15 Surprising Places You Never Considered for Retirement

When you hear the words "retirement destination," places in Arizona and Florida probably spring to mind.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

When you hear the words "retirement destination," places in Arizona and Florida probably spring to mind. But broaden your horizons, and you can find plenty of other great options all across the country.

The following 15 spots may not be popular with retirees now—but contrarian living comes with benefits. Some of these places may offer tax breaks or other perks to try and lure in more older residents. Plus, the existing younger crowds might help keep you young and active.

Check out our list of surprising places for retirement that you probably haven't considered, and see if any hold appeal for your own new home.

Estimates of living costs for retirees, where available, come from the Council for Community and Economic Research. Populations and median home values are from the U.S. Census Bureau. Estimates of states' average lifetime health care costs during retirement for couples retiring at 65 are from HealthView Services. Tax rankings are based on Kiplinger's Retiree Tax Map, which divides states into five categories: Most Tax-Friendly, Tax-Friendly, Mixed, Not Tax-Friendly and Least Tax-Friendly. Crime statistics are from the FBI. Retirement destinations are listed in alphabetical order by state.

Juneau, Alaska

- Cost of living for retirees: 32.6% above U.S. average

- Share of population 65+: 8.4% (U.S.: 14.5%)

- Alaska's tax rating for retirees: Most Tax-Friendly

- Lifetime health care costs for a retired couple: Above average at $426,047 (U.S.: $394,954)

- SEE ALSO: Great Places to Retire in All 50 States

Seniors don't seem too interested in facing the Last Frontier in retirement. Only 7.7% of the entire state's population is age 65 and older. But if you crave adventure—and don't mind long winters and vast swaths of wilderness—it pays to live in Alaska. Literally. The state's oil wealth savings account gives all permanent residents an annual dividend. In 2015, the payout was $2,072 per person. Plus, Alaska has no state income tax or sales tax (although municipalities may levy a local sales tax), and the state doesn't tax Social Security or other retirement benefits. No wonder Alaska ranks as the most tax-friendly state for retirees.

The capital city offers seniors an additional tax perk. For $20, residents age 65 and older can purchase a card that exempts them from the local 5% sales tax. It entitles you to free bus rides, too. Naturally, Juneau offers endless outdoor activities, from kayaking to whale watching, as well as a charming downtown.

Boise, Idaho

- Cost of living for retirees: 7.3% below U.S. average

- Share of population 65+: 11.2%

- Idaho's tax rating for retirees: Mixed

- Lifetime health care costs for a retired couple: Below average at $366,449

Boise is a great college town for your retirement. Boise State University provides plenty of intellectual stimulation to help keep an aging mind sharp. Its Velma V. Morrison Center for the Performing Arts hosts symphony concerts, dance performances and Broadway shows. You can also take classes at the school through the Osher Lifelong Learning Institute; membership costs $70 for a year.

Off campus, you can walk, run or bike the more than 20 miles of paved trails of the Boise River Greenbelt. Other outdoor activities to enjoy around the area include kayaking, boating, fly-fishing, golfing and skiing, just to name a few.

Des Moines, Iowa

- Cost of living for retirees: 9.1% below U.S. average

- Share of population 65+: 11.0%

- Iowa's tax rating for retirees: Mixed

- Lifetime health care costs for a retired couple: Below average at $372,712

There are retirement destinations of all sizes to choose from in Iowa, one of our 10 best states for retirement. For retirees looking to live in a big city on a small budget, Des Moines is a good choice. Affordability is just one reason the Milken Institute ranked the state capital seventh out of 100 large U.S. metro areas for successful aging. Des Moines also boasts a strong economy, numerous museums and arts venues, and plenty of health care facilities specializing in aging-related services.

Bangor, Maine

- Cost of living for retirees: not available

- Share of population 65+: 14.4%

- Maine's tax rating for retirees: Not Tax-Friendly

- Lifetime health care costs for a retired couple: Below average at $372,692

The cold never bothered you anyway? Then Bangor is a lovely retirement destination. The area's great outdoors offer cross-country skiing and snowshoeing, as well as dog-sledding and snowmobiling. In the warmer months, the same trails can be used for walking, hiking or biking. And the waterfront along the Penobscot River is home to the annual American Folk Festival, as well as other concerts during the summer. Plus, despite being home to the King of Horror, Stephen King, you have little to fear in Bangor—there were only 55 violent crimes reported in 2014. That's just 168.8 per 100,000 residents, compared with the national rate of 365.5, according to the FBI.

