8 Risky Stocks That Could Make You Rich

Want big returns?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Want big returns? Take on big risks. So goes the inescapable calculus of investing. With so many investors focused on safety and income these days, we decided to take a contrarian approach by looking for risky companies that have the potential to deliver big payoffs.

We’ve identified eight risky stocks that we believe are worth the risk. Several of these companies, we feel, have the potential to be game-changers in their industries—the proverbial “next Google.” But in exchange for the possibility of a big payoff down the road, investors must be content forgoing profits for the time being (only one of our picks pays a dividend). Others on the list are already profitable and show great potential, but come with other unusual or notable risks. Consider stashing a small portion of your play money into each of these names, then ignoring them for a few years. Chances are not all will succeed. But the one or two (or more) winners on the list could win big.

All prices and returns are through September 9. Price-earnings ratios are based on estimated earnings over the next four quarters. Sales are for the past four quarters.

Alibaba Group

- Symbol: BABAShare price: $99.62Market capitalization: $246.3 billion52-week range: $57.20 - $104.30Annual sales: $17 billionEstimated earnings for the fiscal year ending March 2017: $3.28 per shareEstimated earnings for the fiscal year ending March 2018: $4.21 per sharePrice-earnings ratio: 29Year-to-date return: 23%

- What does the company do? Often called “the eBay of China,” Alibaba is the dominant online retailer in China. Alibaba’s business model is slightly different than those of the U.S. companies it’s often compared to, combining elements of eBay (EBAY), Amazon.com (AMZN) and PayPal (PYPL). Its websites are essentially large online marketplaces, linking buyers with sellers and earning fees from advertising and payment processing. But unlike eBay, it doesn’t operate auctions, and unlike Amazon, it doesn’t sell products itself.

- Why is the stock risky? “It’s risky because we don’t know where China is going,” says Benjamin Segal, manager of the Neuberger Berman International Equity Fund, which owns the stock. Economic growth in China has been slowing, the Shanghai Composite index has fallen more than 40% since June 2015, and economists have been warning of risks in the country’s “shadow banking” sector, in which lightly regulated financial companies have been selling trillions of dollars in risky products.

- Why is it worth the risk? A slowing Chinese economy is still a growing Chinese economy. The country is gradually shifting to a consumer-driven economy from one in which investment spending—including government investments in infrastructure and spending by state-sponsored and private enterprises—has been the main driver of growth. That should spell more business for retailers. Moreover, China doesn’t have the vast array of brick-and-mortar stores that the U.S. does, making newly minted members of the middle class more likely to turn to online shopping first. Alibaba’s profits have grown almost tenfold in the past three years, and analysts expect them to increase by a still-brisk 28% annual pace over the next three to five years. “In an economy that will, in time, be comparable to if not bigger than the U.S., here is eBay, PayPal and Amazon all wrapped into one,” says Segal. Compared with, say, Amazon.com’s P/E ratio of 101, Alibaba, trading at 29 times estimated year-ahead profits, looks cheap.

- SEE ALSO: The Best Stocks From Around the World

Athenahealth

- Symbol: ATHNShare price: $120.12Market capitalization: $4.7 billion52-week range: $114.59 - $170.42Annual sales: $1 billionEstimated 2016 earnings: $1.77 per shareEstimated 2017 earnings: $2.23 per sharePrice-earnings ratio: 62Year-to-date return: –25%

- What does the company do? Athenahealth offers web-based health care software for physicians and hospitals. The software helps health care providers track and collect reimbursements from insurers, store patients’ electronic health records, and coordinate overall office-management tasks. Athenahealth earns its money by charging a percentage of collections, which aligns its incentives with clients and often works out to be cheaper for users than alternative systems.

- Why is the stock risky? The company is barely profitable, and the health care sector is slow-moving and fraught with bureaucracy, meaning providers may be slow to adopt a new way of doing things. Its chief executive officer, Jonathan Bush (nephew to the 41st U.S. President and cousin to the 43rd), is considered controversial because of his tendency to divulge too much information about the inner workings and struggles of his company. And the stock is hardly cheap.

