2019's Most Surprisingly Hot Stocks

The market is off to one of its strongest starts in decades.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The market is off to one of its strongest starts in decades. And although 2019 got rolling with an advantage – coming off the worst December performance in ages – the rally doesn’t look terribly strained just yet.

Even more surprising are some of the names leading the charge. High-profile stocks, such as the FANG tech companies, have enjoyed solid gains. But some of the biggest winners are names that have fallen off many investors’ radars, or were never on them to begin with.

What’s more heartening is that many of these new uptrends seem built to last for all the right reasons – they’re either regaining relevancy, growing the bottom line or both.

Here’s a look at 10 of the markets most surprising large- and mid-cap stock winners so far in 2019. Their underlying stories are taking a turn for the better, at least in investors’ eyes, and all of them merit a closer look, if only for a mental note to reference at a later date.

Data is as of Feb. 13.

Roku

- Market value: $5.7 billion

- 2019 performance-to-date: 64%

Most stocks lost at least a little ground during the fourth quarter of 2018. Roku (ROKU, $50.20), however, took on far more than its fair share of water, falling from October’s peak of more than $77 per share to December’s low near $26. Investors clearly feared the streaming platform company’s best days were in the rear-view mirror.

Big mistake.

Roku released its preliminary fourth-quarter numbers in early January, including a total of 27 million actively used devices. That was the fourth consecutive quarter the company saw at least 40% year-over-year growth in its active customer base. That matters so much more than raw sales figures of its devices.

Unit sales initially were the metric of most investor interest, but Roku has shifted its focus to advertising revenue, selling ad space on the splash screens and other menu-based pages viewed via its set-top receivers and licensed televisions. During the third quarter, not only did ad and services revenue eclipse the $100 million mark for the first time ever, but it was the third consecutive quarter that ad sales were greater than hardware revenue – a disparity that continues to widen. Better yet, gross margins for its platform business finally appear to be stabilizing around 70%.

It’s a savvy business move, in the same vein as the one Apple (AAPL) is making to depend less on devices like the iPhone and lean more on the digital products consumed via that hardware. Digital products and advertisements can drive recurring revenue, whereas the market for devices is limited, and now saturated.

Xerox

- Market value: $6.9 billion

- 2019 performance-to-date: 52%

Yes, the company with a name that was once synonymous with photocopying is still around.

But Xerox (XRX, $30.00) isn’t just photocopiers any longer. In fact, copy machines and printing are the least important growth engine for the company these days. The old company has found new life by offering software – document-management software in particular. It also recently closed on a deal that will bolster its budding 3D printing business.

The stronger focus on software in an environment where traditional document printing is a fading business is a step in the right direction. So far it hasn’t helped enough, though, with revenue steadily sinking since 2010.

But this year could be a turning point.

“XRX had a big resurgence in January and it’s based on three things: stabilizing revenue, new management installed by Icahn, and sustained free cash flow,” says Tim Parker, a partner with New Jersey-based Regency Wealth Management. Parker adds, “(Carl) Icahn saw the free cash flow and the potential for new management to come in to change up the culture and rationalize some of the business. Investors had largely given up on XRX, but now that things look like they are turning around, they are jumping back in.”

That free cash flow should cumulatively total more than $3 billion between now and the end of 2021, according to the company’s recently unveiled three-year plan.

The same efficiency improvements and innovations could drive “at least $4.00 of adjusted EPS in 2020,” though Xerox already is moving toward that goal. Analysts had been calling for a 2019 bottom line of $3.53 per share, up from 2018’s $3.46. But Xerox offered full-year profit guidance of between $3.70 and $3.80, suggesting the pros may improve their outlooks in the foreseeable future.

Coupa Software

- Market value: $5.7 billion

- 2019 performance-to-date: 51%

To be fair, Coupa Software (COUP, $94.72) wasn’t a surprise to everyone – Kiplinger’s Personal Finance columnist James K. Glassman had this mid-cap stock as one of his top stock picks for 2019.

Coupa is anything but a household name. Aside from a relatively small market cap of $5 billion keeping it off most investors’ radars, its target market is enterprise-level entities – not individual consumers. It’s also not profitable, disqualifying it as a potential investment for a few would-be buyers that might stumble across it.

It still merits a closer look, especially because a swing to a respectable profit is on the radar.

Analysts expect revenue growth of 36% this year followed by 24% top-line growth in 2020. That’s expected to bring Coupa from a per-share loss of 21 cents last year to a 13-cent profit in 2019, followed by 20 cents per share of earnings in fiscal 2020.

The key to that margin-widening revenue growth is a superior product that business customers are only beginning to appreciate. Coupa offers a robust business spend management (or BSM) platform that lets large organizations streamline time-consuming activities like expense reimbursement, invoicing and purchasing. Forrester Research recently called Coupa a leading company within the contract lifecycle management (CLM) segment of the BSM market.

