Animal Crossing: 9 Personal-Finance Lessons From Nintendo's Hit Game

The video game Animal Crossing: New Horizons has become a sensation in short order.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The video game Animal Crossing: New Horizons has become a sensation in short order. Released on March 20 for the Nintendo Switch console, ACNH allows players to explore a small island and make it their own. That includes seemingly mundane tasks like pulling weeds, catching bugs or chopping wood.

You might think a video game about chores sounds weird. And … well, it is. However, the ability to explore a virtual island has been a healthy escape for millions amid the coronavirus pandemic. Shut-in gamers eager for the latest entry in this already popular series racked up 5 million digital downloads of the title in March alone – a record for the most digital copies sold in a single month.

Besides, chores are just a means to an end. The real appeal isn't spending 20 minutes catching a dozen sea bass. It's selling those fish for bells – a currency you can use to customize the island and its appearance. You can build bridges, add rooms to your house and even design your own clothes. The sky is the limit, as long as you have the bells to fund your creative vision.

That means it's important to practice good financial discipline if you want to build your best life.

And believe it or not, the personal finance lessons learned in Animal Crossing: New Horizons translate pretty well to how you can practice good behaviors in the real world. Read on as we look at nine solid pieces of financial and investing advice you can reap from this blockbuster title.

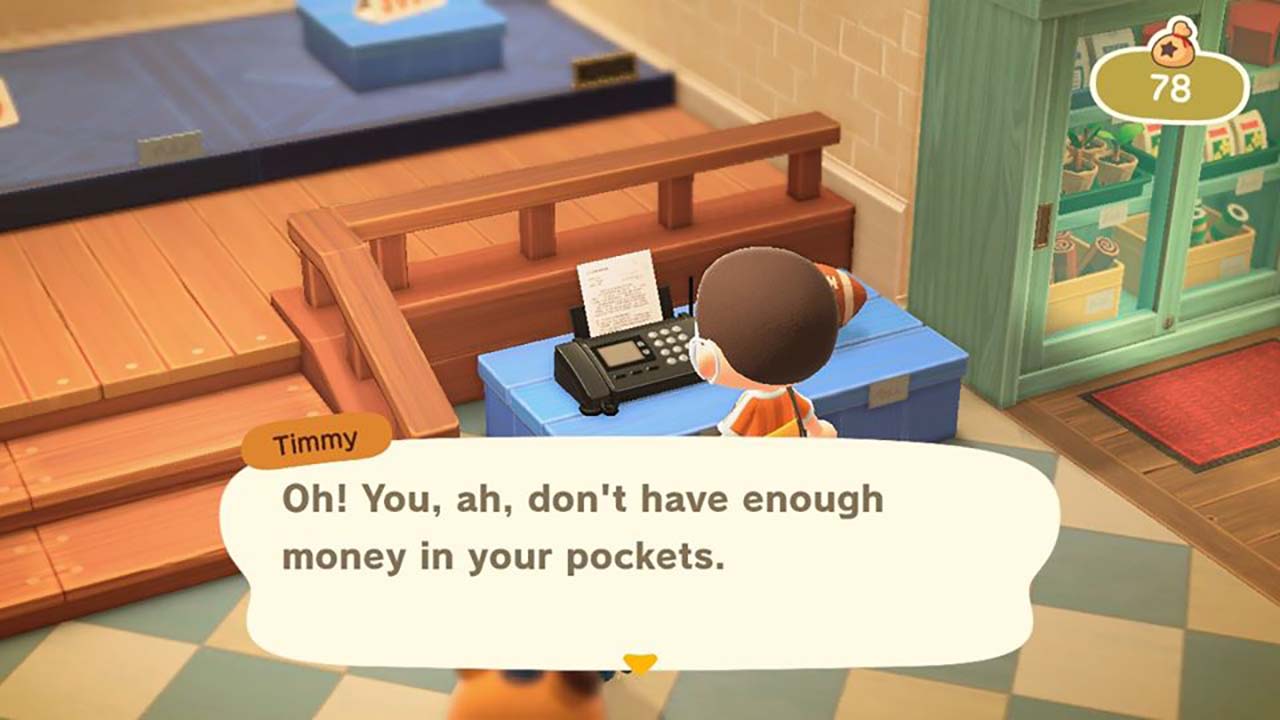

1. Build a Budget

You can have plenty of fun in games like Animal Crossing: New Horizons by just running around buying whatever you feel like at that moment.

Plenty of real-world consumers do the same thing.

Unfortunately, if you're spending your bells down to zero all the time in Animal Crossing, it'll take forever to obtain pricey furnishings like the 76,000-bell deluxe washer. And forget about ever being able to finish that fancy zen bridge that costs 228,000 bells.

