6 Stocks to Buy and Hold (And 6 Picks to Avoid)

Stocks in high-quality firms -- financially strong, well-established companies with lots of cash and little debt -- are better equipped to withstand troubled times and rough markets.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Nothing feeds fear in the stock market like uncertainty, and nothing spreads fear and uncertainty like a global pandemic. As coronavirus worries infected the financial markets, stocks tumbled at a record pace. Standard & Poor’s 500-stock index dropped 34% from its all-time high in about a month. During the Great Recession, it took nearly a year for the index to decline by that amount. A near-total economic shutdown in the country’s biggest cities compounded the damage. “These are unprecedented times,” says Philip Lawlor, managing director, global markets research at FTSE Russell.

But smart investors are greedy when others are fearful, and this time is no different. Fidelity Puritan fund manager Dan Kelley and other fund managers have been busy buying during the sell-off. “Opportunities like these come along once a decade if you’re lucky,” says Kelley, who says he’s finding some of the best investment opportunities he has seen in a long time.

Just because a stock is cheap doesn’t mean it’s a bargain. Stocks in high-quality firms—financially strong, well-established firms with lots of cash and little debt—are better equipped to withstand troubled times and rough markets. Some even emerge from a crisis stronger.

With that in mind, we set out to find stocks with staying power, focusing on firms that lead their industry and have a competitive advantage over peers, a steady history of profitability and good long-term growth prospects. We list our six favorites below.

Prices and other data are as of April 17.

Activision Blizzard

The coronavirus should boost Activision (symbol ATVI, $67) revenue. With people stuck at home, in search of distractions, many are likely to spend money on one of the company’s popular video games: Call of Duty, Candy Crush or World of Warcraft, among others. “Games take years and hundreds of millions of dollars to develop,” says lead manager of Mairs & Power Growth fund Andy Adams. That’s a high hurdle for competitors to overcome. Activision is also an early mover in the fast-growing world of e-sports, or competitive video gaming, adds Adams.

The company is in stable financial shape. At the end of 2019, Activision had $5.8 billion in cash, enough to pay off its long-term debt two times over. What’s more, in 2019, Activision generated $1.7 billion in free cash flow (money left over after spending to run and maintain the business).

Adams eyed Activision for a decade before buying shares at a “reasonable” price earlier this year, he says. The stock has largely recovered from its March low of $52 and has held its own so far this year—up 13.3%, compared with a 10.5% loss for the broad market. Smart investors will be on the lookout to buy on any further dips.

Intuitive Surgical

Intuitive Surgical (ISRG, $526) is likely to take a hit from the pandemic. This medical-device company makes robot-assisted surgical systems for minimally invasive procedures, many of which are elective. Those procedures will be delayed as health professionals focus on treating COVID-19 patients, which isn’t good for Intuitive over the short term.

Even so, robot-assisted surgeries—expected to increase in number by 13% to 16% a year over the next three years—aren’t going to go away, and Intuitive Surgical dominates this field. The firm makes da Vinci surgical systems, sells the instruments and accessories required to use them, and services the systems—all of which provide a recurring revenue stream that accounts for more than 70% of the company’s overall annual sales. The firm has plenty of cash on its books—$3.2 billion at the end of 2019—and zero debt.

When the stock market fell in March, Intuitive shares tumbled to “extraordinary” valuations, says Mitch Rubin, manager of RiverPark Long/Short Opportunity fund, who snapped some up. At $526, the share price has recovered a bit, but it is still well below its 52-week high of $619. That said, the stock could fall further as the effect of delays in elective surgeries becomes clear. Be patient and take advantage of further declines.

Microsoft

Microsoft (MSFT, $179) may be the standard-bearer for fortress-like companies. At the end of 2019, the software-cum-cloud-computing company had a war chest of $134 billion in cash and short-term investments. That’s enough, says CFRA analyst John Freeman, to provide some cushion in an economic slowdown. He rates the stock a “buy.”

Microsoft’s Windows operating system still runs close to 80% of the world’s desktop PCs. Even so, the firm’s future is in its highly profitable cloud business, which accounted for half of the company’s overall revenue in the last quarter of 2019. Part of that business, Microsoft’s Azure cloud service, has been growing faster than Amazon.com’s AWS, the number-one player in the field. Fidelity’s Kelley says the company’s software generally “sells itself.” Microsoft is a top-10 holding in the Puritan fund.

Microsoft is a sleep-easy stock, with some oomph. Analysts expect earnings to rise at a mid-teens annualized percentage rate over the next three years.

Nike

Nike (NKE, $90) is holding up well in the new normal, despite having to close stores in spots around the world. In its fastest-growing region, greater China (which includes China, Hong Kong and Taiwan), sales got whacked for the quarter that ended in February—but not as badly as expected, thanks to brisk business before the closures and a 32% jump in online sales there.