The kicker: A huge degree of Coupa’s business is recurring, subscription-based revenue. In its most recently reported quarter, $55.4 million of its $61.7 million in sales came from subscriptions, up 39% year-over-year.

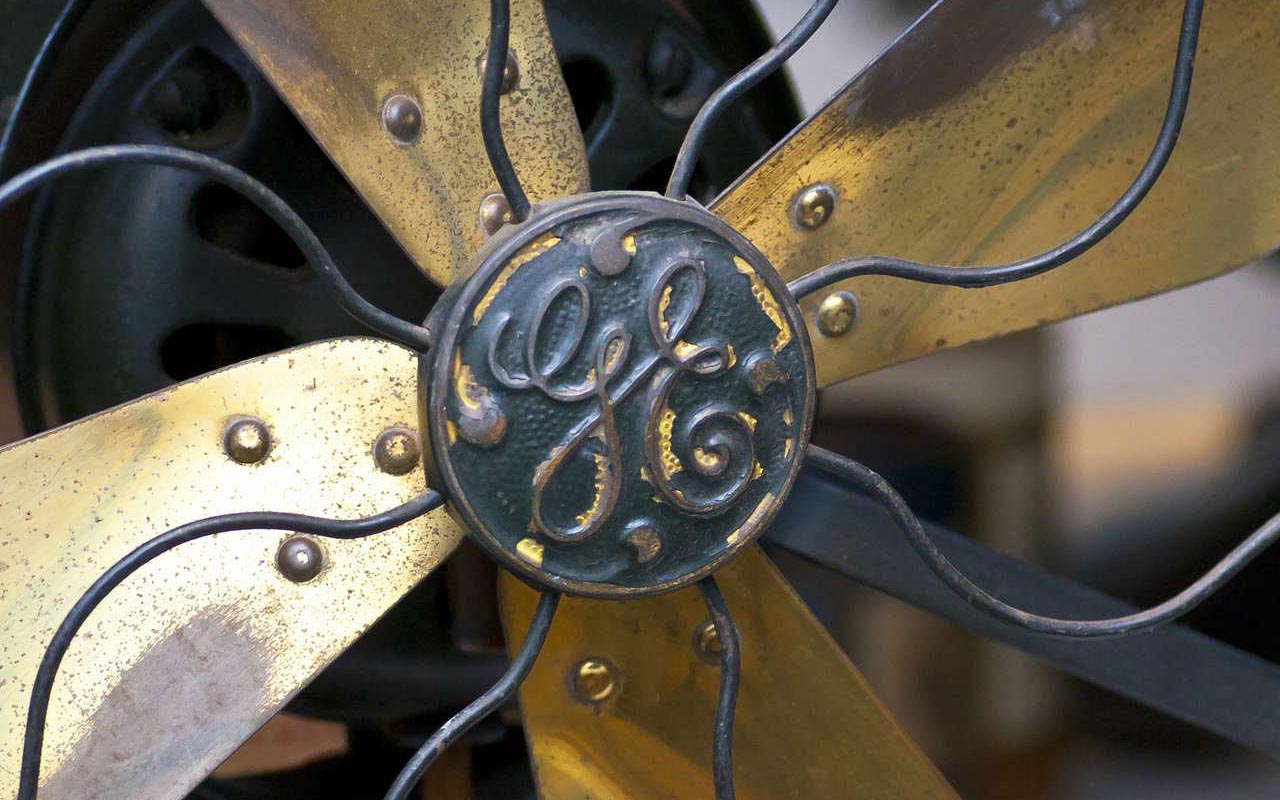

General Electric

- Market value: $86.9 billion

- 2019 performance-to-date: 37%

- General Electric (GE, $10.37) executed what arguably was the most notable fall from grace of the modern era. Once the poster child of American industrialism, GE has been reduced to a mere fraction of its former self. Too many years of poor management and a failure to innovate have left the company saddled with debilitating debt. Gordon Haskett analyst John Inch believes, in a worst-case scenario, General Electric could literally be worthless.

Something clearly has inspired investors over the course of the past few weeks, however. Shares are up 37% since the end of last year, and higher to the tune of 55% from their multiyear lows in mid-December.

The catalyst has been hope for a legitimate turnaround, bolstered by an increasing recognition that investors were a little too harsh on the stock in 2018. They may be onto something, according to CFRA analyst Jim Corridore’s thoughts on General Electric’s fourth quarter report. He wrote:

“GE is making some progress in generating cash and restructuring operations, though it still has a long way to go. … Revenues were stronger than we expected and GE has made progress on asset sales, and repositioning of assets. We were pleased to see GE reach a settlement with DOJ on its mortgage lender WMC for what it had already reserved for, as well as by fewer one-time charges. We expect a GE fix to take time, but today’s results show some much needed progress.”