- Why is it worth the risk? Sure, health care companies are slow to adopt change, but the slow-moving, costly existing process of health care billing is ripe for a makeover, and Athenahealth’s products are the most compelling on the market. Cathie Wood, CEO of ARK Investment Management, says the company’s strategy is reminiscent of that of Amazon.com—forgoing near-term profits in an effort to stake out a dominant market position. “This could be a winner-take-most situation,” says Wood. Investors will need to be patient with the stock, but Athenahealth could be worth the wait.

Bluebird Bio

- Symbol: BLUEShare price: $53.43Market capitalization: $2.1 billion52-week range: $35.37 – $143.08Annual sales: Not meaningfulEstimated 2016 earnings: –$6.15 per shareEstimated 2017 earnings: –$6.52 per shareYear-to-date return: –17%

- What does the company do? Bluebird develops gene therapies, an up-and-coming medical treatment that entails introducing “corrected” genes into a patient’s body, in order to treat or even cure a genetic condition. Bluebird is developing gene therapies to target certain types of genetically caused anemia: severe sickle cell disease and beta thalassemia. The company also has a gene therapy in the works to treat a rare nervous-system disorder and is in the early stages of developing immunotherapies for certain types of cancer.

- Why is the stock risky? All of Bluebird’s products are still in clinical trials, so the company does not yet earn money from selling its products, let alone generate any profits. There’s always the risk that the company burns through its cash before it brings any products to market.

- Why is it worth the risk? Bluebird’s therapies have seen some inspiring results. Although the company’s drug trials have thus far included relatively small numbers of people, in a few cases patients appear to have been cured of all symptoms of a life-threatening genetic condition with just one course of treatment. “Bluebird’s treatments have the potential to be life-changing,” says Dennis Wassung, a portfolio manager with Cabot Wealth Management who owns the stock in separately managed accounts. Results haven’t been uniformly perfect for any of Bluebird’s therapies, but all three of its gene therapies hold promise.

It’s hard to come up with an appropriate price tag for such an early-stage company. But with the stock down 73% from its May 2015 peak of $197.35—because of some unexpected setbacks in trial results and also because of overall weakness among biotech stocks—investors might one day look back at the current share price and see a screaming buying opportunity.

