25 Stocks Every Retiree Should Own

Retirement is a major life milestone, eclipsed only by marriage or the birth of your first child in terms of financial impact.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Retirement is a major life milestone, eclipsed only by marriage or the birth of your first child in terms of financial impact. For many, it’s an exhilarating leap into the unknown. In your working years, you can take investing setbacks in stride, as portfolio losses can be offset by new savings or working an extra year or two.

But once retired, you no longer have that luxury. Your portfolio must last for the the rest of your life, and that of your spouse as well. So, the decision of what retirement stocks you should include your portfolio is an important one.

An ideal retirement stock will pay a healthy dividend. As Sonia Joao, president of Houston-based RIA Robertson Wealth Management, explains, “Four out of five of our clients are in or near retirement, and essentially all of them tell us the same thing. They want safe, secure streams of income to meet their living expenses and replace their paychecks.”

While a good dividend is probably the most important characteristic to look for, it’s certainly not the only one. Yields across most asset classes are lower today than in years past, and retirees need growth to stay ahead of inflation. So, while a retirement portfolio should have a large share of income stocks, it also will include some growth names for balance.

The following are 25 stocks every retiree should own. This group of retirement stocks includes both pure income plays and growth companies, with a focus on very-long-term performance and durability.

Data is as of July 1. Dividend yields are calculated by annualizing the most recent quarterly payout and dividing by the share price.

Public Storage

- Market value: $41.3 billion

- Dividend yield: 3.4%

Self-storage real estate investment trust (REIT) Public Storage (PSA, $236.45) may be the single least sexy stock in the entire Standard & Poor’s 500-stock index. If you mention it at a cocktail party, don’t expect to be the center of attention.

But the boringness is exactly what makes Public Storage such an ideal retirement stock. Self-storage is one of the most recession-proof investments you’re ever likely to find. In fact, recessions are often good for the self-storage industry, as they force people to downsize and move into smaller homes or even move in with parents or other family – and their stuff has to go somewhere.

With the economy looking a little wobbly these days, that’s something to consider. But there’s another angle to this story as well. According to Ari Rastegar – founder of Rastegar Equity Partners, a real estate private equity firm with expertise in the self-storage sector – changes to the broader economy are at work.

“Despite unemployment being exceptionally low, wages haven’t kept pace with rising prices,” Rastegar explains. “This has led to the rise of micro apartments and the general trend of smaller units closer to city centers. All of this bodes very well for the future of the self-storage sector. Your apartment might be shrinking, but you still need to put your personal belongings somewhere.”

Public Storage has a diversified portfolio of nearly 2,500 properties spread across 38 states and additionally has a significant presence in Europe. While the REIT has kept its dividend constant at $2 per quarter for the past two years, it historically has been a dividend-raising machine. Over the past 20 years, Public Storage has raised its dividend by nearly 10-fold.

At current prices, Public Storage yields 3.4%. That’s not an exceptionally high yield by any stretch, but it’s still better than what you’re able to get in the bond market these days – at least not without taking significantly more risk.

Realty Income

- Market value: $21.5 billion

- Dividend yield: 3.9%

No list of retirement stocks would be complete without a mention of triple-net retail REIT Realty Income (O, $68.03). If Public Storage is the most boring stock on Wall Street, Realty Income is a close second.

The REIT owns a diversified portfolio of more than 5,800 freestanding retail properties in high-traffic locations and spread across 49 states and Puerto Rico. Its tenants include the likes of Walgreens (WBA) pharmacies, 7-Eleven convenience stores and LA Fitness gyms. These aren’t exactly exciting destination locations, like a resort hotel, but they’re places where everyone has to take care of their most basic tasks.

Realty Income is a triple-net landlord, which means its tenants pay all taxes, maintenance and insurance costs. Once the property is purchased and let, Realty Income’s only real responsibility is to collect the rent checks. Not bad work, if you can find it.

Realty Income has hiked its dividend with the precision of a Swiss clock over its life, boosting the payout for 86 consecutive quarters. And it has raised its dividend at a 4.6% annual rate since its 1994 IPO. That’s not get-rich-quick money, but it’s above the rate of inflation, and exactly the kind of consistency you want to see in retirement stocks.

At current prices, Realty Income yields a little under 4%. That’s not a monster yield by any stretch, but if history is any guide, it be a little higher every year from now until the end of time. Better still, Realty Income is among several monthly dividend stocks – an added convenience for retirees needing to match their inflows to their regular monthly expenses.

National Retail Properties

- Market value: $8.5 billion

- Dividend yield: 3.8%

For the very same reasons, National Retail Properties (NNN, $52.28) is a solid addition to any retiree’s portfolio.

Like Realty Income, National Retail Properties is a conservative triple-net retail REIT that invests in free-standing, high-traffic retail properties. Just how deep is the triple-net identity to National Retail?

Its ticker symbol – NNN – is shorthand for triple net in the industry.

