15 Stocks to Buy for an Activist Investor Boost

One of the greatest obstacles to share price appreciation is mediocre management, supported by a complacent board.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

One of the greatest obstacles to share price appreciation is mediocre management, supported by a complacent board. But activist investors offer a solution, targeting poorly managed companies and lobbying them for changes they think will sweeten the share price.

Activist investors look for issues such as weak corporate governance or executive compensation schemes when hunting new stocks to buy. They often then take a significant stake in the company and push for things such as asset sales or the return of excess cash to shareholders. Companies slow to implement change may be threatened with “proxy fights” that result in corporate officers and directors being forced from their seats.

These activist investors sometimes create big windfalls for shareholders. For instance, Carl Icahn pushed eBay (EBAY) to spin off its PayPal (PYPL) business in 2015; since then, PayPal has tripled in value. Activist David Einhorn pressured Apple (AAPL) in 2013, urging the iPhone maker to return excess cash to shareholders. Since fiscal 2012, Apple has returned more than $350 billion in the form of buybacks and dividends, with the vast majority of that coming since 2013.

Here are 17 stocks to buy if you believe in the ideas of their activist investors. Some have just recently come under siege, others are in the middle of proxy fights, and still others have already made truces and have implemented changes to unlock value. But all of these stocks carry significant risk – after all, activist investors typically target struggling companies, and no turnaround is a slam dunk. So invest in small amounts, with funds from the portion of your portfolio dedicated to aggressive holdings.

Data is as of May 1.

Avon Products

- Market value: $1.4 billion

Cosmetics maker Avon Products (AVP, $3.15) dodged a 2018 proxy fight – a fight to convince shareholders to vote for changes, sometimes including the installation of new leaders – with Barington Capital by agreeing to put the investment firm’s top executive on its board. Barington, which still has almost 9% of its portfolio invested in AVP shares, already had successfully pressured Avon to replace its CEO and has been lobbying for the sale of the company.

Avon appears to be inching toward that goal.

Shares rallied in March after a Wall Street Journal report claimed Avon was considering a buyout offer from Brazilian rival Natura Cosmeticos SA. Like Avon. Natura sells its cosmetics through a direct sales force. Natura is reportedly interested in acquiring Avon’s privately held North American business and the publicly traded business that operates internationally. Natura Cosmeticos confirmed in a late April statement that it was indeed in talks, and Reuters reported that one person familiar with the talks said they were in advanced stages.

If so, that will be a nice bump for shareholders. If not, the company’s operations are a mixed bag.

On one hand, Avon suffered its worst trading day in almost two years in February after its fourth-quarter results disappointed. Analysts cited challenges in modernizing Avon’s direct-sales model and the loss of many direct-sales reps. The company also has been criticized for failing to develop a successful online strategy.

But Avon has launched a new content tool to support e-commerce growth, and it’s also working on streamlining its business. In September 2018, it announced it would cut about 100 positions and sell one of its New York facilities as part of a broader streamlining effort. AVP also has divested a manufacturing facility in China.

Bed Bath & Beyond

- Market value: $2.2 billion

Three activist funds are threatening a proxy attack on home goods retailer Bed Bath & Beyond (BBBY, $16.30) to force the ouster of the company’s entire 12-member board. They claim that Bed Bath & Beyond has been too slow to adapt to changing consumer tastes, resulting in eight straight quarters of declining same-store sales, and has allowed cost increases to steadily erode margins.

Bed Bath recently said that five of its directors will step down. Ancora Advisors, Legion Partners and Macellum Capital Management recently wrote more than 150 pages explaining why shareholders should vote in their set of nominees for the newly opened seats. The outsiders want Bed Bath & Beyond to focus on its core business and consider shedding non-core brands like Buy Buy Baby and Cost Plus World Market. All of their initiatives should produce more than $5 in earnings per share within three to five years, the activist investors say.

The company’s shares hit 20-year lows during the fourth-quarter market selloff last year, though that was also prompted by a miserable report in September that included flat revenues, declining same-store sales and a profit miss. Standard & Poor’s downgraded the retailer’s credit rating to junk status. Analysts piled on with bearish opinions.

Bed Bath & Beyond has rebounded by 40% in 2019, however, with much of that coming on activist investor interest. But a January announcement that the company was ahead of schedule in implementing a profit improvement plan also put a jolt into shares.