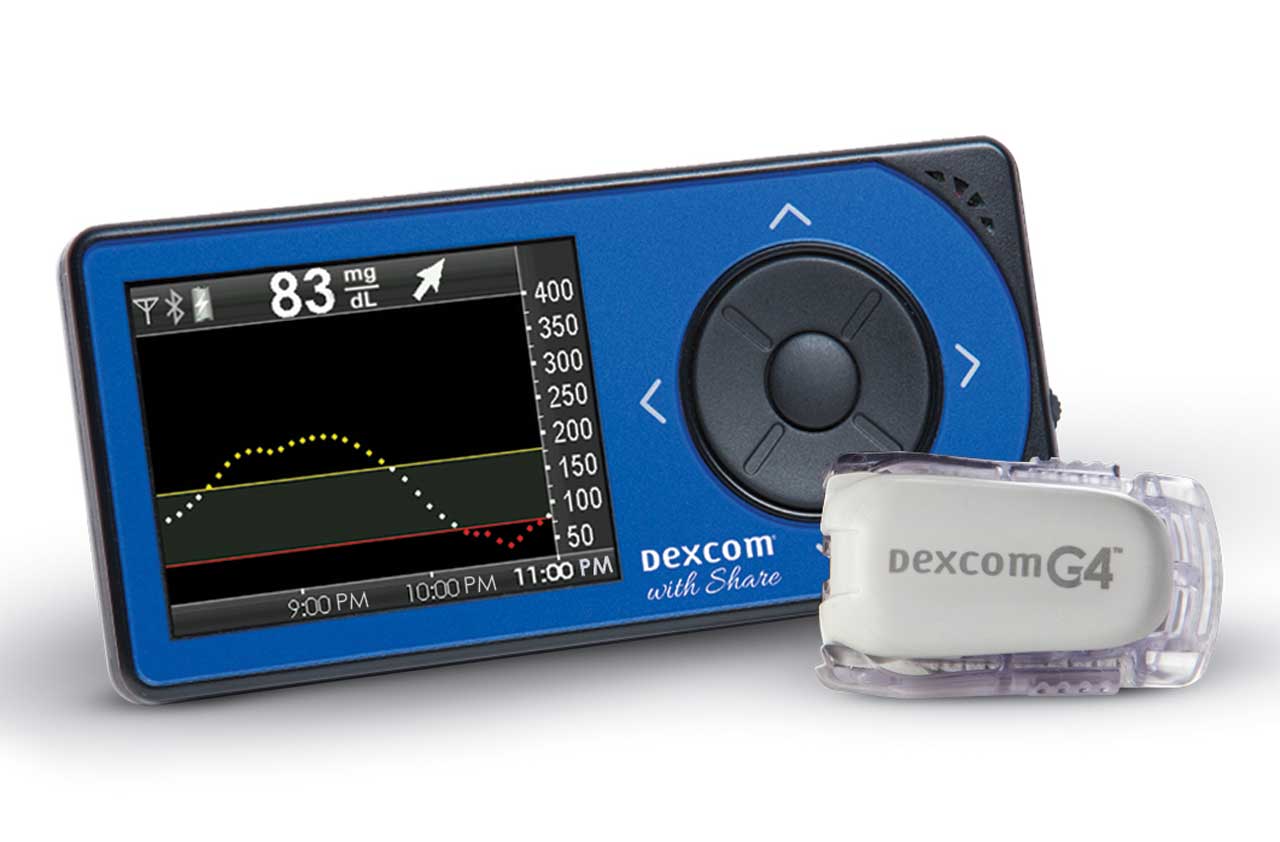

Dexcom

- Symbol: DXCMShare price: $92.96Market capitalization: $7.7 billion52-week range: $47.92 – $103.29Annual sales: $490 millionEstimated 2016 earnings: –$0.57 per shareEstimated 2017 earnings: $0.26 per shareYear-to-date return: 14%

- What does the company do? Dexcom makes continuous glucose monitoring systems for patients with diabetes. An alternative to conventional finger-prick tests, Dexcom’s products essentially provide moment-by-moment tracking of glucose levels, using a sensor that is inserted under the skin. The device automatically transmits data to a small, iPod-like instrument, which allows patients to watch trends on their blood sugar and receive alerts if their glucose levels enter dangerous territory.

- Why is the stock risky? Dexcom has yet to turn profitable, and it’s not the only company offering this type of technology. Plus, the stock has already enjoyed a large run-up—soaring by more than 13 times since November 2011. On a price-to-sales basis, Dexcom trades at a “meaningful premium” to its peers, says Wassung.

- Why is it worth the risk? Dexcom leads competitors in terms of market share and accuracy of its products, so it deserves a premium valuation. Only 15% of patients with type-1 diabetes are using continuous glucose monitoring systems, Wassung says, so an enormous untapped opportunity set remains. “Dexcom’s technology has really just started to hit the mainstream market in the last few years, and is receiving a lot of support from the medical community,” he adds. Analysts expect the company to turn profitable in the fourth quarter of 2016, earn $0.26 per share next year and $0.98 per share in 2018.

Elbit Systems

- Symbol: ESLTShare price: $96.70Market capitalization: $4.0 billion52-week range: $72.05 – $103.28Annual sales: $3.2 billionActual 2015 earnings: $4.74 per shareEstimated 2016 earnings: Not availableEstimated 2017 earnings: Not availableYear to date return: 10.8%

- What does the company do? Elbit Systems makes drones, technology systems for aircrafts, and intelligence-gathering and military communications systems. The company, which is based in Haifa, Israel, sells its products all over the world, with no one country or geographic area dominating its revenues.

- Why is the stock risky? Elbit is based in a tough and volatile neighborhood. Trade with Israel is vulnerable to shifting political winds. And although the shares trade on Nasdaq, Elbit’s shares are not as liquid as a typical U.S. stock.

