Analysts' 7 Top Stock Picks for 2019's Second Half

Stocks are sitting atop the clouds.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks are sitting atop the clouds. All three major indexes have recently surged to surged to all-time highs amid strong signals that the Federal Reserve will cut interest rates soon. Standard & Poor’s 500-stock index just closed above 3,000 for the first time. The Dow Jones Industrial Average recently made its first finish above the 27,000 mark.

But the question of whether the markets can maintain these lofty heights is something you should seriously consider when making stock picks over the next few weeks.

Consider this: More than three-quarters of S&P 500 companies have issued negative earnings per share (EPS) guidance for the second quarter thanks to trade uncertainty and lingering concerns about global growth. (Those earnings reports will be rolling out over the next couple months.) And while Wall Street is absolutely pricing in an interest-rate cut, no one yet knows for sure whether the Fed will cut, and how deeply it will cut if it does.

So tread carefully in the second half. The key is to find stocks that are not just primed to continue outperforming, but also less vulnerable to slumping along with a broader-market pullback. One way to do this is to seek out stocks with a strong Street sentiment. TipRanks tracks more than 5,200 analysts and compiles their ratings to deliver a picture of just how optimistic (or pessimistic) the pros are about most companies you can invest in.

These are the seven top stock picks for the second half, according to analyst ratings doled out over the past three months.

Data is as of July 16.

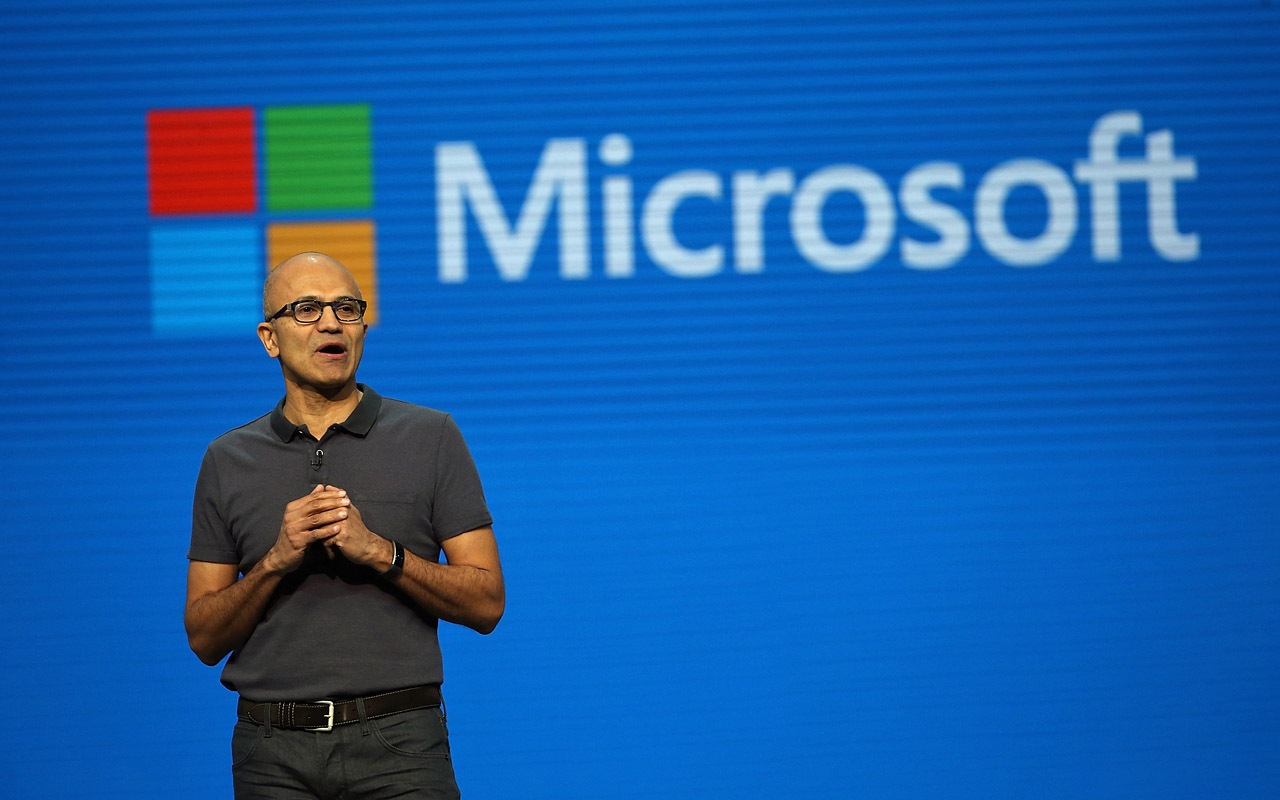

Microsoft

- Market value: $1.1 trillion

- TipRanks consensus price target: $146.65 (7% upside potential)

- TipRanks consensus rating: Strong Buy

Wall Street analysts have a firmly optimistic outlook for tech juggernaut Microsoft (MSFT, $137.08) – now the world’s most valuable company with a market cap of more than $1 trillion. And analysts believe the stock still has more room to climb thanks to its extremely successful cloud business.

