the company aims to reduce debt from 4.2 times EBITDA to 3.5 times.

GIS has paid dividends without interruption for 120 years, increased its payout 14 years in a row and hiked dividends 8% annually over the last five years … but because of the size of the Blue Buffalo acquisition, it announced last year that it would freeze dividend hikes for now.

Still, three analyst firms upgraded ratings on the stock during 2018. Also, Standpoint Research analyst Ronnie Moas recently initiated coverage of General Mills with a “Buy” rating.

Dominion Energy

- Market value: $60.1 billion

- Dividend yield: 4.6%

Energy utility Dominion Energy (D, $74.34) serves more than 7.5 million customers and operates in 18 states. One of America’s largest producers and transporters of energy, Dominion owns $78 billion of assets that provide electric generation, transmission and distribution and natural gas storage, transmission and distribution.

Dominion grew operating earnings 12.5% in 2018 and trimmed debt by approximately $8 billion, achieving its credit quality goals two years ahead of schedule. The company also advanced construction of its Atlanta Coast Pipeline, which is expected to begin operating in late 2019.

In January, Dominion merged with SCANA. This transaction expands the company’s footprint in Georgia and the Carolinas and adds regulated operations that improve Dominion’s risk profile and growth outlook.

Dominion has increased its dividend for 15 consecutive years and generated five-year dividend growth averaging 8.2% annually. The last payout increase was a 10% hike in December.

LyondellBasell Industries

- Market value: $33.3 billion

- Dividend yield: 4.5%

- LyondellBasell Industries (LYB, $88.50) is one of the world’s largest plastics, chemical and refining operations. Its products are used in food safety, water purification, vehicle fuel efficiency and electronics. The company sells in more than 100 countries and is the world’s largest producer of polymer compounds.

Last August, LyondellBasell paid $2.3 billion for A. Schulman, a leading global supplier of high-performance plastic compounds, composites and powders. The acquisition more than doubles the size of LyondellBasell’s existing compounding business and broadens its presence in higher-margin end markets like automotive, construction materials, electronic goods and packaging.

Other growth initiatives include launching a new Advanced Polymers Solutions operation that combines the company’s traditional strength in automotive applications with Schulman’s more diverse business lines, and breaking ground on a new propylene oxide plant in Texas.

In 2018, LyondellBasell grew its revenues by 13%, though EPS trickled slightly lower, from $12.23 to $12.01. The company also paid out $3.4 billion in dividends and stock buybacks during the year, and increased its quarterly payout for the 10th consecutive year, to $1 per share. That keeps up a double-digit dividend growth rate over the past half-decade.

LYB has enjoyed a slew of upgrades over the past few months, including a December grade hike by Deutsche Bank analyst David Begleiter. He moved the stock from “Hold” to “Buy,” noting that the company trades at the low end of the range for commodity chemical stocks and has an attractive dividend that mitigates risk.

Bank of Nova Scotia

- Market value: $70.1 billion

- Dividend yield: 4.5%

With assets under management totaling $998 billion, Bank of Nova Scotia (BNS, $57.10), which operates as Scotiabank, is Canada’s principal international bank and a leading financial services provider to Latin America. The bank derives 56% of its earnings in Canada and 44% from the U.S., Latin America, the Caribbean and other international markets.

In the past five years, Scotiabank has produced 7% annual EPS growth and 6% annual dividend growth while maintaining its strong capital position. Dividends have been paid every year since 1832.

Last year, Scotiabank made $7 billion in acquisitions that expanded its customer base and earnings, enhance economies of scale and bolster its presence in Canada and Latin America.

Purchasing BBVA Chile doubles its market share in that country and positions Scotiabank as Chile’s third largest private bank. The Canadian acquisitions of MD Financial Management and Jarislowsky Fraser strengthen its wealth management practice, add 110,000 new private customers and 500 new institutional customers, and create Canada’s third largest asset manager.

Scotiabank is differentiated from competitors by a sizable international footprint that enables the bank to capitalize on favorable demographics in Latin America, where only about half of the citizens have bank accounts. Over the past four years, Scotiabank has grown earnings from Latin American operations by more than 70%.

The bank is also focused on improving efficiencies through its Structural Cost Transformation program that is delivering more than $1 billion of annual run rate savings.

Chevron

- Market value: $227.6 billion

- Dividend yield: 4.0%

- Chevron (CVX, $119.14) is one of the world’s largest integrated energy companies and ranks 19th on the Fortune 500 list. Chevron participates in every aspect of the oil and natural gas industry from exploration and production to refining, marketing and distribution. It also has significant alternative energy operations, and it is the world’s largest producer of geothermal energy.

