7 Stocks to Buy and Hold for the Next Decade

Legendary value investor Warren Buffett is one of the leading pitchmen for long-term, buy-and-hold investing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Legendary value investor Warren Buffett is one of the leading pitchmen for long-term, buy-and-hold investing. The man behind Berkshire Hathaway (BRK.B) targets stocks to buy not just by identifying great values, but great companies that still will be competitive years, even decades down the line.

Indeed, one of Buffett’s famous quotes is: “If you don’t feel comfortable owning something for 10 years, then don’t own it for 10 minutes.” And you can do worse than follow this tip from one of the world’s most renowned investors.

Today, we’ll look at seven stocks to buy with hopes of holding them for at least the next decade. Using TipRanks’ stock screener, we have identified several stocks that have a consensus “Strong Buy” analyst rating, and thus have a confident backing from Wall Street. From this group, we have culled some of the most intriguing longer-term picks.

One note: While most “buy-and-hold” lists typically are swamped with slow-growth dividend picks, this group of stocks includes several companies that deliver no income and still are well in the midst of their growth ramps. But all of these picks have plenty of runway left.

Data is as of April 30, 2018. Consensus price targets and ratings based on “Best Performing” analysts. Click on ticker-symbol links in each slide for current share prices and more.

Align Technology

- Market value: $20.0 billion

- TipRanks consensus price target: $299 (20% upside potential)

- TipRanks consensus rating: Strong Buy

Global medical device maker Align Technology (ALGN, $249.85) certainly was one of the best stocks to buy at the start of 2017. It was the second-best performer in the Standard & Poor’s 500-stock index last year, with shares exploding 131% to trail only NRG Energy (NRG) and its 132% returns.

Even then, the potential of this stock remains largely untapped.

Align is a pioneer in teeth-straightening technology. You may have seen its popular “clear aligners” known as Invisalign. These removable transparent aligners are fast becoming a viable alternative to traditional metal braces.

“We’ve seen a maturation of Invisalign’s clear aligners over the past decade,” writes Robert W Baird analyst Jeff Johnson. “They went from a product that was passable for some patients but not good for all back in 2011, to a product that by mid-2016, had orthodontists saying, ‘I can use this technology in most cases.’”

Top-100 blogger Keith Speights (view Speights’ TipRanks profile) believes Align has the power to double again over the next couple of years. Even factoring in Invisalign’s rapid uptake, Speights points out that ALGN still only accounts for 11% of the global orthodontics market. Plus, aligners currently are usable in just 65% of teeth misalignment cases. Align wants to take this figure to 80% – substantially expanding its potential consumer audience.

Alphabet

- Market value: $707.5 billion

- TipRanks consensus price target: $1,275 (25% upside potential)

- TipRanks consensus rating: Strong Buy

Google parent Alphabet’s (GOOGL, $1,018.58) growth spurt shows little sign of slowing down. The company is not far removed from its first-quarter earnings report, where it notched its 33rd consecutive quarter of 23% year-over-year top-line growth.

Investors worried about traffic acquisition costs (TAC) coming in heavier than expected can take a little bit of solace from Alphabet’s consistently strong business demand and opportunity, which gives the company confidence to invest aggressively.

RBC Capital’s Mark Mahaney (view Mahaney’s TipRanks profile) believes Alphabet clearly demonstrates the sustainability of ad revenue-based internet businesses. He writes that Google still accounts for about 10% of global ad spend, which means it has plenty more market to play for. Plus, Alphabet is perfectly set up to catch the fast-growing video ad market with YouTube.

Mahaney concludes: “We believe Google defines sustainability, in very large part because its value proposition is so compelling – free Search, free YouTube, free Gmail, free Google Maps, etc. … And the company’s investments in Cloud, Internet-connected Homes, and Autonomous Vehicles potentially set the company up for more years of premium growth & profits.” He anticipates GOOGL shares rising to $1,285 (26% upside potential) in the coming months.

Amazon.com

- Market value: $762.7 billion

- TipRanks consensus price target: $1,818 (16% upside potential)

- TipRanks consensus rating: Strong Buy

- Amazon.com (AMZN, $1,566.13) is a, ahem, prime holding in any buy-and-hold portfolio. The company more than doubled its first-quarter profits year-over-year, and EPS of $3.27 per share obliterated expectations for $1.26. Moreover, Amazon reported its 62nd consecutive quarter of 20%-plus revenue growth.

That’s because Amazon doesn’t just sit still and dominate one business – it has pivoted from e-books to online retail to cloud computing to even groceries, always adding new avenues of growth.

Top RBC Capital analyst Mark Mahaney (view Mahaney’s TipRanks profile) wrote a bullish report on April 24, saying. “Amazon, along with a few other select Internet companies, is an Internet Staple. You know Consumer Staples? Internet Staples is the same thing … except with growth rates 4X, 5X … 10X higher.” Mahaney has a 12-month price target of $1,900, implying 21% upside.