Raymond James analyst Bobby Griffin in March upgraded his rating on the stock to “Strong Buy” and commented that, while his analysis is based on a takeout scenario, many of the factors that make Bed Bath & Beyond an attractive takeover candidate also hold true for the activist case. Morgan Stanley analyst Simeon Gutman reiterated an “Underperform” rating on the stock but believes the recent activist efforts have set a floor for the share price.

Bloomin’ Brands

- Market value: $1.8 billion

Barington Capital also is involved with restaurant chain operator Bloomin’ Brands (BLMN, $19.68), whose brands include Outback Steakhouse, Carrabba’s Italian Grill, Bonefish Grill and Fleming’s Prime Steakhouse and Wine Bar. The company owns or operates approximately 1,500 restaurants across 48 states.

Barington wrote more than a year ago that it wants changes at Bloomin’, among them selling or spinning off some of its chains, as well as improvements to “enhance the guest experience.”

Barington followed up in October, pushing the company to hire an independent chair. In March, Bloomin’ said it was promoting its CFO to CEO and moving its former chief into the board’s executive chair slot – but said it was a planned move unrelated to Barington’s saber-rattling.

BLMN shares did surge in February after the company topped revenue and profit estimates while improving their same-store sales, but the stock still is underperforming the market, up almost 11% to the market’s 16%.

And during its March Analyst Day, the company shared financial performance targets that include 1.5%-2.0% comparable stores sales growth, 10%-15% annual shareholder returns and adding 20 to 40 new restaurants per year.

How effective Barington will be largely hinges on Bloomin’s ability to make its own improvements and turn shares around first – in a way, that’s a win-win, as it makes it more likely for shareholders to get positive change one way or another. But if Bloomin’s initial efforts are unsuccessful, the stock could get much cheaper before it turns around.

Campbell Soup

- Market value: $11.5 billion

Iconic soup and snack maker Campbell Soup (CPB, $38.32) ended a proxy fight with hedge fund Third Point at the end of 2018.

Third Point, led by famed activist investor Daniel Loeb, accused the iconic soup purveyor of misleading investors about the qualifications of board members – three heirs of Campbell Soup founder John Dorrance serve on the board and together control 37% of the company’s stock – and being vague about its CEO search. Third Point also complained that management’s strategic plan lacked transparency and pushed for the sale of some units.

Under pressure, Campbell added two new independent directors and gave the activist firm input on a third director who will be added at the May annual meeting. Third Point also persuaded Campbell to hire a new CEO who previously ran Pinnacle Foods and has deep food industry experience.

Campbell initially was targeted because of declining organic sales, ill-advised acquisitions that loaded the company with debt and the abrupt departure of its CEO in 2018.

Although Campbell’s sales are growing at double-digit rates due to contributions from acquisitions, organic sales are falling as a result of pricing competition. Earnings also have been hurt by rising interest expense and promotional spending.

Third Point recently persuaded the company to sell its Garden Fresh Gourmet business, and CPB is in the process of divesting its Campbell Fresh and Campbell International businesses. The sale proceeds will be used to reduce debt. So far, shareholders like what they have seen, driving shares up 14% in 2019 in steady order.

Cars.com

- Market value: $1.4 billion

Activist hedge fund Starboard Value didn’t sugarcoat its message to online auto shopping site Cars.com (CARS, $20.38). In December 2018, after roughly a year of prodding Cars.com, Starboard criticized the company for a continuous trend of customer losses and revenue declines, mounting expenses and a pattern of missed expectations and downward guidance.

Starboard pushed the company to set realistic financial targets and devise a plan for meeting them. Starboard thought Cars.com should be able to generate roughly $4 per share of adjusted free cash flow by 2020 and warned of more aggressive action if signs of progress weren’t seen, including management changes or a forced sale of the business.

While Cars.com’s initial response said very little, the company in January said it was considering strategic alternatives that could include the sale of the business. Analyst outfit Benchmark Capital thinks Cars.com could fetch prices in the high $20s or low $30s from a buyout deal, while analysts from Barrington Research thinks it could sell for $40 to $45. Research believes the sale price could go as high as $40-45 per share.

