31 Cheapest U.S. Cities for Early Retirement

A low cost of living and economic stability make these places to live attractive to early retirees who might want to pursue a second act during retirement.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

For some, early retirement is a dream -- and, ultimately, a choice. Followers of the FIRE movement -- Financial Independence, Retire Early -- are super-savers who track their money, invest in low-cost funds, avoid high-interest debt and focus their spending on what’s important to them.

For others, early retirement can be forced upon them suddenly—sometimes years ahead of their target date. According to a 2018 survey by the Employee Benefit Research Institute, nearly one-third of workers predict they will remain in the workforce until age 70 or older, and only 10% expect to retire before 60. But in reality, only 7% of retirees surveyed stayed on the job until at least 70, and more than one-third had quit working before age 60. Many end up retiring early because of a job loss, a health problem or caregiving responsibilities.

No matter your reasons for early retirement, you must make your nest egg stretch longer than most. Settling down in a place where the cost of living is below the national average means your retirement savings will pack more purchasing power.

With that in mind, we pinpointed 50 great places in the U.S. for early retirees—one in each state—focusing on living costs, median incomes and poverty rates for residents ages 45 to 64, as well as local tax environments and labor markets (just in case you want a second act to stretch your retirement savings further). Of our 50 picks, these 31 destinations offer particularly low living costs, which heightens the chances of your money lasting through your extra-long retirement and beyond.

The list is ordered alphabetically by state. See "How We Picked the Best Places for Early Retirement" at the end of the list for details on our data sources and methodology.

Huntsville, Ala.

- Total population: 444,908

- Share of population, age 45 to 64: 27.8% (U.S.: 26.1%)

- Retired cost of living: 5.4% below the national average

- Median income, age 45 to 64: $77,266 (U.S.: $69,909)

- State's retiree tax picture: Tax Friendly

As one of the 10 Cheapest States Where You'll Want to Retire, the Heart of Dixie boasts many great spots for affordable living. And Huntsville, in northern Alabama, is one of the best. It offers all the low-cost, low-tax advantages as the rest of the state, but adds more generous household incomes.

Home to NASA's Marshall Space Flight Center, the Redstone Arsenal and the Huntsville campus of the University of Alabama, the city offers a robust economy and a highly educated population. You can also find plenty of cultural attractions, from a sculpture trail to a symphony orchestra, as well as opportunities for outdoor recreation (think bass fishing). In fact, Alabama at-large offers many of Florida's popular retirement attractions—warm weather, nice beaches and plenty of golf—all at a typically lower price.

Lake Havasu City, Ariz.

- Total population: 204,691

- Share of population, age 45 to 64: 28.0%

- Retired cost of living: 0.2% below national average

- Median income, age 45 to 64: $44,328

- State's retiree tax picture: Mixed

Lake Havasu City, situated on the eastern shore of its namesake lake, is a popular destination for co-eds on spring break and snowbirds in the winter—a testament to its attractiveness for a wide age range, making it a great choice for early retirees. Indeed, for the whole year, the local median age is 50.4, compared with 37.8 for the U.S.

Being lake-adjacent, the area along the California border offers plenty of water-related recreation, including boating, fishing and swimming, as well as scuba diving and water skiing. But it's more than just fun and games: Kiplinger named Lake Havasu City one of 15 Satellite Cities Poised to Thrive. That's based on expanding regional business growth and a hot job market, so it offers a strong economic base should you decide to unretire in some form.

