9 Reasons to Buy Walmart's Stock (WMT)

One of the perks of being the world’s biggest brick-and-mortar retailer by sales and square footage is owning a brand name everyone recognizes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

One of the perks of being the world’s biggest brick-and-mortar retailer by sales and square footage is owning a brand name everyone recognizes. Yes, that's Walmart (WMT, $80.53), which boasts sales of $241 billion across the past four reported quarters, as well as 1.1 billion-plus square feet of retail space in its global network of more than 11,600 stores.

No competitor even comes close to those measures.

If you think Walmart has always successfully leveraged its size to remain the most compelling investment in the general merchandise retailing space, however, think again. The company's mostly unfettered growth also allowed Walmart to get a little sloppy in terms of execution, which resulted in a sizable hit to the stock's value in 2015. All told, WMT shares fell roughly 30% that year, prompting some investors to lose interest in the stock.

As the adage goes, though, nothing lasts forever. Walmart has seen the error of its way and has been fixing its issues, achieving a level of success many investors never would have expected from the once-struggling retailer just a couple of years ago. That includes the company's Oct. 10 announcement of a $20 billion share buyback program and a number of optimistic forecasts that sent WMT shares 4.5% higher in response.

Here’s a closer look at nine things the company is doing right that should convince investors to trust WMT again.

Data is as of Oct. 9, 2017. Click on symbol links in each slide for current share prices and more.

1. Sales Are Consistently Growing Again

There’s an old business cliché that “sales cure all,” meaning as long as the top line grows, any other shortcoming is at least tolerable. Walmart is evidence that the axiom is mostly true. While investors still long for a few things, at the very least, sales are growing. In each of the past six quarters, the company’s revenue has been up on a year-over-year basis.

Perhaps more important is the fact that same-store sales have also been on the rise.

Same-store sales, or “comps,” are a means of measuring a retailer’s performance by removing the positive impact of building new stores as well as removing the adverse impact of closing stores within the calculation. The math only considers sales of stores that have been open for at least one year, providing an accurate snapshot of how well the company is managing the in-store customer experience.

On that front, Walmart’s comps in the U.S. have not only been positive for the prior 12 quarters, but the improvement has been broadly accelerating. The pace rolled in at a healthy 1.8% for the most recently reported quarter.

2. Earnings Are Getting Better, Too

Growing sales are meaningless if the bottom line doesn’t grow, too. But no worries there – Walmart’s income is improving. Last quarter's adjusted per-share earnings of $1.08 were up a penny from the year-ago period, marking the second consecutive quarter of profit growth. As it stands right now, the company is on pace to earn $4.37 per share for the fiscal year ended Jan. 31, 2018, which is now halfway done. If successful, this would be the first time in four years the retailer has driven full-year profit growth.

As for the future, Gordon Haskett analyst Chuck Grom sees more of the same – and better – on the horizon. He recently noted expectations for the company’s Oct. 10 analyst day event that included reiterated FY2018 earnings guidance of $4.30-$4.40 per share, a 5% hike in earnings guidance for the fiscal year ended Jan. 31, 2019, and a new share buyback authorization.

Walmart didn’t disappoint, hitting both profit projections on the nose and announcing it will buy back $20 billion in WMT shares over the next two years.

3. It’s Embracing E-Commerce

There's no two ways about it. Walmart simply got caught sleeping, letting Amazon.com (AMZN) become a disruptive force in the world of retail before finally taking the e-commerce giant seriously.

Walmart has made up for lost time, though. In 2015, the company made a two-year commitment to invest about $2 billion into growing its online business, and has since bought online businesses including Jet.com, Bonobos and Moosejaw. It was money well spent. Walmart’s online sales grew 63% on a year-over-year basis during the quarter ended April 31, 2017, then 60% in the quarter ended July 31.

However, while Walmart doesn't provide a breakdown of where its online revenue comes from, it made it clear that the bulk of the first quarter's improvement was driven by organic growth, not acquisitions.

Look for explosive growth going forward, too.

Moody’s lead retail analyst Charlie O’Shea wrote following the release of the prior quarter's results, “Explosive online growth is continuing its post-Jet.com trend, and we expect this level of performance to continue, along with Walmart’s ongoing efforts to leverage Jet by making tactical pure-play online acquisitions similar to the recent Bonobos deal, and therefore put itself in the solid No. 2 position behind Amazon in most online categories.”

Walmart itself provided an optimistic view of its online operations at its recent investor day event, projecting domestic e-commerce sales growth of 40% in fiscal 2019.

