6 Top Stocks to Buy for the Future of Industrial Automation

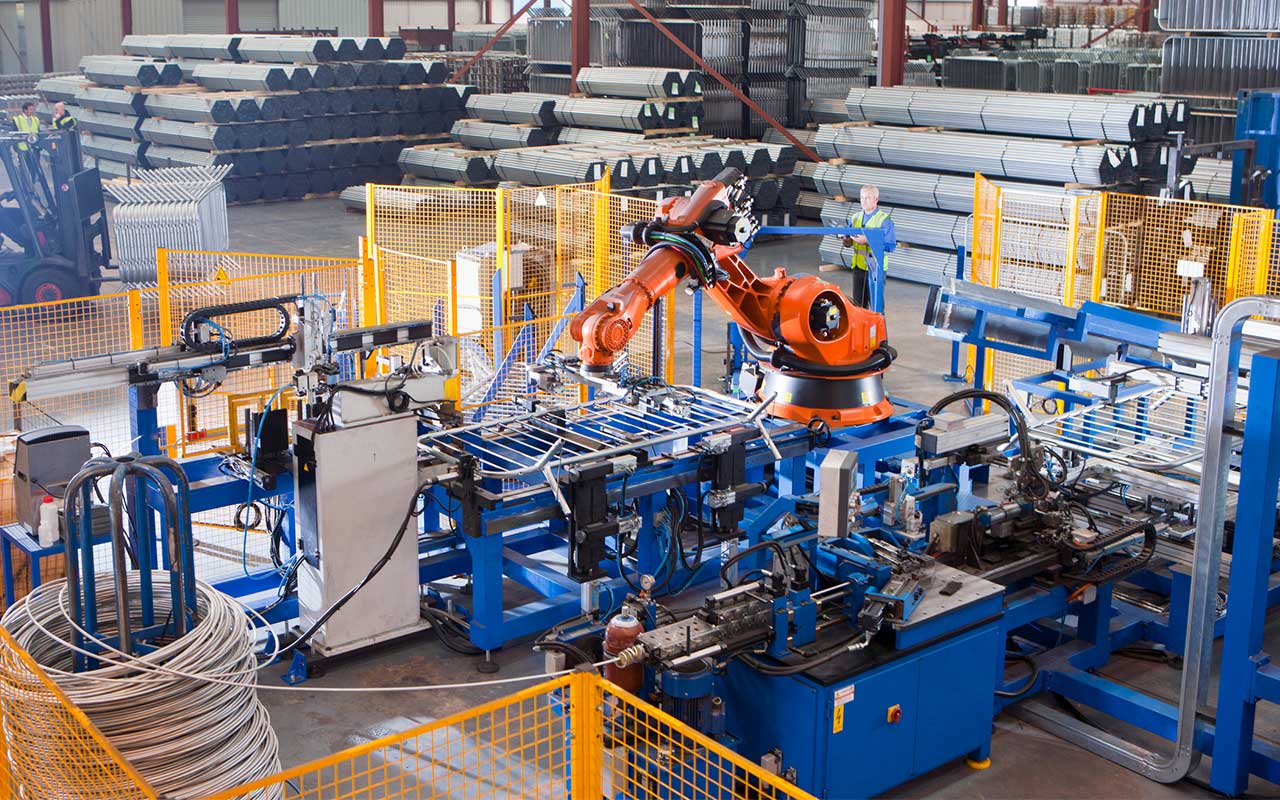

Industrial automation is an area that can thrive regardless of how the economy looks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Industrial automation is an area that can thrive regardless of how the economy looks. When times are good, companies are able to invest more in technology to put themselves ahead of the competition. When times are bad, companies look to get leaner – which means substituting human personnel for cost-saving factory automation systems. (Businesses facing the threat of closure quickly get religion on changes.)

With the threat of recession growing in 2019, industrial automation stocks may prove a great opportunity. In fact, the current market environment might prove doubly important for factory automation companies. Trade conflict, such as the one between the U.S. and China, can put pressure on manufacturers to move their operations – a costly process that entices companies to make their relocated facilities more cost-efficient.

As industry expert Rick Blaisdell has written, the next wave of industrial automation (as well as several other industries) is based on the “Internet of Things” – the interconnectivity of devices past traditional products such as computers and smartphones. IoT solutions using sensors, networks and software can help operate machines, improve quality control, cut down on analytical errors and enhance safety. Thus, many automation plays will be IoT plays, too.

Here are six top stocks to buy if you want to gain exposure to the potential all-weather opportunity of industrial automation.

Data is as of March 21. Dividend yields are calculated by annualizing the most recent quarterly payout and dividing by the share price.

