20 More Best Stocks to Buy That You Haven’t Heard Of

The best stocks aren’t always going to be the most familiar.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The best stocks aren’t always going to be the most familiar. But sometimes, investors confuse the two. Recognizability is a powerful thing – so much so that investors occasionally make the mistake of trusting that familiarity more than a company’s underlying fundamentals. The sheer amount of attention an organization can garner really can dictate perceptions of how investment-worthy its stock is.

This approach won’t always be met with disaster. Corporations that attract the attention of the media and stock pickers tend to do so for good reason. But if you make stock picks like that, you may inherently overlook some opportunities that simply haven’t turned enough heads – yet.

People often associate obscure plays with small-cap stocks – smaller companies with market values of roughly between $300 million and $3 billion. But sometimes, even larger stocks aren’t very visible because their businesses don’t make for riveting, splashy headlines.

Last year, we introduced you to 20 unfamiliar companies. Today, let’s meet 20 more of the best stocks to buy that are anything but household names. Some are merely small, while others operate in obscure markets. However, all of them are worth a closer look from investors aiming to back off from mainstream stocks that have gotten a bit overextended.

Data is as of May 16. Dividend yields are calculated by annualizing the most recent monthly payout and dividing by the share price.

Aptiv

- Market value: $19.0 billion

- Dividend yield: 1.2%

- Industry: Auto parts

Ireland-based auto parts maker Aptiv (APTV, $73.71) is a great example of a large stock that still manages to fly under the radar. Most North American investors haven’t heard of this company, preventing them from stepping into what may be a compelling prospect.

But Aptiv isn’t about steering columns and suspension systems. Rather, it’s one of the unsung pioneers of the connected-car era, and the autonomous car in particular. Formerly known as the mobility side of Delphi Automotive, Aptiv worked with Lyft (LYFT) last year to provide the know-how for the world’s first commercial autonomous vehicle service. The partnership had provided 30,000 rides in Las Vegas as of the end of January. No major problems were reported.

Other car makers and fleet operators working on similar solutions may end up tapping Aptiv as the most cost-effective means of securing self-driving technologies. BIS Research believes autonomous vehicles will log a 20.78% compound annual growth rate globally between 2018 and 2028, when they expect the industry to hit 67.5 million units.

APTV is neither bargain-priced nor a red-hot momentum play. But with the self-driving automobile market finally poised to gain traction, Aptiv is positioned for real growth in the years ahead.

ASGN Inc.

- Market value: $3.0 billion

- Dividend yield: N/A

- Industry: Staffing and outsourcing services

“Generally, staffing companies can begin to trade at discounts to the market late in bull markets, because their profitability can be cut quickly as companies slow hiring,” says Robert Spivey, director of research with equity and credit research outfit Valens Research. “Right now this is the case with ASGN Inc. (ASGN, $57.53), as it trades at close to a 10x P/E, on both as-reported and uniform adjusted (UAFRS) metrics, that remove accounting distortions.”

But this might not be as concerning for ASGN as it would be for other staffing industry companies, making it one of the industry’s best stocks to buy right now.

On the surface, ASGN looks like an ordinary staffing agency. But a closer inspection reveals that it’s so much more. By supplying highly skilled and experienced IT and professional workers to its clients, ASGN is as much of consultant as it is a staffing firm. It can serve customers across a variety of industries, from technology to health care to engineering and more.

Spivey feels being able to meet those more complex needs could shield ASGN from any cyclical slowdown. “This firm has seen significant growth in high-growth areas, particularly in tech, such as around AI, machine learning, cyber security, and other high value-add tech end markets with scarce labor supply,” he says. “Their positioning in these spaces should insulate them somewhat in a market downturn, given secular growth in those areas.”

Spivey further touts the fact that based on uniform accounting metrics, the company has seen adjusted return on assets rise from already high 20% levels in 2011 to almost 50% levels in 2018.