The time that General Electric needs to solidify a turnaround, however, also gives investors time to second-guess their recent buy-in.

The New York Times Co.

- Market value: $5.3 billion

- 2019 performance-to-date: 43%

The newspaper business may be dying in the age of the internet, but at least one newspaper has capitalized on a unique time in American politics.

- The New York Times Co. (NYT, $31.37) shares are up 43% year-to-date “despite being labeled ‘The Failing New York Times’ by President Trump. Or, more likely, because of being labeled ‘The Failing New York Times’ by POTUS,” says Robert R. Johnson, CEO of asset management firm Economic Index Associates. Johnson, who also co-authored Invest With the Fed, goes on to explain, “The election of Trump was the best ‘news’ for NYT shareholders, as the stock has more than doubled since election day in 2016. In the current political environment, NYT is not only reporting the news, it is a big part of the story.”

The company’s results support the premise. Last quarter’s revenue grew 10% year-over-year, driven higher by a 5% improvement in subscription sales and ad sales growth of 11%. The progress lengthens a revenue growth streak that took hold during the first quarter of 2017, when Donald Trump took office. Operating income turned the corner around the same time.

The New York Times Co.’s growth still isn’t the being driven by a rekindled print business, however. Digital subscribers are doing most of the heavy lifting, with another 265,000 of them signing up during the fourth quarter – the biggest growth spurt since the post-election surge – to bring the newspaper’s digital subscriber headcount to 3.4 million. Given the current pace, the company’s goal of 10 million digital subscribers by 2025 doesn’t seem out of reach – particularly if Trump is re-elected.

And credit where credit is due: Glassman also had NYT on his 10 buys for 2019.

Mirati Therapeutics

- Market value: $2.3 billion

- 2019 performance-to-date: 70%

If you’re not familiar with Mirati Therapeutics (MRTX, $72.19), don’t sweat it. Most investors have never even heard of the company, let alone its core growth prospect. The crowd that has bought into the $2.8 billion outfit is a relatively small but enthusiastic one.

This biopharmaceutical company is developing MGCD516, or sitravatinib, as a means of fighting a handful of cancers. It’s being tested in conjunction with existing oncology drugs in most trials, though it’s also being tried as a standalone treatment of non-small-cell lung cancer and melanoma.

Sitravatinib has dished out mixed results. While it has shown glimmers of promise on some fronts, in October, MRTX shares dropped 20% following a Phase 2 trial update with a poor outcome. That tumble came on the heels of a similar setback in September.

The sum and timing of the slide, however, ultimately set the stage for a sharp rebound that began taking shape near the end of 2018. Mirati shares have more than doubled in value since the late-December bottom, spurred by a combination of the company’s first trial dosing of its G12C Inhibitor (MRTX849) as a therapy for KRAS cancers, and word that it was moving into Phase 3 trials of sitravatinib combined with Bristol-Myers Squibb’s (BMY) Opdivo as a treatment for non-small-cell lung cancer. Despite its stumbles, the pipeline still has solid potential.

Just remember: Biotech stocks are notoriously volatile, with many big runups often followed by similar pullbacks.

Bed, Bath & Beyond

- Market value: $2.3 billion

- 2019 performance-to-date: 44%

Home goods retailer Bed, Bath & Beyond (BBBY, $16.26) has been fighting a losing battle for years, with shares falling from a peak near $80 in early 2015 to a low of less than $10 in December of last year.

Some of that selloff was deserved, given the company’s inability to fend off increasingly ferocious competitors, online and off. Some of that selloff might not have been merited, however, and instead was inspired by nothing more than assumptions that its history was a glimpse of the future as well. Yale Bock, portfolio manager with Boston-based Interactive Brokers Asset Management, explains that Bed Bath’s management team “lost credibility with investors because of the belief that the enterprise had lost the ability to grow.”

And yet, the retailer dished out a solid earnings beat in early January, along with an outlook for stabilizing earnings in 2019 that should swing to growth in 2020.

The turnaround reflects a prioritization of profits over revenue growth, which begins with a rethinking of the company’s product mix. Bock says Bed, Bath & Beyond “understands they must have unique products versus commodity offerings,” which should leader to wider margins even if sales stagnate.

Still, while BBBY shares are well up for the year, they remain in a technical downtrend and have yet to move above price levels that would suggest the stock has completely broken out of its bearish rut.

Cleveland-Cliffs

- Market value: $3.3 billion

- 2019 performance-to-date: 49%

At least some of the big gains that Cleveland-Cliffs (CLF, $11.47) shares have dished out in 2019 are less about something the company is doing, and more about what one of its rivals isn’t doing.