While the Pine Tree State can be painfully pricey, the relatively small city (population: 33,000) is more affordable than other well-known areas such as Kennebunkport (where the wealthy Bush clan has a compound) and Mount Desert (a favorite of the Rockefellers). The median home value in Bangor is $145,400, compared with $174,500 for the state and $176,700 for the U.S.

Rochester, Minnesota

- Cost of living for retirees: not available

- Share of population 65+: 12.7%

- Minnesota's tax rating for retirees: Least Tax-Friendly

- Lifetime health care costs for a retired couple: Above average at $403,562

If the cold winters and equally harsh tax situation don't put you off of the North Star State, Rochester is a great place to retire. In fact, the Milken Institute rates it as the seventh-best small metro area for successful aging. It offers an abundance of health care providers, including the renowned Mayo Clinic; hospital units specializing in Alzheimer's; and top-rated nursing homes. The local population also exhibits a healthy lifestyle, with long life expectancies and low obesity rates.

Housing costs won't wipe out your nest egg. The median home value in Rochester of $163,700 is below the national median of $176,700 and the state median of $187,900.

Columbia, Missouri

- Cost of living for retirees: 4.8% below U.S. average

- Share of population 65+: 8.5%

- Missouri's tax rating for retirees: Mixed

- Lifetime health care costs for a retired couple: Below average at $370,190

Columbia is a great place to retire, due in large part to the three colleges that call it home. The University of Missouri, Columbia College and Stephens College bring sporting events, concerts and other artistic and cultural entertainments to the city. You'll also find no shortage of bookstores, shops and restaurants around town. Adults age 50 and older can take courses through Mizzou's Osher Lifelong Learning Institute; the cost is $80 for each eight-week class in the spring and fall.

The city's top-rated hospitals and health care services are another big advantage, and they're a big reason the Milken Institute ranking Columbia the third best small metro area for successful aging. Plus, the care is relatively affordable. For example, the median annual rate for one bedroom in an assisted-living facility is $35,640 in Columbia, less than the national median of $43,200, but more than the $30,300 median for the state. Housing costs for retirees are 13.3% below the national average.

Bismarck, North Dakota

- Cost of living for retirees: 0.8% above U.S. average

- Share of population 65+: 15.4%

- North Dakota's tax rating for retirees: Not Tax-Friendly

- Lifetime health care costs for a retired couple: Below average at $372,433

The capital of the Peace Garden State offers a strong economy that allows your retirement to bloom. Especially if you're considering an encore career, Bismarck is a good choice. It boasts employment opportunities for older adults, particularly in the service sector. For this reason, as well as the robust presence of quality health care, the Milken Institute ranks the city the fourth best small metro area in the country for successful aging.

If you're hoping for a more leisurely retirement, there are a number of biking and hiking trails and parks around the city, as well as on the banks of the Missouri River. You can also enjoy cruising, boating, kayaking and canoeing the river during warmer months. Living costs are on par with the national averages but pricier than most of the rest of the state. The median home value in Bismarck is $163,900, while the rest of the state sports a $132,400 median. A one-bedroom occupancy in a local assisted-living facility costs a median $41,010 a year, compared with $43,200 for the U.S. and $38,865 for North Dakota, according to Genworth.

Tulsa, Oklahoma

- Cost of living for retirees: 11.6% below U.S. average

- Share of population 65+: 12.5%

- Oklahoma's tax rating for retirees: Tax-Friendly

- Lifetime health care costs for a retired couple: Below average at $379,464

- SEE ALSO: Great Places to Retire in All 50 States

Tulsa is a very affordable big city. With a population nearing 400,000, it's the second largest city in the Sooner State, behind Oklahoma City. But the living costs are small; for retirees, bills for everything from groceries to health care fall below average. Housing-related costs for retirees are particularly affordable, at 34.9% below average. The median home value is $122,200, well below the nation's median of $176,700. A private room in a nursing home costs a median $64,788 a year, compared with a median annual $91,250 for the U.S., according to Genworth.

