9 Personal Finance Lessons to Learn From Star Wars

December 15, 2017 marks the release of the eighth official movie in the Star Wars saga, The Last Jedi.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

December 15, 2017 marks the release of the eighth official movie in the Star Wars saga, The Last Jedi. We will finally see what Luke Skywalker has been up to all these years and what is happening with new friends Rey, Poe Dameron and Kylo Ren.

Here at Kiplinger, we find personal-finance lessons in everything -- including blockbuster sci-fi movies. We'll be looking for savvy financial moves within The Last Jedi to add to this collection of money-saving tactics from the Star Wars franchise. With a slew of new Star Wars toys and must-have collectibles hitting the market, you may need these tips to offset those expenses.

Take a look. May the Force be with you – and your wallet.

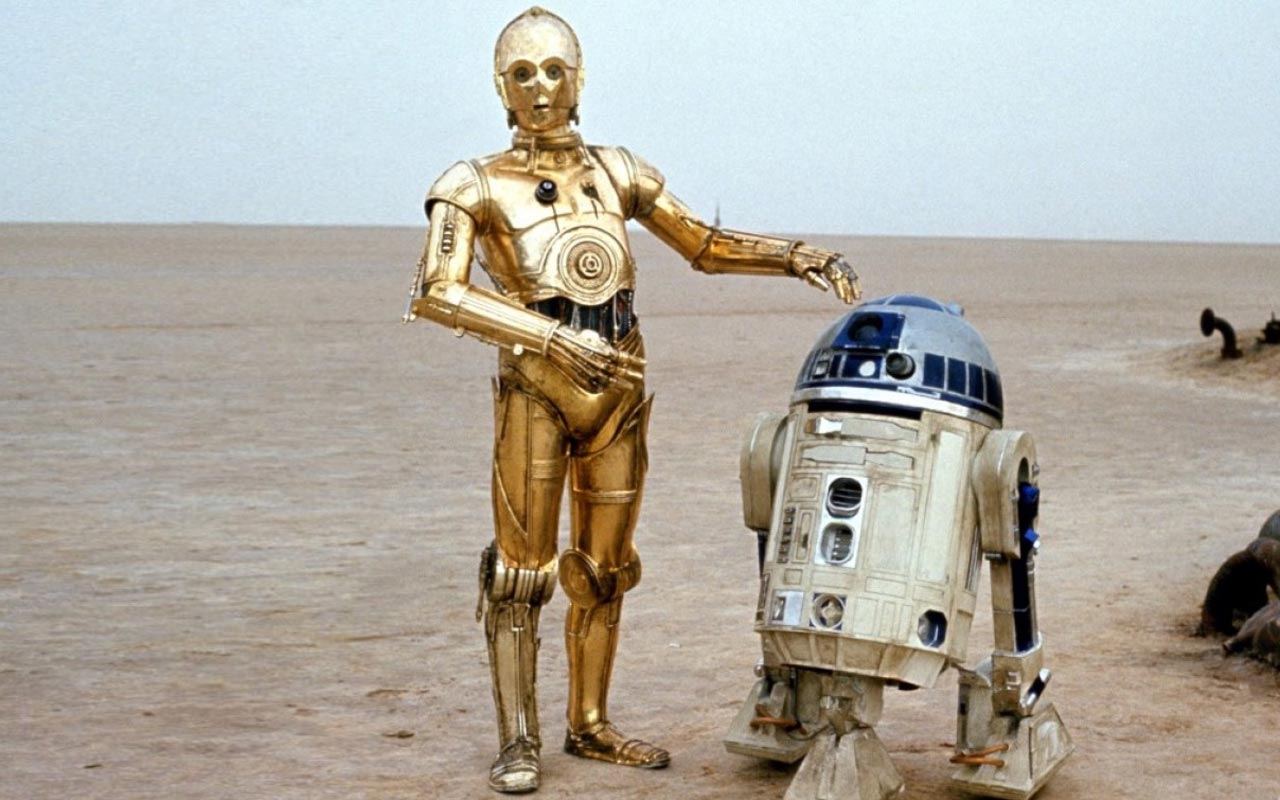

How to Buy Used Robots

Early in the original Star Wars film, young Luke Skywalker and his Uncle Owen bought one of the galaxy’s finest robots — R2D2. But it wasn’t easy. They had to bargain with the jawas on used droid prices, and one of their selections blew up as it began to roll toward them. Uncle Owen expressed skepticism with the jawas’ products, and they quickly responded by offering R2D2 as a replacement.

- Kiplinger’s Jedi tip: Yes, you, too, can buy your own used robot these days. But just as Luke and Uncle Owen discovered, it’s best to see your robot in action before you buy. The Kiplinger Letter forecasts that more companies will let you take robots for a quick test drive. San Francisco-based Lumoid, for instance, lets users try out drones. Other companies offer robot rentals for parties or conferences.

