Silicon Valley's Best Chip Stocks of the Bull Market

Semiconductors are synonymous with Silicon Valley.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Semiconductors are synonymous with Silicon Valley. Chip makers started popping up at the southern end of San Francisco Bay as early as the 1950s. A big draw back then as now: Stanford University and its bevy of researchers and research facilities. Today, seven of the biggest publicly traded semiconductor companies still call Silicon Valley home, with headquarters in such tech-friendly California cities as Santa Clara and San Jose.

Despite the steady decline in computer sales in recent years -- semiconductors are the brains inside PCs -- all seven of these chip stocks have performed well during the current long-running bull market. In fact, six of the seven have handily outpaced the 348% total return (including dividends) of Standard & Poor’s 500-stock index since March 9, 2009. The seventh isn't far behind.

But some Silicon Valley chip stocks have performed significantly better than others over the past eight-and-a-half years. Four of the seven have even beaten the remarkable 530% total return of the Nasdaq-100 Index, which is made up of the largest non-financial stocks listed on the Nasdaq Stock Market by market capitalization. Check out Silicon Valley's best semiconductor stocks of the bull market.

Return data provided by S&P Global Market Intelligence. Prices and returns as of Oct. 13, 2017. Due to the multiple share classes issued by some companies, the Nasdaq-100 Index currently consists of 107 stocks. Market capitalization represents share price multiplied by the number of shares outstanding. The seven stocks on this list, which represent the seven semiconductor companies included in the Nasdaq-100 that are headquartered in Silicon Valley, are listed in order of total returns during the current bull market, from lowest percentage return to highest.

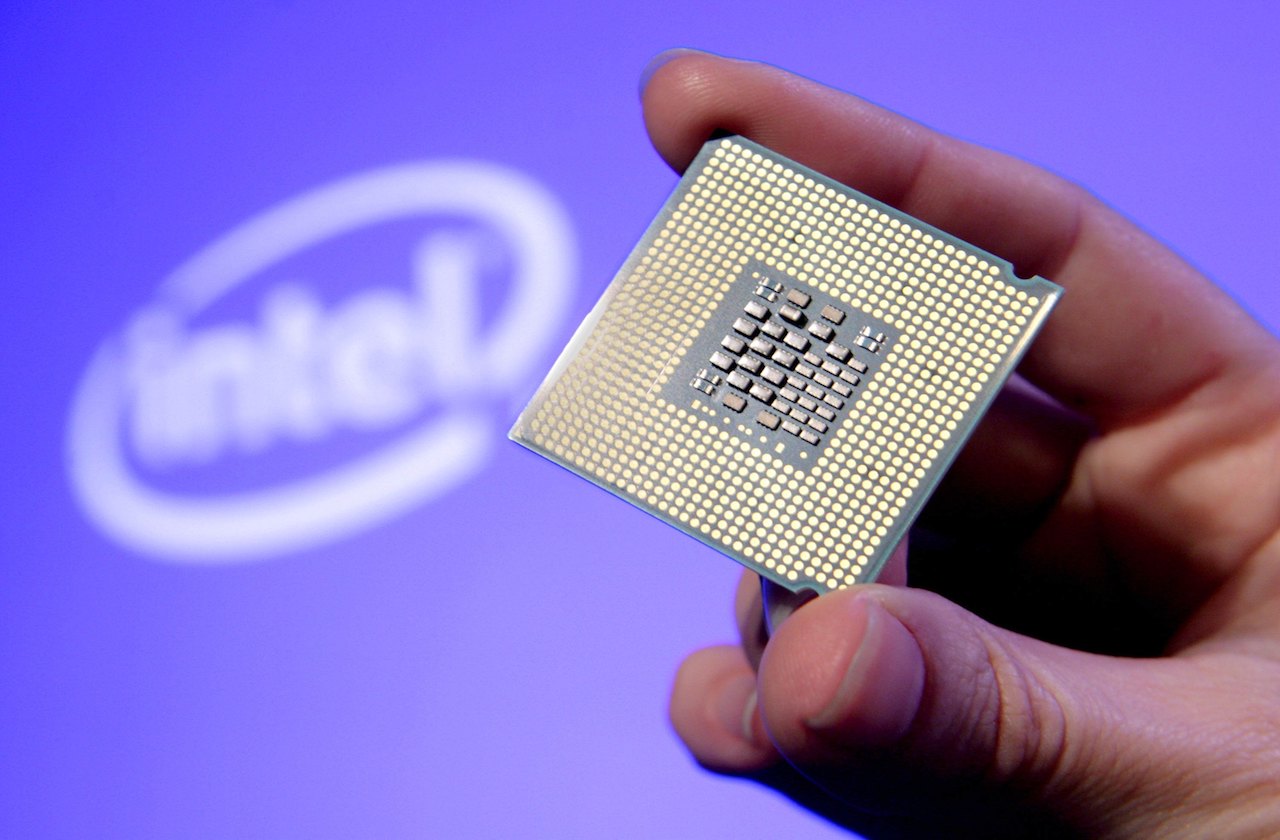

Intel

- Ticker symbol: INTC

- Share price: $39.67

- Bull market return: 317%

- Dividend yield: 2.8%

- Headquarters: Santa Clara, Calif.

