6 Genome Sequencing Stocks to Buy for Big Health-Care Profits

Genome sequencing – basically figuring out the order of DNA, the building blocks of life – was once essentially little more than a lab exercise.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Genome sequencing – basically figuring out the order of DNA, the building blocks of life – was once essentially little more than a lab exercise. But now, it has reached commercial viability and then some.

The field of genomics goes back to the 1950s, though it really started in earnest with the start of the Human Genome Project in 1990 – a 13-year, $2.7 billion enterprise that was completed in April 2013.

Genome sequencing, in which scientists and their myriad machines detail the entire set of human DNA, has fantastic medical potential, allowing researchers to find genetic mutations – errors that can be harmless at times, but other times debilitating or even fatal. Moreover, genome sequencing is starting to reach realistic pricing – the costs have fallen down to about $1,000 at the low end, and companies are racing to cash in on the myriad opportunities.

Here are six genome sequencing stocks to buy for this emerging medical technology. While genomics isn’t the biggest investing buzzword today, this is a promising niche of the market that could take off as it gains more prominence.

Data is as of Dec. 20, 2018.

Illumina

- Market value: $43.0 billion

- Illumina (ILMN, $292.25) sells gene sequencing equipment and array technologies. It’s a leader in the growing market for gene sequencing technology, focusing on the fields of prenatal testing, rare diseases, oncology, population genomics and consumer genomics.

Population genomics is large-scale comparison of DNA sequences of the population by governments and research labs. Meanwhile, consumer genomics is the backbone of growing consumer-facing companies such as 23andMe and Ancestry.com – brands you likely saw heavily advertised during the 2018 holiday season.

Illumina’s big advantage is its installed base of nearly 11,600 systems, found in hospitals, research labs and medical facilities. This equipment is relatively expensive, and carries per-use costs, but the investment the customers make in Illumina technology is what makes switching to a different platform less likely. This installed base gives Illumina runway to grow as genome sequencing takes off. As an example, Illumina genotyped more than 7 million consumer samples in 2017 – approximately equal to its total volume since 2007.

The company has grown revenues at a compound annual rate of approximately 22% since that point. Moreover, Illumina has demonstrated it can capitalize on its lead, generating more than $500 million in free cash flow each year since 2014.

Analysts at Bank of America/Merrill Lynch expect Illumina’s recent $1.2 billion acquisition of Pacific Biosciences to bolster its position in DNA sequencing through lower costs and increased output.

As genome sequencing grows, so grows Illumina.

Myriad Genetics

- Market value: $2.1 billion

- Myriad Genetics (MYGN, $28.64) sells products in a growing niche known as personalized medicine. Myriad’s diagnostics products help consumers understand their odds of eventually getting a particular disease, and provide a pathway for determining which treatment options may prove most effective.

Myriad has a solid franchise in cancer testing with a reputation for accuracy and a large database of variants that helps the company maintain premium pricing. Helping patients find the most effective antidepressant medication may be an even larger opportunity for Myriad. While cancer testing is a $4 billion market with 1.5 million patients, the antidepressant market is two-and-a-half times larger, with approximately 8 million patients.

Myriad’s GeneSight personalized genetic testing has gained favorable reimbursement coverage from insurers based on estimated savings of nearly $3,300 for patients using its tests. Moreover, it represents an important step in diversifying its product portfolio.

Since 2014, Myriad’s revenues and earnings have been flat to slightly negative. However, as its products diversity and its reimbursement coverage continue to improve, the stock is poised for upside.

Genomic Health

- Market value: $2.2 billion

- Genomic Health (GHDX, $59.89), as its name suggests, is a leader in genetic testing. The company achieved profitability in 2017 after years of investing heavily in its products, salesforce and international expansion. And as the company leverages the infrastructure its built, and the overall market for genomic testing grows, the setup for growth is excellent.

Genomic Health is focused exclusively on the oncology market. Its tests, which range in cost from $4,000 to $4,500, “definitely identify who does and who does not benefit from chemotherapy,” according to the company’s investor presentation. This saved the U.S. health-care system roughly $5 billion in 2017, which in turn drives insurance coverage rates for its signature Oncotype DX suite of tests for breast, colon and prostate cancers. Approximately 90% of “insured lives” are covered for Oncotype tests.

Internationally, the opportunity may be even larger. Covered lives in its current markets, which include Canada, the U.K., France and Spain, are approximately 220 million, according to company estimates. These will increase to 490 million covered lives in 2020 and beyond through increased insurance coverage in entrance into new markets., including Japan, Italy and Germany.

