6 Great Stock Picks for an Aging Bull Market

As any bull market hangs on, it gets harder to find bargains.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

As any bull market hangs on, it gets harder to find bargains. So if you’re looking to put money to work, it’s a good time to be cautious: You want stocks that have a decent shot at moving higher in the near term but that can also avoid a severe drop when the market inevitably suffers a correction (decline of 10% to 20%) or worse. And, of course, you want to invest in businesses that are financially sound and have healthy long-term prospects.

We picked six big companies that we believe are reasonably priced relative to their profits. Five carry price-earnings ratios (based on estimated year-ahead profits) that are at or below the P/E of Standard & Poor’s 500-stock index, currently 17. Just as important, all six are leaders in their industries, and all are strongly committed to returning capital to shareholders by paying dividends, buying back shares or both.

Picks are listed in order of their market capitalization. Prices and related figures are as of March 31. Revenue is based on the past 12 months. EPS is based on estimated earnings for the 2015 calendar year. Sources: Thomson Reuters, Yahoo.

Wells Fargo

- Market value: $280.3 billionRevenue: $84.3 billionEarnings per share: $4.17P/E ratio: 13Yield: 2.6%

It may sound counterintuitive, but a big part of the appeal of Wells Fargo (WFC, $54) now lies in expectations that the Federal Reserve will begin raising short-term interest rates soon. Rising rates typically help banks because they’re quicker to boost interest rates on the loans they make than on what they pay depositors. And Wells has historically gotten away with paying below-average rates on its massive base of deposits, which now exceeds $1 trillion, says Morningstar analyst Jim Sinegal. Wells’s depositors just tend to stay put. Their money has helped Wells become the largest U.S. mortgage lender, as well as the biggest bank by stock market value, worth $280 billion.

If the Fed starts to raise rates because the economy keeps improving, and if that improvement results in higher loan demand, so much the better for Wells, which has a long history of putting capital to work more profitably than most other big banks. A key risk, however, is that higher regulatory costs in the post-financial-crisis era will crimp Wells’s earnings power more than anticipated. As it is, Wall Street isn’t expecting much growth this year; analysts on average peg 2015 earnings at $4.17 per share, up slightly from the $4.10 per share that Wells reported in 2014. But profit is expected to reach $4.55 per share in 2016. And with the blessing of regulators, big banks have been freed to return more money to shareholders. Wells was expected to announce a 7% dividend hike shortly after we went to press, and there’s more to come.

Oracle

- Market value: $188.4 billionRevenue: $38.8 billionEarnings per share: $2.88P/E ratio: 15Yield: 1.4%

Many investors look to the technology sector for excitement. But value-oriented fund managers see mature tech companies, such as software giant Oracle (ORCL, $43), more as portfolio bedrock: solid businesses that are growing slowly but can still generate huge amounts of cash that can be funneled to investors.

Oracle is the dominant supplier of complex database programs and other software that is critical for major corporations. Sales were a record $38.3 billion in the fiscal year that ended in May 2014. But the total was up just 3% from the previous year. Oracle’s business of licensing software to users at a hefty up-front cost is being challenged by so-called cloud computing, which delivers software over the Internet on a pay-as-you-go basis.

Oracle isn’t blind to the threat, and is offering its own cloud-based software solutions. In the meantime, it benefits from the wide product line it has built up over the years. That means many clients find it expensive and risky to dump Oracle, and that helps keep them aboard while the company adapts to cloud computing. Surprisingly, sales in the quarter that ended February 28 rose 6% from the year-earlier period, excluding the depressant effect of currency shifts.

Oracle was confident enough to boost its dividend 25% in March. That, and stock buybacks, have enticed the value-oriented investors at the Yacktman and FPA funds, both of which count Oracle as a top holding. With the stock at a reasonable 15 times estimated year-ahead earnings, Wells Fargo Securities expects the share price to keep “grinding higher.”

