Stock Picks That Billionaires Love

Billionaire investors are scooping up beaten-down blue chips when they're on sale.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

You can't get rich simply by copying billionaires' moves, but there's still something irresistible about following their top stock picks.

The billionaires we're about to talk about have larger-than-life reputations when it comes to investing other rich people's money. Meanwhile, their resources for research, as well as their intimate connections to insiders and others, can give them unique insight into their stock picks.

Studying which stocks they're chasing with their capital can be an edifying exercise for retail investors. There's a reason the rich get richer, for one thing. But it's also helpful to see where billionaires sometimes make mistakes — at least in the short term.

No matter how successful they've been in the past, all investors are fallible. Those who've amassed multibillion-dollar personal fortunes have merely made more money being right than they've lost when getting it wrong.

Need proof? As Chairman and CEO Warren Buffett wrote in Berkshire Hathaway's 2022 annual report (PDF): "In 58 years of Berkshire management, most of my capital-allocation decisions have been no better than so-so. Our satisfactory results have been the product of about a dozen truly good decisions."

Berkshire's "satisfactory results" happen to be a stock that has generated compound annual growth of almost 20% since 1965. The S&P 500 delivered compound annual growth of not quite 10% over the same span.

Without further ado, here are five notable top stock picks from the billionaire class.

In each case, the billionaire below initiated a substantial position or added to an existing one in the third quarter. If you're wondering why megacap tech and communication services stocks have been rallying so hard, well, buying pressure on the part of billionaires is at least part of the equation.

Stake values and portfolio weights are as of September 30, 2025. Data courtesy of S&P Global Market Intelligence, YCharts, WhaleWisdom, Forbes and regulatory filings made with the Securities and Exchange Commission, unless otherwise noted. Stocks are listed by weight in the selected billionaire investor's equity portfolio, from smallest to largest.

Meta Platforms

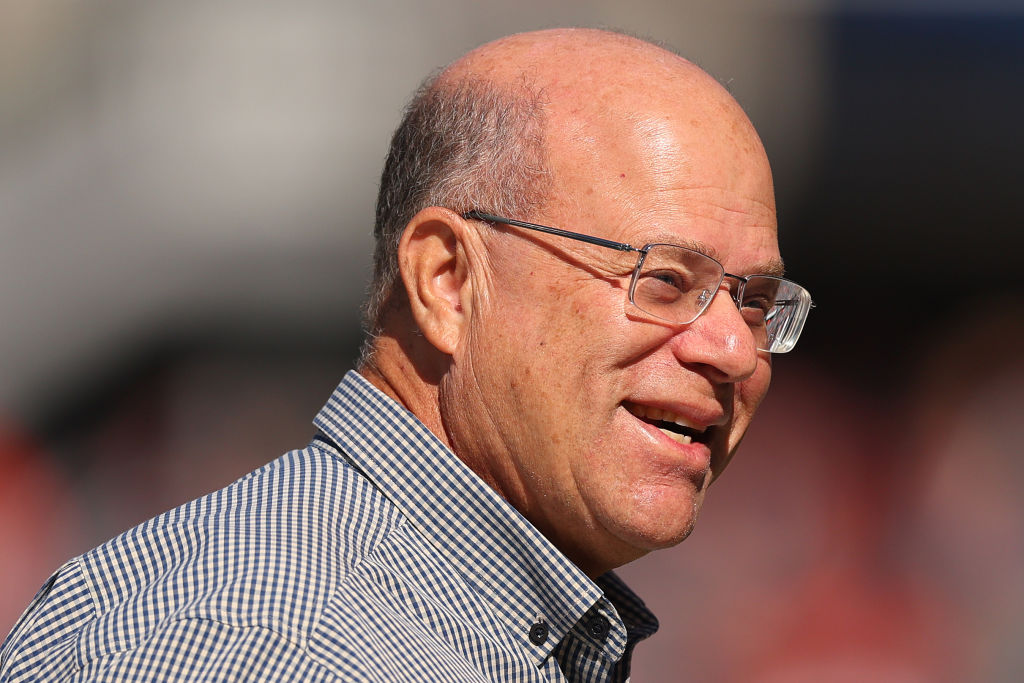

- Billionaire investor: Steve Cohen (Point72)

- Stake value: $602 million

- Percent of portfolio: 0.7%

Steve Cohen is probably best known for using his estimated net worth of $21 billion to buy the New York Mets. But he's also known for adding to positions when stocks he already likes a lot are on sale.

