19 Surprising Stocks With a History of Earnings Surprises

Positive earnings surprises – when profits beat consensus analyst estimates – can have a huge impact on a company’s share price.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Positive earnings surprises – when profits beat consensus analyst estimates – can have a huge impact on a company’s share price. These surprises show that management can both manage and exceed expectations, not to mention “beats” often lead to share-price gains as investors realize Wall Street might be underappreciating these overachievers.

For instance, a FactSet Research study examining Standard & Poor’s 500-stock index components from Q4 2008 to Q1 2018 found that companies that posted positive EPS surprises gained 1.24% on average in the four-day window surrounding their earnings announcement.

Far more significant was what earnings surprises portended for long-term performance. Golden Capital and FactSet Research tracked S&P 500 companies over 15 years and found that those that reported positive EPS surprises experienced bigger share price gains than those that had not – even in cases where the stock’s short-term response to positive surprises was minimal. While the S&P 500 more than tripled over the study’s timeline, positive surprisers more than quadrupled.

The lesson: Companies that properly manage expectations and can “beat the Street” regularly tend to provide stronger long-term performance – even if the initial response isn’t strongly bullish.

Here are 19 great stocks that have delivered positive earnings surprises averaging 10% or better over the past four quarters. Many of these stocks are off the beaten path, most of these stocks have generated double-digit annual earnings growth over the past five years, and all produced double-digit EPS gains in their most recent fiscal year.

Data is as of April 22. Average positive EPS surprise and growth data provided by Zacks Investment Research. Average positive EPS surprise data refers to the average across the past four quarters and is provided by Zacks Investment Research. Five-year average annual adjusted EPS growth data provided by Seeking Alpha.

Bristol-Myers Squibb

- Market value: $73.9 billion

- Average positive EPS surprise: 14.3%

- 5-year average annual adjusted EPS growth: 14.3%

Drugmaker Bristol-Myers Squibb (BMY, $45.24) is a pure-play specialty pharmaceutical giant with industry-leading franchises in oncology, hematology, cardiovascular health and immunology. It owns top-selling drugs such as Opdivo and Yervoy (cancer), Eliquis (heart disease) and Orencia (inflammation).

It’s about to get bigger, too. Bristol-Myers shareholders recently approved the $74 billion buyout of biotech company Celgene (CELG). The merger will create the No. 1 drug company in oncology and cardiovascular health and a top-five competitor in immunology and inflammation treatment. Post-merger, BMY will own nine blockbuster drugs (greater than $1 billion in annual sales). Meanwhile, its pipeline will feature six new products poised for near-term launch that are expected to add more than $15 billion in revenues, 10 drugs in Phase III studies and more than 50 new products in earlier stages of development.

Other benefits: The merger will reduce Bristol-Myers’ reliance on its top three drugs from 70% of sales to just 45% and create $2.5 billion in synergies. The company expects the transaction to be 40% accretive to EPS in the first year and 10% accretive each year thereafter through 2025.

The company’s sales improved by 9% last year and adjusted EPS rose 32%, fueled by big sales gains for Opdivo and Eliquis. And encouragingly, the company has beaten EPS estimates for four consecutive quarters, with positive earnings surprises ranging from 11% to 16%. BMY’s next earnings report is due out before the opening bell on Thursday, April 25.

CACI International

- Market value: $4.7 billion

- Average positive EPS surprise: 29.0%

- 5-year average annual adjusted EPS growth: 12.1%

Mid-cap defense contractor CACI International (CACI, $187.51) supplies business systems, command-and-control hardware and software, cybersecurity products and other high-tech solutions, primarily to agencies of the U.S. government.

CACI plans to enhance its cybersecurity capabilities by acquiring LGS Innovations, a designer of signals intelligence, electronic warfare and cyber products.

At the end of 2018, CACI was awarded a multiyear IT enterprise solutions contract with the U.S. Army valued at up to $12.1 billion. CACI will provide the Army with end-to-end IT enterprise solutions in cyber security, network integration, telecom operations and supply chain management.

Thanks to military contract awards totaling a record $5.2 billion in the fiscal year ended June 30, 2018, CACI increased EPS by 84% in fiscal 2018. At year-end, the company’s contract backlog totaled $11.3 billion and a pipeline of submitted bids exceeded $8.2 billion. During the first half of the year ended June 30, 2019, new business wins produced a 37% improvement in CACI’s adjusted EPS.

The company has been on a roll lately, producing four straight quarters of high-double-digit EPS surprises and three-year average annual EPS growth of about 24%. It hasn’t missed a quarterly estimate in at least three years – a streak it will try to maintain when it reports earnings after the May 1 close.

Vertical Research Partners analyst Krishna Sinha upgraded CACI from “Buy” to “Top Pick,” in March, writing that CACI is undervalued and not given enough credit for the expert way it deploys capital.

American Financial Group

- Market value: $8.9 billion

- Average positive EPS surprise: 12.0%

- 5-year average annual adjusted EPS growth: 2.5%

- American Financial Group (AFG, $99.72) is an insurance holding company that primarily operates in commercial property and casualty insurance, as well as annuities. AFG specializes in niche property and casualty products such as coverage for builders’ risk, contractors’ equipment, truck and marine cargo, boat dealers and excursion vessels. The company also offers crop insurance for farmers and coverage for truck and bus fleets.

