12 Ways to Get Your Retirement Plan Back on Track

If your financial situation hits a rough spot, there are a number of things you can do to get your retirement plan moving in the right direction again once you get back on your feet.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Does it feel like the coronavirus pandemic has pushed all your retirement plans by the wayside? If you recently lost your job or had a reduction in income, you're probably not thinking about your long-term future and retirement plans right now. Instead, you're focused on surviving from one day to the next.

But when you get back on your feet again, don't panic or start thinking that all is lost when it comes to retirement planning. You can get things moving in the right direction again. While there are no easy answers or quick fixes in these uncertain times, here are 12 ways you can shore up your retirement plan and get it back on track.

Make Catch-Up Contributions If You Can

Thanks to the demise of traditional pension plans, most people are responsible for accumulating the bulk of their own retirement savings. One way to optimize your savings is to make catch-up contributions in addition to your regular 401(k) or IRA contributions. Basically, if you're age 50 or older, you can contribute more than younger people to your retirement accounts so that you can "catch-up" on retirement savings before you reach retirement age.

For 2020, 401(k) contributions are limited to $19,500 for most people, but if you're 50 and older, you can make an additional catch-up contribution of $6,500 this year. That means older savers can contribute up to $26,000 in a 401(k) plan in 2020.

With an IRA, the maximum amount you can contribute for 2020 is $6,000 if you're younger than age 50. However, people age 50 and older can add an extra $1,000 per year as a catch-up contribution, bringing the maximum IRA contribution to $7,000.

Maximizing your retirement contributions with catch-up contributions will help grow your nest egg consistently and let your funds get the most from compounding returns.