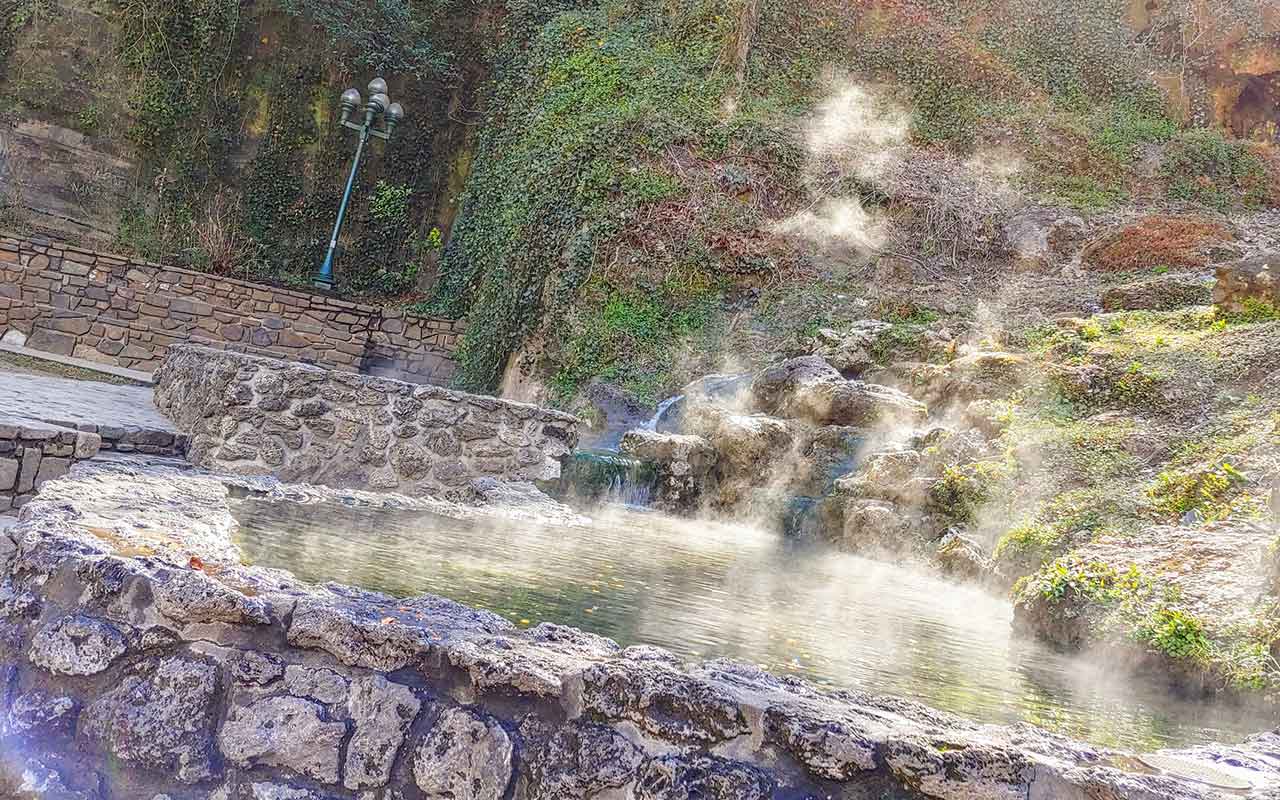

Hot Springs, Ark.

- Total population: 97,994

- Share of population, age 45 to 64: 27.1%

- Retired cost of living: 8.0% below national average

- Median income, age 45 to 64: $49,692

- State's retiree tax picture: Not Tax Friendly

You won’t need to travel far for rest and relaxation if you settle in this retirement hotspot. Surrounding the north end of the city of Hot Springs is Hot Springs National Park, which has 47 hot springs that come out of the mountain of the same name and bathhouses, where you can drink from fountains and soak in the water. The relaxing experience extends into the city proper, where you can find many spa and massage services to choose from. You can also unwind by golfing at one of the area's 11 championship courses or by fishing or boating on one of the three local lakes.

Even your wallet can de-stress. Housing, transportation and health care costs for retirees are particularly low, at 23.3%, 20.3% and 8.2% below the national average, respectively. The median home value in Hot Springs, about 60 miles southwest of Little Rock, is $114,700—far below the national median of $193,500, according to the U.S. Census Bureau.

Tampa, Fla.

- Total population: 3.0 million

- Share of population, age 45 to 64: 27.3%

- Retired cost of living: 9.3% below national average

- Median income, age 45 to 64: $68,759

- State's retiree tax picture: Most Tax Friendly

You can find plenty of great places to retire in Florida, as the scores of resident retirees can tell you. But this area ranked best with us for young retirees, driven mainly by its particularly affordable living costs and younger-skewing population. Tampa is actually one of three major cities that make up the Tampa Bay area, which also includes St. Petersburg and Clearwater. The latter tends to be the most popular among seniors, with seniors making up 21.4% of the population, compared with just 17.7% in St. Petersburg and 12.2% in Tampa.

And of course, the entire area offers all the things you'd look for in a Florida retirement: white sand beaches, warm blue waters, plenty of golf and generous tax breaks.

Savannah, Ga.

- Total population: 377,476

- Share of population, age 45 to 64: 24.0%

- Retired cost of living: 9.8% below national average

- Median income, age 45 to 64: $68,759

- State's retiree tax picture: Most Tax Friendly

With its warm weather and low living costs, Georgia ranks third among our Best States for Retirement. And Savannah (city population: 145,862) is particularly peachy, especially for early retirees. Living costs among retired people are among the lowest in an already low-cost state. Yet incomes for 45- to 64-year-olds are among the most generous, albeit still below the national median. That should make it easier to stretch your savings through an extra-long retirement.

