7 Cult Stocks: Worth Your Devotion?

A longstanding rule on Wall Street is that you should never fall in love with a stock.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A longstanding rule on Wall Street is that you should never fall in love with a stock. But with some companies, investors just can't help themselves: Strong belief in the product, the company's mission and the long-term success of the business can create a cult-like aura around a stock, driving the price to nosebleed levels. That can lead to phenomenal investment success—or massive losses, if things go wrong.

We identified seven stocks that have drawn some of the most intense cult followings and analyzed the arguments for and against them. To make our list, a company had to have a product, service or mission that many consumers have embraced, and the business had to have powerful growth prospects. The heart of the debate, then, becomes what price to pay for the shares, given the risks and the often severe volatility that come with being so intensely adored.

Because we believe that all seven companies have investment appeal at some price, we rate each either "buy" or "pass"—the idea of "pass" being that investors would be better served by waiting for a lower share price to get in. The companies are listed by market capitalization.

Stock prices and related data are as of March 5. Price-earnings ratios are an average of 2015 estimates. Companies appear in order, from largest to smallest, based on market capitalization (share price times number of shares outstanding).

Apple

- Market cap: $736 billionEstimated 2015 earnings growth: 33.2%Estimated 2016 earnings growth: 7.1%Price-earnings ratio: 15

- Apple (AAPL, $126.41) is the cult stock that every cult stock aspires to be. Its early customers, in the 1980s, were the ultimate tech nerds who always believed Apple had a better way and that its technology would eventually wow the world. They were right, though it took until the new millennium for Apple to launch the products that would captivate consumers and Wall Street. Since 2002, the stock has leapt from a split-adjusted 97 cents a share to $126, as Apple's astounding sales and profit growth have made it the world's most valuable company, with a market value of $736 billion.

- Our call: Buy, if you believe Apple's creative genius hasn't peaked. Its $178 billion investment hoard is a rich treasure chest to fund big ideas for a long time to come as well as provide the cash for steadily rising dividends.

But what does the premier cult stock do for an encore? Apple primarily owes its success to its iPhone, which in the fiscal year that ended in September 2014 accounted for 56% of the company's $183 billion in sales and the bulk of its $39.5 billion in profit. So in the near term, a bet on Apple is a bet that tens of millions of global consumers will continue to see the iPhone as indispensable. Accountability Research Corp., an investment advisory firm, sees no slowdown in iPhone momentum and expects strong sales to drive a 33% jump in Apple's earnings in the current fiscal year. But longer term, the Cupertino, Calif., company will need more huge hits in products and services—such as its new payment system, Apple Pay, the upcoming Apple Watch, and the now widely rumored electric car.

The stock’s remarkable run notwithstanding, Apple trades at a relatively low price-earnings ratio: 15 times estimated current-year profits. Investors clearly fear that, given Apple’s massive size, few new ideas will be big enough to significantly boost future results. CEO Tim Cook rejects that idea. Steve Jobs, Apple's late cofounder, "ingrained in us that putting limits on your thinking [is] never good," Cook said at a tech investor meeting in February.

Amazon.com

- Market cap: $180 billionEstimated 2015 earnings growth: Not meaningful*Estimated 2016 earnings growth: 441.5%Price-earnings ratio: 946

- Our call: Pass. With its share price up 35% since last October, Amazon has regained its cult status. But at that level, the stock's P/E is an off-the-charts 946 on estimated 2015 earnings and a still-stratospheric 175 on forecasted 2016 earnings.

Of all the current A-list cult stocks, perhaps none has had a more patient shareholder base than Amazon (AMZN, $387.83). What began as an Internet bookseller 20 years ago has become the dominant online retailer and has branched into smartphones (Fire Phone), entertainment (Amazon Studios), business computer services (Amazon Web) and more. But while revenue soared from $8.5 billion in 2005 to a record $89 billion in 2014, profits peaked in 2010 at $1.15 billion, or $2.53 per share. Amid surging spending to launch new ventures, Seattle-based Amazon was back in the red in two of the past three years.

That made for a rough 2014, as some investors' tolerance wore thin. The stock peaked above $400 early in 2014, then dived as low as $284 in October. But even as Amazon reported a loss for the full year, its fourth-quarter profit of 45 cents a share far surpassed expectations—and raised fresh hopes for sustained earnings growth. Morgan Stanley says it is "increasingly convinced Amazon is entering a phase of improving profitability." One key is the Amazon Prime service, which for $99 a year provides two-day shipping on goods, plus streaming movies and other services. Amazon doesn't disclose the number of Prime members, other than that it's in the "tens of millions" and rose 53% in 2014. Still, even though Amazon has shown it can make money, the question is whether CEO Jeff Bezos is willing to restrain expansion spending enough to keep earnings rising.

