8 Stocks That Will Have You Investing Like Buffett

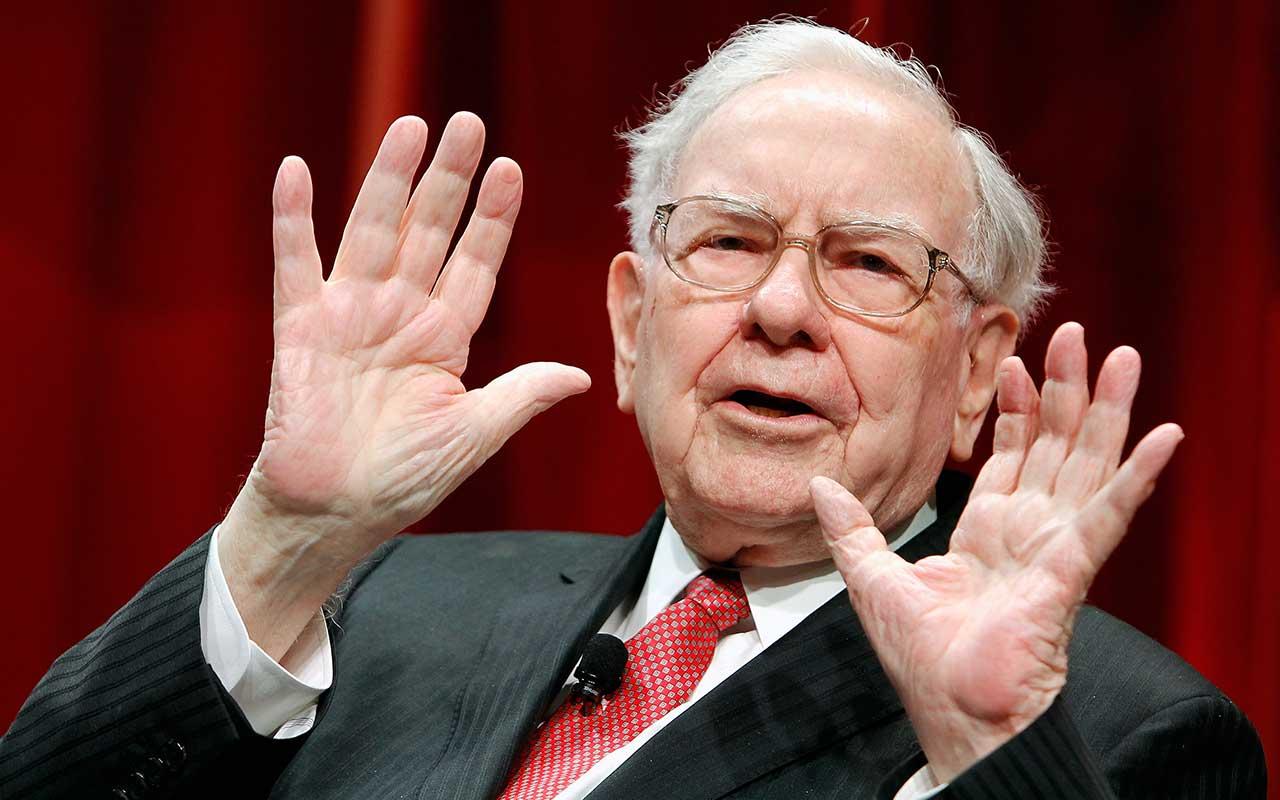

Warren Buffett’s $82.5 billion estimated net worth makes him the world’s third-wealthiest man, behind Microsoft’s Bill Gates and Amazon’s Jeff Bezos.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Warren Buffett’s $82.5 billion estimated net worth makes him the world’s third-wealthiest man, behind Microsoft’s Bill Gates and Amazon’s Jeff Bezos. Unlike Gates and Bezos, however, Buffett’s fortune came from investing in other companies. Since Buffett took control of Berkshire Hathaway in 1964, the price of Berkshire’s A shares has increased at an annualized rate of 20.5%, compared with 9.7% for Standard & Poor’s 500-stock index.

Like most wildly successful investors, Buffett makes it sound easy: Buy quality companies with great businesses, and try to buy low when the opportunity arises. Invest for the long term. Those rules—and a canny eye for opportunity—have led Berkshire to stocks as diverse as Apple, Coca-Cola, Costco and Visa.