The same holds true in real life, where the purchase of a car or new appliance typically demands budgeting and planning. You can start by using our budget worksheet to create a plan that includes dedicated savings for long-term expenses.

2. Exercise Self-Control

A budget is a plan. Self-control is how you stick to that plan.

You're saving up for a new house, but then you stop by a local store and see a slick electric bass guitar for sale. Do you spend the 82,000 bells and run home to rock out to "Walk on the Wild Side," or do you stick to the long-term plan and budget you've created?

Deep down, you know what the responsible answer is. Impulse purchases, particularly ones with big price tags, can derail your financial plan in a hurry. Staying disciplined is not always easy, but it's the only way to achieve ambitious long-term goals such as retirement, buying a house or saving for a child's education.

This is not to say you have to forgo all the fun stuff. But if you have budgeted only a small amount for discretionary expenses, you need to stick to that amount, lest the bigger items remain out of reach.

3. Know the Cost of Convenience

Many of us know it's cheaper to make our own cup of coffee at home or drive to the hardware store and pick out bags of mulch instead of having them delivered to our doorstep. We simply want the convenience of not being hassled by these tasks, and we are happy to find service providers who can do these jobs for us – in exchange for a modest sum, of course.

But knowing what's worth your time and what's not is a crucial part of achieving financial success.

For instance, in Animal Crossing: New Horizons, you can sell all of your bugs and fish at the local shop. However, if you're playing after the shop is closed, you have two options. You can go back home and stash everything away, then pick it all up again and sell it the next day; this takes some time. Or you can quickly sell your goods via the shop's overnight drop box ... for a 20% fee. That fee might not matter when you sell a bunch of crickets for a measly 130 bells a pop, but you might want to sit on that rare golden stag beetle rather than suffer a 2,400-bell convenience charge.

Every convenience has a cost – one that you should always calculate before making a transaction. A cup of coffee might only cost a dollar or two more than home-brewed java. But other items can really add up, and thus might be worth doing yourself or doing differently as a result.

4. Know the Value of Your Labor

In Animal Crossing as in life, raw materials aren't worth as much as fancy finished goods. For instance, the fruit that your island produces sells for only 100 bells per piece. But if you turn 20 apples into apple-themed wallpaper, it's worth 4,000 bells – double the value of that fruit alone!

Few people can make a couch or a chair in real life. But you certainly can do your own painting or wallpapering, and the crafty ones among us can even sew curtains or create decorations.

You can save a lot of money doing a few of these things yourself instead of purchasing finished products. And just like in ACNH, you can turn your handmade goods into a decent side hustle if you find buyers who are willing to pay for them!

5. Declutter Your Life

Spend a few minutes browsing the internet, and you'll find no shortage of pictures that show well-appointed homes and pristine outdoor retreats. But all of us know plenty of households (perhaps even our own) that feature messy basements, garages stuffed to the gills and filing cabinets full of documents from decades past.

That clutter isn't just bad for aesthetics; it's also bad for your pocketbook. Do you really need everything in that storage unit that you're paying rent on? Could you use an online auction site to unload that unused treadmill and make a few bucks in the process?

In Animal Crossing: New Horizons, it's admittedly much easier to pick up an old cello or barbecue grill and sell it in short order than it is in real life. But that doesn't mean you can't find ways to rid yourself of clutter to drive real-world financial benefits.

