15 Industrial Stocks That Can Manufacture Gains in 2018

Leave it to television-star-turned-President Donald Trump to time the unveiling of a massive infrastructure spending plan for maximum effect.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Leave it to television-star-turned-President Donald Trump to time the unveiling of a massive infrastructure spending plan for maximum effect. The stock market is on its heels, having fallen more than 11% from its late January high and still down 8% from that peak. However, the president on Feb. 12 unveiled a plan that could spark $1.5 trillion in infrastructure spending nationwide, reminding investors of why they began pouring into stocks two Novembers ago and putting a jolt into industrial stocks.

In the same sense the market peeled back from its highs for no real good reason (other than valuation concerns, finally), the spending proposal doesn’t inherently make stocks worth more today than they were worth less than a week ago, when they were getting thumped. It’s mostly a psychological game won by traders willing to buy on the big dips we see in the mist of economic strength.

That’s how Sven Balzer, Head of Investment Strategy at private banking and investment management firm Coutts, sees the setback. “In our view, this is a short-term correction driven by technical factors rather than concerns about the underlying economic picture or corporate health,” he says. “Significant declines in equities are almost always associated with a U.S. recession. Our research indicates a very low probability of this happening while the economic cycle is in expansion mode, and the U.S. Federal Reserve also says the likelihood of a recession is low.”

Now that recession seems even less likely. The economy still is humming and the nation’s factories almost as busy as they’ve been at any point in the past 20 years. With the potential for an infrastructure spending tailwind in place, it might be wise to add a little more industrial exposure to your portfolio than you’ve had in recent years. Here’s a list of 15 industrial stocks to get you started on your search.

Data is as of Feb. 9, 2018. Dividend yields are calculated by annualizing the most recent quarterly payout and dividing by the share price. Click on ticker-symbol links in each slide for current share prices and more.

Caterpillar

- Market value: $89.6 billion

- Dividend yield: 2.1%

“If growth continues the way we expect, we should see a rotation out of these mega-cap tech companies and into more of the higher-leveraged value companies” BMO Private Bank Chief Investment Officer Jack Ablin said in late January. “And Caterpillar (CAT, $149.21) is it.”

That was before the marketwide meltdown began in earnest, to be clear. Also, there has been little rotation into much of anything despite plenty of rotation out of the major technology names he was talking about. But his point still is well-taken. That is, Caterpillar looks like a bargain now that it’s priced at less than 15 times next year’s projected profits.

The stage certainly is set for forward progress. Steel and copper prices, along with other industrial metals, are holding their ground at multiyear highs, spurring buying of the kind of earth-moving equipment Caterpillar makes. Meanwhile, construction spending in the United States reached a record annual rate of $1.25 trillion in December of last year. Both point to economic momentum that will be tough to stop.

Stanley Black & Decker

- Market value: $24.0 billion

- Dividend yield: 1.7%

It may seem a bit cliché to fill your portfolio’s industrial sector slot with a toolmaker such as Stanley Black & Decker (SWK, $154.23). But that’s precisely the reason to own it.

Joseph Roseman, managing partner of Charlotte, North Carolina-based wealth management firm OWRS, says the power of the company is in its brand recognition. “If you own a hand or power tool for your car or home, it probably belongs to Stanley Black & Decker brands,” he says. Roseman also points out that the company is “heavily into the automotive, electronics, healthcare, infrastructure and aerospace industries,” rounding out the revenue-generating portfolio.

SWK has largely proven his point of late. For the fiscal fourth quarter of 2017, Black & Decker’s earnings grew 27% year-over-year on a 17% rise in revenue. If America’s manufacturing outfits can reach a self-sustaining escape velocity without the White House’s help, that growth pace could accelerate with it.

Waste Management

- Market value: $34.8 billion

- Dividend yield: 2.2%

It’s easily the most overlooked aspect of any economic growth phase: The busier factories are and the more consumers buy, the more garbage that businesses and consumers create. As such, a reinvigorated industrial surge backed by consumers that are willing and able to spend a little more than they have in the recent past plays right into the hands garbage collection company Waste Management (WM, $80.10).

Waste Management CEO Jim Fish said as much in a recent interview:

“Hey look, times are good. The Baby Boomers are coming into a period of heavy medical spend. All of our parents are aging and spending more on medical spend. There is medical waste generated from that, we are in that business. The industrial economy is important to us. Whether it’s through repatriation from the new tax law, or just through the fact the U.S. and Canada are great places to do business and the industrial economy is showing some signs of life, we are a big industrial player on the back-end of the cycle.”