National Retail Properties’ diverse portfolio includes nearly 3,000 properties spread across 48 states and 37 industries. Convenience stores, at roughly 18%, make up the single largest share of the portfolio; 7-Eleven is the single largest tenant with a little over 5% of the portfolio. Camping World (CWH), Mister Car Wash and AMC Entertainment (AMC) movie theaters are among other top 10 tenants. Nothing is truly “Amazon-proof” these days, But National Retail’s portfolio is about as close as you can reasonably get.

National Retail Properties also isn’t a get-rich-quick play. It’s a landlord to convenience stores, for crying out loud. But you can feel comfortable putting this stock in your retirement portfolio knowing that it will continue to deliver dividends like clockwork. After all, it has raised its dividend every year for the past 29 years and counting.

The world has changed a lot over the past 29 years, and it will no doubt look a lot different 29 years from now. But National Retail likely still will be around … and still delivering cash to its shareholders.

LTC Properties

- Market value: $1.8 billion

- Dividend yield: 5.0%

The core of LTC Properties (LTC, $45.60) can be found right in its name. “LTC” is short for “long-term care,” which is exactly the business this REIT is in. LTC owns a diverse portfolio of skilled nursing and assisted living properties spanning 28 states. Approximately 51% of the portfolio is invested in assisted living properties, with most of the remainder invested in skilled nursing properties.

LTC Properties is a play on the aging of America’s Baby Boomers, which at more than 80 million people represent a population roughly the size of Germany. The Boomers no doubt will put major stress on the system, but they also will create opportunities to profit – such as LTC Properties.

Skilled nursing has been a difficult industry in recent years due an unfortunate mix of stingy government reimbursements and unfavorable demographics, as the Baby Boomers are still a couple years away from needing that kind of care. Demand should grow at a very robust rate over the next two decades, however, so it will pay to be patient.

LTC’s 5% yield is plenty competitive in this market. Also, LTC, like Realty Income, pays its dividend monthly, making it ideal for retirees looking to match their monthly income to their monthly expenses.

American Tower

- Market value: $89.4 billion

- Dividend yield: 1.7%

Here are two questions for you: Do you use more mobile voice and data than you did five years ago? And do you see yourself using less mobile data or voice any time soon?

If you’re like most Americans, your phone has only become more essential to your life in recent years. That likely won’t change at any point in the coming years, maybe ever. That’s a trend you can bank on for your retirement money.

More mobile usage means more demand for cell towers. And that spells opportunity for tower landlord American Tower (AMT, $202.30).

American Tower is not your ordinary REIT. Instead of owning apartments or warehouse, this REIT owns a diverse portfolio of cell towers spread across the United States, Mexico, South America, India and parts of Europe and Africa. The REIT owns more than 170,000 towers, over 40,000 of which are located in the United States. More than 75,000 are located in up-and-coming India, and Brazil and Mexico account for another 19,000 towers and 9,000 towers, respectively.

If you’re looking for a company that is future-proof (or at least close to it), American Tower is it.

AMT’s dividend yield, at less than 2%, is downright low. But this is a stock that raised its dividend literally every quarter since mid-2012. So, what it lacks in yield, American Tower more than makes up in dividend growth – and that will improve your yield on cost over time.

Prologis

- Market value: $50.4 billion

- Dividend yield: 2.7%

The rise of Amazon.com and e-commerce and general has created the perception that brick-and-mortar real estate is quickly becoming obsolete.

That’s debatable. Entertainment and service-based industries (everything from a dental practice to a Starbucks) are not affected by the rise of Amazon, and we’re a long way from completely replacing physical retail.