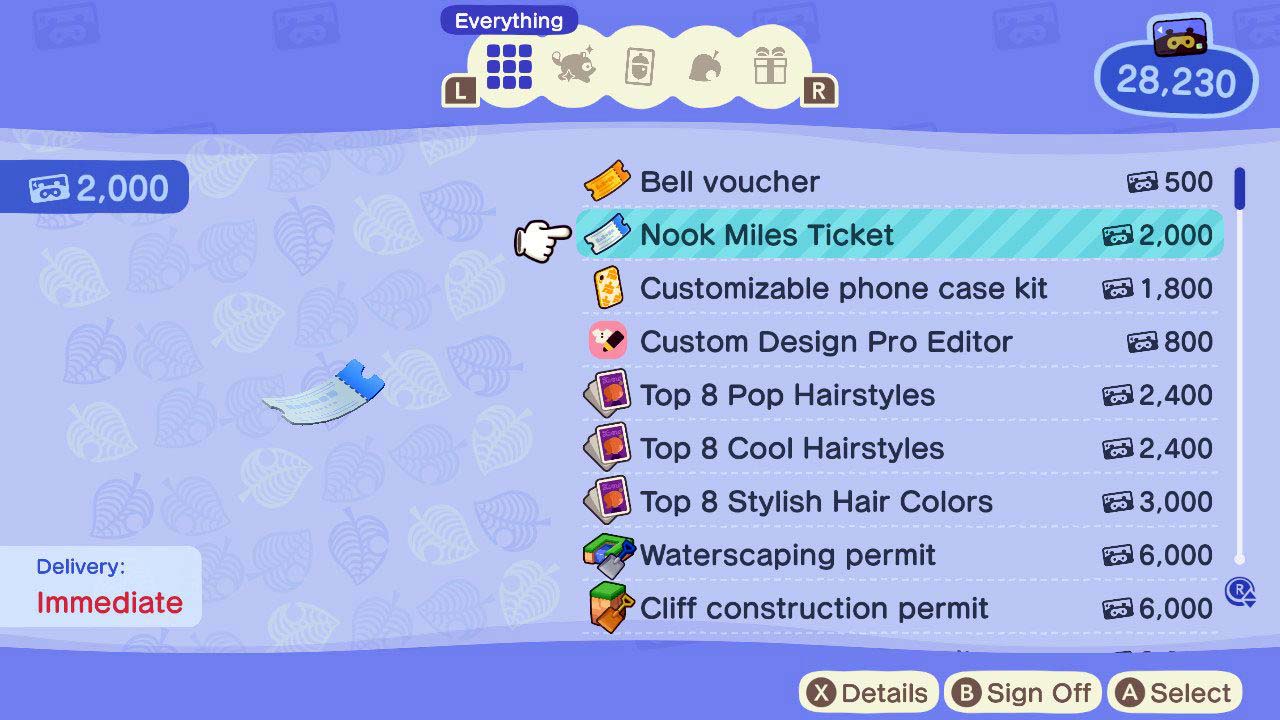

6. Leverage Coupons and Rewards to Save Cash

Another way to save a few bells in Animal Crossing is to focus on coupons and vouchers. You can perform daily tasks for "Nook Miles," which can be exchanged for furniture or clothes. You can shop with Sahara the camel, who offers something of a loyalty program in the form of tickets for each rug you purchase. You get the idea.

In real life, you have a wide variety of ways to apply this tip. There are online coupon codes, cash-back bonuses, even punch cards where you get your 10th sandwich for free at the local deli. These programs can help you access discounts or the occasional freebie, saving you a little cash.

Whether it's in this video game or in real life, smart shopping can help you reach your financial goals.

7. Speculation Is High-Risk, High-Reward

One of the most talked-about features of Animal Crossing: New Horizons is the weekly "stalk market" for turnips. Simply put, a piglet with a runny nose shows up every Sunday to sell the veggies at a fixed cost. If you're lucky, the local shopkeepers will buy them at a higher price over the next few days.

But there's no guarantee they won't offer you less than you paid. That's important to know, because the turnips don't last forever, so if prices stay low and you never sell, you can wind up with a bunch of rotten turnips and nothing to show for your purchase.

Sure, there are tales of Turnip Millionaires who buy low and sell very high. There are also stories of day traders who bet it all on a fast-moving stock and now own a private jet. But these rewards are not the norm, and they shouldn't obscure the real risk of short-term speculation with your hard-earned money.