Solid growth in specialty products and a surge in annuity premiums produced record core earnings and roughly 11% EPS gains for AFG in 2018 – well above the company’s typical single-digit profit growth.

Even after rewarding shareholders with a 14% dividend hike and a $3.00-per-share special dividend, American Financial Group still ended 2018 with $690 million of excess capital still available for acquisitions and organic growth.

AFG has only missed one quarterly earnings mark over the past three years – but that miss came during Q4 earnings reported earlier this year, so keep a closer eye on this stock. But even with the miss, the average quarterly positive EPS surprise last year was 12%. Next up is the company’s first-quarter report, due out after the May 1 closing bell.

Ternium SA

- Market value: $5.3 billion

- Average positive EPS surprise: 25.1%

- 5-year average annual adjusted EPS growth: 27.0%

- Ternium SA (TX, $26.48) is Latin America’s largest flat-steel producer, with manufacturing operations in Mexico, Brazil, Argentina, Columbia and the U.S. The company produces high-value-added steel products for the automotive, home appliance, construction, capital goods, container, food and energy industries.

Most of the company’s recent growth comes from Mexico and Columbia, where Ternium has opportunities to boost market share against imports. Argentina has been a challenge because of economic and currency issues associated with that market.

Ternium mined 3.6 million tons of iron ore and shipped nearly 13.0 million tons of steel last year on the back of strong demand and rising steel prices in Mexico and the successful integration of its acquired Brazilian operations, which benefitted from strong demand for slab steel. That helped generate record income and 70% EPS growth in 2018.

The company has produced eight consecutive quarters of positive earnings surprises, including two massive estimate beats of 59.8% and 62.7% in 2018. The size of those beats suggests that Ternium might be misunderstood or habitually underestimated. We’ll see if that continues before the May 2 opening bell, when TX is expected to report its quarterly financials.

Zacks Equity Research considers Ternium a top value pick based on the company’s strong value metrics and big EPS surprises. Goldman Sachs analyst Thiago Olea initiated coverage in December with a “Buy” rating, commenting that the company should benefit from Brazil’s improving economy, as more steel is demanded for infrastructure projects.

Green Dot

- Market value: $3.2 billion

- Average positive EPS surprise: 17.4%

- 5-year average annual adjusted EPS growth: 23.5%

- Green Dot (GDOT, $61.00) is a financial-technology and banking firm that markets prepaid debit cards, secured credit cards and other banking products under the Green Dot, GoBank and RapidPay brands. It generates sales via more than 100,000 retailers nationwide, as well as numerous pay-card partners, direct-to-consumer websites, tax preparation offices, neighborhood check cashing locations and leading app stores.

Walmart (WMT) is the company’s largest retail partner – and in fact, its heavy dependence on the big-box retailer is actually listed as a potential risk in the company’s corporate materials.

Green Dot had 5.3 million active accounts as of the final quarter of 2018, and processed more than 10.9 million cash transfers during those three months alone. EPS improved by a little more than 35% in 2018.

Green Dot has delivered at least four consecutive years of positive quarterly earnings surprises, with beats ranging from 8% to 37% last year. The company’s average EPS surprise was just above 17%. Next up: A report after the May 8 close.

GDOT shares rose in September when SunTrust analyst Andrew Jeffrey said he expects double-digit organic EBITDA (earnings before interest, taxes, depreciation and amortization) growth to continue on the strength of new mobile banking initiatives and payroll products. Shares have rolled back considerably since then, but Keefe, Bruyette & Woods analyst Steven Kwok upgraded his rating to “Outperform” and said this pullback presents a good entry point. He also says while there are concerns about a potential May 2020 renewal with Walmart, those concerns are priced in, and the company is diversifying through partners such as Intuit (INTU) and Uber.

Methode Electronics

- Market value: $1.1 billion

- Average positive EPS surprise: 22.5%

- 5-year average annual adjusted EPS growth: 13.0%

- Methode Electronics (MEI, $29.44) is a global designer, engineer and manufacturer of devices that send signals through sensors, interconnections and controls. The company mainly serves customers in the automotive, industrial and medical industries. Methode operates worldwide, with manufacturing operations in the US, Europe and Asia, and holds more than 780 patents on its technologies.

Acquisitions are key to the company’s growth and contributed 79% of 2018 revenues. While purchase-related depreciation and amortization has impacted EPS growth, over the past decade, Methode’s EBITDA has expanded at a 26% annual rate. During the first nine months of the fiscal year ending in April 2019, the company’s adjusted EPS rose 13% as a result of big gains in industrial sales and a better performance by the automotive segment.

Methode has produced three positive EPS surprises over four quarters, including a huge 54% positive surprise in the quarter ended January 2019. Its next report has not yet been scheduled.

