7 Stocks to Buy In Case This Bull Market Stalls

This bull market is officially the longest one in history.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

This bull market is officially the longest one in history. And while the major indices are at or near all-time highs, investors have chosen stocks to buy in a curious way: they’ve gone on defense.

Bank of America recently reported that the top-performing sectors of the past three months have been defensive in nature: consumer staples, utilities, health care, telecommunications and real estate investment trusts (REITs).

In other words: Investors aren’t putting their full faith into this record bull market. And Wall Street’s pros seem to agree with their timidity.

Wells Fargo’s Christopher Harvey believes the markets are set to get choppy. “What we’re telling clients is, ‘Don’t light your hair on fire. Start to take down risk prudently, and selectively,’” he recently told CNBC, adding, “It’s going to be painful, but it will be healthy.”

But where do you go from here? Which stocks provide an attractive investing opportunity, but can also withstand increased volatility and downward pressure? Here we turned to TipRanks to source seven stocks to buy that have consensus “Buy” ratings from Wall Street’s analysts, and that all have a beta of less than 1. Beta is a crucial measure of stock volatility, and a sub-1 reading implies a stock is less volatile than the broader market.

Here’s a closer look at these seven highly rated stock picks:

Data is as of Aug. 27, 2018.

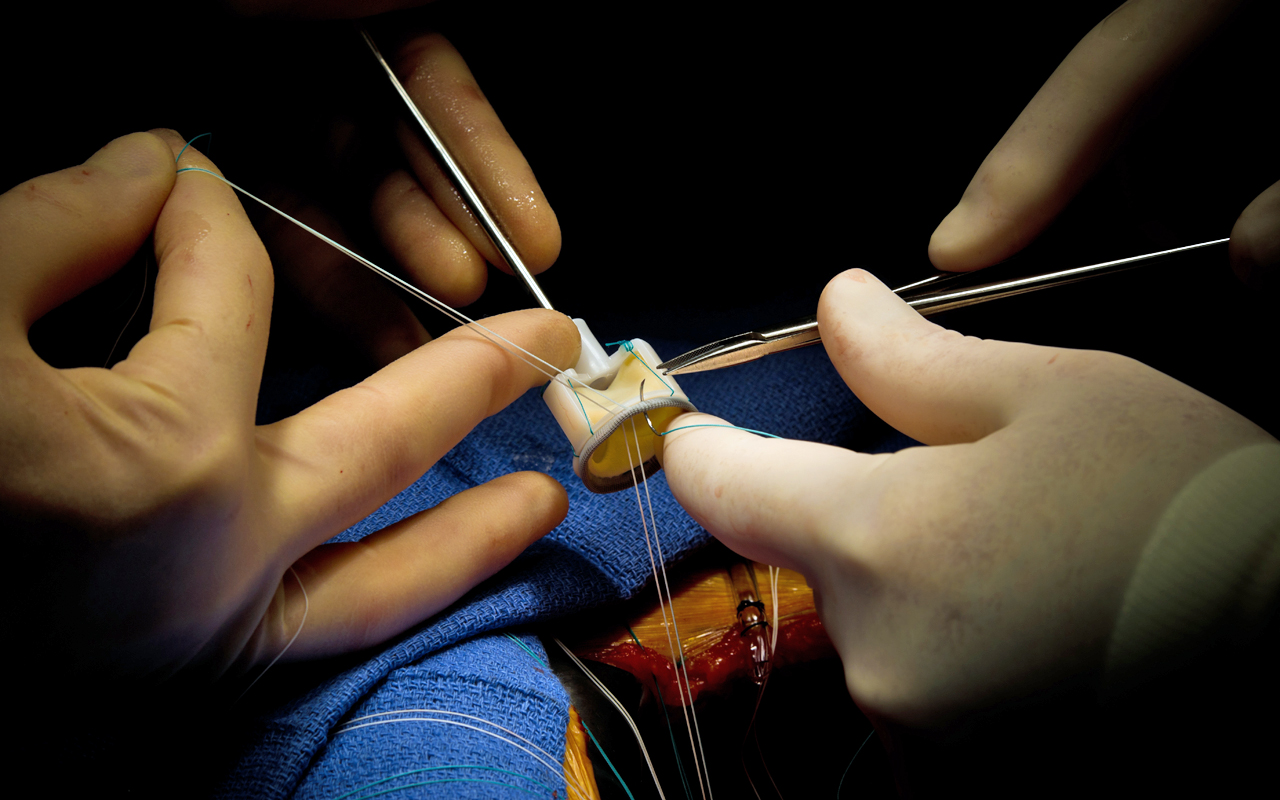

Edwards Lifesciences

- Market value: $29.5 billion

- Beta: 0.72

- TipRanks consensus price target: $159.86 (14% upside potential)

- TipRanks consensus rating: Strong Buy

“Strong Buy” medical device stock Edwards Lifesciences (EW, $140.72) specializes in artificial heart valves and hemodynamic monitoring. Shares already are up 24% year-to-date, and top Canaccord Genuity analyst Jason Mills (view Mills’ profile & recommendations) sees a robust growth runway ahead.