- SEE ALSO: 8 Surprising Jobs That Can Be Done by Robots

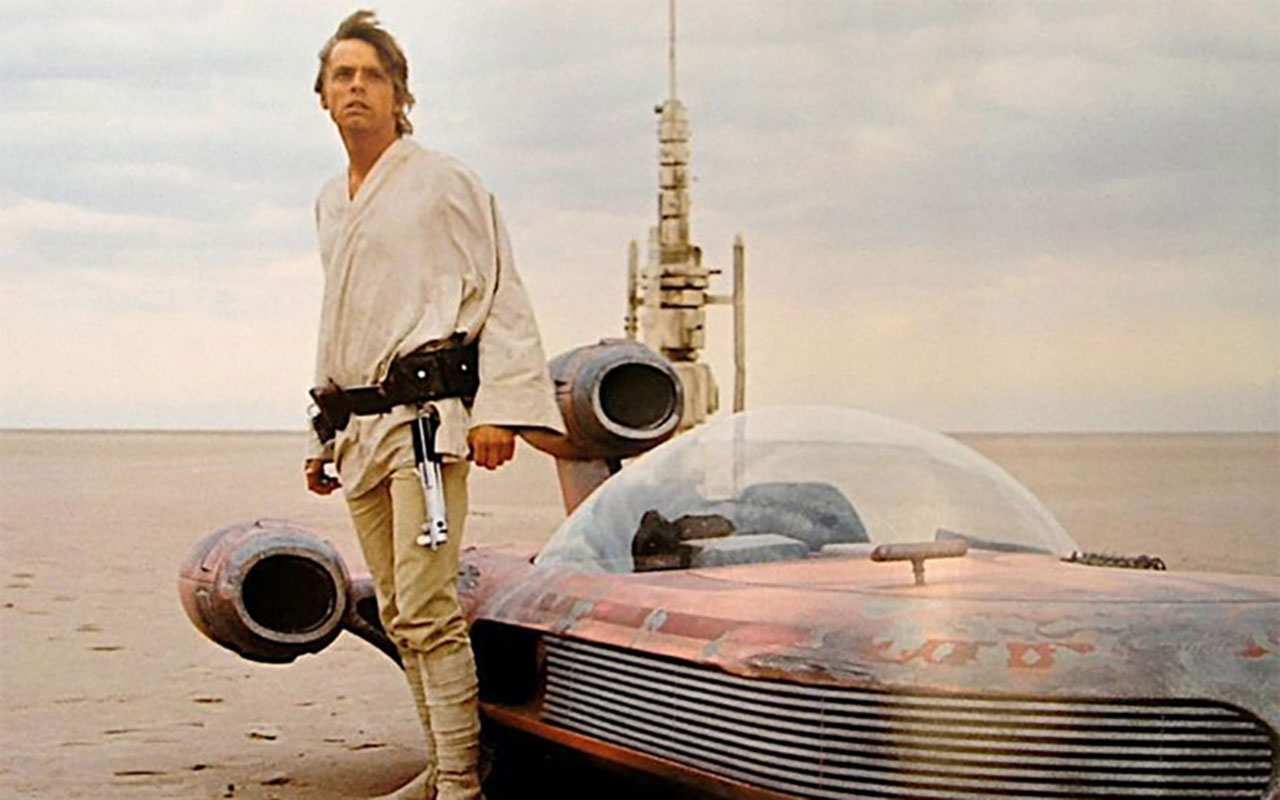

Used Cars Can Be Great Values

Also in the original film, as Obi Wan Kenobi and Luke Skywalker hurry to leave the Mos Eisley spaceport on Tatooine, they must quickly raise funds to pay for their transportation aboard the Millenium Falcon. Luke negotiates the sale of his landspeeder with a vendor, but is saddened by how quickly the value of his model has fallen since new models came to market.

- Kiplinger’s Jedi tip: When you buy a new vehicle, depreciation slices up to 20% off the value in the first year. Choose used, and someone else — in this case, Luke — takes that financial hit.

- SEE ALSO: 8 Hidden Values in the Used-Car Market

Big Debts Can Be a (Budget) Killer

Han Solo spends Episode 4 (the original film) running from Jabba the Hutt, a crime boss to whom he owes money; he is eventually captured in Episode 5 and handed over to bounty hunter Boba Fett. To begin Episode 6, we find our friend Han hanging on Jabba’s wall, frozen in carbonite, as a warning to those who owe money to Jabba.

- Kiplinger’s Jedi tip: It’s incredibly easy to stumble into a debt trap that will lead you into a downward spiral of indebtedness. All it takes is a brief lapse in judgment. Opening a new credit card account without understanding the interest rates and fees, or the implications for your credit score, is just one example.

- SEE ALSO: Proven Tactics to Overcome Big Debts

Try to avoid such debt traps in the first place. But extricating yourself from debt doesn’t require an action plot and special effects. Sometimes in the fight against debt, the money’s actually there: It’s simply a matter of crafting a budget, reining in your spending and funneling more of your income to pay down the debts. Other people need to get creative — and work even harder — to bring in extra money to tackle their debt.

