The Disruptors: 10 Innovative and Irritating Stock Picks

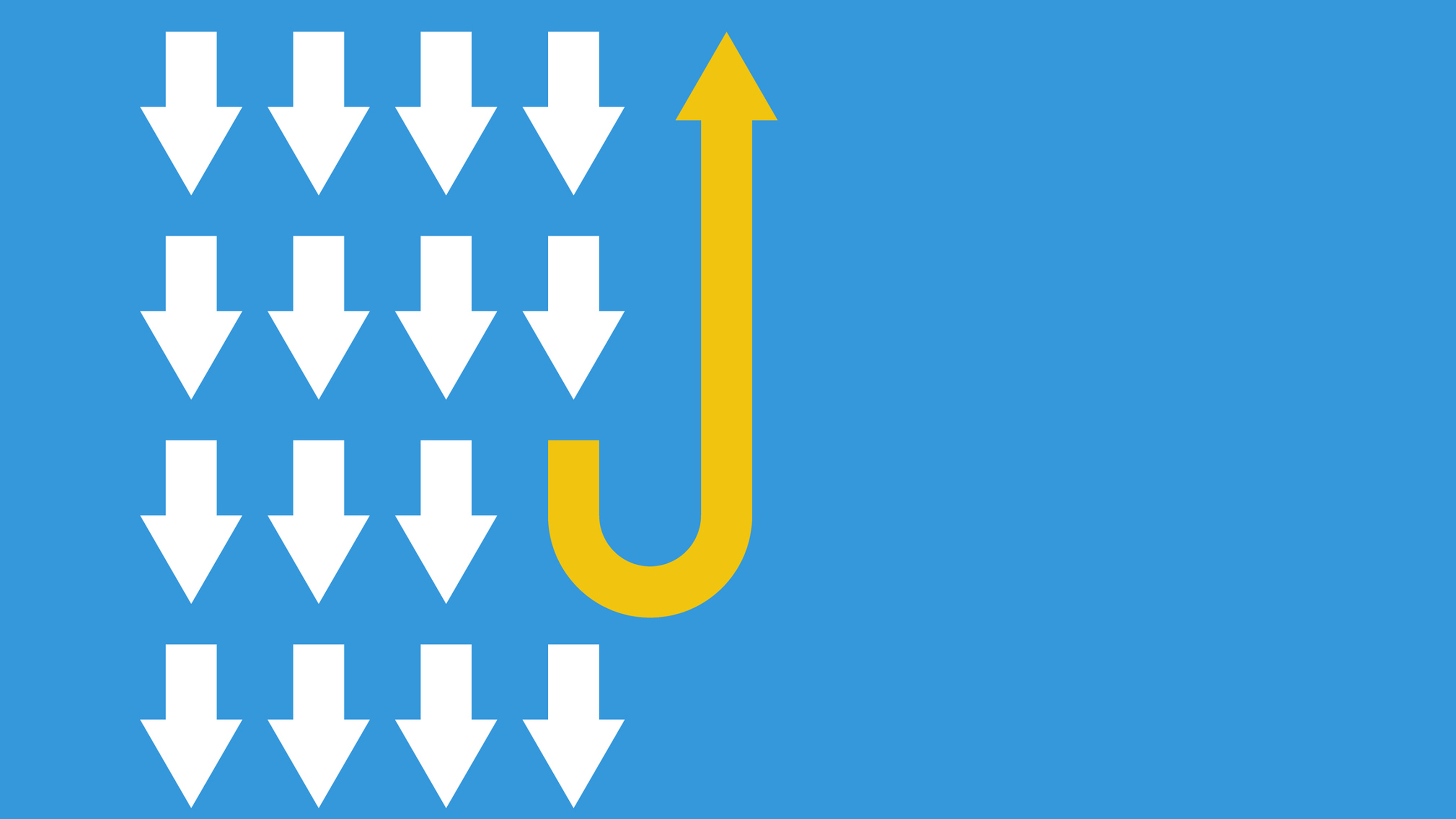

The idea of disruptors – single companies that (usually quickly) change the landscape of an entire industry or sector – isn’t new.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The idea of disruptors – single companies that (usually quickly) change the landscape of an entire industry or sector – isn’t new. Henry Ford and Ford Motor (F) revolutionized automaking in the early 1990s. Phil Knight’s Nike (NKE) forever altered the athletic-shoe industry.

In the process, these and other similar game-changers were colossally successful stock picks, shooting higher year after year as they ate the rest of their industry’s share.