The area also offers plenty of amenities. For active retirees, there are 23 public golf courses, 135 tennis courts, 50 miles of biking and running trails along the Tulsa River, and more hiking trails on Turkey Mountain. There are also lots of dining and shopping options around town, as well as galleries, museums and theaters, including the Tulsa Art Deco Museum, Woody Guthrie Center and the Tulsa Performing Arts Center downtown. High crime rates for the city are notable but tend to be concentrated in the north side; areas of midtown and downtown offer more safety.

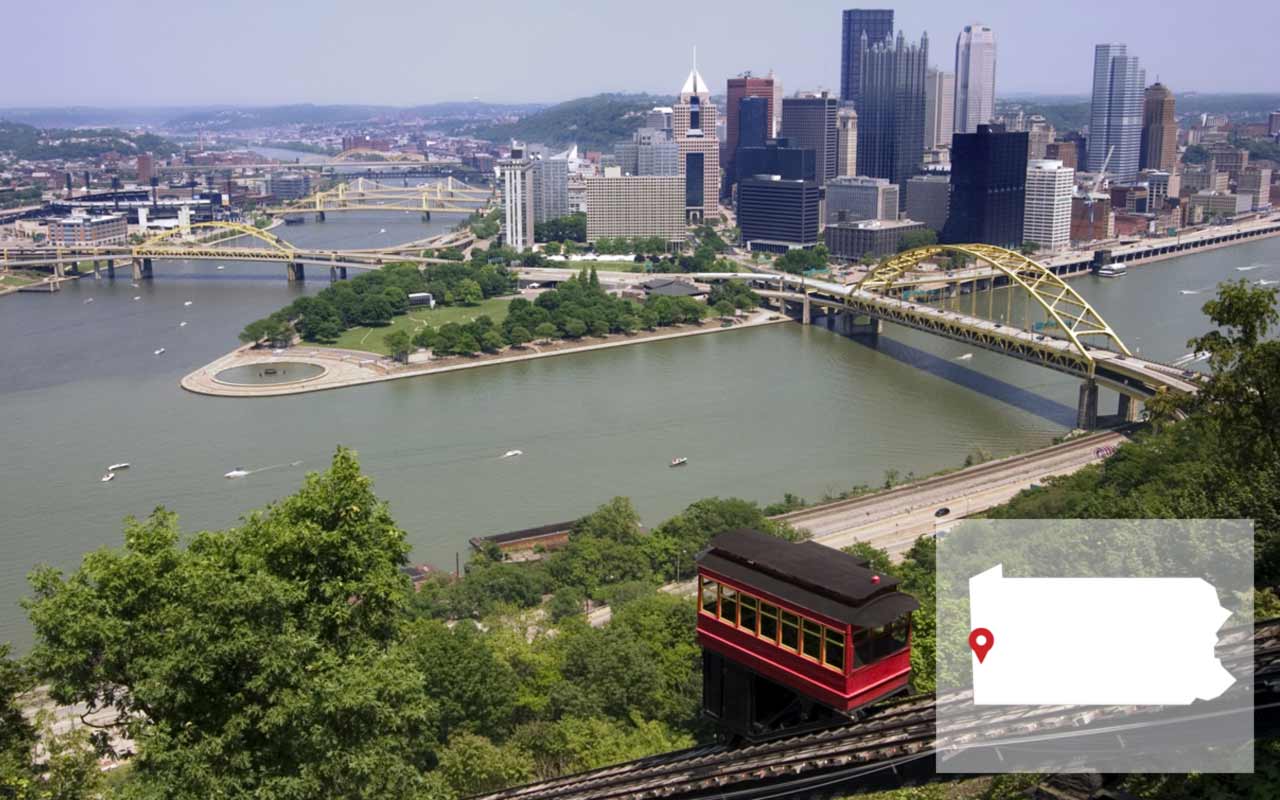

Pittsburgh, Pennsylvania

- Cost of living for retirees: 0.3% above U.S. average

- Share of population 65+: 13.8%

- Pennsylvania's tax rating for retirees: Tax-Friendly

- Lifetime health care costs for a retired couple: About average at $390,204

The Steel City is a good deal for retirees. Overall living costs are on par with the national average, and the median home value is just $89,400, compared with $164,700 for the state and $176,700 for the nation. Plus, the Keystone State offers some nice tax breaks for retirees—Social Security benefits and most other retirement income are not subject to state taxes.