Barring a buyout, Cars.com missed slightly on revenues in the fourth quarter of 2018, but posted adjusted earnings that were almost twice analyst estimates. Barrington Research analyst Gary Prestopino saw signs of progress in rising average monthly unique visitors to the firm’s website and increased monthly revenues per dealer, which he felt justified his “Outperform” (equivalent of “Buy”) rating on the stock.

Dollar Tree

- Market value: $26.2 billion

Starboard Value also reached out to Dollar Tree (DLTR, $109.65), in early January, to argue for changes. The activist wants the discount retailer to test a multi-price point strategy under the Dollar Tree banner and turn around its underperforming Family Dollar chain, which has consistently been a drag on the company’s valuation since it was acquired in 2015.

Starboard thinks Dollar Tree could be worth $150 per share if its recommended changes are implemented.

Dollar Tree announced plans in March to close 390 Family Dollar stores and renovate another 1,000 locations. The renovated stores will sell alcohol and have a wider merchandise selection, with some also offering more fresh and frozen foods. It’s not only scaling back, however. The company plans to open 350 new Dollar Tree stores and 200 new Family Dollar stores in 2019.

Dollar Tree also has agreed to the price-point tests, and Starboard said in early April that it’s withdrawing its board nominations and ending its proxy fight.

Telsey Advisory Group analyst Joe Feldman recently upgraded his rating to “Outperform” and raised his DLTR price target to $117 after a meeting with management persuaded him that Dollar Tree would return to earnings growth in the second half of fiscal 2019. Also in March, UBS analyst Michael Lasser increased his price target to $120 while maintaining his “Buy” rating.

Genesco

- Market value: $795.1 million

Nashville-based Genesco (GCO, $43.33) sells footwear and accessories through more than 1,500 retail stores across North America, the U.K., Ireland and Germany. The company’s best-known brands in the U.S. market are Journeys, Schuh and Johnston & Murphy.

Genesco was targeted by activist investors Legion Partners and 4010 Capital because of weakening results from its Lids hat business, which activists said were dragging down overall performance.

The company reached a “cooperation agreement” with Legion and 4010 about a year ago. Genesco agreed to elevate two new independent directors to the board, sell the Lids business and return all or most of the sale proceeds to investors through share repurchases or a special dividend. Lids indeed was sold in December for $100 million. Genesco said in December that it would use the cash proceeds for share repurchases, boosting the existing buyback authorization to $125 million.

So far, things look better from an operational standpoint. Genesco increased net sales from continuing operations by 3% in the year ended February 2019 and grew comparable-store sales by 5% – the biggest increase in three years. Adjusted earnings per share jumped 23% year-over-year. The stock hasn’t caught up yet, though, up just 6% over the past year versus about 10% for the S&P 500.

Mattel

- Market value: $4.2 billion

- Mattel (MAT, $12.04) owns iconic brands like Barbie, Fisher-Price, Hot Wheels, Thomas & Friends and American Girl.

Southeastern Asset Management took a 10.25% stake in the toymaker in late 2017 after shares plummeted – the result of a lousy earnings report and a downgrade in Mattel’s debt to junk status.

Since then, Southeastern and other activists have convinced Mattel to add a former Lego executive to its board, bringing badly needed toy industry experience, and to hire a new CEO, Ynon Kreiz, who has television and film industry experience. Kreiz plans to strengthen Mattel’s brands by releasing a live-action Barbie film in 2020, developing 22 animated and live-action TV shows based on Mattel’s characters and partnering with MGM to produce films based on the American Girl and View-Master toy lines.

Kreiz also is targeting a $650 million reduction in manufacturing costs to boost margins.

Mattel has been a roller-coaster stock in 2019, down 14% over the past year but up 20% so far through the first four months of 2019. That included a massive surge in February on strong fourth-quarter earnings – then a huge boomerang move lower a week later after saying sales would be flat this year. However, insiders have started buying stock for the first time since last year, when Kreiz was named CEO. That includes a $1 million purchase in February by the chief himself – essentially betting on a turnaround of his new company.