Revenue growth has been tepid over the past five years, growing from $263 million in 2013 to $341 million in 2017. Profitability was achieved in 2017 on an “adjusted basis,” but better is that the company has been profitable without accounting shenanigans through the first nine months of 2018. Next year may see Genomic Health capitalizing on all of the opportunities genomics offers.

CFRA analysts expect the company’s investments in its salesforce, international expansion and a new genetics division to sustain its profit growth.

Agilent Technologies

- Market value: $20.7 billion

- Agilent Technologies (A, $65.19) is another non-pure play on genomics. In fact, it’s a big, somewhat complicated company that participates in a variety of markets, including diagnostics, pharma, academic/government, food energy and environmental. The company’s lab services and laboratory equipment divisions together account for most of its revenue at about 83%.

The Diagnostics and Genomics Group (DGG) participates in Agilent’s fastest-growing end markets, which on average are expanding at 3% to 5%, versus 5% to 7% for DGG. Since 2015, Agilent has been able to grow its genomics business at 8% annually on average, while increasing its operating margins from 9% to 23%, as of the 2018 fiscal year ended Oct. 31.

Agilent has proven competent in using mergers and acquisitions to prop up various parts of its business, and that includes genomics. Agilent bought Lasergen for $105 million in April 2018, two years after taking a 48% stake in the company. Lasergen gives Agilent greater access to the global molecular diagnostics market, via techniques used to analyze biological markers in the genome. That market is projected to reach roughly $10 billion by 2021.