Waste Management isn’t just in the right place at the right time. The company also is starting to pay more attention to things like the use of technology as a means of operating more efficiently, and thinking about ways to better monetize the recycling process.

Dover

- Market value: $15.3 billion

- Dividend yield: 1.9%

It’s likely you’ve used a product made by Dover (DOV, $97.35) without even realizing it. It manufactures, among other things, some of the apparatus that makes a gasoline pump work, refrigeration platforms used in the coolers at your nearby grocery store, inkjet printer components, automation mechanisms and more. Most of its wares serve enterprise-level and manufacturing-level customers rather than consumers.

It is, to be fair, a little boring – but that’s not a bad thing. And while the average consumer/investor rarely sees or thinks about Dover, it’s an indispensable supplier to its customers. Long-term sales and earnings growth are reliable, even if not exciting.

That said, this old-school company is about to enter the 21st century market in a big way.

In January, Dover hired its first-ever chief information officer, Dinu Parel, signaling it was ready to convert information from being a mere backdrop into an outright business-building tool. Parel already was acting as the company’s head of IT, but the company realized the value of more and better technology, and just turned up the heat on the idea. He’s setting the stage for internal innovation, which hasn’t always been easy to encourage at highly fragmented Dover.

Global X U.S. Infrastructure Development ETF

- Market value: $29.3 million

- Dividend yield: N/A*

- Expenses: 0.47%

Not every means of playing the next U.S. industrial revolution spurred by more infrastructure spending has to be a stock. An exchange-traded fund could be just as effective, if not more so.

Enter the Global X U.S. Infrastructure Development ETF (PAVE, $15.98), which aims to capitalize on the looming endeavor to improve the nation’s roads, water systems, electricity grids and telecommunications systems. Some of its top holdings – such as Union Pacific (UNP), Emerson Electric (EMR) and Westlake Chemical (WLK) – paint a picture of the fund’s mission. It’s not just a way to step into an industrial boom. It’s a way to play the companies that will benefit the most from such a boom that’s directly linked to the greater infrastructure spending now on the horizon.

See, PAVE was created in March of 2017, after Donald Trump was elected but before his often-touted infrastructure plan was established, specifically to take advantage of what might be in the cards. Its marketability was its uniqueness. As Jay Jacobs, director of research at Global X, said at the time, “There is no ETF out there with more than 21% overlap in the fund,” meaning you could only create the same basket of infrastructure-specific plays by picking these stocks out for yourself, one at a time.

*Yields for equity ETFs typically are calculated by using payments from the trailing 12 months. While PAVE does distribute dividends, it first started trading on March 3, 2017, and thus does not have a 12-month dividend history as of this writing.

Quanta Services

- Market value: $5.2 billion

- Dividend yield: N/A

- Quanta Services (PWR, $33.53) is anything but a household name, given that Quanta doesn’t make anything in your home. No, Quanta Services is a leading infrastructure solutions provider, erecting power-line towers, building oil and gas pipelines, establishing the framework for telecommunications and more.

Don’t underestimate the potential of these old-school solutions. Last year’s American Society of Civil Engineers report card for the country’s existing energy infrastructure graded it a pitiful D+, noting that most of the electricity distribution lines still in use were built in the 1950s and ‘60s with only a 50-year life expectancy. The nation’s natural gas infrastructure isn’t looking notably better.

A ramp-up of the United States’ manufacturing activity should only put a sharper strain on the country’s energy production and transmission systems.

The scenario bodes well for Quanta Services, and in fact has already proven positive. The company’s top line is projected to have grown nearly 22% in 2017, prodding per-share profits up from 2016’s $1.51 to an estimated $1.95 once the fourth-quarter tally is taken.

Carpenter Technology

- Market value: $2.3 billion

- Dividend yield: 1.5%

The rekindling of America’s manufacturing industries may be on the way, but it’s not picking up speed without consequence. Inflation is on the rise, and interest rates are rising to keep it in check. The Federal Reserve has ratcheted up the nation’s base rate five times over the course of the past couple of years, and the market is counting on at least three more before the end of 2018.

That doesn’t have to spell bad news for investors, however. In fact, it may be an opportunity.