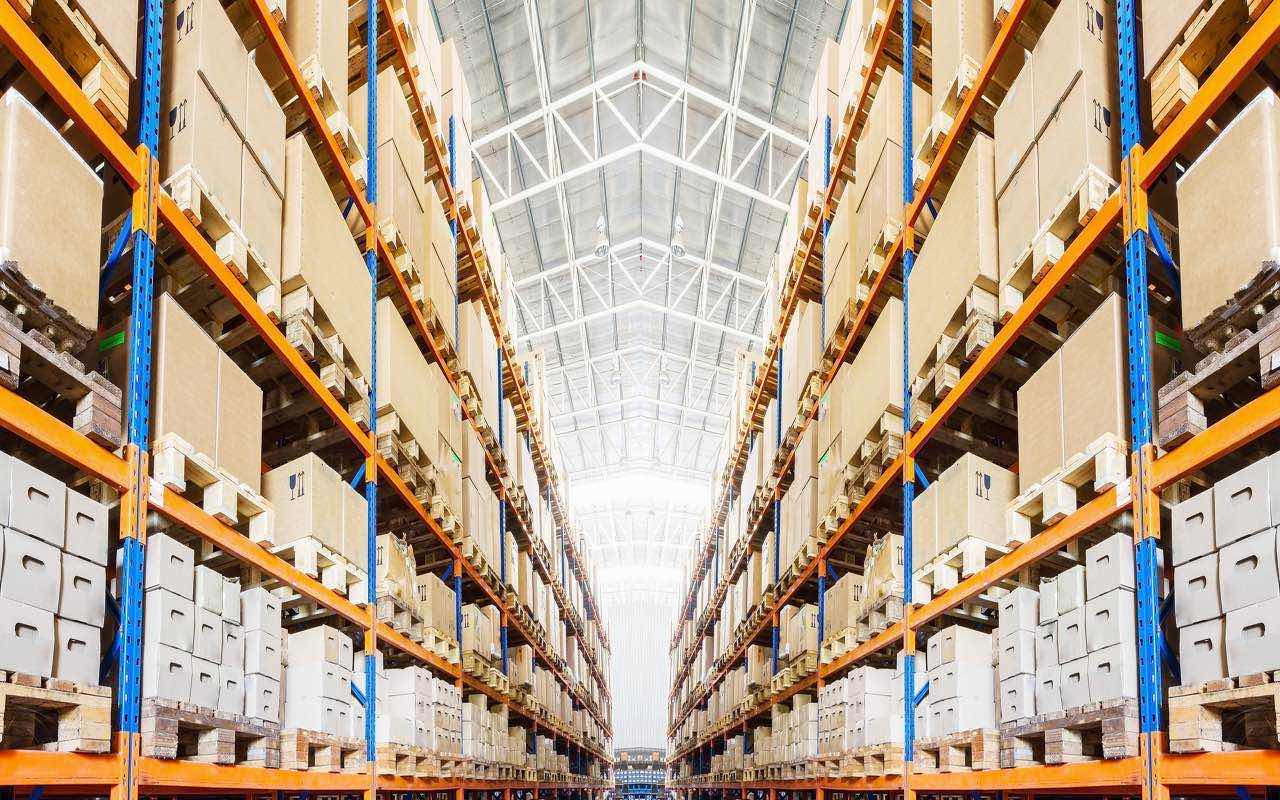

But let’s say for a moment the bears are right about the death of retail. That still would present a fantastic opportunity for a few real estate landlords, such as logistical specialist Prologis (PLD, $79.92). Prologis is a REIT that deals in warehouse and distribution properties, owing or having significant investments in over 770 million square feet in 19 countries. Among its biggest tenants are heavyweights such as United Parcel Service (UPS), FedEx (FDX) and Home Depot (HD).

Prologis also is highly diversified. The United States makes up around 60% of its portfolio, with the rest scattered across Europe, Asia and the rest of the Americas. Its top 25 tenants represent just 19% of its net effective rents.

If you believe in the inevitable rise of e-commerce, Prologis is a good way to play that trend while also getting paid a growing dividend. The REIT consistently hikes its payout by about 10% per year.

Physicians Realty Trust

- Market value: $3.2 billion

- Dividend yield: 5.3%

Medicine and medical properties are an obvious investment theme in America, but also a tricky one – one that’s subject to shifting regulatory landscape. Making it worse, Uncle Sam is ultimately responsible for paying for Medicare and Medicaid patients, and he’s proven to be a tough customer. Medicare and Medicaid routinely change their reimbursement rates, often with little warning.

So you want to play the trend of increased medical demand due to America’s aging population, while avoiding having to handicap the likelihood of getting paid by the government. Medical office properties thread this needle. As the landlord, the underlying profitability of the medical practice isn’t your concern. So long as the doctor’s office makes enough money to pay its rent, you’re good to go.

- Physicians Realty Trust (DOC, $17.29) is an interesting way to play this trend. 96% of its portfolio is invested in medical office buildings, with most of the small remainder invested in hospitals.

We can’t say with any certainty what the economy will look like in 20 years. But it’s likely people still will be visiting doctors’ offices, and DOC gives us a convenient way to play that trend while collecting a 5.3% dividend.

Enterprise Products Partners LP

- Market value: $63.2 billion

- Distribution yield: 6.1%

If consistency is something you want in a retirement stock, it’s hard to find too many stocks that are more consistent than natural gas pipeline operator Enterprise Products Partners LP (EPD, $28.87). EPD has raised its distribution by between 4% and 6% over the past three years, five years and – you guessed it – 10 years.

Enterprise is anything if not consistent, and that’s exactly what you want in your retirement stocks.

This blue-chip master limited partnership (MLP) went public in 1998, and during the past 20-plus years, it has slowly but steadily grown into an energy infrastructure empire with nearly 50,000 miles of pipelines transporting natural gas and natural gas liquids.

Over the long-term, renewable energy sources such as solar and wind will continue to reduce our dependence on fossil fuels. But natural gas will continue to grow as use of petroleum and particularly coal decline. Among traditional fossil fuels, natural gas is the greenest option. And over the retirement timeframe of anyone reading this article, natural gas is likely to be an important part of America’s energy infrastructure.

Note that, as a master limited partnership, Enterprise Products is best not held in an IRA or other retirement account due to the complexities of unrelated business taxable income (UBTI).

* Distributions are similar to dividends but are treated as tax-deferred returns of capital and require different paperwork come tax time.