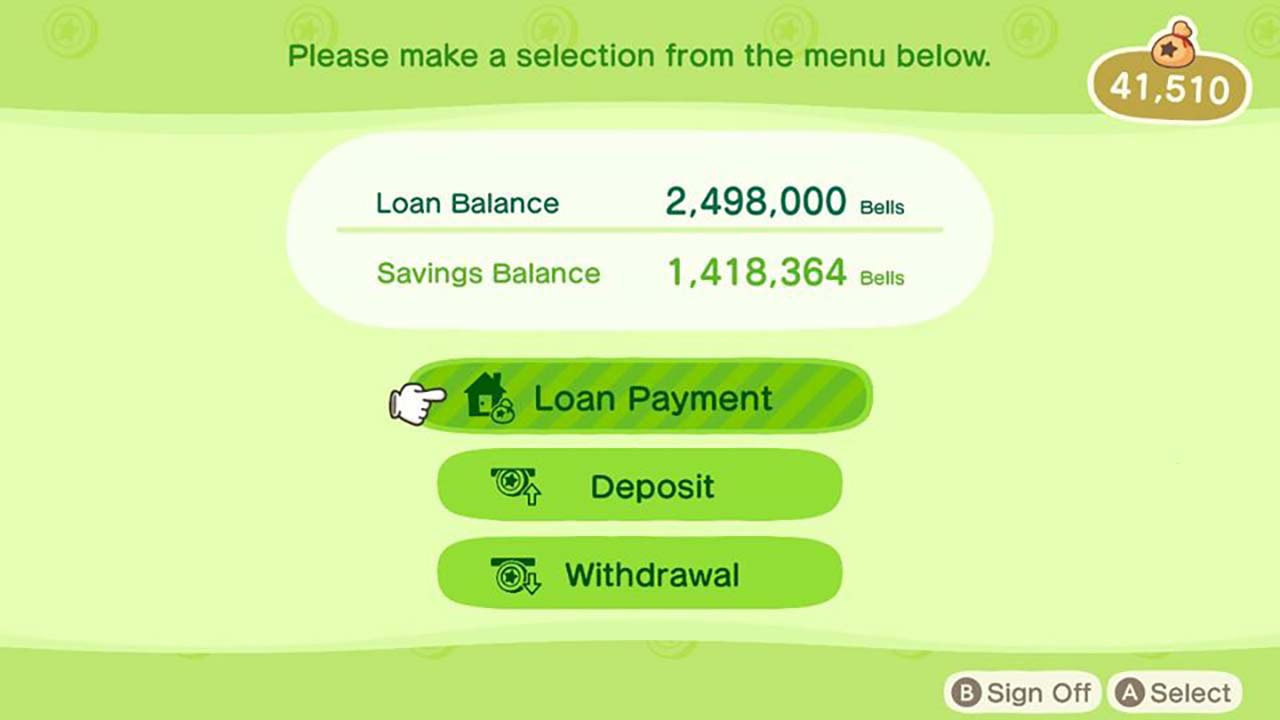

8. Low-Risk Instruments Offer More Modest but Safer Returns

An alternative approach to the stalk market is the far less lucrative method of relying on interest from your savings at the bank. In Animal Crossing, as in real life, this return is pretty darn low: a mere 0.05%, or 5 bells on 10,000 saved, after the Bank of Nook lowered rates from a much healthier 0.5% in April.

However, the interest on savings is a sure thing each month, as opposed to the volatility and uncertainty of turnips. And those hard-working gamers with millions of bells in the bank enjoy a decent payday.

Investing always involves some self-reflection on your long-term financial goals, your budget and how much risk you're willing to take. While some might view bank interest as too small to matter, others might be happy to miss out on the high ceilings of riskier methods if it means they can be more certain about their finances.

9. Money Can’t Buy Friendship!

It's natural to want to have nice things, and many of us take great satisfaction in showing off our fancy clothes or beautiful homes. But it's important to remember that money can't buy everything in life.

In Animal Crossing: New Horizons, as you build friendships with the other island residents, you can give them gifts such as flowers you just picked, decorations you crafted by hand and other items that might not seem to be worth much. You'll also find that if you give gifts, folks will sometimes reciprocate in kind – or if you're really lucky, they just pay you in bells above what you'd get by selling the item directly at the store!

But ultimately, your friends simply enjoy the camaraderie; talking to them and showing you care will keep them happy and content to remain on your island.

This is a subtle but important lesson. In the words of the immortal K.K. Slider, "Rambling this crazy world is squaresville without some pals."

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jeff Reeves writes about equity markets and exchange-traded funds for Kiplinger. A veteran journalist with extensive capital markets experience, Jeff has written about Wall Street and investing since 2008. His work has appeared in numerous respected finance outlets, including CNBC, the Fox Business Network, the Wall Street Journal digital network, USA Today and CNN Money.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Money for Your Kids? Three Ways Trump's ‘Big Beautiful Bill’ Impacts Your Child's Finances

Money for Your Kids? Three Ways Trump's ‘Big Beautiful Bill’ Impacts Your Child's FinancesTax Tips The Trump tax bill could help your child with future education and homebuying costs. Here’s how.

-

Key 2025 Tax Changes for Parents in Trump's Megabill

Key 2025 Tax Changes for Parents in Trump's MegabillTax Changes Are you a parent? The so-called ‘One Big Beautiful Bill’ (OBBB) impacts several key tax incentives that can affect your family this year and beyond.

-

What to Do With Your Tax Refund: 6 Ways to Bring Growth

What to Do With Your Tax Refund: 6 Ways to Bring GrowthUse your 2024 tax refund to boost short-term or long-term financial goals by putting it in one of these six places.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

15 Reasons You'll Regret an RV in Retirement

15 Reasons You'll Regret an RV in RetirementMaking Your Money Last Here's why you might regret an RV in retirement. RV-savvy retirees talk about the downsides of spending retirement in a motorhome, travel trailer, fifth wheel, or other recreational vehicle.

-

QCD Limit, Rules and How to Lower Your 2026 Taxable Income

QCD Limit, Rules and How to Lower Your 2026 Taxable IncomeTax Breaks A QCD can reduce your tax bill in retirement while meeting charitable giving goals. Here’s how.

-

The Six Best Places to Retire in New England

The Six Best Places to Retire in New Englandplaces to live Thinking about a move to New England for retirement? Here are the best places to land for quality of life, affordability and other criteria.

-

The 10 Cheapest Countries to Visit

The 10 Cheapest Countries to VisitWe find the 10 cheapest countries to visit around the world. Forget inflation and set your sights on your next vacation.