Chevron grew its bottom line by 61% year-over-year to $14.8 billion in 2018. That was helped by record annual net oil-equivalent production of 2.93 million barrels per day (up 7% from 2017). Gains were fueled by a production ramp-up from Chevon’s Wheatstone field in Australia and from operations in the U.S. Permian Basin.

Earnings from international upstream operations more than doubled year-over-year thanks to higher oil and natural gas realizations. Chevron’s average sales price for crude oil ticked higher from $50 in Q4 2017 to $56 in 2018’s final quarter; natural gas selling prices came in higher, too.

Chevron plans to invest $20 billion in 2019 exploration and production activities, with more than two-thirds of these projects expected to produce cash flows within two years. A new project underway in Kazakhstan taps 9 billion barrels of known recoverable oil and could contain as much as 25.5 billion barrels of oil.

Chevron has hiked dividends for 32 years in a row, including a 6.3% increaseearlier this year. Over the past decade, dividend growth has averaged 6% annually, but slowed to less than 3% in the past five years.

Sixteen of the 24 analysts covering CVX call it a “Buy” or “Strong Buy,” with another seven “Holds.” UBS was the most recent analyst outfit to join the bull camp, upgrading the stock to “Buy” in January, citing the company’s free-cash-flow generation, stability and dedication to the dividend.

Royal Dutch Shell

- Market value: $255.2 billion

- Dividend yield: 6.0%

- Royal Dutch Shell (RDS.A, $62.36) is an integrated energy giant that operates in 70 countries, produces 3.9 million barrels of crude per day and has interests in 21 refineries. With 2017 revenues of $240 billion, Shell ranks seventh on the list of Fortune 500 companies.

Shell is actively re-shaping its portfolio and has shed more than $30 billion of non-core assets in recent quarters. The proceeds from asset sales has been reinvested in new energy projects that are expected to add 400,000 barrels per day to production and $7 billion to cash flow by 2020.

The 2016 acquisition of BG Group, the U.K.’s third largest energy player, made Shell the world’s leading producer of liquefied natural gas (LNG). The company plans to leverage its strength in this clean energy niche by constructing a massive LNG processing plant in Canada. World demand for LNG is forecast to rise from around 300 million tons currently to 500 million tons by 2030, fueled by growing demand from Asia.

Shell is allocating $25 billion for share repurchases through 2020 and reduced debt by $14.5 billion in 2018. The company also paid its dividend completely in cash this year – a stated goal.

Royal Dutch Shell is rated “Buy” or “Strong Buy” by 10 analysts and “Hold” by just one.