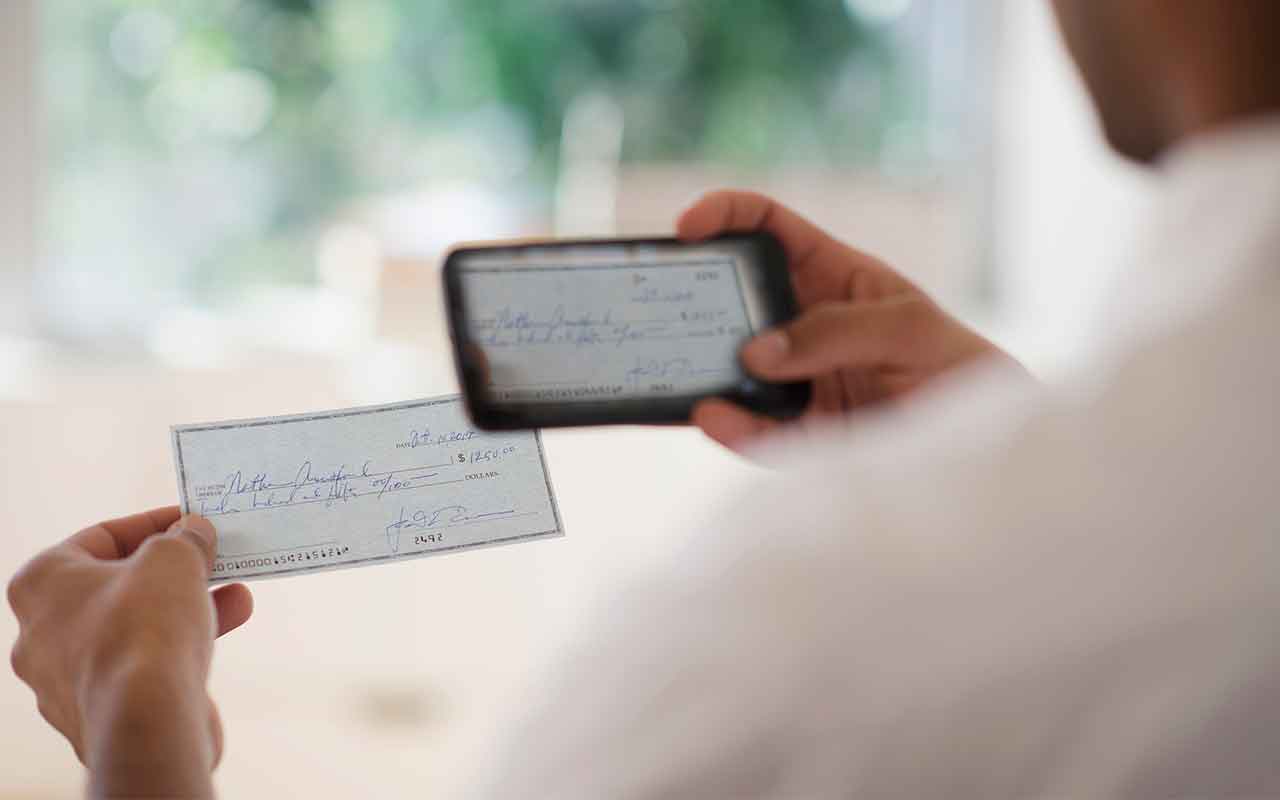

Mitek Systems

- Market value: $467.5 million

- Mitek Systems (MITK, $12.07) is a dominant player in the mobile check deposit market. Its technology is used by approximately 6,100 American banks to verify customer identities and process mobile deposits. It also has been through some turmoil: Trading in the stock was halted last August after shares plummeted following the announcement that its CEO and CFO both planned to leave.

However, Mitek’s activist investor interest didn’t begin until October 2018, when it rejected a buyout offer from Florida-based ASG Technologies that was backed by activist Elliott Management. Elliott then approached Mitek’s board to ask for board changes, relief from a poison pill (so it could boost its stake to 14.9%) and reconsideration of ASG’s takeout offer.

In December, ASG increased its cash offer for Mitek from $10 to $11.50 per share. Mitek responded that the new offer was still too low but offered ASG another opportunity to sweeten its bid if Elliott and ASG agreed to a confidentiality contract during the due diligence period.

Mitek reportedly attracted multiple offers from potential buyers, with Benchmark analyst Mark Schappel suggesting Jack Henry (JHKY), Fidelity National Information (FIS) and Paylocity (PCTY), among others, could be interested.