Nike may have survived the virus in China, but store closures in Europe (25% of fiscal year 2019 sales) and North America (41%) will test the company further. BofA Securities analyst Robert Ohmes expects earnings to shrink 16% in the fiscal year ending in May compared with the year before. But he forecasts profits will increase by 18% in both 2021 and 2022 and rates the stock a “buy.”

Technology is Nike’s secret weapon. Its “customize” option at www.nike.com and its Nike By You (www.nike.com/nike-by-you) service allow shoppers to personalize and design shoes. The service is rolling out in Nike shops, too, and the firm is making other customer-engagement and do-it-yourself experiences a hallmark of its brick-and-mortar stores. Meanwhile, global e-commerce sales—14% of total revenue—are increasing at a rate of more than 30% a year, says Ohmes. Sales in stores are growing at a rate in the mid-to-high single digits.

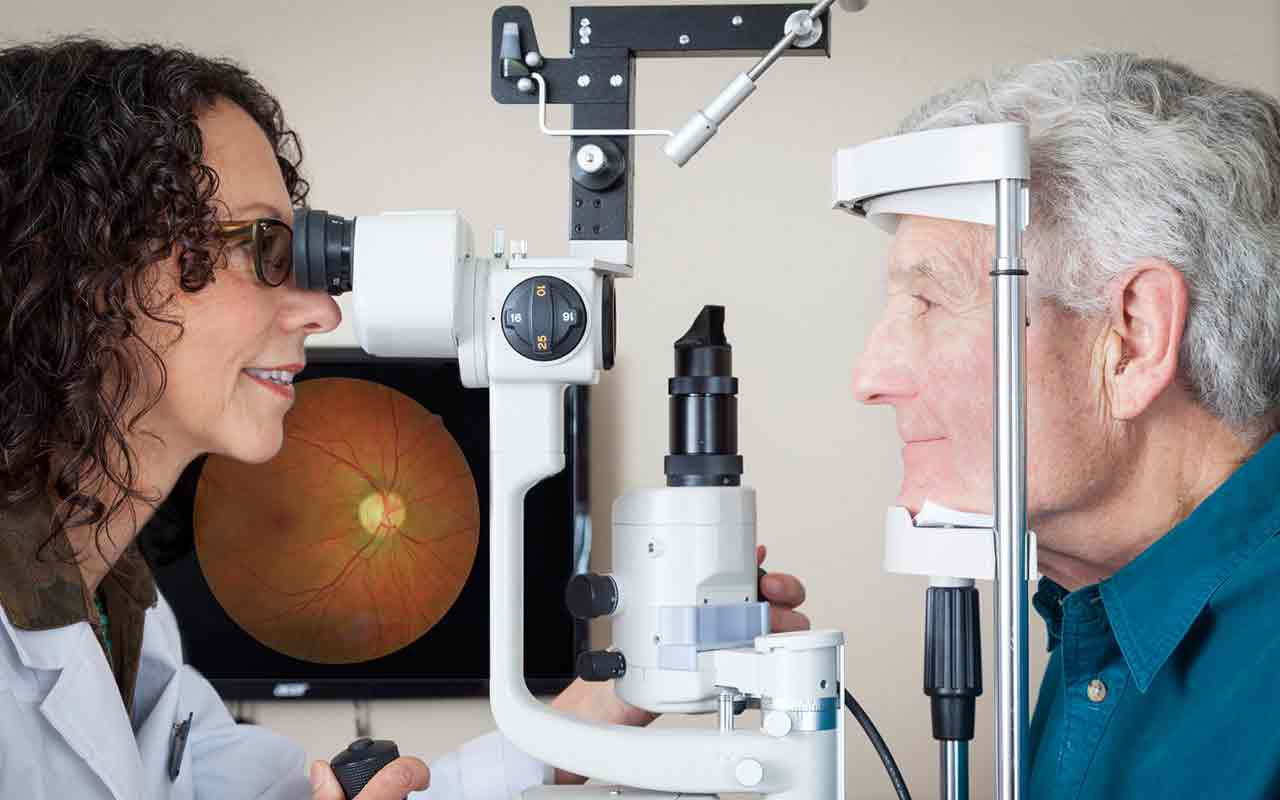

Regeneron Pharmaceuticals

Regeneron (REGN, $569) stock has climbed 51% since the start of 2020, thanks to excitement about the biotech firm’s efforts to fight the coronavirus. It is testing a rheumatoid arthritis medicine it created with French firm Sanofi to treat severe COVID-19 cases; the company is also developing a new antibody drug to prevent or treat the virus.

If these treatments fail, the stock may give back some of those gains. But Regeneron still has its blockbuster macular-degeneration drug, Eylea. Despite rising competition, Eylea is a “significant cash cow,” with $4.6 billion in annual sales in 2019, says Brian P. Skorney, an analyst at investment firm Robert W. Baird. Dupixent, a treatment for eczema and asthma—and possibly a slew of other ailments, if testing goes well—may be a blockbuster, too. Regeneron has four other drugs on the market and more than a dozen therapies in mid- to late-stage development.

