7 S&P 500 Stocks That Have Lost 40% or More

As of Dec.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

As of Dec. 17, the Standard & Poor’s 500-stock index had lost 13.1% from its Sept. 20 all-time high. That’s correction territory, typically defined as a decline of 10% or more from a peak, but still well short of bear-market territory, a decline of 20% or more.

More than half the S&P 500’s stocks, however, have indeed entered a bear market.

These are not two-bit companies that discovered that their main product causes your fingers to fall off, either. Apple (AAPL), currently sitting on a mountain of cash, is down 29.8% from its Oct. 3 high. Charles Schwab (SCHW) is down 32.4% from its May 21 high.

But those aren’t the worst in this kidney stone of a market. Wall Street has not only thrown some stocks out the window, but run them over with a steamroller for good measure. For the morbidly curious, here are seven of the hardest-hit S&P 500 stocks in the market’s most recent tantrum, listed by their declines from their 52-week high.

Data is as of Dec. 17, 2018, and is courtesy of S&P Global Market Intelligence.

Halliburton

- Market value: $25.5 billion

- Drop from peak: 49.7% since Jan. 23, 2018

Most investors have focused on the rout in technology stocks, but energy companies have been pumping mud all year thanks to tumbling oil prices. A barrel of West Texas intermediate crude oil closed at $49.16 on Dec. 17, down from $77.41 in June.

While Halliburton (HAL, $29.09) beat earnings expectations in the third quarter, the oil services companies warned that pipeline and shipping bottlenecks could hurt fourth-quarter performance. Haliburton also had to eat $3.5 billion in termination fees from its failed merger with Baker Hughes (BHGE).

Bad as things are for Haliburton, investors in rival Schlumberger (SLB) have fared worse. The company’s stock is down 51.4% since its Jan. 23 peak.

The worst oil play of the current market ugliness: Newfield Exploration Company (NFX), down 58.6%.

Invesco

- Market value: $7.0 billion

- Drop from peak: 55.8% since Jan. 29

Selling mutual funds in a market downturn is about as much fun as selling termites at a carpenter’s convention. Invesco (IVZ, $17.00) has watched its mutual fund assets fall to $926 billion in November from $988 billion in August, a 6% decline. The company has been in an acquisitive mode recently, purchasing the exchange-traded fund business from Guggenheim Partners and sealing a deal in October to buy OppenheimerFunds. Although the OppenheimerFunds deal will bring Invesco’s assets to about $1.2 trillion, analysts worry that Invesco’s debt levels will preclude it from other acquisitions.

And like all mutual fund companies, Invesco is under pressure to lower fees – good news for their fund investors, but not for those who buy the company’s stock.

Invesco isn’t alone in the mutual fund doghouse. Affiliated Managers Group (AMG), another fund company, has seen its stock tumble 56% since its high on Jan. 26, and T. Rowe Price (TROW), the Baltimore fund giant, has taken a 28.6% hit since its June 7 high.

Brighthouse Financial

- Market value: $3.8 billion

- Drop from peak: 52.6% since Jan. 29

- Brighthouse Financial (BHF, $32.04) offers annuities and life insurance products – something that would seem to be an easier sale in the current environment than during a red-hot bull market. Furthermore, with 10,000 baby boomers retiring every day, the company would seem to be well-positioned for future growth.

Nevertheless, Brighthouse is also highly leveraged, and $3.8 billion in debt could weigh down its growth prospects.

Other financial services companies that have suffered in the stock market’s latest tantrum: American International Group (AIG), down 42.4% from its Jan. 29 high; Synchrony Financial (SYF), down 42.1% from its Jan. 29 high; and Ameriprise Financial (AMP), down 40.9% from its Jan. 16 high.

Coty

- Market value: $5.3 billion

- Drop from peak: 67.4% since Feb. 20

While retail stocks have done reasonably well during the downturn, some just haven’t, and beauty products maker Coty (COTY, $7.07) is one of them. Unfortunately, its consumer beauty segment has been its softest division, and it is facing stiff competition worldwide. In the first quarter of fiscal 2019, reported in early November, revenues at the consumer beauty segment plunged 20.6% to $828.8 million.

Other retail stocks that aren’t faring well: L Brands (LB), whose brands include Victoria’s Secret and Bath & Body Works, down 53.2% since Dec. 26, 2017; Michael Kors (KORS), down 49.8% since Aug. 22; and Hanesbrands (HBI), down 44.4% since Jan. 24.

Nvidia

- Market value: $87.6 billion

- Drop from peak: 51.0% since Oct. 2

When the chips are down, they are really down. In Nvidia’s (NVDA, $143.58) case, the chipmaker has been hit by weaker demand for gaming semiconductors, the suspension of test drives for its driverless vehicles and even the collapse of cryptocurrencies, which use specialized chips for mining new coins.

On top of that, the industry competes as fiercely for business as hyenas do for gazelle carcasses.

Other chip companies getting crumbled: Micron (MU), down 47.6% from its May 30 high; Applied Materials (AMAT), down the same since its May high; and Advanced Micro Devices (AMD), down 44.8% since its September peak.