Magellan Midstream Partners LP

- Market value: $14.6 billion

- Distribution yield: 6.3%

- Magellan Midstream Partners LP (MMP, $64.05) is one of the few MLPs that can actually compete with Enterprise in terms of sheer quality. But they are different. Unlike Enterprise, which transports mostly natural gas and natural gas liquids, Magellan transports mostly crude oil and refined products. It also has massive storage capacity for more than 60 million barrels of gasoline, crude and diesel.

While the MLP space tends to be dominated by “cowboys” that can be somewhat cavalier with risk, this isn’t the case with Magellan. MMP has been a model of prudent and conservative growth since it first went public in 2001.

Magellan has also done a fine job of taking care of its unitholders (MLPs have “unitholders,” not “shareholders”). The company was one of the first to eliminate the incentive distribution rights that favor management over the investors.

At current prices, MMP yields an attractive 6.5%, and it has raised that distribution by fully 665% since 2001, or about 15.7% per year.

Kinder Morgan

- Market value: $47.3 billion

- Dividend yield: 4.8%

- Kinder Morgan (KMI, $20.88) is one of the largest and longest-operating pipeline companies in America, with over 84,000 miles of pipelines in service. The company was a pioneer in this space and remains one of its most formidable competitors.

Among pipeline companies, Kinder Morgan is going to be a little more controversial than Enterprise Products or Magellan Midstream. Unlike its more conservative peers, Kinder got a little too aggressive during the boom years of the early 2010s and frankly borrowed more than it should have to simultaneously boost its capital spending and its dividend.

That was a mistake and one that cost the company’s shareholders dearly. Kinder Morgan had to slash its dividend in 2015, and its share price today trades at less than half its old all-time high.

Yet despite this, Kinder Morgan remains a solid choice for a retirement portfolio. The company learned its lesson in 2015, and it has been managed far more conservatively ever since. Today, Kinder Morgan operates like a “normal” company, funding most of its growth via retained earnings as opposed to dipping into the debt and equity markets.

Management isn’t keen to repeat the humiliation of cutting its dividend in 2015. So, investors buying today can enjoy an attractive dividend just shy of 5% that should steadily, sustainably grow for years to come. Kinder Morgan raised its dividend by 25% last quarter, and comparable dividend growth is expected over the next year.

While Kinder Morgan is a pipeline operator like Enterprise Products and Magellan Midstream, it is organized as a corporation and can be held in a retirement account without any UBTI issues.

Walt Disney

- Market value: $254.9 billion

- Dividend yield: 1.3%

It’s not a controversial statement these days to say that Netflix (NFLX) and its streaming competitors have changed TV viewing habits forever. While the concept of “binging” a show isn’t necessarily new, it previously involved weeks of DVR recordings. But today, Netflix has made it ridiculously easy to access multiple seasons of a single show and watch it for days on end.

Due in large part to the quality and affordability of streaming services like Netflix, approximately 14% of Americans have “cut the cord,” cancelling their paid TV service, and that number only rises with every passing year.

But while Netflix may have been the first to blaze this trail, it could be streaming upstart Walt Disney (DIS, $141.65) that ends up being the biggest beneficiary.

Disney is launching its own streaming service, Disney+, later in 2019. And unlike Netflix, Disney doesn’t have to spend a fortune on new content. It already had it. Disney benefits from having nearly a century’s worth of programming to draw from, and it wouldn’t be surprising to see virtually every American household with children subscribing to the service within a couple years of launch.

Add to this Disney’s traditional amusement parks business and its movies and merchandising businesses, and you have the makings of a future-proof retirement stock.

Waste Management

- Market value: $49.0 billion

- Dividend yield: 1.9%

- Waste Management (WM, $115.29) does the dirty work for us.

You and I don’t really want to think about our trash once we leave it at the curb or toss it down the chute. That’s exactly why waste collection and processing is big business, and will be, regardless of the state of the economy – people generate a lot of garbage no matter what. And industry leader Waste Management takes it a way.

Out of sight, out of mind.

Waste Management has a diversified customer base of more than 21 million residential and commercial customers across the U.S. and Canada. No customer accounts for more than 2% of revenue.

This also is a green company – a critical political issue in recent years. WM operates 103 recycling facilities and 130 landfill gas-to-energy facilities. Roughly 8,700 of Waste Management’s 14,500 routed trucks run on alternative energy, and the company operates 123 natural gas fueling stations. This isn’t just good PR; recycling makes up 7% of revenues.

The stock currently pays a sub-2% yield, but the dividend grows consistently, and a low payout ratio means there’s room for that to continue. That, and the future-proof business model, makes Waste Management a gem of a retirement stock.

Amazon.com

- Market value: $946.4 billion

- Dividend yield: N/A

- Amazon.com (AMZN, $1,922.19) is not your typical retirement stock. At all. The company has only been around for a couple decades, and it has mostly built a reputation for being a momentum stock, not a long-term dividend payer. In fact, it doesn’t pay a dividend, nor has it telegraphed the idea that it will start one anytime soon.