*Amazon reported a loss for 2014.

Netflix

- Market cap: $28 billionEstimated 2015 earnings growth: -7.6%Estimated 2016 earnings growth: 60.4%Price-earnings ratio: 137

- Our call: Pass. The P/E is a rich 137 based on estimated 2015 earnings. A pullback to $300 again would make the stock much more intriguing.

The investor cult around Netflix (NFLX, $467.65) nearly disbanded in 2011 and 2012, as the company's decision to split its DVD movie rental business and its online streaming business into separate entities triggered a bitter backlash, drove its stock from $300 to $50, and fueled predictions that the company was finished. It was a dumb bet: As Netflix’s leaders foresaw, the streaming business has mushroomed. The Los Gatos, Calif., company today is the biggest U.S. name in video on demand, with 57.4 million members worldwide—24.1 million of whom joined in the past two years. Financial results hit records in 2014, with revenues of $5.5 billion and earnings of $267 million, or $4.32 a share. As Wall Street saw what was coming, the stock recovered in 2013 and topped $450 by early 2014.

But over the past year, the shares have swung between $314 and $484 as investors have again hotly debated Netflix's future. Some analysts see a peak in streaming customers on the horizon and wonder what happens after that. FBR Capital Markets figures that Netflix’s U.S. business will reach saturation at between 60 million and 90 million subscribers. At 39 million now, "Netflix's domestic subscriber growth appears to be slowing as it gets closer to the low end" of its limits, FBR says. Netflix is expanding worldwide and also is committed to producing more original programming, such as "House of Cards," as it battles rivals Amazon, Hulu and others for eyeballs. Morningstar notes that Netflix has been brilliant about mining data on what its subscribers watch to decide what kind of new content to finance. But analysts worry that earnings could flag as the company spends more to expand overseas and produce new programming. Netflix is asking investors to sit tight. "We intend to generate material global profits from 2017 onwards," the company says.

Tesla Motors

- Market cap: $25 billionEstimated 2015 earnings growth: Not meaningful*Estimated 2016 earnings growth: 333%Price-earnings ratio: 207

- Our call: Pass at this price, unless your faith in Musk is absolute—and you can hold for five to 10 years. Morningstar assesses Tesla's "fair value" at $193 a share but warns that the expectations built into the stock at these levels are "immense."

Of the seven cult stocks on our list, only one company has yet to turn an annual profit: Tesla Motors (TSLA, $200.63). The long-term prospects of Tesla's electric car technology also may trigger the most heated discussions of any of the seven, given the huge environmental ramifications of the fossil-fuel-versus-electric debate. Tesla shares shot from $30 at the end of 2012 to a record $291 last September as the company ramped up production of its first mass-market car, the Model S. Consumer Reports has ranked it the overall best car for two years straight. Yet the market lately has grown more doubtful about the company's potential, and the shares have slumped. It didn't help that the Palo Alto, Calif., firm lost money again in the fourth quarter, when Wall Street expected a profit. For all of 2014, Tesla lost $294 million, or $2.36 per share, on sales of $3.2 billion.

For investors, it often comes down to Tesla’s visionary, 43-year-old cofounder, Elon Musk: Do you believe his hype, or not? In his year-end letter to shareholders, Musk blamed the fourth quarter loss in part on bad weather, which blocked some car shipments. Nonetheless, he said, Tesla was on track to deliver a total of about 55,000 Model S (sedan) and new Model X (SUV) cars in 2015, up 70% from 2014. But even if Musk can deliver as promised in 2015, the longer-term question is whether enough people will spend $71,000 and up on Tesla cars to make the company an auto powerhouse, especially as competition rises. Musk, of course, is confident. He recently said that he believes Tesla's market value could reach $700 billion in 10 years, up from $25 billion now.

*Tesla reported a loss for 2014.

Chipotle Mexican Grill

- Market cap: $20.8 billionEstimated 2015 earnings growth: 21.7%Estimated 2016 earnings growth: 19.9%Price-earnings ratio: 39

- Our call: Buy—if you can take the long view and can handle the risk of a stock priced at 39 times estimated 2015 earnings. If fast-casual dining keeps eating fast-food's lunch, Chipotle is the future.

Every cult stock makes enemies. In April 2013, Chipotle Mexican Grill (CMG, $670.49) learned that it had one of America’s top investors rooting against it. Jeffrey Gundlach, the bond guru who heads DoubleLine, suggested "shorting" the restaurant chain's stock—that is, betting that the price would plunge—after its spectacular gains over the prior four years. " 'Gourmet burrito' is an oxymoron," Gundlach said, implying that Chipotle's consumer appeal was overblown. But the bond maestro got this call dead wrong: After a brief selloff that spring, Chipotle's shares have almost doubled since Gundlach's dig.