Forecasts for Regeneron’s profits vary widely among analysts, even in the best of times. At $569 a share, the stock trades at 21 times consensus earnings estimates for the year ahead, well below the stock’s 10-year median price-earnings ratio of 36. With $6 billion in cash and securities and little debt, Regeneron is a stalwart.

Visa

If anything, the pandemic may accelerate the global trend toward mobile electronic payments. Even before the coronavirus outbreak, analysts expected the volume of electronic transactions to rise an average of 14% per year through 2022. Visa’s vast payment network has reached “essentially universal acceptance in most developed markets,” says Morningstar analyst Brett Horn. That gives it an edge over smaller e-payment competitors. What’s more, the Visa (V, $170) brand is viewed as “one of the safest and most reliable ways to make payments,” says CFRA analyst Chris Kuiper, who rates Visa a “buy.”

In a recession, however, consumers will spend less, and over the short term, Visa shares may suffer as revenue and earnings drop—providing investors who have a long-term view with a favorable entry point. At $170, shares are down 20% from their February high, but they have regained some ground after a March low of $135.

6 Picks to Avoid

Where to start? Maybe with the obvious. The “stay home” directive wiped away weeks of revenue for many retailers, airlines, restaurants and hoteliers. Energy companies got slammed as oil and gas prices fell to record lows. And it will take a lot—perhaps too much for now—to revive sentiment for cruise-line stocks.

The shutdown is temporary, of course. But financially shaky firms will find it harder to tough out the pause, especially if a recession lingers. We think the stocks below are the most vulnerable in the hardest-hit sectors.

Delta Air Lines (DAL) flies to the top of the troubled list among airlines. The firm has $2.9 billion in cash but $3 billion in short-term debt, plus billions more in long-term IOUs. Delta accepted a $5.4 billion lifeline loan from the government to pay workers, part of which must be repaid. Dividends and share buybacks are barred until September 2021, and the deal lets Uncle Sam buy a 1% stake in the airline at $24 a share over a period of five years.

Ford (F) is buckling under all its debt. In late March, the automaker suspended its quarterly dividend. Earnings have dwindled since 2018, and analysts expect profits to drop another 76% in 2020 compared with 2019. Shares in Occidental Petroleum (OXY) have collapsed along with oil prices, and Moody’s Investors Service recently downgraded its debt to junk status. That came after OXY cut its quarterly dividend to $0.11 a share from $0.79, effective in July. Activist investor Carl Icahn may stir things up at the firm, but for now, analysts expect losses of $3.31 per share in 2020, compared with a $1.62 gain in 2019.

At the end of 2019, Marriott International (MAR) had $225 million in cash and close to $12 billion in debt. Volatile currency-exchange rates, travel bans and a looming recession all spell trouble for the global hotel firm. Its March quarterly dividend will be its last for now, and it has suspended share buybacks.

Brick-and-mortar retailers were hurting before the pandemic. Earnings and cash flow have been shrinking at Kohl’s (KSS), Macy’s (M) and Nordstrom (JWN) in recent years. Coronavirus closures forced all three to furlough thousands of employees.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

How Inflation, Deflation and Other 'Flations' Impact Your Stock Portfolio

How Inflation, Deflation and Other 'Flations' Impact Your Stock PortfolioThere are five different types of "flations" that not only impact the economy, but also your investment returns. Here's how to adjust your portfolio for each one.

-

Why I Still Won't Buy Gold: Glassman

Why I Still Won't Buy Gold: GlassmanOne reason I won't buy gold is because while stocks rise briskly over time – not every month or year, but certainly every decade – gold does not.

-

Should You Use a 25x4 Portfolio Allocation?

Should You Use a 25x4 Portfolio Allocation?The 25x4 portfolio is supposed to be the new 60/40. Should you bite?

-

Retirement Income Funds to Keep Cash Flowing In Your Golden Years

Retirement Income Funds to Keep Cash Flowing In Your Golden YearsRetirement income funds are designed to generate a reliable cash payout for retirees. Here are a few we like.

-

10 2024 Stock Picks From An Investing Expert

10 2024 Stock Picks From An Investing ExpertThese 2024 stock picks have the potential to beat the market over the next 12 months.

-

Bond Basics: How to Reduce the Risks

Bond Basics: How to Reduce the Risksinvesting Bonds have risks you won't find in other types of investments. Find out how to spot risky bonds and how to avoid them.

-

Special Dividends Are On The Rise — Here's What to Know About Them

Special Dividends Are On The Rise — Here's What to Know About ThemMore companies are paying out special dividends this year. Here's what that means.