20 Top Stock Picks the Analysts Love for 2019

Volatility was the name of the game for stocks in 2018.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Volatility was the name of the game for stocks in 2018. The market plunged to severe lows in both February and December, but all-time highs in September. The Standard & Poor’s 500-stock index and Dow Jones Industrial Average were both on the precipice of bear markets late in the year. However, we enjoyed a surprising “Santa Claus” rally that saw the Dow climb more than 1,000 points – its biggest single-day point gain ever – on Dec. 26.

When you’re evaluating stock picks for 2019, expect more of the unexpected.

Continued volatility seems unavoidable considering unsolved trade tensions and heightened worries about the Federal Reserve and interest-rate hikes. The flip side? “Despite the volatility that we have witnessed in the global markets, for 2019 our analysts are maintaining a pro-growth, pro-cyclical bias,” RBC Capital writes in its 2019 outlook. Many Wall Street analysts, in fact, predict upside in 2019. That includes Deutsche Bank, whose 3,250 target for the S&P 500 next year implies more than 30% upside for the market!

With this outlook in mind, here are some of the analyst community’s top stock picks for 2019. These are stocks, large and small, that boast a “Strong Buy” analyst consensus and significant upside potential. We used TipRanks to ensure that these picks also enjoy the support of top-performing analysts who have strong track records.

Data is as of Dec. 27, 2018. Stocks are listed in alphabetical order.

Alphabet

- Market value: $732.5 billion

- TipRanks consensus price target: $1,347.81 (28% upside potential)

- TipRanks consensus rating: Strong Buy

- Alphabet (GOOGL, $1,052.90), whose Google division is the largest ad-revenue-based internet business, has averaged 23% growth over the past 35 quarters and still is running hot. Moreover, it has $100 billion of net cash on its balance sheet – “dry powder (that) should give investors extra confidence amid market turbulence,” five-star RBC Capital analyst Mark Mahaney writes.

“That’s why we call Alphabet an internet staple.”

Alphabet is overwhelmingly an ad-based company (RBC estimates that approximately 85% of the company’s 2018 revenue will come from advertising), but it’s trying to expand into other key businesses. Investments in hardware, cloud, Internet-connected homes and autonomous vehicles give GOOGL the potential for several more years of premium top-line growth and profits.

As with most stock picks in 2019, Alphabet isn’t a 100% slam dunk. “There is regulatory risk,” Mahaney writes, “though we have yet to find evidence that regulations will adversely impact the usefulness of Google for consumers or advertisers.”

GOOGL’s valuation is “very reasonable,” he added when he reiterated his “Buy” call with a bullish $1,400 price target, indicating 33% upside from current levels. He’s just one of 32 bull calls on the stock, out of 35 analysts covering Alphabet right now. If you’re interested in more information on Alphabet’s shares, get a free GOOGL Research Report from TipRanks.

Amazon.com

- Market value: $714.7 billion

- TipRanks consensus price target: $2,150.00 (47% upside potential)

- TipRanks consensus rating: Strong Buy

- Amazon.com (AMZN, $1,461.64) shares are officially in a bear market (a decline of 20% or more from a peak), including a 27% selloff in the past three months. However, analysts now spy a compelling entry point for the e-commerce giant, which despite its recent losses is up 25% for the year-to-date.

“We reiterate our Buy rating on AMZN as the recent decline has created a major buying opportunity and we are adding it to our Research Focus List and Focus Opportunity Portfolio,” Tigress Research analyst Ivan Feinseth wrote to investors in a recent note.

Feinseth is optimistic about the company’s long-term growth prospects. “We believe AMZN’s innovative ability and growing market share will continue to drive increased revenue growth and significant cash flow,” he writes. More specifically, accelerating business performance is starting to drive gains – especially its Amazon Web Services cloud unit, which continues to gain significant customer wins. Research firm Gartner estimates that AWS revenue could reach almost $84 billion by 2021; the division delivered $17.5 billion in sales in 2017.

Feinseth concludes that AMZN has “significant” upside from current levels. Most analysts remain bullish despite the beating Amazon has taken; 36 of 38 analysts covering Amazon have come out with positive stances in the past three months. Learn more about their views on this stock via TipRanks’ AMZN Research Report.

