8 Tech Stocks that Could Perform Magic

"Any sufficiently advanced technology is indistinguishable from magic," British author and futurist Sir Arthur Clarke once observed.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

"Any sufficiently advanced technology is indistinguishable from magic," British author and futurist Sir Arthur Clarke once observed. If that's the case, there's plenty of magic in today's wired world, from smart phones that can tell jokes to machines that can tell you why they're malfunctioning. As these technologies turn into necessities, tech stocks can turn out to be surprisingly magical, too. "It's a great sector to invest in," says Bernie Williams, chief investment officer of USAA's money-management division. "It's got something for everyone."

Whether you're looking for steady dividends from an established giant such as Apple or Microsoft or wanting to place a bet on a fast-growing upstart, opportunities abound. Here are eight stocks worth a look. (The stocks are listed in order of market value.)

Prices and related data are as of the June 10 close. Price-earnings ratios are based on earnings estimates for the next four quarters. Sales are for the last four quarters.

Apple

- Headquarters: Cupertino, Calif.

- Price: $94.25

- Market capitalization: $568.3 billion

- 52-week range: $55.55 - $95.05

- Annual sales: $176.0 billion

- Estimated earnings growth: 11.1% in the fiscal year that ends in September 2014; 8.9% in the year that ends in September 2015

The death of Steve Jobs, Apple's CEO and creative genius, in October 2011 set investors on edge. When Apple's profits slumped last year, Wall Street thought its worst expectations had been confirmed, and Apple stock (symbol AAPL) went into a tailspin. But with new iPhone models out and more coming, revenues and earnings are climbing again. Apple's leaders are notoriously tight-lipped about product launches, but Jobs's successor as CEO, Tim Cook, has been hinting that new products—including, perhaps, an iWatch—are in the offing. Meanwhile, Apple has been boosting its dividend and buying back billions of dollars worth of its stock. Moreover, on June 9, Apple executed a seven-for-one stock split, its first split since February 2005. Splits have no impact on the value of investors' holdings or on measures of a stock's value. But companies generally split their stocks when their executives are optimistic about the future. Apple shares sell for 14 times projected earnings and yield 2.0%.

Microsoft

- Headquarters: Redmond, Wash.

- Price: $41.11

- Market capitalization: $339.6 billion

- 52-week range: $30.84 - $41.66

- Annual sales: $83.3 billion

- Estimated earnings growth: 6.5% in the fiscal year that ends in June 2015; 9.8% in the year that ends in June 2016

Change has been good for Microsoft (MSFT) shareholders. The stock has climbed 15% since February 4, when the company announced that Microsoft veteran Satya Nadella would replace longtime CEO Steve Ballmer. Nadella, who previously ran the firm's cloud and enterprise group, has promised that under his leadership Microsoft will revive the innovative spirit that put the company on the map. UBS Securities analyst Brent Thill is particularly encouraged by the fact that Nadella has been "refreshingly non-committal" about continuing to spend money on costly operations that have failed to win significant market share—a problem that has weighed on Microsoft's earnings over the past decade. By cutting costs, Thill says, Microsoft will be able to significantly boost profits. The shares sell for 15 times projected earnings and boast an above-average dividend yield of 2.7%.

Oracle

- Headquarters: Redwood City, Calif.

- Share price: $42.66

- Market capitalization: $190.3 billion

- 52-week range: $29.86 - $42.88

- Annual sales: $37.9 billion

- Estimated earnings growth: 9.7% in the fiscal year that ends in May 2015; 8.3% in the year that ends in May 2016

Wall Street had been treating software giant Oracle (ORCL) as if it was a bit too long in the tooth. True, cloud-based competitors have gained steam on the 37-year-old specialist in database-management programs, and Oracle's growth turned tepid. However, it's way too early to write off Oracle, says Mark Landecker, co-manager of the FPA Crescent fund. Given the nature of Oracle's business model, customers stick with the company; about 90% re-up every year. Now that Oracle is making its own inroads into the cloud, profits should perk up, analysts say. Meanwhile, Oracle is sitting on $34 billion in cash, which it has been using to buy back stock. And although the stock has gained 29% over the past year, it is not especially pricey, selling for 14 times estimated earnings.

