10 Reasons You’ll Never Be Rich

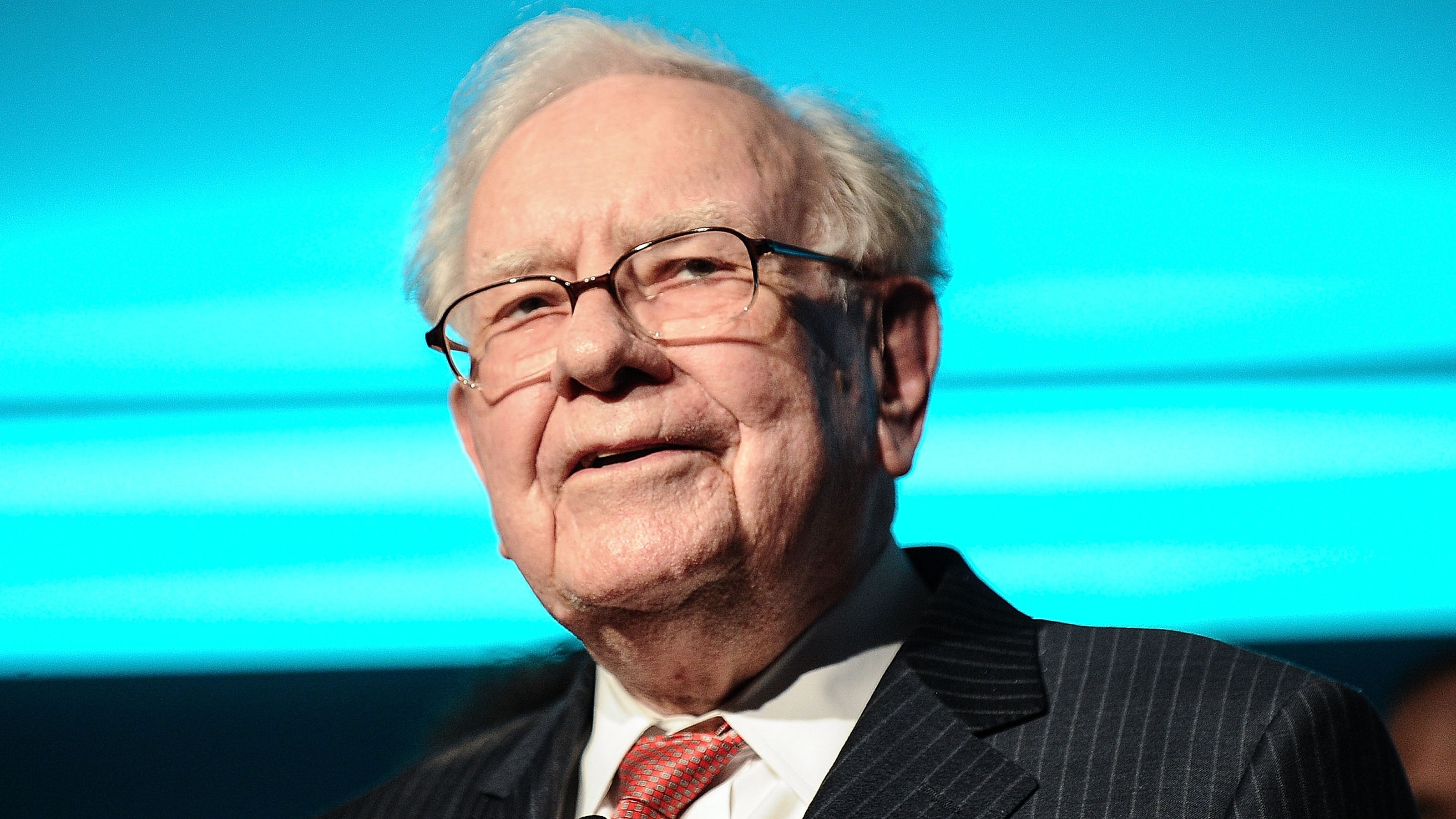

You don’t have to inherit money, win the lottery, or even be the next Bill Gates or Warren Buffett to become financially secure.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

You don’t have to inherit money, win the lottery, or even be the next Bill Gates or Warren Buffett to become financially secure. With a little bit of knowledge and a lot of hard work and discipline, almost anyone can accumulate sufficient wealth -- and perhaps even great wealth -- to enjoy the creature comforts of life.

But how do you get ahead if you’re living paycheck to paycheck? The fact is, no matter how much you earn you could be creating your own barriers to financial success without even knowing it. Here are ten things you might be doing that are preventing you from achieving prosperity. Change your ways and you could find yourself well on the way down the road to riches.

You Spend Too Much

Plenty of Americans live beyond their means but don’t even realize it. A 2012 Country Financial survey found that more than one-half of respondents (52%) said their monthly spending exceeded their income at least a few months a year. Yet only 9% of respondents said their lifestyle was more than they could afford. Of the 52% who routinely overspend, 36% finance the shortfall by dipping into savings; 22% use credit cards.

