10 Financial Commandments for Your 20s

Thou shalt not be broke forever.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Thou shalt not be broke forever. It just may feel that way when you're first starting out on the road to financial independence.

Managing your finances for the first time can be overwhelming—what with the daily expenses, big-ticket costs such as housing and health care, heavy debts and long-term goals, including your ridiculously distant retirement. But the sooner you start making a financial plan for yourself, the brighter your future will be. "Building habits, especially in your 20s, is so important for long-term success," says John Deyeso, a financial planner in New York City, who works with a lot of younger people.

Here are the 10 things you should do in your 20s to take control of your finances:

1. Develop a Marketable Skill

Before you can start worrying about what to do with your money, you need to earn some.

Think in terms of your career, not just a job. Because let's face it: You're probably not going to love your first job, and it won't be your last job. But you should try to make the best of it. My first job consisted mostly of fetching documents for colleagues and doing data entry. Ho-hum. But I learned all I could. Sure, sometimes the lesson of the day was: "I never want to do this again." But I also learned basic skills, such as the magic of Excel as well as proper office phone and e-mail etiquette, which are still extremely useful in my career.

Most importantly, I established a valuable skill (writing) and looked for and created opportunities to use it. I talked to my bosses about my writing, and I wound up penning our press releases, editing an online column and writing anything that needed writing at our small company. Outside the office, I blogged and took on various freelance assignments—some for no money—to practice my craft and build my network.

- Don't be afraid to experiment. "You may need to take risks when you're younger," says Erin Baehr, a financial planner in Stroudsburg, Pa., and author of Growing Up and Saving Up. "You may take one job over another and find it doesn't work out. But when you're younger, you have the ability to do that. And then that can parlay into a bigger return down the road."

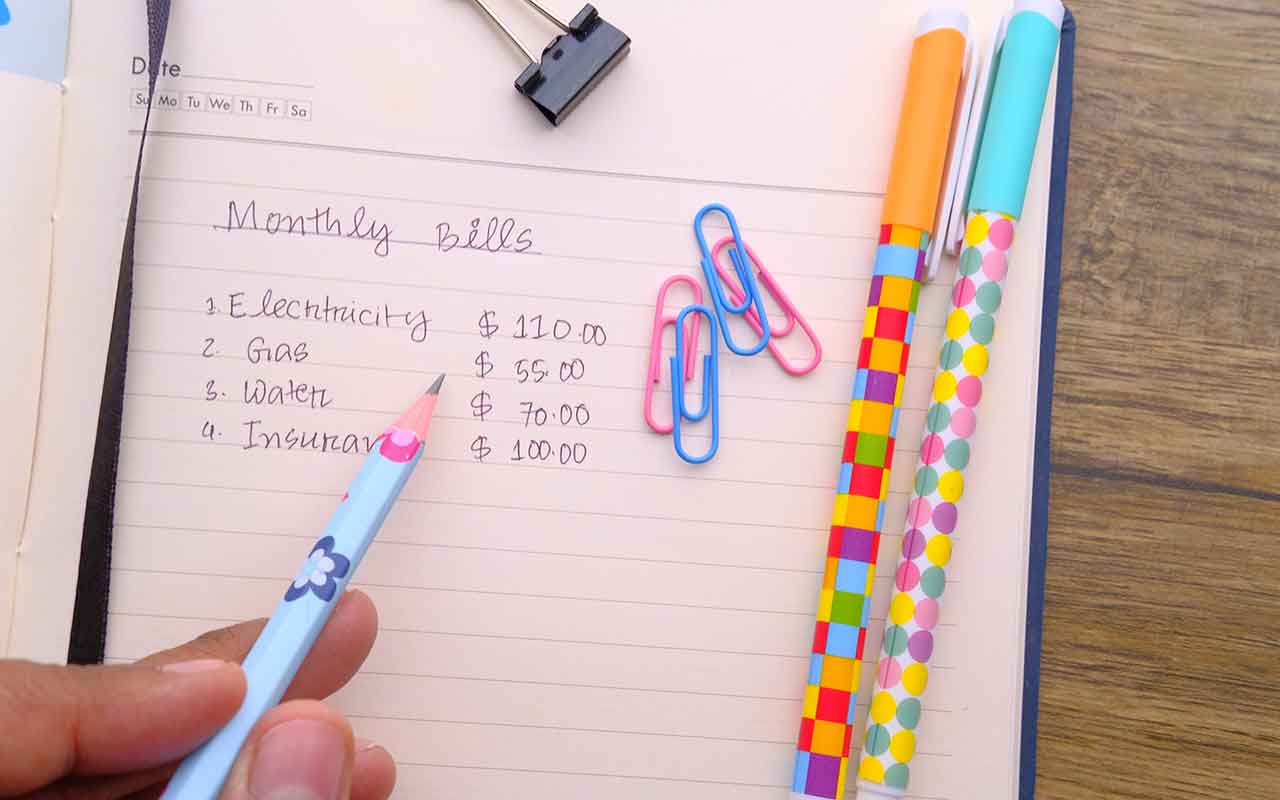

2. Establish a Budget

Once you're bringing home the bacon, you'll have to figure out how to slice it up. Without a budget, you risk overspending on discretionary items and undersaving for important big-ticket purchases. "The big thing is really to differentiate between your needs, your wants and your dreams," says Lauren Locker, a financial planner in Little Falls, N.J., who also teaches a personal finance course to undergraduate students at William Paterson University.