Amenity-wise, the historic Georgia city offers beautiful sights, just right for strolling through retirement, including classic American architecture, town squares and riverfront views. Tybee Island, with its wide beaches and still-operating lighthouse, is just a 20-minute drive east of the city. You can also enjoy an array of restaurants, museums and theaters, particularly in downtown Savannah.

Twin Falls, Idaho

- Total population: 105,287

- Share of population, age 45 to 64: 22.6%

- Retired cost of living: 9.3% below national average

- Median income, age 45 to 64: $58,063

- State's retiree tax picture: Mixed

The Gem State is a brilliant blend of affordability and economic stability that can make a great home for early retirees. In fact, Idaho is the number one state for fastest job growth rate with high-tech firms, including Boise-based Micron, being attracted to its low operating costs and drawing investors and workers alike.

Twin Falls is particularly cheap for retired residents, compared with all of Idaho's already low living costs 5% below the national average for the general population. But you can still find plenty to do, especially if you're an outdoor enthusiast. The area, on the edge of Snake River Canyon in Southern Idaho, offers beautiful vistas and a good setting for hiking, camping, bird watching and kayaking.

Champaign-Urbana, Ill.

- Total population: 237,849

- Share of population, age 45 to 64: 21.6%

- Retired cost of living: 9.7% below national average

- Median income, age 45 to 64: $73,227

- State's retiree tax picture: Mixed

This part of central Illinois, home to the University of Illinois and Parkland College, offers affordability with no shortage of things to do, including college sporting events, film and music festivals and educational opportunities. The metro area is also home to a number of tech startups, fostered by the University Research Park's 43,000-square-foot business incubator called EnterpriseWorks. So young retirees can enjoy small-town charms and costs while exploring and developing big ideas and innovations.

Evansville, Ind.

- Total population: 315,263

- Share of population, age 45 to 64: 27.2%

- Retired cost of living: 6.4% below national average

- Median income, age 45 to 64: $61,349

- State's retiree tax picture: Least Tax Friendly

In the southwest corner of Indiana, near the borders of Illinois and Kentucky, the Evansville metro area is a cultural hub with five distinct arts districts, as well as the University of Southern Indiana, the University of Evansville and Ivy Tech Community College. So you can find plenty of attractions and activities to entertain you throughout your long retirement, all with below-average living costs. And as you age through retirement, you may appreciate the abundance of health care facilities, including six major hospitals nearby with approximately 2,000 beds.

Des Moines, Iowa

- Total population: 623,113

- Share of population, age 45 to 64: 24.9%

- Retired cost of living: 9.2% below national average

- Median income, age 45 to 64: $80,898

- State's retiree tax picture: Not Tax Friendly

For retirees looking to live in a big city on a small budget, Des Moines is a good choice. Affordability is just one reason the Milken Institute ranked the state capital fifth out of 100 large U.S. metro areas for successful aging. Des Moines also boasts a strong economy and plenty of health care facilities specializing in aging-related services.

Retirees won’t lack for things to do, either. There are numerous museums and arts venues, including an outdoor sculpture park, a zoo and botanical gardens. There’s even a casino and racetrack in nearby Altoona that hosts annual camel, ostrich and zebra races (sorry, no wagering allowed).

Topeka, Kan.

- Total population: 233,382

- Share of population, age 45 to 64: 27.2%

- Retired cost of living: 8.2% below national average

- Median income, age 45 to 64: $65,788

- State's retiree tax picture: Least Tax Friendly

If you're looking for affordability—as early retirees should be—there's no place like Kansas. The whole state has living costs 14% below the national average. And in capital city Topeka, retirees enjoy particularly affordable housing costs, 21.6% below the national average. Indeed, the median home value in Topeka is $100,400, compared with $139,200 in all of Kansas and $193,500 across the country.

And now is a great time to take advantage of those low costs. Downtown Topeka is enjoying something of a renaissance, with a multi-million revitalization project that began in December 2012 now bearing the fruits of their labor. Improvements to infrastructure, including widening sidewalks, and the addition of new pocket parks, pavilions and public art works helped draw new businesses and restaurants. And that's just the beginning: Construction of a new plaza began just this year and is scheduled to go public in March 2020. Evergy Plaza will offer a large performance stage, a digital screen and several fountains and will convert into an ice rink for winters.

Louisville, Ky.

