7 Midyear Moves Retirees Can Make to Trim 2019 Tax Tabs

As July Fourth nears, there are fireworks to enjoy and cookouts to attend.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

As July Fourth nears, there are fireworks to enjoy and cookouts to attend. But in the midst of all the celebrating, assess where you stand with Uncle Sam halfway through the tax year. “It’s a good time to do a status check,” says Tim Steffen, director of advanced planning for Baird. Consider maneuvers that can shave your tax tab for 2019 as well as over the longer term.

Look to 2018 for guidance. “Review the outcome of that return,” says certified public accountant Robert Westley, a member of the American Institute of CPAs’ Personal Financial Specialist Committee. This year’s tax rules are similar to last year’s; you’ll need to factor in thresholds and limits that are adjusted annually, which should help keep more of your money in your pocket in 2019. Since many tax-reform changes remain in effect through 2025, any longer-term moves could be considered within the same framework.

Review Savings

Are you on track to max out your retirement savings for the year? If your 50th birthday falls anytime in 2019, you now qualify for catch-up contributions. This year, those 50 and older can stash up to $7,000 in an IRA and up to $25,000 in a 401(k). You can contribute to an IRA for 2019 through the tax-filing deadline in 2020, but you must max out your 401(k) by the end of the year. Also, consider boosting the amounts you put into other pretax savings, such as a flexible spending account or health savings account.

Consider a QCD

If you are 70½ or older, you can do a qualified charitable distribution of up to $100,000 a year from your IRA directly to charity. The distribution won’t show up in your adjusted gross income and can count toward your required minimum distribution. The QCD move lets retirees be strategic with their RMDs, says David Levi, senior managing director at CBIZ MHM.

To have the QCD do double duty as your IRA RMD, be sure to do the QCD before you satisfy your RMD. (The first dollars that come out of an IRA each year are considered RMD money.) So if your RMD is $20,000 and you want to do a QCD of $10,000, you could ask your IRA custodian to send $10,000 to charity and put $10,000 into your bank account. Your $20,000 RMD will be satisfied, while only $10,000 of income will be added to your AGI for 2019. If you do your $20,000 RMD first, you could still do the $10,000 QCD—but you would be taxed on $20,000, and $30,000 would be withdrawn from your IRA.

Bunch Deductions

Assess whether your itemized deductions might surpass the standard deduction amount, which is $12,200 for single filers and $24,400 for married couples filing jointly. The extra standard deduction for those age 65 and older is $1,300 per person for joint filers and $1,650 for single filers.

If you are in range of itemizing, consider a “bunching” strategy—shifting some of next year’s deductible expenses into the current tax year. Charitable giving is a prime area to use this strategy, because “you have the highest degree of control over that deduction, both in time and amount,” says Westley. For instance, you might pull some 2020 donations into 2019, or set up a donor-advised fund, says Steffen. You get an immediate tax deduction for a donor-advised fund contribution but later direct the money to specific charities.

As you tote up your itemized deductions, check whether your medical expenses may fall into the deductible zone. Unreimbursed medical costs exceeding 10% of AGI are deductible if you itemize for 2019.

Harvest Losses and Gains

Market volatility may have thrown your portfolio’s allocation out of whack. As you rebalance, consider harvesting investment losses—and perhaps gains, too. Investment losses can be written off dollar for dollar against capital gains, and up to $3,000 can offset ordinary income. Mind the wash-sale rules: If you buy back the same security within 30 days, you’ll disqualify the write-off.

