Best Places to Retire in the US

Thinking about the best places to retire? These states tend to have lower taxes, decent weather and other benefits for retirees.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Summary: Where are the best places to retire in the U.S.? A 2025 WalletHub study identifies the options, considering factors like tax rates, cost of living, healthcare access, and activities. Florida ranks first for its low taxes and quality of life, despite hurricane risks and high living costs. Minnesota, Colorado, Wyoming, and South Dakota follow, each offering unique benefits and drawbacks. Where you retire significantly impacts your financial well-being and quality of life, so choose wisely.

Not all of the best places to retire are warm-weather states like Florida. In fact, Minnesota, known for freezing temperatures and snowdrifts, comes in at number two. If you're curious (and a bit cautious) about where to enjoy your retirement, we've got you covered. A 2025 study from WalletHub narrowed down the best states to retire in based on metrics such as tax rates, the cost of living, access to quality medical care and fun activities.

But maybe you're thinking more about moving closer to family and the grandkids. Perhaps you want a change of scenery. Or, maybe you just want to know how income taxes in retirement stack up in all 50 states — to keep more of your hard-earned cash in the bank.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

By 2030, the U.S. will have more adults aged 65 years or older — retirement age — than children under 18, according to the U.S. Census Bureau. By 2060, about 94.7 million Americans will be 65 or older. Like you, many of these same people will start thinking about where to hang their hat when they retire, if they haven't already done so.

So, whether you're thinking about "one of these days" or you're already retired and itching to make a move, it makes good sense to poke around to find the best places to retire in the U.S. before you pack your bags.

Wondering about the least desirable spots to retire? Our companion article looks at the worst places to retire in the U.S. (quick note: some of the best places are also the worst for other reasons).

These are just some of the factors you might want to consider that can make (or break) the effort of packing up and moving worthwhile.

- High-quality public health care

- Affordable housing

- Good public transportation

- Lots of green space

- A welcome sense of community

- The ease of making new friends

- Lower taxes

- Weather: cold vs. hot, or humid over dry

Before you permanently uproot your life, take a look at the best states to retire to in 2025, according to WalletHub. We’ve highlighted the top 10.

Top 10 places to retire in 2025

Rank | State | Total Score* | Affordability | Quality of Life | Healthcare |

1 (same as 2024) | Florida | 62.76 | 2 | 2 | 27 |

2 | Minnesota | 62.74 | 27 | 6 | 1 |

3 | Colorado | 61.71 | 15 | 18 | 3 |

4 | Wyoming | 60.79 | 1 | 3 | 38 |

5 | South Dakota | 60.76 | 18 | 19 | 4 |

6 | Pennsylvania | 60.44 | 22 | 5 | 9 |

7 (same as 2024) | New Hampshire | 58.64 | 23 | 8 | 14 |

8 | Delaware | 58.62 | 4 | 35 | 18 |

9 | North Dakota | 58.45 | 14 | 30 | 13 |

10 | Wisconsin | 57.75 | 17 | 20 | 21 |

*Rounded up or down. A rank of 1 represents the best conditions for that metric category.