Intel is the old-timer of Silicon Valley. The company was founded in 1968 and held its initial public offering in 1971. But Intel’s longevity is a big reason it’s one of the greatest tech stocks of all time. Through the end of 2016, the stock has generated a staggering $259 billion in lifetime wealth for its shareholders, according to stock research conducted by Hendrik Bessembinder, a finance professor at Arizona State University. Returns have been leaner during the current bull market as declining demand for PCs has hurt demand for Intel’s semiconductors. That has forced Intel, the world's largest maker of the central processing units that serve as a PC's brain, to find new ways to generate revenue growth. The expansion of cloud-based services has been a boon, thanks to its dominance of the market for server chips. Analysts at Credit Suisse think Intel is well-positioned for the long term because of its scale and investments in research and development.

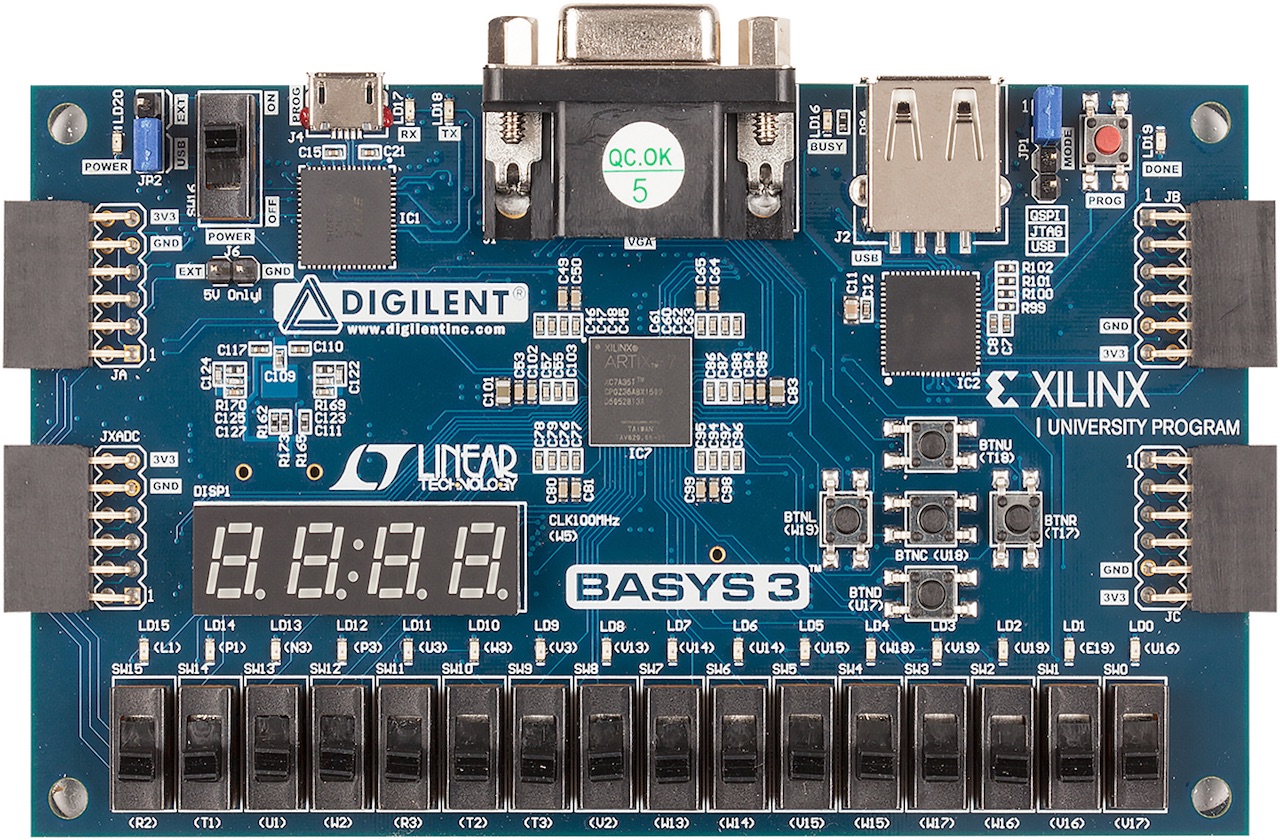

Xilinx

- Ticker symbol: XLNX

- Share price: $72.81

- Bull market return: 421%

- Dividend yield: 1.9%

- Headquarters: San Jose, Calif.