Robert Baird analyst David Leiker upgraded his rating on Methode to “Outperform” in December. Catalysts for driving the share price higher include the Grakon acquisition, which adds significant new revenues and margin expansion, and the company’s exposure to General Motors’ (GM) new T1XX pickup/SUV platform.

MasTec

- Market value: $4.0 billion

- Average positive EPS surprise: 17.3%

- 5-year average annual adjusted EPS growth: 13.4%

- MasTec (MTZ, $52.35) is a leading infrastructure construction firm operating primarily in North America. MasTec builds and installs wireless and fiber optic telecom networks, energy pipelines and facilities, electrical transmission grids and power-generation assets such as windmills. Most of the company’s sales are to oil-and-gas and telecom-infrastructure customers.

MasTec has generated 20% average annual sales growth and 26% yearly EBITDA gains between 2007 and 2018. Major investments by large telecom providers in 5G networks bodes well for MasTec’s future growth, with network infrastructure investments estimated to range from $60 billion to $250 billion over the next decade.

In the energy segment, the company also will benefit from plans for more than 10,000 miles of new American pipeline to be built over the next three years, mainly in the Permian Basin (Texas and New Mexico). Another 12,000 miles of new pipelines are planned in Mexico.

MasTec’s adjusted EPS rose 29% in 2018, and the company is guiding for at least 15% EPS growth this year. MasTec hasn’t missed an earnings estimate since 2016 and produced quarterly positive surprises averaging 17% last year. It will next report earnings after the May 2 close.

In December 2018, Stifel analyst Noelle Dilts added MasTec to his “Top Selections” list for 2019, commenting in his note that MasTec’s energy and telecom infrastructure businesses will be firing on all cylinders as full-scale 5G rollout begins. rollout of 5G begins. In addition to major opportunities in telecom, Dilts believes MasTec’s EPS guidance may prove conservative given a robust outlook for energy pipeline construction though 2020.

Lennar

- Market value: $16.8 billion

- Average positive EPS surprise: 67.5%

- 5-year average annual adjusted EPS growth: 20.2%

- Lennar (LEN, $52.05) has shed its title insurance and real estate brokerage operations to focus solely on homebuilding. Through its Lennar Multifamily operations, the company is one of the country’s largest developers of apartment communities. Lennar has interests in 55 apartment communities valued at $6.3 billion. Of these, 23 communities are completed and operating, five are in the leasing stage, 19 are under construction and the remainder are under contract.

The company constructed 45,627 new single-family homes last year, and the average sale price for a Lennar home is $413,000. Lennar ended 2018 with backlog of homes under sales contracts exceeding $6.6 billion and anticipates delivering most of those homes to customers in 2019.

Lennar has generated 28% annual sales growth and 20% yearly EPS gains over the past five years. Adjusted EPS improved 65% in 2018, fueled by a 55% increase in home deliveries and a 51% rise in orders for new homes. Home deliveries fell short of the company’s guidance in the February 2019 quarter due to weather-related issues, causing a negative EPS surprise, but the company sees housing markets improving in the May quarter.

Lennar’s long-term management hasn’t been stellar, with a peppering of misses over the past four years. But the company has posted three positive profit surprises over the past four quarters – all double-digit beats. Even with a miss last quarter, Lennar’s average quarterly positive EPS surprise over four quarters was impressively high at more than 67%. Lennar’s next report should come in late June.

JPMorgan analyst Michael Rehaut has an “Overweight” rating on Lennar and recently added the company to the firm’s “Focus List” of companies with the potential to increase earnings over multiple fronts. KeyBanc analyst Kenneth Zener also rates the stock “Overweight” and thinks homebuilders will benefit from an improved macro environment this year. Keefe, Bruyette & Woods analyst Jade Ramani likes Lennar for its product segmentation and large geographic footprint.

Arista Networks

- Market value: $25.1 billion

- Average positive EPS surprise: 11.4%

- 5-year average annual adjusted EPS growth: 41.1%

- Arista Networks (ANET, $327.60) supplies software-based cloud networking solutions to large-scale Internet companies, cloud services providers and data campuses. The company offers a wide variety of gigabit ethernet switches that significantly improve the price and performance of datacenter networks.

Demand for cloud connectivity is skyrocketing, and Arista is capitalizing on its industry-leading technology to grow market share, sales and earnings. Arista in October 2018 won a $100 million multiyear contract from the Department of Defense that previously had been awarded to Cisco Systems (CSCO).

In the past five years alone, Arista has increased revenue 43% per year and expanded EPS 41% annually. Adjusted EPS rose 42% in 2018, fueled by acquisitions and new products such as network architecture that addresses the transition to IoT (Internet-of-Things) and an improved multi-function platform for cloud computing.

Arista has outperformed analyst estimates every quarter for the past four years and produced quarterly EPS surprises ranging from 9% to almost 15% in 2018. The company’s average quarterly EPS surprise was 11%. Arista’s next report is due out after the May 2 close.

Goldman Sachs analyst Rod Hall in March added Arista to the firm’s “Conviction Buy” list for 2019 and sees significant growth opportunities for the firm in data campus switching. He notes that Arista has one of the highest EPS growth rates in his coverage universe and looks for 23% sales growth this year and next.