Today, institutional investors with deep pockets still are committing large sums of capital to disruptive technologies. For instance, in Canada, Quebec’s largest pension fund – Caisse de dépôt et placement du Québec – recently announced that it would invest up to $2 billion in public-company stocks and pre-initial public offering (IPO) companies with the potential to become leaders in their industries.

Here in the U.S., investment managers such as Ark Investment Management LLC, are focused exclusively on disruptive innovation. Ark defines disruptive innovation “as the introduction of a technologically enabled new product or service that has the potential to change an industry landscape by creating simplicity and accessibility while driving down costs.” This sounds like the kinds of innovations harnessed by Ford and Nike in their heydays.

Today, we’ll explore 10 stock picks that have the potential to be disruptors themselves. A few of these are established companies that are delving into new markets, while others are younger companies that are only starting to be a thorn in other companies’ sides. Just be cautious. A few aren’t even profitable yet, which makes them considerable risks and more suitable for aggressive allocations.

Data is as of Aug. 19.

Disney

- Market value: $243.7 billion

“I think the most important thing one has to do when they’re contending with change is to admit that it’s occurring and to assess very carefully what the impact of the change is on all the businesses.” That was Disney (DIS, $135.29) CEO Bob Iger sounding off at Bank of America Merrill Lynch’s Media, Communications & Entertainment Conference in 2017.

Since then, Iger has pulled off a multibillion-dollar acquisition (21st Century Fox’s entertainment assets) and brought a video streaming package to the table that is going to seriously compete with Netflix (NFLX), which is easily the biggest player in the growing industry.

On Aug. 6, Disney announced that in November, it will introduce a bundle package of Disney+, ESPN+ and an ad-supported version of Hulu for $12.99 a month – on par or better than any of the competition, including Netflix.

Separately, the ad-supported Hulu and ESPN+ cost $10.98 a month combined. Add in Disney+, which goes for $6.99 on its own, and you’re talking about a 28% discount when you bundle all three services. And unlike the other services out there, you’re also getting some live sports – something that could be a deciding factor in households trying to pick which streaming services to keep, and which to ditch.

Stitch Fix

- Market value: $2.1 billion

Stitch Fix (SFIX, $20.57) is a San Francisco-based clothing subscription company that uses artificial intelligence and machine learning to understand more about each customer’s styles and preferences, thus delivering a better experience for its loyal patrons.

Each month, Stitch Fix sends a specific dollar value of clothes to a client based on those preferences. Whatever the customer doesn’t like, they send back. All of the data is collected and used to select more appropriate choices in subsequent months.

“We knew from the beginning that the only way to provide accessible personal styling at scale was to combine humans and data science,” CEO Katrina Lake said in Time’s 2019 list of “tech optimists.”

To add another revenue stream, Stitch Fix is considering entering the rental market, which has been very good to Seattle-based Rent the Runway. Even if it doesn’t, SFIX already looks like a potential disruptor in the retail space.

Stitch Fix is a young company that was founded in 2011 and went public in November 2017 at $15 per share. The ride has been bumpy, including a nasty 26% spill over the past month. But its 37% returns from its IPO price are still almost triple the 13% return of Standard & Poor’s 500-stock index in that time.

Stifel Nicolaus analyst Scott Devitt upgraded SFIX from Hold to Buy in late July simply based on weakness in the share price. The stock has shed a quarter of its value since then, bringing it to a downright reasonable price-to-sales ratio of 1.4 that’s actually cheaper than the S&P 500. The company projects revenue growth of 20% to 25% through 2022. Devitt is more conservative, projecting 19% annual revenue growth, and still thinks the stock is buy-worthy.

Square

- Market value: $27.4 billion

On Aug. 1, Square (SQ, $64.08) announced that it was selling Caviar – the company’s all-in-one food ordering platform – for $410 million to DoorDash, one of the country’s largest food delivery platforms. Square acquired Caviar in 2014 for $90 million, and it reportedly tried to sell the company for $100 million in 2016 but failed to find any buyers.

Three years later, the company that is already disrupting the payments industry is finally getting out of a business that didn’t make much sense for it. But don’t weep for anyone involved. DoorDash is getting an asset that fits right in with its mission and that it can take to the next level – and Square is making an estimated $320 million profit. That’s a win-win.

“We are increasing our focus on and investment in our two large, growing ecosystems – one for businesses and one for individuals. This transaction furthers that effort,” CEO Jack Dorsey said about the move. “And we believe partnering with DoorDash provides valuable and strategic opportunities for Square.”