Despite being light on costs, Pittsburgh is still heavy on attractions. (It's one of our picks for cheapest places where you'll want to retire.) You can enjoy the Andy Warhol Museum, the Pittsburgh Ballet Theatre, a plethora of jazz joints and all the offerings of local universities, which include Duquesne, Carnegie Mellon and the University of Pittsburgh. And if watching all the collegiate and professional sports isn't enough activity for you, you have plenty of opportunities nearby to golf, hunt, fish, bike, hike and boat.

Sioux Falls, South Dakota

- Cost of living for retirees: 5.8% below U.S. average

- Share of population 65+: 10.9%

- South Dakota's tax rating for retirees: Most Tax-Friendly

- Lifetime health care costs for a retired couple: Below average at $370,154

If you've never considered moving to South Dakota, perhaps you should. For one thing, it's really easy to avoid crowds there. The entire Mount Rushmore State is home to fewer than 900,000 people, or 10.7 people per square mile. (By comparison, New Jersey, the most densely populated state, holds 1,195.5 people per square mile.) But Sioux Falls is filled with advantages, including a booming economy, low unemployment and hospitals specializing in geriatric services. For all these reasons, plus the city's recreational activities (including regularly scheduled pickleball), the Milken Institute dubbed Sioux Falls the best small metro area for successful aging.

And all that comes pretty cheap for retirees. Along with low overall living costs in Sioux Falls, the median home value is $152,200, compared with $176,700 for the U.S. (The median for the state at $132,400.) Plus, the state's tax picture is one of the best for retirees.