- Total population: 1.3 million

- Share of population, age 45 to 64: 27.4%

- Retired cost of living: 6.8% below national average

- Median income, age 45 to 64: $65,005

- State's retiree tax picture: Most Tax Friendly

The biggest city in Kentucky, Louisville is a solid blend of metropolitan attractions, southern and midwestern charm and affordability. Housing is particularly cheap at 20.3% below the national average for retirees. The median home value in Louisville is $146,900, according to the U.S. Census Bureau, a bit pricier than the rest of the state (median: $130,000) but less than the national median of $193,500. And home options are varied, from downtown apartments and historic homes in walkable neighborhoods to million-dollar houses and acres of land within and surrounding city limits.

Along with the affordability, you can also enjoy plenty of cultural attractions in Louisville, including the Kentucky Center for the Arts, which hosts traveling Broadway shows, operas, and performances by the city's professional ballet company and orchestra. Bonus: Louisville is home to the Kentucky Derby, giving fans of horses, fancy hats and mint juleps an extra reason to love it here. Also, bourbon.

Lafayette, La.

- Total population: 487,633

- Share of population, age 45 to 64: 25.4%

- Retired cost of living: 8.5% below national average

- Median income, age 45 to 64: $55,140

- State's retiree tax picture: Tax Friendly

If you're craving Cajun and Creole culture, Lafayette is the place to retire. Known as the "Cajun Capital City," the area is rich in history, distinctive foods and two-stepping tunes. Nature lovers can appreciate the area, too, located on the Mississippi Flyway and the Atchafalaya Loop of America's Wetland Birding Trail. Bird watchers have gotten a glimpse of 240 species, so far.

And all that comes with smaller costs than you'd find in the Big Easy. The cost of living for retirees in New Orleans is 1.1% above the national average.

Grand Rapids, Mich.

- Total population: 1.0 million

- Share of population, age 45 to 64: 25.5%

- Retired cost of living: 2.2% below national average

- Median income, age 45 to 64: $71,042

- State's retiree tax picture: Not Tax Friendly

Michigan was hit hard by the Great Recession, when the automotive industry took a particularly sharp dive. A decade later, the business of cars has somewhat recovered, and the state's overall economic picture is generally improving. But poverty remains a big problem, especially in certain areas, including Detroit, Flint and Kalamazoo, where the overall poverty rate ranges from 31% to 42%, compared with 12.3% for the U.S., according to the U.S. Census Bureau.

Grand Rapids is in a relatively better economic state. The overall poverty rate is lower at 22.5% and is actually below average among 45- to 64-year-olds at 8.2%, versus 10.6% across the country. And while living costs are a bit higher than than they are in other parts of the state (Kalamazoo's retirees have living costs 21.1% below the national average), they're still lower than the rest of the country, and higher median incomes help cover the spread. Plus, the local art, food and music scenes, along with an abundance of outdoor recreation options, will keep you entertained. Lake Michigan beaches are just 30 minutes away. And nicknamed Beer City, Grand Rapids has an "Ale Trail" with more than 80 breweries.

Gulfport-Biloxi, Miss.

- Total population: 388,082

- Share of population, age 45 to 64: 26.3%

- Retired cost of living: 13.0% below national average

- Median income, age 45 to 64: $53,386

- State's retiree tax picture: Most Tax Friendly

First, the bad news: Mississippi is the most impoverished of all 50 states in the nation with a poverty rate of 19.8% among all residents, compared with 12.3% for the U.S. The 45- to 64-year-old cohort of the Gulfport-Biloxi metro area suffers less with a 14.1% poverty rate, but that's still greater than the 10.6% rate for the age group across the country. Plus, the state faces "extremely significant damage" due to tariffs, according to the U.S. Chamber of Commerce, making its current economic outlook unclear.

The good news: If you can head down to the Magnolia State with a healthy nest egg, the low living costs and generous tax breaks should allow you to comfortably make it last throughout your long retirement. In fact, the Gulfport-Biloxi metro area is among the cheapest in the U.S. Gulfport offers more affordable housing with a median home value of $118,300 versus $154,800 in Biloxi (and $193,500 for the U.S.). And either city affords you access to white sand beaches on the Gulf of Mexico, casinos, oodles of outdoor recreation—including kayaking, birding, fishing and shrimping, camping and golfing.

St. Louis

- Total population: 2.8 million

- Share of population, age 45 to 64: 27.5%

- Retired cost of living: 9.9% below national average

- Median income, age 45 to 64: $72,205

- State's retiree tax picture:

The Gateway to the West can be a nice place to enter retirement, especially when you retire early and need to stretch your savings extra long. Housing is particularly affordable with costs for retirees 28.6% below the national average. Indeed, the city's median home value is $123,800, compared with $145,400 for the state and $193,500 for the nation, according to the U.S. Census Bureau.