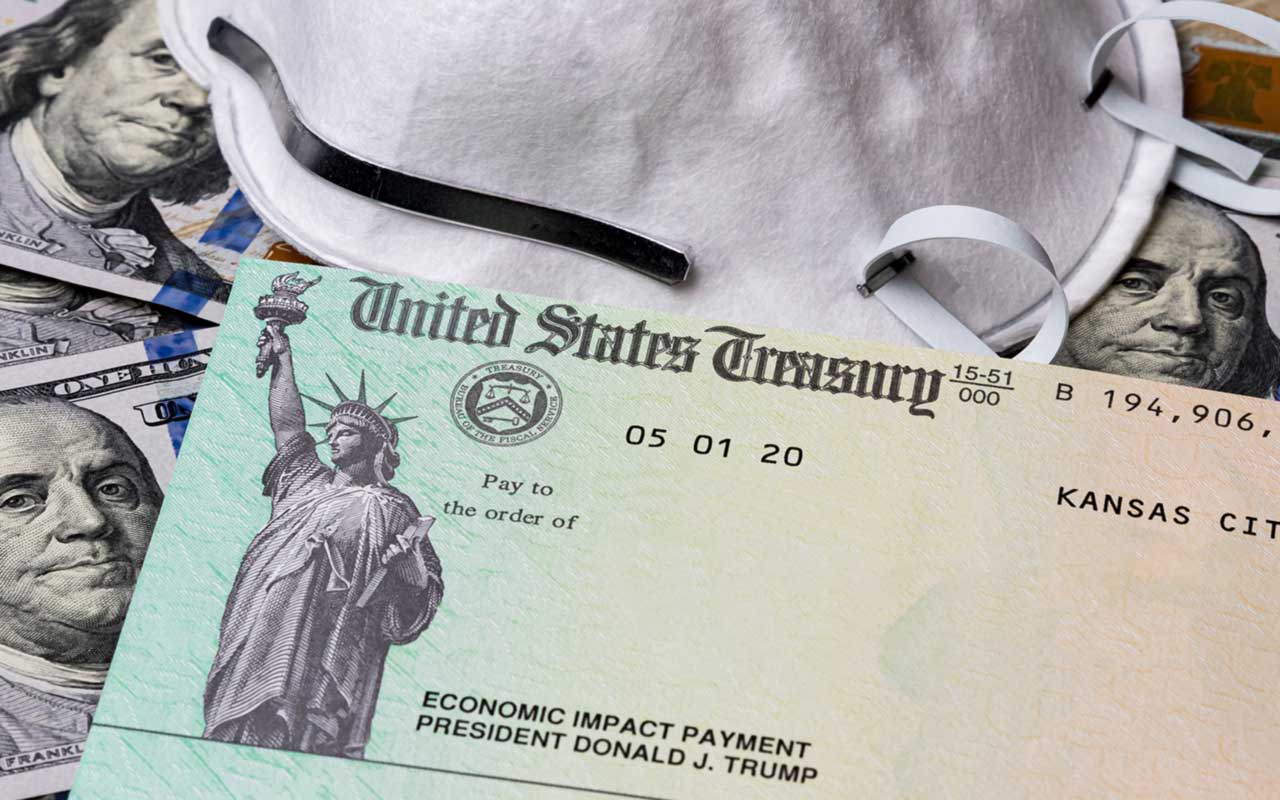

Put Your Stimulus Check in an IRA

The federal government is sending out stimulus checks to most Americans (although not everyone will get one). Depending on your income, your check could be for as much as $1,200, plus and extra $500 for each child under 17 years old. Once you receive your payment, investing the money in an IRA is a smart move if you have your basic needs covered. If you haven't already maxed out your IRAs for 2019, it isn't too late to put more money in for 2019. The IRS extended the 2019 contribution deadline from April 15 to July 15, 2020. If you already fully funded your IRAs for 2019, you have until April 15, 2021, to put money into them for 2020.

Your IRA contributions might be tax-deductible, too. If you and your spouse, if married, don't have a 401(k) or other retirement plan at work, you can deduct the full amount of contributions to a traditional IRA. If you do have a retirement plan at work, you still might be able to deduct some or all your contribution. Singles with modified adjusted gross income of $65,000 or less and joint filers with income of up to $104,000 can deduct their full contribution for the 2020 tax year. Deductions decrease and phase out completely once income reaches $75,000 for singles and $124,000 for joint filers. Just remember that you generally must have earned income to contribute to an IRA, and your stimulus check alone won't cut it because it isn't considered earned income.

If you're already retired, also don't forget that you can now keep contributing to an IRA as you grow older. Before this year, contributions to a traditional IRA were not allowed by anyone age 70½ and older. However, that restriction was lifted by the SECURE Act, which was enacted in December 2019.

Consider a Roth Conversion

Now might be a good time to convert a traditional IRA into a Roth IRA. With a traditional IRA, you pay tax when you withdraw funds from the account in retirement. With a Roth IRA, you pay tax now, but withdrawals in retirement are tax free. So, it's a pay me now or pay me later situation.

If you do convert a traditional IRA to a Roth IRA, you pay tax on the transferred funds in the year of conversion. However, doing it in 2020 might be a good move in the long run if you can handle the additional tax this year.

First, tax rates are relatively low right now. And, depending on the November elections and how the government decides to pay for all the recent coronavirus relief measures, rates very well may go up after 2020. If your income is lower this year, you might be in a lower tax bracket for that reason, too. So, if you wait, a conversion could cost more in taxes next year or further down the road.

The sagging stock market also makes it a good time to do a Roth conversion. You tax bill will be lower since the value of your converted investments will be lower. Once funds are shifted into a Roth IRA, they will continue to grow in the new account, and you can take tax-free distributions from the account when you retire.

Pay Off 401(k) Loans As Soon As Possible

If you have a 401(k) loan, pay it off as soon as possible. Otherwise, you're putting your short-term needs ahead of your long-term goals. The purpose of a 401(k) is to save for your retirement, and if you borrow from this account, it may lead to your retirement being inadequately funded. Also, the money you borrow is no longer being invested, so you'll miss out on any potential growth for the duration of your loan.

In addition, most plans require that a 401(k) loan be repaid within 60 to 90 days if you leave your job. This can keep you tied to your job, forcing you to pass on better opportunities that may come your way. If you're unable or unwilling to pay within the time allotted in your plan, the full amount will be treated like a distribution, subject to income tax and a 10% early-withdrawal penalty if you're under 59½ years old. Also keep in mind that many employers won't allow you to contribute to your 401(k) plan until the loan is paid off.

You'll also lose the tax advantage of a 401(k) plan because, when you repay the loan, you'll be paying it back with money that has already been taxed. You'll also pay taxes when the money is eventually withdrawn from the account, so you'll end up paying taxes on that money twice.

So, rather than borrow from your 401(k) at the first sign of trouble, work on saving at least three to six months' worth of living expenses in a no-fee, high-yield savings account for unexpected situations that may arise. This will give you the cushion you need and keep your retirement money safely invested in your 401(k) plan.

