Goldman Sachs VIPs: 5 Top Hedge Fund Stock Picks

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Hedge funds often are referred to as the “smart money,” and right now, their stock picks are proving them right.

Goldman Sachs recently released a report revealing that its list of hedge fund VIP stocks are greatly outperforming the market. These are stocks that feature heavily as top-10 holdings based on the latest SEC filings for 848 funds investing a total of $2.3 trillion.

Goldman chief U.S. equity strategist David Kostin says these VIP stocks are “most positively correlated with growth stocks, a strategy that has delivered extraordinary returns during the past 18 months.” In 2018 alone, growth stocks are up 4% on average – significantly better than the 2.9% return of the Standard & Poor’s 500-stock index.

Kostin says this trend in the category is here to stay: “2019 should continue to benefit growth stocks.”

Here are five hedge fund stock picks that are really setting Wall Street ablaze. We used TipRanks’ data to assess the outlook on these stocks, which are averaging 19% returns year-to-date, from the Street’s best analysts. By pinpointing stocks with a bullish outlook from top-performing analysts, we can be confident that these stocks are primed for success.

Data is as of June 6, 2018. Click on ticker-symbol links in each slide for current share prices and more.

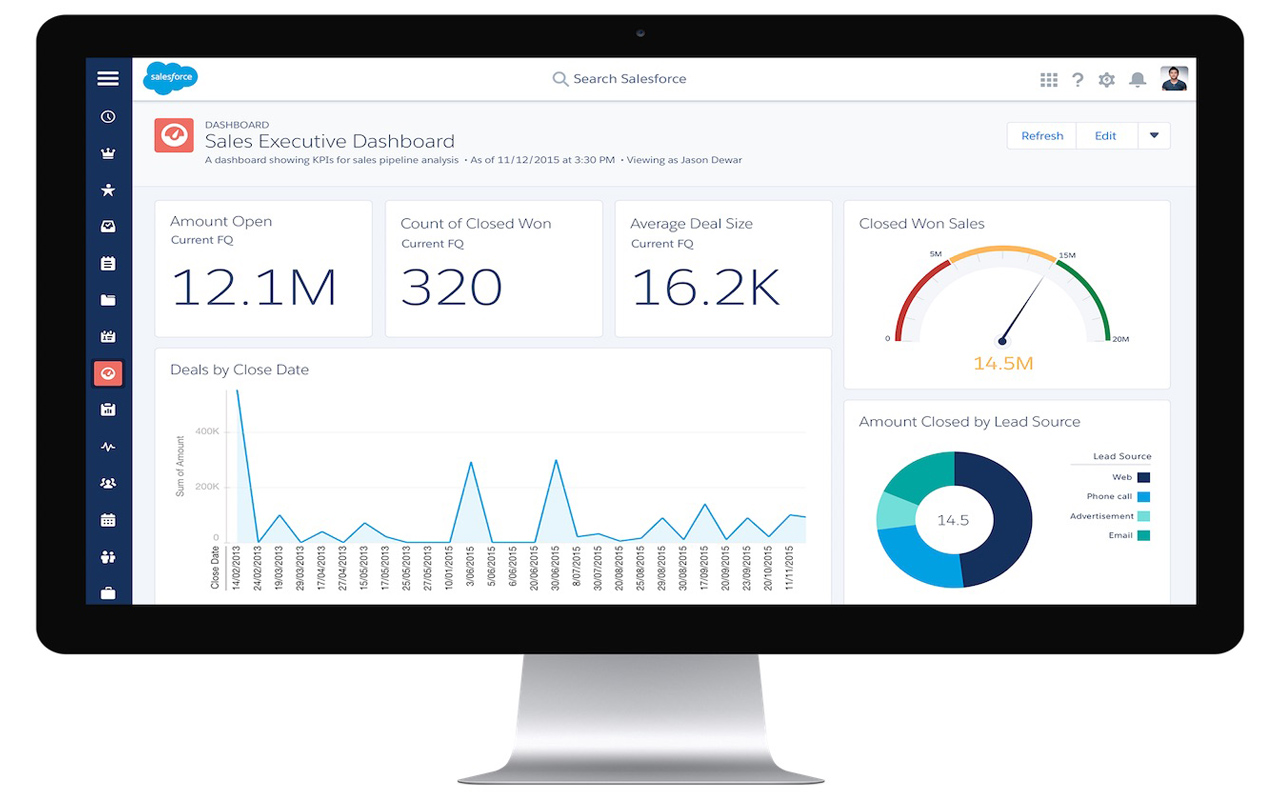

Salesforce.com

- Market value: $98.9 billion

- TipRanks consensus price target: $147.74 (9% upside potential)

- TipRanks consensus rating: Strong Buy

- Salesforce.com (CRM, $135.55) describes itself as the “world’s No. 1 enterprise cloud platform.” It’s certainly among the top performers in the cloud-stock space.

