13 Tech Stocks with Big Promise

Whatever they’re selling, companies often aim to entice you with a dazzling vision of the future.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Whatever they’re selling, companies often aim to entice you with a dazzling vision of the future. Whether it’s a reimagination of the car, a new treatment for cancer or a robot that can operate more precisely than the human hand, the promise of a better tomorrow through technology can make true believers of us all.

Buying shares of these businesses can be lucrative, too. Since the last bear market bottomed, in March 2009, technology stocks in Standard & Poor’s 500-stock index have returned a total of 371%, or 22% annualized. Over the same period, the S&P 500 itself has returned 298%, or 19% annualized (figures include dividends).

Investing in technology is risky. Tech companies often succumb to competitive pressures as rivals pump out similar products faster and more cheaply. Other firms flop when their inventions turn out to be too far ahead of their time. And sometimes the emergence of new technologies renders their products obsolete. You may have to contend with steep valuations, too, as euphoria for new technologies sends stocks soaring far beyond what their earnings will ever justify.

Still, many of today’s tech leaders are riding high on more than Silicon Valley pipe dreams. The industry is humming with companies that are. We’ve listed 13 companies that are producing real sales and fast-growing profits and have immense potential to cash in on the future.

Share prices, returns and other data are as of January 31. Click on ticker-symbol links in each slide for current prices and more.

Revenues are for the past 12 months. Net income is based on earnings for the past 12 months. Estimated 2017 earnings growth is based on the current fiscal year. Price-earnings ratio is based on estimated earnings for the next four quarters. Sources: Yahoo, Zack's Investment Research.