ABB Ltd.

- Market value: $39.8 billion

- Dividend yield: 4.3%

Zurich, Switzerland-based ABB Ltd. (ABB, $19.30) has been shrinking for years, but it now looks primed to grow again.

ABB specializes in robotics, electrical equipment, power solutions and automation technologies. Its industrial automation segment serves a host of heavy industries, from oil and chemicals to utilities to pharmaceuticals and food.

ABB late last year announced it would sell 80.1% of its power grid unit for $11 billion in a deal that should close in 2020. That influx of cash will help ABB continue to invest in producing high-tech equipment such as parts-assembly robots, optical sensors and renewable-energy systems.

These investments have ABB on a path to growth, which is why Citigroup upgraded the stock from “Neutral” to “Buy” last September. After years of declining revenues, ABB turned it around with a marginal uptick in 2017, followed by a 4% improvement in 2018. Analysts now expect 5.5% top-line growth this year, followed by another 3% in 2020.

This attractive international dividend stock currently trades at just 16 times future earnings estimates and a price-to-sales ratio of 1.4 – both metrics are cheaper than the Standard & Poor’s 500-stock index. It also yields more than twice as much as the index.

Eaton

- Market value: $33.9 billion

- Dividend yield: 3.5%

- Eaton (ETN, $82.01) – another international player, this one based in Dublin, Ireland – makes industrial electrical systems, fuel systems for airplanes, and car and truck parts. It also has become a leader in the industrial Internet of Things (IIoT), It provides sensors, switches and artificial intelligence for factory equipment to do things such as improve power management and maintain equipment before anything breaks down.

Eaton, like ABB, is expecting modest but steady growth in the years ahead. Analysts are modeling a 3.6% bump in revenues this year followed by 2.2% in 2020, which should result in 9% and 6% growth in profits, respectively.

Speaking of the analyst community, the “pros” have gotten more optimistic about Eaton of late. ETN received an upgrade from KeyBanc analyst Jeffrey Hammond in mid-March, to “Overweight” (equivalent of “Buy”) from “Sector Weight” (equivalent of “Hold”). The analyst says shares trade at an “unwarranted discount” to its peers, and believes that its product mix and focus on organic growth puts it in a place where it can grow regardless of the broader economic environment.

Eaton also offers a nice dividend that yields 3.5% on a 71-cent quarterly payout that has been growing for years and should continue to expand. The company is projecting earnings of $5.70 to $6 per share for the current year; even at the low end, Eaton would be using less than half its profits to fund the dividend.

Honeywell International

- Market value: $114.0 billion

- Dividend yield: 2.1%

A half-century ago, Honeywell International (HON, $158.45), was failing to beat International Business Machines (IBM) in mainframe computing. Following a checkered career that included merging into defense contractor Allied Signal, Honeywell today is an industrial conglomerate preparing to break itself up. The company will spin off two new entities – Resideo Technologies (security and home) and Garrett Motion (transportation systems).

The new Honeywell will be primarily an industrial business focused on making cities as well as factories work more efficiently.

Honeywell’s industrial automation products include instruments, smart sensors and whole integrated systems that control and monitor processes, manage emissions and deliver critical data to better manage their facilities. The company’s “predictive maintenance” systems, in which sensors pass data to computer systems for analysis, share a market growing at 24% per year, with manufacturing the biggest niche.

Edward Jones has a "Buy" rating on the stock, and analyst senior equity analyst Jeff Windau considers it a good buy for long-term investors. “There are long-term opportunities to grow sales” in many of its industrial markets, he writes.

Mike Bailey, director of research at FBB Capital Partners in Bethesda, Maryland, says Honeywell is betting on increased demand for automation worldwide by purchasing Transnorm, a European developer of warehouse automation products, for about $500 million.

The company also is using its own products, Bailey says, adding sensors and Internet of Things technology “from the front door to the back door” of its Greer, South Carolina, aerospace factory.

PTC

- Market value: $11.1 billion

- Dividend yield: N/A

- PTC Inc. (PTC, $94.96), originally called Parametric Technology Corp., is the smallest play on this list of factory automation stocks to buy … but it also might be the most exciting.

PTC is a software and services company that started out in computer-aided design (CAD) software and a product lifestyle management product. Since then, it has expanded heavily into the industrial Internet of Things and is a key player in industrial automation.

The company’s ThingWorx – which it bought for $112 million in 2013 – is an IIoT platform with several apps that help manufacturers and other industries implement IoT, augmented reality and other technologies into their processes. The platform helps connect devices and sensors in a way that companies can harvest useful data, then can help them analyze that data, which can educate changes to make processes and systems more efficient. Its augmented-reality software lets industrial designers model how new factories will operate, not just how they look.