American Eagle Outfitters

- Market value: $3.4 billion

- TipRanks consensus price target: $26.13 (35% upside potential)

- TipRanks consensus rating: Strong Buy

The word on the Street is that American Eagle Outfitters (AEO, $19.37), the famous teen-focused retailer, is undervalued right now. Even with the recent quick-hit Santa Claus rally, AEO shares are off by more than 20% over the past three months. That’s in part because a few months ago, the company delivered weak fourth-quarter earnings guidance (of 40 to 42 cents per share). But RBC Capital’s Brian Tunick isn’t too concerned.

“While 4Q estimates are coming down on timing shifts and investment pressures, we remain impressed on AEO’s quality of sales,” the analyst told investors in a recent note.

Tunick points out impressive gains for American Eagle’s Aerie lingerie brand and says 60 to 70 new store openings are planned around the brand for 2019. He also believes Aerie is steadily on track to reach its $1 billion-plus sales target.

The stock has no recent hold or sell ratings, but instead eight buy ratings over the past three months. That includes UBS analyst Jay Sole, who sees an “attractive opportunity to buy a growth stock at a value multiple.” He has a $31 price target on the stock, implying 60% upside potential. Check out other analyst targets in TipRanks’ AEO Research Report.

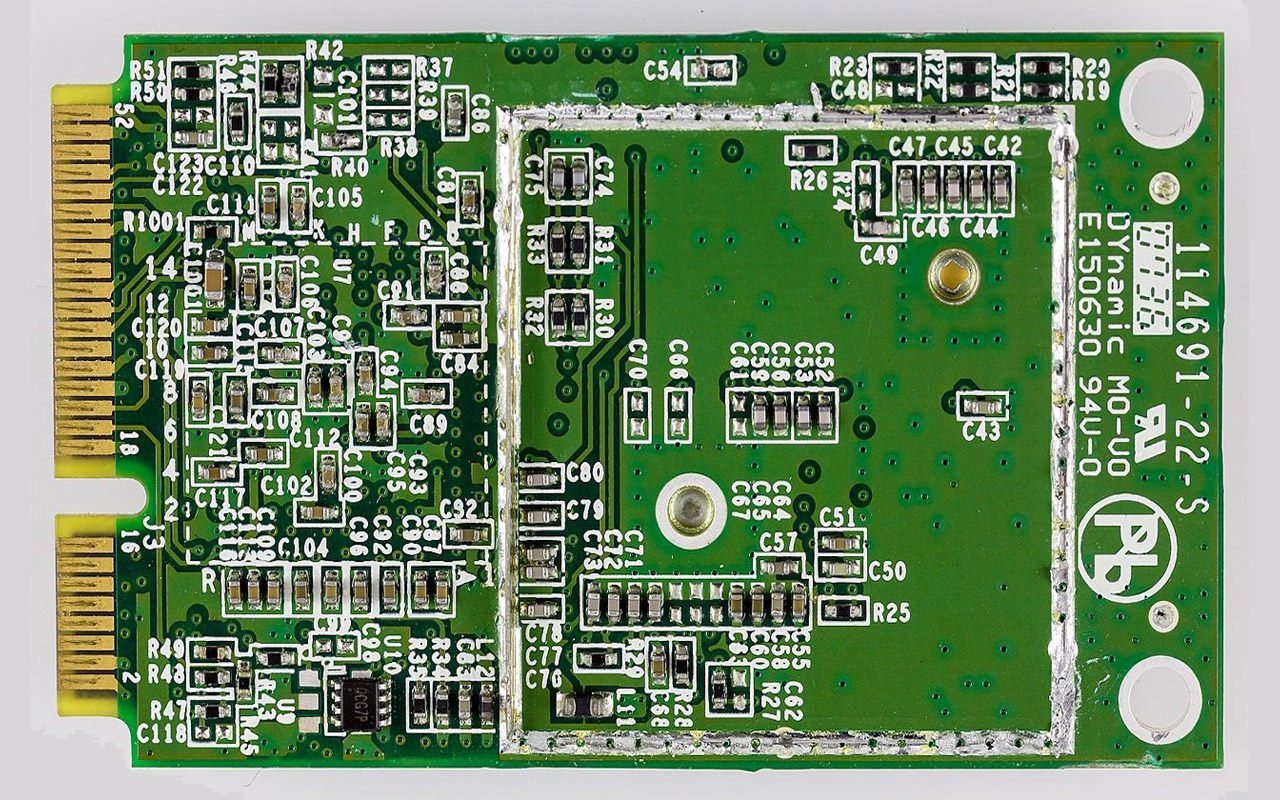

Broadcom

- Market value: $102.2 billion

- TipRanks consensus price target: $291.20 (16% upside potential)