4. Walmart Is Getting Serious About Private-Label Goods

If you've ever seen brand names like Great Value and White Cloud on the shelves at your local Walmart, you've already been exposed to the company's private-label program.

Look for a lot more of those goods in the near-future.

The upside of selling your own goods rather than a third party's is obvious: These goods tend to drive higher margins, translating into better profitability. That's why the company's plan to expand this program bodes so well.

Examples of this expansion include Jet.com's recently launched private-label groceries intended to appeal to millennials, as well as a stepped-up assortment of Parent's Choice baby-care goods. Walmart is not only relaunching 100 existing Parent's Choice goods, it’s adding roughly 120 new ones, including premium diapers.

Gone are the days where the word “generic” also inherently meant lower quality, and Walmart is capitalizing on this shift. Retail consultant Burt Flickinger noted Jet.com's private-label goods “will be better quality than many of the national name brands.”

5. Its Electronics Departments Are Getting Makeovers

Most of Walmart’s locations have yet to go through this overhaul, but the company is slowly but surely making its electronics departments look more like Best Buy (BBY) stores – an environment highly conducive to sales of consumer electronics.

It matters. Although Walmart sells a little bit of everything, including groceries, Statistic Brain estimates that electronics are the biggest single source of Walmart's revenue, contributing 16% of the top line. That figure doesn't include sales of video games, either. Throw them into the mix, and the retailer's electronics department accounts for 22% of Walmart's business.

It just makes sense for the company to make itself as competitive as possible not just with Best Buy, but Amazon as well, on this very important front.

6. The Retailer Is Thinking Outside the Box

Some business ideas are good, and some ideas aren't so good. Many consumers likely won’t embrace Walmart's idea of delivering groceries all the way into your refrigerator, for instance. Most people are willing to get their food from the front door to the kitchen on their own rather than permit an un-escorted delivery person into their home.

The experiment still speaks volumes, though, about the fact that at least the company is thinking creatively. That's new in itself, suggesting Walmart is at least open to new ideas that may be more marketable.

Walmart has targeted a few marketable and mainstream ideas, including acquiring websites Jet.com and Bonobos, the latter of which sells higher-end men's clothing. And just a few days ago, Walmart announced it would be acquiring a delivery service called Parcel, which should help combat the speedy deliveries Amazon is promising. It only covers New York City, but it's something the retailer likely would not have considered just a few years ago.

7. Walmart Is Focusing on Its Proven Core Business

Kudos to any company willing to try new things. Sometimes, however, the best decision is not trying to enter new business ventures, but improving the execution of existing business lines.

Walmart learned that lesson last year.

After taking aim at the likes of Dollar General (DG) and Dollar Tree (DLTR) in earnest back in 2014 by ramping up openings of its small-footprint stores called Walmart Express, by early 2016 the company had realized that sliver of the retail world wasn't bearing enough fruit. It opted to close all 102 of those units and put its focus back on more viable opportunities.

8. It’s Paying Higher Wages

The knee-jerk reaction to reports that Walmart was upping its minimum hourly pay for workers was understandable. Payroll costs are a huge part of the retailer's operational expenses, and boosting its hourly rate to a minimum of $9 followed by a pretty quick raise to no less than $10 posed a sizeable threat to the bottom line.

Initially, investors lamented the increase in costs. However, as it turns out, there’s a decided upside to paying your workers more than the absolute minimum.

With higher pays comes higher employee engagement and lower turnover, making in-store operations even more productive and raising the quality of service. Interestingly, the pay raises have coincided with sales growth and, more recently, earnings growth and gains in WMT shares.

For now, higher pay seems to be paying off.

9. Walmart Is Increasingly Green-Friendly

Last but not least, while it won't do one single thing to help grow sales, Walmart is to be commended for taking a more progressive attitude when it comes to sustainable business practices.

It's starting out with a goal of reducing sales of potentially harmful chemicals by 10% by 2022. That new goal follows the company's decision last month to be the first retailer to participate in the Chemical Footprint Project survey, which ultimately is aimed at curbing the use of many dangerous chemicals.

Zach Freeze, Walmart’s senior director for strategic initiatives for sustainability, said about the initiatives, “We’re trying to center around a broader approach that emphasizes three elements: building trust, delivering impact and really staying ahead of regulation.”

Many people don't know this, but Walmart is one of the nation's biggest corporate-level users and installers of solar panels, and hopes one day to become 100% powered by renewable energy. It's not just good for the environment – it’s good for Walmart’s bottom line.