Invest with the Fed co-author and The American College of Financial Services President/CEO Robert Johnson recently said, “In a rising-interest-rate environment, one of the best performing sectors is steel products.” From that sliver of the market, “Carpenter Technology (CRS, $47.53) appears attractive. It currently sells at a price-to-earnings ratio of 14, well below the market. The firm recently announced adjusted earnings of 55 cents for the quarter versus analyst expectations of 51 cents.”

Johnson’s point may have undersold the company. Carpenter Technology’s revenues last quarter were up 14% year-over-year in an environment that’s still not quite red-hot. But it’s getting there.

Gardner Denver

- Market value: $6.3 billion

- Dividend yield: N/A

- Gardner Denver (GDI, $31.75) makes blowers, compressors and a few other industrial products. You won’t find its wares in anyone’s homes, though you’ll very likely find something made by Gardner Denver in a large building – especially a manufacturing facility.

You won’t find much of an operating history for Gardner Denver. While it has been around for more than 100 years, it wasn’t a publicly traded entity (again) until May 2017, when private equity outfit Kohlberg Kravis Roberts & Co. (KKR) sold the company back to investors via a public offering. But the company is doing just fine, including a Q3 2017 that saw sales grow 40% year-over-year as strong economic growth spurred a wave of new orders.

In fact, investors’ unfamiliarity with GDI may be more reason to look at this overlooked name. The market may have yet to learn enough about it to value it appropriately.

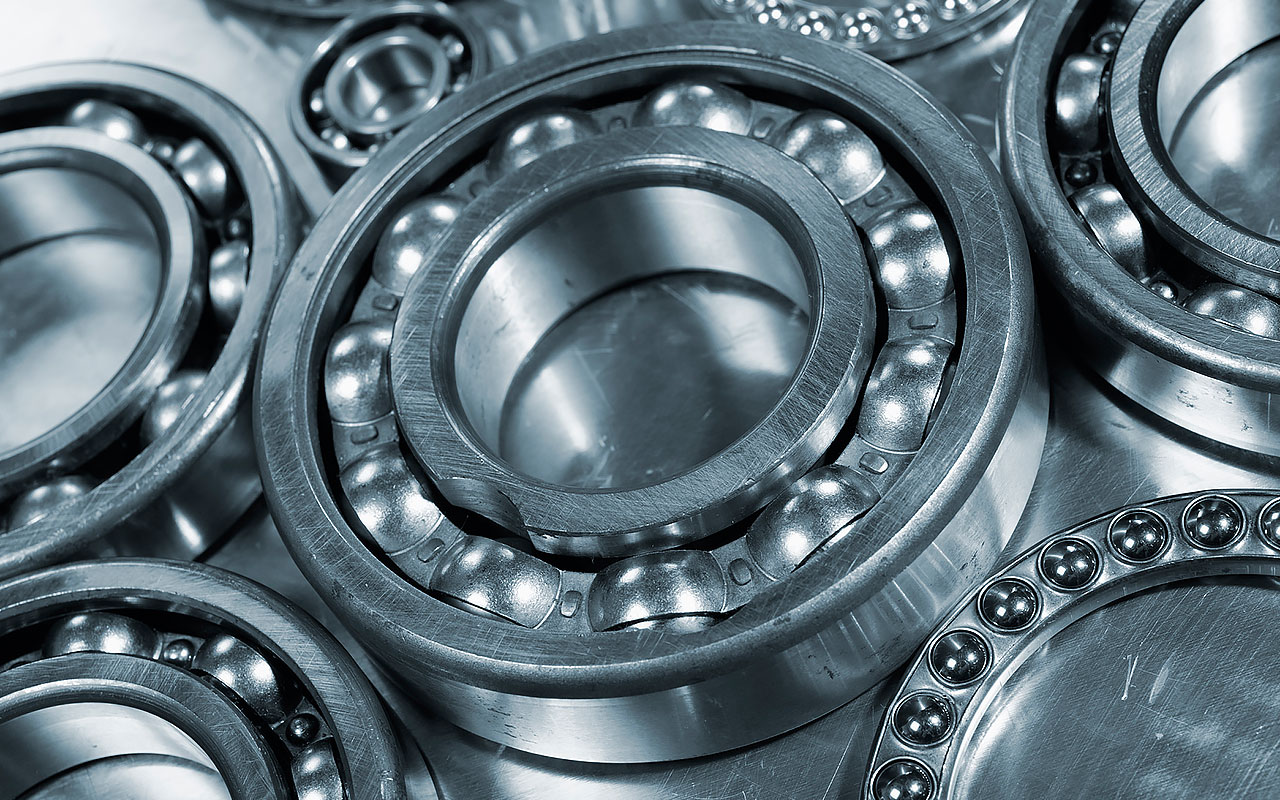

The Timken Company

- Market value: $3.4 billion

- Dividend yield: 2.5%

The Timken Company (TKR, $44.45) – which makes heavy-duty ball bearings and mechanical transmission machinery – may have been one of the names Daren Fonda was describing last month when pointing out how the Fidelity MSCI Industrials ETF (FIDU) – which has been added to the Kiplinger ETF 20 – included a fair number of small and mid-sized industrial names.

