9 Stocks to Make You Rich

Investors dream of owning stocks that will make them rich—companies with game-changing technology, a miracle drug or a service that will prove so popular for such a long time that it catapults the company into prominence and its stock into the stratosphere.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Investors dream of owning stocks that will make them rich—companies with game-changing technology, a miracle drug or a service that will prove so popular for such a long time that it catapults the company into prominence and its stock into the stratosphere. But finding and holding on to those companies is no easy feat. Buying growth stocks is a bit like riding a bucking bronco, says Mike Lippert, manager of the Baron Opportunity fund. The ride, while rewarding, is both rocky and treacherous.

Lately, investors have lost their appetite for growth stocks, especially those with ultra-high valuation measures. The selloff gives contrarian investors more-attractive entry points. The nine stocks we feature are suitable only if you have the stomach for a lot of volatility and can handle big losses. And if you do, it’s best to buy at least a few of them—if not all.

Prices and related figures are as of May 16. Annual sales are for the past four quarters. Earnings estimates provided by Thomson Reuters.

- Headquarters: Menlo Park, Cal.Share price: $58.0252-week range: $22.67-$72.59Market capitalization: $148.9 billionAnnual sales: $8.9 billionEstimated earnings growth: 62.5% in 2014, 28.0% in 2015

After stumbling in its first year as a public company, Facebook (FB) has come back with a vengeance.

It earned $1.5 billion in 2013, and growth in the first three months of 2014 was spectacular: Earnings surged 193% from the same period a year earlier, and sales jumped 72%. One key is that advertising revenue has risen sharply thanks to a revamp that makes ads a more prominent part of Facebook news feeds. Sterne Agee analyst Arvind Bhatia thinks the company will continue to exceed analysts’ estimates by boosting user engagement and using firms it has purchased or intends to acquire—such as Instagram and WhatsApp—to stimulate growth in mobile advertising. Although the stock, at 39 times estimated year-ahead earnings, looks expensive, the potential growth justifies the price.

Amber Road

- Headquarters: East Rutherford, N.J.Share price: $12.0052-week range: $11.90 - $17.90*Market capitalization: $298.7 millionAnnual sales: $53 millionEstimated earnings growth: Not meaningful (company losing money)

Named after the ancient trade routes that carried precious cargo between the Baltic and Mediterranean seas, Amber Road (AMBR) helps importers and exporters negotiate the cacophony of tariffs and trade restrictions that can hamper their ability to get products to market.

Operating in 125 countries, the company uses cloud-based technology to update its customers on rapidly changing rules and regulations and to ensure the ideal routing for their goods. Amber Road isn’t yet profitable. But that’s because the company has been grappling with the substantial upfront costs of investigating trade rules and putting the results into their system. Analyst Brendan Barnicle, of Pacific Crest Securities, says that the proceeds from Amber Road’s initial public offering in March gave the company enough cash to finance the marketing and sales initiatives necessary to win new business and make better use of all that infrastructure. The demand for global trade logistics is great, he adds, so he expects rapid growth in revenues and, once the company turns profitable, in earnings as well. Analysts on average see revenues growing by 19.4% this year 17.4% in 2015.

*Publicly traded for less than one year

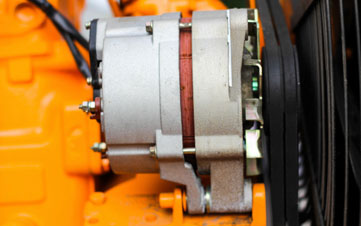

Motorcar Parts of America

- Headquarters: Torrance, Cal.Share price: $25.4052-week range: $5.75-$29.29Market capitalization: $379.6 millionAnnual sales: $406.2 millionEstimated earnings growth: 261.2% in the March 2015 fiscal year, 21.9% in the March 2016 fiscal year

Unlike all the other companies on our list, Motorcar (MPAA) is a turnaround play rather than a pure growth stock.

