Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Jewelry? A pen set? An engraved plaque? Sure, they're nice. But how about giving your grad something nice and useful?

Here are a dozen gifts that'll give grads a head start in the real world.

A SHARP NEW LOOK

Grads can make a good impression and land that job if you help them dress for success. A suit is staple interview attire, so take your grad shopping for a good-quality one that fits well. For women, get a suit that includes a skirt and a pair of pants (for guys, just stick to the pants). Keep to dark or neutral colors. See Dress for Success for Less to learn more.

On a modest budget, give a quality tie, a pair of sensible shoes or a crisp dress shirt.

JUMP START ON RETIREMENT

If your grad will have earned income from a job this year, he'll probably be eligible to save money in a tax-sheltered Roth IRA for retirement. However, with all the new demands on his finances, this is probably furthest from his mind. You can seed his account yourself, though, up to $5,000 in 2008.

A Roth can also double as savings for his first home. See Why You Need a Roth IRA to learn more.

STUDENT LOAN RELIEF

The cost of a higher education keeps going up, and the average college grad enters the world with about $19,000 in student loans. You can ease the burden by giving the gift of his first loan payment. The standard monthly payment on a ten-year repayment plan at 6.8% interest will be $218.

And a bonus gift: Your grad can write off student loan interest paid by someone else on his own federal tax return.

A FINANCIAL EDUCATION

Unless your grad majored in business or finance, odds are she didn't take a single course in money management. Give a good book that'll capture her interest and teach the basics, such as Life After School Explained by Cap & Compass ($14), Get a Financial Life by Beth Kobliner ($15) or The Wealthy Barber by David Chilton ($14).

And help your grad continue her financial education with a year's subscription to Kiplinger's Personal Finance magazine ($12).

HEALTH & WEALTH

Trading in an active college life for a sedentary desk job can take its toll. Every year after age 25, the average American gains one pound of body weight yet loses about one-half pound of muscle.

Plus, studies show that the healthier you are, the wealthier you'll become (see Want to Get Rich? Get in Shape). So help your grad build his wealth and battle the bulge before it has a chance to sneak in. A set of hand weights ($10-$30), a pair of good running shoes ($70-$100) or a membership to the gym or local YMCA make great gifts for new grads.

ENTERTAINMENT OR TRAVEL

Want to give something fun? A pair of season tickets to a beloved sports team, an annual pass to a local museum or theater or a Netflix subscription all make great gifts.

Now also is an ideal time for your grad to explore the world before he's saddled down with job and family responsibilities. An all-expenses-paid getaway can be just the ticket if your budget can swing it.

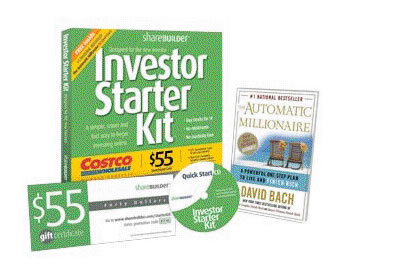

INVESTOR STARTER KIT

Want to get your grad excited about investing? Give her some seed money -- and the tools -- to be successful. Online broker ShareBuilder has an investor starter kit that makes a great gift.

We found the $20 package at Costco.com, and it includes a $55 stock gift certificate, a copy of the book The Automatic Millionaire by David Bach and a CD-ROM that explains how to invest online.

LAPTOP

Whether your grad is going to graduate school or starting his first job, a new laptop is a welcome gift.

The experts at CNET.com recommend shopping for a laptop with an AMD Turion 64 or Intel Core Duo processor, at least 1 GB of RAM (but 2GB is even better), an 80 GB hard drive (more if your grad will store a lot of pictures and MP3 files on the computer) and a DVD burner.

FURNITURE

A big mistake a lot of young adults make is spending too much to furnish their first place and racking up huge credit card bills. You can help by buying one key piece -- and suggesting they fill in the rest as they can afford it. A comfortable sofa, a dining table and chairs or a good mattress are sensible choices. (See How to Outfit Well-Dressed Digs for tips.)

For the modest gift budget, consider a grown-up set of sheets or a comforter to replace the Simpons set he used at college. Or a new matching set of plates, cups or utensils.

CASH

You can't go wrong with a gift of money. If you want to give money to go toward something specific, say so. "I know you need money for your move," or "this is to help you furnish your new apartment."

If you want to give money for a long-term goal –- say, a down payment on a house -- consider giving it in a bank certificate of deposit. That way, your grad can't touch it until the CD's term expires without paying a penalty.

NEXT: Get more advice for young adults just starting out in life

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

21 Last-Minute Gifts for Grandparents Day 2025 to Give Right Now

21 Last-Minute Gifts for Grandparents Day 2025 to Give Right NowHoliday Tips Last-minute gifting is never easy. But here are some ideas to celebrate Grandparents Day.

-

Texas Sales Tax-Free Weekend 2025

Texas Sales Tax-Free Weekend 2025Tax Holiday Here's what you needed to know about the Texas sales tax holiday.

-

Alabama Tax-Free Weekend 2025

Alabama Tax-Free Weekend 2025Tax Holiday Here’s everything you need to know about the 2025 back-to-school Alabama sales tax holiday.

-

What to Do With Your Tax Refund: 6 Ways to Bring Growth

What to Do With Your Tax Refund: 6 Ways to Bring GrowthUse your 2024 tax refund to boost short-term or long-term financial goals by putting it in one of these six places.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

15 Reasons You'll Regret an RV in Retirement

15 Reasons You'll Regret an RV in RetirementMaking Your Money Last Here's why you might regret an RV in retirement. RV-savvy retirees talk about the downsides of spending retirement in a motorhome, travel trailer, fifth wheel, or other recreational vehicle.

-

The Sweet 23: States Where Twix and Kit Kat Avoid the ‘Candy Tax’

The Sweet 23: States Where Twix and Kit Kat Avoid the ‘Candy Tax’State Taxes There’s something spooky this Halloween, and it’s not just the ghouls. Find out if your state’s sales tax takes a bite out of sweet savings.

-

Florida Back-to-School Tax-Free Holiday 2025

Florida Back-to-School Tax-Free Holiday 2025Sales Taxes The new tax-free holiday in Florida brought month-long savings on computers, clothing and other school supplies.