Square will focus on continuing to build its Cash App, which had grown from $0 revenue per quarter when it was launched in 2016, to $135 million in its most recent second-quarter results released Aug. 1. “The Cash App ecosystem continues to exceed our expectations,” Dorsey said during the earnings call.

For what it’s worth, Square has dropped almost 20% since that report. The company beat earnings expectations, though. The negative reaction is largely tied to its announcement that it would spend more on marketing ahead of the holiday season. So aggressive investors can view this as a better deal on a company that still have plenty of disruption in the hopper.

Farfetch

- Market value: $3.3 billion

When it comes to buying Farfetch (FTCH, $10.83) stock, it pays to heed the advice of Warren Buffett, who once said, “Be fearful when others are greedy and greedy when others are fearful.”

Farfetch – the world’s leading tech platform for luxury fashion retail – announced second-quarter results after the Aug. 8 close. Its stock dropped on the news to under $11. FTCH went public on September 2018 at $20 per share, so it’s currently trading at a little more than half its IPO price after less than a year on the public markets.

But the issue wasn’t the fact that its $209.3 million in revenue still resulted in a $95.8 million operating loss. Guidance scared the Street. Farfetch expects gross merchandise value (GMV) to grow by just 50% year-over-year to $2.1 billion for fiscal 2019. In fiscal 2018, Farfetch grew GMV by 55% to $1.4 billion.

Farfetch nonetheless expects to grow its share of the online luxury business, which founder, CEO and co-chairman José Neves believes will expand by $100 billion over the next decade. As part of its plan to grab share, Farfetch also announced Aug. 8 that it would pay $675 million to acquire New Guards Group – a luxury goods platform that was launched in 2015 to develop up-and-coming luxury brands including Off White and Palm Angels. By acquiring this platform, Farfetch is further putting its stamp on online luxury e-commerce.

FTCH is a hybrid tech/retail disruptor, though it’s not without its risks. If you’re willing to invest in companies that aren’t making money yet, Farfetch is worth considering for the long haul.

Shopify

- Market value: $40.7 billion

- Shopify (SHOP, $361.83) CEO Tobi Lütke is a multi-billionaire who owns 55% of the company’s multiple-voting Class B shares. He’s also the person driving its growth in 2019 and beyond.

The tiny company he created in 2004 wasn’t the grand vision of what it would become. Shopify currently helps 820,000 small businesses via its e-commerce platform, which offers services from payments to shipping to customer engagement. But when it started, it was just a necessary technology that Lütke and his partners needed to sell snowboards online.

Shopify started as Snowdevil, then morphed into Jadd Pixel. It only actually became Shopify in 2006 as more and more companies asked to use its e-commerce software.

The rest, as they say, is history.

While many companies involved in online retail might look at Amazon.com (AMZN) as an existential threat, Shopify is different. In a recent Globe and Mail article discussing his company, Lütke admitted that if Amazon were to go out of business, Shopify actually would be hurt by its disappearance from the e-commerce arena.

“The important thing for the small businesses we represent is that they rely on online shopping becoming a larger part of the total retail experience,” Lütke said. “Amazon provides convenience especially across all the products that people need – toilet paper, laundry detergent and all these kinds of products. For that, Amazon is unbeatable, and without that I think consumer behaviour would change.”

Shopify – whose stock is up 161% so far in 2019 – has yet to make an annual profit on a generally accepted accounting principles (GAAP) basis. However, excluding stock-based compensation and payroll taxes related to that compensation, the company reported an adjusted net profit of $26 million during the first six months of the year – almost four times the amount it generated a year earlier.

If the company can keep gaining scale, profits and cash flow should follow.

Phreesia

- Market value: $953.7 million

Initial public offerings have done generally well this year. The Renaissance IPO Index that tracks such offerings is up 33% versus roughly 17% for the S&P 500. Among the winners is New York City-based Phreesia (PHR, $26.86), which has developed a payments platform for health care providers. Phreesia began trading July 18 at $18 per share, above its $15 to $17 price range. It gained 39.3% on its first day of trading and has climbed a little higher since.

The company helps the health care experience for both patients and providers, whether it’s ensuring a patient’s appointment is verified or helping a provider collect copays and balances.

“We continuously partner with lots of companies all throughout the health care ecosystem, because we don't think one company could change health care.” CEO Chaim Indig told Yahoo! Finance in July. “We think being a public company gives us the ability to remain independent for a long, long time, and continue building on that mission of improving the health care experience for all the stakeholders.”

