8 Good Dividend Stocks Trading at Bargain Prices

In a high-flying stock market, some nervous investors are looking for insurance.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

In a high-flying stock market, some nervous investors are looking for insurance. Here's an old-school idea: Buy big-name stocks with above-average dividend yields and below-average price-earnings ratios.

Some on Wall Street call them YARP stocks, for “yield at a reasonable price.” Not surprisingly given the bull market's age, relatively few stocks offer both high yields and good value. But with help from research firm Morningstar, we found eight to highlight.

To make our initial cut, a company had to have a market capitalization of more than $5 billion. Then we looked for stocks that were cheaper than, and yielded more than, Standard & Poor's 500-stock index. To be specific, we sought stocks that yielded at least as much as the index’s 2.1% yield and traded for less than its price-earnings ratio of 17 (based on estimated year-ahead earnings).

The caveat is that YARP stocks tend to be slow-growing businesses. In other words, they're cheap for a reason. But we also wanted our picks to have catalysts to potentially drive faster growth, as well as a commitment to rising dividends.

Stocks are listed alphabetically. Prices and related data are as of September 1. Price-earnings ratios are based on estimated earnings over the next four quarters.

AFLAC

- Symbol: AFLShare price: $73.87Market capitalization: $30.3 billionDividend yield: 2.2%52-week high/low: $74.50/$54.57Estimated earnings per share: 2016, $6.85; 2017, $6.99Price-earnings ratio: 11

- The business: Famous for its unusual spokesman, an accident-prone duck, Aflac is a major provider of insurance policies in the U.S. and Japan. Its policies typically fill in gaps in its clients’ primary coverage. The U.S. business includes policies for accidents, cancer, dental care and short-term disability. The Japanese business also includes health care policies as well as life insurance. Aflac is Japan's biggest life insurer.

- The valuation story: Aflac has been a great success story, particularly in Japan. Japan accounted for about 70% of the company’s revenue of $20.8 billion last year. But Wall Street worries that Japan's relative dearth of young people will sap Aflac's growth. What's more, Aflac, like most insurers, has seen its investment income slide amid record-low bond yields. Aflac is aggressively boosting sales efforts in both the U.S. and Japan. In the latter, post offices are a popular place to buy insurance. In mid 2015, Aflac doubled, to 20,000, the number of Japanese post offices that sell its cancer insurance policies. Still, in the near term, analysts on average see earnings edging up just 2% in 2017, to $6.99 per share. The stock sells for just 11 times estimated year-ahead earnings. Bulls say the market is underestimating Aflac's long-term potential, given its strong brand name and robust finances.

- The yield story: The 2.2% dividend yield slightly tops the overall market’s. But the main attraction for many investors has been Aflac's track record: 33 straight years of dividend increases. And because the current payout amounts to less than 11% of annual free cash flow (cash profits left after the capital expenditures needed to maintain the business), Aflac has ample room for further dividend hikes and share buybacks. This is a stock for investors who prefer a slow-but-steady strategy to build wealth.

BB&T

- Symbol: BBTShare price: $38.32Market capitalization: $31.2 billionDividend yield: 3.1%52-week high/low: $39.47/$29.95Estimated earnings per share: 2016, $2.75; 2017, $3.06Price-earnings ratio: 13

- The business: With $222 billion in assets, North Carolina-based BB&T is one of the nation's biggest regional banks. It operates in 2,279 locations across 15 states, mostly in the South and Mid Atlantic. Total revenue was a record $9.8 billion in 2015.

- The valuation story: Financial stocks have historically traded at relatively low P/Es, in part because of their above-average risks. After the banking sector's near-meltdown in 2008, many investors have become even warier of the stocks. Yet unlike many of its larger and smaller peers, BB&T remained profitable throughout the financial crisis. The stock sells for 13 times estimated year-ahead earnings, but bulls, including brokerage SunTrust Robinson Humphrey, say the shares deserve better given BB&T's high-quality loan portfolio, strong deposit growth and successful strategy of expanding via careful acquisitions of smaller banks. SunTrust expects more investors to take notice of BB&T in the next six to 12 months, as profits improve due to cost savings from recent acquisitions and as the company ramps up share buybacks.