With a market cap of less than $4 billion, Timken simply doesn’t turn a lot of heads. As Fonda explained, however, these smaller companies should become relatively more profitable than their bigger brothers, as the recent tax cuts broadly provide a bigger benefit to domestic-focused names than the larger multinational outfits.

Even without the bullish backdrop of tax relief, though, Timken is on a roll. Its recently reported fourth-quarter results topped sales and earnings expectations, and the company is calling for revenue growth of as much as 10% this year. Projected per-share profits of between $3.20 and $3.30 for the year underway are miles ahead of 2017’s tally of $2.58.

Xylem

- Market value: $12.9 billion

- Dividend yield: 1.2%

Water may be the world’s most important yet most neglected resource. Nobody can survive without it for more than about three days, but the United States alone wastes billions of dollars worth of it every year. Thanks to broken water mains and leaky pipes, the nation squanders more than a trillion gallons annually, and we’re not much more efficient when it comes treating and recycling it.

Enter Xylem (XYL, $70.82).

Xylem makes a variety of water treatment and wastewater management equipment, which are increasingly important in a world where potable water is increasingly scarce. The rising cost of water along with simply greater awareness of how little water we actually have access to has put Xylem in the proverbial catbird seat. Last year’s organic sales growth of 4% may not be riveting, though an acquisition spree has yielded fruit in the form of higher margins.

The recent purchase of EmNet LLC is another nice revenue-bearing add-on that solidifies the roll-up strategy.

Ingersoll-Rand

- Market value: $22.5 billion

- Dividend yield: 2.0%

OWRS’s Roseman also is a fan of Ingersoll-Rand (IR, $89.16), and for good reason.

Ingersoll-Rand makes products ranging from compressed air systems to temperature-controlled transportation solutions to zero-emission golf carts. In many ways, it’s the backbone for much of the industrial sector, and as such is as much an industrial play as any other stock in the sector.

More important, however, Ingersoll-Rand is a standout because it’s forever innovating. Roseman points out that the company has had “more than 200 product launches in last three years,” giving it more and more to sell to drive its growth.

And IR has been growing. Its top line expanded by 5% in 2017, driving a 9% improvement in per-share earnings. Analysts expect roughly the same growth for both measures this year. That might not be the hair-raising performance you’ll see from other sectors, but by industrials’ standards, that’s respectable.

3M

- Market value: $135.7 billion

- Dividend yield: 2.4%

Lots of companies are diversified, but none so much as 3M (MMM, $225.21). It’s the name behind Post-it notes, power transformers sitting on top of poles, electric sanders, sign-making supplies, industrial adhesives and more.

If you can think of it, 3M likely at least has a hand in it.

It must be tough at times to manage all the disparate pieces of the same company, but 3M has had years of practice to perfect the art. It also has had years to figure out what works in terms of cross-selling, and what doesn’t.

That said, the chief selling point of 3M isn’t its diverse base of revenue-bearing products. That certainly helps, smoothing out the rough edges of any cyclical headwinds. (Its Scotch Tape brand of tape sells reasonably well in all environments).

Where 3M really shines as an investment is its dividend. The current dividend yield of 2.2% may not be a head-turner, but what it lacks in size it makes up for in growth. 3M has logged an increase in its annual payout going all the way back to 1977, and has expanded the payout by 114% in just the past five years alone.

Emerson Electric

- Market value: $45.0 billion

- Dividend yield: 2.8%

Not only is Emerson Electric (EMR, $69.07) one of the key holdings of the previously mentioned Global X U.S. Infrastructure Development ETF, but it’s also one of the top industrial picks from American Dream Investing CEO Karl Kaufman.

Contrary to popular belief, Emerson isn’t just thermostats and ceiling fans. Those are just a couple of its consumer-oriented lines, but they don’t make up the bulk of its business. Emerson also manufactures fabrication solutions for carmakers, equipment used by power-generation companies, water-treatment plants and more – areas that will grow in tandem with the broad industrial sector.