In fiscal 2019, Phreesia facilitated more than 54 million patient visits at more than 1,600 healthcare provider organizations, processing more than $1.4 billion in patient payments.

Phreesia’s software platform was named the 2019 Category Leader for Patient Intake Management by health care IT research firm KLAS. As health care continues to get more complicated, companies such as Phreesia have become increasingly important to improving outcomes between patients and providers.

Beyond Meat

- Market value: $8.7 billion

You could make a case that Beyond Meat (BYND, $144.51) – the California-based plant-based food company – is 2019’s disruptor of the year.

If you haven’t heard about Beyond Meat’s stock success, you need to read more investing headlines. The company priced its IPO at $25 per share and started trading on May 1. It popped 163% on its first day of trading and another 120% since then for a combined gain of 478% from its IPO price – and that includes a significant plunge over the past few weeks.

It seems every restaurant on the planet wants to sell the Beyond Burger – a plant-based product with no soy, gluten or GMOs that tastes an awful lot like real meat – and many of its competitors’ products. Beyond Meat’s biggest competition could be Impossible Foods, which has yet to go public but just won a big contract from Burger King that saw the plant-based Impossible Whopper rolled out at all 7,200 locations across the U.S.

Beyond Meat and Impossible Foods are so disruptive, in fact, that some states have passed laws that say only foods made of animal flesh can use monikers like “meat” or “burger” on their labels. Fake meat supporters have a few arguments, including that if they can’t call a product by how it looks and tastes, their First Amendment right to freedom of speech is being violated. Expect this battle to heat up in the years to come.

This pair of disruptors are causing such an uproar that Tyson Foods (TSN), one of the largest meat producers in the world, recently introduced Raised & Rooted – its version of alternative protein. Tyson actually owned 6.5% of Beyond Meat until selling its shares in April, just before the company’s IPO.

Buyer beware: Even though shares have lost more than a quarter of their value from their July peak, they still sell at an astronomical 56 times revenues. Only one of eight analysts tracking the stock view it as a Buy, with the rest at Hold, largely because of its high valuation. But they do expect the company to flip from a non-GAAP loss of 26 cents per share this year to a 26-cent profit next. So BYND might be a wait-and-buy-the-next-dip situation.

Fiverr International

- Market value: $701.1 million

If you’re familiar with the term “gig economy,” there’s a good chance you’ve heard of Fiverr International (FVRR, $22.62). This Israel-based online marketplace, which was launched in 2010, connected services buyers with sellers, who did tasks for $5. (A “fiver.”)

Fiverr has since moved beyond that narrow focus to concentrate on creative services for larger amounts of money, persuading larger companies to also utilize the platform.

Since its inception, Fiverr has facilitated more than 50 million transactions between 5.5 million buyers and more than 830,000 sellers. Fiverr gets a fee for facilitating the transaction. In 2018, the company received 25.7% of every dollar transacted over its platform, up 120 basis points from 2017. More than 70% of its transactions are generated from the U.S., U.K., Canada, Australia, and New Zealand. Repeat buyers make up 57% of its revenue.

However, like many tech IPOs in 2019 (the company went public on June 13), FVRR doesn’t make money – it lost $36.1 million on sales of $75.5 million in 2018. But its gross margin of 79% is healthy.

As Fiverr increases the number of active buyers on its platform and expands its geographical footprint outside its main countries of operations, its operating costs – including the hiring of staff, research and development, and increased marketing expenses – will all substantially rise. Therefore, it’s unlikely that it will make money in the foreseeable future. Analysts do, however, see non-GAAP losses dropping from 89 cents per share this year to 65 cents in 2020.

If you believe in the gig and freelance economy, Fiverr is the ultimate disruptor. You’ll just have to be patient for profits.

- Market value: $18.1 billion

One of the words you often hear about disruptors is scaling: a company’s ability to grow its business not just quickly, but efficiently, too.

- Pinterest (PINS, $33.33) is the unicorn 2019 IPO that few people expected to do well. But it gained 28% on April 18, its first day of trading. Since then, it has shot another 43% higher.

The big reason investors should have known the social media disruptor would be an IPO success had everything to do with its financial situation. Yes, it recorded a $74.7 million loss last year on revenues of $755.9 million, but it’s not torching its cash. As of the end of December, it had $627.8 million in cash and marketable securities – 11.8% less than a year earlier. It would have taken Pinterest almost eight years to burn through that much. Plus, the IPO helped lift its cash and marketable securities to $1.8 billion as of the second quarter.