No deal has emerged, but in March, Schappel increased his price target on Mitek from $12 to $15 and reiterated his “Buy” rating, citing the expansion in industry valuation multiples since his earlier report, continued positive progress by Mitek and the company’s recent hiring of a new CEO.

Unlike the typical under-performing activist target, Mitek has an impressive track record of 30%-plus annual sales growth over seven years and 20 consecutive quarters of adjusted profits, as of the quarter reported in January. The company participates in a $10 billion worldwide mobile payments market estimated to be growing 16% annually.

Nestle SA

- Market value: $285.9 billion

Loeb’s Third Point has encouraged Nestle SA (NSRGY, $96.12), the world’s largest packaged food company, to speed up its pace of divestitures and set more aggressive profit margin targets.

In a 34-page letter to Nestle last year, Third Point urged the spin off non-core businesses, the reorganization of Nestle into beverage, nutrition and grocery businesses and the recruitment of outside directors who have food industry expertise.

Nestle has responded by divesting its Gerber Life Insurance and U.S. confectionery businesses and announcing plans to sell its Nestle Skin Health and Herta charcuterie operations. Several private-equity firms are bidding on the skin-care business, which sources say could fetch as much as $7 billion.

Nestle also is pursuing deals in high-growth markets such as pet care, infant nutrition and premium waters. The company is looking to acquire Canada-based Champion Petfoods and signed a deal with Starbucks (SBUX) last year to sell its packaged coffees and teas worldwide.

Lastly, the foods giant has committed to operating margin goals of 17.5% to 18.5% by 2020 and accelerating its $20.8 billion share repurchase program.

Newell Brands

- Market value: $6.1 billion

About a year ago, consumer goods giant Newell Brands (NWL, $14.35) agreed to add four new board members proposed by activist Carl Icahn, including Icahn’s son Brett. Icahn has a nearly 9% stake in the company.

Newell owns well-known consumer brands including Paper Mate and Sharpie pens, Elmer’s glue, Coleman stoves, Rubbermaid containers and Graco car seats.

Despite recent asset sales that include the $500 million sale of the Process Solutions business and the Rexair business for an undisclosed sum, sales trends remained disappointing. The new Newell board put pressure on CEO Michael Polk, who announced in March that he would retire after this year’s second quarter.

Newell has sold or plans to sell eight businesses that together represent about 35% of the company’s sales. These include its Team Sports, Beauty, U.S. Playing Cards, Jostens and Pure Fishing operations. The remaining businesses are expected to generate annualized revenues of approximately $9.5 billion by 2020 and operating margins roughly 300 basis points above current levels.

The company said the proposed asset sales would generate enough proceeds to deleverage its balance sheet while creating a leaner, more profitable Newell. But Newell did disappoint analysts by later saying it expected to raise just $8.8 billion from asset sales, down from a $9 billion estimate. Still, that will help enormously in hacking away at most of the company’s debt and simplifying the business.

PayPal

- Market value: $130.3 billion

Daniel Loeb’s Third Point established a stake in PayPal (PYPL, $110.94) last July because it likes the online payments business. According to Third Point, PYPL could be the next Netflix (NFLX) or Amazon.com (AMZN), offering as much as 50% upside over its July share price of $86.

PayPal serves more than 267 million customer accounts, including 21 million merchant accounts. Since its spinoff from eBay, the company has aggressively expanded its payment platform via acquisition, emerging as the dominant player in online transactions.

PayPal’s revenues grew 21% in 2018, filtering down to a 28% jump in adjusted profits. The company added 39 million new active accounts last year, including 2.9 million via acquisitions. Third Point especially likes the company’s Venmo social payments app, which surpassed eBay volumes for the first time in 2018, and the company’s ability to generate free cash flow, which was an adjusted $3.2 billion last year.

PayPal is guiding for 16%-17% revenue growth and 17%-20% gains in non-GAAP EPS in 2019. The company also anticipates generating more than $3 billion in free cash flow.

Nomura analyst Bill Carcache has a “Buy” rating and recently raised his PayPal price target, noting strong core operating trends despite currency headwinds. BTIG analyst Mark Palmer also boosted his price target and reiterated his “Buy” rating. He said PayPal deserves a premium multiple because it can grow twice as fast as its peers.