Chipotle has been one of the biggest stars in the restaurant industry's "fast casual" niche, a genre that offers made-to-order meals at relatively low prices. While many fast-food companies struggled, Chipotle saw its sales soar from $1.1 billion in 2007 to $4.1 billion in 2014 and its earnings surge from $71 million to $445 million, or $14.13 per share. Yet the Denver company, with almost 1,800 stores and plans to open about 200 more this year, is cautious about 2015. It predicts that sales at stores open at least one year will rise in the low- to mid-single-digit percentages, down sharply from nearly 17% in 2014. Execs could just be setting the bar low. But even if the forecast is accurate, brokerage Sterne Agee says that Chipotle has long-term appeal: "We believe that CMG has created the best restaurant model to date…that can be replicated across various food categories. This creates a multi-decade growth opportunity." Sterne Agee notes that Chipotle already is experimenting with Asian and pizza chains.

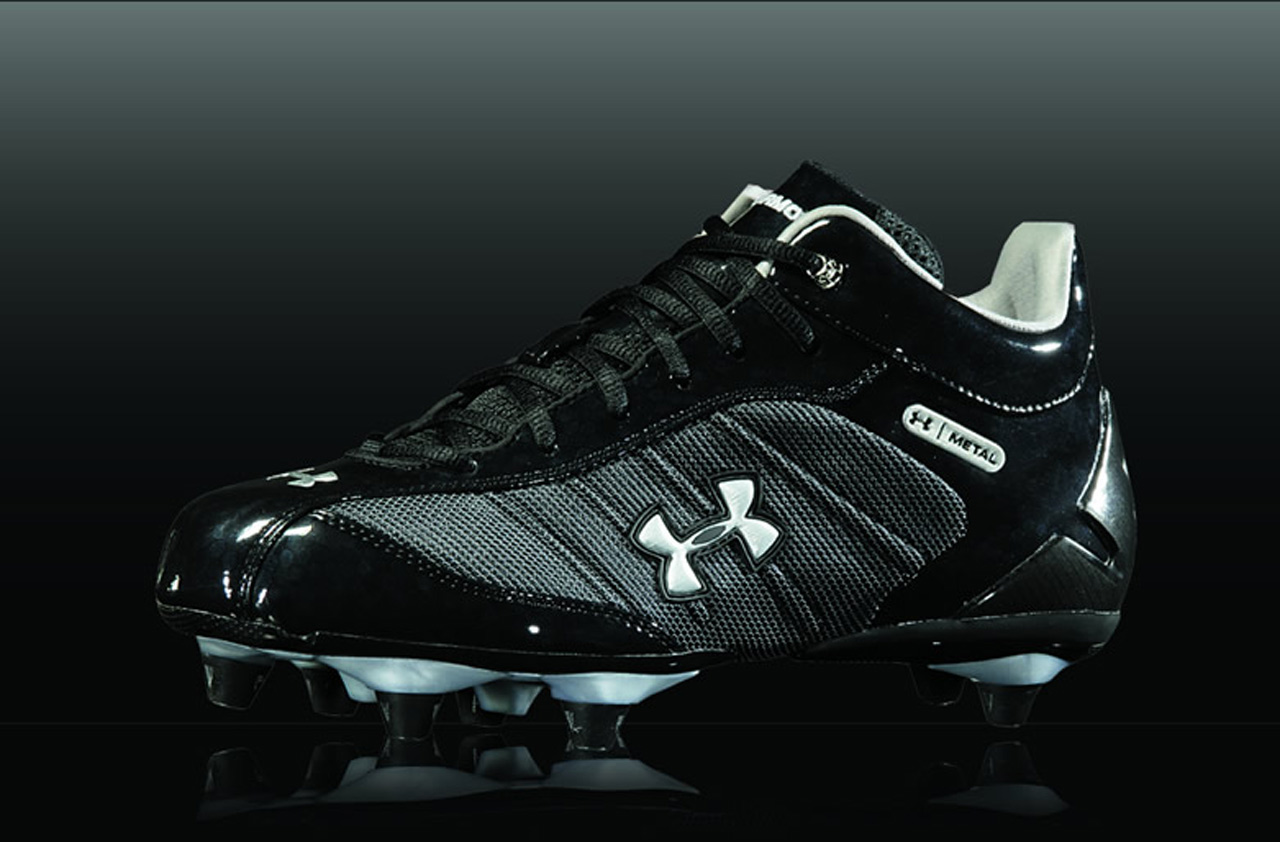

Under Armour

- Market cap: $16.2 billionEstimated 2015 earnings growth: 13.7%Estimated 2016 earnings growth: 33.3%Price-earnings ratio: 70