- TipRanks consensus rating: Strong Buy

Semiconductor stock Broadcom (AVGO, $250.85) is in the limelight right now after JPMorgan’s Harlan Sur called AVGO his top semiconductor stock pick heading into 2019. Sur also added AVGO to the firm’s Analyst Focus List, citing “several strong growth tailwinds” including increased iPhone content and an upcoming datacenter networking upgrade cycle.

Sur is bullish on the semiconductor industry in general, too. “We believe further downside is limited and similar to past cycles,” he writes. “Though we model sub-seasonal demand trends through (the third quarter of 2019), we believe the stocks should start to discount improving fundamentals in (the first half of 2019, after the first two rounds of number cuts).”

AVGO has earned buy ratings from 18 out of 22 covering analysts over the past three months. Jefferies’ Mark Lipacis is one of them. His report in early December touted a “compelling” 10% free cash flow yield and 4.3% dividend yield. Indeed, Broadcom juiced its dividend by 51% this month. You can get more analysis in TipRanks’ AVGO Research Report.

Deere

- Market value: $46.7 billion

- TipRanks consensus price target: $182.71 (25% upside potential)

- TipRanks consensus rating: Strong Buy

Tractor maker Deere (DE, $145.96) is enjoying something of a renaissance with the Street right now. BMO Capital analyst Joel Tiss goes so far to say that the stock is one of his “favorite longer-term ideas.” It’s tough to predict a farming replacement cycle, but he still sees “years of growth and margin expansion ahead” because farmers must replace aging equipment to stay afloat.

Similarly, Baird’s Mircea Dobre has boosted the stock to “Fresh Pick” status with a $165 price target (13% upside). He spies multiple tailwinds for the company into 2019, including 1) continued demand growth, 2) better price/cost dynamics, 3) strong seasonal tailwinds and 4) significant capital deployment/buyback potential.

For further stock insights, turn to TipRanks’ DE Research Report.

Global Blood Therapeutics

- Market value: $2.1 billion

- TipRanks consensus price target: $91 (128% upside potential)

- TipRanks consensus rating: Strong Buy

- Global Blood Therapeutics (GBT, $39.90) is a small, clinical-stage biopharma focusing on sickle cell disease. And Oppenheimer’s Mark Breidenbach calls GBT his top idea for December-January – the biotech stock he believes is most likely to outperform over the next 12 months.

“We rate GBT Outperform based on our optimism that the company’s Phase 3 asset, GBT440 (also known as voxelotor), could find regulatory and commercial success in sickle cell disease (SCD) and may substantially improve the standard of care in this indication” he writes.

Indeed, GBT has announced that the U.S. Food and Drug Administration has agreed to an accelerated approval pathway for voxelotor in SCD. Breidenbach now expects a New Drug Application filing in the second quarter of 2019 – a potential catalyst for shares.

The analyst estimates a 2020 launch date, and his $82 price target indicates that he thinks shares can more than double. Find out more from TipRanks in its GBT Research Report.

Inogen

- Market value: $2.6 billion

- TipRanks consensus price target: $245.25 (99% upside potential)

- TipRanks consensus rating: Strong Buy

Medical-technology stocks have fared relatively well in 2018, and the outlook for 2019 remains upbeat.

Needham’s Michael Matson calls med-tech stock Inogen (INGN, $122.81) his top mid-cap pick for 2019, singling out the company as one of his two favorite stocks heading into the new year. He believes share prices will spike a whopping 120% from current levels.

“(Inogen is) offering a disruptive technology (portable oxygen concentrators, or POCs) through a disruptive business model (direct-to-consumer or DTC),” he writes. The company’s goal: to improve the life of patients who need supplemental oxygen.

Matson sees multiple catalysts driving INGN higher in 2019, including new product offerings and meaningful upside to consensus estimates. Plus there’s opportunity for significant international growth: “We do not view INGN as a “one-trick pony” focused simply on the U.S. POC market. International regions, particularly emerging markets, represent a very large opportunity for INGN given high rates of smoking and pollution.”