Kaufman likes Emerson for other reasons, too. For instance, he’s bullish on EMR after pegging it as one of the top beneficiaries of the recent U.S. tax overhaul, explaining, “Tax reform is a once-in-a-generation opportunity for businesses and their investors. Besides the obvious benefit of the corporate tax rate being cut from 35% to 21%, companies in the industrial sector that invest heavily in plants, equipment and other capital expenditures (or capex), can immediately claim a 100% deduction in the first year.”

That’s a huge deal for a company like Emerson, which needs machinery to make machinery.

Illinois Tool Works

- Market value: $55.1 billion

- Dividend yield: 2.0%

- Illinois Tool Works (ITW, $160.13) didn’t just top last quarter’s earnings estimates of $1.62 per share. At $1.70 per share, profits left the consensus expectation well behind. In fact, ITW has handily topped earnings estimates in each of the past four quarters, and hasn’t missed (or even merely met) any quarterly earnings outlooks for a few years now.

Illinois Tool Works is actually growing the bottom line, too. Last year’s per-share profits were up 16% on a more modest 5% improvement in sales.

Look for this multi-faceted company to produce similar results in 2018 too, on the heels of nothing in particular besides making what industrial manufacturers all over the world need. During last quarter’s report, ITW also upped its profit guidance for the year to a range of between $7.45 and $7.65 per share. That’s far better than 2017’s bottom line of $6.59 per share.

Honeywell

- Market value: $112.2 billion

- Dividend yield: 2.0%

Last but not least, add Honeywell (HON, $147.90) to a list of industrial stocks to consider adding to your portfolio.

Like Emerson, Honeywell is more than just thermostats and humidifiers. The company makes major equipment as well, including solutions for utility providers, airlines, automobile manufacturers, healthcare providers and more. Its sheer size makes it tough to drive hyper-sized growth, but its size also shields it from all the volatility a smaller company might dish out to investors. There’s a lot to be said for consistency.

Honeywell does have a high-potential growth kicker on the horizon, however. The company’s president for Southeast Asia recently said of China’s young but fast-growing air travel and passenger jet manufacturing businesses, “It’s a real plus for us because we provide the products, the systems, the services that go on any aircraft. So we support all the major OEMs (original equipment manufacturers) globally.”

Aircraft maker Boeing (BA) has predicted the world’s airlines will need to purchase 41,030 new passenger jets over the course of the next 20 years. For perspective, 23,500 commercial jets are in use today. A wide swath of those purchases will be made by Chinese carriers, with at least some of them (perhaps many of them) being purchases of planes made by the Commercial Aircraft Corporation of China – an organization Honeywell has a good relationship with.

Even if COMAC’s planes aren’t the preferred plane from China’s air carriers, the airline industry’s tailwind bodes well for Honeywell.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Dives 870 Points on Overseas Affairs: Stock Market Today

Dow Dives 870 Points on Overseas Affairs: Stock Market TodayFiscal policy in the Far East and foreign policy in the near west send markets all over the world into a selling frenzy.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

3M, GM, Blue Chips Lead to the Upside: Stock Market Today

3M, GM, Blue Chips Lead to the Upside: Stock Market TodayThe S&P 500 followed the Dow Jones Industrial Average into green territory, but the Nasdaq lagged the other indexes because of its tech exposure.

-

What Tariffs Mean for Your Sector Exposure

What Tariffs Mean for Your Sector ExposureNew, higher and changing tariffs will ripple through the economy and into share prices for many quarters to come.

-

Stock Market Today: Stocks Step Back From New Highs

Stock Market Today: Stocks Step Back From New HighsInvestors, traders and speculators continue the low-volume summer grind against now-familiar uncertainties.

-

What Wall Street's CEOs Are Saying About Trump's Tariffs

What Wall Street's CEOs Are Saying About Trump's TariffsWe're in the thick of earnings season, and corporate America has plenty to say about the Trump administration's trade policy.

-

Stock Market Today: Stocks Soar on China Trade Talk Hopes

Stock Market Today: Stocks Soar on China Trade Talk HopesTreasury Secretary Bessent said current U.S.-China trade relations are unsustainable and signaled hopes for negotiations.

-

Stock Market Today: Mixed Messages Muddle Markets

Stock Market Today: Mixed Messages Muddle MarketsStocks cruised into pre-market action on encouraging news for the AI revolution but stumbled on yet another policy disturbance.