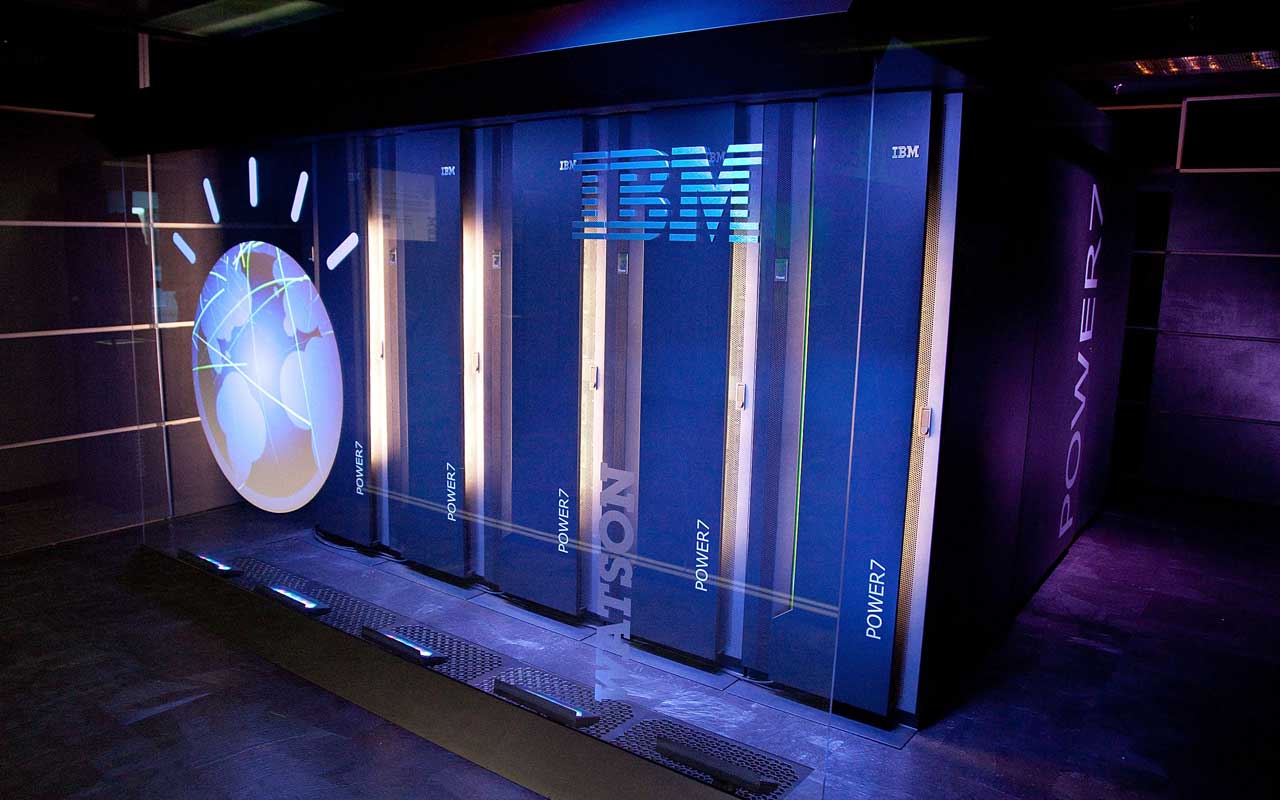

International Business Machines

- Market value: $125.3 billion

- Dividend yield: 4.6%

As part of its Strategic Imperatives Plan for accelerating top-line growth, International Business Machines (IBM, $137.84) is downplaying legacy hardware, software and services businesses to focus instead on hybrid cloud computing, analytics/AI, digital and security products. The early success of these initiatives is evidenced by financial results, which show Strategic Imperative revenues up 9% in 2018 and cloud-related revenues up 12%.

IBM’s $34 billion acquisition of Red Hat (RHT) is a game-changer that positions the company as the top solutions provider in hybrid cloud computing. This acquisition also is expected to accelerate revenue growth, expand margins and produce operating synergies that amplify free cash flow growth over the next 12 months. Red Hat produces higher-margin revenues and has been growing its top-line at a 20% annual rate.

The Red Hat purchase is being funded with cash and debt. IBM plans to free up cash for debt reduction by suspending 2020-21 share repurchases. The company had been an aggressive repurchaser of its own shares, buying back nearly $64 billion of stock since 2011 while paying nearly $36 billion of dividends.

IBM has paid dividends every year since 1916 and has raised dividends 23 years in a row. Five-year dividend growth has averaged 11%. With a payout ratio typically less than 50%, IBM is able to grow its payout even amid industry difficulties.

Altria Group

- Market value: $94.4 billion

- Dividend yield: 6.4%

Shares of Altria Group (MO, $50.37) have declined roughly 20% over the past year, pushing the stock’s dividend yield above 6% and around eight-year highs. Altria owns leading tobacco brands such as Marlboro, Skoal and Copenhagen, and also sells premium wines under its Ste. Michelle label.

A big reason for the share-price decline is the huge price ($38 billion) paid by Altria to acquire a 35% stake in Juul, the market leader in e-vaping products. Altria is paying $12.8 billion for a business that generated $1 billion of revenues last year. Citibank analyst Adam Spelman complained in a note to investors that Altria was overpaying for Juul and downgraded his rating on the stock from “Neutral” to “Sell.”

The Juul transaction comes on the heels of shelling out $1.8 billion for a 45% ownership stake in Cronos Group (CRON), a global leader in cannabis products. This deal also includes warrants that could increase Altria’s stake in Cronos to 55% over the next four years.

In its communications with investors, Altria argued that there are significant new growth opportunities associated with Juul’s dominant position in a $23 billion worldwide e-vaping market and highlighted Chronos Group’s leadership role in a global cannabis market poised for rapid growth over the next decade.

Altria’s high recurring revenues, substantial cash flow and low existing debt should facilitate a rapid paydown of acquisition-related debt. Over the past five years, the company has generated 9% annual EPS growth and returned more than $30 billion to shareholders through dividends and share repurchases.

In addition, Altria recently announced a cost reduction program aimed at cutting $500 million to $600 million from annual expenses next year. The cost reduction will offset most of the increased interest expense associated with the Juul and Cronos acquisitions.