In the meantime, analysts are starting to realize that the social media site dedicated to pictures rather than words, is going to get to profitability much more quickly than a lot of the big-name IPOs in 2019 such as Uber Technologies (UBER) and Lyft Inc. (LYFT).

Deutsche Bank analysts upgraded PINS from Hold to Buy on Aug. 2, with a price target of $40. They said their stance reflects “a meaningful increase to estimates and more confidence the company can scale its ad business – in the US and internationally – faster than expected.”

The exciting part about Pinterest is that while it has almost three times as many international monthly active users (MAUs) as U.S. MAUs, it currently makes just one-third the average revenue from those international users as it does those in the U.S. Once it monetizes those international users, profits should follow.

Medallia

- Market value: $4.6 billion

Worldwide spending on customer experience (CX) technology is expected to grow by 8.2% annually between 2018 and 2022, reaching $641 billion, according to IDC estimates.

Enter Medallia (MDLA, $37.68), which went public just more than a month ago (July 18) at $21 per share – well above its expected range of $16 to $18.

The company’s Medallia Experience Cloud is a SaaS (software-as-a-service) platform that helps companies understand and manage the customer experience better. Using proprietary artificial intelligence, Medallia’s platform analyzes data across human, digital, and internet of things (IoT) interactions to generate personalized and predictive insights that generate tangible results.

The company’s platform analyzes more than 4.9 billion “experiences” each year, performing an average of 8 trillion calculations every day to help company make business decisions. The Medallia platform encompasses all four areas of experience management: customer experience, business experience, employee experience and product experience.

The opportunity? Very few companies are good at providing an excellent customer experience. Even fewer are capable of analyzing the data behind the customer experience to understand why the customer was disappointed.

Medallia’s 565 customers are up from 469 a year ago. Approximately 79% of its revenue is from the sale of subscriptions, with the rest from professional services. In its fiscal 2019 that ended in January, it generated $313.6 million in revenue, up from $261.2 million a year earlier. It lost $82.2 million from operations, however – a 17% wider loss than in fiscal 2018.

This isn’t uncommon for newly public companies, and its losses could get even deeper before they get better. That’s the risk with these types of companies; it’s difficult to gauge if and when that pivot toward profitability will actually happen.

But Medallia has a chance to be a disruptor and has plenty of market to grow into: The company estimates the four areas of experience management to have a total addressable market of $68 billion.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Will has written professionally for investment and finance publications in both the U.S. and Canada since 2004. A native of Toronto, Canada, his sole objective is to help people become better and more informed investors. Fascinated by how companies make money, he's a keen student of business history. Married and now living in Halifax, Nova Scotia, he's also got an interest in equity and debt crowdfunding.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Dow Dives 797 Points as Government Opens: Stock Market Today

Dow Dives 797 Points as Government Opens: Stock Market TodayThe process of pricing and re-pricing realities old and new never stops, and next week promises to be at least as exciting as this week.

-

Stocks Rally on Apple Strength: Stock Market Today

Stocks Rally on Apple Strength: Stock Market TodayThe iPhone maker will boost its U.S. investment by $100 billion, which sent the Dow Jones stock soaring.

-

Stock Market Today: Stocks Rise Despite Stagflation Risk

Stock Market Today: Stocks Rise Despite Stagflation RiskThe business of business continues apace on continuing hope for reduced trade-related uncertainty.

-

4 Turnaround Stocks to Consider – and 2 More to Keep an Eye On

4 Turnaround Stocks to Consider – and 2 More to Keep an Eye OnA turnaround stock is a struggling company with a strong makeover plan that can pay off for intrepid investors.

-

Stock Market Today: Stocks Waver as Big Tech Slumps on Spending Concerns

Stock Market Today: Stocks Waver as Big Tech Slumps on Spending ConcernsMarkets seesawed amid worries over massive costs for artificial intelligence and mixed economic news.

-

Is Disney Stock Still a Buy After Earnings?

Is Disney Stock Still a Buy After Earnings?Walt Disney stock is down Wednesday after the entertainment and media company beat fiscal 2025 first-quarter expectations. Here's what you need to know.

-

Is Netflix Stock Still a Buy After Earnings, Price Hikes?

Is Netflix Stock Still a Buy After Earnings, Price Hikes?Analysts were bullish on Netflix stock ahead of its earnings beat, but what is Wall Street saying now? We take a closer look.