This Goldman Sachs VIP hedge fund stock pick is trading up 28% year-to-date. Big fund managers heavily invested in CRM include Frank Sands, founder of the massive growth investment fund Sands Capital Management.

If you are considering following Sands’ lead, note that Salesforce currently boasts a “Strong Buy” Street consensus. In the past three months, CRM has received 25 buy-equivalent ratings and only two holds. One of the stock’s biggest cheerleaders is five-star Monness analyst Brian White (view White’s TipRanks profile). He has just bumped up his price target to $158 (18% potential) from $152 previously. The stock’s growth momentum in the cloud means it deserves a premium valuation, White argues.

Indeed, Salesforce has just reported strong first-quarter results for its fiscal 2019 and raised its full-year revenue outlook. The company posted revenues of $3 billion (up 25% YoY) and earnings of 74 cents per share. “The tone of the (earnings) call was positive with Salesforce winning the largest transaction in the company’s history” White says.

Most excitingly, on the AI front, CRM’s “smart” customer success platform Einstein is expanding very quickly. The platform is now providing nearly 2 billion predictions each day – double the previous quarter.

“Given Salesforce’s leadership position in the SaaS market with an expanding portfolio in the midst of a strong secular trend around the cloud, combined with a history of strong growth and a predictable subscription-based model, we believe investors will drive Salesforce’s valuation higher than historical averages,” White writes.

PayPal Holdings

- Market value: $99.2 billion

- TipRanks consensus price target: $88.47 (4% upside potential)

- TipRanks consensus rating: Strong Buy

Shares in top hedge fund pick PayPal (PYPL, $85.21) have exploded by a whopping 13% year-to-date, and by 55% over the past year. The stock’s surge is being fueled by increasing adoption of digital payment systems to conduct transactions, but there are a few more catalysts on the horizon.

The online payment giant has announced that it is snapping up iZettle for a cool $2.2 billion – a deal that should close in the third quarter of 2018. IZettle is a Swedish startup that concentrates on providing payment solutions tools and analysis to small businesses, and often is referred to as the “Square of Europe.” The deal substantially expands PayPal’s reach on a global scale.

“In today’s digital world, consumers want to be able to buy when, where and how they want,” PayPal CEO Dan Schulman said in a release. “With nearly half a million merchants on their platform, Jacob de Geer and his team add best-in-class capabilities and talent that will expand PayPal’s market opportunity to be a global one-stop solution for omnichannel commerce.”

This could have a knock-on effect on U.S. mobile payments rival Square. According to Morgan Stanley’s James Faucette (view Faucette’s TipRanks profile) the tie-up is “likely to be a check” on Square’s international ambitions. He highlights the U.K., Japan, Canada and Australia as countries that will now be particularly “challenging” for Square to crack.

Meanwhile, top-rated Oppenheimer analyst Glenn Greene (view Greene’s TipRanks profile) feels more confident in PayPal’s long-term outlook post-deal. He writes: “Encouragingly, some of our concerns about PYPL’s long-term competitive positioning within the payment processing ecosystem have been allayed by recent partnerships. We anticipate high-teens revenue growth and >20% EPS growth for the next several years.” The five-star analyst boosted his price target from $85 to $90.