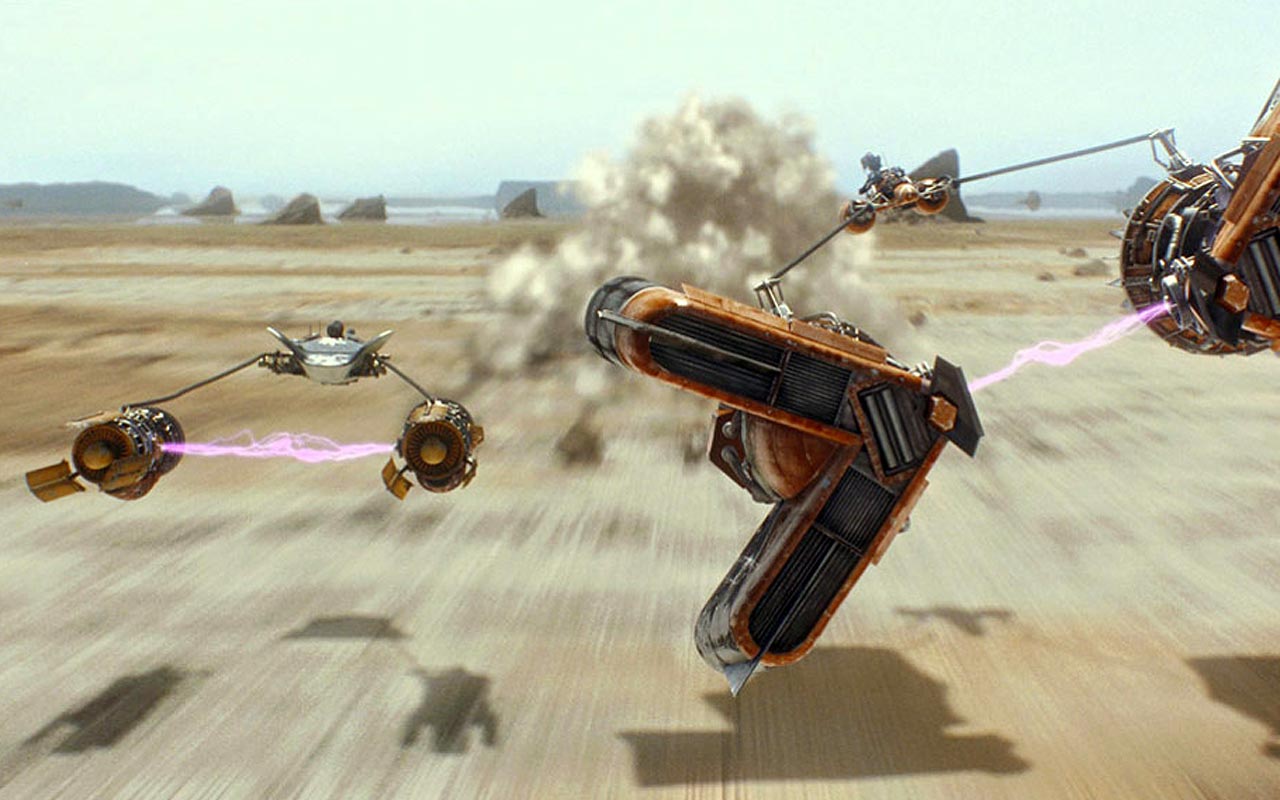

Don’t Gamble With Your Future

In Episode 1: The Phantom Menace, Qui Gon Jinn bets his spaceship that Anakin will win a pod-race in order to free Anakin from Watto, a slimy merchant for whom Anakin provides valuable slave labor. After Anakin wins the race, Watto says, “You swindled me. I lost everything.” Qui Gon replies, “Whenever you gamble my friend, eventually you lose.”

- Kiplinger’s Jedi tip: In Knight Kiplinger’s 8 Keys to Financial Security, he tells us, “In investing, as in baseball, those who swing for the fences do hit the occasional home run. But they strike out a lot too, and their lifetime batting average — average annual total return — suffers accordingly. So shy away from highly volatile stocks, Initial Public Offerings (IPOs), buying on margin and commodity trading. Don't try to time markets, because no one does it consistently well. Use dollar-cost averaging to invest regularly in markets good, bad and lackluster. Have the patience to wait out the occasional (and inevitable) bear markets.”

Risky Jobs Can Pay Big Bucks

Bounty hunting — a dangerous form of contract work — is a way of life for many characters in the Star Wars films. In Episode 2: Attack of the Clones, Zam the bounty hunter is hired to kill Queen Amidala. The reward for completing the assignment is lucrative, but the task itself contains great risk. Obi Wan and Anakin discover her attempting to plant killing bugs in the Queen’s bed and chase her through the streets of Coruscant. She ultimately falls to her death in her attempt to escape from the Jedi in pursuit.

- Kiplinger’s Jedi tip: If you're going to take a risky job, you should at least get compensated handsomely for it. A couple years ago, we crunched the numbers on injuries, fatalities and salaries to identify ten occupations offering fat paychecks that more than make up for the elevated risks. And because no career is worth dying for, we tried to favor those with low incidences of on-the-job fatalities. Top earners in many of these fields can enjoy six-figure salaries, in some cases even without college degrees.

Small, Steady Contributions Can Grow Into a Sizable Stash

The rise of the Empire did not happen overnight. It took long-term planning that only became evident to our Jedi heroes when it was too late. In Attack of the Clones, Obi Wan visits the Kaminoans to investigate an assassin who tried to kill him; he discovers that this assassin was the model for more than 200,000 clones in production. The Empire soon takes control of the galaxy, largely due to the use of Stormtroopers, a clone army amassed over 10 years.