Badger Meter

- Market value: $1.5 billion

- Dividend yield: 1.1%

- Industry: Scientific and technical instruments

You may use a Badger Meter (BMI, $52.84) product, but you probably don’t know it. Badger makes smart water meters and other, more industrial-minded flow-measurement tools, helping the world get a better grip on the consumption of its most important natural resource.

The need for more intelligent monitoring of water usage has never been greater. Pipe leaks alone in the U.S. waste nearly a trillion gallons worth of potable water every year, according to the EPA, while newer water-using appliances can reduce water consumption by 20% compared to older ones. And water scarcity, which used to be a solely international headline, has become a domestic problem. Watchdog organization Food & Water Watch has determined that that half a million U.S. households are threatened by a water supply shortage.

Installing a smart water meter alone won’t resolve all those challenges, but it’s a start that utility companies and consumers can get behind – and increasingly are.

The most recent quarter’s revenues were flat, but Badger Meter’s long-term sales trajectory remains pointed higher, and at a healthy clip. Last year’s revenue of $434 million was better than the $403 million logged in 2017 and the $394 million it recorded in 2016. Operating income growth has been reliable, too, and analysts expect BMI to average 14.9% annual profit growth over the next five years.

The world is also quietly inching its way to mandated smart water meters too, which would prove a major boon for Badger Meter.

Boston Omaha

- Market value: $560.1 million

- Dividend yield: N/A

- Industry: Conglomerate

It wouldn’t be quite accurate to say Boston Omaha (BOMN, $24.99) does a little of everything; it picks and chooses its investments according to its strengths. But it would be accurate to say that Boston Omaha is a diversified conglomerate not unlike the cash-generating collection of companies that defined Berkshire Hathaway (BRK.B) in its early years.

In fact, it has strong familial ties to Berkshire. Robert R. Johnson – professor of finance at Creighton University’s Heider College of Business and CEO of asset management firm Economic Index Associates – points out that Boston Omaha co-CEO Alex Rozek is the grandnephew of Berkshire Hathaway founder Warren Buffett. And like his great uncle, Rozek prefers reliably profitable entities such as billboards firm Link Media Outdoor, insurance companies and real estate plays.

“While the firm has yet to reach profitability, it is growing revenues rapidly, as the year-over-year revenue growth in the most recent quarter was over 200%,” Johnson says.

Losses likely won’t be the norm for long. Analysts expect BOMN to report a loss of 15 cents per share this year, then a whittled-down 4 cents in 2020. Beyond that, the pros are modeling net profits.

Colfax

- Market value: $3.2 billion

- Dividend yield: N/A

- Industry: Industrial manufacturing and engineering

- Colfax (CFX, $27.44) is an old-school industrial play, making everything from welding equipment to knee braces to air and gas handling solutions.

That product mix has changed dramatically in recent weeks, however, and could be about to change again. In February, it completed its acquisition of orthopedic and musculoskeletal solutions provider DJO. Recent reports say the company is close to shedding its air and gas handling arm for $1.8 billion. And in 2017, it sold off its fluid handling unit to Circor.

Such changes might prove disruptive for most organizations. But for Colfax, each deal seems to bring the company a little closer to the proverbial end zone. Colfax hasn’t failed to beat a quarterly earnings estimate in more than three years, and per-share earnings are on pace for their third straight year of growth. Analysts are forecasting a fourth.

You can’t find many more boring stocks to buy than Colfax, and given the company’s willingness to buy and sell pieces of itself, you never truly know if what you have today is what you’ll have next quarter. But the analyst community still thinks it’s worth $32.46 per share, though – 18% better than current prices.

Coupa Software

- Market value: $6.8 billion

- Dividend yield: N/A

- Industry: Business software

You wouldn’t expect keeping track of expenses to still be a challenge. We have near-infinite cloud-based access to all sorts of accounting software. Even smartphones can take a picture of a check then deposit it automatically.

Nonetheless, large corporations and major enterprises still struggle to determine exactly where their money is going.