Wall Street’s analysts have been nothing but bullish on INGN over the past three months. Discover more about this lesser-known stock in the TipRanks’ INGN Research Report.

Lumentum

- Market value: $2.98 billion

- TipRanks consensus price target: $63.69 (57% upside potential)

- TipRanks consensus rating: Strong Buy

Telecom equipment stock Lumentum (LITE, $40.67) recently snapped up optics company Oclaro for a cool $1.8 billion. Analysts are applauding the deal, which boosts LITE’s scale and depth.

“We note that, even prior to the Oclaro transaction, LITE boasted a strong telecom product portfolio,” writes B. Riley FBR’s Dave Kang. “Following the deal, Oclaro’s products which consists of mainly ACOs (Analog Coherent Optics) and PICs (Photonic Integrated Circuits) should further strengthen and extend the company’s lead against competitors.” His $62 price target indicates 52% upside lies ahead.

Meanwhile, Barclays’ Blayne Curtis writes, “We view the deal positively and despite some of the near-term headwinds (trade, weaker AAPL) like the value proposition of the combined entity.”

Indeed, this ‘Strong Buy’ stock has received only buy ratings from top analysts recently. You can learn more about analysts’ views on this stock via TipRanks’ LITE Research Report.

Marvell Technology Group

- Market value: $10.3 billion

- TipRanks consensus price target: $24.24 (54% upside potential)

- TipRanks consensus rating: Strong Buy

- Marvell Technology Group (MRVL, $15.70) is a producer of storage, communications and consumer semiconductor products. And it has been receiving several positive analyst reviews, including an upgrade (from “Hold” to “Buy”) from five-star Citigroup analyst Atif Malik.

That brings Malik back in line with the rest of Wall Street. The semiconductor stock has received 16 buy ratings and only one hold rating over the past three months.

Malik cited two key reasons for the bullish move: increasing sales diversification and expansion of gross margins. Although his $19 price target falls far below the Street’s average target, it still indicates upside potential of more than 20%.

Oppenheimer’s Rick Schafer is even more bullish, writing, “Management’s established record of execution and MRVL’s expanding growth/margin/FCF profile continue to support our long thesis. Our top self-help story, we remain long-term buyers here with a $30 target.” That target suggests shares could almost double from current levels. To learn more, get the TipRanks MRVL Research Report.

McDonald’s

- Market value: $135.5 billion

- TipRanks consensus price target: $193.09 (10% upside potential)

- TipRanks consensus rating: Strong Buy

Fast-food giant McDonald’s (MCD, $175.71) is a promising 2019 stock pick. This is thanks in part to its modernization efforts, which are impressing the Street’s top analysts.

Morgan Stanley’s James Glass recently boosted his MCD rating from “Hold” to “Buy” while ramping up his price target to $210 from $173 previously. From current levels, that indicates shares can soar 20%.

Glass says the market underappreciates McDonald’s sizable opportunity. “We are endorsing the notion that McDonald’s massive store modernization efforts, first rolled out in select international markets and now in the US (its single largest market), will begin to pay off in ‘19 and should produce best in class sales results for more years to come,” Glass writes.

McDonald’s also represents a savvy “defensive” stock pick “during periods of economic slowing,” he writes, thanks in part to its decent yield of 2.6%. MCD has racked up eight buy ratings from the analyst community in the past month alone. Get the TipRanks’ MCD Research Report.