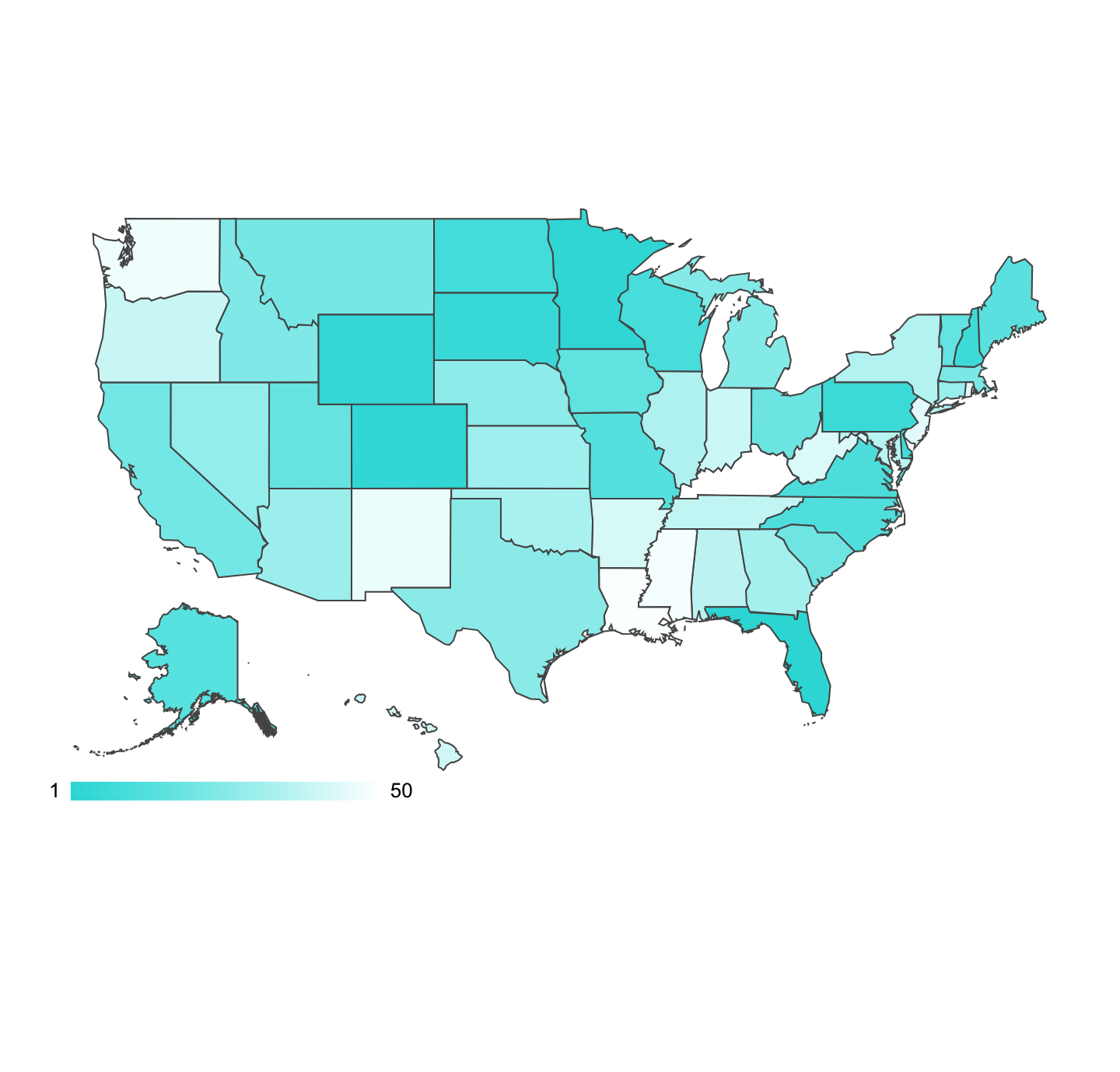

The best places to retire are indicated from dark blue - the best, to lighter blue - the worst.

The best of the best: the top 10 places to retire in the U.S.

1. Florida

Florida ranks as the best state to retire in for the second year in a row. Like last year, Florida tops the list due to its relatively low taxes for retirees, including no estate, inheritance or income taxes. (Check out our Florida State Tax Guide.) Besides that, Florida receives more funding per senior from the Older Americans Act than all but two other states. This money is used to fund things like homemaker assistance, transportation and nutrition programs for seniors.

It's no secret that Florida is popular with retirees, so dig into the nine reasons people retire in Florida. A few highlights include: the Sunshine State has the second-most shoreline miles of any state, allowing for plenty of relaxing at the beach. It also has the second-most adult volunteer activities, the fifth-most theater companies, and the seventh-most golf courses. Florida also has the third-lowest death rate in the country for people ages 65+.

On the flip side, Florida transplants don't often realize just how severe property damage can be from hurricanes or how to tell if a house will flood. It can be very expensive to obtain home insurance in some areas of the state, especially if you are in a flood zone. Besides that, home prices have dropped quite a bit (5.1% over the past year), with a current state average of $378,031, according to Zillow. And, unfortunately, the overall cost of living is also quite high, compared to other states.

2. Minnesota

Minnesota is the land of 10,000 lakes, hot summers and brutal winters. It is located in the Upper Midwest and has become a popular retirement destination for many retirees. In fact, in 2025, Minnesota takes the number two slot. Although the winters are snowy and cold, the largest city in Minnesota, Minneapolis (and State Capital, neighboring St. Paul), offers access to outdoor activities, a vibrant cultural scene and a diverse community for retirees. Within the city limits, you'll also find beautiful lakes and dozens of scenic parks.

Move further north to cities like Duluth and Ely (near the Canadian border and on the edge of the world-famous Boundary Waters Canoe Area Wilderness) and you'll find abundant hiking, fishing and hunting. One of the deepest, cleanest and largest Great Lakes, Lake Superior, also offers opportunities for boating, walking the sandy beaches and sightseeing not found in many other places.

The latest data from the World Population Review shows that Minnesota had a population of just over 5.8 million people as of 2024. Just over 962,143 people are retired. The state has the 10th-best elder abuse protections in the country, which guards elderly residents against physical and financial harm, and the 15th-lowest violent crime rate. The state is also home to many highly-rated hospitals and health care systems, including the Mayo Clinic and the University of Minnesota Health System. However, the Minnesota housing market is tight, with an average home value of $344,191 statewide.