- Coupa Software (COUP, $111.33) offers a platform with a singular focus. Coupa is “the only Business Spend Management platform that empowers you to spend smarter and maximize the value of every dollar your business spends.” Whether it’s procurement, expenses or spending analysis, Coupa can help. The fact that Procter & Gamble (PG), Unilever (UN), Airbus (EADSY) and even cloud giant Salesforce.com (CRM) are some of its client companies speaks volumes about the power of Coupa’s product.

More evidence that corporations are realizing how much they need such a tool? Coupa has recorded 10 straight quarters of uninterrupted quarter-over-quarter revenue growth. Moreover, sales are expected to jump a little more than 25% this year, then repeat the feat in 2020, making COUP one of the best stocks to buy for reliably high growth.

Coupa isn’t coasting, either. Earlier this month, the company completed its acquisition of contract lifecycle management platform Exari. It’s a nice, marketable value-add product that should appeal to Coupa’s existing customer base and may even draw in new clients.

CyrusOne

- Market value: $7.1 billion

- Dividend yield: 2.9%

- Industry: Data center real estate

- CyrusOne (CONE, $62.95) is a real estate investment trust (REIT), but it’s far from your typical rental-real estate play. The company owns and operates data centers – more than 45 of them across the globe – leasing access to companies that need storage and computing space in the cloud.

It’s a brilliant idea. By 2024, the data center market is expected to be worth $174 billion. The road to there from here, however, is proving a tough and expensive one to navigate.

CyrusOne was downgraded three separate times early in 2019, largely because of funding worries. Bank of America/Merrill Lynch analyst Michael Funk was particularly worried that the $600 million raised by the issuance of equity earlier this year may ultimately drag down shares, given how the labor market continues to tighten and materials costs continue to grow. The end result, Funk fears, are overly optimistic estimates for funds from operations (FFO, an important metric of REIT profitability).

BofA/Merrill upgraded CONE back to a “Buy” in April, but Credit Suisse and Jefferies are still unconvinced. Jefferies analyst Jonathan Petersen worries that modest pre-leasing in Europe, where CyrusOne had invested heavily in growth, could mean 2020 will be as tepid at 2019 is shaping up to be.

Consider CyrusOne a “watch list” stock. This business model has promise, and with the right tweaks and tailwinds, CONE could be a new-tech winner that wouldn’t have even existed a few years ago.

Element Solutions

- Market value: $2.9 billion

- Dividend yield: N/A

- Industry: Chemicals

When most investors envision the process of making semiconductors and computer chips, it involves a robotized assembly line whisking a component from one station to the next. That picture is mostly on-target, but as computers shrink and simultaneously improve, chemicals have been introduced into the foundry process. Sometimes the best production path to a high-performance solid physical object involves the use of a liquid.

Enter Element Solutions (ESI, $11.12) and its subsidiary MacDermid Enthone Industrial Solutions.

The two offer a variety of materials to meet the complex needs not just of the technology and computing markets, but of industrial markets as well. For instance, Element Solutions makes and markets a liquid chemical bath solution that becomes the copper circuit patterns on a printed circuit board. Element Solutions also develops alloys and nanomaterials used to assemble all sorts of electronics. MacDermid Enthone delivers several industrial coating solutions as well, including nickel plating that doesn’t require the use of an electrical current.

It’s far from a thrilling business line, but Element’s diversity makes it a solid, reliable company. It solves problems for the packaging industry, water treatment outfits, telecom-tech players, the energy sector, automobile makers and more. That broad lineup translates into fiscal stability and forecasts for modest growth.

Glu Mobile

- Market value: $1.3 billion

- Dividend yield: N/A

- Industry: Video games

The video game market isn’t what it used to be. The industry once was focused around consoles and computers and played by hardcore gamers seeking intense experiences, but it has expanded heavily into mobile, driven by casual players seeking a more relaxing but repeatable playing experience. Industry research firm NewZoo says more than half the video game market’s revenues now comes from mobile devices, and it’s the fastest growing piece of the gaming business.