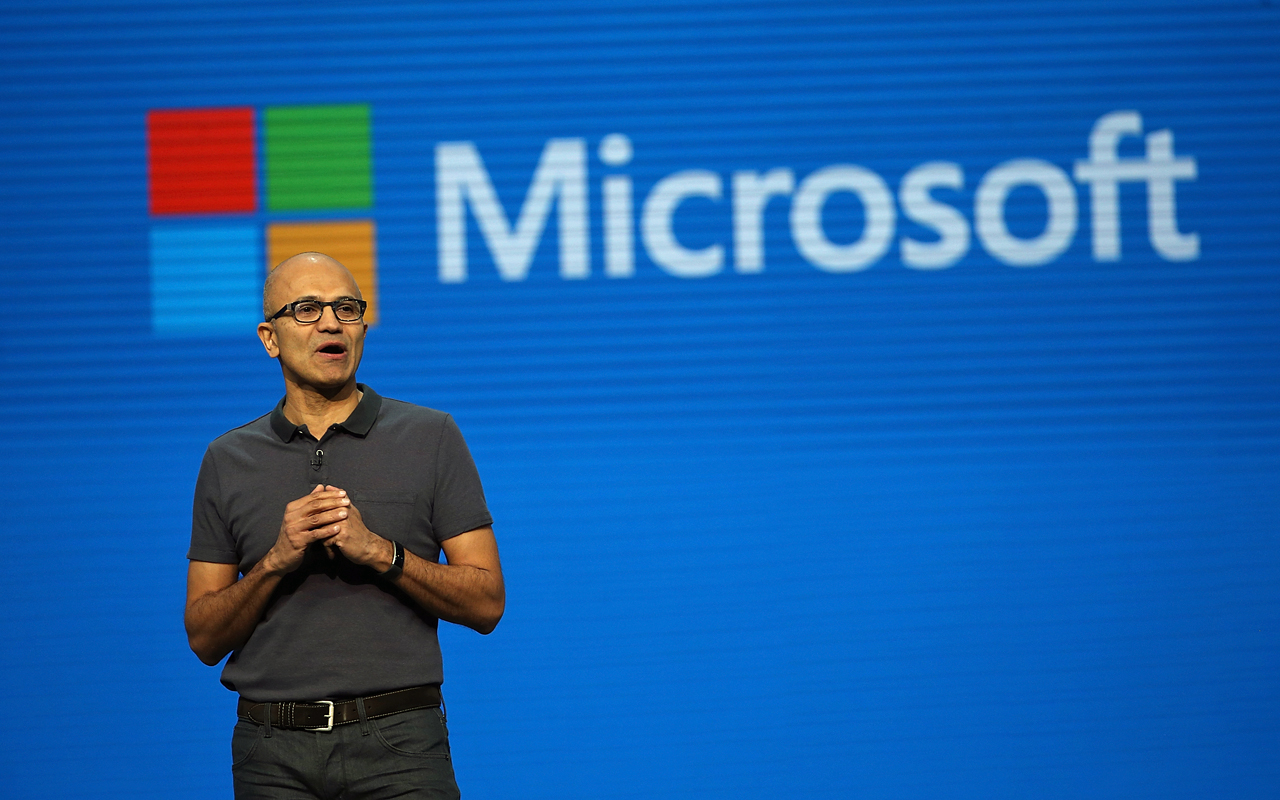

Microsoft

- Market value: $776.7 billion

- TipRanks consensus price target: $124.32 (23% upside potential)

- TipRanks consensus rating: Strong Buy

- Microsoft (MSFT, $101.18) is “in the sweet spot”: So says RBC Capital’s Ross MacMillan, who currently is the No. 2-ranked analyst on TipRanks (out of more than 5,000) for his stock picking savvy.

The analyst says that although comparisons will be tougher in the second half of the company’s fiscal 2019, especially on gross margins, “we continue to see many sustainable growth drivers.”

MacMillan, who has a “Buy” rating on the stock with a $124 price target (23% potential upside), continues, “Multi-year growth engines of (Office 365) and Azure continue to show fundamental strength, and margin expansion across Commercial Cloud is continuing with scale and execution.”

Luckily, the very large total addressable market for Azure – Microsoft’s rapidly expanding cloud service – means revenues and gross-profit growth should continue to accelerate. “We think Azure can scale to multiples of its current size as workloads grow on hyperscale cloud platforms,” MacMillan writes.

At the moment, 19 out of 20 analysts covering MSFT are currently optimistic about the stock’s prospects. See what they have to say in the MSFT Research Report.

Nutanix

- Market value: $7.1 billion

- TipRanks consensus price target: $62.91 (58% upside potential)

- TipRanks consensus rating: Strong Buy

- Nutanix (NTNX, $39.91) is an innovative cloud computing software company. It sells what it calls hyper-converged infrastructure appliances and software-defined storage.

Two analysts have just initiated coverage of NTNX, both with buy ratings.