Founded in 1984, Xilinx is another longtime denizen of Silicon Valley in the chip business that hasn't pulled its weight through the current bull market. Shares trail the Nasdaq-100 Index by 109 percentage points even after accounting for dividends. A change in the landscape promises better times ahead for the maker of programmable chip technology. Although Xilinx faces tough competition from Intel, investors are excited about the payoff from selling chips to Amazon.com’s (AMZN) thriving cloud-computing business, Amazon Web Services. And the boom in data centers beyond Amazon offers additional avenues of growth.

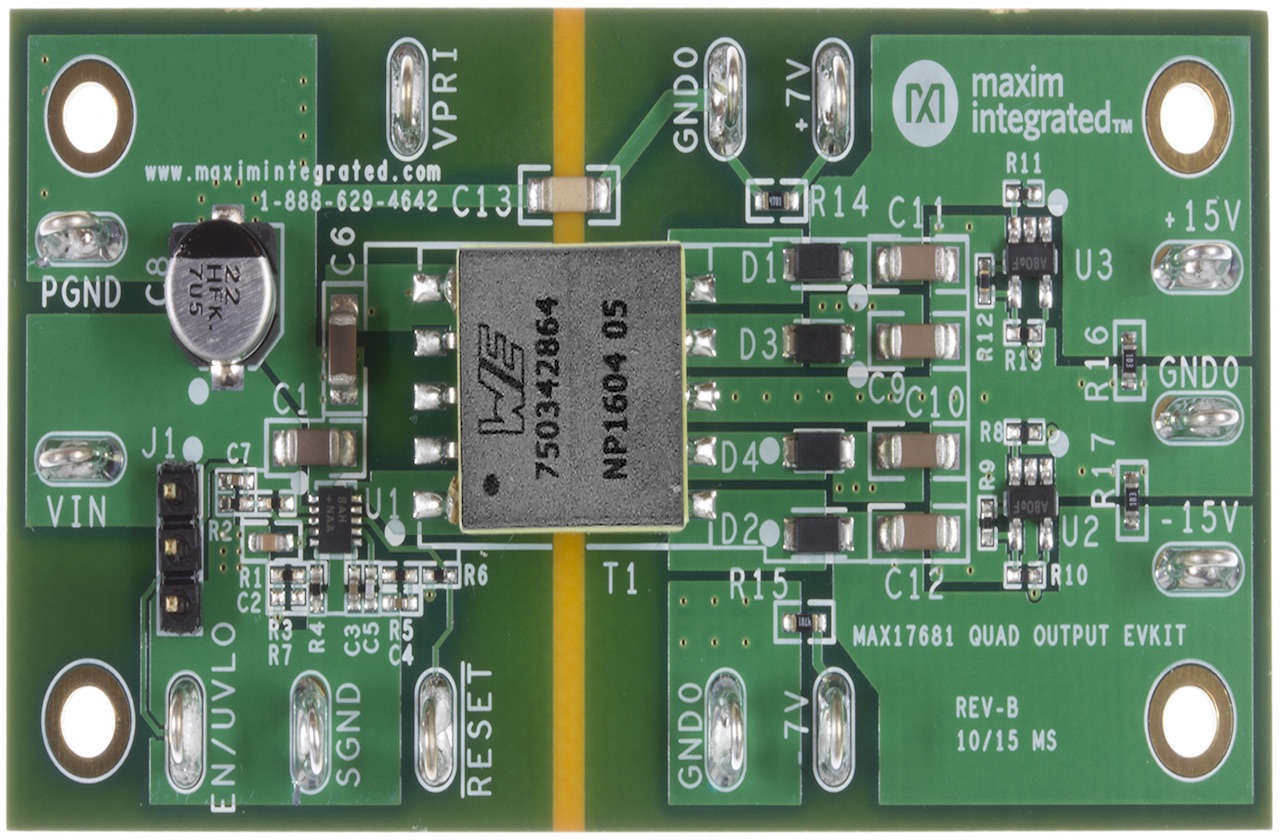

Maxim Integrated Products

- Ticker symbol: MXIM

- Share price: $48.42

- Bull market return: 489%

- Dividend yield: 3.1%

- Headquarters: San Jose, Calif.