Again, Amazon is a key player in multiple markets now. Amazon Web Services, its cloud-computing business, accounted for $17.5 billion in 2017 revenues – about 10% of its annual top line. Better still, this market has an enormous growth runway. Mahaney says Amazon’s “Growth Outlook is arguably the strongest of the Major ‘Net Platforms” thanks to total addressable markets of $20 trillion in retail, $1 trillion in cloud, $1 trillion in advertising and others.

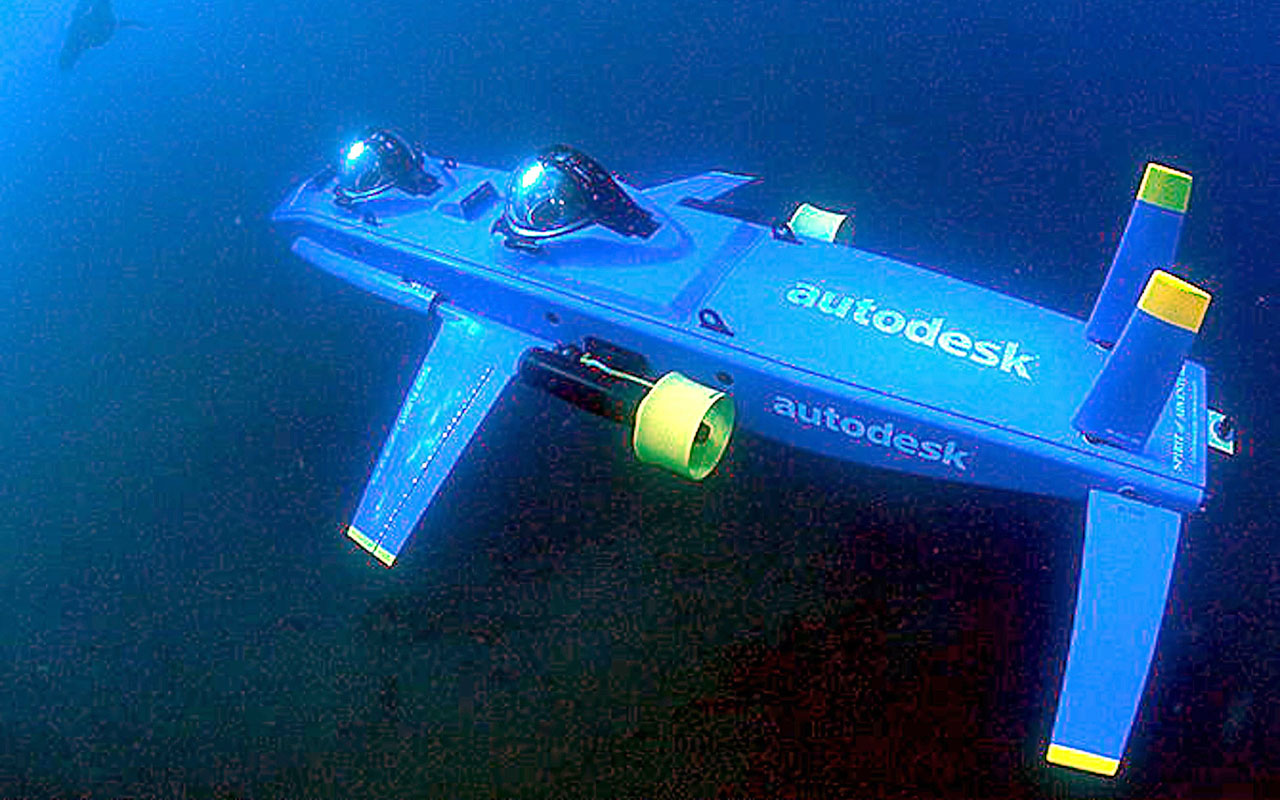

Autodesk

- Market value: $27.5 billion

- TipRanks consensus price target: $153 (22% upside potential)

- TipRanks consensus rating: Strong Buy

Groundbreaking 3D design company Autodesk (ADSK, $125.90) makes software for people who make things – so, architects, animators, constructors and engineers, among others. The company is in prime position for the digitalization of design, and in fact is leading the charge.

This stock rarely appears in lists of long-term stocks to buy and hold, but it should be. It’s downright beloved by Wall Street. Fourteen analysts have published buy ratings on ADSK in the past three months alone, and there are no hold or sell ratings in TipRanks’ analyst data.

Top Oppenheimer analyst Koji Ikeda (view Ikeda’s TipRanks profile) recently selected Autodesk as his “top large-cap stock pick.” Ikeda cites the company’s dominant market positioning, rapid innovation and strong execution.

Ikeda’s view of Autodesk as “an industry-standard, must-have technology in nearly every industry it operates in” is compelling. And now Ikeda is even more bullish on ADSK following a deep dive into construction industry trends. The results of these checks “lend support to our long-term thesis that the business is one of the best-positioned software vendors for future share gains of construction industry technology spend.”

Ikeda, who has a $150 price target on shares, concludes that ADSK is “well positioned in a large but lightly penetrated construction industry that is yearning for next-generation technologies, like Autodesk’s, to help digitize the industry, which should act as a pillar for Autodesk’s next leg of growth beyond FY2020.”