The auto-parts maker’s earnings tanked the past couple of years after the acquisition of Fenwick Automotive in 2011. Fenwick, which rebuilds old car parts, turned out to be a bust. But Motorcar Parts has split off Fenwick’s assets and debts, and Fenwick is now liquidating through Chapter 7 of the federal bankruptcy code. The separation eliminated a drag on profits and allowed Motorcar to focus on its rapidly growing parts business. The increasing propensity of drivers to hang on to their cars, combined with severe winter weather, which has been tough on electrical systems and gears, has revved up sales. But because of the company’s past problems, investors are underestimating its earnings potential, says Michelle Stevens, portfolio manager of the Baird SmallCap Value fund.

Navigator Holdings

- Headquarters: LondonShare price: $25.3552-week range: $19.48 to $60.00*Market capitalization: 1.4 billionAnnual sales: $261.8 millionEstimated earnings growth: 25% in 2014.

Companies drilling for oil and gas in U.S. and Canadian shale formations have found a mother lode of other liquefied petroleum products, such as propane, butane and ethane. The domestic market for these fracking byproducts is glutted, but the fuels are in high demand in Europe and Asia, where they sell for two to three times the domestic price.

Navigator (NVGS) owns refrigerated shipping vessels that can transport propane and butane overseas. The company has been growing at a blistering pace, with sales soaring 62% and profits increasing 34% in 2013. Eight new ships are set to come on line in the next two years, bringing the number of ships in Navigator’s fleet to 31. In addition, the company, which is registered in the Marshall Islands but has its executive offices in London, recently struck a deal to buy ships that transport ethane. The combination of surging propane, butane and ethane supplies and the tapping of the previously ignored market for ethane is likely to fuel Navigator’s earnings for years to come, says Stevens.

*Publicly traded for less than one year

Priceline

- Headquarters: Norwalk, Conn.Share price: $1,137.1652-week range: $784.32 to $1,378.96Market capitalization: $59.6 billionAnnual sales: $7.1 billionEstimated earnings growth: 25.2% in 2014, 22.8% in 2015.

Priceline (PCLN) has already made patient, long-term investors rich, soaring from a split-adjusted $6.50 in December 2000 to its lofty four-figure price today.

But Joe Fath, manager of the T. Rowe Price Growth Stock fund, thinks the company is just getting started. The travel Web site, which competes with the likes of Orbitz and Expedia, has the most durable business model of all its competitors, Fath says. And it’s in the midst of a virtuous cycle: As it signs up an increasing number of hoteliers in the U.S., Asia and Europe, it brings more customers to its sites, which include Booking.com, Rentalcars.com and Agoda, a Japanese-language site. Visitors book more reservations, which makes the sites more valuable to hoteliers, customers and stockholders. Priceline’s success in the U.S. is impressive, says Fath, but rapid overseas growth is the key to further earnings gains and additional share-price appreciation.

Prothena

- Headquarters: Dublin, IrelandShare price: $20.9352-week range: $9.14 to $49.24Market capitalization: $458.5 millionAnnual sales: $32.7 millionEstimated earnings growth: Not meaningful (company losing money)

Anyone who has watched the medical drama House is likely familiar with amyloidosis—the disease no doctor wants to consider because there is no cure. Tiny Prothena (PRTA) is trying to come up with a happier ending.

Early-stage trials of the biotechnology company’s NEOD001 drug found few side effects and tremendous results, says Wedbush Securities analyst Chris Marai. Although the drug has many hurdles to clear, Prothena plans to conduct more-advanced studies late this year. Because amyloidosis has no cure and Prothena’s medication has been shown to be safe in early tests, Marai thinks the drug could win rapid approval from the U.S. Food and Drug Administration, opening the door to a business that could account for $1.4 billion in annual sales. In addition, the company is testing treatments for the far more common Parkinson’s disease. Prothena is expected to lose money through 2017, but Marai thinks its medications are so promising and likely to become such blockbusters that long-term investors will profit mightily from the stock. (Although Prothena is registered in Ireland, its executive headquarters are in San Francisco.)