- The yield story: The 3.1% yield is higher than those of many of BB&T’s regional peers and also is above the yields on high-quality megabanks Wells Fargo (WFC) and JPMorgan Chase (JPM). BB&T has increased the payout twice this year, by 3.7% on June 1 and by 7% on Sept. 1. It's worth remembering, too, that BB&T (like most banks) would benefit if the Federal Reserve pushed interest rates higher — because loan rates typically rise faster than rates banks pay on deposits. A boost in earnings from higher rates could also translate into faster dividend growth.

Boeing

- Symbol: BAShare price: $129.90Market capitalization: $82.1 billionDividend yield: 3.4%52-week high/low: $150.59/$102.10Estimated earnings per share: 2016, $6.31; 2017, $9.64Price-earnings ratio: 13

- The business: Boeing is one of the world's major manufacturers of commercial jetliners, with Europe's Airbus its only significant rival. Boeing has six commercial jets in production: the 737, 747, 767, 777, 777X and 787. The company also is one of the largest defense contractors in the world.

- The valuation story: Wall Street has accepted that 2016 will be a disappointing year for Boeing. The company recorded one-time charges for production-cost issues in both its jet and defense units in the second quarter. The result: Full-year profit is expected to fall to $6.31 per share from a record $7.44 in 2015. Total revenue may slip about 2%, to $94 billion, because of weakness in defense spending. Boeing stock, which peaked near $160 early in 2015, declined for much of that year, then dived to as low as $102 in February 2016 following reports that U.S. securities regulators had concerns about the firm's accounting. But the stock recovered fairly quickly, for one key reason: Investors still see blue skies ahead for Boeing, thanks to its mammoth backlog of 5,800 jet orders. With airlines' fleets aging and with global travel rising, demand for new jets remains robust. Research firm S&P Capital says Boeing's write-offs in the April-June quarter "cleared the deck," allowing investors to focus on future growth. Profit is seen at a record $9.64 per share in 2017. Looking further ahead, Boeing projects that it will deliver 900 jets in 2019, compared with 740 this year. And the P/E, at 13, is well below the market’s P/E.

- The yield story: As cash generated by Boeing's business has surged over the past five years, the company has sharply boosted its dividend — from $1.68 per share in 2011 to the current annualized rate of $4.36. As long as demand for jets holds up, Boeing's dividend largesse should, too. But investors should keep in mind that building jets is a complicated business. For the stock, if not the dividend, there's more risk in Boeing than in many simpler companies.

Cisco Systems

- Symbol: CSCOShare price: $31.58Market capitalization: $160.4 billionDividend yield: 3.3%52-week high/low: $31.88/$22.46Estimated earnings per share: fiscal year ending July 2017, $2.43; fiscal year ending July 2018, $2.56Price-earnings ratio: 13

- The business: Cisco is the world's largest manufacturer of computer networking equipment, such as routers and switches. Its hardware is the backbone of the internet. The company generated earnings from operations of $12 billion, or $2.36 per share, on revenue of $48.7 billion in the fiscal year that ended July 31.

- The valuation story: Given Cisco's size and the extent of its domination of the hardware markets, its fast-growth days are just a memory. In the last fiscal year, sales rose a mere 3%. That slow growth explains the stock's low P/E of 13. Yet value-hunting investors have made the stock a big winner over the past four years, with the price doubling in that period. Cisco's appeal now is twofold: First, its massive router and switch business generates huge amounts of cash, which supports fat dividends. Second, it is slashing costs in its old-line businesses while investing heavily to drive a new growth phase: selling software to run its hardware. The idea is to offer Cisco's hardware users a way to make their computer networks more efficient and easier to manage. For Cisco, the attraction of software is that profit margins are richer than for hardware.

- The yield story: There is no guarantee Cisco will succeed in significantly boosting growth. But investors can still be confident about earning hefty dividends along the way. Since 2011, the dividend has risen at an annualized rate of 34%. With $66 billion in cash and securities on its balance sheet, Cisco has the resources to keep dividend hikes coming. Brokerage Barclays calls the company a "steady ship and an attractive industrialized tech play."