- Kiplinger’s Jedi tip: If you're decades from retirement, contributions to a 401(k) or other retirement plan will have years to compound and grow. Even a modest contribution now will pack a much greater wallop than a significantly larger contribution when you're in your forties and fifties.

- SEE ALSO: How to Retire Rich

If you start socking away $200 a month in a retirement account from the moment you land your first full-time job at age 22, within ten years you'll have a stash of more than 37,000 Stormtroopers... er, dollars. That assumes your investments grow 8% a year. In 20 years, you'll have more than $122,000, and by the time you reach age 67, your nest egg will be worth $1.2 million.

Getting Hitched Makes for a Bigger, Stronger Portfolio

In Episode 6: Return of the Jedi, our heroic band of rebels need help to bring down the shield protecting the Empire’s new Death Star. They find a willing group of partners in the Ewoks, who have seen the Empire take over their forest-moon home. What the Ewoks lack in size and strength, they more than make up for in numbers, courage and sheer ingenuity. As the Ewoks battle the guards, Princess Leia and Han are able to slip into the facility. Faced with more resistance from Empire Stormtroopers, a couple of Ewoks help Chewbacca take out the opposition and get the rebels a step closer to taking down the Empire.

- Kiplinger’s Jedi tip: Marriage conveys 1,138 tax breaks, benefits and protections (such as guaranteed medical leave to care a family member), according to the Human Rights Campaign. And, together, a couple has the ability to balance their overall risk profile by investing as a team. By taking a big-picture view of investments and making sure the overall asset allocation is appropriate for age and goals, a couple can balance their portfolio with different but complementary strategies.

- QUIZ: Are You Saving Enough for Retirement?

Junk Can Have Real Value

When we first meet Rey in Episode VII: The Force Awakens, we see her as a masked scavenger digging through the remains of a downed Imperial Star Destroyer. She immediately displays her bravery in sorting through the wreckage to find small items of value, which she takes to her boss, Unkar Platt, for food rations.

- Kiplinger's Jedi tip: If parts of your home resemble the wreckage of a doomed spacecraft, consider a decluttering mission that can put extra money in your pocket. Sell unwanted items via an estate sale, online auctions or on consignment -- or donate them for a tax deduction next spring.