Brazilian competitor Vale (VALE) was forced to halt operations at a key mine in January after a Minas Gerais dam burst. Macquarie Research’s analysts noted “the direct impact on production is likely to be modest.” But Vale’s stumble still translates into a window of opportunity for Cleveland-Cliffs at a time it was already starting to catch a tailwind.

The larger part of this year’s big advance arguably stems from a true turnaround in the company’s steel business. Last year’s top line of $2.3 billion was more than a 30% improvement on 2017’s tally, and enough to drive a 67% year-over-year improvement in EBITDA. Net income nearly tripled.

The prod for the fiscal progress, of course, was new tariffs on steel imported into the United States in an economic environment that supports modestly higher prices. Buyers turned to American sources such as Cleveland-Cliffs, where it was cheaper, to meet sustained demand for steel-based products.

But if those tariffs abate, or are outright removed, Cleveland-Cliffs will run into a competitive headwind again.

Box

- Market value: $3.5 billion

- 2019 performance-to-date: 43%

“Some of the biggest growth stories like Amazon and Alphabet have slowed,” says David Russell, vice president of content strategy with TradeStation Securities. “Which seems to be producing two results. First, investors are taking money out of those giant names and looking for the next major growth stories. Second, some of those big tech stocks could now acquire some of those exciting new names. Either way, the message is clear: out with the old, in with the new.”

One of those new names is Box (BOX, $24.16), which provides enterprise-level customers with a cloud-based file-sharing and collaboration platform.

It’s not a brand-new idea, but it is starting to catch on in a big way. Revenue is expected to grow at a 20% clip this year and improve at the same pace in 2020. That progress also is expected to drive a swing to profitability, from last year’s loss of 43 cents per share to full-year EPS of 3 cents in 2020.

That growth, Russell notes, makes Box “exactly the kind of company that investors love: established but not mature, big enough to know they have a business but small enough to deliver growth for years into the future.” He also believes much of this year’s gains may reflect Box’s potential as an acquisition target.

Sage Therapeutics

- Market value: $7.3 billion

- 2019 performance-to-date: 65%

For all intents and purposes, Sage Therapeutics (SAGE, $157.63) is a pre-revenue company. But that could change soon.

The biotech firm’s claim to fame is a developmental postpartum depression drug called Zulresso. An FDA advisory panel recommended in November that the regulatory agency approve the drug when it’s scheduled to make the final decision in late March. The market is largely expecting Zulresso to get that green light, making Sage a player in a market that’s crowded, but not terribly well served.

Zulresso isn’t the only drug in Sage Therapeutics’ pipeline, though. Also in Phase 3 trials is SAGE-217 – another postpartum depression treatment that’s still at least a year away from any approval, but just as promising. Recently posted results of the late-stage trial indicated remission in 45% of patients and a statistically significant improvement of postpartum depression symptoms in the test group as a whole.

Yes, in some regards, the two drugs would end up competing with one another. Although SAGE-2017 would be administered daily for two weeks while Zulresso would only need to be dosed once, intravenously, for 60 continuous hours, it’s an either/or matter. Sage Chief Business Officer Mike Cloonan, however, believes there’s room for both treatments, and the stock’s recent runup suggests investors feel the same.

The risks still are significant, of course, as is the case with all biopharma names.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

5 Stocks to Sell or Avoid Now

5 Stocks to Sell or Avoid Nowstocks to sell In a difficult market like this, weak positions can get even weaker. Wall Street analysts believe these five stocks should be near the front of your sell list.

-

Best Stocks for Rising Interest Rates

Best Stocks for Rising Interest Ratesstocks The Federal Reserve has been aggressive in its rate hiking, and there's a chance it's not done yet. Here are eight of the best stocks for rising interest rates.

-

The Five Safest Vanguard Funds to Own in a Volatile Market

The Five Safest Vanguard Funds to Own in a Volatile Marketrecession The safest Vanguard funds can help prepare investors for market tumult but without high fees.

-

The 5 Best Inflation-Proof Stocks

The 5 Best Inflation-Proof Stocksstocks Higher prices have been a major headache for investors, but these best inflation-proof stocks could help ease the impact.

-

5 of the Best Preferred Stock ETFs for High and Stable Dividends

5 of the Best Preferred Stock ETFs for High and Stable DividendsETFs The best preferred stock ETFs allow you to reduce your risk by investing in baskets of preferred stocks.

-

What Happens When the Retirement Honeymoon Phase Is Over?

What Happens When the Retirement Honeymoon Phase Is Over?In the early days, all is fun and exciting, but after a while, it may seem to some like they’ve lost as much as they’ve gained. What then?

-

5 Top-Rated Housing Stocks With Long-Term Growth Potential

5 Top-Rated Housing Stocks With Long-Term Growth Potentialstocks Housing stocks have struggled as a red-hot market cools, but these Buy-rated picks could be worth a closer look.