Blowing your entire paycheck (and then some) each month isn’t an ingredient in the recipe for financial success. Neither is draining your savings or running up card balances. To rein in spending, start by tracking where the money goes every month. Try to zero in on nonessential areas where you can cut back. Then create a realistic budget that ensures you have enough to pay the bills as well as enough for contributions to such things as a retirement account and a rainy-day fund. Our household budget worksheet or an online budgeting site can help.

You Save Too Little

If you’re like most folks, your savings habits could use some improvement. The personal savings rate in the U.S. is just 4.9% of disposable income, down from a high of 14.6% in 1975. Only about one-half of Americans (54%) say they have a savings plan in place to meet specific goals, according to a 2013 survey commissioned by America Saves, a group that advocates for better saving habits.

Saving needs to be a priority in order to build wealth. Begin with an emergency fund that can be tapped in the event of an illness, job loss or other unexpected calamity. A 2012 survey by the Financial Industry Regulatory Authority found that 56% of individuals say they have not set aside even three months’ worth of income to handle financial emergencies. Once your emergency fund is well under way, you can divert small amounts toward other goals, such as buying a home or paying for college. These six strategies can help you save more, no matter your income.

You Carry Too Much Debt

Americans have $846.9 billion in credit card debt alone. That’s $7,050 per household, according to NerdWallet.com, a Web site that analyzes financial products and data. If you’re only making minimum monthly payments on $7,050, it’ll take 28 years and cost you $10,663 in interest before you’re debt-free, assuming a 15% interest rate. And that only holds true if you don’t make any additional charges.

Some debts can lead to financial success -- a mortgage to purchase real estate, a credit line to start a business or a student loan to fund a college education -- but a high-interest credit card balance usually doesn’t. Pay down credit cards with the steepest rates as quickly as possible. Putting $250 per month toward that same $7,050 debt will retire it in three years and save you about $9,000 in interest versus making minimum payments. See Escape the Debt Trap for more strategies to chip away at what you owe.

You Pay Too Many Fees

Late fees, banking fees, credit-card fees -- the amounts might seem insignificant when taken individually. After all, an overdue library book or Redbox DVD might only run you a dollar. But if you’re regularly paying penalties and fees, these charges can quickly eat a hole in your budget. Consider this: The average bank overdraft fee is $32.20, according to Bankrate.com, and the average charge for going outside your ATM network is $4.13. Late-payment penalties for credit cards can climb as high as $35.

So how do you avoid pesky fees? Read the fine print so you understand fee rules, and stay organized so you avoid breaching those rules. Here are 33 common fees you can avoid -- or at least reduce -- with just a bit of effort. With the extra cash, you can pay down debt or boost your savings.

You Pass Up Free Money

Would you ignore a hundred-dollar bill on the sidewalk? Of course not. You’d bend over and pick it up. So why are you passing up other opportunities to get free money? If your employer matches employee contributions to a 401(k) but you’re not participating in the retirement plan, then you’re passing up free money. If you let rewards points from loyalty programs or credit cards expire, then you’re passing up free money. If you claim the standard deduction on your tax return when you qualify for itemized deductions that could lower your tax bill even more, then you’re passing up free money.

Believe it or not, there might even be free money out there that you forgot about -- or never knew of in the first place. There are more than $41 billion worth of unclaimed assets ranging from old tax refunds and paychecks to forgotten stocks and certificates of deposit being held by state agencies, according to the National Association of Unclaimed Property Administrators. Do a search on MissingMoney.com to find out if there are unclaimed assets that belong to you.

You Neglect Retirement

It’s easy to focus on the present -- the bills you have to pay, the things you want to buy -- and assume you’ll have time in the future to start saving for retirement. But the longer you wait, the tougher it will be to amass a sufficiently large nest egg. For example, if you wait until you are 35 to start saving for retirement, you'll have to set aside $671 a month to reach $1 million by age 65 (assuming an 8% annual return). But if you start at age 25, you'll need to save just $286 a month to hit $1 million by the time you’re 65.

Even if you’re creeping closer to retirement, it’s not too late to start putting away money. In fact, Uncle Sam makes it easier for procrastinators to catch up on retirement savings. If you’re 50 or over, you can contribute up to $23,000 annually to a 401(k) (versus $17,500 for those younger than 50). The contribution limit for older savers to traditional and Roth IRAs is $6,500 a year (versus $5,500 for everyone else). Use our Retirement Savings Calculator to figure out how much you need to save.

You Buy High and Sell Low

Does this sound like your investing strategy? You hear about a stock that is soaring, and you want to get in on the action, so you impulsively buy. But soon after, the stock starts tanking. You can’t bear the pain of watching your shares decline further in value, so you immediately sell at a loss. As a result, you’re wasting money rather than building wealth.

Unfortunately, many investors buy high and sell low because they follow the herd blindly into the latest hot stock. You can resist the urge to go with the crowd if you adhere to smart investing techniques. One such technique is dollar-cost averaging, a simple system of investing at regular intervals no matter what the market is doing. While it doesn’t guarantee success, it does eliminate the likelihood that you're always buying at the top -- plus, it takes the guesswork and emotion out of investing. See the 7 Deadly Sins of Investing to learn how to overcome common missteps.