California-based Glu Mobile (GLUU, $9.15) already has published hundreds of games over the years and enjoyed more than its fair share of winners. But it also may be close to finalizing a huge hit.

“Glu Mobile already has several strong mobile games such as Design Home and Tap Sports Baseball,” explains Chartwell Investment Partners’ Frank Sustersic, portfolio manager of the Chartwell Small Cap Growth Fund (CWSVX). “What is truly exciting however, is the upcoming launch of Sorcerer’s Arena, which is a game being developed with Disney and Pixar. This game truly has massive appeal, incorporating Disney characters from across every Disney movie, with each character having a unique skillset.“

When all is said and done, Chartwell’s Sustersic believes this particular role-playing game “has the potential to be a top 20 title, and that would have a potentially significant positive impact for a company the size of Glu Mobile.”

Huya Inc.

- Market value: $4.3 billion

- Dividend yield: N/A

- Industry: Media

Most investors are well aware that digital video can be “streamed” via the internet. Increasingly, though, video games are being streamed – played – online, too.

Streamed video games aren’t installed on a local device and merely connected to other online players of the same game. Streaming video games are hosted in the cloud and accessed remotely by gamers. This sort of arrangement is often cheaper and better for the player, though some gamers remain skeptical of the relatively new development.

The video gaming market was worth $138 billion in 2018, and the prospect of plugging into it in a way that circumvents consoles has lured several recognizable companies. Alphabet (GOOGL) subsidiary Google announced earlier this year it would launch a new game-streaming platform, called Stadia, sometime this year. Advanced Micro Devices (AMD) stepped up to the plate to make graphics processors powerful enough to make Stadia the high-performance platform it has to be.

There’s a smaller company called Huya Inc. (HUYA, $20.97), however, that has a head start on many Johnny-come-lately outfits. It has been live-streaming games since 2014.

Information on China-based Huya is so far scant for North American investors, mostly because it became a publicly traded entity a little more than a year ago. But don’t be fooled by the lack of awareness. Huya is a multibillion-dollar outfit that’s expected to grow earnings by a whopping 53% this year, then another 74% in 2020.

It caught the front edge of the streaming trend.

Integer Holdings

- Market value: $2.4 billion

- Dividend yield: N/A

- Industry: Medical devices

You won’t find any medical devices with Integer Holdings (ITGR, $73.00) branding in your doctor’s office or at your local hospital. That’s because it’s a contract manufacturer of medical goods for the other companies you’ve already heard of.

Integer isn’t just scalpels and EKG machines. It is deep into the high-tech health care arena, able to build neuromodulators, cardiovascular equipment and surgical catheters, just to name a few.

The business model provides more consistency than might be expected, considering Integer’s clients aren’t committed enough to a product line to establish their own manufacturing option. Earnings do tend to ebb and flow in approximately two-year cycles, but the $5.56 per share in profits it has generated over the trailing 12 months is a far cry from the $1.78 over the same period ending in Q1 2014. Revenue growth has been steady, too, and is projected to improve nearly 5% this year followed by 4.5% growth in 2020.

ITGR is followed by only a handful of analysts, but those keeping tab on it collectively say the stock is worth $100.25 per share. That’s 37% upside potential.

LexinFintech Holdings

- Market value: $2.4 billion

- Dividend yield: N/A

- Industry: Credit services

China’s peer-to-peer lending craze has run into an inevitable wall, not unlike its U.S. counterpart. Because it was mostly unregulated in its infancy, too many players made ill-advised entries into the marketplace and burnt a few too many investors.

China put sweeping regulations in place for the P2P lending business in 2018, forcing what wobbly players remained out of the business. New rules still are coming that could shut down as much as 70% of the remaining lending middlemen, according to an estimates from Yingcan Group.