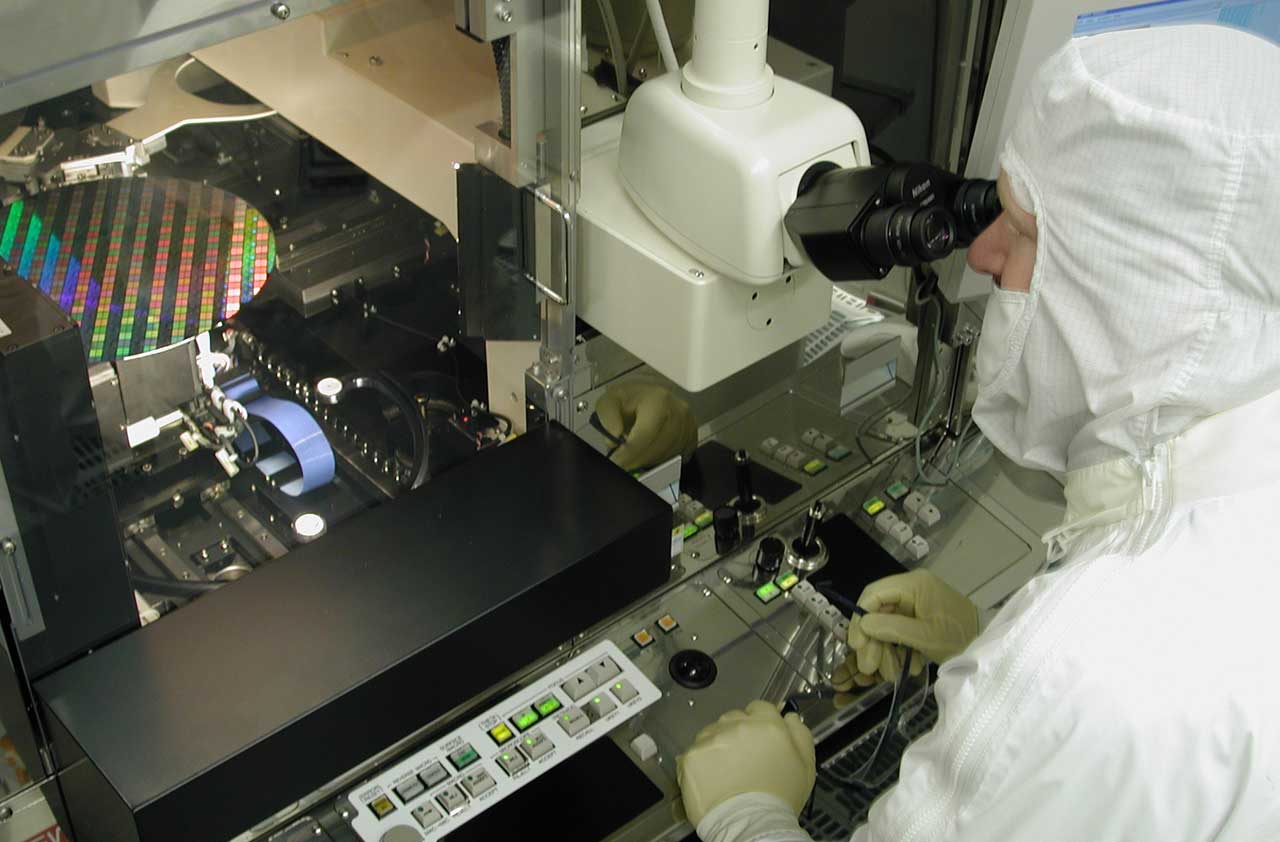

Intel

- Symbol: INTCShare price: $36.02Market capitalization: $170.9 billionDividend yield: 2.9%52-week high/low: $36.30/$27.68Estimated earnings per share: 2016, $2.50; 2017, $2.73Price-earnings ratio: 14

- The business: The world's largest manufacturer of microprocessors, Intel is synonymous with the rise of Silicon Valley and the personal computer. As PC sales fade, the company is betting its future on a more diverse menu of chips.