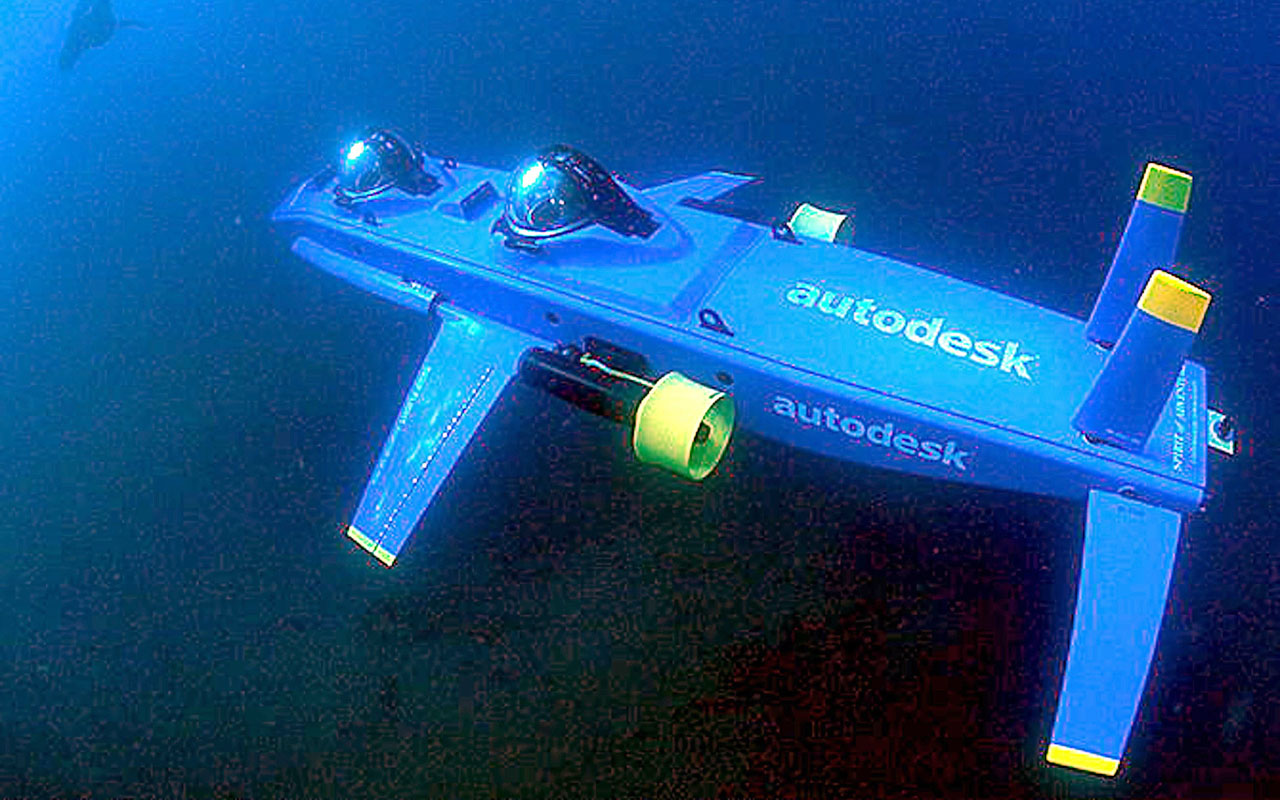

Autodesk

- Market value: $29.4 billion

- TipRanks consensus price target: $157.73 (14% upside potential)

- TipRanks consensus rating: Strong Buy

- Autodesk (ADSK, $137.93) is a leader in 3D design, engineering and entertainment software. The company basically develops software for people who make things – this runs the gamut from architecture to manufacturing, construction, media and entertainment. As a result, ADSK is now in prime position to benefit from the digitization of industries such as construction.

Hedge funds clearly are impressed by the stock’s growth potential. The Goldman Sachs report reveals that this 3D specialist is a top-10 holding for 24 hedge funds. They’ve benefitted from a 28% pop in shares year-to-date.

Autodesk recently reported strong results for fiscal Q1 with key metrics trending positively. Top Oppenheimer analyst Koji Ikeda (view Ikeda’s TipRanks profile) sees the results as evidence of the company’s successful ongoing transition to a subscription-based model.

“We believe the key to subscription model transitions is entrenchment and the ability to maintain price, which Autodesk is clearly demonstrating” Ikeda writes. “We are attracted to Autodesk’s dominant market positioning, rapid innovation, and strong execution.”

Ikeda reiterated his “Buy” rating on ADSK with a $150 price target on May 25. The Street is even more bullish, with an average analyst price target of roughly $157.

