7 Diverse Stocks to Buy to Make a Buck Off Air Travel

A big swath of the country is finally coming out of a deep freeze that kept many of us hunkered down in our homes for most of this winter.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A big swath of the country is finally coming out of a deep freeze that kept many of us hunkered down in our homes for most of this winter. That’s because traveling was neither easy nor fun, whether by plane, train or automobile.

As the weather improves, Americans will start to make travel plans for the summer ahead – and that should educate investors as they hunt down stocks to buy amid this bull run.

Summer is the Super Bowl of air travel. Last year, trade association Airlines for America estimated that 246 million people would travel by air between June 1 and Aug. 3 of 2018. Turns out, that was a great estimate. The Transportation Security Administration (TSA), 253 million people traveled by air between the Wednesday before Memorial Day (May 23) and the Tuesday after Labor Day (Sept. 4).

Industry statistics also suggest that the amount of air travel is on the rise – a trend investors can benefit from if they know where to look. The problem is there’s no good fund that covers the gamut of industries that contribute to commercial aviation. It’s not just airlines and aircraft manufacturers – airport operators, hospitality businesses, construction firms, retailers, car rentals, even cosmetics companies, benefit directly or indirectly from more crowded skies.

Here are seven stocks to buy that benefit from healthy air travel, several of which tend to fly under many investors’ radars.

Data is as of April 3.

Delta Air Lines

- Market value: $38.8 billion

- Forward P/E: 8.5

- Dividend yield: 2.5%

Asia will require an additional 261,000 pilots and 317,000 cabin crew over the next 20 years to satisfy the insatiable demand for air travel with China leading the way, according to a Boeing forecast.

