Best Online Brokers, 2018

As the world of online brokers continues to evolve, it has become increasingly difficult for firms to stand apart from one another.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

As the world of online brokers continues to evolve, it has become increasingly difficult for firms to stand apart from one another. In this year's ranking, TD Ameritrade beat Charles Schwab by less than a nose, with Fidelity and then E*Trade close behind. But zoom in, and you’ll find that each firm, along with the four others we surveyed, has something different to offer—a niche that lets it shine in one way or another.

With commissions about $7 or less at most firms, we gave that category less weight this year. But because the firms we surveyed told us that investors increasingly interact with them on smartphones or tablets, we gave more importance to mobile apps. The biggest, best-known firms, you’ll notice, score better overall in our survey. But almost all of the firms let you trade stocks, exchange-traded funds, mutual funds and individual bonds online, as well as offer some online advisory services.

Read on to find out how each of these eight firms scored—and which would be best match for you.

With additional reporting by Kyle Woodley

Category weighting for overall score: commissions and fees, 10%; investment choices, 20%, mobile app, 20%; user experience, 20%; ease of use, 15%; mobile, 10%; advisory services, 15%; and tools, research and advisory services, roughly 12% each.

Since our story went to press, Firstrade announced it would offer free online trading for stocks, ETFs, options and mutual funds (down from $2.95 per trade). Also, Ally Invest announced it would offer more than 100 exchange-traded funds commission-free (in other words, there is no sales charge to buy or sell shares) to customers on its online trading platform. (Previously, all ETFs purchased on the Ally Invest platform incurred a $4.95 commission; $3.95 for active traders or customers with high balance.)

TD Ameritrade

TD Ameritrade distinguishes itself with its commitment to investor education. The website’s education center is a treasure trove of short explanatory videos on everything from the basics of money market accounts to the ins and outs of cryptocurrency. Longer and more detailed online courses are also available, with titles such as “Trading Options” and “Fundamental Analysis.” The firm held nearly 6,000 webinars on online-trading education in 2017 alone.

TD Ameritrade also scores points in user experience for meeting clients where they spend their time—texting on their smartphones or browsing Twitter or Facebook on a computer, tablet or smartphone. Anyone can contact TD through direct messages on Twitter, on Facebook Messenger, through the iPhone Messages app or by talking to their Amazon Alexa–equipped device.

For example, you might use Facebook’s messaging feature to ask a broad investing question, get a stock quote, or even buy or sell shares—all without leaving the Facebook app. TD uses artificial intelligence to generate automated responses to your query; if that doesn’t satisfy you, TD will automatically connect you with a live representative.

Charles Schwab

Schwab’s advisory service stands out for the breadth, quality and price of its offerings. Schwab’s robo adviser, Intelligent Portfolios, does not charge an asset-management fee, which sets it apart from others. You need $5,000 to open an account at Intelligent Portfolios, which is on the high end of minimums (but not the highest). But once funded, Intelligent Portfolios use low-cost ETFs to tailor dozens of portfolios (43 in all) tailored to your goals, tolerance for risk and stage in life.

Intelligent Portfolios has a couple of downsides: It requires $5,000 or more to start, and its most aggressive portfolio currently holds a hefty 7% cash position, a potential drag on returns. But according to The Robo Report, which tracks the performance of digital advisory portfolios, Schwab has achieved good results over time.

Schwab also offers more no-fee mutual funds than any other broker: at last count, 4,121.

Fidelity

Plenty of brokerages offer reasonable fees and commissions, thanks to the decades-long brokerage price wars. The latest salvo from Fidelity eliminated all account fees, including fees to wire money domestically, among others. The firm offers more than 4,000 mutual funds with no sales load and no fee, and is now also offering index funds with a 0% expense ratio.

Fidelity’s mobile app wins the highest marks for checking all the essential boxes. You can buy or sell stocks, ETFs, mutual funds and bonds on Fidelity’s app—no other firm in our survey can say the same. But Fidelity also excels in this category because its app offers virtually all of the other conveniences that brokerage clients now expect, such as mobile bill pay and check deposit, as well as the ability to set up watch lists and view educational videos.

Fidelity is the best choice for investors who want access to initial public offerings. Over the past two calendar years, Fidelity has made 397 IPOs available to customers, compared with 64 for E*Trade and 48 for TD Ameritrade. In each case, gaining access to shares comes with eligibility requirements.