*Publicly traded for less than one year

Skyworks Solutions

- Headquarters: Woburn, MassShare price: $40.7552-week range: $20.62 to $44.17Market capitalization: $7.7 billionAnnual sales: $1.9 billionEstimated earnings growth: 27.7% in the September 2014 fiscal year, 13.5% in the September 2015 fiscal year

Skyworks Solutions (SWKS) makes analog semiconductors that are used in cell phones and other products that connect to the Web. But with Skyworks, you really don’t care whether Apple or Samsung wins the wireless wars. Its products are in both companies’ phones, not to mention in about half of all the phones sold in China, says Baird’s Michelle Stevens. As more people upload photos and videos, the demand for Skyworks’ amplifiers, modulators, synthesizers and switches soars, she says. Despite the company’s tremendous growth potential, the stock is relatively cheap, selling for 13 times estimated year-ahead earnings.

Workday

- Headquarters: Pleasanton, Cal.Share price: $71.7652-week range: $59.87 to $116.47Market capitalization: $13.2 billionAnnual sales: $469 millionEstimated earnings growth: Not meaningful (company losing money)

Remember PeopleSoft, the hot human-resources software firm that was bought out by Oracle for $10 billion almost a decade ago? The same dynamic duo who launched PeopleSoft are now behind Workday (WDAY), a human-resources and financial-management company that delivers its software and services via the cloud.

Instead relying on the old model—selling products to clients who keep returning for upgrades—Workday sells its software on an as-needed basis. For clients, that turns big upfront capital outlays into more modest operating expenditures. And because the software is delivered via the cloud, it’s regularly updated, providing customers a better user experience. Workday’s revenues climbed 86% last year and more than doubled the year before, but the company is still in the red. Profits are likely a few years off, but Baron Opportunity fund's Lippert thinks shareholders will be richly rewarded for patience.

Wynn Resorts

- Headquarters: Las VegasShare price: $201.7752-week range: $121.84 to $249.31Market capitalization: $20.3 billionAnnual sales:$5.8 billionEstimated earnings growth: 16.2% in 2014, 9.7% in 2015

U.S. investors best know Wynn Resorts (WYNN) as an operator of Las Vegas casinos run by gambling mogul Steve Wynn. But the domestic gambling recovery isn’t what’s driving the company’s earnings, says T. Rowe Price’s Joe Fath. Wynn is a long-term buy because of the properties it has developed on the Chinese island of Macau and its growing presence in the island’s Cotai district. Even though Macau generates ten times more gambling revenue than Las Vegas does, the peninsula’s gambling business is growing much faster than Las Vegas’s. Fath thinks Wynn’s Cotai properties could lead to a doubling of the company’s revenues over the long term. Japan is also opening up its gaming market, and Wynn is in an ideal position to capitalize on that, he says.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

How Inflation, Deflation and Other 'Flations' Impact Your Stock Portfolio

How Inflation, Deflation and Other 'Flations' Impact Your Stock PortfolioThere are five different types of "flations" that not only impact the economy, but also your investment returns. Here's how to adjust your portfolio for each one.

-

Why I Still Won't Buy Gold: Glassman

Why I Still Won't Buy Gold: GlassmanOne reason I won't buy gold is because while stocks rise briskly over time – not every month or year, but certainly every decade – gold does not.

-

Should You Use a 25x4 Portfolio Allocation?

Should You Use a 25x4 Portfolio Allocation?The 25x4 portfolio is supposed to be the new 60/40. Should you bite?

-

Retirement Income Funds to Keep Cash Flowing In Your Golden Years

Retirement Income Funds to Keep Cash Flowing In Your Golden YearsRetirement income funds are designed to generate a reliable cash payout for retirees. Here are a few we like.

-

10 2024 Stock Picks From An Investing Expert

10 2024 Stock Picks From An Investing ExpertThese 2024 stock picks have the potential to beat the market over the next 12 months.

-

Special Dividends Are On The Rise — Here's What to Know About Them

Special Dividends Are On The Rise — Here's What to Know About ThemMore companies are paying out special dividends this year. Here's what that means.

-

How to Invest in AI

How to Invest in AIInvestors wanting to know how to invest in AI should consider these companies that stand to benefit from the boom.