Alibaba

- Market value: $522.7 billion

- TipRanks consensus price target: $250.00 (20% upside potential)

- TipRanks consensus rating: Strong Buy

Chinese e-commerce giant Alibaba (BABA, $208.30) is not just a top-10 holding for 45 hedge funds, but also a major holding in numerous international mutual funds and exchange-traded funds. The stock has already delivered a 17% gain this year, and Wall Street sees plenty of growth potential left.

In fact, BABA shares currently enjoy unanimous support among the TipRanks-polled analysts covering the stock, including 14 buy ratings in the past three months alone.

Five-star Raymond James analyst Aaron Kessler (view Kessler’s TipRanks profile) recently bumped up his BABA price target from $250 to $300, representing 44% upside potential. Alibaba is working hard to increase monetization from consumers and businesses, and these initiatives encourage Kessler.

“We believe Alibaba has multiple take rate levers including increased personalization and targeting, increasing ad load, increased competition for ad slots, additional inventory expansion, as well as increases in commission rates on Tmall,” he writes.

Alibaba itself certainly seems secure that these new methods will pay off. “Recent management commentary and robust FY19 guidance suggests confidence in continued monetization levers” Kessler says.

Kessler is a long-time fan of the stock, which he calls the “biggest winner” of China’s booming e-commerce industry. China boasts more than 730 million internet users right now, and that number still is rising rapidly thanks to an explosion in the country’s middle class.

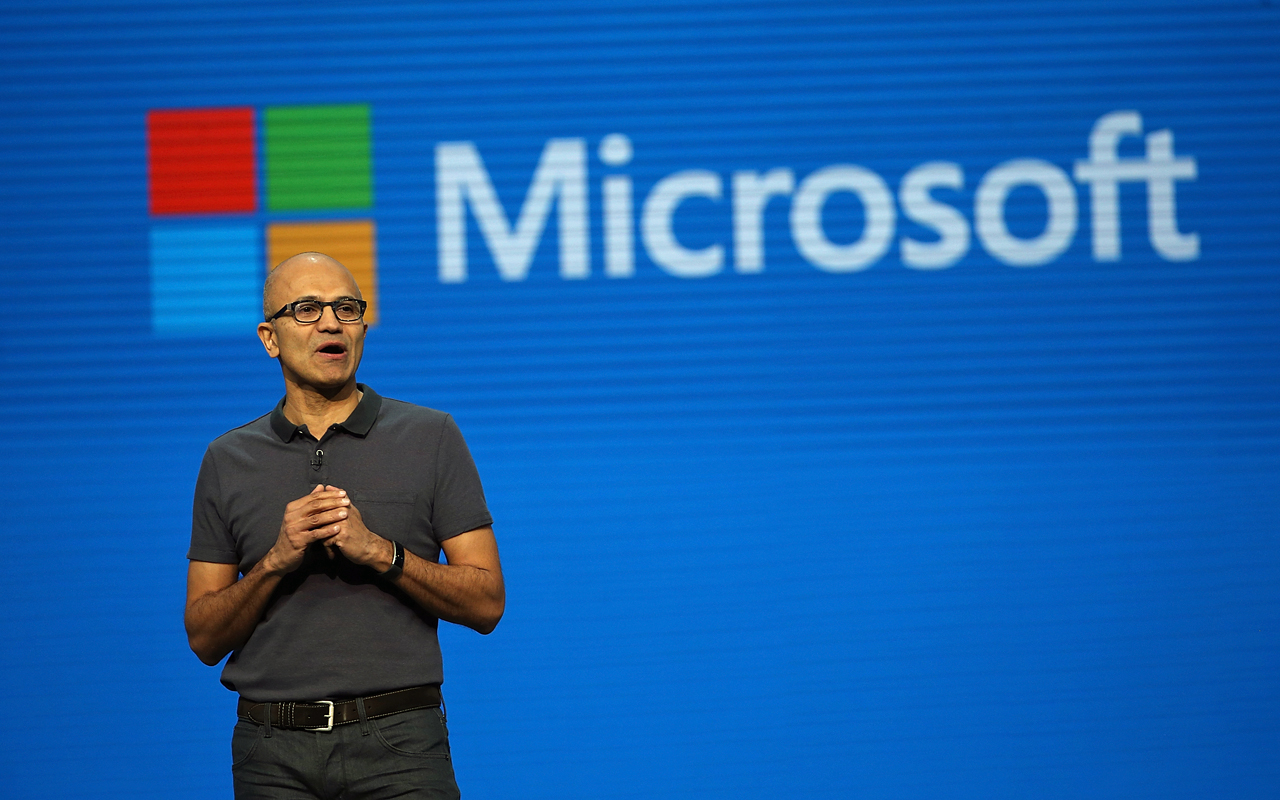

Microsoft

- Market value: $780.9 billion

- TipRanks consensus price target: $113.71 (11% upside potential)