Lennar

- Market value: $13.2 billion

- Drop from peak: 44.5% since Jan. 22

The housing market has hit some headwinds in the past year, including rising labor costs, higher land prices and increasingly expensive mortgage rates. Tariffs on Canadian lumber also have driven up costs.

While Lennar (LEN, $40.02) is a leading U.S. homebuilder with a diversified lineup of property types, it has been hit particularly hard by Wall Street, losing nearly 45% since its late-January highs.

Other homebuilders have been hit hard, but not quite as hard: PulteGroup (PHM) has tumbled 27.2% since January, for example. In the meantime, home repair companies such as Home Depot (HD) have entered bear market territory. Lowe’s (LOW) has fallen 23.2% since September, and Home Depot’s stock is down 22.0% since then.

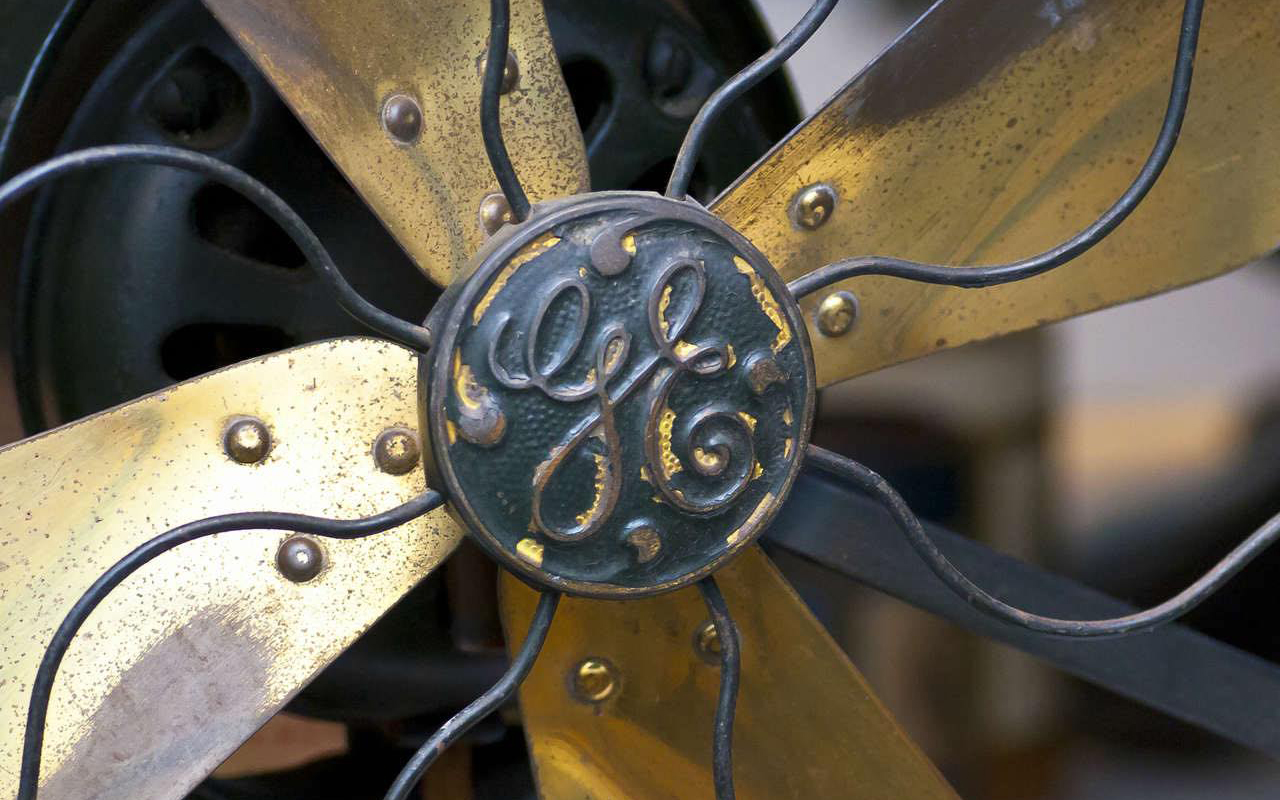

General Electric

- Market value: $62.2 billion

- Drop from peak: 63.2% since Jan. 11

Sometimes, everything goes wrong, and that’s the case for this one-time blue-chip member of the Dow Jones Industrial Average. Too much debt, not enough growth, a weakening power business and weaker-than-expected results for the third quarter have all kicked General Electric (GE, $7.14) when it already was down.

Other once-big names that have fallen on hard times in this market: Xerox (XRX), down 43.1% since January; Mattel (MAT), down 40.8% since January, and Whirlpool (WHR), down 40.5% since January.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

4 Estate Planning Documents Every High-Net-Worth Family Needs

4 Estate Planning Documents Every High-Net-Worth Family NeedsThe key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares in This Situation

How to Get the Fair Value for Your Shares in This SituationWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.