But low costs don't limit opportunities for living it up. Foodies can enjoy an eclectic collection of dining options, many influenced by the various ethnic groups that call the city home. (Italian-influenced toasted ravioli is a local favorite.) What to wash it all down with? Beer, naturally. Home to Anheuser-Busch, as well as a growing crop of craft breweries and brew pubs, St. Louis takes suds seriously. You can balance out all that good food and spirits by exploring the area's hundreds of parks and miles of trails and waterways. And as you age, you might appreciate that St. Louis also has an abundance of health care facilities, more than 40 establishments per 1,000 seniors in the metro area, double the U.S. average.

Omaha, Neb.

- Total population: 914,190

- Share of population, age 45 to 64: 24.9%

- Retired cost of living: 3.8% below national average

- Median income, age 45 to 64: $76,471

- State's retiree tax picture: Least Tax Friendly

Home to investing guru Warren Buffett, Omaha has been and continues to invest in itself, making it an increasingly attractive—and still affordable—place to live at any age. Just this year, the city has broken ground on a $300 million Riverfront Revitalization project that aims revamp an old industrial area to add housing, office space and entertainment areas. And already, you can enjoy an array of restaurants, shops, art galleries, concert halls and sporting events in town. (Some areas and activities may be disrupted by the revitalization project during the construction period, scheduled to complete in 2024.) Walking and biking trails throughout the city, along with five area lakes and two rivers, also provide plenty of outdoor activity.

All that comes at a low cost, with housing being particularly affordable. Indeed, Buffett bought his own modest home there in 1958 for just $31,500—his most famously frugal money move and what he's called the third best investment of his life (after his two wedding rings). Home prices aren't quite that cheap anymore, but the median home value of $146,500 is still relatively affordable, compared with the national median of $193,500.

Albuquerque, N.M.

- Total population: 905,049

- Share of population, age 45 to 64: 26.1%

- Retired cost of living: 2.4% below national average

- Median income, age 45 to 64: $59,944

- State's retiree tax picture: Least Tax Friendly

You can find a lot to enjoy in Albuquerque throughout your long retirement. Local casinos—complete with concert venues, restaurants and more, along with table games, slots and bingo—help energize the local nightlife. In the light of day, you can explore the many hiking and biking trails in and around the city, go hot air ballooning, enjoy a variety of golf courses and just enjoy the 310 sunny days Albuquerque tends to get each year through all four seasons.

All that comes with below-average costs, but also below-average incomes. And many people aren't able to strike a balance: The poverty rate in Albuquerque is 18.2%, compared with 12.3% for the U.S., but better than the 19.7% rate for New Mexico.

Buffalo, N.Y.

- Total population: 1.1 million

- Share of population, age 45 to 64: 28.3%

- Retired cost of living: 6.1% below national average

- Median income, age 45 to 64: $67,558

- State's retiree tax picture: Not Tax Friendly

This metro area, which includes Cheektowaga and Niagara Falls, offers a pocket of affordability in a largely expensive Empire State. Health care and housing costs for retirees are particularly low at 12.7% and 9.5% below the national average, respectively. While the median home value in New York is a whopping $293,000, compared with $193,500 for the U.S., it's just a fraction of that in Buffalo at just $77,800.

For your outdoor recreation, how do you like shoveling? The average snowfall is 94.4 inches each winter, but in four of the past six years, the accumulation has topped 100 inches, including 101.1 inches in the 2018-19 season. Once you dig yourself out, you partake in a wonderland of skiing, skating, tubing, pond hockey and a blizzard of other winter activities.

Raleigh, N.C.

- Total population: 1.3 million

- Share of population, age 45 to 64: 25.9%

- Retired cost of living: 7.3% below national average

- Median income, age 45 to 64: $82,608

- State's retiree tax picture: Not Tax Friendly

A high median income plus low living costs adds up to a good setting to stretch your savings through an extra-long retirement. Housing for retirees is particularly affordable, at 12.4% below the national average.

Part of North Carolina's Research Triangle, along with Durham and Chapel Hill, Raleigh also comes with powerhouse employers (and college sports teams) that provide the area with a solid economic base. Indeed, the state boasts one of the highest job growth rates in the U.S., and the Triangle is the center of growth in tech jobs while Raleigh also posts strong growth in professional and business services. That should give early retirees ample opportunity to dip back into the workforce as desired.

Bismarck, N.D.

- Total population: 128,673

- Share of population, age 45 to 64: 25.8%

- Retired cost of living: 2.8% below national average

- Median income, age 45 to 64: $82,884

- State's retiree tax picture: Tax Friendly

The capital city’s strong economy means plenty of employment opportunities for early retirees who want the option of popping back into the workforce, if only part time. It also means you can find an array of restaurants and shops around town, as well as attractions, including the Lewis and Clark Riverboat, the North Dakota Heritage Center, Fort Abraham Lincoln and the Dakota Zoo.