You Buy Everything New

New stuff is nice, but it’s often not the best investment. Take cars. Estimates vary, but some experts say a new vehicle loses 30% of its value within the first two years -- including an immediate drop as soon as you drive off the dealer’s lot. According to Kelley Blue Book, the average vehicle is worth 44% less after five years.

If you’re not comfortable buying something that someone else has owned, get over your hang-up because you’re missing a big money-saving opportunity. Many pre-owned items can cost up to 50% to 75% less than the price you’d pay if you purchased them new. From designer jeans to college textbooks, here are 11 things that you should consider buying used because you often can find them in good or almost-new condition at a fraction of the price.

You Retire Too Early

An early retirement is a dream for many, but calling it quits if you’re too young has several potential drawbacks. For starters, you could incur a 10% early-withdrawal penalty if you tap certain retirement accounts, including 401(k)s and IRAs, before age 59½. (There are exceptions.) You can claim Social Security as early as age 62, but your benefit will be reduced by as much as 30% from what it would be if you wait until your full retirement age, which falls between 66 and 67 depending on your year of birth.

Health care is another big issue. You must be 65 to qualify for Medicare. In the meantime, without access to an employer-sponsored plan, you might have to pay a lot more out of pocket for individual coverage until you’re eligible for Medicare.

And speaking of health, the longer you live in retirement, the more likely you are to outlive your nest egg. Let’s say you make it to the age of 90. A $1 million portfolio evenly split between stocks, bonds and cash has a 92% likelihood of lasting until you turn 90 if you retire at 65, according to Vanguard. But retire at age 55 and the likelihood drops to 66%. Use our Retirement Savings Calculator to determine when you can really afford to retire.

You Don’t Invest in Yourself

This might be the single biggest obstacle on your path to riches. If you’re not investing in continuing education, training and personal development, you’re limiting your ability to make more money in the future. “Your own earning power--rooted in your education and job skills--is the most valuable asset you'll ever own, and it can't be wiped out in a market crash,” writes Kiplinger’s Personal Finance Editor in Chief Knight Kiplinger in Eight Keys to Financial Security.

Consider taking nondegree courses online to boost your knowledge of your field or enrolling in a graduate program (see 5 Advanced Degrees Still Worth the Debt). If you don’t have a college degree, see our picks for best college values or check out these four alternatives to a four-year college degree. Just keep in mind that some college majors (think finance, computer science or nursing) lead to more lucrative careers than others (sorry, arts and humanities lovers).

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Award-winning journalist, speaker, family finance expert, and author of Mom and Dad, We Need to Talk.

Cameron Huddleston wrote the daily "Kip Tips" column for Kiplinger.com. She joined Kiplinger in 2001 after graduating from American University with an MA in economic journalism.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Should You Do Your Own Taxes This Year or Hire a Pro?

Should You Do Your Own Taxes This Year or Hire a Pro?Taxes Doing your own taxes isn’t easy, and hiring a tax pro isn’t cheap. Here’s a guide to help you figure out whether to tackle the job on your own or hire a professional.

-

Trump $10B IRS Lawsuit Hits an Already Chaotic 2026 Tax Season

Trump $10B IRS Lawsuit Hits an Already Chaotic 2026 Tax SeasonTax Law A new Trump lawsuit and warnings from a tax-industry watchdog point to an IRS under strain, just as millions of taxpayers begin filing their 2025 returns.

-

States That Tax Social Security Benefits in 2026

States That Tax Social Security Benefits in 2026Retirement Tax Not all retirees who live in states that tax Social Security benefits have to pay state income taxes. Will your benefits be taxed?

-

I Need to Cut $1,000 From My Monthly Budget, and I've Already Given Up Starbucks and Dining Out. What Else Can I Do?

I Need to Cut $1,000 From My Monthly Budget, and I've Already Given Up Starbucks and Dining Out. What Else Can I Do?Here are some creative ways to save up to $1,000 a month, even if you feel like you've already made all of the obvious cuts.

-

I'm a Government Employee and Need to Get By Until the Shutdown Ends. What Can I Do?

I'm a Government Employee and Need to Get By Until the Shutdown Ends. What Can I Do?The second-longest shutdown in history is leaving many federal workers with bills due and no paycheck to cover them. Here's what you can do to get by.

-

I'm an Investing Expert: This Is How You Can Invest Like Warren Buffett

I'm an Investing Expert: This Is How You Can Invest Like Warren BuffettBuffett just invested $15 billion in oil and gas, and you can leverage the same strategy in your IRA to potentially generate 8% to 12% quarterly cash flow while taking advantage of tax benefits that are unavailable in any other investment class.

-

What to Do With Your Tax Refund: 6 Ways to Bring Growth

What to Do With Your Tax Refund: 6 Ways to Bring GrowthUse your 2024 tax refund to boost short-term or long-term financial goals by putting it in one of these six places.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

12 Great Places to Retire in the Midwest

12 Great Places to Retire in the MidwestPlaces to live Here are our retirement picks in the 12 midwestern states.

-

15 Cheapest Small Towns to Live In

15 Cheapest Small Towns to Live InThe cheapest small towns might not be for everyone, but their charms can make them the best places to live for plenty of folks.