E*Trade

E*Trade has made it a priority to teach and inform customers about investing. “Our goal is to make investing easier for people,” says E*Trade’s Rich Messina. E*Trade caters to beginner investors with “All Star” lists of recommended ETFs, stocks and mutual funds, plus ready-to-go ETF portfolios.

Bond traders will appreciate E*Trade's access to tens of thousands of corporate and municipal bonds.

We knocked E*Trade for its sprawling and sometimes lumbering website, including the way graphics show up (or don’t) on E*Trade’s site.

Merrill Edge

Customers with deep pockets can pay $0 in commissions at Merrill Edge. If you have an active Bank of America checking account and a three-month average balance of $50,000 at Bank of America, Merrill Edge or Merrill Lynch investment accounts (singly or in combination), you can join a rewards program and qualify for no commissions on up to 30 stock and ETF trades per month. Investors with a $100,000 average balance can get 100 free trades every month.

Merrill’s platform transforms the sometimes-daunting work of analyzing your portfolio and researching stocks into an engaging experience. In “Portfolio Story” mode, the site poses eight questions that investors should ask about their portfolio, from “How is my portfolio performing?” to “What could I potentially earn?” It even examines how your investments rank on certain environmental, social and corporate governance measures. You'll find the same approach for stock research with “Stock Story,” a similarly engaging tool that investors can use to work through four essential questions of stock analysis.

Merrill Edge’s app is also worth a mention. Its intuitive interface, particularly when it comes to stock research, makes it one of the most engaging apps on our list. The app lost a few points, however, because it doesn’t offer bond trading or let you transfer money electronically between other banks. (Transfers between Bank of America and Merrill Edge, however, are instantaneous.)