Curtiss-Wright

- Market value: $4.8 billion

- Average positive EPS surprise: 17.0%

- 5-year average annual adjusted EPS growth: 16.4%

- Curtiss-Wright (CW, $112.16) manufactures precision components and highly engineered products for the aerospace, defense, industrial and power generation markets. The company’s instruments are used in most military fighter jets, unmanned aerial vehicles, helicopters, ground vehicles and naval vessels. Curtiss-Wright also provides avionics and electronics, flight test equipment and aircraft data management systems for the commercial aerospace industry.

CW’s adjusted EPS rose 28% in 2018 as a result of higher sales in all its end markets, led by strong naval defense and industrial demand. The company also benefitted from last year’s acquisition of Dresser-Rand’s government business, which expands its footprint in naval vessels.

In March, CW acquired Tactical Communications Group, a leading designer of tactical data link software for military communications systems. The acquired business adds roughly $15 million to annual sales and will be accretive to 2019 EPS.

Curtiss-Wright targets at least 10% annual EPS growth over the next three years. A major profit contribution will come from its China Direct AP1000 project; the company has contracted to build 16 nuclear reactor coolant pumps for China valued at nearly $500 million.

CW has missed quarterly earnings estimates just once in the past three years, and quarterly surprises ranged from 8% to 41% last year. Its next chance at a beat comes on May 8, when the company is expected to report financials following the closing bell.

William Blair analyst Nicholas Heymann has an “Outperform” rating on CW shares and thinks the stock may move higher as its growth prospects become more apparent to investors. Trade tariffs are hurting other industrial stocks, but Heymann thinks CW’s high-margin China contract will remain profitable.

Grubhub

- Market value: $6.0 billion

- Average positive EPS surprise: 11.0%

- 5-year average annual adjusted EPS growth: 48.2%

- Grubhub (GRUB, $65.94) is the nation’s largest online and mobile food ordering and delivery marketplace. The company’s network consists of more than 105,000 restaurant partners across 2,000 U.S. cities. Grubhub served 17.7 million diner accounts in 2018, processed approximately 435,900 orders every day and delivered food and beverages valued at $5.1 billion to its customers.

The company expanded via acquisitions (LevelUp and Tapingo) last year, increased its restaurants partners to 105,000, expanded active diner members on its platform by 3.2 million, and increased the average daily order size every quarter. The company’s adjusted EPS grew 44% last year on 47% sales growth.

Grubhub has produced seven EPS beats and one miss in eight quarters – though that one miss was a 32% whiff for the December quarter. Still, its beats ranged from 10% to 33% in the first nine months of 2018. Its next report will come Thursday, April 25, after the closing bell.

BTIG analyst Peter Saleh recently initiated coverage of Grubhub with a “Buy” rating and $95 price target. He notes that Grubhub at present only covers 105,000 of the country’s 467,288 restaurants, suggesting opportunities for massive growth as demand for delivery services grows. He also sees a competitive advantage in Grubhub’s focus on independent restaurants, which don’t have deep enough pockets to create their own online ordering platforms.

Estee Lauder

- Market value: $61.4 billion

- Average positive EPS surprise: 11.7%

- 5-year average annual adjusted EPS growth: 11.3%

- Estee Lauder’s (EL, $169.92) well-known luxury products in skincare, cosmetics, fragrances and haircare are EL’s biggest sales generators, together accounting for 80% of revenues. Estee Lauder has sales in more than 150 countries through high-end department stores, pharmacies, beauty salons, spas, company-owned kiosks at airports and online. Prominent brands include Estee Lauder, Clinique, Aramis, Mac, Lab Series, Origins and Bobbi Brown.

Thanks to its focus on prestige brands, the fastest-growing beauty products category, EL has delivered sales and EPS gains beating analyst estimates every quarter since 2016, with quarterly EPS beats ranging from 9% to 15% over the past year.

Estee Lauder also benefits from its broad skincare and cosmetics portfolio. digital expertise and strength in social media, which is helping the company grow faster than the overall prestige beauty category. Over the past five years, EW has grown sales 6% a year and adjusted EPS by 11% annually.

EL’s adjusted EPS rose 25% during the December quarter and first six months of fiscal 2019 as a result of strong growth in skincare products, increased demand in Asia Pacific, and an improved performance by on-line and travel retail channels.

Argus Research analyst John Staszak rates Estee Lauder’s stock a “Buy” rating and recently increased his price target, noting that EW benefits from strong demand for high-end beauty products, a solid mix of retail, travel retail and e-commerce sales and investments in developing its business. JPMorgan analyst Christina Brathwaite upgraded EL in March to “Overweight” after gaining confidence at the company’s annual investor day presentation that Estee Lauder can hit its sales targets.

Estee Lauder is expected to report earnings ahead of the May 1 market open.

Salesforce.com

- Market value: $122.4 billion

- Average positive EPS surprise: 39.7%

- 5-year average annual adjusted EPS growth: 51.0%

- Salesforce.com (CRM, $158.76) is a market leader in customer relationship management (CRM) software and other tools companies use to improve their interactions with customers. More than 150,000 companies worldwide use Saleforce.com cloud-based services to store and analyze data, generate and monitor sales leads, connect service agents with consumers and optimize marketing strategies.