NXP Semiconductor

- Headquarters: Eindhoven, Netherlands

- Price: $64.40

- Market capitalization: $16.2 billion

- 52-week range: $29.03 - $64.69

- Annual sales: $5.0 billion

- Estimated earnings growth: 33.7% in December 2014; 14.1% in December 2015

You may not be aware of it, but you're as likely to be using products made by NXP Semiconductors (NXPI) as you are to use Microsoft's Office or Apple's iPhone. That's because NXP makes a wide array of components that go into everything from smart phones and smart credit cards to automobiles and environmentally friendly light bulbs. The company says big trends that demand better security and energy efficiency in an increasingly interconnected world are driving its profits. USAA's Williams notes that NXP makes the chips for smart credit cards, which should see rapid growth in the wake of credit-card data breaches at Target and other companies. NXP also sells chips that go into cell phones, allowing consumers to buy products by merely waving a phone at the cash register. For a company that's expected to generate 30% earnings growth this year, NXP shares look unusually cheap at 14 times projected earnings.

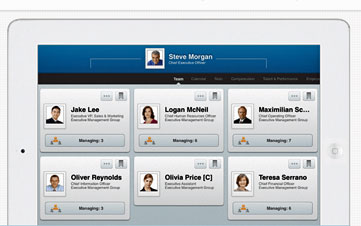

Workday

- Headquarters: Pleasanton, Calif.

- Price: $79.83

- Market capitalization: $14.6 billion

- 52-week range: $59.87 - $116.47

- Annual sales: $468.9 million

- Estimated earnings growth: Not meaningful (company is losing money)

The case for Workday (WDAY) is based on a promising future, not on current profits, of which there are none. Workday is a consulting firm that helps companies manage their human resources and finance departments. But unlike most human-resources software companies that sell expensive corporatewide systems that must be periodically updated, Workday's software is sold on an as-needed basis and is constantly updated through the cloud technology that delivers it. That makes the software more affordable and user-friendly. Workday's revenues have been growing at a blistering pace; analysts see them soaring 60% in the fiscal year that ends in January 2015 and 46% the following year. The company's first profits aren't expected until sometime in 2017. That makes the stock more speculative than most on this list. That said, the stock is a better bet today than it was in February, when it was selling at $115. The fall was simply due to a shift in the market's mood, says Steve Ashley, an analyst with Robert W. Baird & Co. He thinks the stock will hit $95 within a year.

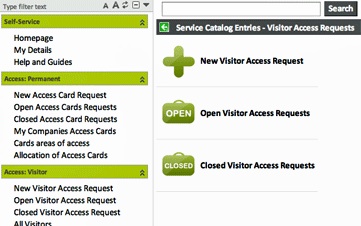

ServiceNow

- Headquarters: Santa Clara, Calif.

- Price: $55.97

- Market capitalization: $8.0 billion

- 52-week range: $35.90 - $71.80

- Annual sales: $477.8 million

- Estimated earnings growth: Not meaningful (the company is losing money)

What Workday does for human-resources management, ServiceNow (NOW) does for the information-technology department. Baird & Co. analyst Ashley thinks the company's software is game-changing. It's able to consolidate fragmented and redundant systems and allow for better tracking of performance and prioritization of work. Better yet, it can do all that at a lower cost than traditional IT software. As with Workday, ServiceNow is delivering astounding revenue gains—analysts estimate 54% growth this year—and the company is expected to deliver its first quarterly profit in the July-September period. Profits have not yet materialized, but analysts believe ServiceNow will break into the black next year. After that, profits are expected to grow rapidly. But the stock sells at a pricey 107 times estimated 2016 earnings, so if you buy the stock, be prepared for a wild ride. As with Workday's stock, ServiceNow shares took a hit in March, when investors got skittish about high valuations for growth stocks. But Ashley thinks ServiceNow will recover to $65 within a year.