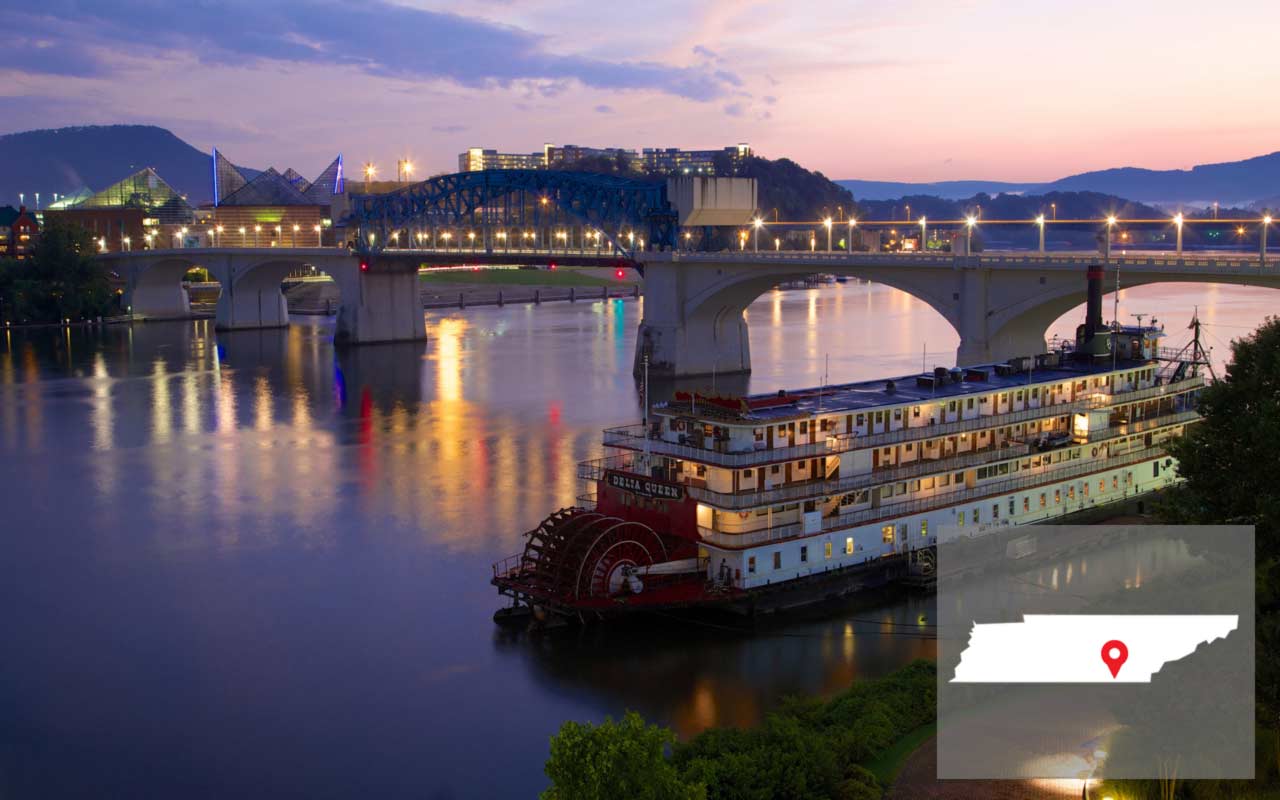

Chattanooga, Tennessee

- Cost of living for retirees: 6.0% below U.S. average

- Share of population 65+: 14.7%

- Tennessee's tax rating for retirees: Tax-Friendly

- Lifetime health care costs for a retired couple: Below average at $382,360

The Volunteer State is a good choice for most retiree budgets. On top of the friendly tax situation, most areas have below-average living costs across the board for retired residents. Chattanooga's housing-related costs for retirees are notably low, at 12.9% below average. The city's median home value is just $138,100, compared with $176,700 for the U.S. Single occupancy at an area assisted-living facility costs a median $41,400 a year; the national median is $43,200 a year.

The city's vibrant arts scene is a nice draw, with many galleries scattered throughout the Bluff View Art District, as well as the NorthShore and Southside districts. You can also enjoy a lot of quality music events, such as the nine-day Riverbend Festival and Three Sisters Bluegrass Festival, and you can take in theater performances year-round. For outdoor recreation, you can take an easy bike ride or stroll along the Tennessee River, or challenge yourself with area rock climbing, mountain biking, white-water rafting or hang gliding. Be aware of the high crime rates for the state and city. But also recognize that you can certainly find safe neighborhoods, such as Ryall Springs and West View—the safest neighborhoods in Chattanooga, according to www.neighborhoodscout.com.

Sherman, Texas

- Cost of living for retirees: 13.0% below U.S. average

- Share of population 65+: 13.2%

- Texas's tax rating for retirees: Tax-Friendly

- Lifetime health care costs for a retired couple: About average at $393,414

With a population of less than 40,000, the small city of Sherman offers retirees big savings. Overall living costs are cheap, and housing-related costs for retirees are particularly affordable, at 24.8% below average. The median home value is $98,100 in Sherman proper and $79,100 in Denison (also part of the greater metro area)—well below the state's $128,900 median. Residents can save on taxes, as well: The Lone Star state levies no income tax.

In Sherman, you can enjoy boutique shopping, unique cafés and several community gatherings throughout the year, including an Earth Day festival and free "Shakespeare in the Grove" performances. Also explore the 12,000-acre Hagerman National Wildlife Refuge, home to about 500 different wildlife species. And when you feel the urge for big-city stimulation, Dallas is about an hour's drive away.

Spokane, Washington

- Cost of living for retirees: 6.0% below U.S. average

- Share of population 65+: 12.8%

- Washington's tax rating for retirees: Tax-Friendly

- Lifetime health care costs for a retired couple: About average at $392,810

Located about 300 miles east of Seattle, between the Cascade Mountains and Rocky Mountains, Spokane is a nice choice for retirees looking to retreat to nature. On top of all the hiking and biking afforded by the mountains, as well as the 37 miles of the downtown Centennial Trail, the area boasts 76 lakes and rivers for you to enjoy swimming, boating, fishing and more. There are also 33 golf courses, more than 20 wineries and many breweries and distilleries around the region.