Twenty-three analysts rate Microsoft a Buy, versus just one Hold and one Sell. Cowen’s Nick Yako is among the most recent bulls, slapping a Buy rating and $150 price target (9% upside) on the stock. He sees Microsoft’s cloud revenue exploding by 39% a year to $49.1 billion by fiscal 2025, giving MSFT stock a 25% market share of this lucrative market.

“We believe MSFT’s hybrid approach will continue to resonate with customers who want to migrate (to the cloud) at their own pace,” Yako wrote.

A similarly robust perspective comes from top-rated Wedbush analyst Daniel Ives. He is bullish on Microsoft, given 1) Azure’s cloud momentum, 2) Office 365 transition providing growth tailwinds for at least 12 to 18 more months, and 3) strong potential for newer integrated product initiatives (for example, LinkedIn, which already has more than 610 million users).

“These dynamics should enable Nadella to further transform MSFT into a cloud behemoth over the coming years and translate to further earnings and multiple expansion into FY20,” writes Ives, who has a $155 price target on the stock (13% upside potential). See what other top analysts have to say about MSFT on TipRanks.

Boston Scientific

- Market value: $58.2 billion

- TipRanks consensus price target: $46.25 (10% upside potential)

- TipRanks consensus rating: Strong Buy

Medical device specialist Boston Scientific (BSX, $41.86) is among popular stock picks for the second half. The company just held its biannual investor day, and the tone was upbeat.

BSX management provided an update on its strategy, new product pipeline, market growth expectations and financial targets. For example, the company plans to launch a whopping 75 new products by 2022 – many of those spanning six high-growth markets that total roughly $22 billion. Boston Scientific says these launches should accelerate organic revenue from 7% during 2017-19 to 6%-9% in 2020-22.

The event sparked eight analysts to reiterate their Buy ratings on Boston Scientific shares. Needham analyst Mike Matson reiterated his Strong Buy rating, writing, “We believe BSX has assembled one of the best pipelines in its peer group.”

For BTIG’s Sean Lavin, the meeting reaffirmed his view that Boston Scientific is strategically and geographically well-positioned – especially in the lucrative medical and surgical markets. “We anticipate improving growth in the back half as comps ease, supply issues dissipate, and recent acquisitions pad revenue,” he wrote in a note that saw his price target jump from $42 per share to $46 (10% upside). Find out how the Street’s average price target for BSX breaks down.

Teladoc Health

- Market value: $5.0 billion

- TipRanks consensus price target: $80.27 (16% upside potential)

- TipRanks consensus rating: Strong Buy

If you need quick medical advice, Teladoc Health (TDOC, $69.20) has the answer. “Speak to a licensed doctor by web, phone or mobile app in under 10 minutes,” promises this health-tech-telecom company, which has developed a tech system that allows doctors to “see” patients remotely.

Teladoc’s disruptive platform is growing rapidly, and shares are enjoying robust gains as a result. TDOC has shot up nearly 40% so far in 2019.

Top Chardan analyst Steven Wardell recently reiterated his Buy rating on TDOC, giving it a $90 price target that implies 30% more gains from current levels. He writes that Teladoc’s market leadership and revenue growth are “class-leading,” and that “we have confidence in Teladoc’s business model and market demand based on channel checks.”

Those checks indicate continued strong demand for “telehealth” over the next couple of years by employers and managed-care organizations. Also bullish: TDOC has just snapped up MédecinDirect for an undisclosed sum, considerably expanding its European footprint.

“This acquisition will allow TDOC to access local market in France and capitalize (on) MédecinDirect’s relationship with 30 insurance companies in France,” Wardell writes. What are other financial experts saying about Teladoc’s outlook? Find out on TipRanks.

Skechers

- Market value: $5.4 billion

- TipRanks consensus price target: $36.67 (6% upside potential)

- TipRanks consensus rating: Strong Buy

- Skechers (SKX, $34.56) has rallied by more than 50% so far this year, boosted by strong international performance and successful growth initiatives. That includes reaping benefits from heavy investment in its digital business, as well as new product releases and store remodeling.

Despite its run-up, analysts still list SKX among their top stock picks for the rest of 2019. So what will the second half of 2019 hold?

Top-rated Susquehanna analyst Sam Poser recently met with Skechers management, and afterward told investors, “Buy SKX. Post our lunch with management … checks at recent trade shows, we are confident momentum is building.”

He expects a positive inflection in Skechers’ business (and shares) in the second half when revenues from an improving backlog start to be realized. He also sees strength in men’s casual and work, and thinks the GoWalk 5 and GoWalk Smart will boost the women’s athletic business.