- LexinFintech Holdings (LX, $13.68) is on the other side of that tidal wave. Not only is it one of China’s more credible peer-to-peer-lending stocks to buy, but it’s one of the more profitable ones. It’s also one of the few that are available to American investors in the public markets.

As more of its rivals are forced out of the business, more of China’s borrowers will find LexinFintech Holdings’ Fenqile platform to be an alternative, bolstering already impressive expansion. This year’s projected revenue growth of 5% is expected to accelerate to 15% next year, pumping up per-share operating profits from $1.87 per share to $2.28.

Macquarie Infrastructure

- Market value: $3.6 billion

- Dividend yield: 9.6%

- Industry: Conglomerate

- Macquarie Infrastructure (MIC, $41.90) “owns, operates and invests in a portfolio of infrastructure and infrastructure-like businesses in the U.S.” The company’s core businesses provide bulk-liquid terminal services in 17 places in the United States and two more in Canada, distribute gas in Hawaii and offer ground operations at 70 U.S. airports. (Ground operations include fueling, hangaring and towing passenger jet planes when they’re not in the air.)

Macquarie is a perpetually moving target, however. In April, the company decided to sell its renewables business. Last year, it sold its Bayonne Energy Center. But it’s just as apt to invest in or outright add new businesses as opportunities arise.

Its acquisitions and existing business lines may appear disparate on the surface, but they have one common element. Macquarie seeks out large-scale and capital intensive infrastructure businesses that “employ long-lived, high-value physical assets that serve, in part, to create a privileged position in their respective markets.” Holdings of this ilk “serve to protect operating margins throughout market cycles, enabling MIC to produce generally growing levels of cash flow.”

That cash flow has made Macquarie Infrastructure the dividend machine it was designed to be. Its quarterly payout is certainly more inconsistent than what you get from blue-chip stocks. But the current yield of just under 10% is difficult to find elsewhere, and long-term growth is reliable.

Neurocrine Biosciences

- Market value: $7.3 billion

- Dividend yield: N/A

- Industry: Biotechnology

- Neurocrine Biosciences (NBIX, $80.00) is a one-trick pony, but what a trick that pony can do!

Most investors likely haven’t heard of a condition called tardive dyskinesia – a condition sometimes induced by the use of antipsychotic medications than can cause involuntarily facial muscle contractions. Neurocrine says only more than 500,000 people in the U.S. are impacted by TD, and of those, only half are thought to be officially diagnosed.

That’s not much of a market. It’s only effectively served by a couple of players, however, one of which is Neurocrine Biosciences’ Ingrezza. With an annual price tag in five-figure territory, it doesn’t take a great deal of market penetration to drive significant growth.

And Neurocrine Biosciences is indeed enjoying growth. During the final quarter of last year, the company sold $130 million worth of the relatively new drug, more than doubling Q4 2017’s tally.

Better still, it’s early innings for Ingrezza. Even after dialing back his peak-sales estimate after the drug was disqualified as a potential treatment for Tourette’s syndrome, Baird analyst Brian Skorney still believes Ingrezza’s peak annual revenue will be around $1.2 billion. Others say $1.3 billion is a plausible figure. Either way, the drug is nowhere near either. And Neurocrine has a couple more drugs in the pipeline that are in promising late-stage trials.

Neurocrine Biosciences might not be right for buy-and-hold investors. But it might be one of the best stocks to buy for more aggressive portfolios.

Packaging Corporation of America

- Market value: $9.2 billion

- Dividend yield: 3.3%

- Industry: Packaging and containers

Sometimes the best stocks are bets on goods we buy, use and throw away over and over again without giving them a second thought.

Odds are good that most investors have held a Packaging Corporation of America (PKG, $97.30) product in their hands. As the moniker implies, the company manufactures the boxes, bubble wrap and display bins for a wide array of products.

This isn’t a high-growth engine. Analysts are looking for sales to tick 2% higher this year, then 1% next. They also expect profits to mostly stand still over that time.