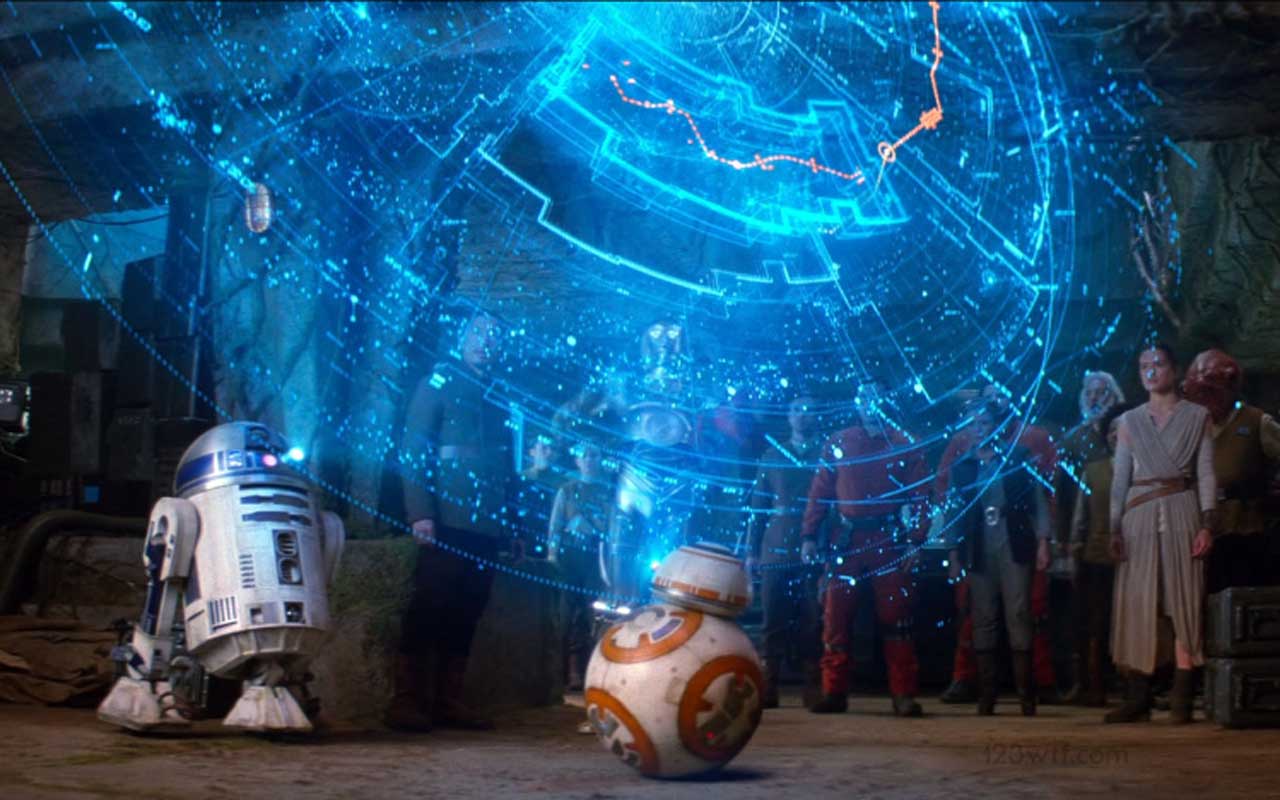

Patience Pays Off

Where is Luke Skywalker? The question is asked in the opening crawl of The Force Awakens with the answer only coming during the film's final frames. Rey's path to discover Luke only becomes clear as the pieces of a map are eventually connected throughout the movie. And even once she finds the reclusive Jedi, her own adventures with the Force are just starting to unfold.

- Kiplinger's Jedi tip: An elusive sense of financial security is your quest, and it's rarely a swift or easy journey. Different life stages require different tactics and savings vehicles. Get rich slowly by piecing together smart financial moves -- saving early, investing in your own education and insuring yourself against disaster, among other keys.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

What to Do With Your Tax Refund: 6 Ways to Bring Growth

What to Do With Your Tax Refund: 6 Ways to Bring GrowthUse your 2024 tax refund to boost short-term or long-term financial goals by putting it in one of these six places.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

15 Reasons You'll Regret an RV in Retirement

15 Reasons You'll Regret an RV in RetirementMaking Your Money Last Here's why you might regret an RV in retirement. RV-savvy retirees talk about the downsides of spending retirement in a motorhome, travel trailer, fifth wheel, or other recreational vehicle.

-

The Six Best Places to Retire in New England

The Six Best Places to Retire in New Englandplaces to live Thinking about a move to New England for retirement? Here are the best places to land for quality of life, affordability and other criteria.

-

The 10 Cheapest Countries to Visit

The 10 Cheapest Countries to VisitWe find the 10 cheapest countries to visit around the world. Forget inflation and set your sights on your next vacation.

-

15 Ways to Prepare Your Home for Winter

15 Ways to Prepare Your Home for Winterhome There are many ways to prepare your home for winter, which will help keep you safe and warm and save on housing and utility costs.

-

Six Steps to Get Lower Car Insurance Rates

Six Steps to Get Lower Car Insurance Ratesinsurance Shopping around for auto insurance may not be your idea of fun, but comparing prices for a new policy every few years — or even more often — can pay off big.

-

How to Increase Credit Scores — Fast

How to Increase Credit Scores — FastHow to increase credit scores quickly, starting with paying down your credit card debt.