Most stocks, even the ones Buffett loves, aren’t cheap. “Prices are sky-high for businesses possessing decent long-term prospects,” Buffett said in his 2018 shareholder letter. The eight stocks here embody virtues that Buffett loves. Not all are bargains, but all are high-quality stocks with rock-solid balance sheets, strong competitive advantages, prodigious cash generation or the power to raise prices, even in tough times.

Share prices and other data are as of March 15.

T. Rowe Price

Buffett loves a company with lots of cash and little debt, which means it can see its way through tough times and even snap up rivals at bargain prices when the economy turns south.

Mutual fund company T. Rowe Price (symbol TROW, $102) boasts a balance sheet with no debt. Zero. Zip. Nada. At the end of 2018, the company had $3.02 billion in cash and discretionary investments (money invested in its own funds), up from $2.7 billion a year earlier. The stock yields a hefty 3.0%.

T. Rowe, like other fund companies, is feeling the pressure to lower its fees—good for investors but challenging for the bottom line. Analysts expect a 6.5% increase in earnings per share from 2019 to 2020. Market downdrafts can put a dent in the value of assets under management, as happened in the fourth-quarter 2018 downturn. Nevertheless, the company generated a 13% increase in advisory fees in 2018. And analysts at research firm CFRA estimate that two-thirds of T. Rowe’s assets are in retirement accounts, which tend to stay in one place.

A.O. Smith

Milwaukee-headquartered A.O. Smith (AOS, $51) makes water heaters for customers around the world. The company had $221.4 million in long-term debt at the end of 2018. That’s down from $410.4 million a year earlier, and less as a percentage of shareholders’ equity than the average for companies in similar businesses and the companies in the S&P 500.

Management expects sales to increase 1% to 2.5% in 2019, a cautious outlook that reflects a slowdown in China, the firm’s largest market outside of the U.S. Wall Street shared the company’s caution and knocked the share price down 29.1% in 2018, although it has recovered some since.

The firm can be a wise buyer of its own shares. During the 2018 fourth-quarter market downturn, management snapped up 1.2% of available shares. A.O. Smith has raised its dividend for 27 consecutive years; the shares yield 1.7%. The stock is a good value, considering the company’s healthy 14% net profit margin and a history of beating earnings expectations, says analyst Ryan Connors, of Boenning & Scattergood Equity Research.

Walt Disney

A wide moat is a competitive advantage that keeps corporate competitors away. Sometimes a wide moat can be a brand’s great reputation, such as Apple’s or Coca-Cola’s. Or it can be the cost or the headache of switching to a competitor.

Walt Disney (DIS, $115) has introduced families to such beloved characters as Mickey Mouse, Buzz Lightyear and Princess Anna of Arendelle. They make Disney a premier producer of children’s movies and draw visitors to the company’s theme parks. Studio entertainment, which includes movies and live stage plays (think Disney on Ice), accounts for roughly 12% of the company’s revenues. Media networks, such as ESPN and the Disney Channel, bring in 39%. Theme parks plus consumer products (all those souvenirs!) account for 45% of sales.

Disney is expected to dig a wider moat now that it has closed a $71 billion deal to purchase Twenty-First Century Fox. The acquisition could add more than 350 television channels in 170 countries. Disney has also decided to pull its movies from Netflix and launch its own streaming video service, which investment research firm UBS estimates will draw 50 million subscribers in the first five years. Trading at 16 times analysts’ earnings estimates for the year ahead—a touch less than the S&P 500—the stock looks cheap given Disney’s robust 18.5% profit margin and its growing media stake.

State Street Corp.

Incorporated in Boston in 1832, investment firm State Street Corp. (STT, $70) caters to institutional investors such as mutual funds, retirement plans and investment managers. Funds and other money managers need a separate custodian to hold the securities they buy, and State Street does just that. The company also helps administer pensions and other financial businesses. All told, it has more than $31.6 trillion in assets in custody and administration.

State Street’s moat is twofold: First, its size enables it to be the low-cost provider for many of the world’s largest investment managers, and second, switching from one custodian to another is a headache of Brobdingnagian proportions.

As investment managers have cut fees, State Street has had to embark on major cost-cutting measures of its own. The company expects to realize $350 million in cost savings in 2019. Analysts expect State Street to earn $6.81 per share in 2019 and $7.61 in 2020, compared with $6.40 in 2018. As with T. Rowe Price, a bear market could cut into fees at State Street, but the firm’s solid balance sheet should be more than adequate to weather any storms.