Boeing

- Market value: $194.3 billion

- TipRanks consensus price target: $401 (20% upside potential)

- TipRanks consensus rating: Moderate Buy*

Shares in one of the world’s largest aerospace companies, Boeing (BA, $333.56), have exploded by 145% in the past two years, including roughly 80% gains in the past 52 weeks. But Boeing is not out of growth ramp yet.

Boeing announced at the end of April that it will buy aerospace parts supplier KLX for about $3.2 billion. The news comes on the back of comments by CEO Dennis Muilenburg that growing Boeing’s services unit “is a top priority.” This savvy move will allow Boeing to make a play for the higher-margin services and spare-parts revenue following the sale of a plane. In fact, the unit already is Boeing’s most profitable.

Boeing also is a strong dividend grower. While BA only yields 2.1% at the moment, that’s simply because its share-price growth has outpaced what is still exceptional payout expansion. The company’s dividend has jumped by 134% since 2014, to its current annualized dividend of $6.84.

Writes Cowen & Co’s Cai Rumohr (view Rumohr’s TipRanks profile): “BA remains our #1 pick … (we see) dividends moving up to $9.20/share. This assume 85% of free cash goes to shareholders vs. BA’s target of 100%.”

Rumohr has a price target of $430, or about 29% upside potential.

* Boeing garners a consensus “Strong Buy” from TipRanks-designated “Top” advisers.

Chevron

- Market value: $239.1 billion

- TipRanks consensus price target: $140 (12% upside potential)

- TipRanks consensus rating: Strong Buy

Energy darling Chevron (CVX, $125.11) is an integrated oil major that boasts one of the largest holdings in the lucrative Permian Basin. Today, Chevron controls 2.2 million acres of Permian rock – about the same size as Yellowstone National Park. Moreover, profitability is comparatively high as CVX pays little or no royalties on 80% of these holdings.

RBC Capital analyst Biraj Borkhataria (view Borkhataria’s TipRanks profile) says Chevron has just upgraded both its production and resource guidance. Production is expected to hit 650,000 barrels of oil equivalent every day by 2022. The advantage of this kind of scale is that CVX can easily create value through divestments or acreage swaps, while focusing on developing core areas.

Borkhataria writes: “Growing volumes, improving margin mix, low development costs and a rate-able capex profile all point to higher returns to Chevron shareholders over time.”

Barclays’ Paul Cheng joins in the bullish chorus: “(Chevron’s) positive first-quarter result was an encouraging sign that Chevron is executing well and we remain constructive on the company’s long-term, shareholder-friendly plan.” He projects share prices of $145 (16% upside potential). Better still, Chevron is a Dividend Aristocrat that has improved its annual payout for 31 consecutive years – making it a great stock to buy and hold not just for its growth potential, but income too.

UnitedHealth Group

- Market value: $226.4 billion

- TipRanks consensus price target: $1,818 (16% upside potential)

- TipRanks consensus rating: Strong Buy

- UnitedHealth Group (UNH, $236.40) is the nation’s largest health-care insurance company, covering more than 40 million consumers. It also is an analyst favorite, with eight experts doling out buy ratings over the past three months.

One of these analysts is Oppenheimer’s Michael Wiederhorn (view Wiederhorn’s TipRanks profile). This five-star analyst has just ramped up his price target from $260 to $276, or 17% upside potential. UNH ticks all the boxes for Wiederhorn, who writes, “We believe UNH is well positioned by virtue of its diversification, strong track record, elite management team and exposure to certain higher growth businesses.”

Wiederhorn also cites the company’s big long-term expansion potential, especially with its extremely successful Optum business. This is a leading IT health services platform that already processes nearly 1.3 billion drug prescriptions annually. “The company’s Optum business is a nice complement to its core managed care operations and is expected ultimately to grow to 30-40% of earnings,” he says.

Moreover, the international arm, UNH Global, already serves more than 4 million people, but the potential for expansion here is massive.

Harriet Lefton is head of content at TipRanks, a comprehensive investing tool that tracks more than 4,700 Wall Street analysts as well as hedge funds and insiders. You can find more of TipRanks’ stock insights here.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

Dow Dives 870 Points on Overseas Affairs: Stock Market Today

Dow Dives 870 Points on Overseas Affairs: Stock Market TodayFiscal policy in the Far East and foreign policy in the near west send markets all over the world into a selling frenzy.

-

Stocks Struggle for Gains to Start 2026: Stock Market Today

Stocks Struggle for Gains to Start 2026: Stock Market TodayIt's not quite the end of the world as we know it, but Warren Buffett is no longer the CEO of Berkshire Hathaway.

-

Stocks Extend Losing Streak After Fed Minutes: Stock Market Today

Stocks Extend Losing Streak After Fed Minutes: Stock Market TodayThe Santa Claus Rally is officially at risk after the S&P 500's third straight loss.

-

Santa Claus Rally at Risk as Tech Stocks Slump: Stock Market Today

Santa Claus Rally at Risk as Tech Stocks Slump: Stock Market TodayThe Nasdaq Composite and Dow Jones Industrial Average led today's declines as investors took profits on high-flying tech stocks.