“We view Nutanix as disruptive, as the hyper-converged market leader, and as the thought leader in hybrid cloud management,” writes Baird analyst Jonathan Ruykhaver. “The company is quickly transitioning to a software-only model and continues to show large deal traction in large enterprise.”

He starts the stock off with a $58 price target (45% upside potential), arguing that prices are way too cheap right now. Its enterprise-value-to-sales multiple of roughly five times FY20’s revenue looks inexpensive, especially for “a market leader with a growth opportunity in excess of 25% for the next several years,” he writes.

This “Strong Buy” stock pick has won over 10 of 12 covering analysts. You can learn more about the analyst community’s views on Nutanix via this TipRanks NTNX Research Report.

Pioneer Natural Resources

- Market value: $22.2 billion

- TipRanks consensus price target: $225.00 (73% upside potential)

- TipRanks consensus rating: Strong Buy

American energy producer Pioneer Natural Resources (PXD, $130.08) has received a double whammy of support recently, with two upgrades that signal a sentiment shift in the right direction. The upgrades come from Seaport Global’s Mike Kelly and William Capital’s Gabriele Sorbara.

“At the current valuation, we believe investors will revisit PXD, considering its ~660,000 net acres in the Midland Basin with the strongest balance sheet in the sector,” writes Sorbara, who has a $209 price target on the stock (61% upside).

Specifically, Sorbara is modelling for a solid production trajectory and significant free cash flow generation in 2020 and beyond. Bear in mind, PXD also is in the process of divesting its Eagle Ford Shale assets, which Sorbara values at $200 million to $250 million. This will transform PXD into a pure-play Midland Basin company.

“With its Midland Basin scale, long term growth trajectory and pristine balance sheet we believe PXD should be awarded a premium,” Sorbara writes. For further insights, check out TipRanks’ PXD Research Report.