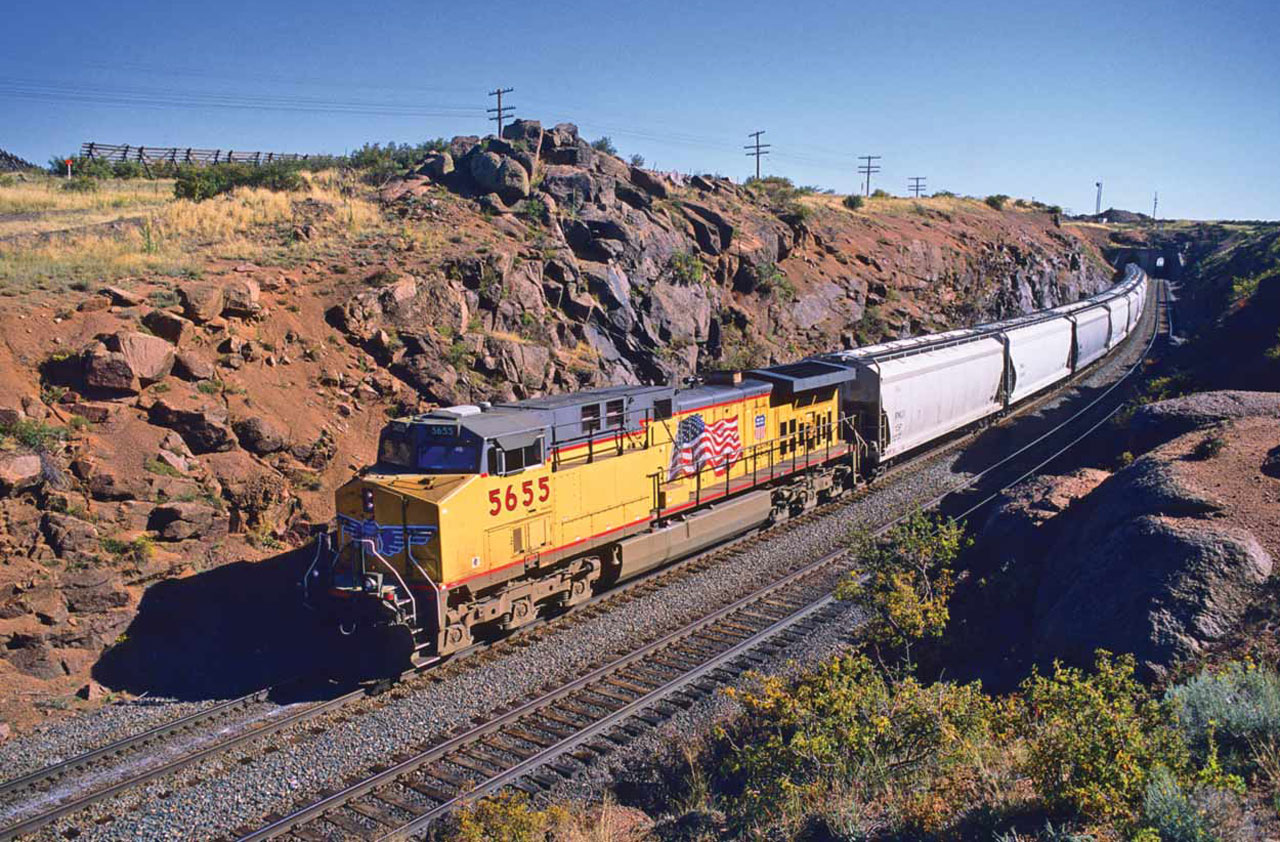

Union Pacific

- Market value: $95.5 billionRevenue: $24.0 billionEarnings per share:: $6.55P/E ratio: 17Yield: 2.0%

Start-up businesses are disrupting all sorts of established industries today. But no start-up has figured out how to magically move a ton of grain, steel or coal a thousand miles. For that, we still depend on railroads. What may surprise many investors is just how lucrative the railroad industry has been in this new millennium. Union Pacific (UNP, $108), the largest U.S. rail line, saw sales rise from $13.6 billion in 2005 to $24 billion in 2014, while earnings rocketed from $1 billion to $5.2 billion. The stock has soared 783% since 2005, nearly seven times the gain of the S&P 500. Simply put, the railroad infrastructure is highly efficient at moving goods and is impossible to replicate. The stock market gets it.

Even so, the business is subject to cyclical swings. With the crash in oil prices, shipments from the midwestern shale-oil belt are expected to decline in the near term. Likewise, winter labor strife at West Coast ports caused shipping delays. Fears of weakening traffic have slammed rail stocks recently, driving Union Pacific from a high of $125 to $108.

But the drop is a gift to investors who can hold on for the next 10 years. The shares are now priced at 17 times estimated 2015 earnings and sport a dividend yield of 2.0%, the same as the overall market. BB&T Capital Markets says that Union Pacific has the most diversified shipping mix of any railroad. What’s more, the company boasts a long string of years with double-digit-percentage annual profit growth, interrupted only briefly by the 2007–09 recession. And even then, earnings fell a relatively modest 17% in 2009 before quickly rebounding.