But Packaging Corporation of America wasn’t built to be a red-hot growth machine. It’s a steady Eddie, designed do repeat business selling consumable goods in good times as well as bad.

There, it has filled its role. The company breezed through the 2007-09 subprime-mortgage lull with little damage and survived 2015’s economic turbulence nicely to boot, steadily growing profits the whole time. Although it took some deal-making to do it, this year’s projected bottom line of $8.20 per share is solid improvement on the $3.99 per share banked in 2014. PKG acquires and integrates wisely, allowing it to develop the scale it needs to remain profitable as well as competitive in the de-fragmenting packaging market.

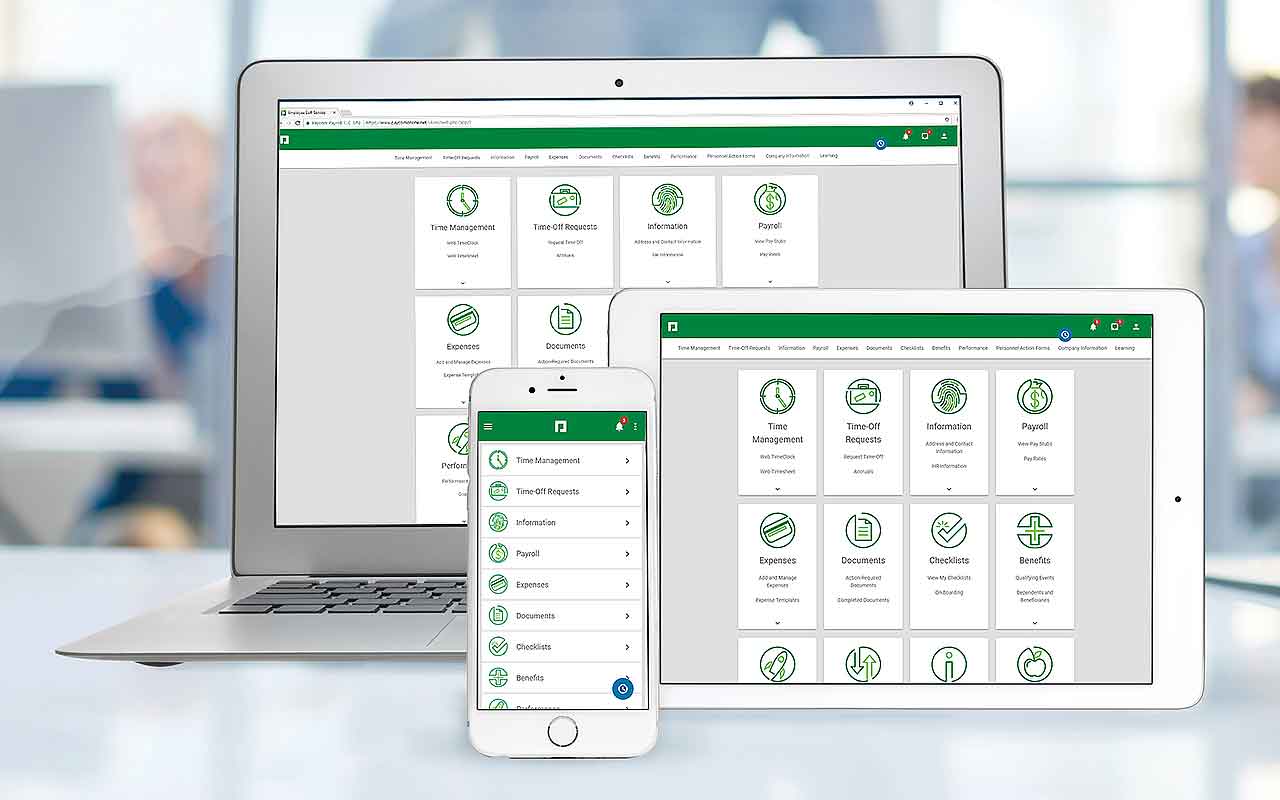

Paycom Software

- Market value: $12.4 billion

- Dividend yield: N/A

- Industry: Business software

Not to be confused with digital payments middleman PayPal (PYPL), Paycom Software (PAYC, $212.05) provides a platform enterprise-level customers use to hire, manage and pay employees.