Sarepta Therapeutics

- Market value: $6.8 billion

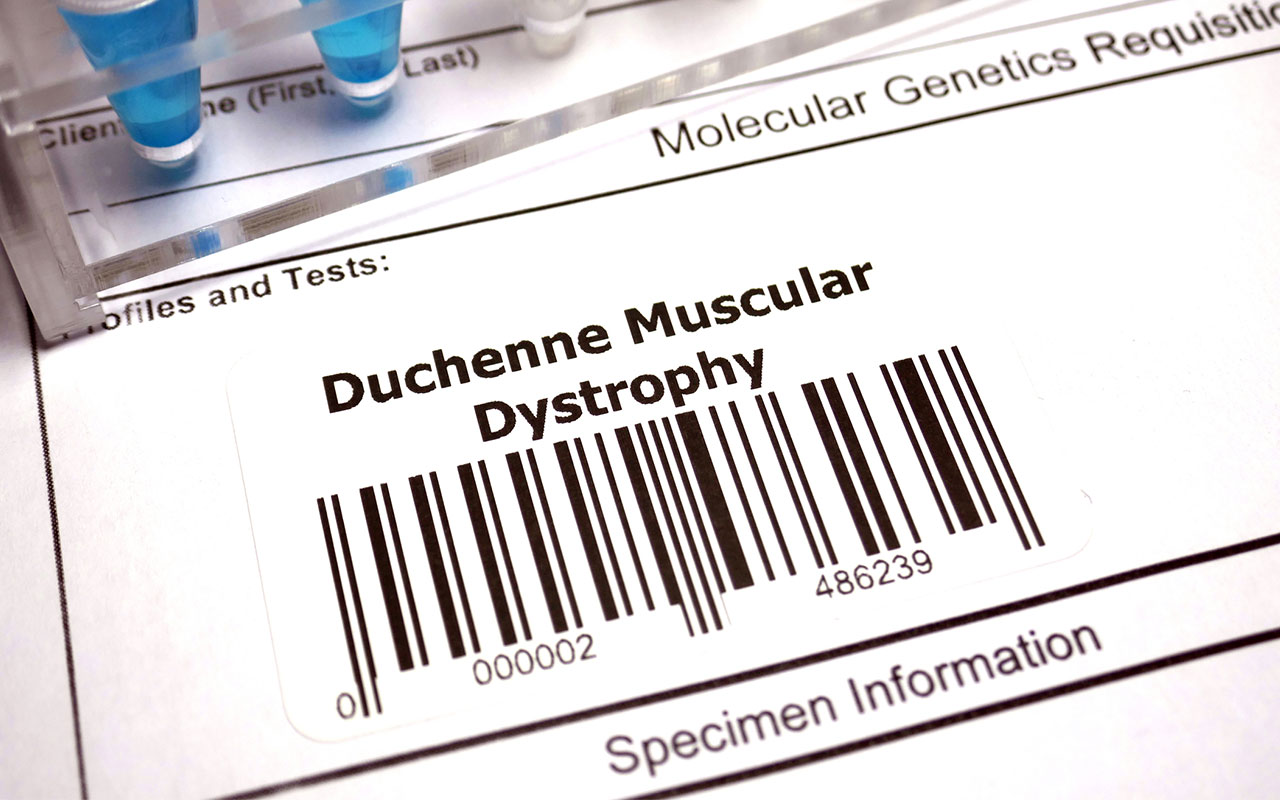

The market for genomic testing is promising, and as the previous slides indicate, there are plenty of entrants. By contrast, Sarepta Therapeutics (SRPT, $101.79) is capitalizing on advances in genome technology to provide gene therapy to an increasing number of rare diseases.

In June, Sarepta presented strong results from a gene therapy for Duchenne muscular dystrophy (DMD), a muscle-wasting disease. The company’s gene therapies are also used to treat Limb-girdle muscular dystrophy (LGMD), and it is forming a partnership to develop other treatments for the above diseases, as well as diseases of the central nervous system.

The company’s flagship eteplirsen for treatment of DMD was approved in 2016 and is anticipated to deliver approximately $300 million sales in 2018. And Sarepta has a deep pipeline to boot. The company currently is developing 21 therapies for rare muscular diseases. To wit, analysts at Bank of America/Merrill Lynch predicate their “Buy” rating on SRPT on the company building its core revenue stream with new products.

Spark Therapeutics

- Market value: $1.5 billion

- Spark Therapeutics (ONCE, $40.01), a gene therapy company, launched Luxturna – a treatment for certain types of genetically driven blindness – in the U.S. this year, with strong success so far. The drug contributed $4.3 million in net sales to the company’s $25.2 million in total revenues – all the rest was driven by agreements with Pfizer (PFE).

There is also a much larger opportunity for Spark to develop a one-time treatment for hemophilia. In August 2018, the company updated results for hemophilia A therapy and handed off development of its hemophilia B drug to Pfizer (PFE). The World Federation of Hemophilia says about 150,000 people worldwide are inflicted with hemophilia A and about 30,000 people are inflicted with hemophilia B.

Spark’s revenues are expected to explode from $12.1 million last year to $81.3 million in 2018, followed by a more modest (but still robust) 36% improvement to $110.4 million.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Website: gorillatrades.com

LinkedIn: Gorilla Trades

Phone: (866) 222-6639

Ken Berman has been buying and selling stocks since he was a teenager and met with early success trading then-fledgling biotech stocks like Amgen, Biogen and Immunex. He later became a broker and worked for two wire houses, where he developed a proprietary system for buying and selling equities. In 1999, Mr. Berman formalized his method under the Gorilla Trades name and now has subscribers in the U.S. and 55 other countries around the world.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

Stock Market Today: Stocks Are Mixed Ahead of the Fed

Stock Market Today: Stocks Are Mixed Ahead of the FedTwo of the three main equity indexes closed higher on the first day of the final Fed Week of 2024.

-

Why You Should Invest In Healthcare Stocks

Why You Should Invest In Healthcare StocksIt stands to reason that investing in healthcare is less volatile than investing in other sectors. After all, people get sick in both good times and bad.

-

5 Stocks to Sell or Avoid Now

5 Stocks to Sell or Avoid Nowstocks to sell In a difficult market like this, weak positions can get even weaker. Wall Street analysts believe these five stocks should be near the front of your sell list.

-

Best Stocks for Rising Interest Rates

Best Stocks for Rising Interest Ratesstocks The Federal Reserve has been aggressive in its rate hiking, and there's a chance it's not done yet. Here are eight of the best stocks for rising interest rates.

-

The Five Safest Vanguard Funds to Own in a Volatile Market

The Five Safest Vanguard Funds to Own in a Volatile Marketrecession The safest Vanguard funds can help prepare investors for market tumult but without high fees.

-

The 5 Best Inflation-Proof Stocks

The 5 Best Inflation-Proof Stocksstocks Higher prices have been a major headache for investors, but these best inflation-proof stocks could help ease the impact.

-

5 of the Best Preferred Stock ETFs for High and Stable Dividends

5 of the Best Preferred Stock ETFs for High and Stable DividendsETFs The best preferred stock ETFs allow you to reduce your risk by investing in baskets of preferred stocks.