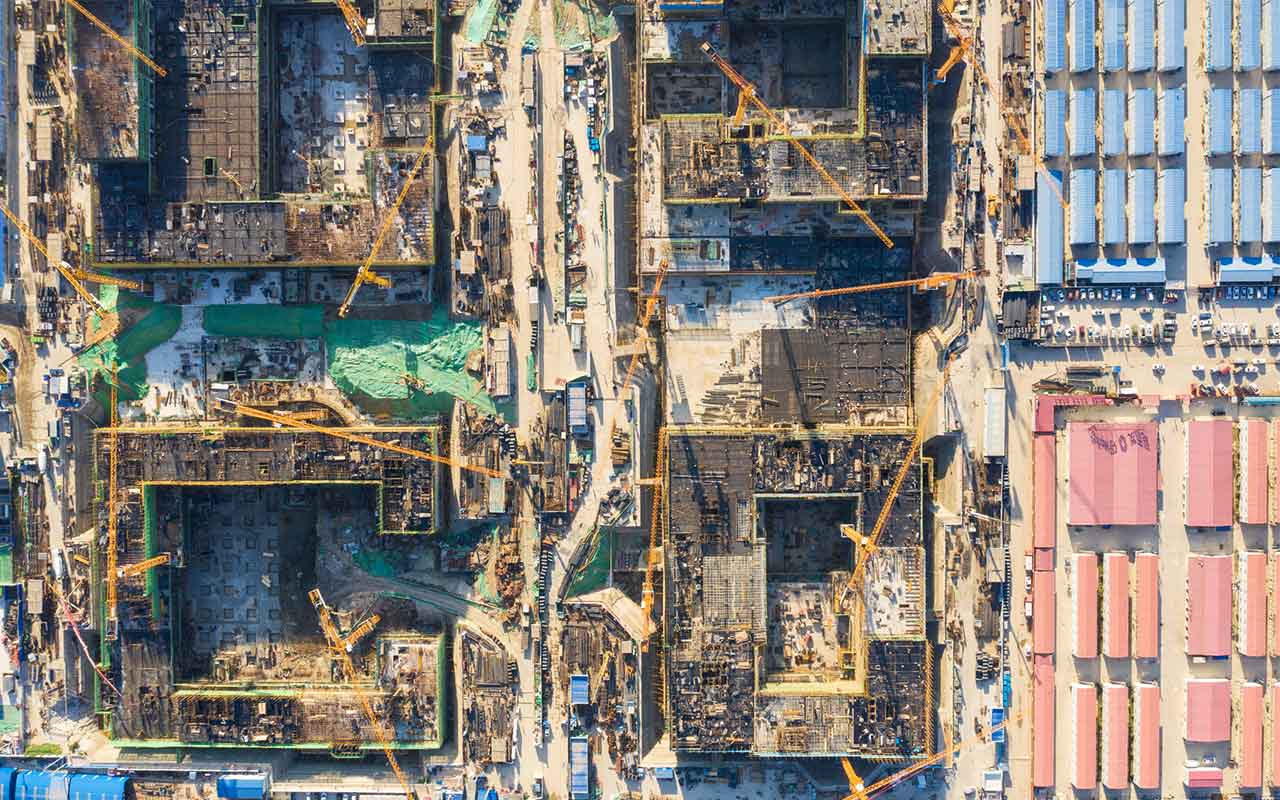

The International Air Transport Association (IATA) believes that China will overtake the U.S. as the world’s largest aviation market by 2030. China will build 74 new airports by 2020 to meet the demand of its growing middle class. India and Indonesia are among other Asian markets expected to deliver the goods over the next few years.

Two-thirds of Delta Air Lines’ (DAL, $57.00) revenues come from the U.S., but CEO Ed Bastian sees a future overseas. “Long-term at Delta, I think our opportunity is international,” Bastian told an audience at the National Press Club last year.

Delta resumed service to India last June, and admitted at the time that it’s looking to Asia for revenue growth. To accomplish this, Delta has made Seattle’s airport one of the airline’s major hubs, with flights departing from Seattle for Hong Kong, Shanghai, Tokyo, Beijing and Seoul.

It also has a joint-venture revenue-sharing arrangement with Korean Airlines that will allow it to develop Seoul into an Asian hub. This partnership allows Korean Airlines to send Delta customers arriving in Seoul nonstop to more than 80 different destinations in Asia, making Delta the biggest American player on the continent.

A global recession would slow this growth, but the secular trend is too strong to overlook. And while the focus here is Delta, investors willing to delve into overseas stock exchanges may want to start looking into Asian airlines, too.

Boeing

- Market value: $223.1 billion

- Forward P/E: 19.0

- Dividend yield: 2.1%

An investment in Boeing (BA, $384.74) has become less clear-cut following the March 10 crash of Ethiopian Airlines Flight 302, a Boeing 737 Max 8. That’s the second fatal crash for this relatively new aircraft – its first commercial flight was on May 22, 2017 – in less than six months.

The death of 346 people in two plane crashes combined with the worldwide grounding of the 737 Max 8 sent Boeing stock on a quick downward spiral, losing 10% of its value in a week.

A $28 billion reduction over five days is a big deal, but given the seriousness of the issue, it could have been a lot worse. That doesn’t mean Boeing is out of the woods – the Department of Justice and the Senate are among the bodies investigating the development of the 737 Max 8 aircraft. So you can expect Boeing stock to remain volatile for the rest of this year.

Long-term, however, the opportunity to own the world’s biggest and best aircraft manufacturer at even a small discount doesn’t come around very often.

Boeing is the best-performing Dow stock over the past decade. Between 2011 and 2018, it grew free cash flow by 33% on an annual basis. Add to this the fact China is a significant customer, you have a runway of growth that will only end if people stop flying.

Grupo Aeroportuario del Pacifico

- Market value: $5.3 billion

- Forward P/E: 18.0

- Dividend yield: 4.0%

If you headed to warmer climes this winter and Mexico was your destination, there’s a good chance you flew to one of Grupo Aeroportuario del Pacifico’s (PAC, $92.96) 12 airports in the country. Four of those – La Paz, Los Cabos, Puerto Vallarta and Manzanillo – service tourist-heavy parts of the country.

Grupo Aeroportuario del Pacifico also has airports in the major cities of Guadalajara and Tijuana, as well as in five smaller cities throughout the country. And if Jamaica is more your speed, PAC also operates the Montego Bay airport.