- Under Armour (UA, $75.79) has prospered at the intersection of two cultish businesses: fashion and fitness. Its investor fans believe the athletic apparel maker's potential remains huge. Critics look at the stock's valuation—70 times estimated 2015 earnings—and say one misstep could mean catastrophe for shareholders. Both camps may well be right. For now, the stock continues to hit new highs, buoyed by the 19-year-old company's dramatic recent growth. Year-over-year sales have risen more than 30% for five straight quarters, as consumers have snapped up the firm’s athletic performance wear—apparel mainly designed to keep athletes cool or warm, dry and light. The Baltimore company earned a record $208 million, or 95 cents a share, in 2014 on sales of $3.1 billion.

- Our call: Pass. After more than tripling over the past two years, the stock price leaves no room for even slight disappointment. Any stumble, though, could provide a great opportunity to get aboard.

By sales, Under Armour is about one-tenth the size of rival Nike (NKE). Bulls say that shows that Under Armour’s growth prospects are mammoth, particularly overseas. Although foreign revenues are just 9% of total sales, the figure doubled last year. The company now is making some major moves to drive long-term growth. Most intriguing is Under Armour's continuing push into online fitness-monitoring services. It agreed in February to pay $475 million for MyFitnessPal. Combined with two smaller such services previously acquired, the deal gives Under Armour a base of 120 million consumers worldwide to monitor—and market to, says Wells Fargo Securities. But the cost of these expansion moves will put pressure on near-term earnings.

GoPro

- Market cap: $5.3 billionEstimated 2015 earnings growth: 5.3%Estimated 2016 earnings growth: 20.9%Price-earnings ratio: 30

- Our call: Pass. The stock is down but still trades at 30 times estimated 2015 earnings. That’s a steep price to pay for a hardware maker, even one as exciting as GoPro.

Action-camera maker GoPro (GPRO, $41.08) is the smallest of our seven cult stocks, but the company's millions of customers—some of whom undoubtedly also are shareholders—may well be the most rabid devotees in the bunch. GoPro's rugged, go-anywhere video cameras ($130 and up) have come to define active, curious and passionate lifestyles. And the company is trying to appeal to a much broader audience than just extreme surfers and bungee-jumpers. The pitch is that any favorite activity is worth GoProing and sharing. Investor excitement over GoPro's future made for a wild stock debut last June. The San Mateo, Calif., company went public at $24, jumped 31% on the first day, then climbed to $98 by October. Since then, however, the shares have surrendered 56%.

In part, Wall Street has feared that company insiders would dump an avalanche of shares once "lock-up" restrictions expired after the stock's debut. Indeed, insiders have sold some of their shares, not surprisingly. But the biggest weight on the stock is uncertainty about future growth. GoPro is just 10 years old, and although sales hit a record $1.4 billion in 2014 (up 41% from 2013), the size of the market is a question mark—as is the level of competition GoPro will face. Analysts expect sales of $1.7 billion and earnings of $1.39 per share this year, then $2.1 billion and $1.68 in 2016. The long-term wild card is the burgeoning growth of the online GoPro Network, on which the company shares user videos. The idea, brokerage Stifel, Nicolaus & Co. says, is that "captivating content leads to product purchases" while also bringing in a wealth of ad and licensing revenue. But for now that's the dream, not the reality.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Look Out for These Gold Bar Scams as Prices Surge

Look Out for These Gold Bar Scams as Prices SurgeFraudsters impersonating government agents are convincing victims to convert savings into gold — and handing it over in courier scams costing Americans millions.

-

How to Turn Your 401(k) Into A Real Estate Empire

How to Turn Your 401(k) Into A Real Estate EmpireTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

My First $1 Million: Retired Nuclear Plant Supervisor, 68

My First $1 Million: Retired Nuclear Plant Supervisor, 68Ever wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

Dow Dives 870 Points on Overseas Affairs: Stock Market Today

Dow Dives 870 Points on Overseas Affairs: Stock Market TodayFiscal policy in the Far East and foreign policy in the near west send markets all over the world into a selling frenzy.

-

Small Caps Can Only Lead Stocks So High: Stock Market Today

Small Caps Can Only Lead Stocks So High: Stock Market TodayThe main U.S. equity indexes were down for the week, but small-cap stocks look as healthy as they ever have.