It’s not a novel idea. Automatic Data Processing (ADP), Kronos, ClearCompany and Ascentis are just some of the dozens of names in the business. Paycom is proving itself as one of the key go-to solutions providers, however. Its first quarter’s sales of $200 million improved 30% year-over-year to top estimates of $196 million. Earnings grew 24%, at $1.19 per share, to also beat expectations of $1.12.

None of this should surprise. Paycom has grown its quarterly revenues by double digits every quarter for the past five years, and it has topped earnings estimates every quarter for the past three years. In fact, exceeding expectations is a key part of why Jefferies analyst Samad Samana recently upped his price target on PAYC from $210 to $233.

Along with a solid first-quarter report, Paycom Software upped its full-year revenue and EBITDA (earnings before interest, taxes, depreciation and amortization) guidance, and both metrics are projected to continue double-digit growth. Given Paycom’s history, however, Samana suspects the company still is understating its true potential.

Resources Connection

- Market value: $511.4 million

- Dividend yield: 3.3%

- Industry: Business services

If not for 2009’s acquisition of Sitrick and Company and the 2017 purchase of Accretive Solutions, Resources Connection (RECN, $15.97) might not have mustered any measurable earnings growth over the past few years. But a nose for selecting and integrating other units has resulted in steady income that has supported solid dividends. Its current yield of 3.3% is above average, and current quarterly payout of 13 cents has more than tripled since 2010, rising in every year since then.

Resources Connection is a business consulting firm that was founded in 1996 as a division of Deloitte & Touche. Then-executive Chairman Don Murray led a buyout/spinoff in 1999, and the company went public in December 2000. Its stock performed amazingly well in tandem with the economic recovery following the dot-com meltdown that took shape around that time.

RECN shares haven’t performed nearly as well coming out of 2008’s subprime-loan-driven implosion. In fact, shares are currently priced where they were in early 2015.

There’s more growth potential than it seems on the surface, however. Yes, last quarter’s top and bottom lines fell short of expectations, but they both were up year-over-year. Gross margins improved from 36.3% to 37.8%, too, while selling and administrative spending fell 110 basis points, overcoming challenges in Europe that may soon prove temporary.

Shopify

- Market value: $31.0 billion

- Dividend yield: N/A

- Industry: E-commerce

Online store promotion has been tried over and over, usually ending in failure, and never ending as a clear, smashing success. That’s why Shopify (SHOP, $278.01) is one of the best stocks to buy among lesser-known names: because it might turn out to be one of the rare success stories within the industry.

Shopify COO Harley Finkelstein explained in an April interview, “Now all of a sudden these small businesses can compete with the biggest retailers on the planet.”

Investors have heard this statement before. But unlike most of Shopify’s predecessors, this company can back it up. Shopify’s client companies have sold more than $100 billion worth of goods since the platform was created in 2004, and they’re still collectively growing. Using access to the tools and apps Shopify provides, those members spurred a 50% spike in revenue last quarter, fueling a 125% pop in profits. Shopify earned 9 cents per share to trounce the 5-cent loss Wall Street expected.

The key is scale. In the aggregate, Finkelstein notes that Shopify’s 820,000 merchants technically make the company the third-biggest online retailer in the United States. The fact that you can’t readily see this is a testament to how serious the company is about putting its merchants first.

Trimble

- Market value: $10.3 billion

- Dividend yield: N/A

- Industry: Scientific and technical instruments

If you know it at all, you might know Trimble (TRMB, $40.99) better by its former name, Trimble Navigation – one of the earliest names in automotive GPS systems that also helped fleet managers keep tabs on their vehicles. The organization wisely changed its name in 2016 because the old moniker woefully under-explained everything the company makes and markets now.