PAC was granted 50-year concessions to the 12 airports in Mexico, but those don’t end until 2048. The Montego Bay concession it won in 2003 doesn’t expire until 2033. In the meantime, Mexico’s largest privately owned airport operator should continue to enjoy growth. In 2018, PAC processed 44.9 million passengers through its 13 airports – a 10% increase over 2017. Those passengers helped the company generate $661 million in revenue (up 14.7%) and $266 million in profits (up 8.6%).

Grupo Aeroportuario del Pacifico currently is trying to generate more revenues from its non-aeronautical business. Theses ancillary revenues include parking, commercial rent, the operation of VIP lounges, duty-free stores, etc. That arm of the business grew sales by 15% year-over-year. Its aeronautical business – which accounts for 75% of overall revenue – improved sales by the same degree. PAC boasted double-digit increases in virtually all key performance indicators.

The future looks good, too. An Airbus Global Market forecast says air travel in and out of Mexico is expected to grow by 4.5% annually between 2017 and 2037. That growth rate is better than both the U.S. and Europe.

Starbucks

- Market value: $92.5 billion

- Forward P/E: 27.4

- Dividend yield: 1.9%

When investors think of Starbucks (SBUX, $74.33) and growth, airports aren’t the first market that comes to mind. China is, and that’s the right thought.

From a revenue standpoint, airport concessions are the cherry on top.

The airport market isn’t an easy one to penetrate if you’re a tiny operation, but Starbucks partners with some of the world’s largest airport food and beverage concessionaires, making expansion a relatively straightforward matter.

In Salt Lake City, the municipal government operates the city’s international airport, which processes 25 million passengers a year. It’s building a new airport so it can adequately handle all of these people. It’s expected to be ready in 2020. On Feb. 21, HMSHost – a company with more than $3.3 billion in annual revenues operating in 120 airports around the world – announced that it had won a 10-year, $418 million contract for the new airport. Starbucks will have three stores there.

Airports continue to get built and remodeled to meet the demands of increasing air travel. As mentioned earlier, China is building 74 airports by the end of 2020 to satisfy the country’s insatiable appetite to fly both domestically and internationally. You can bet that Starbucks will be in a lot of those airports, given that the company boasted 3,684 stores in that country as of the end of December – 560 more locations than it had a year earlier.

China is a far bigger deal. But Starbucks’ airport business will continue to surprise and delight investors.

Estee Lauder

- Market value: $59.0 billion

- Forward P/E: 29.7

- Dividend yield: 1.1%

Although it’s somewhat counterintuitive, cosmetics are a big seller in airports around the world. People spend an average of a little more than two hours at the airport from the time they get there to the time the plane’s door shuts. Once through check-in and security, there’s little time for anything but a quick purchase at one of the newsstands or duty-free shops. And cosmetics are generally compact and easily stored in a purse, making them an ideal impulse buy.

When considering stocks to buy to play this reality, you have two options.

You could invest in a duty-free specialist, but most of them are international companies whose stocks are only available over-the-counter and trade on light volume. Or you could invest in the shares of Estee Lauder (EL, $164.28), the global cosmetics company that does sport a successful travel retail business that’s an essential part of its growth.

“Our strongest growth engines this quarter included the skin care category globally, the Asia/Pacific region, the online and travel retail channels, and most brands, including Estée Lauder, La Mer, M•A•C and our artisanal fragrance brands,” CEO Fabrizio Freda said in February about the quarter ended in December.

While Estee Lauder doesn’t break out travel retail in its financials, the Moodie Davitt Report suggests numerous quarters of double-digit revenue growth over the past couple years.

With or without travel retail, Estee Lauder is a winning stock. Over the past decade, EL has generated an annual total return of 30.5%.

AerCap Holdings

- Market value: $6.8 billion

- Forward P/E: 7.0

- Dividend yield: N/A

According to the Centre for Asia Pacific Aviation (CAPA), aircraft leasing accounts for half the world’s commercial aircraft. Commercial aircraft aren’t cheap, which explains why so many airlines prefer to lease rather than buy. As air travel continues to grow, aircraft leasing also should increase.

CAPA’s fleet database suggests that aircraft leasing is higher in Latin America, Europe and Asia, and lower in North America and Africa. Of the aircraft leased by lessors, most prefer regional jets and narrowbodies; widebodies are less favorable.