On the banks of the Missouri River, you can enjoy more active leisure in the summertime. That’s when it’s warm enough to go cruising, boating, kayaking and canoeing, as well as hiking and biking on the trails around the city and golfing at Hawktree Golf Club. Otherwise, hope you love snow. Bismarck gets an average 46 inches of snow each year, compared with an average 28 inches for the U.S. And the average temperature in January, the coldest month, is 2 degrees.

Cincinnati

- Total population: 2.2 million

- Share of population, age 45 to 64: 27%

- Retired cost of living: 4.2% below national average

- Median income, age 45 to 64: $72,675

- State's retiree tax picture: Mixed

With relatively high incomes and relatively low living costs, the numbers add up favorably for an early retirement to Cincinnati. Housing for retirees is the biggest driver of affordability, falling 17.5% below the national average. The median home value in the city is $124,200, lower than the median $193,500 in the U.S. and even the median $135,100 in all of Ohio.

Despite the cheap costs, Cincinnati is rich with big-city amenities, including an active arts and entertainment scene, plenty of restaurants and breweries, major sports teams and a healthy job market. The diverse local economy is home to eight Fortune 500 companies, as well as the University of Cincinnati and nearby Northern Kentucky University.

Oklahoma City

- Total population: 1.4 million

- Share of population, age 45 to 64: 24.1%

- Retired cost of living: 13.9% below national average

- Median income, age 45 to 64: $65,355

- State's retiree tax picture: Not Tax Friendly

The biggest city in the Sooner State charges residents little in living costs. Housing-related expenses are particularly affordable, at 27.3% below average. The median home value is $148,500, well below the nation's median of $193,500.

Cowboys may feel particularly at home in Oklahoma City (it has one of the largest livestock markets in the world). But given the area's downtown revitalization effort, everyone can find something to enjoy. The Bricktown Entertainment District has a variety of restaurants and nightlife options. And in neighboring Norman, the University of Oklahoma plays host to bigtime sporting and cultural events.

Greenville, S.C.

- Total population: 872,463

- Share of population, age 45 to 64: 26.3%

- Retired cost of living: 2.6% below national average

- Median income, age 45 to 64: $59,527

- State's retiree tax picture: Tax Friendly

The metro area, including Anderson and Mauldin, multiplies the local population to hundreds of thousands, but the city of Greenville remains relatively small with just about 68,500. That's despite a virtual flood of new residents arriving at a rate of 15.9% since 2010, compared with population growth of just 9.9% for the entire Palmetto State and 6.0% for the U.S.

What's the big draw? Low costs and and low taxes are highly motivational for anyone looking to stretch their savings. The metro area's housing for retirees is particularly affordable at 19.8% below the national average. But note that Anderson holds all the affordability on that front: The median home value in Greenville proper is $255,600 while in Anderson, it's significantly lower at $123,200. You'll find more action in Greenville, though, with a revitalized downtown area filling with a variety of new restaurants, shops and businesses.

Pierre, S.D.

- Total population: 21,956

- Share of population, age 45 to 64: 27.8%

- Retired cost of living: 2.5% below national average

- Median income, age 45 to 64: $71,807

- State's retiree tax picture: Most Tax Friendly

South Dakota consistently tops our rankings of best states for retirement, what with its low living costs, tax friendliness and strong fiscal health. And while its farm economy is currently hurting from the recent tariffs situation, the financial services and tourism industries continue to hum along and contribute to the state's jobs growth.

Capital city Pierre, situated on the Missouri River, is a nice place to settle in the Mount Rushmore state, particularly for fisherman and hunters. Lake Oahe, Lake Sharpe and smaller surrounding lakes offer anglers year round action. And nearby Fort Pierre National Grassland consists of 116,000 acres of federal land, where hunters can bag pheasants, prairie chickens and sharp-tail grouse, as well as waterfowl, white-tail deer and wild turkeys.

Knoxville, Tenn.

- Total population: 862,490

- Share of population, age 45 to 64: 27.2%

- Retired cost of living: 17.4% below national average

- Median income, age 45 to 64: $58,303

- State's retiree tax picture: Tax Friendly

The Volunteer State is another good choice for budget-conscious retirees, with below-average living costs throughout the state and a friendly tax situation for all residents. It ranks fifth on our list of best states for retirement, but the tax advantages kick in well before normal retirement age with no broad-based income tax.