“Buy EW aggressively here” advises Mills, who sees shares spiking about 26% to $177. He backs up his Buy rating and Street-high price target here:

“The reason we are adamant about adding to positions in EW owes to our belief that the firm will deliver accelerating growth in underlying Transcatheter Valve Therapy (TVT) revenue over at least the next 2 quarters, and quite possibly the next 4 to 6, given myriad catalysts.” These catalysts include new products, low-risk data and indication expansion through the second half of 2019.

Mills believes this will send shares soaring. He writes, “We think growth acceleration in TVT, which we expect to start in (the second half of 2018), and possibly extend through 2019, will drive both operating leverage and multiple expansion in EW.”

Dollar Tree

- Market value: $22.1 billion

- Beta: 0.77

- TipRanks consensus price target: $104.69 (12% upside potential)

- TipRanks consensus rating: Strong Buy

Discount retailer Dollar Tree (DLTR, $93.07) sells items for $1 or less, making this a popular defensive stock pick that should hold up well in unfavorable economic times. Indeed, from the end of 2007 through mid-2009, DLTR shares climbed a whopping 54% versus a 36% loss for the Standard & Poor’s 500-stock index.

Fast forward to today, and the outlook for Dollar Tree remains bullish.

Out of 10 recent analyst ratings, eight analysts are bullish while only two are staying sidelined.

Oppenheimer’s Rupesh Parikh (view Parikh’s profile & recommendations) has a “Buy” rating on the stock and an upbeat long-term outlook for the company. He cites multiple positive factors, including 1) a compelling market growth opportunity, 2) potential for double-digit EPS growth and 3) an attractive valuation.

Meanwhile, top Loop Capital Markets analyst Anthony Chukumba (view Chukumba’s profile & recommendations) echoes this analysis. Despite near-term challenges, he remains impressed by management’s growth execution “on both the operational side and on the demand creation front.” He has a $120 price target on Dollar Tree that implies 29% upside potential.

Walmart

- Market value: $281.4 billion

- Beta: 0.42

- TipRanks consensus price target: $106.35 (12% upside potential)

- TipRanks consensus rating: Moderate Buy

American retail giant Walmart (WMT, $94.54) is buzzing right now. Shares surged 9% after the company reported the best sales growth in a decade. “We look very favorably upon WMT’s Q2 results,” cheers Guggenheim consumer analyst Bob Drbul (view Drbul’s profile & recommendations). This five-star analyst has now ramped up his price target from $100 to $110, implying 16% upside potential.

He writes, “The WMT U.S. comp was the strongest in >10 years, led by grocery (strongest in 9 years), with broad strength continuing through back-to-school.” Encouragingly, U.S. online sales – a critical category – also rose 40% during the most recent quarter.

Drbul concludes, “We believe the business remains healthy, with inventory in great shape (-3.4% in total), traffic increasing (+2.2%), and e-commerce accelerating (+40% growth).”

Walmart also recently announced a savvy 77% stake in India’s Flipkart Group – the country’s largest homegrown retailer. The $16 billion deal positions Walmart perfectly to gobble up a slice of India’s massive $600 billion retail industry.

This, as well as the retailer’s low-cost position in the U.S., should protect WMT somewhat should a bear market hit; note that Walmart shares rose by 5% during the Great Recession.

Monster Beverage

- Market value: $33.4 billion

- Beta: 0.92

- TipRanks consensus price target: $66.44 (10% upside potential)

- TipRanks consensus rating: Strong Buy

Beverage company Monster Beverage (MNST, $60.44) owns multiple drink brands including its namesake energy drink, as well as Relentless and Muscle Monster protein shakes.

The company recently reported strong Q2 earnings results, including impressive 13.2% volume growth that drove a 12% improvement on the top line. Top Jefferies analyst Kevin Grundy (view Grundy’s profile & recommendations) described the report as “boringly good.”

Post-earnings, Grundy assigned a bullish $71 price target to the stock (17% upside potential). He also ramped up EPS estimates by 1% and confirmed that Monster remains a “top large cap growth idea.”

According to Grundy, MNST offers strong sales growth – with impressive international market share gains – and an attractive valuation. Interestingly, he also floats the idea that Coca-Cola (KO) could acquire the remaining 82% of outstanding shares. This would drive the stock toward his “bull case” price of $88 – a whopping 46% from current prices.

Costco Wholesale

- Market value: $101.1 billion

- Beta: 0.99

- TipRanks consensus price target: $237.77 (3% upside potential)

- TipRanks consensus rating: Strong Buy

Member-only retail club Costco Wholesale (COST, $230.03) is up more than 20% year-to-date. And word on the Street is that there is still a long-growth runway ahead. Ten analysts have published “Buy” ratings on the stock in the last three months – no “Holds” or “Sells.”