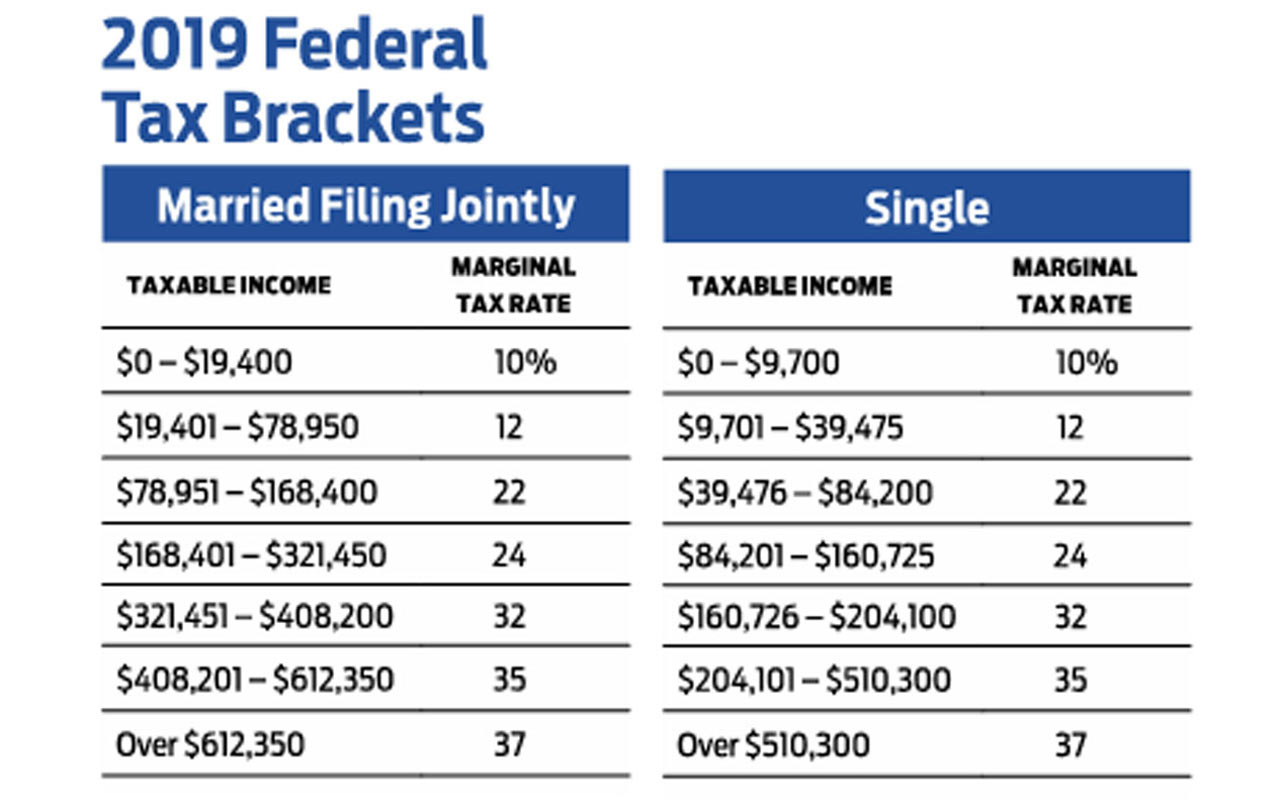

Some taxpayers may want to consider harvesting gains. Single filers with taxable income of up to $39,375 and married couples filing jointly with taxable income of up to $78,750 can snare the 0% rate for their capital gains. “There’s no wash-gain rule,” says Westley, so you can sell a security at a gain and “buy it right back.” The higher price will then be your new basis.

Gift to Grandkids

With fall tuition just around the corner, consider gifting money to help cover the costs of school for grandkids. Levi notes that you could pay tuition directly and avoid gift-tax issues. Or you could give up to $15,000 per individual to make use of your annual gift-tax exclusion amount. If you give money to a 529 college-savings account for your grandchild, you may score a state income tax deduction. You can contribute up to five years’ worth of gifts at once to a 529, for a maximum per recipient of $75,000 if you’re a single filer and $150,000 if married filing jointly in 2019.

Set a Conversion Strategy

Consider whether to convert some traditional IRA money to a Roth IRA before year-end. Because taxpayers can no longer undo Roth conversions, take a tactical approach. You could convert small amounts now and later in the year, or wait to execute the conversion toward year-end. If the market swings south, consider pulling the trigger on a conversion at that point—a lower account value results in a smaller conversion tax bill. Conversions are taxed at your ordinary income tax rate.

Check Tax Payments

Compare your expected tax tab with how much tax you have paid already this year through withholding or estimated tax payments. If you’re not on track to avoid underpayment penalties for 2019, adjust your withholding or estimated tax payments. Pay 100% of your 2018 tax tab (or 110% for higher-income taxpayers) or 90% of your 2019 tax tab by year-end, and you’ll avoid underpayment penalties. While the IRS was lenient on underpayment penalties for 2018, Steffen says, “they won’t be this year.”

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

States That Tax Social Security Benefits in 2026

States That Tax Social Security Benefits in 2026Retirement Tax Not all retirees who live in states that tax Social Security benefits have to pay state income taxes. Will your benefits be taxed?

-

What to Do With Your Tax Refund: 6 Ways to Bring Growth

What to Do With Your Tax Refund: 6 Ways to Bring GrowthUse your 2024 tax refund to boost short-term or long-term financial goals by putting it in one of these six places.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

12 Great Places to Retire in the Midwest

12 Great Places to Retire in the MidwestPlaces to live Here are our retirement picks in the 12 midwestern states.

-

15 Cheapest Small Towns to Live In

15 Cheapest Small Towns to Live InThe cheapest small towns might not be for everyone, but their charms can make them the best places to live for plenty of folks.

-

15 Reasons You'll Regret an RV in Retirement

15 Reasons You'll Regret an RV in RetirementMaking Your Money Last Here's why you might regret an RV in retirement. RV-savvy retirees talk about the downsides of spending retirement in a motorhome, travel trailer, fifth wheel, or other recreational vehicle.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

The Six Best Places to Retire in New England

The Six Best Places to Retire in New Englandplaces to live Thinking about a move to New England for retirement? Here are the best places to land for quality of life, affordability and other criteria.