QEP Resources

- Market value: $1.7 billion

An unsolicited buyout bid sent shares of oil and gas producer QEP Resources (QEP, $7.23) up 40% in January. Elliott Management, which began accumulating its 5% stake last September, made its buyout offer contingent on QEP closing the $735 million sale of its oil and natural gas operations in Louisiana.

In a letter to the company, Elliott commented that QEP has made significant progress repositioning itself as a pure play on the Permian Basin, but thought an outright sale of the business would create greater value for shareholders. Elliott offered $8.75 a share for QEP, which was a 44% premium over the pre-buyout offer.

QEP said it was considering Elliott’s offer and terminated an agreement to sell its Williston Basin assets to Vantage Energy (VEAC).

While QEP waits for a resolution, it also has announced plans to cut 45% from general and administrative expenses over the next two years to make its cost structure competitive with industry peers. This announcement followed the release of fourth-quarter 2018 sales and earnings that fell short of analyst estimates.

SandRidge Energy

- Market value: $295.5 million

Two years post-bankruptcy, SandRidge Energy (SD, $8.28) is making headway thanks to unsolicited help from legendary investor Carl Icahn.

SandRidge was a successful early player in the shale drilling boom but earned Icahn’s wrath after a failed bid to acquire Bonanza Creek Energy. Icahn called the deal too expensive.

Icahn won control of the board in June of last year after a proxy fight. He argued that SandRidge was overpaying executives, had offered too much for Bonanza, had failed to pursue a buyout offer from MidStates Petroleum (MPO) and was blocking progress with a “poison pill” that entrenched management.

Icahn installed new management, put in place a formal process for reviewing buyout offers that requires a shareholder vote and pushed through a top-to-bottom review of SandRidge’s executive compensation plan.

The stock has bombed by more than 50% since Icahn won his proxy vote, but the company is starting to show operational improvements. SandRidge produced 12.3 million barrels of energy last year and has proved reserves valued at $1.04 billion, which is roughly three times its market value. The company generated $167 million of adjusted EBITDA in 2018 and has no net debt. Also, its borrowing capacity exceeds $356 million, which gives SandRidge ample flexibility for small acquisitions or stepping up its drilling activities.