The company holds the No. 1 position and a 30% market share for sales CRM tools as well as the No. 1 spot for service CRM products based on its 19% market share. Salesforce.com has grown by expanding its footprint with very large companies (more than $20 million in annual sales) and cross-selling its services. Organic growth fueled by product line extensions and cross-selling, supplemented by acquisitions, helped the company deliver 26% sales gains and 24% cash flow growth for the year ended Jan. 31, 2019, and caused EPS to nearly triple.

The company has exceeded analyst EPS estimates every quarter for the past four years and beat by 27% last quarter. Its report for the fiscal first quarter of 2020 should come in early June.

UBS analyst Jennifer Swanson Lowe has a “Buy” rating on CRM stock and increased her price target in March, commenting that the company offers a solid combination of secular growth, stable free cash flow and a defensible free cash flow-based valuation. Mizuho Research analyst Gregg Moskowitz recently initiated coverage of CRM with a “Buy” rating and considers it a top pick. He sees significant upside over the next two to three years from the company displacing legacy offerings and leveraging its global network of partners and customers. He said CRM’s ecosystem is “akin to a freight train that we doubt can be stopped.”

Evercore

- Market value: $3.9 billion

- Average positive EPS surprise: 36.8%

- 5-year average annual adjusted EPS growth: 41.8%

- Evercore (EVR, $94.54) is a leading global investment bank that serves high-net-worth families and financial institutions with customized investment advisory, financial planning, trust and custodial services. The company was recognized by Euromoney magazine in 2017 as the world’s best independent investment bank.

Evercore offers its customers strategic corporate advice on mergers and acquisitions, activist investors and transaction structuring. The company also advises on debt and equity financings and provides equity sales, trading and research services. EVR is well-positioned to benefit from a robust global outlook for M&A activity in 2019; Wall Street Journal’s Investment Banking Scorecard ranks Evercore No. 6 in 2019 deal value, with $279.8 billion year-to-date; the company finished eighth in 2018 with $187.1 billion.

Evercore focuses on expanding its reach and capabilities in the U.S. and abroad and has rewarded investors with 10 consecutive years of steady growth in revenues and net income. Adjusted EPS have improved by 40% annually over the past five years, including a 65% bump in 2018, through a combination of advisory fee growth and a lower tax rate.

The company has exceeded analyst revenue and EPS estimates eight quarters in a row, including an 80% EPS beat in the December quarter. Evercore’s next quarterly earnings report comes Wednesday, April 24, before the opening bell.

Hyatt Hotels

- Market value: $8.0 billion

- Average positive EPS surprise: 69.4%

- 5-year average annual adjusted EPS growth: 38.7%

- Hyatt Hotels (H, $76.24) is a global hospitality company that develops, owns and franchises full- and select-service hotels, resorts and other properties.

As of the end of 2018, Hyatt’s portfolio consisted of more than 208,000 rooms across 843 hotels. It operates full-service properties under the Park Hyatt, Grand Hyatt, Hyatt Regency, Andaz and Hyatt Centric brand names and select-service hotels under the Hyatt Place and Hyatt House brands. The company added five new brand names to the portfolio last year by acquiring Two Roads Hospitality, which owns lifestyle hotels that appeal to high-end travelers.

Hyatt’s growth strategy focuses on differentiating its brands and personalizing the customer’s experience. This strategy has paid off with five consecutive years of rising market share for Hyatt properties. Other components of the growth strategy are a robust new rooms pipeline which has grown 14% annually over nine years, and an increased emphasis on international markets. The Two Roads Hospitality purchase establishes Hyatt’s presence in 20 new markets.

Going forward, the company is transitioning to an asset-light business model whereby it sheds non-core assets. More than $1 billion of asset sales were closed in 2018.

Hyatt has posted EPS beats in 11 consecutive quarters, with surprises ranging from 7% to a whopping 114% over the past four quarters, good for an average EPS surprise of 69%. Hyatt rewarded shareholders last year with a 27% dividend hike that was funded by a 33% jump in adjusted EPS. Its next report comes after the May 1 closing bell.

That said, some analysts are cautious about the stock. Nomura Research analyst Harry Curtis likes Hyatt’s business model and move to an asset-light strategy but has a “Neutral” (equivalent of “Hold”) rating on the stock due to liquidity concerns. And Raymond James analyst William Crow rates Hyatt at “Market Perform” (also a “Hold” equivalent). He thinks the company’s overall growth plan is positive, but worries about a slowing global economy and insufficient visibility around Hyatt’s disclosures and guidance.