But remember, a retirement stock should be one that you are comfortable holding for years, and it should be largely future-proof.

Amazon goes a step further. It’s a future creator. It has done more to create the world of e-commerce we live in than any other company. It also turned cloud computing into a massive, profitable business. It’s also a groundbreaker in warehousing and distribution logistics, smart speakers and drone technology.

If none of that convinces you, that’s OK. Just ask yourself: Are you likely to do more of your shopping online or less of your shopping online in the years ahead?

If there is any common complaint about Amazon stock, it is simply the price. At 80 times earnings and nearly 4 times sales, Amazon is pricey by any objective measure. But it’s also one of the few large companies that could credibly have the potential to grow into a valuation like that if held over the course of 20 or more years.

It’s also worth noting that Warren Buffett’s Berkshire Hathaway (BRK.B) recently took a large position in AMZN. If the notoriously conservative Mr. Buffett is comfortable owning Amazon, that says a lot about its maturity as a company.

International Paper

- Market value: $17.4 billion

- Dividend yield: 4.6%

The running theme of this list of retirement stocks is finding companies that are future-proof, or at least as close to future-proof as you can get.

So, paper seems like an odd choice.

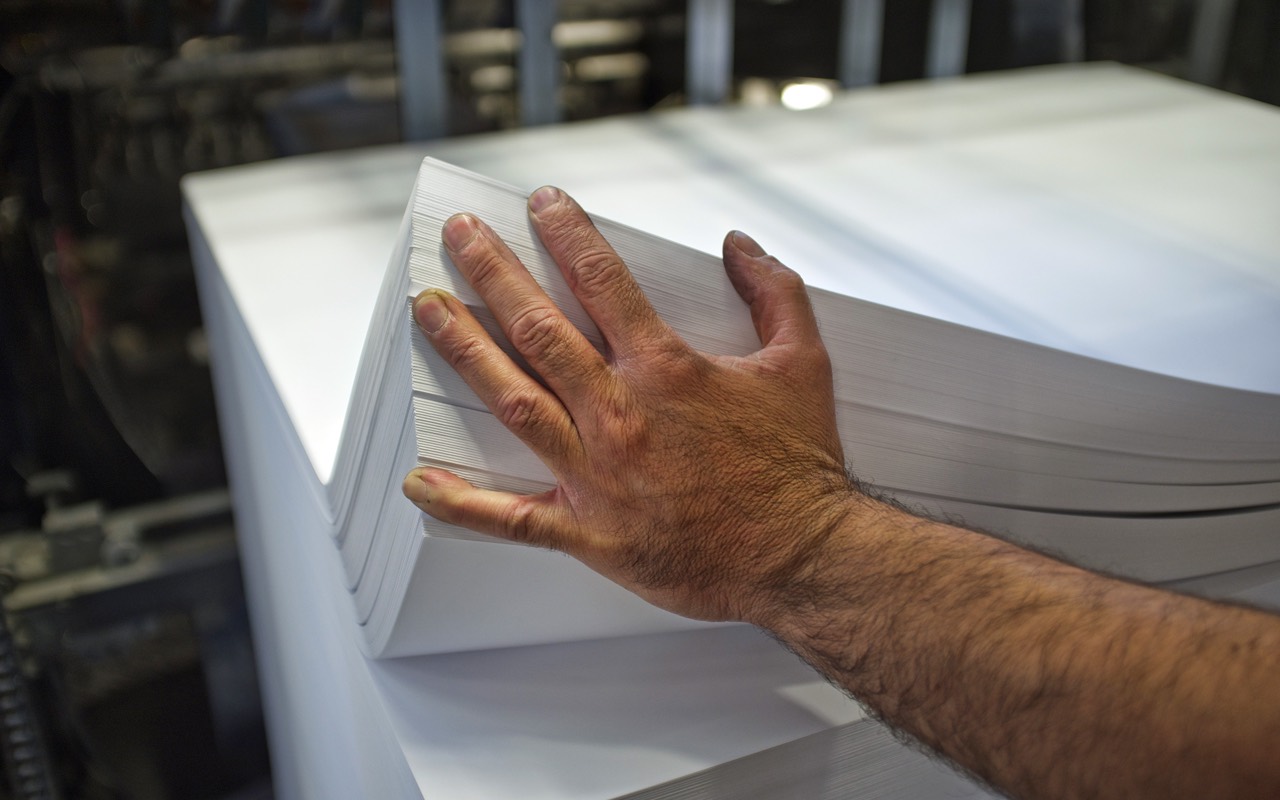

But the appeal of International Paper (IP, $43.75) ties directly to a certain e-retailer from Seattle. You know, the one founded by Jeff Bezos.

As e-commerce grows, so grows demand for cardboard packaging. And while environmental activists rightly complain that the amount of cardboard and plastic packaging used per shipment can and should be reduced, shipments still are expected to grow for the foreseeable future – and that ultimately will line the pockets of International Paper.