Nvidia

- Symbol: NVDA

- Share price: $109

- Market value: $58.9 billion

- Revenue: $6.1 billion

- Net income: $1.2 billion

- Est. 2017 earnings growth: 16.0%

- P/E ratio: 39

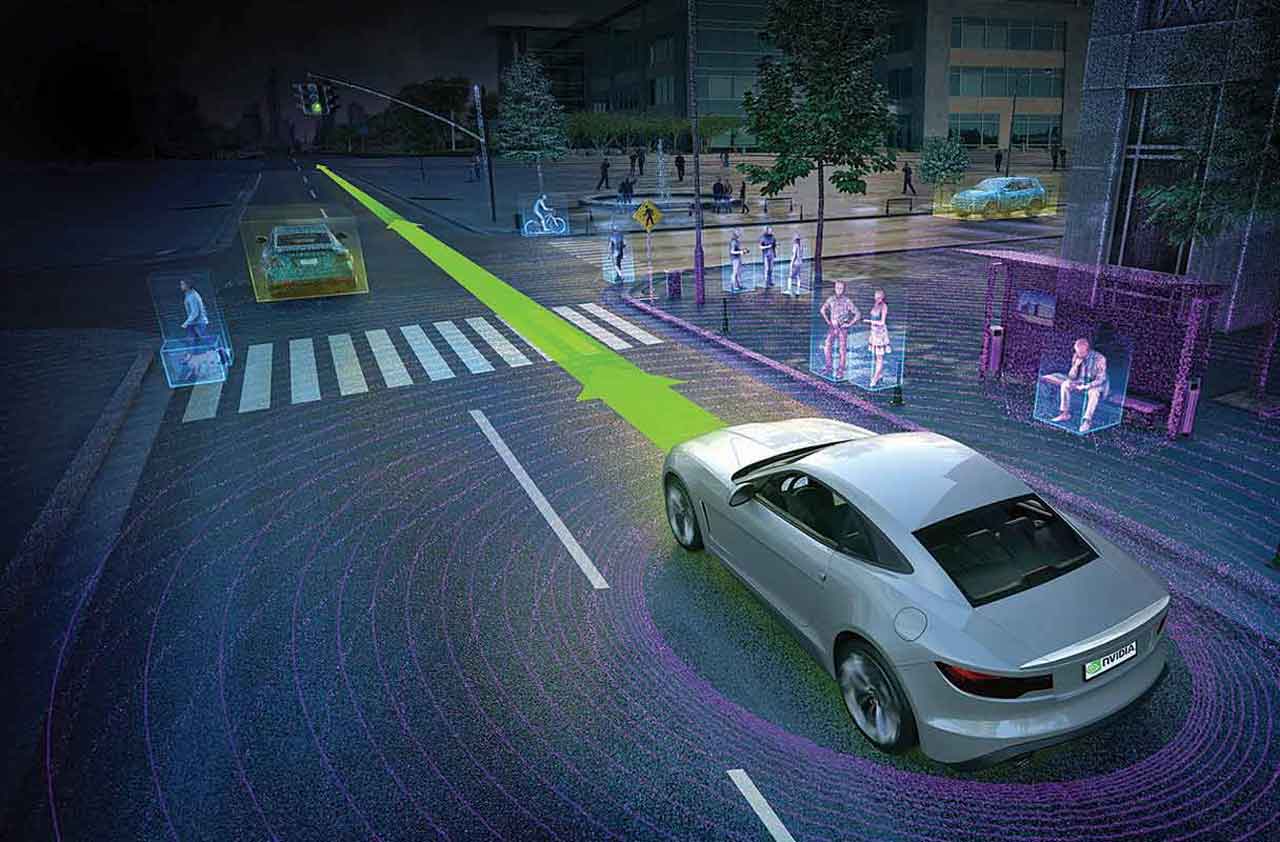

In the auto industry, the biggest potential gains belong to the companies supplying carmakers with artificial-intelligence brains, semiconductors and sensing technology. At the forefront of this trend is chip maker Nvidia. The company has long dominated the market for powerful graphics-processing chips that are used in computers and video-game systems. Now those processors are becoming hot sellers in the car market, too.

Fusing data from onboard sensors, cameras and laser-based systems, the firm’s new Drive PX 2 technology can “understand” a vehicle’s environment and help guide the car down the road. At full power, Nvidia says, the system can process “24 trillion deep learning operations per second”—enough AI brainpower to replace a human driver. Nvidia says Tesla plans to deploy this mini supercomputer in its vehicles, and other carmakers are buying versions of the technology.

Nvidia’s automotive sales amounted to $359 million for the nine-month period that ended last October—less than 10% of total sales, most of which come from gaming chips. But auto-related sales climbed 60% from a year earlier and should increase steadily as more carmakers buy Nvidia’s chips. Nvidia recently announced deals with Audi and Mercedes–Benz to include its technology in forthcoming models.

Qualcomm

- Symbol: QCOM

- Share price: $53

- Market value: $79.0 billion

- Revenue: $23.8 billion

- Net income: $6.2 billion

- Est. 2017 earnings growth: 19.0%

- P/E ratio: 11

Chip maker Qualcomm is racing into the auto industry, too. The firm’s Snapdragon lineup of processors runs “infotainment” systems and applications such as 3-D navigation. Qualcomm’s auto business could get a big lift, too, from its planned merger with NXP Semiconductors (NXPI), the world’s largest maker of automotive chips and sensors (the deal is expected to close later this year).

Outside its automotive business, Qualcomm makes chip sets for the wireless industry and earns hefty royalties from licensing CDMA technology—a critical component of wireless devices and mobile networks around the world. Qualcomm faces lawsuits and charges that its licensing practices are anti-competitive, and the stock tumbled 18% in January because of fears that the highly lucrative licensing business may not be as profitable in the future. If more legal issues arise, the stock could slump again.

Still, Qualcomm’s deal for NXP should be a big winner, helping to boost the firm’s sales and profits in the automotive space and other high-growth areas, such as security and networking. The company should also retain its “pole position” in wireless technology, says Sonu Kalra, manager of the Fidelity Blue Chip Growth Fund. Trading at just 11 times earnings, the stock looks inexpensive. As a bonus, the shares possess a healthy 4.0% dividend yield.