It's been steady as she goes for Maxim Integrated Products' stock for much of the bull market, thanks in part to the inexorable rise of digital mobile devices. Among other areas of operation, the company, founded in 1983, supplies chips to smartphone giants Apple and Samsung. That leaves it exposed to risk if either of those partners were to have a change of plans. But Stifel analysts say the company's ongoing diversification efforts give it multiple opportunities for growth without becoming too dependent on a single customer. So while it’s hard to imagine consumers abandoning their iPhone and Galaxy smartphones in droves, Maxim should be safe if they do since it depends on neither Apple nor Samsung for more than 10% of its overall business.

Applied Materials

- Ticker symbol: AMAT

- Share price: $53.94

- Bull market return: 654%

- Dividend yield: 0.7%

- Headquarters: Santa Clara, Calif.

Wall Street is increasingly bullish on Applied Materials. Of the 14 analysts covering the stock tracked by Zacks, 10 call it a "Strong Buy," two have it a "Buy," and two have it "Hold." There are no “Sell” ratings. It's easy to see where the optimism comes from. Applied Materials' core business of semiconductor equipment and services benefits from today's trends. The rise of artificial intelligence, cloud computing, the Internet of Things, mobile devices and Big Data are driving increased demand for chips. As a supplier to the companies that make the chips powering all these technologies, Applied Materials finds itself in an enviable position. The company also supplies products for making displays for TVs, tablets, computers and smartphones. And don’t be fooled into thinking of Applied Materials as a relative newcomer to Silicon Valley. It was founded in Mountain View, Calif., in 1967 – a year before Intel.

Lam Research

- Ticker symbol: LRCX

- Share price: $189.90

- Bull market return: 938%

- Dividend yield: 1.0%

- Headquarters: Fremont, Calif.

Shares of Lam Research have seen some ups and down along the way, but the bottom line is that this supplier of equipment to chip makers delivered outsized total stock returns since the bull market began. Analysts at Zacks Equity Research note that the company continued its impressive earnings momentum with another better-than-expected profit beat in its most recent quarter. Furthermore, analysts are raising their profit estimates. Of the 13 analysts covering the stock polled by Zacks, 9 have Lam at "Strong Buy," two call it a "Buy" and two rate it at "Hold." Lam got its start in Santa Clara in 1980, making it one of the early players in the lucrative Silicon Valley semiconductor industry.

KLA-Tencor

- Ticker symbol: KLAC

- Share price: $105.30

- Bull market return: 970%

- Dividend yield: 2.3%

- Headquarters: Milpitas, Calif.

The KLA-Tencor we know today came into being in 1997 from the merger of KLA Instruments and Tencor Instruments. But its experience in the semiconductor industry stretches back to the 1970s, when its predecessor companies got their respective starts. Experience has paid off. KLA-Tencor shares have delivered impressive price appreciation over the last eight-plus years of the bull market, but what really sets this Silicon Valley stock apart is an unusually generous dividend. The technology sector as a whole pays an average dividend of just 1.4%, according to Dividend.com. Suppliers of equipment to the semiconductor industry, which is what KLA-Tencor does, are even more stingy. The company's competition coughs up an average dividend yield of less than 1%. In August, KLA-Tencor hiked its quarterly dividend to 59 cents a share from 54 cents, a 9.3% increase.

Nvidia

- Ticker symbol: NVDA

- Share price: $194.59

- Bull market return: 2,426%

- Dividend yield: 0.3%

- Headquarters: Santa Clara, Calif.

Much like the Backstreet Boys and NSYNC, Nvidia was a unique product of the 1990s. Founded in 1993 and public since 1999, the company blossomed as computers and gaming consoles became more popular and more complex. In its early days Nvidia was primarily known in the gaming community for making high-end video graphics cards. It turns out that graphical processing units (GPUs) have a wide range of applications in today's data-rich world. From the automotive industry to mining for Bitcoins, Nvidia has customers across the business and consumer landscapes. The next big area of growth is expected to be artificial intelligence, which industry observers call the "killer app" for its chips. Analysts expect the company's sales to increase 30% this year, according to Thomson Reuters, while earnings per share should gain 40%. Bull market or not, it's reasonable to question whether shares in Nvidia can keep up such a torrid pace. After all, they've returned well over 2,000% in the past eight and a half years. But for now, at least, Nvidia is holding up its end of the bargain thanks to the impressive top- and bottom-line growth.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.