3. Colorado

Colorado is the third-best state for retirees. It has one of the lowest rates of social isolation for seniors and boasts the 10th-best geriatric hospitals in the country. In 2025, Colorado is home to the fourth-highest percentage of seniors who are in good health and the third-highest percentage who are physically active. There are very few residents above age 65 who live in poverty, and, like number one-ranked Florida, Colorado offers similar taxpayer-friendly conditions, with no estate or inheritance taxes. (Check out our Colorado State Tax Guide).

On top of all that, Colorado has plenty to keep seniors active and engaged. For example, it has the sixth-most volunteer opportunities, the ninth-most scenic byways and the 11th-most theaters per capita. Although the value of homes across the state dropped a bit in early 2025, the average home sells for $541,198, according to Zillow.

4. Wyoming

Home to Yellowstone National Park, Wyoming has it all — gorgeous parks, low crime rates, affordable housing and a slower pace of life for retirees. It is also the 10th largest state by area and the least populated. Summers are hot and humid with 222 days of sunshine, which means retirees can enjoy a lot of time outdoors and get a good amount of the essential Vitamin D.

And, while there is plenty of sunshine, as winter approaches, the weather can get harsh with strong winds and high snowfall. Wyoming has low violent crime rates and some of the cleanest air in the country. When it comes to finances, Wyoming also ranks among the states with the lowest tax burdens for retirees; the state has no estate or inheritance taxes. (Check out our Wyoming State Tax Guide.)

5. South Dakota

South Dakota can be an excellent choice for retirees looking for a low cost of living, abundant outdoor activities — Badlands National Park to the well-known (and often visited!) Mount Rushmore — and friendly communities. A largely rural state, retirees who prefer a wide range of amenities and entertainment options may want to consider other states when deciding where to retire. That said, Sioux Falls is the largest city in South Dakota and offers many of the amenities retirees look for like restaurants, shopping and entertainment venues.

South Dakota has a population of just over 900,000 people, with over 16% of the population over the age of 65. The state also has many high-quality health care facilities. There is no state income tax in South Dakota, which means income from retirement savings accounts, such as a 401(K) or IRA, pensions and Social Security will not be subject to state income tax. However, it does have one of the highest sales tax rates in the country. Take a look at our South Dakota Tax Guide.

6. Pennsylvania

Located on the East Coast of the U.S., Pennsylvania has a rich history dating back to the American Revolution. Seniors will find a blend of large cities, like Philadelphia and Pittsburgh, and scenic landscapes perfect for outdoor activities.

Overall, the cost of living in Pennsylvania is higher than the national average. But that's tempered by the fact that the state doesn't tax any traditional types of retirement income, such as IRAs and 401(k)s. Social Security and pensions are also not taxed. The state offers excellent healthcare, has low crime and boasts nearly 17 million acres of forested land.

However, winters can be very cold and Pennsylvania also has an inheritance tax (up to 15%), bad roads and year-round air pollution in the big cities. Although the average value of a home across the state is rising, you can still find reasonable home prices in some areas, with the average home value listed at $281,369, according to Zillow.

7. New Hampshire

New Hampshire is proud of its natural beauty and scenic landscapes. It’s a small state, only 9,349 square miles, where you'll find easy access to the beautiful outdoors. However, you'll have to trade off city amenities like entertainment, shopping and dining for all that beauty. Winters can also be harsh and the cost of living can be high compared to other areas of the country. BestPlaces.net reports an average of 68 inches of snow per year across the state, compared to the U.S. average of 28 inches.

On the upside, New Hampshire doesn’t charge a sales tax or levy Social Security benefits, retirement income or pensions. However, New Hampshire has one of the highest property tax rates in the country — $4,636.00 on average or 1.86% of the home's value — with only two states levying higher property taxes. And, if you're looking for a 'sense of community, only 12% of the state’s residents are seniors, which may make enjoying activities and making new friends a bit difficult. But did we say, it is a gorgeous state.

8. Delaware

Delaware ranks as the eighth-best state for retirement, boasting one of the lowest overall tax burdens in the country, including no estate or inheritance taxes. It also has a large population of seniors. Delaware has the lowest rate of poverty among people age 65 and older and the state offers seniors a variety of things to do and places to go, from the beaches of Rehoboth to the historic streets of Wilmington. Overall, the First State offers a unique blend of experiences for retirees.

Delaware is a retirement oasis. With pristine beaches, gorgeous scenery, quaint beach towns and award-winning restaurants, retirees have many opportunities to meet new people and enjoy a lively retirement lifestyle. The state also boasts no sales tax, inheritance or estate taxes, and property taxes that are some of the lowest in the nation. (Check out our Delaware State Tax Guide.)