Broadcom

- Symbol: AVGO

- Share price: $200

- Market value: $84.2 billion

- Revenue: $13.2 billion

- Net income: $4.1 billion

- Est. 2017 earnings growth: 24.0%

- P/E ratio: 14

Built through a series of mergers, Broadcom sells a wide assortment of chips, sensors and other high-tech gear, much of it related to wireless communications, data storage and networking.

Those technologies are at the core of Internet of Things (IoT) — the vast world of digitally connected objects, from traffic signals to much more prosaic items, such as trash cans. Research firm Gartner estimates that 6.4 billion “things” were connected to the internet last year, up 30% from 2015. By 2020, Gartner estimates, the figure will rise to 20.8 billion. IDC Research sees spending on IoT-related goods and services jumping from $737 billion in 2016 to $1.29 trillion in 2020.

Broadcom sold some of its IoT-related technology to Cypress Semiconductor (CY) in 2016. But the deluge of data created by IoT devices is lifting demand for Broadcom’s products, especially from data centers, where companies are upgrading networking gear and computers to handle the digital flood. Broadcom is the 800-pound gorilla in data centers, says Paul Wick, comanager of the Columbia Seligman Communications and Information Fund. The firm’s profits are zooming, too.

Splunk

- Symbol: SPLK

- Share price: $58

- Market value: $7.9 billion

- Revenue: $0.9 billion

- Net income: -$0.3 billion

- Est. 2017 earnings growth: Profit expected in current year

- P/E ratio: 107

Software maker Splunk should also benefit from the IoT and related spending on cloud computing.

The firm’s software translates machine data into visual form, helping businesses identify and analyze digital trends in real time and diagnose problems in industrial networks. Customers pay Splunk based partly on the quantity of data coursing through its system, a setup that should lift revenues as more data flows through, says Morningstar analyst Rodney Nelson. Because Splunk is spending heavily to build its business, it isn’t profitable yet. But most of Splunk’s customers have moved only 20% to 25% of their machine data to Splunk’s system, estimates Bank of America Merrill Lynch. That should leave plenty of room for growth as the IoT expands and Splunk signs up more businesses.

Intuitive Surgical

- Symbol: ISRG

- Share price: $693

- Market value: $26.8 billion

- Revenue: $2.7 billion

- Net income: $0.8 billion

- Est. 2017 earnings growth: 24.0%

- P/E ratio: 14

A leader in the burgeoning field of robotic surgery, Intuitive Surgical has sold more than 3,800 of its da Vinci machines over the past 15 years. Physicians use the da Vinci’s arms to perform minimally invasive surgery, which usually is easier on patients and can be more precise than traditional operating techniques. Da Vinci is now used in more than 80% of prostate cancer surgeries in the U.S., and it’s being deployed for scores of other operations, such as hysterectomies and coronary bypasses. Intuitive estimates that more than 700,000 robotic medical procedures were conducted in 2016, an increase of about 15% from the previous year.

Despite that impressive growth, Intuitive isn’t close to saturating the market. The company launched a more advanced da Vinci system in 2014, expanding its potential uses and fueling sales growth as hospitals upgrade older systems. The company is also making money selling accessories and services, and it should continue to expand as doctors become more comfortable with the system and consumers increasingly request robotic surgery, says Fidelity fund manager Kalra.

Cognex

- Symbol: CGNX

- Share price: $68

- Market value: $5.8 billion

- Revenue: $0.5 billion

- Net income: $0.1 billion

- Est. 2017 earnings growth: 10.0%

- P/E ratio: 39

Another U.S. company riding the automation wave is Cognex. The firm makes machine-vision technology, such as cameras, lenses and software, for bar-code readers, industrial equipment and “vision-guided” robots. These sophisticated machines are playing a greater role in assembling cars, computer chips and other precision-engineered products, and they can take over dangerous industrial work, such as manipulating parts on a metal-cutting saw. Cognex recently bought two 3-D vision companies to boost sales in the automotive, electronics and logistics industries. Factory automation now accounts for more than 95% of its revenues, which are climbing steadily.