Deckers Brands

- Market value: $4.4 billion

- Average positive EPS surprise: 67.8%

- 5-year average annual adjusted EPS growth: 6.6%

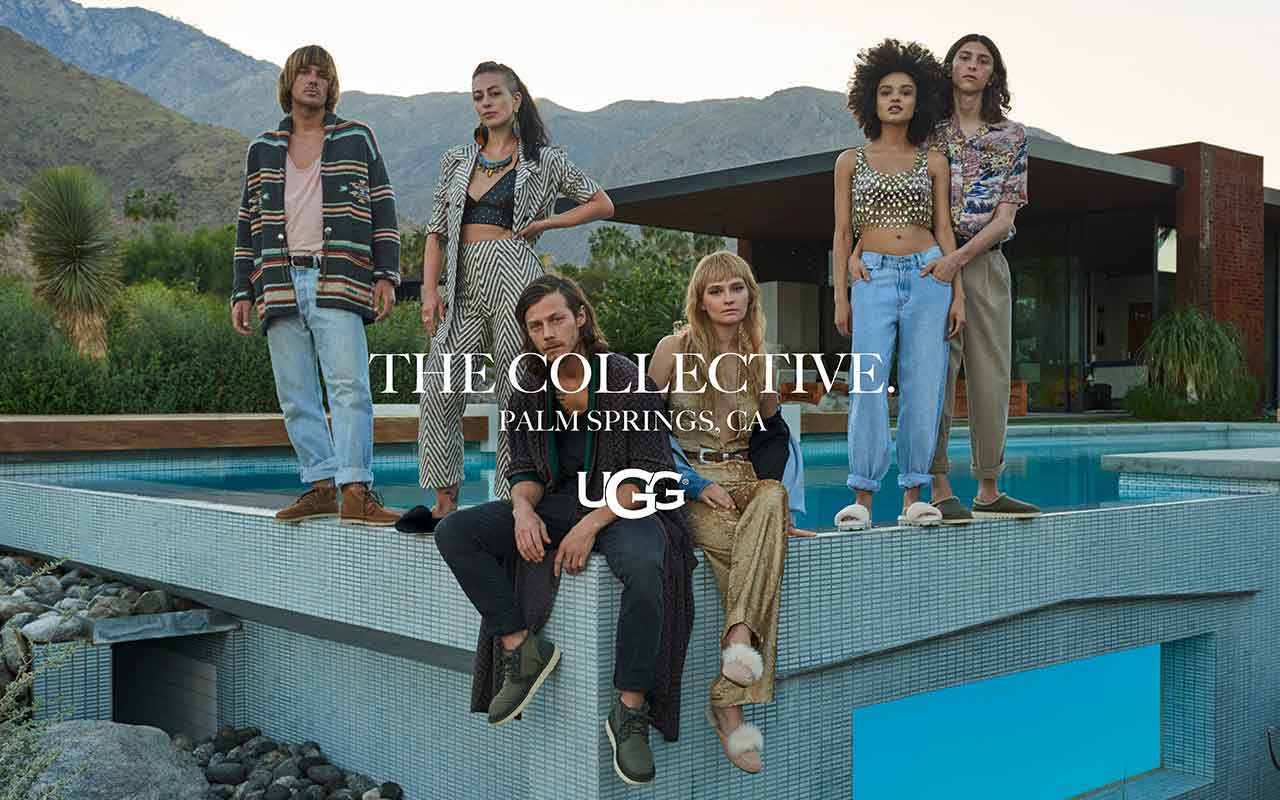

- Deckers Brands (DECK, $149.87) is a leading name in footwear and casual apparel. Its products are sold in more than 80 countries through department and specialty stores, company-owned stores and the Internet. Deckers’ popular brand names include Ugg, Koolaburra, Hoka One One, Teva and Sanuk.

Deckers plans to grow by selling Hoka running shoes internationally, adding more fitness and outdoor products, increasing penetration for men’s products and attracting younger consumers to its Ugg brand. The company also is developing spring/summer products for its Ugg brand to create a year-round business.

During the first nine months of its fiscal year ended March 31, 2019, Deckers grew adjusted EPS by 50%, reflecting strong sales of new Ugg products and enhanced growth for the Hoka and Koolburra brands. It also upgraded its full-year guidance; we’ll see how accurate it is after the May 23 closing bell.

Deckers has beaten quarterly analyst EPS estimates for more than two years and delivered positive EPS surprises ranging from 24% to 161% over the past four quarters.

DECK shares are near all-time highs, but Zacks Equity Research thinks the stock still has room to scale higher because of a still-attractive valuation and sound fundamentals. Susquehanna Research analyst Sam Poser downgraded the stock to “Neutral” in February, however. While he thinks the company remains in great shape and is positively inclined toward the business, he commented that DECK’s share price at the time allowed little upside. His price target for DECK is $161.

