6 Millionaires Who Lost It All, but Came Back

Just because you’ve attained wealth doesn’t mean you’ll keep it.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Just because you’ve attained wealth doesn’t mean you’ll keep it. In 2011, the number of millionaire households in the U.S. dropped by nearly 2.5% (from 5,263,000 in 2010 to 5,134,000 in 2011), according to The Boston Consulting Group, a global management consulting firm.

Even the richest of the rich aren’t immune from sudden -- and complete -- plunges in net worth. The big names we’ve rounded up here, from Olympic gold medalist Dorothy Hamill to financial businessman Bill Bartmann, all filed for bankruptcy at one point, falling into the same money-draining traps that can cost us all: poor budgeting, loose spending habits, failed business ventures, even extending too much financial support to friends and family. They’ve managed to rebuild their professional and financial lives. Here’s how they did it.

EDITOR’S NOTE: A previous version of this slideshow included a slide, based on a respected news source, reporting that the musician Elton John had filed for bankruptcy in 2002. Although that claim circulates widely on the Web, we have since learned that it is false. Elton John has not filed for bankruptcy. We regret the error.

We attempted to contact all of the people mentioned for an interview; however, some declined to comment.

Bill Bartmann

Who he is: Entrepreneur, author, founder and former CEO of the debt-collection firm Commercial Financial Services (CFS)

How he lost his money: In 1998, Bartmann, a one-time billionaire, was forced to shut down CFS and file for bankruptcy. He and his business partner, Jay Jones, were charged with accounting fraud and conspiracy for allegedly inflating sales reports to ratings agencies. “We were doing so well, and then one afternoon it was all over,” Bartmann told Kiplinger. Jones was convicted; Bartmann was cleared of any wrongdoing.

How he came back: Wrote books about his lessons learned.

After his acquittal in 2003, he slowly started to piece his life back together. In 2005, he wrote his first book, “Billionaire Secrets to Success.” Bartmann followed up with “Bailout Riches” in 2009, which became a bestseller on Amazon. In July 2010, he returned to the debt-collection business and launched a new version of his former company, calling it CFS II.

CFS II took in $10 million in revenue last year. When asked how his previous ordeal helped shape how he runs CFS II, Bartmann told Kiplinger, “I’d be remiss in my duties if I assumed everyone is doing a great job . . . Don’t walk away from your ability to supervise a relationship just because you like someone as a person.”

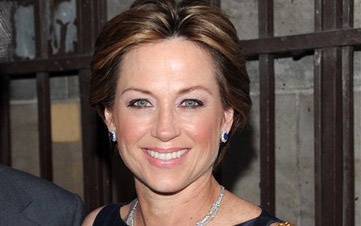

Dorothy Hamill

Who she is: Olympic gold medal figure skater and television personality

How she lost her money: At the height of her career in the 1980s, Hamill was reportedly raking in $1 million a year to skate in prime-time TV specials. However, after years of excessive spending, which included a weakness for expensive jewelry, and a series of bad investments, including the purchase of the fledgling Ice Capades franchise, Hamill had to file for bankruptcy in 1996.

How she came back: Parlayed her strong brand into related new opportunities.

Hamill toured the professional ice skating circuit for several years to help pay off her debt. She also returned to television, appearing in the 1998 NBC special “The Christmas Angel: A Story on Ice.” In October 2007, her autobiography, “A Skating Life: My Story,” hit bookstores and made the New York Times bestseller list. That same year, she appeared in “Blades of Glory,” an ice skating parody film starring comedian Will Ferrell. Recently, Hamill has found herself back in the spotlight as a contestant on season 16 of ABC’s “Dancing With the Stars.” She also continues to perform in professional ice skating shows and is currently on tour with “Stars on Ice.”

MC Hammer

Who he is: Grammy award-winning rap artist and television personality

How he lost his money: At the height of his fame in the late 1980s and early 1990s, Hammer’s net worth was valued at around $33 million. However, he was reportedly spending $500,000 a month on his 200-person staff. Other costly expenses included the mortgage on his $10 million mansion, the maintenance and upkeep on 17 luxury cars, and the acquisition and care of 21 racehorses. When Hammer eventually filed chapter 11 in 1996, he claimed $1 million in assets and $10 million in debt.

How he came back: Reinvented himself.

After his superstar status faded, Hammer became an entrepreneur. He created a handful of record labels, has dabbled in tech start-ups and is currently the CEO of Alchemist Management, a Los Angeles-based athlete management and marketing firm specializing in mixed-martial-arts fighters. Hammer, who has more than three million followers on Twitter, often lectures about social media and marketing at business schools, including Stanford University and Harvard University. In 2009, he produced his own reality TV show on A&E, called “Hammertime,” and he performed at the 2012 American Music Awards, as well as on ABC’s “New Year’s Rocking Eve 2013.”