- The valuation story: The decline of PC sales is forcing Intel to reinvent itself, but the process has been slow. Total revenue of $55.4 billion in 2015 was up just 2.5% from 2011, and per-share earnings were down 2.5% over the same period. The lack of growth has, understandably, left investors unwilling to put a high valuation on the shares, which trade for just 14 times estimated year-ahead earnings. But optimism about 2017 has given the stock a lift this year, to its best levels since early 2015. Bulls on Intel note the pickup in demand for chips used in powerful servers at the heart of "cloud" computing (the delivery of myriad computer services via the internet). S&P Capital also sees "significant opportunities" in new memory chips and in chips for the "Internet of Things" (smart household appliances, for example). Another profit source: Intel has ramped up making chips under contract for other companies, including for cell phones — a sector in which Intel stumbled badly with its own chip designs. All in all, analysts on average see sales hitting a record $59.8 billion in 2017 and profits reaching a record $2.73 per share.

- The yield story: Intel hasn't been as generous with dividends as some other tech giants. The company's payment has risen 8.7% per year, on average, since 2010. Still, the current yield is a decent 2.9%. That may be enough for optimists who are content to bet on — and wait for — Intel's new chip opportunities to finally generate substantial returns.

Qualcomm

- Symbol: QCOMShare price: $63.47Market capitalization: $93.5 billionDividend yield: 3.3%52-week high/low: $63.70/$42.24Estimated earnings per share: 2016, $4.29; 2017, $4.75Price-earnings ratio: 14

- The business: Founded in 1985, Qualcomm is the genius behind much of the technology that makes cell phones work. It is a major designer of computer chips for wireless phones and also earns royalties from other companies that license its cell technology.

- The valuation story: Qualcomm's shares soared from nearly $10 in 2002 to more than $80 in 2014 as revenues and profits surged. But since 2014, a number of challenges have caused earnings to decline and raised doubts about the company's long-term outlook. One issue is rising competition from such chip giants as Samsung. Another worry: government probes into the fairness of Qualcomm's licensing fees. Qualcomm shares were nearly cut in half from April 2014 to February 2016, before rebounding this year. But with the stock trading at 14 times estimated year-ahead earnings, brokerage Goldman Sachs says it’s still a bargain. Qualcomm delivered a surprisingly strong profit report for the quarter that ended June 30, and Goldman says the company was "particularly positive" about both global chip demand and about resumed royalty collections in China, which settled its probe with Qualcomm in 2015. Long term, the company expects to benefit from advances in phone technology and from chip demand from emerging industries, such as self-driving cars.

- The yield story: Qualcomm's royalties, about 35% of total revenue, have helped fund a generous dividend. The per-share payment has nearly doubled since 2012, and the stock now yields 3.3%. What's more, Qualcomm’s hoard of $31 billion in cash and investments provides security for the dividend and the wherewithal for reinvesting in the chip business. That said, the key to additional gains in the share price is whether last quarter's earnings momentum will continue.

Valero Energy

- Symbol: VLOShare price: $54.29Market capitalization: $25.1 billionDividend yield: 4.4%52-week high/low: $73.88/46.88Estimated earnings per share: 2016, $3.31; 2017, $5.26Price-earnings ratio: 13

- The business: Valero is the world's largest independent oil refiner, operating 15 refineries — mostly in the U.S. — that can produce 3 million barrels of gasoline and other refined products per day. The company also is a major producer of ethanol. Revenues in 2015 totaled $87.8 billion.

- The valuation story: The stock of any company whose earnings are at risk of wide swings typically will sell for a low P/E. That's the case with Valero: The refining business can be highly volatile, subject to price swings in crude oil as well as swings in demand for gasoline. Valero's profit soared in 2015 as crude oil prices dived. But this year profit has been squeezed between rising crude prices on one side and a glut of gasoline inventory on the other. Analysts on average expect earnings of $3.31 per share in 2016, off from $7.99 in 2015. The stock has fallen 24% from its 2015 high. But Valero's fans say this is the time to focus on the long-term outlook. Morningstar thinks Valero is "particularly well-positioned" to benefit from changes in U.S. crude oil supplies, with the company's Gulf Coast refineries able to take in more U.S. shale oil and Canadian crude. At the same time, if the price of overseas oil is below that of domestic crude, those state-of-the-art refineries can easily switch over to the cheaper oil.