Ireland-based AerCap (AER, $47.92) is the world’s largest owner of commercial aircraft with 1,421 aircraft owned, managed or on order.

Over the past five years, AerCap purchased leased or sold more than 2,000 aircraft. Its average remaining lease term on its planes is almost seven-and-a-half years, providing investors with cash flow certainty.

AerCap is good at turning a profit – it has done so for each of the past 12 years. AerCap did see revenues shrink 4.7% year-over-year in 2018, to $4.8 billion, but it managed to keep its earnings flat at $1.02 billion. And because the company prefers stock buybacks over paying a dividend, its earnings per share grew by 6.2% to $6.83.

The company will feel the “Boeing effect,” even if just to a small extent. The company presently has only five Boeing 737 Max 8s in its fleet, but it’s supposed to take delivery of 17 in 2019, 24 in 2020 and 58 beyond that, representing approximately 30% of its aircraft on order. The coming year could require some changes to its order book to account for expected delays. Long-term, however, this should not be a material concern. Investors don’t seem worried: AER shares have rallied 21% in 2019.

Aecom

- Market value: $4.8 billion

- Forward P/E: 10.9

- Dividend yield: N/A

- Aecom (ACM, $30.55) doesn’t seem a natural fit among the best stocks to buy for an uptick in air travel. It’s an engineering firm, after all.

But as air travel increases, more airports are getting built to accommodate more passengers. Someone has to build them – and one company that generates significant revenue from airport construction is Aecom.

Aecom is a major builder of infrastructure projects in the U.S. and around the world. It was the construction manager for the joint venture that built Mercedes-Benz Stadium in Atlanta, where football fans this February saw the New England Patriots win another Super Bowl.

United Continental (UAL) has invested $1.6 billion in new facilities and projects currently under development at Los Angeles International Airport. Aecom is the prime contractor for this work. Other airports Aecom has worked on include Logan International Airport in Boston, Sydney Airport in Australia and John F. Kennedy International Airport in New York City. Aecom will be involved with JFK again, too. During the company’s first quarter ended Dec. 31, 2018, Aecom’s joint venture with Walsh Construction was selected as construction manager for the $7 billion redevelopment of Terminal 1.

Aecom’s aviation business falls under the company’s Construction Services segment. In the first quarter, this segment reported a 5% year-over-year decline in revenues to $2 billion (2% lower excluding currency considerations). However, Aecom’s backlog was a record $59.5 billion – 22% higher than a year earlier.

As Aecom continues to simplify its business by exiting countries and markets with lower profitability, its backlog will become more profitable. Airport construction will be an important part of that.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Will has written professionally for investment and finance publications in both the U.S. and Canada since 2004. A native of Toronto, Canada, his sole objective is to help people become better and more informed investors. Fascinated by how companies make money, he's a keen student of business history. Married and now living in Halifax, Nova Scotia, he's also got an interest in equity and debt crowdfunding.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

What to Do With Your Tax Refund: 6 Ways to Bring Growth

What to Do With Your Tax Refund: 6 Ways to Bring GrowthUse your 2024 tax refund to boost short-term or long-term financial goals by putting it in one of these six places.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

15 Reasons You'll Regret an RV in Retirement

15 Reasons You'll Regret an RV in RetirementMaking Your Money Last Here's why you might regret an RV in retirement. RV-savvy retirees talk about the downsides of spending retirement in a motorhome, travel trailer, fifth wheel, or other recreational vehicle.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

The Six Best Places to Retire in New England

The Six Best Places to Retire in New Englandplaces to live Thinking about a move to New England for retirement? Here are the best places to land for quality of life, affordability and other criteria.

-

The 10 Cheapest Countries to Visit

The 10 Cheapest Countries to VisitWe find the 10 cheapest countries to visit around the world. Forget inflation and set your sights on your next vacation.

-

15 Ways to Prepare Your Home for Winter

15 Ways to Prepare Your Home for Winterhome There are many ways to prepare your home for winter, which will help keep you safe and warm and save on housing and utility costs.

-

Delta To Open Three 'Premium' Lounges This Year

Delta To Open Three 'Premium' Lounges This YearThe move follows Delta’s about-face last fall on some of the changes it made to its SkyMiles loyalty program.