Get a New Job

Gone are the days when it was common to stay with one company for your entire career. So, don't be afraid to move on for a better opportunity – particularly if you can get a higher salary or better benefits. Since you're responsible for most of your retirement savings these days, a bump in salary or a good 401(k) plan can jump start your retirement planning, too.

If you're lucky enough to still be employed during this pandemic, make sure that that you continue networking like you need a job to keep your career on track. Take the time to keep in touch with industry peers, friends, and colleagues. If you make it a point to invest your time in these types of activities, it will make finding a new opportunity much easier when you need it. It will also cut down on the time you will spend searching for a job.

If you're unemployed or had your work hours reduced, this might be a good time to consider starting that new business you've always dreamed about but never found the time for because of your full-time work commitments. At the very least, get out and explore the new field you're interested in and see if it's feasible now.

If you have the resources, also think about getting the education you need to move on or grow in your career. Opportunities for remote learning abound, so start looking for classes you can take to improve yourself. Consider it a career "reboot" and get started on it as soon as possible.

Explore a Side Gig

If you're employed and have extra time and energy, look for a side hustle to boost your income. If you can manage it along with your full-time job, this will let you get your retirement planning back on track because you can funnel that extra cash into your retirement savings accounts. This type of temporary employment has been a growing phenomenon over the past few years as companies look for more flexibility in how they fill positions and workers seek greater control over when and where they work.

Workers age 55 and older are especially enthusiastic about the beauty of a side hustle, according to a recent report by the Bureau of Labor Statistics. They're attracted by the opportunity to make a few more bucks through part-time remote work. Because of their experience, older workers are often in a better position to work for themselves, too.

There are many ways to make money on the side. For some suggestions, see 38 Ways to Earn Extra Cash With a Cool Side Hustle.

Work Longer Than You Planned

If you're still employed during the pandemic, but you're close to retirement, consider staying on the job for a few more years. This will make a huge difference in your retirement savings because you can continue making contributions to your retirement funds and hold off tapping into them. You'll also be able to delay taking Social Security right away, which means you'll earn a bigger benefit when you do start receiving benefits (see below). And you'll have fewer years of retirement to fund.

If you don't want to work full-time in your golden years, taking on a part-time job in retirement can help as well. There are a number of high-paying part-time jobs that are perfect for seniors with a career's worth of experience. Think bookkeeper, career coach, consultant, instructor, web developer, copy editor, and the like.

Maintain Your Health Insurance

If you lose your job, it's important that you continue to maintain your health insurance. You don't want to be in a situation where you're forced to divert funds earmarked for retirement savings to pay off medical bills. You don't want to dip into existing retirement accounts to cover medical costs, either. Fortunately, if you're without health insurance benefits due to a job loss, there are some things you can do.

One option is to join your spouse's health plan if you can. The loss of your job is considered a "qualifying life event" that allows your spouse to add you to his or her health plan outside the regular enrollment period.

If that option isn't viable, consider buying into your former employer's health insurance plan for a period of time. The Consolidated Omnibus Budget Reconciliation Act (COBRA) lets you buy this coverage for up to 18 months as long as you pay for it, which can be expensive.

You can also get insurance through the health insurance marketplace created by the Affordable Care Act and operated by the states, the federal government, or a state-federal partnership. Make sure you compare the various "Obamacare" plans because they have varying costs and coverage levels.

Keep in mind that the marketplaces are typically open only during specific open enrollment periods with a qualifying event such as a marriage, move, or job loss. But some states have recently expanded the enrollment period to help uninsured residents get coverage during the coronavirus pandemic. Make sure you check the marketplace for the state where you live.

Stick with Stocks

Believe it or not, now is the perfect time to invest in the stock market for retirement savings if you have a little disposal income. One tip is to consider investing in a target-date fund. These investment vehicles automatically adjust the risk level based on your age – more risk and growth potential when you're young; less risk and more security as you get closer to retirement age.

Long-term investors should also consider dollar-cost averaging. With this strategy, you invest in a stock or fund in regular, equal portions over time. This allows you to buy more shares in a company when they're cheaper, and fewer shares when they're more expensive. In the end, you may get a lower average cost basis when compared to investing the same amount of money at once.

Also, make sure your asset allocation or mix of stocks and bonds is right. Diversify your overall portfolio, too. Ensuring diversification will make sure you remain on track for retirement despite the ups and downs of the stock market. As part of your diversification strategy, look to invest in companies right now that can actually survive (or maybe even do better) in a recession. Also look for defensive dividend stocks that aren't overly sensitive to market volatility.