Gary Heavin

Who he is: Co-founder of Curves International

How he lost his money: In 1976, Heavin dropped out of college at age 20 and started his first gym, Women’s World of Fitness. Success came right away, and he was a millionaire by age 25. However, Heavin’s aggressive expansion plans didn’t add up. He added amenities to the gym, such as tanning beds and swimming pools, that were expensive to maintain. “At 25, it was all about me, and that’s a foundation for disaster,” Heavin told Kiplinger. By 1986, overhead costs began to exceed the amount the company was bringing in from new memberships, and at age 30 his business went bankrupt.

How he came back: Tried again with the same business idea, applying lessons learned from his initial failure.

Marrying his future business partner, Diane, gave Heavin the motivation he needed to give entrepreneurship a second try. In 1992, the couple opened the first Curves, a women-only gym, in Harlingen, Texas. Heavin once again found immediate success. In 1995, the pair turned the business into a franchise; today, there are 10,000 Curves locations across the world. In 2000, he released his first book, “Permanent Results without Permanent Dieting: The Curves for Women Weight Loss Method,” and it became a New York Times bestseller. On finding success a second time around, Heavin says, “I had to lose everything I owned before I was capable of running a business the right way.” Today, he’s a billionaire.

Read more about Gary Heavin and how he became an entrepreneur in our slide show 5 Midlife Millionaires.

Larry King

Who he is: Emmy-winning broadcast journalist and former host of CNN’s “Larry King Live”

How he lost his money: During his early days in radio in the 1960s, King’s low-level salary didn’t support his big spending habits, including a fondness for gambling. By 1978, he had to file for bankruptcy after accumulating more than $350,000 in debt.

How he came back: Capitalized on early opportunities in an emerging industry -- cable TV.

The same year that he declared bankruptcy, King was hired by WIOD Radio in Miami to host a national nighttime talk show that eventually caught the attention of CNN founder Ted Turner. In 1985, Turner hired him to host his own television show, “Larry King Live.” King would host the cable show for 25 years, making as much as $10 million a year before signing off for good in 2010.

Wally Amos

Who he is: Entrepreneur and founder of Famous Amos cookies

How he lost his money: Amos started a cookie business after deciding to leave his cushy job as a talent manager for the William Morris Agency in New York in 1975. By the early 1980s, Famous Amos hit $12 million in sales. However, his ego and lack of business acumen eventually brought the company down.

How he came back: Despite hitting hard times, Amos’s entrepreneurial spirit never died. In 1993, he founded Uncle Noname Cookie Company (he’d lost the right to use “Famous Amos” as the result of his earlier failure), and in 1995 he changed it to Uncle Wally’s, with a focus on muffins. Last year, Amos returned to his roots with the launch of Wamos Cookies. When discussing how to become a successful entrepreneur and stay that way, he told Kiplinger, “You can’t be profitable unless you have a team that’s working as a unit. I learned that lesson from losing Famous Amos.”

Read more about Wally Amos and how he became an entrepreneur in our slide show 5 Midlife Millionaires.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Browne Taylor joined Kiplinger in 2011 and was a channel editor for Kiplinger.com covering living and family finance topics. She previously worked at the Washington Post as a Web producer in the Style section and prior to that covered the Jobs, Cars and Real Estate sections. She earned a BA in journalism from Howard University in Washington, D.C. She is Director of Member Services, at the National Association of Home Builders.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

What to Do With Your Tax Refund: 6 Ways to Bring Growth

What to Do With Your Tax Refund: 6 Ways to Bring GrowthUse your 2024 tax refund to boost short-term or long-term financial goals by putting it in one of these six places.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

15 Reasons You'll Regret an RV in Retirement

15 Reasons You'll Regret an RV in RetirementMaking Your Money Last Here's why you might regret an RV in retirement. RV-savvy retirees talk about the downsides of spending retirement in a motorhome, travel trailer, fifth wheel, or other recreational vehicle.

-

The Six Best Places to Retire in New England

The Six Best Places to Retire in New Englandplaces to live Thinking about a move to New England for retirement? Here are the best places to land for quality of life, affordability and other criteria.

-

The 10 Cheapest Countries to Visit

The 10 Cheapest Countries to VisitWe find the 10 cheapest countries to visit around the world. Forget inflation and set your sights on your next vacation.

-

15 Ways to Prepare Your Home for Winter

15 Ways to Prepare Your Home for Winterhome There are many ways to prepare your home for winter, which will help keep you safe and warm and save on housing and utility costs.

-

Six Steps to Get Lower Car Insurance Rates

Six Steps to Get Lower Car Insurance Ratesinsurance Shopping around for auto insurance may not be your idea of fun, but comparing prices for a new policy every few years — or even more often — can pay off big.

-

How to Increase Credit Scores — Fast

How to Increase Credit Scores — FastHow to increase credit scores quickly, starting with paying down your credit card debt.