That said, IP is more than just packaging – it also produces fluff pulp for baby and adult diapers and other hygiene products. So you’re getting some product diversity.

You’re also getting a dividend yield well north of 4% on a payout that has been improved every year for a decade.

Microsoft

- Market value: $1.0 trillion

- Dividend yield: 1.4%

Author F. Scott Fitzgerald famously wrote that “there are no second acts in American lives.” The same can be said of American companies. It is exceptionally rare to find a market-dominating company fall from grace and successfully reinvent itself into a leader in a new market. Microsoft (MSFT, $135.68) is one of those precious few exceptions.

Most people associate Microsoft with operating systems and office productivity software and with good reason. Globally, around 75% of all personal computers run on Microsoft Windows, and Microsoft Office remains the undisputed leader in office software. But these are yesterday’s products, and Microsoft spent most of the past decade watching the PC market stagnate while Apple (AAPL) and Google parent Alphabet (GOOGL) surged ahead in smartphones and tablets.

Microsoft essentially missed the mobile era but has since reinvented itself with its cloud services division (Azure) that is now second only to Amazon.com in market share.

Microsoft is by no means a cheap dividend stock at today’s prices. It yields only 1.4% and trades for nearly 30 times earnings. But if you believe that cloud computing is the future, then owning Microsoft in a long-term portfolio is a sensible move.

Walmart

- Market value: $315.8 billion

- Dividend yield: 1.9%

Few companies are less interesting than Walmart (WMT, $110.62). Yes, it’s the world’s largest retailer as well as its largest private employer. And yes, Walmart has done more to revolutionize retail than any company in history (at least until Amazon came along). But still … it’s Walmart: a boring, utilitarian retailer.

But boring doesn’t mean stagnant. Walmart has survived, and even thrived, amid an ever-changing consumer landscape. WMT is one of the very few large, mass-market retailers that can even pretend to compete head-to-head with the mighty Amazon.com – that’s thanks to smart web purchases such as Jet.com that put a nitro boost into its e-commerce operations.

Every week, Walmart serves an average of 275 million customers. That’s 84% of the entire U.S. population … every week. Globally, the company operates 11,300 stores. And its e-commerce business – while still far behind that of Amazon – benefits from the fact that Walmart already has a logistics network in place in the form of its stores and truck fleet that give it an incredible advantage over most rivals.

Walmart’s dividend yield isn’t exactly generous, but it’s respectable. That said, WMT is a Dividend Aristocrat that has upped the ante on its payout annually without interruption since 1975. Over the past decade, the company has raised the dividend at a 9.0% annualized clip.

Home Depot

- Market value: $231.4 billion

- Dividend yield: 2.6%

- Home Depot (HD, $210.28) is another company that has managed to go toe-to-toe with Amazon.com as Bezos’ behemoth has encroached on its territory. The company has lasted in the era of e-commerce by the very nature of its business. Many (perhaps most) home improvement products are messy affairs that involve spur-of-the-moment trips to the hardware store for tools or supplies.

The thing is, people who shop at Home Depot don’t always know exactly what it is they need to buy. They need to browse the aisles and probably ask an employee for help. All of this makes it very unlikely that Amazon or other e-tailers will gain much in the way of market share.

Even if they try, Home Depot is ready for them. They company has a thriving online business of its own with more than 1 million products available.

Per its brick-and-mortar presence: Home Depot operates almost 2,300 stores across North America doing nearly $110 billion in revenue. It’s a powerhouse company and one that belongs in a diversified retirement portfolio. The housing market will have its ups and downs, but Home Depot has proven its ability to navigate the cycle.

McDonald’s

- Market value: $157.5 billion

- Dividend yield: 2.2%

- McDonald’s (MCD, $206.30) is perhaps one of the most adaptable companies in the history of commerce.

The iconic burger chain has been a fixture in American life since the 1950s, and today the company has more than 38,000 restaurants in over 100 countries. And McDonald’s has remained so relevant by being willing to make changes when necessary. A couple years ago, it reignited customer interest by offering all-day breakfast. McDonald’s is proving its flexibility again by rolling out self-service kiosks in its U.S. locations in response to rising labor costs and a preference by customers to embrace technology.

Here’s a fun fact about those self-service kiosks: McDonald’s has found that customers actually order more when left to their own devices. So this strategy has evolved from pure cost cutting to a broader sales improvement method.

McDonald’s has raised its dividend for 43 consecutive years and counting and at today’s prices yields a respectable 2.2%. McDonald’s menu will likely look a lot different in the decades ahead, but it’s a safe bet the company will still be alive and kicking and throwing off a reliable dividend – making it a healthy choice for your retirement portfolio.

Procter & Gamble

- Market value: $277.1 billion

- Dividend yield: 2.7%

- Procter & Gamble (PG, $110.49) is one of the most ubiquitous companies on the planet – or at least, its brands are among the most ubiquitous. Its stable of billion-dollar brands includes Tide laundry detergent, Crest toothpaste, Pampers diapers, Gillette razor blades and a host of other household names.