First, lay out all your daily expenses (such as commuting costs and food bills) and recurring monthly payments (rent, utilities, debts). When you know where all your money is going, you can more easily see how to cut costs. For example, when I first made a budget, I was stunned to learn how much I was spending on take-out food. Being aware of the cost allowed me to trim it by ordering less food, less often.

Next, factor in your short- and long-term savings goals, such as an emergency fund (see commandment #5) and retirement kitty (commandment #6). And if you ever expect to settle down and buy a house, you should probably start saving for the down payment as soon as possible.

A budgeting site such as Mint.com can be a big help if you want to digitize your budget. For more on how such sites work, see 7 Budgeting Tools to Get Your Finances in Order.

3. Get Insured

Mayhem truly is everywhere (as Allstate has dramatized), and as an adult, you are responsible for protecting yourself and all your stuff from it. When horrible things happen to you—say, a trip to the emergency room or a fire in your apartment—insurance may save you from shelling out thousands of dollars all at once.

For more on health care, see How New Grads Can Buy Health Insurance. If you rent your home, see Why Renters Need Insurance. And if you have a car, take our quiz, Car Insurance: Are You Covered?

4. Make a Debt-Repayment Plan

Debt is a reality for most young adults. But letting it linger—or, worse, grow—can set you back for years to come in the form of greater interest payments and lower credit scores.

For your student loans, be sure you have a good repayment plan in place—see Smart Ways to Manage Your Student Loans—and consider some programs that can help reduce the burden, such as the Peace Corps or Americorps. A much easier way to trim this cost is to set up automatic payments for your federal student loans; doing so cuts 0.25% off your interest rate.

Work out a plan to tackle your credit card debt, too. Hopefully, being so young, you haven't had time to bury yourself in much. But if you've been quick on the swipe, your first step is to establish a budget (see commandment #2) and rein in your spending. You should then start paying down debt on your highest-rate cards first. Try our Credit Card Payoff Calculator and Student Loan Refinance Calculator to see how quickly you can get out of debt.

5. Build an Emergency Fund

Insurance alone (see commandment #3) won't cover all of your problems. You still need to have liquid savings on hand as an added precaution.

Some call it a rainy day fund. I think of mine as a polar vortex fund. One frigid winter in our early years of homeownership, my house's heat pump gave up. A new HVAC unit cost me and my husband about $4,000. Home insurance was no help, but our emergency fund saved us from going into debt to cover the replacement or (ack!) asking our parents for the money.

Kiplinger's recommends stashing enough to pay three to six months' worth of expenses in a safe and easy-to-access savings account. Contributing to your fund should be a top priority in your budget. Aim to sock away at least 10% of each paycheck until you reach your goal, and add a boost any time you luck into some extra income, such as a bonus or birthday gift. To help speed up the process, see 7 Strategies to Build an Emergency Fund.

6. Start Saving for Retirement

I know, I know, retirement seems like forever from now. But it's more important than ever for us to focus on this savings goal as soon as possible. "Our generation, the twenty- and thirtysomethings, may be the first to have to save for retirement for as long as your work career," says Deyeso.

The sooner you start saving, the better. Because of the magic of compounding, time will fatten up your retirement kitty. For example, if a 25-year-old saves just $100 a month, assuming an 8% return and quarterly compounding, she'll have $346,039 by the time she turns 65.

Don't think of saving for retirement as subtracting money from your paycheck or checking account. Rather, consider them automatic payments to your future self. If you participate in your company's 401(k)—as you should—your contribution can be automatically deducted from each paycheck before taxes. If you have a Roth IRA (also highly recommended), you can set up automatic transfers through your bank or brokerage. "It hurts at first, but people adapt," says Deyeso. "That money gets forgotten about."

7. Build Up Your Credit History

You'll need to take on some debt ("having no credit is as bad as having bad credit," says Locker) and show that you know how to manage it well (see commandment #4) in order to build up your credit history and earn a good credit score. This number, along with the credit report on which it's based, is the key to many milestones in your financial life. A good score means lower rates on credit cards and loans. Landlords may consider your score before offering you a lease. And employers might take a look at your credit report during the hiring process.