It’s a big list, including tools for use by the constriction, agricultural, forensics, indoor mapping, resource mining, surveying and telecom industries, just to name a few. Knowing exactly where people and property and objects are, as it turns out, makes all sorts of matters more efficient and cost-effective.

Revenue growth hasn’t materialized in a straight line. Ditto for earnings expansion. But since 2006, trailing 12-month profits have always been higher than they were five years ago, and trailing 12-month revenues have been higher than they were three years prior.

Trimble isn’t resting on its laser-ranging and GPS laurels, either. The company has developed on-board video recording devices that further protect fleet owners.

Jim Angel, vice president of video intelligence solutions for Trimble, recently told Freightwaves, “The adoption rate (of video intelligence) is probably five times what it was five years ago,” adding that an American Trucking Associations report from a few years ago determined that 80% of incidents involving large trucks are the fault of the other vehicle.

Trupanion

- Market value: $1.1 billion

- Dividend yield: N/A

- Industry: Pet insurance

Pet mania is no mere fad. American consumers have grown their collective annual spending on their furry friends from 1994’s $17 billion to 2018’s $72.6 billion, with neither the recession linked to the busted dot-com bubble nor the subprime-mortgage meltdown slowing that growth. Pets have become a major investment – and like most major investments, consumers want ways to proect their pets without breaking the bank.

The pet-centric paradigm shift has given rise to a new industry: pet insurance. It’s well-organized, in many regards closely mirroring the same health insurance people enjoy.

- Trupanion (TRUP, $33.02) has emerged as one of the top providers, and while 2019 should be a particularly strong year, 2020 could be transformative. Analysts are expecting Trupanion’s years of uninterrupted revenue growth to continue with a 23.1% jump in 2019, followed by still-hot 19.7% growth in 2020. But next year also should see the company come out of the red, with analysts estimating it will turn a 2-cent loss this year into a 17-cent profit next year.

That makes Trupanion among the best niche stocks to buy right now, as does the possibility for international growth in the distant future. The pet craze, once an American phenomenon, has caught on overseas, where Trupanion continues to follow it. In early May, the company began offering pet insurance in Australia. That expansion could lead to other international growth.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

5 Stocks to Sell or Avoid Now

5 Stocks to Sell or Avoid Nowstocks to sell In a difficult market like this, weak positions can get even weaker. Wall Street analysts believe these five stocks should be near the front of your sell list.

-

Best Stocks for Rising Interest Rates

Best Stocks for Rising Interest Ratesstocks The Federal Reserve has been aggressive in its rate hiking, and there's a chance it's not done yet. Here are eight of the best stocks for rising interest rates.

-

The Five Safest Vanguard Funds to Own in a Volatile Market

The Five Safest Vanguard Funds to Own in a Volatile Marketrecession The safest Vanguard funds can help prepare investors for market tumult but without high fees.

-

The 5 Best Inflation-Proof Stocks

The 5 Best Inflation-Proof Stocksstocks Higher prices have been a major headache for investors, but these best inflation-proof stocks could help ease the impact.

-

5 of the Best Preferred Stock ETFs for High and Stable Dividends

5 of the Best Preferred Stock ETFs for High and Stable DividendsETFs The best preferred stock ETFs allow you to reduce your risk by investing in baskets of preferred stocks.

-

What Happens When the Retirement Honeymoon Phase Is Over?

What Happens When the Retirement Honeymoon Phase Is Over?In the early days, all is fun and exciting, but after a while, it may seem to some like they’ve lost as much as they’ve gained. What then?

-

5 Top-Rated Housing Stocks With Long-Term Growth Potential

5 Top-Rated Housing Stocks With Long-Term Growth Potentialstocks Housing stocks have struggled as a red-hot market cools, but these Buy-rated picks could be worth a closer look.