Splunk

- Headquarters: San Francisco

- Price: $43.85

- Market capitalization: $5.1 billion

- 52-week range: $39.35 - $106.15

- Annual sales: $302.6 million

- Estimated earnings growth: Not meaningful (company is losing money)

Named after a sport that involves digging through caves, Splunk (SPLK) dives into the vast and often murky performance data produced by corporate machinery. By capturing the incessant clamor of machine error messages and electronically sorting through and identifying the ones that are meaningful, Splunk's software effectively gets corporate machinery to tell their owners when something is broken. That has drastically reduced the time it takes to find and fix system errors, says Derrick Wood, an analyst with Susquehanna Financial Group. And it has made Splunk one of the hottest properties on Wall Street. The company is now using its technological know-how to figure out when hackers are trying to attack its customers' computer networks. Splunk "has fantastic technology that helps customers solve real problems," says Morningstar analyst Norman Young. Like many of the other hot upstarts, Splunk is not yet profitable, but analysts expect the company to produce black ink in the quarter that ends in October 2014. Splunk shares have fallen 57% since late February. Although Young thinks the stock is worth $54, he suggests that investors wait for the shares to fall into the $30s before pouncing.

NetScout Systems

- Headquarters: Westford, Mass.

- Price: $41.33

- Market capitalization: $1.7 billion

- 52-week range: $22.71 - $41.86

- Annual sales: $396.6 million

- Estimated earnings growth: 16.0% in the fiscal year that ends in March 2015; 15.4% in the year that ends in March 2016

At 23 times estimated earnings, NetScout (NTCT) is a bit more expensive than the tech behemoths but nowhere near as pricey as the upstarts. NetScout provides software and services that allow a customer to detect technical problems by watching how traffic progresses through its computer network. For years, NetScout's primary service alerted corporate tech administrators to errors and glitches with servers, switches and software. Last year, NetScout introduced a product that helps companies enhance network performance—not just detect problems. The company also started using its data analytics recently to find cyber-criminals attempting to scale corporate firewalls. Matt Robison, an analyst with Wunderlich Securities, thinks this winning combination of products and services will help fuel steady double-digit-percentage earnings growth. NetScout's shares took a mild hit during the growth-stock selloff in March and early April, but they now trade at record highs.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Reduce Stress With a Layered Approach for Your Retirement Money

Reduce Stress With a Layered Approach for Your Retirement MoneyTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

5 Stocks to Sell or Avoid Now

5 Stocks to Sell or Avoid Nowstocks to sell In a difficult market like this, weak positions can get even weaker. Wall Street analysts believe these five stocks should be near the front of your sell list.

-

Best Stocks for Rising Interest Rates

Best Stocks for Rising Interest Ratesstocks The Federal Reserve has been aggressive in its rate hiking, and there's a chance it's not done yet. Here are eight of the best stocks for rising interest rates.

-

The Five Safest Vanguard Funds to Own in a Volatile Market

The Five Safest Vanguard Funds to Own in a Volatile Marketrecession The safest Vanguard funds can help prepare investors for market tumult but without high fees.

-

The 5 Best Inflation-Proof Stocks

The 5 Best Inflation-Proof Stocksstocks Higher prices have been a major headache for investors, but these best inflation-proof stocks could help ease the impact.

-

5 of the Best Preferred Stock ETFs for High and Stable Dividends

5 of the Best Preferred Stock ETFs for High and Stable DividendsETFs The best preferred stock ETFs allow you to reduce your risk by investing in baskets of preferred stocks.

-

What Happens When the Retirement Honeymoon Phase Is Over?

What Happens When the Retirement Honeymoon Phase Is Over?In the early days, all is fun and exciting, but after a while, it may seem to some like they’ve lost as much as they’ve gained. What then?

-

5 Top-Rated Housing Stocks With Long-Term Growth Potential

5 Top-Rated Housing Stocks With Long-Term Growth Potentialstocks Housing stocks have struggled as a red-hot market cools, but these Buy-rated picks could be worth a closer look.