The company has grown steadily through other acquisitions, too. For instance, in 2018, it bought Frustum – a Colorado-based creator of design software it will plug into its Creo design system – for $70 million.

The company still has more than $300 million in cash against $643 million in debt, which isn’t ideal, but it’s manageable. The company also pays no dividend but is the healthiest growth prospect of the group. Analysts expect 6.2% revenue growth this year and 13.1% in 2020. That should fuel a 23% jump in profits for 2019, and a 44% leap next year.

Rockwell Automation

- Market value: $20.6 billion

- Dividend yield: 2.2%

Milwaukee’s Rockwell Automation (ROK, $177.02) sells both industrial automation hardware and software. Perhaps its best-known brand is its Allen-Bradley line of automation components and integrated control systems that include monitoring products, lighting and motion control, networks security and infrastructure, sensors and power supplies.

Rockwell has been branding itself as creating “the connected enterprise” in advanced manufacturing and signed a strategic partnership with PTC in June that is already delivering products to the market.

Analysts are expecting decent growth looking forward – 4% sales increases both this year and next, but significantly better 11% and 8% bottom-line improvements in 2019 and 2020. It is a bit on the pricey side, however, trading at more than 17 times future estimates and three times sales. The yield isn’t much better than the market, either, at just 2.2% in yield. But it makes up for it in dividend growth; the payout has ballooned by 67% over the past five years.

Edward Jones currently has a “Hold” rating on the stock, and Windau says that “Rockwell’s business is heavily influenced by the health of the industrial economy.” If trade friction forces companies to make more goods in the U.S., he says, business could pick up this year.

3M Co.

- Market value: $118.9 billion

- Dividend yield: 2.8%

Industrial conglomerate 3M (MMM, $209.61) isn’t a pure play on anything, and that includes industrial automation. Its businesses are wide-reaching, and in fact, most people recognize 3M for its consumer brands, which include Post-it notes, Scotch-Brite and 3M-branded window insulation. But 3M makes everything from traffic signs to health information systems, including software used in the production of food and drugs.

It also has a hand in industrial automation, but mainly through components. For instance, its 3M Link Connectors, Mini-Clamp II Plug and Power Clamp Connectors are typically applied in factory automation and industrial controls. The company also has partnered with Eckhart to develop an automated robotic taping system, leveraging 3M’s adhesives expertise. And many of its products find their way into factories regardless of the level of automation, whether it’s abrasives, filtration or even just lightweight futuristic materials.

Bailey of FBB Capital Partners says, “3M could see more rapid growth coming out of the other side of a recession as cyclical customers ramp up orders.”

3M also is a true dividend superstar. The company not only is in the ranks of the Dividend Aristocrats, which boast a minimum of 25 consecutive years of annual dividend increases. But at 60 years counting, it owns one of the longest dividend-growth histories among all dividend stocks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

5 Stocks to Sell or Avoid Now

5 Stocks to Sell or Avoid Nowstocks to sell In a difficult market like this, weak positions can get even weaker. Wall Street analysts believe these five stocks should be near the front of your sell list.

-

Best Stocks for Rising Interest Rates

Best Stocks for Rising Interest Ratesstocks The Federal Reserve has been aggressive in its rate hiking, and there's a chance it's not done yet. Here are eight of the best stocks for rising interest rates.

-

The Five Safest Vanguard Funds to Own in a Volatile Market

The Five Safest Vanguard Funds to Own in a Volatile Marketrecession The safest Vanguard funds can help prepare investors for market tumult but without high fees.

-

The 5 Best Inflation-Proof Stocks

The 5 Best Inflation-Proof Stocksstocks Higher prices have been a major headache for investors, but these best inflation-proof stocks could help ease the impact.

-

5 of the Best Preferred Stock ETFs for High and Stable Dividends

5 of the Best Preferred Stock ETFs for High and Stable DividendsETFs The best preferred stock ETFs allow you to reduce your risk by investing in baskets of preferred stocks.

-

What Happens When the Retirement Honeymoon Phase Is Over?

What Happens When the Retirement Honeymoon Phase Is Over?In the early days, all is fun and exciting, but after a while, it may seem to some like they’ve lost as much as they’ve gained. What then?

-

5 Top-Rated Housing Stocks With Long-Term Growth Potential

5 Top-Rated Housing Stocks With Long-Term Growth Potentialstocks Housing stocks have struggled as a red-hot market cools, but these Buy-rated picks could be worth a closer look.