World Wrestling Entertainment

- Market value: $7.5 billion

- Average positive EPS surprise: 32.5%

- 5-year average annual adjusted EPS growth: 97.9%

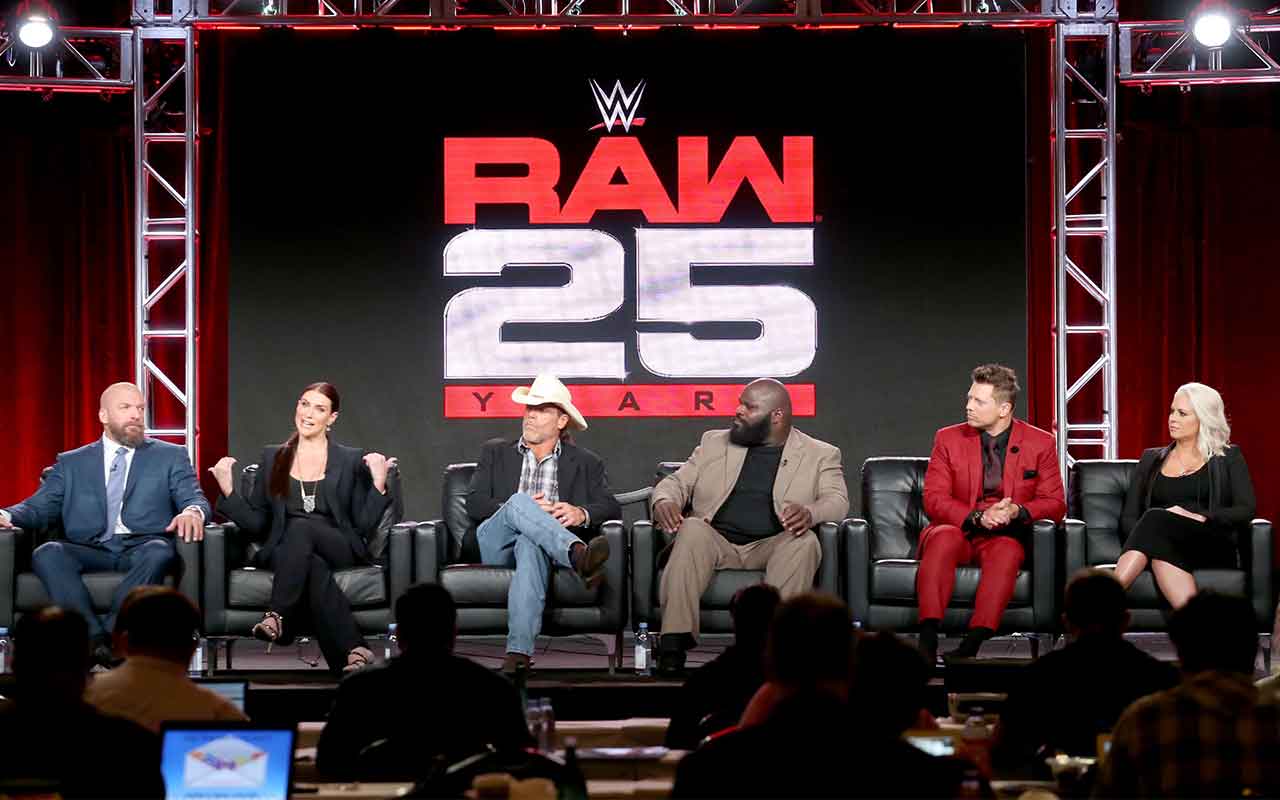

- World Wrestling Entertainment (WWE, $96.11) is a sports entertainment company that produces television, digital and social media content and live pay-per-view events such as WrestleMania. The company also merchandises WWE-branded products such as video games, toys and apparel. WWE was the top sports channel on YouTube last year at 22.5 billion views. The company hosted 23 live pay-per-view events last year with average ticket prices exceeding $60.

The company’s paid subscriber base has been growing 39% annually, and WWE continues to see pay-per-view TV as the most profitable platform for monetizing its events. The company uses digital and social media content to build brand awareness, attract new viewers and promote its WWE network.

The company’s adjusted EPS has risen 52% annually over the past three years. And international sales and new agreements with Fox Sports and USA network helped WWE rocket from 7 cents per share in adjusted earnings in 2017 to 44 cents per share last year.

WWE has generated positive quarterly EPS surprises six times over the past eight quarters. The company missed EPS estimates by 31% in the June quarter, but beat by 95% in the September quarter and 59% in the December quarter. Its next report is due out after April 25’s closing bell.

Wolfe Research analyst Marci Ryvicker upped her price target for WWE shares by nearly 50% in March. She thinks the company’s strong revenue and EBITDA growth warrants comparisons to Liberty Media Formula One (FWONA). JPMorgan analyst David Karnovsky has an “Overweight” rating on the stock. He thinks WWE’s domestic content is underpriced relative to other sports, sees a major boost coming from the Fox Sports agreement and notes that the company is getting better at monetizing viewership of its video content in foreign markets.

PulteGroup

- Market value: $8.4 billion

- Average positive EPS surprise: 16%*

- 5-year average annual adjusted EPS growth: -12.0%**

- PulteGroup (PHM, $30.22) is the third-largest American homebuilder. The company has built roughly 725,000 homes since its founding more than six decades ago and developed well-known brands such as Pulte, Centex and Del Webb. PulteGroup operates in 45 markets across 25 US states. Its largest market is the western U.S., which accounts for 27% of sales.

The company offers its homes at multiple price points. Roughly 30% of sales last year were homes priced from $300,000 to $399,999 and 25% were homes priced above $500,000. The core of PulteGroup’s business is move-up buyers with the ability to spend extra for options and premium lots. The company emphasizes build-to-order homes that allows consumers to add high-end features.