Spokane also offers affordability. Although health care costs for retirees are 10.5% above the national average, housing-related costs are 13.4% below average. The median home value is $160,500 in the city; by comparison, Seattle's median home value is $433,800. Single occupancy in an assisted-living facility is typically about $48,000 a year in the Spokane metro area. That's more than the national median of $43,200 a year, but less than the $55,500 state median.

Morgantown, West Virginia

- Cost of living for retirees: 0.9% above U.S. average

- Share of population 65+: 8.1%

- West Virginia 's tax rating for retirees: Tax-Friendly

- Lifetime health care costs for a retired couple: Below average at $389,905

West Virginia University offers a number of benefits to retirees in Morgantown. Residents 65 and up can take WVU courses at a discount. Or if you're 50 or older, you can join the local chapter of the Osher Lifelong Learning Institute. Membership gets you access to interest groups, trips, social gatherings and program classes, including local and international history, music, computers, yoga, and more. To be a full member for a year costs $100.

The school also helps boost local health care services with its many medical facilities, including the Eye Institute, Heart Institute and Ruby Memorial Hospital. The Milken Institute actually credits the area's large pool of doctors, orthopedic surgeons and excellent nurses for contributing to Morgantown's high ranking (15th) among small metro areas. Health care is also relatively affordable, at 2.1% below average for retirees.

Cheyenne, Wyoming

- Cost of living for retirees: not available

- Share of population 65+: 13.5%

- Wyoming's tax rating for retirees: Most Tax-Friendly

- Lifetime health care costs for a retired couple: About average at $395,273

- SEE ALSO: Great Places to Retire in All 50 States

Loner types should love the Cowboy State. It has a population of fewer than 585,000—that's just six people per square mile. (By comparison, the country's smallest state in size, Rhode Island, hosts more than a million people, with more than 1,000 people per square mile.) Even the capital city is relatively small, with fewer than 63,000 residents.

The lack of crowds doesn't leave you a lack of activities. You have plenty of outdoor diversions, such as miles of trails for hiking, biking and horseback riding; fishing and boating; and birding and other wildlife viewing. Train aficionados can enjoy the area's railroad history and displays of locomotives, including the world's largest steam engine (also retired). Another big local attraction: Every summer since 1897, Cheyenne hosts the world's largest outdoor rodeo and Western celebration, Frontier Days, now a 10-day event.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Rapacon joined Kiplinger in October 2007 as a reporter with Kiplinger's Personal Finance magazine and became an online editor for Kiplinger.com in June 2010. She previously served as editor of the "Starting Out" column, focusing on personal finance advice for people in their twenties and thirties.

Before joining Kiplinger, Rapacon worked as a senior research associate at b2b publishing house Judy Diamond Associates. She holds a B.A. degree in English from the George Washington University.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

States That Tax Social Security Benefits in 2026

States That Tax Social Security Benefits in 2026Retirement Tax Not all retirees who live in states that tax Social Security benefits have to pay state income taxes. Will your benefits be taxed?

-

What to Do With Your Tax Refund: 6 Ways to Bring Growth

What to Do With Your Tax Refund: 6 Ways to Bring GrowthUse your 2024 tax refund to boost short-term or long-term financial goals by putting it in one of these six places.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

12 Great Places to Retire in the Midwest

12 Great Places to Retire in the MidwestPlaces to live Here are our retirement picks in the 12 midwestern states.

-

15 Cheapest Small Towns to Live In

15 Cheapest Small Towns to Live InThe cheapest small towns might not be for everyone, but their charms can make them the best places to live for plenty of folks.

-

15 Reasons You'll Regret an RV in Retirement

15 Reasons You'll Regret an RV in RetirementMaking Your Money Last Here's why you might regret an RV in retirement. RV-savvy retirees talk about the downsides of spending retirement in a motorhome, travel trailer, fifth wheel, or other recreational vehicle.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

The Six Best Places to Retire in New England

The Six Best Places to Retire in New Englandplaces to live Thinking about a move to New England for retirement? Here are the best places to land for quality of life, affordability and other criteria.