8 Things That Will Cost Less in 2014

Life may be unfair, even unkind at times.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Life may be unfair, even unkind at times. But some things are trending in consumers’ favor as 2014 gets underway. Here are eight products that will likely drop in price in 2014, thanks to the law of supply and demand, rapid innovation, changing markets or a bit of all of the above. Take a look:

Gasoline

Expect calmer energy markets in 2014 as U.S. domestic production continues to rise and tensions in Middle East hot spots simmer down. One of energy’s brightest spots will be at the gas pump, where regular unleaded gasoline will cost motorists an average of $3.40 a gallon in 2014, versus $3.50 in 2013, The Kiplinger Letter forecasts. For diesel, expect a slight drop from 2013’s $3.92-per-gallon average to $3.90.

Used Cars

After surging because of tight supply in recent years, values of used vehicles are softening as sales of new cars ramp up and more leased autos hit used-car lots.

For the “previously owned” market, Kiplinger expects price drops in the 1% to 2% range in 2014. The models that will see the biggest depreciation this year: used compact SUVs and low-end luxury cars. Supplies of both are rising fast. Ditto for used hybrids. The reason: Better fuel economy in gas models makes hybrids less enticing. Sweeter deals will be found on used commercial vans as more new models hit the market.

Gold

An improving economy and surging stock market ended a 12-year run of rising prices for the precious metal last year. The price dropped almost 30% in 2013, to $1,200 an ounce. Most analysts expect the slide to continue this year. On January 9, Bank of America Merrill Lynch forecast that prices will drop at least another $50 (4%), to $1,150, by the end of 2014, and they could drop as low as $1,000 an ounce as investors continue to reduce their exposure. Silver prices are in the same boat: BofA Merrill Lynch sees silver prices dropping to about $18 an ounce, down from a $22 to $24 range in 2013.

Chicken Legs and Thighs

Time to break out that recipe for coq au vin or beer-marinated smoked chicken leg quarters. While beef will remain pricey this year, dark chicken meat—legs and thighs—will drop in price. Supply is outpacing demand. U.S. packers usually export about 40% of leg quarters, but world demand slipped last summer and fall, sending late-2013 supplies of frozen leg quarters up 60% over late-2012 supplies, according to The Kiplinger Agriculture Letter. You can expect grocers to feature bags of chicken leg quarters for as low as 60 cents a pound through midyear at least, versus the typical range of 70 cents to $1 a pound.

Ultra-High-Definition Computer Monitors

Getting crystal-clear images on your desktop machine will be far more affordable this year. Everything from photos to games to Web sites looks amazing on ultra-high-definition computer monitors, dubbed 4K because they pack four times the resolution of standard HD screens. If you dabble in DSLR photography, the new monitors show intricate details and subtle shades of color never before seen on a computer screen. This month, Dell rolls out its new 28-inch ultra-HD monitor for $699, a steep price cut from more than $1,000 in 2013.

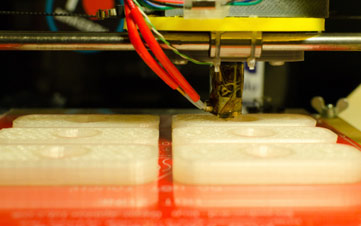

3D Printers

MakerBot, which has sold 3D printers to consumers since 2009, will start shipping its brand-new Replicator Mini 3D printer this spring. It’s priced at $1,375, which is 40% less than the company’s current cheapest printer, the bigger Replicator 2X. The smaller size comes with limitations, such as printing smaller objects, but a lower price tag makes it easier to bring home. Plus, you can save once it’s out of the box. One industry study says a 3D printer could save an average household $300 to $2,000 per year compared with buying the same products online. Potential printed creations include an iPhone case, a jewelry organizer, a garlic press, a shower head, a safety razor and a paper-towel holder. More price cuts for 3D printers are on the way; some models will sell for as little as $500. Software will be simpler, too, so you can scan an object and print it on the spot.

College Tuition

Each fall, college prices rise. And each fall, families fret over financing a heftier tuition bill. But 2014 will be different at a handful of schools, with at least ten institutions cutting undergraduate tuition by 10% to nearly 50%.

For example, Alaska Pacific University, in Anchorage, will cut tuition from $29,600 to $19,950, and Converse College, in Spartanburg, S.C., will lower tuition from $29,124 to $16,500. For most enrollees, the financial benefit is minimal. The lower sticker prices match what many students are already paying after aid. One group that could benefit from the change is families that don’t meet the definition of financial need and expect to pay full freight. A few law schools will also be cheaper in 2014, including the University of Iowa and Penn State University.

See Also: Some Colleges Move to Slash Tuition

Insurance

This one’s up to you, dear reader. Most life, disability and long-term-care insurance companies will reduce their rates if you become less risky to them—but only if you ask and usually only if you show proof of a long-term change. Lost weight in 2013? Most insurers will reduce your premiums once you keep the weight off for a full year. Some insurers give you a break if you stop smoking for at least one year.

See Also: Cut Your Risk, Cut Your Insurance Rates

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

I Need to Cut $1,000 From My Monthly Budget, and I've Already Given Up Starbucks and Dining Out. What Else Can I Do?

I Need to Cut $1,000 From My Monthly Budget, and I've Already Given Up Starbucks and Dining Out. What Else Can I Do?Here are some creative ways to save up to $1,000 a month, even if you feel like you've already made all of the obvious cuts.

-

I'm a Government Employee and Need to Get By Until the Shutdown Ends. What Can I Do?

I'm a Government Employee and Need to Get By Until the Shutdown Ends. What Can I Do?The second-longest shutdown in history is leaving many federal workers with bills due and no paycheck to cover them. Here's what you can do to get by.

-

What to Do With Your Tax Refund: 6 Ways to Bring Growth

What to Do With Your Tax Refund: 6 Ways to Bring GrowthUse your 2024 tax refund to boost short-term or long-term financial goals by putting it in one of these six places.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

15 Reasons You'll Regret an RV in Retirement

15 Reasons You'll Regret an RV in RetirementMaking Your Money Last Here's why you might regret an RV in retirement. RV-savvy retirees talk about the downsides of spending retirement in a motorhome, travel trailer, fifth wheel, or other recreational vehicle.

-

The Six Best Places to Retire in New England

The Six Best Places to Retire in New Englandplaces to live Thinking about a move to New England for retirement? Here are the best places to land for quality of life, affordability and other criteria.

-

The 10 Cheapest Countries to Visit

The 10 Cheapest Countries to VisitWe find the 10 cheapest countries to visit around the world. Forget inflation and set your sights on your next vacation.

-

15 Ways to Prepare Your Home for Winter

15 Ways to Prepare Your Home for Winterhome There are many ways to prepare your home for winter, which will help keep you safe and warm and save on housing and utility costs.