Five-star RBC Capital analyst Scott Ciccarelli (view Ciccarelli’s profile & recommendations) has just delivered a bullish verdict on Costco’s recent earning results. He notes solid e-commerce growth with strong traffic trends (up 4.7% worldwide, and 4.5% in the U.S.). But the best part is that Costco continues to offer a unique investing proposition:

“With what we view as a significant competitive advantage (buying better and working on lower mark-up than almost any other company) and (high-single-digit/low-double-digit) EPS growth, we continue to believe that COST provides investors with scarcity value that simply can’t be found in many other places in the market.”

Even amid competition from rivals Amazon.com (AMZN) and Walmart, comps continue to exceed estimates and e-commerce growth continues to grind higher. Ciccarelli, who has a $246 price target on the stock (7% upside potential), sums up: “Continued in-store traffic growth coupled with a burgeoning e-commerce channel, makes Costco one of the best stories in Hardline/Broadline Retail. Remain buyers.”

McDonald’s

- Market value: $124.8 billion

- Beta: 0.65

- TipRanks consensus price target: $183.27 (14% upside potential)

- TipRanks consensus rating: Moderate Buy

- McDonald’s (MCD, $160.48) managed to stay afloat during the Great Recession when many other companies sank. Shares stayed flat (up by 0.03%) while the rest of the world crashed. Could this be because McDonald’s is a “premium consumer staples company”?

That’s how RBC Capital’s David Palmer (view Palmer’s profile & recommendations) describes McDonald’s in a note reiterating his “Buy” rating on MCD with a $175 price target.

This five-star analyst believes McDonald’s is on the right track as it focuses on upgrading its asset base, improving food quality, improving digital/delivery convenience, and establishing compelling value messages.

More specifically, he expects the U.S. business to improve over the next 12 to 18 months thanks to such factors as increased effectiveness of digital and loyalty initiatives and a refocus on past sales drivers (e.g. chicken and breakfast).

“These initiatives should result in 105%+ free cash flow conversion, high-single-digit EPS growth, and low-double-digit total shareholder return over the long term,” Palmer writes.

O’Reilly Automotive

- Market value: $26.6 billion

- Beta: 0.95

- TipRanks consensus price target: $337.11 (2% upside potential)

- TipRanks consensus rating: Strong Buy

Last but not least, we have O’Reilly Automotive (ORLY, $330.08), one of the world’s leading auto parts retailers with more than 4,000 stores. And this company has held up well in rough times, with shares climbing 14% during 2007-09.

Not that ORLY is a slouch when times are good – the stock is up 37% year-to-date.

Earlier this month, five-star Oppenheimer analyst Brian Nagel (view Nagel’s profile & recommendations) significantly boosted his ORLY price target from $305 to $360. “For a long while, we have highlighted Outperform-rated O’Reilly Auto (ORLY) as the best-run and most optimally-positioned chain amongst leading auto parts retailers,” Nagel wrote.

O’Reilly is set to outperform going forward, too. Nagel writes, “As we look forward, we are encouraged that ORLY remains well positioned to capitalize on a solid sector backdrop and market share opportunities coming as a result of ongoing struggles at leading competitors.”

Harriet Lefton is head of content at TipRanks, a comprehensive investing tool that tracks more than 4,700 Wall Street analysts as well as hedge funds and insiders. You can find more of TipRanks’ stock insights here.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

5 Stocks to Sell or Avoid Now

5 Stocks to Sell or Avoid Nowstocks to sell In a difficult market like this, weak positions can get even weaker. Wall Street analysts believe these five stocks should be near the front of your sell list.

-

Best Stocks for Rising Interest Rates

Best Stocks for Rising Interest Ratesstocks The Federal Reserve has been aggressive in its rate hiking, and there's a chance it's not done yet. Here are eight of the best stocks for rising interest rates.

-

The Five Safest Vanguard Funds to Own in a Volatile Market

The Five Safest Vanguard Funds to Own in a Volatile Marketrecession The safest Vanguard funds can help prepare investors for market tumult but without high fees.

-

The 5 Best Inflation-Proof Stocks

The 5 Best Inflation-Proof Stocksstocks Higher prices have been a major headache for investors, but these best inflation-proof stocks could help ease the impact.

-

5 of the Best Preferred Stock ETFs for High and Stable Dividends

5 of the Best Preferred Stock ETFs for High and Stable DividendsETFs The best preferred stock ETFs allow you to reduce your risk by investing in baskets of preferred stocks.

-

What Happens When the Retirement Honeymoon Phase Is Over?

What Happens When the Retirement Honeymoon Phase Is Over?In the early days, all is fun and exciting, but after a while, it may seem to some like they’ve lost as much as they’ve gained. What then?

-

5 Top-Rated Housing Stocks With Long-Term Growth Potential

5 Top-Rated Housing Stocks With Long-Term Growth Potentialstocks Housing stocks have struggled as a red-hot market cools, but these Buy-rated picks could be worth a closer look.