- Why is it worth the risk? Elbit’s growth prospects are excellent thanks to its broad geographic diversification. For example, in the first half of 2016, sales to Europe increased by 31% compared with the same period in 2015, as European members of NATO boosted spending on their militaries because of concerns about Russia’s expansionist aims. The company’s high-tech focus should continue to give it an edge; it recently signed contracts for delivery of thermal-imaging observation systems and tactical communication systems. The company has a backlog of orders worth $6.8 billion, equivalent to more than two years of annual revenue. First-half profits of $106 million ($2.49 per share) were up 18% from the first six months of 2015. The stock has been on a tear, more than tripling since August 2012, but we think it still has room to run. Elbit is the only company on our list that pays a dividend. The stock yields 1.7%.

Skechers USA

- Symbol: SKXShare price: $23.48Market capitalization: $3.7 billion52-week range: $22.50 – $49.58Annual sales: $3.4 billionEstimated 2016 earnings: $1.83 per shareEstimated 2017 earnings: $2.14 per sharePrice-earnings ratio: 12Year-to-date return: –22%

- What does the company do? Known mainly for its sneakers, Skechers also makes other casual footwear, such as boots and sandals

- Why is the stock risky? Skechers’ shoes haven’t been, well, cool, in a long time. The brand’s heyday was in the late ’90s and early aughts, arguably peaking in 2001, when Brittany Spears appeared on the cover of Forbes in a pair of Skechers (alongside a story proclaiming that the company might be the “next Nike”). Since then, sales have grown at a respectable 8.9% per year, but Skechers has made missteps in its quest to regain its former trendiness. In 2012, for example, the company settled charges with the Federal Trade Commission that its Shape Up shoes (endorsed by Kim Kardashian) would help wearers lose weight and tone their backsides. The stock has sunk 27% since July 21, when the company reported second-quarter results that came in below analysts’ estimates.

- Why is it worth the risk? Skechers may never again be the hottest must-have shoe. Instead, the company has shifted its strategy to offering a lot of inexpensive versions of popular styles, aiming to capture a portion of market share in a variety of categories rather than focusing on a single trendy shoe. In 2015, Skechers surpassed Adidas to become the second-biggest seller of athletic footwear in the U.S., behind only Nike (NKE).

Sales and earnings have grown robustly in recent years. Sales rose an annualized 26% from 2012 through 2015, and profits skyrocketed from $10 million to $232 million. The streak came to a halt in the second quarter, with sales expanding by only 10% from the same period in 2015 and earnings actually slipping by 7%. However, much of the slowdown was due to onetime issues. Wassung says investors have been too hard on the stock in the past month and a half, and he sees a buying opportunity.

Tesla Motors

- Symbol: TSLAShare price: $194.47Market capitalization: $28.9 billion52-week range: $141.05 – $271.57Annual sales: $4.6 billionEstimated 2016 earnings: –$0.95 per shareEstimated 2017 earnings: $1.71 per sharePrice-earnings ratio: Not meaningfulYear-to-date return: –19%

- What does the company do? Tesla is best known for its sleek electric vehicles, and almost all of its revenues come from selling cars and related products and services. But the ambitions of Elon Musk, the company’s enigmatic CEO, don’t stop at high-end cars. Tesla is in the process of acquiring SolarCity (SCTY), a maker of solar panels, and Musk has said he wants Tesla to become a one-stop shop to help consumers power their households. He plans to accomplish this by selling panels along with efficient batteries for storing generated energy (because solar panels generate a lot of energy at certain times of day, and none at others).

- Why is the stock risky? Tesla has yet to turn a profit, although analysts expect it to earn money in the current quarter. And lofty expectations are already baked into the stock, which trades at 185 times estimated year-ahead earnings (profits are so low, the P/E isn’t especially meaningful). Moreover, Tesla’s proposed acquisition of SolarCity has been criticized as a bailout of the solar company, which came close to running out of cash this year and has been unable to persuade other potential suitors to invest. Tesla has itself reported in regulatory filings that it will need to issue additional stock or debt before the end of the year, in part to bankroll the merger.