James Brumley held none of the aforementioned stocks as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

AI Stocks Lead Nasdaq's 398-Point Nosedive: Stock Market Today

AI Stocks Lead Nasdaq's 398-Point Nosedive: Stock Market TodayThe major stock market indexes do not yet reflect the bullish tendencies of sector rotation and broadening participation.

-

Nasdaq Rises 2.7% as Musk Tweets TSLA Higher: Stock Market Today

Nasdaq Rises 2.7% as Musk Tweets TSLA Higher: Stock Market TodayMarkets follow through on Friday's reversal rally with even bigger moves on Monday.

-

Dow Erases 717-Point Gain to End Lower: Stock Market Today

Dow Erases 717-Point Gain to End Lower: Stock Market TodayThe main indexes started the day with solid gains, but worries of an AI bubble weighed on stocks into the close.

-

Coulda, Woulda, Shoulda: Are These 5 Stocks Too Overvalued to Buy Now?

Coulda, Woulda, Shoulda: Are These 5 Stocks Too Overvalued to Buy Now?Investors worried about missing the boat on overvalued stocks need not fret. These five names, while expensive, are still seeing lots of love from analysts.

-

S&P 500 Extends Losing Streak Ahead of Powell Speech: Stock Market Today

S&P 500 Extends Losing Streak Ahead of Powell Speech: Stock Market TodayStocks continued to struggle ahead of Fed Chair Powell's Friday morning speech at Jackson Hole.

-

Stocks Struggle Ahead of Busy Fed Week: Stock Market Today

Stocks Struggle Ahead of Busy Fed Week: Stock Market TodayThe minutes from the July Fed meeting will be released Wednesday, while Chair Powell will deliver a key speech at Jackson Hole on Friday.

-

Dow Hits New Intraday High: Stock Market Today

Dow Hits New Intraday High: Stock Market TodayValue-hunters with big stakes in a particular component kept one of the main U.S. equity indexes in positive territory.

-

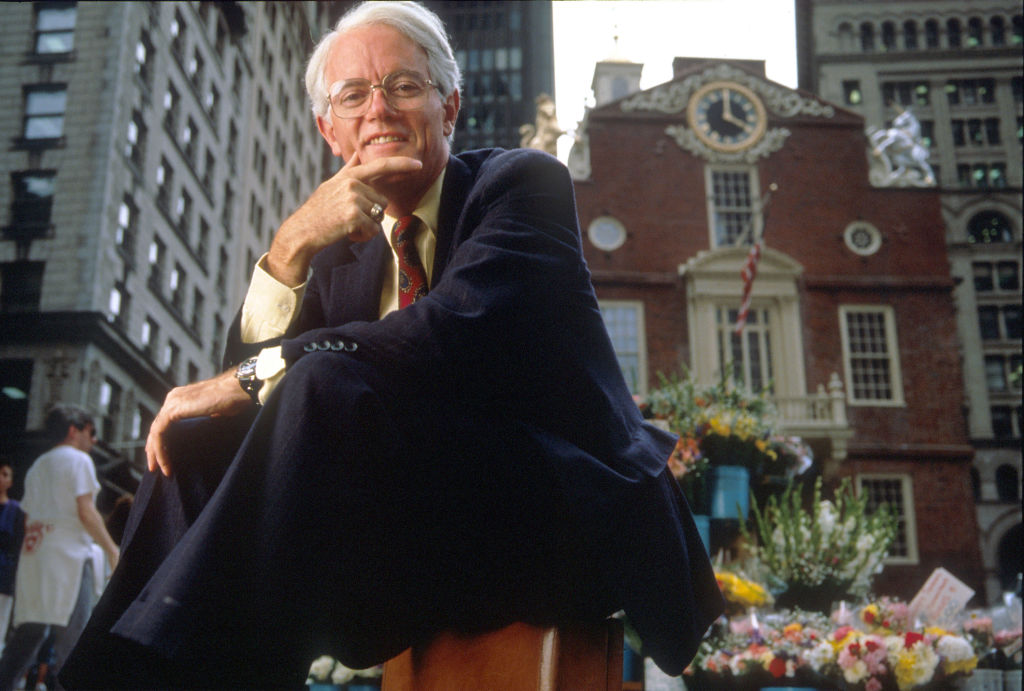

We Are Peter Lynch: How to Invest in What You Know

We Are Peter Lynch: How to Invest in What You KnowTake a look around, go to a free stock market data website, and get to work.