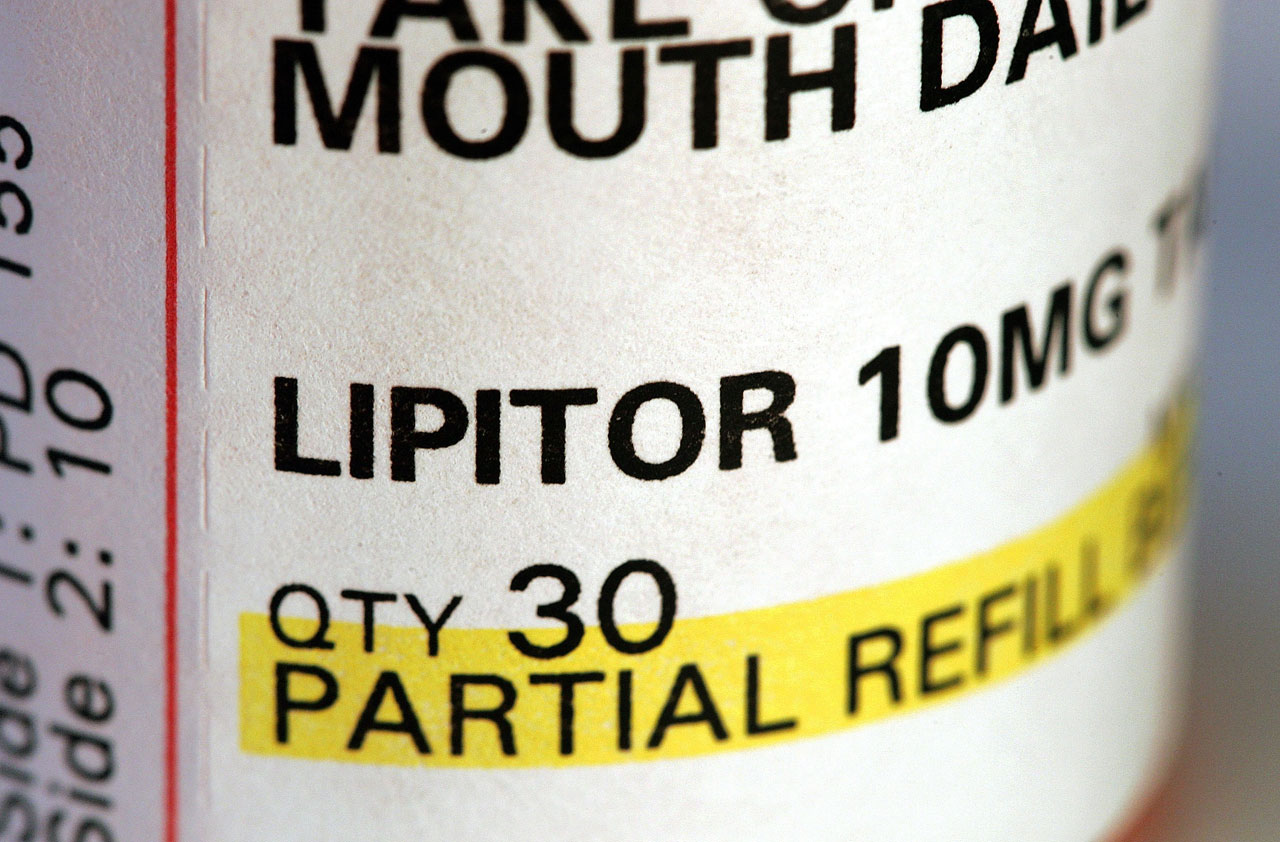

Express Scripts

- Market value: $63.1 billionRevenue: $100.9 billionEarnings per share: $5.43P/E ratio: 16Yield: 0.0%

Pharmacy-benefit manager Express Scripts (ESRX, $87) is a work in progress, which helps explain why the market has been somewhat standoffish about the stock. The company mushroomed in size when it bought rival Medco in 2012. It’s now the biggest U.S. drug-benefit manager, filling 1.3 billion prescriptions in 2014 and racking up gargantuan sales of $101 billion.

But the merged firm is still integrating operations, which has caused service disruptions and has driven some corporate clients to drop Express Scripts. The ongoing integration problems have also led the company to get investors to focus on financial results that exclude temporary merger costs. By that measure, the firm earned $4.88 per share in 2014, up 13% from 2013. In 2015, the company expects a profit of at least $5.35 per share. With the stock at $87, the P/E is 16.

The stock’s fans say the market isn’t paying enough, given Express Scripts’ potential. An aging population means rising consumption of drugs. The biggest drug-benefit manager should have an advantage in ensuring its own profitability, as well as working to keep drug costs down for consumers. Express Scripts showed its clout in December, when it forced two makers of costly hepatitis C treatments into a price war.

Brokerage Raymond James thinks the stock is undervalued in part because of expected U.S. approval of “biosimilar” drugs in the next few years. Biosimilars are essentially cheaper versions of drugs now used to fight many cancers and other serious diseases. Their arrival should allow many more patients to get treatment for deadly illnesses.

Accenture

- Market value: $58.9 billionRevenue: $32.4 billionEarnings per share: $4.78P/E ratio: 20Yield: 2.2%

“Never give advice. Sell it!” goes the old vaudeville line. That strategy has built Accenture (ACN, $94) into a global leader in consulting, delivering advice to companies and governments on management, technology and other issues. The firm is also a big provider of outsourcing services, such as call centers.