- Why is it worth the risk? Few companies can truly lay claim to having the potential to change the world, but Tesla is one of them. Musk has said he expects the company to be producing 1 million electric vehicles per year by 2020, as Tesla works on making its factories more efficient. That would put its output at roughly one-seventh of the annual output of Ford Motor (F). The company is also investing heavily in its battery technology, which has the potential to serve applications far beyond vehicles and solar-powered homes. “Lots of investors don’t like the fact that they can’t hang their hat on certain quarterly numbers,” says Wood, of ARK Investment Management, a firm that runs actively managed exchange-traded funds and owns the stock. “We don’t mind because we see the big picture.”

- QUIZ: How Well Do You Know Dividends?

TubeMogul

- Symbol: TUBEShare price: $8.99Market capitalization: $326 million52-week range: $8.75 – $14.46Annual sales: $202 millionEstimated 2016 earnings: –$0.58 per shareEstimated 2017 earnings: –$0.31 per shareYear-to-date return: –34%

- What does the company do? TubeMogul develops self-service advertising software that allows advertisers and advertising agencies to directly purchase TV, online and mobile ad spots. Its business model represents a dramatic shift for the advertising industry. Print, online and broadcast ads have traditionally been bought and sold through a laborious and costly process of soliciting requests for proposals, with layers of middlemen taking cuts of deals.

- Why is the stock risky? The company is not yet profitable. Analysts, on average, don’t expect it to make money until 2018, but it could remain in the red for longer than investors expect.

- Why is it worth the risk? “Disruption” is a buzzword that gets wildly overused in the world of start-ups, but TubeMogul’s business model does seem to have the potential to be a game-changer for digital advertising. It’s a cheaper model for advertisers and it allows them to, with a few clicks, target the exact demographic groups they want to reach on the exact mediums they want to use. And it provides up-to-the-moment analytics on whether an ad campaign is reaching the right people. Plus, the stock looks reasonable on the basis of its price-to-sales ratio. The shares sell at 1.7 times the past 12 months’ sales, matching the price-to-sales ratio for industrial companies in Standard & Poor’s 500-stock index.

- SEE ALSO: 5 Good Dividend Stocks to Buy While They Are Cheap

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

Dow Dives 878 Points on Trump's China Warning: Stock Market Today

Dow Dives 878 Points on Trump's China Warning: Stock Market TodayThe main indexes erased early gains after President Trump said China is becoming "hostile" and threatened to cancel a meeting with President Xi.

-

Dow Hits New Intraday High: Stock Market Today

Dow Hits New Intraday High: Stock Market TodayValue-hunters with big stakes in a particular component kept one of the main U.S. equity indexes in positive territory.

-

Stock Market Today: Mixed Messages Muddle Markets

Stock Market Today: Mixed Messages Muddle MarketsStocks cruised into pre-market action on encouraging news for the AI revolution but stumbled on yet another policy disturbance.

-

eBay Stock Slides on Soft Outlook

eBay Stock Slides on Soft OutlookeBay stock is falling Thursday after the e-commerce company topped fourth-quarter expectations but issued a soft first-quarter outlook.

-

Stock Market Today: Dow Dives 748 Points as UnitedHealth Sells Off

Stock Market Today: Dow Dives 748 Points as UnitedHealth Sells OffA services-sector contraction and a worse-than-anticipated consumer sentiment reading sent bulls scrambling Friday.

-

Stock Market Today: Growth Concerns Drag on Stocks

Stock Market Today: Growth Concerns Drag on StocksForward-looking commentary from a major retailer outweighed its backward-looking results as all three major equity indexes retreated on Thursday.

-

Why Alibaba Stock Is Soaring After Earnings

Why Alibaba Stock Is Soaring After EarningsAlibaba stock is higher Thursday after the China-based e-commerce platform beat expectations for its fourth quarter. Here's what you need to know.

-

PayPal Stock Falls Despite Earnings Beat, Strong Outlook

PayPal Stock Falls Despite Earnings Beat, Strong OutlookThe payments stock is suffering Tuesday under the weight of high expectations. Here's what you need to know.