That’s normally all you can ask of a consumer staples company. But its mega-brands have weirdly been a curse in addition to a blessing over the past decade. That’s because, following the 2008 meltdown, cash-strapped consumers switched to generic and “white-label” grocery brands – and many have yet to return to higher-priced premium brands. Also, facial hair is more popular these days, crimping razor sales.

P&G was taken by surprise, though it has adapted to market conditions by shedding underperforming brands and concentrating its efforts on leveraging its core products. Where the company finds it difficult to compete, it often simply buys the competition, as it did in 2018 when it purchased German Merck KGaA’s consumer health division.

Procter & Gamble yields a decent 2.9% at current prices. The stock won’t provide market-beating growth – at least not for a few years – but it will be alive and kicking well into your retirement.

Unilever

- Market value: $163.1 billion

- Dividend yield: 3.1%

Anglo-Dutch consumer products company Unilever (UN, $60.72) also is attractive as a long-term retirement stock and for essentially the same reason. Like Procter & Gamble, Unilever’s products are disposable consumer staples that have to be regularly replaced. Some of its most popular brands are Axe body spray, Dove soap, Vaseline petroleum jelly, Hellman’s salad dressing, Lipton tea and Ben & Jerry’s ice cream.

Yet the timelessness of its brands hasn’t stopped the company from being innovative. As a direct attack on rival Procter & Gamble’s Gillette, Unilever bought discounted razor-blade maker Dollar Shave Club for $1 billion. Cheaper alternatives like Dollar Shave Club have been particularly popular among millennials, potentially setting up Unilever to benefit from decades of brand loyalty.

As with much of the market these days, Unilever isn’t particularly cheap, trading at around 25 times earnings. But its nearly 3% dividend yield is competitive with Treasury bonds and high-grade corporate bonds.

Albemarle

- Market value: $7.5 billion

- Dividend yield: 2.1%

Revolutionary automaker Tesla Motors (TSLA) may or may not still be around in five years. The company consistently bleeds cash, can’t seem to consistently turn a profit and is overly dependent on the cult of personality surrounding founder Elon Musk.

Yet whatever happens with Tesla, the future almost assuredly belongs to electric vehicles.

Consumer acceptance of EVs has been slow because, frankly, until very recently, the products were terrible. Prices were high, styling was clunky and performance left something to be desired. Yet Tesla proved that electric cars can be a smash hit with consumers if they are stylish and high-performance vehicles. Traditional automakers have entered the market en masse. European climate regulations all but guarantee demand will massive rise across the European Union in the years ahead, and likely the rest of the world too. China is starting to throw its weight into EVs.

Electric vehicles require lithium-ion batteries, which means that demand for mined lithium should only continue to rise. Lithium is arguably the new oil and the most important commodity of the next decade.

One of the easiest ways to invest in this long-term trend is by investing in leading lithium miner Albemarle (ALB, $70.33). Albemarle is more volatile than most of the stocks on this list, as you might expect from a commodity producer. But it’s important that retirees have a little growth in their portfolios, and Albemarle allows them to ride the adoption of EVs, which is expected to be one of the more powerful trends of the next 20 years.

It’s worth noting that Albemarle has had a rough couple of years and is now trading at 2016 prices. It’s also at very cheap valuations of 11 times earnings and a price/earnings-to-growth ratio of 0.8 (anything under 1 is considered undervalued compared to its growth prospects). But it might be smart to be patient and let the stock stabilize before making a major investment.

After all, if you’re looking for a stock to last through your retirement years, you don’t have to run out and buy it today.

Exxon Mobil

- Market value: $324.1 billion

- Dividend yield: 4.6%

There is a lot of awareness these days about climate change and the desirability of moving away from traditional fossil fuels and towards renewable energy sources such as solar and wind power. Governments and the private sector alike are doing what they can to push us in that direction. Thus, it makes sense to invest in this theme by buying lithium stocks such as Albemarle.

But realistically, we’re not escaping fossil fuels entirely within the lifetimes of anyone in or near retirement today. A growing global economy needs energy, and fossil fuels – as politically incorrect as they might be – are going to be a big part of the energy grid for the foreseeable future.

Among the integrated supermajors, Exxon Mobil (XOM, $76.56) is the bluest blue chip of the group. It’s largest, with a market cap of more than $320 billion, and it’s globally diversified. The stock pays a dividend of just under 5%, which is about as high of a yield as you can find outside of the REIT, telecom or tobacco sectors.

Exxon Mobil has raised its dividend for an incredible 37 consecutive years and counting. It may not be sexy in the age of Tesla, but it’s a reliable dividend payer and a solid retirement stock.

Unlike some of the other energy companies mentioned in this article, which get the overwhelming majority of their revenues from midstream energy transportation, Exxon Mobil does have a degree of commodity-price risk. But given the company’s size, scale and financial strength, it should be able to survive and thrive regardless of what happens to the price of a barrel of crude oil.