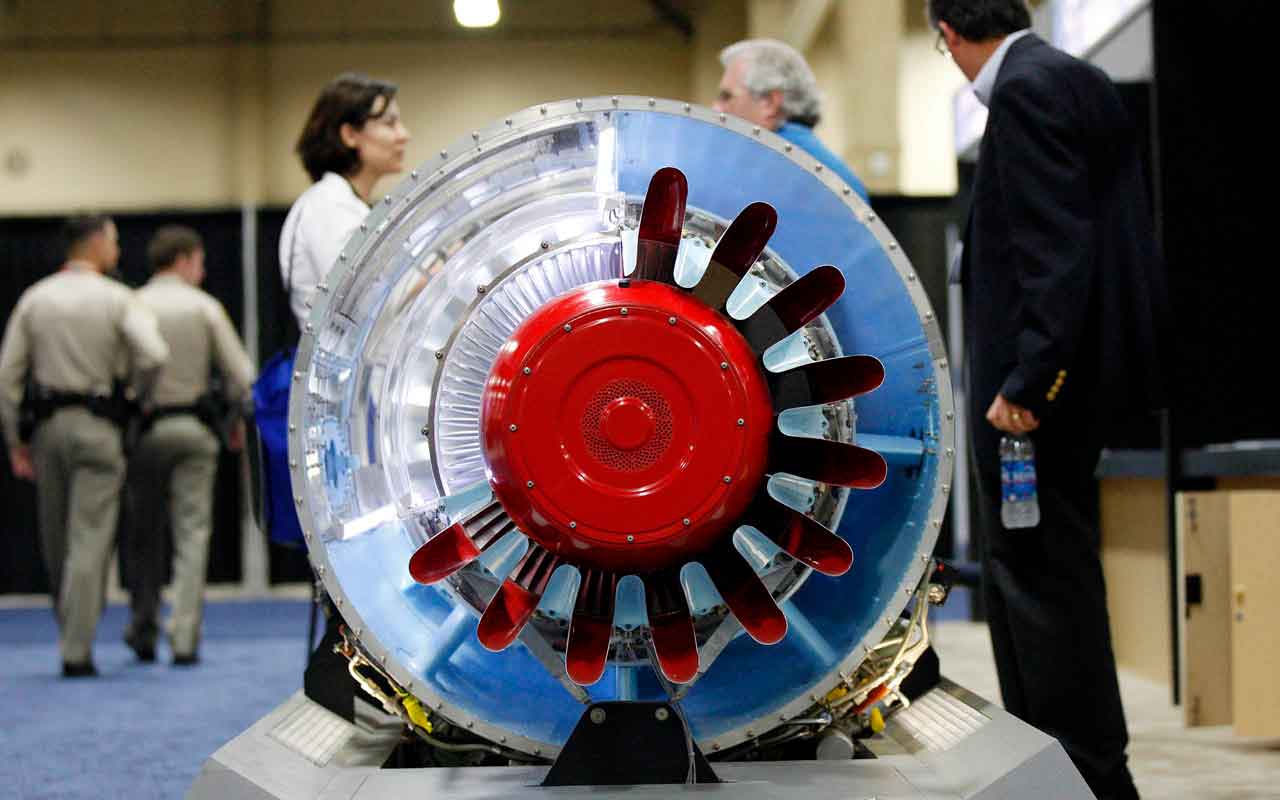

United Technologies

- Market value: $122.1 billion

- United Technologies (UTX, $141.58) is the maker of Pratt & Whitney jet engines, Otis elevators and Carrier air conditioners. And Third Point and Pershing Square Investors were instrumental in pushing UTX to separate into three businesses, suggesting the breakup – which will split Otis and Carrier off into their own companies – could unlock $20 billion of incremental shareholder value.

In a year-end 2018 letter to investors, Pershing Square said the company’s aerospace and elevator businesses are well-insulated from cyclicality because of strong order bookings, multiyear backlogs and long-term service contracts. United Technologies has committed to breaking up its businesses and recently hired two veteran CEOs to guide the company through the spinoff process.

Morgan Stanley analyst Rajeev Lalwani sees a favorable risk/reward for United Technologies, calling shares “far from broken.” He has an “Overweight” rating on United Technologies and a $150 share price target, which he based on his sum-of-the-parts analysis.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Lisa currently serves as an equity research analyst for Singular Research covering small-cap healthcare, medical device and broadcast media stocks.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

Why I Trust These Trillion-Dollar Stocks

Why I Trust These Trillion-Dollar StocksThe top-heavy nature of the S&P 500 should make any investor nervous, but there's still plenty to like in these trillion-dollar stocks.

-

Stocks Slip Ahead of July CPI Report: Stock Market Today

Stocks Slip Ahead of July CPI Report: Stock Market TodayThe latest inflation updates roll in this week and Wall Street is watching to see how much of an impact tariffs are having on cost pressures.

-

Nasdaq Ends the Week at a New High: Stock Market Today

Nasdaq Ends the Week at a New High: Stock Market TodayThe S&P 500 came within a hair of a new high, while the Dow Jones Industrial Average still has yet to hit a fresh peak in 2025.

-

Stocks Swing Lower as Eli Lilly, Fortinet Spiral: Stock Market Today

Stocks Swing Lower as Eli Lilly, Fortinet Spiral: Stock Market TodayThe main indexes finished well off their session highs after a disappointing batch of corporate earnings reports.

-

Stocks Rally on Apple Strength: Stock Market Today

Stocks Rally on Apple Strength: Stock Market TodayThe iPhone maker will boost its U.S. investment by $100 billion, which sent the Dow Jones stock soaring.

-

The Best Stocks of the Century

The Best Stocks of the CenturyAs we near the 25-year mark, we looked at which stocks have returned the most. Here are the 10 best stocks of the century so far.

-

Stock Market Today: Nasdaq Hits a New High as Nvidia Soars

Stock Market Today: Nasdaq Hits a New High as Nvidia SoarsA big day for Nvidia boosted the Nasdaq, but bank stocks created headwinds for the S&P 500.

-

Stock Market Today: Mixed Messages Muddle Markets

Stock Market Today: Mixed Messages Muddle MarketsStocks cruised into pre-market action on encouraging news for the AI revolution but stumbled on yet another policy disturbance.