However, a home will set retirees back about $397,350, up 2.5% over last year, compared to an average home value in the US of $363,505. Delaware is also the second-smallest state in landmass, but it accounts for a vast population of approximately one million residents. That means the streets and be congested and getting around can be difficult. Also, public transportation in Delaware isn't very reliable.

9. North Dakota

North Dakota offers unique benefits for retirees looking for a quieter and more affordable lifestyle. The state's three main cities, Bismarck, Fargo, and Grand Forks, are some of the top (and largest) locations for retirees living in North Dakota.

North Dakota also has a relatively low cost of living compared to many other states, making it an attractive destination for retirees on a fixed income. However, pensions, 401(k) and IRA distributions are taxable. (See our North Dakota Tax Guide.)

According to the latest data from the U.S. Census Bureau, North Dakota had a population of 796,568 people in 2024, with over 16% of the population being 65 years of age or older. That makes South Dakota one of the top states with a large population of retirees.

The average Fargo, North Dakota home value is about $315,427, up 3.1% over the past year, but lower than the national average of $363,505.

10. Wisconsin

Retiring in Wisconsin can be an adventure. The state offers an abundance of outdoor activities, which are a great benefit considering you will have a lot of free time on your hands when you retire.

Wisconsin has a moderate cost of living, good health care, and a variety of year-round festivities, parks and lakes. However, the state also has long winters, poor roads and high property taxes.

On the upside, Wisconsin has one of the lowest sales tax rates in the country, and your heirs won't pay state taxes on their inheritance because Wisconsin doesn't have an estate or inheritance tax. Besides that, Wisconsin doesn't tax Social Security or Railroad Retirement benefits. Military pay that is exempt from federal taxation is also exempt in Wisconsin. (See our guide on Retirement Taxes in All 50 States.)

10 other states worthy of merit

The following 10 states also earn the distinction of being good states to retire in 2025.

- Virginia

- North Carolina

- Missouri

- Alaska

- Maine

- Iowa

- Vermont

- Utah

- Ohio

- South Carolina

Where you retire matters

“Retirement is supposed to be relaxing, but it can also be incredibly stressful given that it typically puts people on a fixed income, which may not be enough for them to live comfortably," says Chip Lupo, WalletHub analyst. "As a result, the best states for retirees are those that have low taxes and a low cost of living to help retirees’ budgets stretch as far as possible. Having access to excellent medical care and homemaking services is also crucial, especially for people who don’t plan to retire in close proximity to their families.”

Still not certain if making a move is best for you? Check out the Worst Places to Retire in the U.S., based on 46 key indicators like not-so-easy access to quality health care, higher housing costs and taxes.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

For the past 18+ years, Kathryn has highlighted the humanity in personal finance by shaping stories that identify the opportunities and obstacles in managing a person's finances. All the same, she’ll jump on other equally important topics if needed. Kathryn graduated with a degree in Journalism and lives in Duluth, Minnesota. She joined Kiplinger in 2023 as a contributor.

-

Look Out for These Gold Bar Scams as Prices Surge

Look Out for These Gold Bar Scams as Prices SurgeFraudsters impersonating government agents are convincing victims to convert savings into gold — and handing it over in courier scams costing Americans millions.

-

How to Turn Your 401(k) Into A Real Estate Empire

How to Turn Your 401(k) Into A Real Estate EmpireTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

My First $1 Million: Retired Nuclear Plant Supervisor, 68

My First $1 Million: Retired Nuclear Plant Supervisor, 68Ever wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

How to Turn Your 401(k) Into A Real Estate Empire — Without Killing Your Retirement

How to Turn Your 401(k) Into A Real Estate Empire — Without Killing Your RetirementTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

Don't Bury Your Kids in Taxes: How to Position Your Investments to Help Create More Wealth for Them

Don't Bury Your Kids in Taxes: How to Position Your Investments to Help Create More Wealth for ThemTo minimize your heirs' tax burden, focus on aligning your investment account types and assets with your estate plan, and pay attention to the impact of RMDs.

-

Are You 'Too Old' to Benefit From an Annuity?

Are You 'Too Old' to Benefit From an Annuity?Probably not, even if you're in your 70s or 80s, but it depends on your circumstances and the kind of annuity you're considering.

-

In Your 50s and Seeing Retirement in the Distance? What You Do Now Can Make a Significant Impact

In Your 50s and Seeing Retirement in the Distance? What You Do Now Can Make a Significant ImpactThis is the perfect time to assess whether your retirement planning is on track and determine what steps you need to take if it's not.

-

Your Retirement Isn't Set in Stone, But It Can Be a Work of Art

Your Retirement Isn't Set in Stone, But It Can Be a Work of ArtSetting and forgetting your retirement plan will make it hard to cope with life's challenges. Instead, consider redrawing and refining your plan as you go.

-

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)Struggling with picking a date? Experts explain how to get out of your head and retire on your own terms.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.