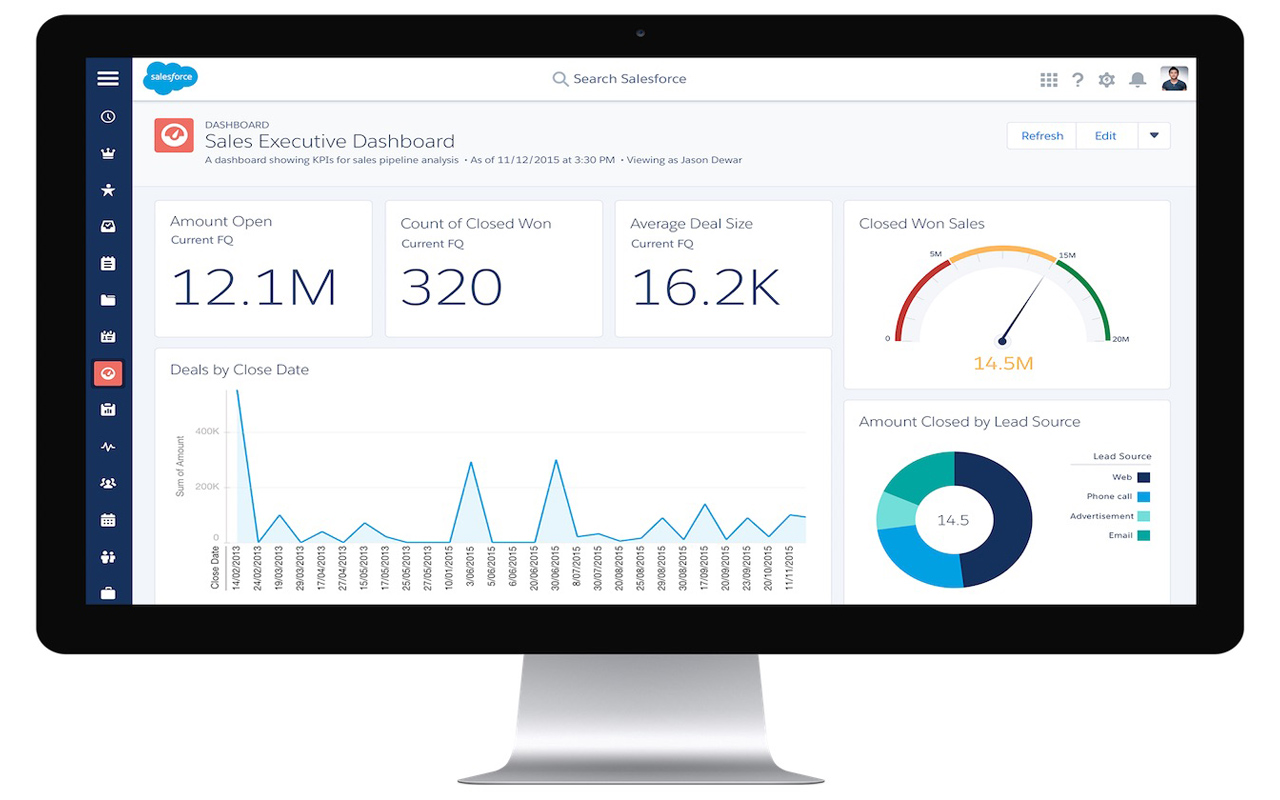

Salesforce.com

- Market value: $103.4 billion

- TipRanks consensus price target: $172.11 (27% upside potential)

- TipRanks consensus rating: Strong Buy

- Salesforce.com (CRM, $135.20) calls itself the No. 1 player in customer relationship management. And it likely won’t forfeit the title anytime soon.

Top-ranked Monness analyst Brian White recently attended the Salesforce World Tour, now an annual tradition for cloud-computing watchers each holiday season in NYC.

“Spirits were high at this year’s event after the company’s strong performance in 2018 and the unveiling of new innovations for customers to enjoy,” he writes. This includes Lightning Web Components – a programming model that makes it easier for JavaScript developers to code on the Lightning Platform.

“We believe the momentum at Salesforce can continue in (fiscal 2020) and we view the company as the best vehicle for investors to play the cloud trend,” White concludes.

White reiterated his “Buy” rating with a $172 price target (32% upside potential). Overall, Salesforce has received 20 recent buy ratings, with only two covering analysts staying on the sidelines. See what other experts are saying with TipRanks’ CRM Research Report.

Splunk

- Market value: $15.2 billion

- TipRanks consensus price target: $134.56 (31% upside potential)

- TipRanks consensus rating: Strong Buy

- Splunk (SPLK, $102.74) provides a unique software platform for collecting and analyzing machine-generated data, such as log files and configuration files. This data can be found in every type of IT system, device and application.

The Street broadly thinks this stock is poised for significant growth. “Splunk technology is potentially applicable and disruptive in several market segments including IT operations, security and compliance, and business intelligence,” Merrill Lynch’s Kash Rangan writes. He calculates that these market segments are collectively worth $28 billion today.

Rangan believes we could be looking at the next ServiceNow (NOW). “Given the strength in ACV (annual contract value), we could see stronger software revenues in future” close to ServiceNow’s 30%-plus year-over-year expansion. No wonder he sees significant upside (43%) ahead.

Over the past three months, 16 out of 18 covering analysts have recorded a bullish sentiment on the stock. See what other experts are saying with TipRanks’ SPLK Research Report.

SVB Financial

- Market value: $10.1 billion

- TipRanks consensus price target: $321.53 (69% upside potential)

- TipRanks consensus rating: Strong Buy

California-based SVB Financial (SIVB, $190.05) is a high-tech commercial bank that has helped fund more than 30,000 startups. The company has just hosted its first investor day in seven years, and analysts are impressed.

“Overall, the long- term outlook remains intact and we continue to view the company’s unique niche value proposition as superior to many of its peers,” writes RBC Capital’s Jon Arfstrom – one of the top 20 finance analysts on TipRanks. He recently reiterated his “Buy” rating on the stock with a $320 price target, indicating upside potential of approximately 69%.

One driver of SIVB’s strong growth outlook is the company’s substantial international opportunity. Another is the recent acquisition of Leerink Holdings for $280 million, which is on track to close in the first quarter of 2019.

“We continue to view this acquisition very favorably and believe it will ultimately pay attractive dividends over the long-term,” Arfstrom writes. Investors interested in more analyst feedback on this “Strong Buy” financial stock pick can find it in this free SIVB Research Report from TipRanks.