Knoxville is particularly affordable for retirees, compared with, say, Nashville, where living costs among retired people are a mere 1.6% below the national average. Housing costs for retirees in Knoxville are the biggest factor bringing down costs, at nearly 30% below the national average. The city's median home value is just $124,500 versus $191,400 in Nashville and $193,500 across the country. Indeed, Knoxville is one of the cheapest U.S. cities to live in.

Sherman, Texas

- Total population: 126,146

- Share of population, age 45 to 64: 26.8%

- Retired cost of living: 14.3% below national average

- Median income, age 45 to 64: $64,446

- State's retiree tax picture: Tax Friendly

This small Texas city offers big savings for retirees with below-average costs in every spending category. It's actually among the cheapest U.S. cities to live in. Housing costs are particularly cheap—27.3% below the national average for retirees. The median home value in Sherman is $106,100, compared with $151,500 in all of Texas and $193,500 in the U.S.

In town, you'll find charming amenities, such as boutique shopping, a number of unique restaurants (and many more chains) and community gatherings throughout the year, including a free summer concert series. Nature lovers might also appreciate the local 12,000-acre Hagerman National Wildlife Refuge, with more than 500 species identified so far.

Ogden, Utah

- Total population: 642,274

- Share of population, age 45 to 64: 20.7%

- Retired cost of living: 0.7% below national average

- Median income, age 45 to 64: $84,527

- State's retiree tax picture: Least Tax Friendly

Low costs plus fat paychecks can add up to big savings in Ogden. Ski aficionados, in particular, will appreciate the local world-class ski resorts, including Snowbasin and Powder Mountain, without the high price tags of, say, Provo. And even when the snow melts away, the area still covered with opportunities for outdoor adventure, as well as downtown attractions including a plethora of restaurants, shops and nightlife venues.

Roanoke, Va.

- Total population: 313,069

- Share of population, age 45 to 64: 28.4%

- Retired cost of living: 10.3% below national average

- Median income, age 45 to 64: $62,803

- State's retiree tax picture: Tax Friendly

Nestled between the Blue Ridge and Allegheny mountains, Roanoke is a haven for those looking to hike through their retirements. You can find more than 600 miles of hiking trails in the Roanoke Valley—including the Appalachian Trail—ranging from easy strolls to challenging climbs. If you'd rather take in the views with less effort, try a scenic drive along the Blue Ridge Parkway. For an even more leisurely afternoon, grab a pint at one of the many local craft breweries.

Whatever you do there, you're likely to enjoy low costs while doing it. Housing is particularly affordable for retirees at 21.6% below the national average. While the median home value in Virginia is $255,800, compared with $193,500 for the U.S., in Roanoke, it's just $133,700.

Morgantown, W.V.

- Total population: 137,475

- Share of population, age 45 to 64: 23.2%

- Retired cost of living: 6.3% below national average

- Median income, age 45 to 64: $63,746

- State's retiree tax picture: Not Tax Friendly

West Virginia University offers a number of benefits to retirees in Morgantown, from sports games to cultural activities such as Broadway shows and art exhibitions to highly rated medical facilities. If you're 50 or older, you can join the local chapter of the Osher Lifelong Learning Institute. Membership, which costs $100 a year to be a full member, gets you access to interest groups, trips, social gatherings and program classes, including local and international history, music, computers and yoga. And once you're 65 and older, you can take WVU courses at a discount.

Beyond the University, you can find a world of outdoor recreation with ample opportunities for hiking, biking, fishing, birding, whitewater rafting and more.

Green Bay, Wis.

- Total population: 315,847

- Share of population, age 45 to 64: 27.6%

- Retired cost of living: 10.2% below national average

- Median income, age 45 to 64: $70,934

- State's retiree tax picture: Least Tax Friendly

The University of Wisconsin brings all the benefits of retiring in a college town to the industrial city of Green Bay. That includes a thriving cultural and arts scene, quality medical care, a walkable downtown with an array of dining and shopping options and of course sports.

And while the state's tax situation leaves something to be desired, low living costs are attractive. Green Bay is particularly affordable, with below-average costs for retirees across all spending categories. Housing expenses are notably low, with costs for retirees falling 20% below the national average. Couple that with the above-average income, and your budget should have no problem extending throughout your retirement here.

Cheyenne, Wyo.

- Total population: 97,031

- Share of population, age 45 to 64: 25.9%

- Retired cost of living: 7.9% below national average

- Median income, age 45 to 64: $75,418

- State's retiree tax picture: Most Tax Friendly

Retiring early to escape the noise and crowds of the workforce? The Cowboy State offers an abundance of space and quiet—and a scarcity of people. It has a population of fewer than 580,000—that's about six people per square mile. (By comparison, the country's smallest state in size, Rhode Island, hosts more than a million people, with more than 1,000 people per square mile.) Even the capital is relatively small, with about 64,000 residents living in the city proper.