Archer Daniels Midland

- Market value: $23.2 billion

- Dividend yield: 3.4%

Farming is what defines the onset of civilization. So, if you’re looking for a stock that is likely to still be around decades or even centuries from now, farm products company Archer Daniels Midland (ADM, $41.40) is a solid choice.

ADM was founded in 1902 and has been a public company since 1924. The company has approximately 500 crop procurement locations and connects crops to markets in all six inhabited continents. In addition to food also produces animal feed and various organics used for industrial and energy applications.

As you would expect from a company with Archer Daniels Midland’s history, the company has reacted to changing consumer tastes and embraced organic products. Just this year, the company introduced a line of organic flours for use by bakers looking to make organic bread.

At current prices, ADM yields more than 3%. And impressively, it has raised its dividend every year since 1976.

The stock is down by about 20% from its 2018 highs, as commodity-oriented companies have had something of a rough patch. Still, farming is a critical piece of the economy, and that means companies such as Archer Daniels Midland won’t be going anywhere.

CVS Health

- Market value: $71.4 billion

- Dividend yield: 3.6%

Just about every retail chain in America is, in one way or another, in direct competition with Amazon.com and other internet rivals. Many, as we highlighted earlier, are doing a fantastic job. Others are really struggling.

Pharmacy chain CVS Health (CVS, $54.93) has been particularly innovative is countering the Amazon threat while also providing an attractive solution to the single biggest long-term threat to American prosperity: the rising cost of health care.

Years ago, CVS made the decision to open “MinuteClinic” retail health clinics in many of its stores, offering basic medical care for a fraction of the cost of a trip to the doctor’s office and without the long waits. Today’ CVS is expanding this program via its HealthHUB, a more comprehensive health provider that, in addition to basic clinic services, also offers in-house dieticians and even personalized health concierge services.

And naturally, if you’re going to a CVS store to have a routine medical checkup or procedure done, you’re likely to buy something on your way out the door, whether it be prescription drugs or something more frivolous like a magazine or a box of candy.

This is the future of medicine. And today, CVS is very reasonably priced, yielding 3.8%.

However, if you’re not already invested in CVS Health, you might consider waiting to hear the final result of a federal judge’s review of its merger with insurer Aetna before jumping in. The deal has gotten every approval it needs but one – and this surprising wrinkle has stumped Wall Street. A ruling could come as soon as July, so wait for the stock to settle following said ruling before diving in.

Union Pacific

- Market value: $121.4 billion

- Dividend yield: 2.1%

The world has changed a lot in the past 120 years. America has added states and fought in two world wars. We saw the rise and fall of fascism and communism. And women won the right to vote.

But what hasn’t changed that entire time is railroad operator Union Pacific’s (UNP, $171.50) willingness to take care of its shareholders. The company has paid a dividend without interruption for 120 years and counting. That’s not a bad run. And it’s not likely to be broken any time soon.

Union Pacific controls more than 32,000 miles of railways and hauls virtually everything from raw commodities to finished consumer goods. Union Pacific is the American economy.

At current prices, Union Pacific yields a respectable 2.1%.

If you’re looking for a company that will survive and prosper throughout your retirement years – and likely for decades after you’re dead and in the ground – then Union Pacific is worth considering.

Charles Sizemore was long EPD, KMI, NNN, O and WMT as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Charles Lewis Sizemore, CFA is the Chief Investment Officer of Sizemore Capital Management LLC, a registered investment advisor based in Dallas, Texas, where he specializes in dividend-focused portfolios and in building alternative allocations with minimal correlation to the stock market.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

States That Tax Social Security Benefits in 2026

States That Tax Social Security Benefits in 2026Retirement Tax Not all retirees who live in states that tax Social Security benefits have to pay state income taxes. Will your benefits be taxed?

-

Dow Dives 797 Points as Government Opens: Stock Market Today

Dow Dives 797 Points as Government Opens: Stock Market TodayThe process of pricing and re-pricing realities old and new never stops, and next week promises to be at least as exciting as this week.

-

Stocks Rally on Apple Strength: Stock Market Today

Stocks Rally on Apple Strength: Stock Market TodayThe iPhone maker will boost its U.S. investment by $100 billion, which sent the Dow Jones stock soaring.

-

Stock Market Today: Stocks Rise Despite Stagflation Risk

Stock Market Today: Stocks Rise Despite Stagflation RiskThe business of business continues apace on continuing hope for reduced trade-related uncertainty.

-

What to Do With Your Tax Refund: 6 Ways to Bring Growth

What to Do With Your Tax Refund: 6 Ways to Bring GrowthUse your 2024 tax refund to boost short-term or long-term financial goals by putting it in one of these six places.

-

4 Turnaround Stocks to Consider – and 2 More to Keep an Eye On

4 Turnaround Stocks to Consider – and 2 More to Keep an Eye OnA turnaround stock is a struggling company with a strong makeover plan that can pay off for intrepid investors.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.