Altria Group has grown dividends 49 years in a row and delivered annual growth averaging 10.3% over the past five years. The payout ratio is relatively high at approximately 75%, but the company’s predictable cash flow provides a safety cushion for the distribution.

Verizon Communications

- Market value: $232.0 billion

- Dividend yield: 4.3%

Wireless services provider Verizon (VZ, $56.15) operates the nation’s largest 4G network, providing access to more than 98% of the American population. Since 2000, the company has invested more than $126 billion in building out its wireless network. Next year, it will spend $17 billion to $18 billion on the same thing, including getting its 5G wireless technology off the ground.

Verizon put out a mixed fourth-quarter report earlier this year. On the one hand, revenues missed expectations and the company said its 2019 adjusted earnings should be flat from 2018. On the other, it added 653,000 postpaid subscribers, which was nearly double the 355,600 that analysts expected.

The accelerated rollout of 5G services during 2019 should provide additional growth momentum. Verizon has partnered with Samsung to launch the nation’s first commercial 5G service in Houston, Indianapolis, Los Angeles and Sacramento.

In addition, the company remains on track to deliver its goal of $10 billion in cumulative cash savings by 2021. Initiatives include zero-based budgeting and an employee buyout program that has already reduced headcount by 10,400 workers.

Verizon generated $34.3 billion in cash flow, which was used to fund $17.6 billion in capital expenditures and $9.8 billion in dividends.While debt appears high at $113.1 billion, Verizon has no significant near-term debt maturities and a comfortable debt-to-EBITDA ratio of 2.3.

Verizon has recorded 14 consecutive years of dividend growth, and its increases have averaged 8.8% annually over the past five years.

AbbVie

- Market value: $118.5 billion

- Dividend yield: 5.4%

Shares of AbbVie (ABBV, $78.75) have taken a beating this year thanks to the announcement of a $4 billion impairment charge in connection with poor clinical trial results from a new cancer drug being developed by Stemcentrx, as well as a drop in Humira sales. AbbVie paid $5.8 billion to acquire Stemcentrx two years ago.

The failure of this one development-stage drug, as well as the dip in Humira revenues, shouldn’t overshadow the steady progress AbbVie has made growing its top line and reducing its dependence on its blockbuster arthritis drug that accounts for 60% of sales. Humira has U.S. patent protection until 2023 but is already facing competition from biosimilars in Europe.

AbbVie recently introduced new oncology drugs (Imbruvica and Venclexta) that are contributing $4 billion to revenues already and are growing at double-digit rates. By 2025, these drugs could add $9 billion to sales. Two new best-in-class immunology agents (Upadacitinib and Risankizumab) are expected to contribute another $10 billion of sales. By 2025, AbbVie expects non-Humira sales to exceed $35 billion versus 2018 total sales of $32.8 billion.

The company has hiked its payout every year for 46 consecutive years, including an 11.5% bump in 2019.

However, Wall Street analysts have soured on ABBV a bit, with only half the analysts covering the stock calling it a “Buy” or “Strong Buy” – the rest are “Holds.”

Exxon Mobil

- Market value: $329.7 billion

- Dividend yield: 4.2%

Integrated energy giant Exxon Mobil (XOM, $77.82) generated $36 billion in cash flow from operating activities – its highest mark in the metric since 2014 – thanks to production gains, better pricing and improvements in its refinery business. Fourth-quarter 2018 liquids production was up 4% year-over-year, thanks in large part to growth in the low-cost Permian Basin.

The company used that cash – as well as $4 billion more from asset sales – to fund $25.9 billion in capital expenditures and $13.8 billion in dividends.

Exxon plans to enhance 2019 production by ramping up activity in key growth areas like the Permian Basin, where it has 38 drilling rigs deployed, and starting up major new drilling projects in Guyana, Brazil and Angola. The company recently made its ninth major offshore discovery in Guyana, acquired additional acreage in Brazil and began producing oil from its Kaombo Project in Angola, where production is expected to reach 230,000 barrels per day.

Exxon also is investing in its refinery operations. The company commenced production at a new line at its Baytow, Texas, processing complex that will produce 1.5 million metric ton of feedstocks per day and supply one of the largest plastics manufacturing facilities in the world. As part of an agreement with China, Exxon is also constructing a massive chemicals plant that will supply plastics feedstocks for the growing Chinese market.

Exxon has a track record of 36 straight years of dividend growth. Over the past five years, dividends have increased 5.6% annually.