Perhaps that's why his family office — Point72 Asset Management based in Stamford, Connecticut — upped its stake in Meta Platforms (META) when shares traded sideways in Q3.

Point72, with $221 billion in assets under management (AUM), bought another 611,420 shares in META – nearly a 300% increase – over the course of the third quarter, adding to a position the firm initiated in the second quarter of 2020.

With 819,325 shares worth $602 million as of the end of Q3, META stock leapfrogged into a top 10 holding. Previously, it was the fund's 59th-largest position.

Over the past three years, META generated an annualized return of more than 75%, easily outperforming the broader market's return of 20%.

Sea Limited

- Billionaire investor: Daniel Sundheim (D1 Capital Partners)

- Stake value: $231 million

- Percent of portfolio: 2.7%

Daniel Sundheim's D1 Capital Partners made a name for itself during its seven years of existence. The New York hedge fund began trading with "only" $5 billion in capital. Today, D1 boasts nearly $28 billion in AUM.

Along the way, Sundheim built an estimated net worth of $2.6 billion, according to Forbes. In a nod to his precocious success, some wags called Sundheim the LeBron James of investing.

Shareholders surely hope Sundheim brings his scoring touch to D1's new position in Sea Limited (SE). The hedge fund initiated a stake in the Singapore-based online gaming, shopping and financial services company in Q3.

With 1.3 million shares worth $231 million as of September 30, SE is among Sundheim's top 20 holdings. Sadly, SE is off 27% over the past three months vs a 4% rise in the broader market.

Broadcom

- Billionaire investor: Stephen Mandel (Lone Pine Capital)

- Stake value: $511.2 million

- Percent of portfolio: 3.7%

It should come as no surprise that yet another billionaire investor initiated yet another big bet on a mega-cap tech stock in Q3. After languishing during the market's spring rout, shares in Broadcom (AVGO) are beating the broader market wide a margin in the second half of 2025.

Stephen Mandel picked up more than 1.5 million shares in the chipmaker in Q3. Mandel amassed an estimated net worth of $2.5 billion by knowing how to spot momentum, so count this as encouraging news for AVGO bulls.

Mandel's Lone Pine Capital hedge fund ($20.1 billion AUM) now owns a stake in AVGO worth more than half-a-billion dollars as of September. At 3.7% of the portfolio, Broadcom is the fund's 13th-largest holding.

Meanwhile, shares are up 18% over the past three months vs a 4% gain for the broader market.

Nvidia

- Billionaire investor: David Tepper (Appaloosa)

- Stake value: $354.5 million

- Percent of portfolio: 4.8%

Nvidia (NVDA) was well on its way to becoming the first company to top $5 trillion in market cap when David Tepper once again added to his hedge fund's position in the third quarter.

The owner of the NFL's Carolina Panthers accumulated an estimated net worth of $23.7 billion in part by knowing how to ride a hot hand. His Appaloosa hedge fund (AUM $17.8 billion) boosted its stake in the chipmaker in Q3 by nearly 9%, or 150,000 shares.

Appaloosa, which has owned NVDA since early 2023, now holds 1.9 million shares worth nearly $355 million as of the end of the third quarter. With a weight of 4.8%, Nvidia is Tepper's fourth-largest position, up from No. 7 in the previous quarter.

Microsoft

- Billionaire investor: Philippe Laffont (Coatue Management)

- Stake value: $2.4 billion

- Percent of portfolio: 5.9%

Philippe Laffont built an estimated net worth of $7.9 billion partly by knowing how to stick with winners. Such skills were on display when Laffont's Coatue Management hedge fund (AUM $69.5 billion) increased its stake in Microsoft (MSFT) by another 18% in Q3.

Coatue, which has owned MSFT since the third quarter of 2021, held 4.6 million shares worth $2.4 billion as of September 30, according to regulatory filings. With a portfolio weight of 5.9%, MSFT is the New York hedge fund's second-largest position.

If nothing else, Laffont finds himself in good company. Not only is Microsoft one of the most popular blue chip stocks among hedge funds, but it also gets the highest consensus recommendation of all 30 Dow Jones stocks.

It also doesn't hurt that MSFT has done extraordinary things for truly long-term shareholders. Anyone who put $1,000 into MSFT stock a couple of decades ago has clobbered the S&P 500 by a wide margin.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.