“Further, over the last several quarters, management’s focus on controlling costs, inventory discipline, and a willingness to sacrifice sales to drive profitability is a positive sign,” writes Poser, who has a $37 price target (7% upside) on SKX.

Over the past three months, Skechers has received only Buy ratings from the analyst community. Check out more opinions from the pros at TipRanks.

Slack Technologies

- Market value: $17.4 billion

- TipRanks consensus price target: $39.55 (15% upside potential)

- TipRanks consensus rating: Strong Buy

- Slack Technologies (WORK, $34.40) is a fresh-faced entry the public markets. The fast-growing workplace messaging platform held a direct market listing in late June, with employees and investors converting their ownership into stock. That’s in contrast to the more traditional initial public offering (IPO) approach, where the company raises fresh capital from outside investors.

Shares surged almost 50% in first day trading to $38.62, vs the New York Stock Exchange reference price of $26 per share. While Slack has cooled off considerably since then, analysts are nonetheless confident that WORK is a compelling stock pick.

Slack recently has picked up several Buy ratings, including from five-star KeyBanc analyst Brent Bracelin. He initiated coverage on WORK on July 16 with a price target of $44 (28% upside potential).

“By pioneering a new product category to challenge e-mail as the primary method for digital communications, Slack channels have redefined digital work, quickly expanding to 95K paid customers and a revenue run-rate of $539M in a short span of five years,” explained the analyst.

He sees Slack as a “Trojan horse” with potential to automate the middle-office. Thus, he initiated WORK stock at Overweight based on the “potential to become an automation platform for the middle-office where revenue could eclipse $3B within five years and $10B within ten years.” See why other top analysts are also bullish on Slack.

Six Flags

- Market value: $4.5 billion

- TipRanks consensus price target: $59.33 (10% upside potential)

- TipRanks consensus rating: Strong Buy

Theme park giant Six Flags (SIX, $53.79) has received three consecutive upgrades from a trio of analyst outfits – Wells Fargo, Wedbush and Keybanc – from Hold to Buy.

Why the wave of bullish activity?

Six Flags has joined their second-half stock picks thanks to a slew of positive catalysts, including the company’s new Membership 2.0 program. This new tiered membership plan should “generate significant upside to per-capita spending,” Wedbush analyst James Hardiman writes.

That’s alongside progress with for Six Flags’ Chongqing, China, development, which if approved could boost Wedbush’s EBITDA estimate by $10 million to $15 million. Management has now met with management officials to discuss the approval for Chongqing, and further down the road, its Nanjing project.

“While none of these are a sure thing, any of them likely results in meaningful upside to SIX shares, particularly given the sell-off of the past year that has resulted in a discounted valuation with respect to the sizable dividend,” Hardiman writes to investors, adding, “This gives us confidence to upgrade SIX shares now, ahead of the bigger weather-related catalyst in 3Q.”

The analyst also boosted his price target on the stock from $51 to $62. From current levels, that suggests 15% upside potential lies ahead. Discover how the overall analyst consensus breaks down on TipRanks here.

Amazon.com

- Market value: $989.5 billion

- TipRanks consensus price target: $2,250.16 (12% upside potential)

- TipRanks consensus rating: Strong Buy

E-commerce giant Amazon.com (AMZN, $2,009.90) continues to deliver for investors. The stock has put on a 34% sprint since the start of the year, and it sits among analysts’ top stock picks for the remainder of 2019 and beyond. Over the past three months, AMZN has received 35 Buy ratings versus just one Hold.

Most recently, Barclays analyst Ross Sandler called Amazon his favorite internet stock for the critical second-quarter earnings season. “AMZN is our top mega-cap long idea heading into 2Q – you own the name into retail revenue growth acceleration regardless of margin compression, full stop,” he writes.

The firm’s checks and data suggest accelerating retail revenues thanks both to organic growth and next-day shipping offered across several U.S. ZIP codes. Sandler also says the company’s recent Prime Day could boost third-quarter revenue guidance. Indeed, Loop Capital’s Anthony Chukumba already predicts that AMZN’s 48-hour Prime Day was “highly successful” at generating “significant volume” during a typically slow sales period.

“Owning AMZN into accelerating growth in retail is a winning strategy in our view,” Sandler writes. See why other top analysts are also bullish on Amazon.

Harriet Lefton is head of content at TipRanks, a comprehensive investing tool that tracks more than 5,000 Wall Street analysts as well as hedge funds and insiders. You can find more of their stock insights here.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

Dow Dives 870 Points on Overseas Affairs: Stock Market Today

Dow Dives 870 Points on Overseas Affairs: Stock Market TodayFiscal policy in the Far East and foreign policy in the near west send markets all over the world into a selling frenzy.