Vodafone Group

- Market value: $48.8 billion

- Dividend yield: 6.0%

International telecom giant Vodafone (VOD, $18.28) ranks as the world’s second largest mobile operator, supplying service to well more than 500 million mobile customers worldwide. The company has its primary presence in Europe, but is also well-represented in higher-growth emerging markets such as Africa, Latin America and Asia. In addition, Vodafone recently paid $22 billion to acquire Liberty Global’s (LBTYA) assets in Germany, the Czech Republic, Hungary and Romania, expanding its footprint in these fast- growing Eastern Europe regions.

New CEO Nick Read has made generating more consistent results and improving the productivity of the company’s assets his top 2019 priorities, along with paying down debt. The company expects to capture $11.5 billion of capital expenditures and cost savings from merging Vodafone India with Idea Cellular, and $615 million of cost synergies from merging Liberty Global’s assets.

During the first half of 2018 – announced in November – Vodafone’s earnings fell due to a write-down on the Idea Cellular merger, but EBITDA improved 2.9% year-over-year and the company upped its EBITDA and free cash flow guidance. Vodafone is guiding for 3% EBITDA growth and free cash flow exceeding $6.2 billion, versus earlier guidance of $6 billion.

Vodafone has maintained or grown its dividend every year in the past decade and recently ensured investors no dividend cut was planned. The dividend will be frozen this year to facilitate debt reduction, but growth is likely to resume next year as cost savings fuel free cash flow growth. The company expects to generate nearly $20 billion of free cash flow over the next three years, which is more than enough to cover $4.6 billion of annual dividends.

Vodafone is rated “Buy” or “Strong Buy” by 11 analysts, “Hold” by two analysts and “Sell” by just one analyst.

BP plc

- Market value: $142.8 billion

- Dividend yield: 5.8%

Nine years after the Deepwater Horizon rig disaster, BP plc (BP, $42.29) has re-emerged with one of the best drilling portfolios in the oil and gas industry. Spill damages costing $7 billion to $8 billion per year are predicted to drop to less than $1 billion per year beginning in 2020 and should be easily covered by $6.8 billion of annualized free cash flow.

Last July, BP announced its biggest acquisition in 20 years, paying $10.5 billion for US shale assets owned by mining firm BHP Billiton (BHP). This acquisition increases BP’s American onshore oil-and-gas resources by 57% and should quickly help the company’s bottom line. Unlike offshore assets that take many years to develop, the acquired shale assets can be immediately drilled and monetized.

Two new crude oil discoveries in the North Sea are expected to double BP’s production from that region this year, and new natural gas projects are likely to add 900,000 barrels to production by 2021. In 2018, production grew 3% year-over-year to 3.7 million barrels of oil equivalent per day. As a result, corporate profits more than doubled year-over-year to $12.7 billion.

In addition to prolific drilling assets and world-class refineries, BP is building a presence in retail fuel markets in China and Mexico. The company also holds a major stake in the world’s largest solar project developer and investments in India’s renewable energy market.

BP signaled its improving earnings prospects by hiking its dividend 2.5% in the second quarter. This was the company’s first dividend increase since 2014.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Lisa currently serves as an equity research analyst for Singular Research covering small-cap healthcare, medical device and broadcast media stocks.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

What Fed Rate Cuts Mean For Fixed-Income Investors

What Fed Rate Cuts Mean For Fixed-Income InvestorsThe Fed's rate-cutting campaign has the fixed-income market set for an encore of Q4 2024.

-

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)State Taxes Living in one of these places could lower your 2025 investment taxes — especially if you invest in real estate.

-

The Final Countdown for Retirees with Investment Income

The Final Countdown for Retirees with Investment IncomeRetirement Tax Don’t assume Social Security withholding is enough. Some retirement income may require a quarterly estimated tax payment by the September 15 deadline.

-

What Tariffs Mean for Your Sector Exposure

What Tariffs Mean for Your Sector ExposureNew, higher and changing tariffs will ripple through the economy and into share prices for many quarters to come.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

Stock Market Today: Stocks End Mixed Ahead of Powell

Stock Market Today: Stocks End Mixed Ahead of PowellPolitical upheaval in South Korea kept investors on their toes Tuesday.

-

Stock Market Today: Stocks Drop, Oil Spikes After Iran Attacks Israel

Stock Market Today: Stocks Drop, Oil Spikes After Iran Attacks IsraelA massive port strike and dismal economic data also weighed on the main indexes Tuesday.

-

Stock Market Today: Stocks Gain After Powell Talks Rate Cuts

Stock Market Today: Stocks Gain After Powell Talks Rate CutsA late-day burst of buying power helped the main indexes close higher for the day, month and quarter.