- TipRanks consensus rating: Strong Buy

Goldman Sachs also has highlighted software king Microsoft (MSFT, $102.49) as a top hedge fund stock. Their research reveals that 63 funds have Microsoft among their 10 biggest holdings. Indeed, the latest filings show that hedge funds held a total of 363 million MSFT shares in Q1, up 7.5% from the previous quarter.

No doubt these fund managers are cheering Microsoft’s latest acquisition of code-hosting and collaboration site GitHub for a mind-blowing $7.5 billion. This is the company’s most pricy purchase since buying LinkedIn two years ago for $26.2 billion. GitHub gives Microsoft valuable access to 85 million code repositories, developed by more than 28 million contributors including over 1,000 Microsoft employees.

“We will accelerate enterprise developers’ use of GitHub, with our direct sales and partner channels and access to Microsoft’s global cloud infrastructure and services,” Microsoft CEO Satya Nadella said at the time.

The deal has received a collective thumbs-up from the Street. Piper Jaffray’s Alex Zukin (view Zukin’s TipRanks profile) has described the move as “highly positive.” He sees it is a savvy strategic advance that will give Microsoft an edge when it comes to designing next-generation applications. Plus there are potentially big synergies with Microsoft’s Intelligent Cloud and Productivity and Business Processes (PBP) units, which include Office and LinkedIn.

Harriet Lefton is head of content at TipRanks, a comprehensive investing tool that tracks more than 4,700 Wall Street analysts as well as hedge funds and insiders. You can find more of TipRanks’ stock insights here.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

How to Turn Your 401(k) Into A Real Estate Empire

How to Turn Your 401(k) Into A Real Estate EmpireTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

My First $1 Million: Retired Nuclear Plant Supervisor, 68

My First $1 Million: Retired Nuclear Plant Supervisor, 68Ever wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

How to Position Investments to Minimize Taxes for Your Heirs

How to Position Investments to Minimize Taxes for Your HeirsTo minimize your heirs' tax burden, focus on aligning your investment account types and assets with your estate plan, and pay attention to the impact of RMDs.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

5 Stocks to Sell or Avoid Now

5 Stocks to Sell or Avoid Nowstocks to sell In a difficult market like this, weak positions can get even weaker. Wall Street analysts believe these five stocks should be near the front of your sell list.

-

Best Stocks for Rising Interest Rates

Best Stocks for Rising Interest Ratesstocks The Federal Reserve has been aggressive in its rate hiking, and there's a chance it's not done yet. Here are eight of the best stocks for rising interest rates.

-

The Five Safest Vanguard Funds to Own in a Volatile Market

The Five Safest Vanguard Funds to Own in a Volatile Marketrecession The safest Vanguard funds can help prepare investors for market tumult but without high fees.

-

The 5 Best Inflation-Proof Stocks

The 5 Best Inflation-Proof Stocksstocks Higher prices have been a major headache for investors, but these best inflation-proof stocks could help ease the impact.

-

5 of the Best Preferred Stock ETFs for High and Stable Dividends

5 of the Best Preferred Stock ETFs for High and Stable DividendsETFs The best preferred stock ETFs allow you to reduce your risk by investing in baskets of preferred stocks.

-

What Happens When the Retirement Honeymoon Phase Is Over?

What Happens When the Retirement Honeymoon Phase Is Over?In the early days, all is fun and exciting, but after a while, it may seem to some like they’ve lost as much as they’ve gained. What then?

-

5 Top-Rated Housing Stocks With Long-Term Growth Potential

5 Top-Rated Housing Stocks With Long-Term Growth Potentialstocks Housing stocks have struggled as a red-hot market cools, but these Buy-rated picks could be worth a closer look.