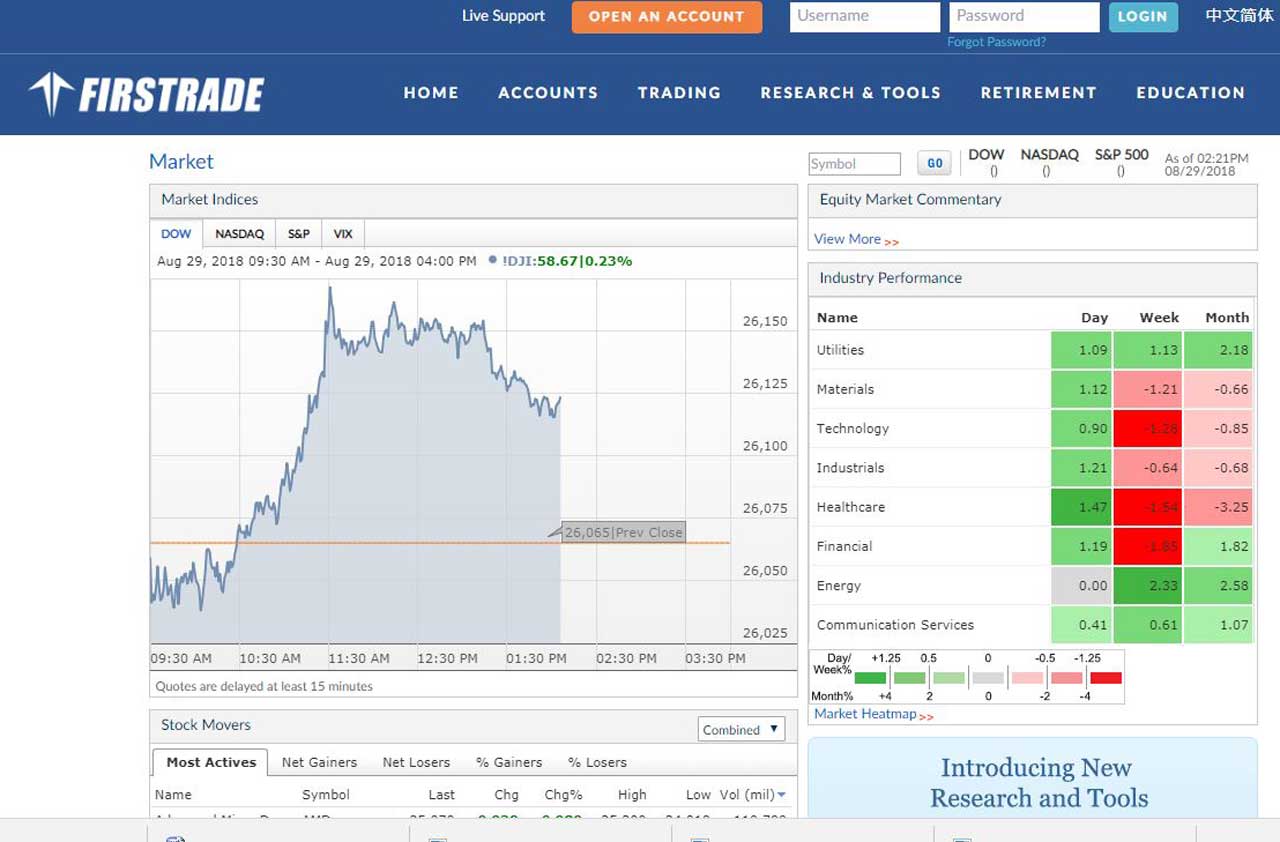

Firstrade

Firstrade slays the competition in our survey with its roster of 703 commission-free exchange-traded funds. It includes 15 of the Kiplinger ETF 20, our favorite ETFs, including iShares Core S&P 500 (symbol IVV), Vanguard Dividend Appreciation (VIG) and Pimco Active Bond (BOND).

Firstrade also offers access to more corporate and municipal bonds than any broker in our survey, but trades them on a “net yield” basis. That means the price of the bond includes a mark-up that represents the dealer’s profit. This pricing model is generally more expensive and is certainly less transparent than the flat fees others offer.

Currently the firm offers no advisory services whatsoever, though it is considering launching an online robo advisor later this year.

Ally

Ally Invest offers a digital advisory service, Advisors Managed Portfolio. It charges a 0.30% management fee and requires just $2,500 to get started. But the firm suffers in this category ranking because it doesn’t offer as hearty an array of planning advice (estate planning specialists, for example) as other firms.

Ally Invest also fell behind in our mobile app judging, lacking mutual fund or bond trading, mobile check deposits, or bill pay.

WellsTrade

At WellsTrade, which is affiliated with Wells Fargo, you can get a break on stock and ETF commissions if you have money in a checking or savings account at the associated bank. For instance, WellsTrade customers who link their brokerage account with a Portfolio by Wells Fargo checking account can get their stock commissions knocked down to $2.95 from the typical $5.95 charge.

We were unable to get a demo account to test Wells Fargo's user experience.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

What Really Happens in the First 30 Days After Someone Dies

What Really Happens in the First 30 Days After Someone DiesThe administrative requirements following a death move quickly. This is how to ensure your loved ones won't be plunged into chaos during a time of distress.

-

AI-Powered Investing in 2026: How Algorithms Will Shape Your Portfolio

AI-Powered Investing in 2026: How Algorithms Will Shape Your PortfolioAI is becoming a standard investing tool, as it helps cut through the noise, personalize portfolios and manage risk. That said, human oversight remains essential. Here's how it all works.

-

Why Some Michigan Tax Refunds Are Taking Longer Than Usual This Year

Why Some Michigan Tax Refunds Are Taking Longer Than Usual This YearState Taxes If your Michigan tax refund hasn’t arrived, you’re not alone. Here’s what "pending manual review" means and how to verify your identity if needed.

-

Best Mutual Funds to Invest In for 2026

Best Mutual Funds to Invest In for 2026The best mutual funds will capitalize on new trends that emerge this year, all while offering low costs and solid management.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

Best 401(k) Investments: Where to Invest

Best 401(k) Investments: Where to InvestKnowing where to find the best 401(k) investments to put your money can be difficult. Here, we rank 10 of the largest retirement funds.

-

Fidelity Strategic Income Fund Excels In Hard Year for Bonds

Fidelity Strategic Income Fund Excels In Hard Year for BondsThe fixed-income market was volatile in 2023, but this Fidelity bond fund outperformed its peers thanks to strategic moves by management.

-

What Is Margin Trading?

What Is Margin Trading?Margin trading is buying and selling stocks with borrowed money. It can generate big rewards, but margin trading also involves multiple risks.

-

How to Find the Best 401(k) Investments

How to Find the Best 401(k) InvestmentsMany folks are likely wondering how to find the best 401(k) investments after signing up for their company's retirement plan. Here's where to get started.

-

How to Master Index Investing

How to Master Index InvestingIndex investing allows market participants the ability to build their ideal portfolios using baskets of stocks and bonds. Here's how it works.

-

5 Stocks to Sell or Avoid Now

5 Stocks to Sell or Avoid Nowstocks to sell In a difficult market like this, weak positions can get even weaker. Wall Street analysts believe these five stocks should be near the front of your sell list.