Despite some softening markets for homebuilders, PulteGroup ended the year with backlog of 8,722 sold homes valued at $3.8 billion. The average sales price for a backlog home was unchanged from the prior year at $440,000.

PulteGroup has exceeded analyst EPS estimates in five of the past six quarters. That includes its latest report, out April 23, where it reported flat profits of 59 cents per share that easily exceeded analyst estimates for 47 cents. “Helped by the recent decline in mortgage rates, homebuyers have been steadily returning to the market after a period of slowing demand that began in the second half of 2018,” PulteGroup CEO Ryan Marshall said in the release.

JPMorgan analyst Michael Rehaut upgraded his rating on PHM stock to “Neutral” in April, citing more stable demand for new homes due to declining mortgage rates. He raised his share price target 6%, based on expectations of positive momentum continuing in the near-term for the housing sector.

KeyBanc analyst Ken Zener upgraded PHM shares to “Overweight” in January, noting that homebuilders may benefit from more optimistic macro sentiments and lower mortgage rates that are boosting home sales after a rough patch.

* This figure does not include its earnings beat from the morning of Tuesday, April 23.

** This figure is primarily caused by a massive income tax benefit in 2013 that skewed PulteGroup’s earnings. Annual earnings have been steadily growing each year since 2015.

Shake Shack

- Market value: $2.2 billion

- Average positive EPS surprise: 67.0%

- 5-year average annual adjusted EPS growth: 23.6%

- Shake Shack (SHAK, $59.59) is a rapidly expanding casual restaurant chain that has quickly grown over eight years to 124 U.S. locations, with another 40 planned in 2019. These restaurants serve premium all-natural burgers, chicken and hot dogs. Craft beers are also available at some locations.

Shake Shack has expanded its U.S. franchises at a 43% annual rate since 2012 and entered eight new markets in 2018, including Denver, Charlotte, the San Francisco Bay area and Seattle.

The company also is expanding internationally through licensing deals and has 84 licensed locations across 13 countries. Shake Shack opened its first location in mainland China location in Q1 2019 and plans to add restaurants in Mexico, the Philippines and Singapore this year. By year-end 2019, Shake Shack expects to be operating in 16 countries.

Revenues have risen 45% annually and cash flow has grown by 53% a year over the past half-decade. Last year’s results were fueled by new locations and rising same-store sales. Shake Shack delivered 14% EBITDA gains and 28% adjusted net income growth; on a Generally Accepted Accounting Principles (GAAP) basis, EPS flipped from a 1-cent loss in 2017 to a 52-cent profit in 2018.

Shake Shack, which reports earnings after the May 2 close, has produced eight consecutive quarters of positive EPS surprises, including a 6-cent profit for the December quarter that doubled up analyst estimates.

But Shake Shack, up just 32% over the past five years, is proof that earnings beats do not always equate to big returns. And analysts still aren’t high on this stock. Seven of the 11 analysts covering SHAK have a “Hold” or “Sell” rating on it. Jeffries analyst Andrew Barish likes Shake Shack’s cult brand and impressive unit growth but has a “Hold” on the stock because of his concern about slowing comparable store sales. Longbow Research analyst Alton Stump downgraded his rating to “Neutral” in April on valuation concerns.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Lisa currently serves as an equity research analyst for Singular Research covering small-cap healthcare, medical device and broadcast media stocks.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

5 Stocks to Sell or Avoid Now

5 Stocks to Sell or Avoid Nowstocks to sell In a difficult market like this, weak positions can get even weaker. Wall Street analysts believe these five stocks should be near the front of your sell list.

-

Best Stocks for Rising Interest Rates

Best Stocks for Rising Interest Ratesstocks The Federal Reserve has been aggressive in its rate hiking, and there's a chance it's not done yet. Here are eight of the best stocks for rising interest rates.

-

The Five Safest Vanguard Funds to Own in a Volatile Market

The Five Safest Vanguard Funds to Own in a Volatile Marketrecession The safest Vanguard funds can help prepare investors for market tumult but without high fees.

-

The 5 Best Inflation-Proof Stocks

The 5 Best Inflation-Proof Stocksstocks Higher prices have been a major headache for investors, but these best inflation-proof stocks could help ease the impact.

-

5 of the Best Preferred Stock ETFs for High and Stable Dividends

5 of the Best Preferred Stock ETFs for High and Stable DividendsETFs The best preferred stock ETFs allow you to reduce your risk by investing in baskets of preferred stocks.

-

What Happens When the Retirement Honeymoon Phase Is Over?

What Happens When the Retirement Honeymoon Phase Is Over?In the early days, all is fun and exciting, but after a while, it may seem to some like they’ve lost as much as they’ve gained. What then?

-

5 Top-Rated Housing Stocks With Long-Term Growth Potential

5 Top-Rated Housing Stocks With Long-Term Growth Potentialstocks Housing stocks have struggled as a red-hot market cools, but these Buy-rated picks could be worth a closer look.