Review Your Social Security Strategy

Social Security will undoubtedly be a major part of your retirement plan. Unlike the stock market, that part of your income won't go down and will be adjusted for inflation yearly. That's why it's important to consider when you'll start collecting benefits.

You can start taking Social Security at age 62 if you think you need it, but your benefits will be permanently reduced by up to 30%. Full retirement age is at 66 if you were born between 1943 and 1954. It gradually increases to 67 for people born between 1955 and 1960 – and then stays at 67 for everyone born after 1960. If you can afford it, however, think about waiting until age 70 to claim benefits because they will increase 8% per year if you wait to take them.

Married couples have something else to consider – survivor benefits. If the higher-earning spouse dies first, the surviving spouse will be able to take over the deceased spouse's benefits. So, if the higher-earning spouse delays taking benefits, the surviving spouse will get a larger monthly benefit.

Trim Your Expenses

To free up more money for retirement savings, try to reduce any expenses that you can, even if they're small because it all adds up. Some ideas include eating out less often, cutting your cable bill, or replacing your car less frequently. If you work in a city where you can get by with public transportation, consider selling your car and getting rid of associated expenses (like insurance, gas, maintenance, etc.) to help pad your retirement accounts.

If you need to make bigger cuts, consider downsizing to a condo or moving from a high-tax state to a tax-friendly state such as Florida, Georgia, or Arizona. If you're able to work remotely for your employer, take advantage of that flexibility by moving to a lower-cost state. Remote work is a trend that will likely gain momentum long after the pandemic ceases, according to a recent Brookings Institution report.

Taking these types of steps now could mean that you'll be able to save even more in your retirement accounts for later down the road when you really need the money.

Hire a Financial Adviser to Help You Stay the Course

Everyone can use a little extra financial guidance, especially during the COVID-19 pandemic. It's difficult enough investing when the economy is humming along, but it's even harder in unprecedented times like these. A financial adviser can help you stay level-headed and focused on your long-term retirement goals. A financial adviser can also help you develop a more holistic plan that will encourage you to look at the "big picture."

Look for an adviser with credentials, such as a Certified Financial Planner (CFP), which is the most common type of certification for financial advisers. To earn the CFP designation, an adviser must take several courses, pass a two-day exam, and complete three years of work experience. They also have to complete 30 hours of continuing education every two years. Other types of certifications include Chartered Financial Consultant (ChFC), Master of Sciences in Financial Services (MSFS), and Registered Financial Consultants (RFC). If you see these designations, you at least know the adviser has a certain level of skill and knowledge.

Before selecting a financial adviser, also make sure you understand how he or she will be paid. There's no standard fee system among financial planners. Some work only for fees, while others work on commissions – and many get paid through a combination of fees and commissions. Unless you're dealing with a fee-only adviser, expect to get suggestions that you purchase an investment or insurance product that the planner sells. That's fine … if the product is right for your financial situation. But if it isn't, don't feel you have to follow the adviser's particular recommendation on that product. The adviser's overall assistance will still help you see the big picture.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

States That Tax Social Security Benefits in 2026

States That Tax Social Security Benefits in 2026Retirement Tax Not all retirees who live in states that tax Social Security benefits have to pay state income taxes. Will your benefits be taxed?

-

What to Do With Your Tax Refund: 6 Ways to Bring Growth

What to Do With Your Tax Refund: 6 Ways to Bring GrowthUse your 2024 tax refund to boost short-term or long-term financial goals by putting it in one of these six places.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

12 Great Places to Retire in the Midwest

12 Great Places to Retire in the MidwestPlaces to live Here are our retirement picks in the 12 midwestern states.

-

15 Cheapest Small Towns to Live In

15 Cheapest Small Towns to Live InThe cheapest small towns might not be for everyone, but their charms can make them the best places to live for plenty of folks.

-

15 Reasons You'll Regret an RV in Retirement

15 Reasons You'll Regret an RV in RetirementMaking Your Money Last Here's why you might regret an RV in retirement. RV-savvy retirees talk about the downsides of spending retirement in a motorhome, travel trailer, fifth wheel, or other recreational vehicle.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

The Six Best Places to Retire in New England

The Six Best Places to Retire in New Englandplaces to live Thinking about a move to New England for retirement? Here are the best places to land for quality of life, affordability and other criteria.