CyberArk Software

- Symbol: CYBR

- Share price: $53

- Market value: $1.8 billion

- Revenue: $0.2 billion

- Net income: $0.0 billion

- Est. 2017 earnings growth: 13.0%

- P/E ratio: 40

Behind the scenes at many big companies, a game of digital cat and mouse goes on day and night. Hackers try to breach a computer system, cybersecurity police chase them down, and the process repeats itself. With data breaches and cybertheft growing more prevalent, spending on security products is expected to rise steadily. CyberArk Software should thrive in this heightened-threat climate.

Based in Israel, the company sells software to thwart hackers who try to breach “privileged” accounts in corporate computing networks. Closely guarded in the digital world, these accounts often provide access to sensitive corporate data, holding the “keys to the IT kingdom,” as CyberArk puts it. If attackers do penetrate, CyberArk can lock down and isolate the accounts, preventing data theft or damage to corporate computer systems.Although the firm competes against much larger cybersecurity outfits, it dominates the privileged-account niche with a “unique” technology, says Columbia Seligman’s Wick. Analysts expect revenues to increase 22% this year and profits to climb almost 13%.

Check Point Software Technologies

- Symbol: CHKP

- Share price: $99

- Market value: $17.3 billion

- Revenue: $1.7 billion

- Net income: $0.7 billion

- Est. 2017 earnings growth: 21.0%

- P/E ratio: 19

Another Israeli firm, Check Point Software Technologies offers broader solutions to cyber threats. It sells bundles of devices and software to create “unified threat management” systems that, ideally, can protect an entire global network of computers, applications and data.

Check Point is now targeting small and midsize businesses with its cybersecurity bundles, and it’s expanding into areas such as “advanced threat protection” for mobile devices and “virtual” desktops—a burgeoning business as more employees work remotely.

Illumina

- Symbol: ILMN

- Share price: $160

- Market value: $23.5 billion

- Revenue: $2.4 billion

- Net income: $0.4 billion

- Est. 2017 earnings growth: 20.0%

- P/E ratio: 44

- llumina, the leading maker of gene-sequencing machines and related products, stands at the forefront of the DNA revolution.

Researchers are using its technology to investigate the genetics of people, microorganisms and diseases such as cancer, resulting in more-precise diagnoses and more-personalized treatments. Illumina is now launching a new generation of machines that it says will be able to sequence an entire human genome in less than 24 hours for as little as $100, a development that could vastly expand the technology’s reach. The company is also teaming up with firms such as IBM (IBM) and Dutch conglomerate Philips (PHG) to develop more medical diagnostic tools that should extend sales in the health care field.

Illumina’s growth isn’t a slam dunk. Sales could slump if labs curb spending on genetic testing and research. The company is battling rivals such as Thermo Fisher Scientific (TMO) and Qiagen (QGEN) in the gene-sequencing space. Illumina’s sales growth has slowed sharply in recent years, too. But don’t be discouraged, says Bank of America Merrill Lynch. Illumina now has “the pieces in place” to return to “mid teens” revenue growth by 2018, says Merrill, which rates the stock a buy.

BioMarin

- Symbol: BMRN

- Share price: $88

- Market value: $15.1 billion

- Revenue: $1.0 billion

- Net income: -$0.2 billion

- Est. 2017 earnings growth: Not meaningful

- P/E ratio: Not meaningful

Among drugmakers, BioMarin Pharmaceutical should flourish as a leader in treatments for rare genetic diseases. The company sells medicines for illnesses such as Morquio A syndrome (a cellular disorder) and PKU (a metabolic disease), and it may win approval this year to sell a medicine for Batten disease, an often-fatal pediatric neurological disorder. Also in the works are another drug to manage PKU and a treatment for dwarfism.