Teck Resources

- Market value: $12.4 billion

- TipRanks consensus price target: $30.75 (42% upside potential)

- TipRanks consensus rating: Strong Buy

Diversified Canadian mining company Teck Resources (TECK, $21.65) is a world leader in coal production. It also has a portfolio of five copper growth projects and has just revealed a savvy deal for Quebrada Blanca Phase 2 (QB2), a copper development project in Chile. This deal involves selling a 30% interest in Compañia Minera Teck Quebrada Blanca S.A. – a Teck subsidiary that controls the QB2 project – for $1.2 billion.

Eight analysts have since published “Buy” ratings on TECK, including one upgrade. B. Riley FBR’s Lucas Pipes sees the deal as a “major positive catalyst.” He writes, “The consideration of $1.2B is far exceeding market expectations (that we believe were nearly half of the contribution).” Plus, “the structure of the deal significantly de-risks the development.”

Pipes doesn’t publish a price target, but he does speak of a “persistent valuation disconnect.” The average analyst price target points to this disconnect, implying more than 40% upside exists. For more information, get the TipRanks’ TECK Research Report.

Vertex Pharmaceuticals

- Market value: $41.5 billion

- TipRanks consensus price target: $207.58 (28% upside potential)

- TipRanks consensus rating: Strong Buy

Innovative biotech stock Vertex Pharamceuticals (VRTX, $162.37) specializes in cystic fibrosis therapies.

VRTX recently reported impressive results from its triple regimen therapy for homozygous and heterozygous CF patients. The therapy is moving rapidly to readouts in the first quarter of 2019, with a planned New Drug Application in mid-2019.

Oppenheimer’s Hartaj Singh projects a long growth runway ahead.

“This could be just the beginning of the upside story” he writes. “The company is positioned to deliver strong sales and earnings growth over the next five years, with the potential for even greater growth if near and mid-term product launches outperform and (operating expenditures) reaches steady state,” Singh writes.

The Street seems to agree. VRTX has 100% Street support – meaning it has received only buy ratings – over the past year, including 10 buy ratings in the past three months alone. You can learn more from TipRanks’ VRTX Research Report.

Visa

- Market value: $299.9 billion

- TipRanks consensus price target: $166.92 (26% upside potential)

- TipRanks consensus rating: Strong Buy

RBC Capital highlights financial-services giant Visa (V, $132.01) as one of its Top 30 Global Ideas for 2019.

Visa offers “tremendous line of sight” into 2019, writes RBC’s Daniel Perlin. In other words, the company’s growth outlook for 2019 is already pretty much a done deal. That’s thanks to 1) Europe’s multi-pronged growth strategy, 2) new payment flows via Visa Direct and B2B, 3) contactless payments and 4) double-digit net revenue growth, creating a powerful earnings wedge.

Specifically, Perlin dubs Visa Europe “the gift that keeps on giving.” He also believes contactless payments help protect Visa’s competitive moat. Increasingly, contactless payments encourage consumers to use cards instead of cash, even for relatively small payments.

The analyst has a $170 price target on the stock (29% upside potential). Out of 14 analysts covering the stock, an impressive 13 are bullish. Get the TipRanks’ V Research Report.

Wix.com

- Market value: $4.2 billion

- TipRanks consensus price target: $112.50 (25% upside potential)

- TipRanks consensus rating: Strong Buy

- Wix.com (WIX, $90.25) provides a DIY website builder for individuals and small businesses. Essentially, you can create a high-quality website for a relatively low price, without any coding knowledge.

Analysts are buzzing over the company’s just-launched Ascend offering. This is a new all-in-one suite combining 20 products, including a new inbox feature, chat, workflows, email marketing, SEO and social media.

KeyBanc’s Monika Garg attended the Ascend release event. “While early, Ascend presents interesting growth opportunities, and we will be watching progress closely,” she told investors. She sees Ascend as reflective of Wix’s commitment to helping businesses with their online presence, which presents secular tailwinds.

“We believe Wix is a high-quality company with strong growth opportunities and free cash flow support,” writes Garg, whose $122 price target translates into 36% upside potential.

RBC Capital’s Mahaney, meanwhile, recently upgraded WIX from “Hold” to “Buy” and given it a new $110 price target. He calls the stock “one of the best fundamental assets in our Mid/Small Cap coverage galaxy.” Get the TipRanks’ free WIX Research Report.

Harriet Lefton is head of content at TipRanks, a comprehensive investing tool that tracks more than 5,000 Wall Street analysts as well as hedge funds and insiders. You can find more of their stock insights here.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.