Cisco

A company that generates lots of free cash flow—cash left over after operating expenses and capital outlays—has many options for spending the money. Management can pay dividends, buy back shares, retire debt or buy other businesses.

Cisco (CSCO, $53) makes the internet work through its switches and applications. The company plays a substantial role in internet security, the internet of things, cloud computing and wireless communications. Cisco generated $12.8 billion in free cash flow in 2018, ranking it sixth among all tech companies.

And Cisco wants to share the wealth. The firm plans to return half of its free cash flow to investors in dividends and share repurchases annually. The stock yields 2.5%; Cisco bought back $17.7 billion of its own shares in 2018 and authorized an additional $25 billion worth of purchases for an indefinite period. The shares trade at a price that would make Buffett smile: 16 times estimated earnings for the year ahead.

Progressive Corp.

Insurance companies such as Progressive Corp. (PGR, $74) collect premiums, which they can invest until they need to pay claims—a period that can last many years. Progressive’s assets—the amount available to invest—grew to $46.6 billion in 2018, up 20% from 2017.

The company has been on a growth spurt, with 20.4 million policies in force at the end of 2018, up 12% from 2017. New auto insurance applications rose 20% in 2018 from a year earlier, and property insurance applications jumped 53%. Management has been focusing on retaining those new customers, and its policy life extension, a measure of customer retention, has been improving.

As with any property-casualty firm, there’s always the risk of an uptick in catastrophic events, such as hurricanes and tornadoes.

CSX

“If you’ve got the power to raise prices without losing business to a competitor, you’ve got a very good business,” Buffett told the Financial Crisis Inquiry Commission in 2011. That’s particularly true in a period of tame inflation overall, such as now.

CSX (CSX, $73) operates 21,000 miles of track in 23 states, the District of Columbia, Ontario and Quebec. If you need to move a lot of anything, from cars to coal to corn, CSX can generally do it, and more cheaply than trucks can.

Large companies, such as General Motors, can sometimes dicker with CSX on price, but CSX has good pricing power over smaller customers with limited alternatives, says CFRA analyst Jim Corridore. The company should pick up more of those customers with CSX’s intermodal—train to truck—business, which is especially valuable for shippers seeking to minimize time spent on busy East Coast highways.

Price hikes and fuel savings drove a 10% increase in revenues in the fourth quarter of 2018 compared with the same quarter a year earlier. Analysts expect earnings at CSX to increase 10% in 2019 compared with 2018 and another 11% in 2020.

Costco

Shoppers might think of bargains, not price hikes, when it comes to Costco (COST, $234). But the warehouse club giant (and Buffett holding) raised its regular Gold Star membership fees to $60 from $55 in 2017. Executive memberships (for businesses) went up $10, to $120. Overall, Costco collected $3.1 billion in membership fees in 2018, up from $2.9 billion in 2017. Those fees account for about three-fourths of Costco’s operating profits. The company has a 90% membership renewal rate in the U.S. and Canada, and 88% worldwide.

But much of Costco’s pricing power remains invisible to shoppers. Because the company sells a limited number of products from select suppliers, it is able to negotiate better deals with those vendors.

The company’s shares reflect its premium prospects, so look for a sale on a down day in this volatile market, or else plan to hold for the long term.

Let a Pro Pick for You

If you want to invest like Warren Buffett, you could always buy Berkshire Hathaway B shares (BRK.B, $204). But several mutual funds also concentrate on finding high-quality companies. Jensen Quality Growth (JENSX) looks for stocks that have achieved a 15% return on equity (a profitability measure) for 10 consecutive years. The fund has averaged a 12.9% annual return for the past five years, compared with 11.2% for Standard & Poor’s 500-stock index.

For index fans, there’s Fidelity SAI U.S. Quality Index fund (FUQIX), which tracks the MSCI USA Quality Index. Stocks in the index have a high return on equity, stable earnings growth and low debt. The fund has gained an average 15.6% annually over the past three years, compared with 14.2% for the S&P 500.

Where there’s a mutual fund, there’s generally an exchange-traded fund, and Morningstar tracks 24 ETFs that focus on quality. The largest is iShares Edge MSCI USA Quality Factor ETF (QUAL), which tracks the MSCI USA Sector Neutral Quality index. “Sector neutral” means that it doesn’t place bets on industry sectors but instead keeps them weighted at a set percentage of the portfolio. The fund has squeaked past the S&P 500 with an average 11.5% annual return over the past five years.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.