Perhaps most exciting is BioMarin’s experimental gene therapy for hemophilia A, which afflicts up to one in 5,000 males worldwide. Patients with this disease now rely on infusions of blood-clotting agents to survive. BioMarin’s technology replaces a missing gene that hemophiliacs need for blood clotting, potentially reducing or eliminating regimens of injections. Although the gene-therapy product is still in early development, the firm plans to mass-produce it for more-extensive clinical trials in 2018. Credit Suisse analyst Alethia Young estimates that, if approved, the drug could eventually deliver $1 billion in annual sales, nearly as much as BioMarin’s total forecast sales of $1.3 billion in 2017.

The big risk with the stock is that BioMarin’s experimental drugs won’t pan out. If they do eventually reach the market, though, they could be worth $4 billion in annual sales, says Young. The company possesses one of “the most diversified and promising” pipelines of potential products among midsize drugmakers, she says, making the stock a buy.

Amazon.com

- Symbol: AMZN

- Share price: $823

- Market value: $391.3 billion

- Revenue: $128.0 billion

- Net income: $2.1 billion

- Est. 2017 earnings growth: 85.0%

- P/E ratio: 93

Many investors dream of winning the lottery with a small company that hits the big time. But technology giants can pay handsomely, too. Trends such as cloud computing and artificial intelligence “are reinforcing the power of the largest players,” says Kennard Allen, manager of the T. Rowe Price Science & Technology Fund. Big companies can exploit these trends, he says, and “enjoy their fruits” more than firms with fewer resources.

Leading the way is Amazon.com. Not only is it dominating online shopping, but it is also building other high-growth businesses. Amazon Web Services, its cloud-computing division, could generate $100 billion in annual sales by 2027, estimates Allen, up from $12.2 billion in 2016. Amazon is also betting on artificial intelligence: Its Alexa virtual assistant gets smarter every year, “learning” thousands more skills (well beyond shopping and home-control tasks). Topping things off are Amazon’s plans to field more package-handling robots in its warehouses and to scrap delivery trucks in favor of home-delivery drones. “I see Amazon as the biggest company in the world eventually,” says Allen, who expects the stock to double over the next five years.

- Symbol: GOOGL

- Share price: $820

- Market value: $557.6 billion

- Revenue: $90.3 billion

- Net income: $19.5 billion

- Est. 2017 earnings growth: 20.0%

- P/E ratio: 20

These trends also favor Alphabet. The parent of Google is investing heavily in artificial intelligence that it hopes will manage data centers, electrical grids, homes and health care systems—and play a greater role behind the scenes of Google’s many online businesses.

Alphabet has wrapped its tentacles around the wireless industry with its Android operating system (running nearly nine in 10 mobile devices worldwide), and it is developing sensors and software for self-driving cars. Wall Street adores all this—along with Alphabet’s hefty profits—granting the company a market capitalization of $558 billion, second only to that of Apple. But Alphabet’s many products and growth prospects warrant a higher stock price, says Credit Suisse, which sees the shares hitting $1,100 over the next 12 months.

Microsoft

- Symbol: MSFT

- Share price: $65

- Market value: $502.7 billion

- Revenue: $85.7 billion

- Net income: $23.0 billion

- Est. 2017 earnings growth: 16.0%

- P/E ratio: 39

Sure, it’s been around a long time. But Microsoft has generated immense sales and profits from its Windows operating systems and applications software, which run on more than 90% of the world’s personal computers.

Microsoft is now plowing that cash into high-growth areas, such as its thriving cloud-computing business (Azure), a new machine-learning division, and products for the Internet of Things. All told, Microsoft should benefit from most of the major tech trends, says Bank of America Merrill Lynch.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.