Unfortunately, because you're young, you're at a disadvantage. The length of your credit history counts for 10% of your FICO score, the most widely used model. But a lot of your score, 35%, depends on your payment history. So you can easily raise your financial grade by paying all your bills on time. Another 30% of your score is based on how much you owe, calculated as a percentage of your available credit. In other words, maxing out your credit card every month is bad, even if you always pay off the entire balance. Be sure to use your card sparingly. "FICO high achievers," who score at least 750 on a scale of 300 to 850, typically use just 7% of their available credit.

8. Quit the Bank of Mom and Dad

What better way to show your parents that you love them than to set them free of your financial responsibilities? "In your 20s, the main goal is becoming self-sufficient," says Baehr. "Look to get off of your parents' payroll and onto your own."

Obviously, financial independence starts with a job (see commandment #1). You also ought to cut the cord by getting your own insurance (commandment #3), car, cell-phone plan, home, everything. Slightly less obvious, you don't want to resort to getting help from Mom and Dad even in a pinch—hence, the need for an emergency fund (commandment #5).

Of course, all of this is easier said than done. If you do need financial assistance from your parents, approach them maturely and responsibly.

9. Clean Up Your Online Presence

Time to put down the red cups, folks, or at least scrub them from your public image. Like it or not, your social media activity is viewable by the entire Web-surfing world, including all your current or potential employers. Get your digital act together by searching for yourself online. Check Spokeo.com and Pipl.com, as well as the obvious Google, to see what's already out there, and double-check your privacy settings on Facebook, Instagram and other networks to make sure you're not adding to the mix unintentionally.

Add to your positive persona by pumping up the good stuff in cyberspace. For example, your LinkedIn account should be a glowing representation of your professional potential. And if you're an expert on a certain subject, you can show off your knowledge via Twitter, Tumblr, WordPress or other sites.

10. Get Your Key Financial Documents in Order

You—not your parents—should have your birth certificate, Social Security card and other official IDs in your possession. Also keep a list of all your banking and investment accounts, household bills and insurance policies, along with any online usernames and passwords.

Be sure to get details on any funds your parents might have administered for you, such as custodial accounts, as well as any lingering savings bonds. Store all this important information in a secure place, such as an actual safe, and make sure someone you trust knows where it's located. Other documents you might need to keep in mind: your apartment lease, roommate agreement, and car registration and title.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Rapacon joined Kiplinger in October 2007 as a reporter with Kiplinger's Personal Finance magazine and became an online editor for Kiplinger.com in June 2010. She previously served as editor of the "Starting Out" column, focusing on personal finance advice for people in their twenties and thirties.

Before joining Kiplinger, Rapacon worked as a senior research associate at b2b publishing house Judy Diamond Associates. She holds a B.A. degree in English from the George Washington University.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

I want to sell our beach house to retire now, but my wife wants to keep it.

I want to sell our beach house to retire now, but my wife wants to keep it.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

How to Add a Pet Trust to Your Estate Plan

How to Add a Pet Trust to Your Estate PlanAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

I Need to Cut $1,000 From My Monthly Budget, and I've Already Given Up Starbucks and Dining Out. What Else Can I Do?

I Need to Cut $1,000 From My Monthly Budget, and I've Already Given Up Starbucks and Dining Out. What Else Can I Do?Here are some creative ways to save up to $1,000 a month, even if you feel like you've already made all of the obvious cuts.

-

I'm a Government Employee and Need to Get By Until the Shutdown Ends. What Can I Do?

I'm a Government Employee and Need to Get By Until the Shutdown Ends. What Can I Do?The second-longest shutdown in history is leaving many federal workers with bills due and no paycheck to cover them. Here's what you can do to get by.

-

What to Do With Your Tax Refund: 6 Ways to Bring Growth

What to Do With Your Tax Refund: 6 Ways to Bring GrowthUse your 2024 tax refund to boost short-term or long-term financial goals by putting it in one of these six places.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

15 Reasons You'll Regret an RV in Retirement

15 Reasons You'll Regret an RV in RetirementMaking Your Money Last Here's why you might regret an RV in retirement. RV-savvy retirees talk about the downsides of spending retirement in a motorhome, travel trailer, fifth wheel, or other recreational vehicle.

-

The Six Best Places to Retire in New England

The Six Best Places to Retire in New Englandplaces to live Thinking about a move to New England for retirement? Here are the best places to land for quality of life, affordability and other criteria.

-

The 10 Cheapest Countries to Visit

The 10 Cheapest Countries to VisitWe find the 10 cheapest countries to visit around the world. Forget inflation and set your sights on your next vacation.

-

15 Ways to Prepare Your Home for Winter

15 Ways to Prepare Your Home for Winterhome There are many ways to prepare your home for winter, which will help keep you safe and warm and save on housing and utility costs.