But as a sluggish world economy and rising competition have held back growth in some of Accenture’s traditional lines, the company has pushed hard into digital services, such as advising businesses on social media. The move is paying off: Growth in digital services was a key reason revenues rose a brisk 12% in the quarter that ended February 28, before adjusting for the strong dollar. Accenture also raised its revenue growth forecast for the full fiscal year, which ends in August, to 8%–10% (before currency-swing adjustments ), from 5%–8%.

Accenture’s digital-services revenues rose 20% in the first half of the fiscal year and now account for 20% of total revenues, says analyst Lou Miscioscia, of investment firm CLSA Americas. “We are still in the early innings of digital,” he says. More companies will seek help with digital strategies, “driving considerable growth for Accenture,” he adds. But as has been the case at many multinational firms, the strong dollar is vexing Accenture. Although the company is based in Ireland, it operates worldwide and reports results in dollars. Its 12% revenue gain in local currencies last quarter became a modest 5% increase in greenbacks.

The strong buck is also holding back earnings. Wall Street sees a profit of $4.78 per share in the current calendar year, up just 5% from the previous year. Based on this year’s estimate, the P/E is 20. But knowing that currency turmoil is transient, investors are willing to pay up for the prospect of better future growth and the likelihood that Accenture will keep boosting its dividend, Miscioscia says.

Macy’s

- Market value: $22.1 billionRevenue: $27.9 billionEarnings per share:: $4.78P/E ratio: 14Yield: 1.9%

The conventional wisdom is that department stores are on the road to extinction. But Macy’s (M, $65) seems to have taken a bypass. Sales have continued to edge higher since the 2007–09 recession, even as the retailer has closed underperforming stores. More important, Macy’s has boosted earnings every year since 2009 and driven up its net profit margin (net profits as a percentage of revenues) to levels that now exceed those of rivals Kohl’s and Nordstrom. Macy’s has also focused on channeling cash to shareholders via stock buybacks and by raising its dividend more than fivefold since 2010. All in all, Morgan Stanley calls Macy’s “the best-positioned department store.”

Still, the trend toward online shopping isn’t about to reverse. In 2014, Macy’s joined the growing ranks of retailers that allow shoppers to buy online and pick up their items in stores. After lifting profit margins over the past five years, the retailer’s goal now is to maintain those margins while driving faster sales growth in its 825 Macy’s and Bloomingdale’s stores and online, says brokerage Stifel Nicolaus. One new step in that direction: Macy’s is buying cosmetics and spa chain Bluemercury and plans to open locations in select stores. Macy’s shares have soared from $8 to $65 over the past six years, but at 14 times estimated earnings for the fiscal year that ends in January 2016 and yielding 1.9%, the stock is a solid bet in a growing economy, says Stifel.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Stocks See First Back-to-Back Losses of 2026: Stock Market Today

Stocks See First Back-to-Back Losses of 2026: Stock Market TodayRising geopolitical worries and a continued sell off in financial stocks kept pressure on the main indexes on Wednesday.

-

Stocks Swing in Volatile Session: Stock Market Today

Stocks Swing in Volatile Session: Stock Market TodayThe main indexes fell sharply in early trading on rising China tensions, but rebounded thanks to encouraging bank earnings.

-

The Best Bank Stocks to Buy

The Best Bank Stocks to BuyBank stocks are part of the financial services sector and are a way to gain exposure to the broader economy. Here, we look at how you can find the best ones.

-

Stock Market Today: Nasdaq Hits a New High as Nvidia Soars

Stock Market Today: Nasdaq Hits a New High as Nvidia SoarsA big day for Nvidia boosted the Nasdaq, but bank stocks created headwinds for the S&P 500.

-

Stock Market Today: A Historic Quarter Closes on High Notes

Stock Market Today: A Historic Quarter Closes on High Notes"All's well that ends well" is one way to describe the second quarter of 2025, at least from a pure price-action perspective.

-

We Are Peter Lynch: How to Invest in What You Know

We Are Peter Lynch: How to Invest in What You KnowTake a look around, go to a free stock market data website, and get to work.

-

Stock Market Today: Uncertainty Proliferates: Dow Loses 1,014 Points

Stock Market Today: Uncertainty Proliferates: Dow Loses 1,014 PointsWeaker-than-expected consumer inflation data wasn't enough to stabilize sentiment during another volatile day for financial markets.

-

Stock Market Today: Dow Rises 854 Points From Its Intraday Low

Stock Market Today: Dow Rises 854 Points From Its Intraday LowIf there's one thing markets hate, it's uncertainty. But uncertainty is all they're getting these days.