- The yield story: After suffering heavy losses during the 2008-09 economic crisis, Valero has focused in part on improving its finances and boosting its free cash flow — the cash profits left after the capital spending needed to maintain the business. That has allowed the company to boost its annual dividend rate from 65 cents per share in 2012 to the current $2.40. The most recent raise, a 20% increase paid in March despite weak results in the fourth quarter of 2015, "demonstrates our confidence in Valero's earnings power," the company said in announcing the payout hike. Valero’s 4.4% dividend yield is twice the overall market’s.

Verizon Communications

- Symbol: VZShare price: $52.56Market capitalization: $215.2 billionDividend yield: 4.3%52-week high/low: $56.95/$42.40Estimated earnings per share: 2016, $3.89; 2017, $4.03Price-earnings ratio: 13

- The business: One of the original Baby Bells, Verizon now is the biggest U.S. wireless telecom company, providing service for 112 million retail customers. The company also provides a host of other communications services to consumers and businesses, and it recently agreed to buy most of digital media firm Yahoo. The company is expected to ring in revenues of $127 billion in 2016.

- The valuation story: Verizon's success in the wireless business and its sturdy dividend have made it a favorite holding of conservative investors since the financial crisis. Even though the stock has doubled since mid 2010, it still trades at 13 times estimated year-ahead earnings, making it a good choice for value-focused investors who want a rich dividend yield — in this case, 4.3%. The caveat is that near-term earnings growth potential is dim, owing partly to intense competition for wireless customers. Analysts see Verizon earning $4.03 per share in 2017, up just 3.6% from 2016. Longer term, Verizon is betting on making more money off customers by offering online services that will either generate new fees or ad revenue, or both. That was the motivation for buying online content firm AOL in 2015, and for the recent deal, not yet consummated, to buy Yahoo's operations. Brokerage Pacific Crest Securities notes that Verizon also is moving into areas such as "telematics" — allowing a delivery firm to easily track use of its trucks, for example.

- The yield story: Don't buy Verizon for fast income growth: The dividend has risen just 3.1% a year, on average, since mid 2012, to the current $2.26 per share annual rate. Verizon must balance its payout with the need to pare heavy debt. Still, ample cash flow from wireless most likely assures the dividend's safety. That seems enough for Warren Buffett: Berkshire Hathaway (BRK.B), which he heads, has built a stake of 15 million shares since 2014.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

What Fed Rate Cuts Mean For Fixed-Income Investors

What Fed Rate Cuts Mean For Fixed-Income InvestorsThe Fed's rate-cutting campaign has the fixed-income market set for an encore of Q4 2024.

-

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)State Taxes Living in one of these places could lower your 2025 investment taxes — especially if you invest in real estate.

-

The Final Countdown for Retirees with Investment Income

The Final Countdown for Retirees with Investment IncomeRetirement Tax Don’t assume Social Security withholding is enough. Some retirement income may require a quarterly estimated tax payment by the September 15 deadline.

-

Why Wells Fargo's Revenue Miss Isn't Worrying Wall Street

Why Wells Fargo's Revenue Miss Isn't Worrying Wall StreetWells Fargo is one of the best S&P 500 stocks Wednesday even after the big bank's top-line miss. Here's what you need to know.

-

Constellation Energy Stock Soars on Its $26 Billion Buy. Here's Why Wall Street Likes the Deal

Constellation Energy Stock Soars on Its $26 Billion Buy. Here's Why Wall Street Likes the DealConstellation Energy is one of the best S&P 500 stocks Friday after the utility said it will buy Calpine in a cash-and-stock deal valued at $26 billion.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

What Scott Bessent's Treasury Secretary Nomination Means for Investors

What Scott Bessent's Treasury Secretary Nomination Means for InvestorsMarkets are reacting positively to Trump's nomination of Scott Bessent for Treasury secretary. Here's why.

-

TJX Stock: Wall Street Stays Bullish After Earnings

TJX Stock: Wall Street Stays Bullish After EarningsTJX stock is trading lower Wednesday despite the TJ Maxx owner's beat-and-raise quarter, but analysts aren't worried. Here's why.