The lack of crowds doesn't leave you a lack of activities. You have plenty of outdoor diversions, such as miles of trails for hiking, biking and horseback riding; fishing and boating; and birding and other wildlife viewing. Train aficionados can enjoy the area's railroad history and displays of locomotives, including the world's largest steam engine (also retired). Another big local attraction: Every summer since 1897, Cheyenne hosts the world's largest outdoor rodeo and Western celebration, Frontier Days, now a 10-day event.

How We Picked the Best Places for Early Retirement

To pinpoint one great retirement destination in each state, we weighed a number of factors:

- Cost of living for retirees in specified major metropolitan and micropolitan statistical areas is provided by the Council for Community and Economic Research (C2ER) through its cost of living index for retired households. The index includes costs of housing, food and groceries, transportation, utilities, health care and miscellaneous expenses. For select cities, where data specifically for retired households was not available, cost of living comes from Sperling's Best Places and includes all residents, as noted.

- Population data, including the percentage of the population that is age 45 to 64, is provided by the U.S. Census Bureau. The figures, unless otherwise noted, represent the populations of major metropolitan and micropolitan statistical areas that often include multiple cities despite being named after just the principal city.

- Household incomes, poverty rates and unemployment rates for 45- to 64-year-olds are also from the U.S. Census Bureau.

- Taxes on retirees, based on Kiplinger's Retiree Tax Map, divides states into five categories: Most Tax Friendly, Tax Friendly, Mixed, Not Tax Friendly and Least Tax Friendly.

- Average health care costs in retirement are from HealthView Services and include Medicare, supplemental insurance, dental insurance and out-of-pocket costs for a 55-year-old couple who are both retired and are expected to live to 87 (husband) and 89 (wife).

- Rankings of each state's economic health are provided by the Mercatus Center at George Mason University and are based on various factors including state governments' revenue sources, debts, budgets and abilities to fund pensions, health-care benefits and other services.

- Rankings of the health of each state's population are from the United Health Foundation and are based on more than 30 factors ranging from residents' bad habits (smoking and excessive drinking) to the quality of hospital and nursing home care available in the state.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Rapacon joined Kiplinger in October 2007 as a reporter with Kiplinger's Personal Finance magazine and became an online editor for Kiplinger.com in June 2010. She previously served as editor of the "Starting Out" column, focusing on personal finance advice for people in their twenties and thirties.

Before joining Kiplinger, Rapacon worked as a senior research associate at b2b publishing house Judy Diamond Associates. She holds a B.A. degree in English from the George Washington University.

-

How to Turn Your 401(k) Into A Real Estate Empire

How to Turn Your 401(k) Into A Real Estate EmpireTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

My First $1 Million: Retired Nuclear Plant Supervisor, 68

My First $1 Million: Retired Nuclear Plant Supervisor, 68Ever wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

How to Position Investments to Minimize Taxes for Your Heirs

How to Position Investments to Minimize Taxes for Your HeirsTo minimize your heirs' tax burden, focus on aligning your investment account types and assets with your estate plan, and pay attention to the impact of RMDs.

-

States That Tax Social Security Benefits in 2026

States That Tax Social Security Benefits in 2026Retirement Tax Not all retirees who live in states that tax Social Security benefits have to pay state income taxes. Will your benefits be taxed?

-

What to Do With Your Tax Refund: 6 Ways to Bring Growth

What to Do With Your Tax Refund: 6 Ways to Bring GrowthUse your 2024 tax refund to boost short-term or long-term financial goals by putting it in one of these six places.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

12 Great Places to Retire in the Midwest

12 Great Places to Retire in the MidwestPlaces to live Here are our retirement picks in the 12 midwestern states.

-

15 Cheapest Small Towns to Live In

15 Cheapest Small Towns to Live InThe cheapest small towns might not be for everyone, but their charms can make them the best places to live for plenty of folks.

-

15 Reasons You'll Regret an RV in Retirement

15 Reasons You'll Regret an RV in RetirementMaking Your Money Last Here's why you might regret an RV in retirement. RV-savvy retirees talk about the downsides of spending retirement in a motorhome, travel trailer, fifth wheel, or other recreational vehicle.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

The Six Best Places to Retire in New England

The Six Best Places to Retire in New Englandplaces to live Thinking about a move to New England for retirement? Here are the best places to land for quality of life, affordability and other criteria.