Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Apple (AAPL, $207.74) hit all-time highs last fall as investors held their collective breath to see whether the iPhone XS and iPhone XR would kickstart stalled iPhone sales.

They didn’t.

Smartphone sales are in decline globally, and Apple is far from immune. On Nov. 1, the company took the step of announcing it would no longer report unit sales of iPhones. Several experts believed it was because iPhone sales were flat or in decline, prompting a decline in Apple stock.

Something’s changing, and it’s not good news for the first American company to hit $1 trillion in market value. In January, Apple reported its first holiday-quarter revenue decline since 2001 on the back of a 15% year-over-year iPhone revenue slide. Sales dipped again in Q2. The company is discounting iPhones in an attempt to boost sales. Adding to investor unease, at the end of June, long-time design chief (and Steve Jobs collaborator) Jony Ive announced he was leaving Apple.

The “next iPhone” used to be a reference to other companies with products that had the potential to change the face of technology and send shares soaring to the moon. But now, Apple is in search of its own “next iPhone” to deal with the very real slump in its transformative smartphone.

So, what is Apple’s next iPhone – or does such a thing even exist? We’ll look at current Apple products, as well as other future launches that have a chance of powering AAPL stock over the next decade, to determine whether any of them have the potential to replicate the juggernaut smartphone’s success.

Data is as of July 28.

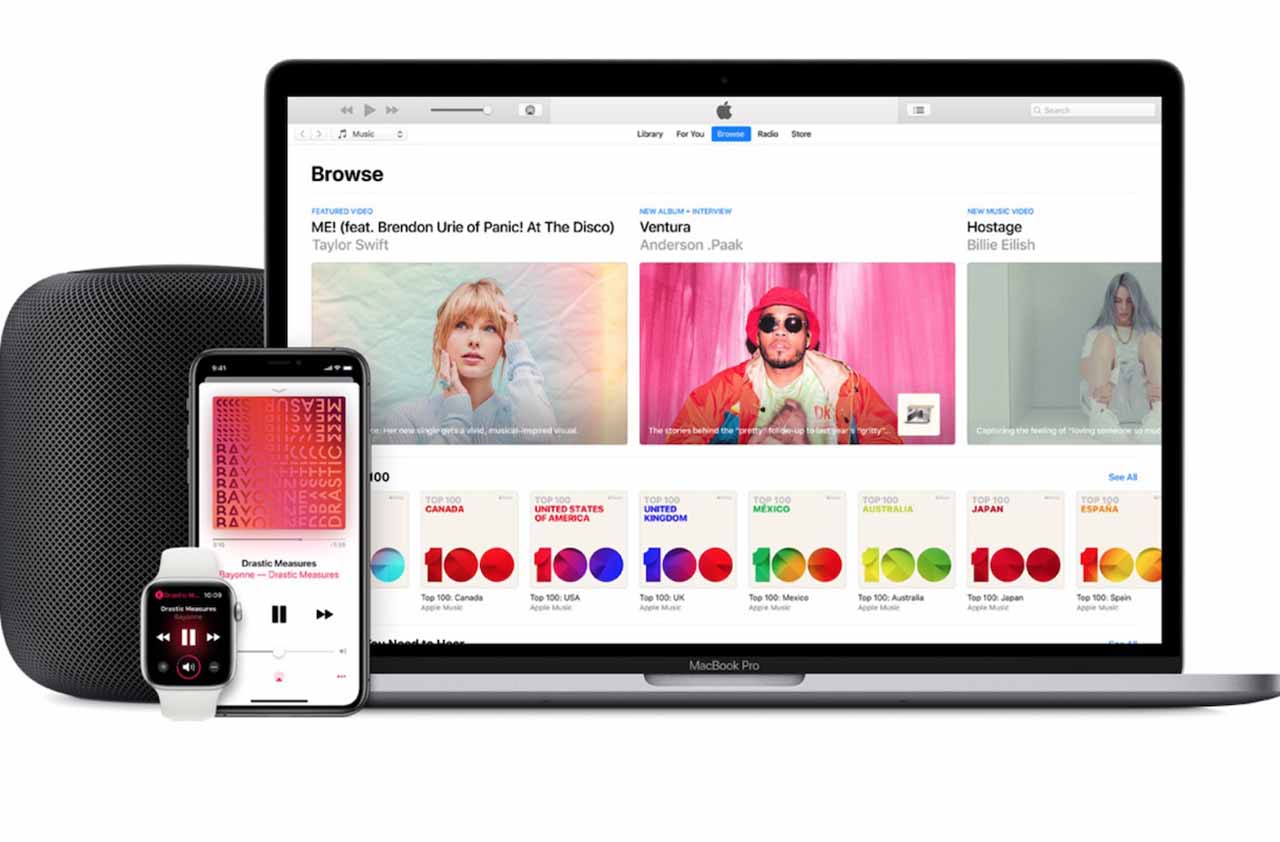

Services

Apple has a huge number of active installed devices that totaled 1.4 billion at last count. That gives the company a tremendous opportunity to sell its customers on the various offerings in its Services division. These include Apple Music memberships, Apple Pay and iTunes move rentals, as well as new offerings announced earlier this year: the Apple Card, Apple TV+, Apple News+ and Apple Arcade.

Services revenue hit a new quarterly high of $11.5 billion in Q2 (up from $9.85 billion the previous year), showing the company’s efforts are paying off. That’s still miles away from peak iPhone revenue ($61.6 billion in Q1 2018). But there are two upshots:

- It’s growing fast.

- Much of that revenue is subscription-based and thus recurring, making it easier to predict than hardware sales, which can ebb and flow with release cycles. Services revenue also offers high margins once any required infrastructure is built out.

Trip Miller, founding and managing partner of investment advisory Gullane Capital Partners, is bullish on Apple’s Services division. Miller is telling his clients that for the next three years, “Apple’s Services segment (will be) the company’s biggest growth opportunity.”

But there are looming risks that signal Services might not ever catch up to what iPhone sales are today. For one, the Supreme Court in May allowed a lawsuit to go forward that accuses Apple, which takes a 30% cut of all app sales, of using a monopoly-like situation in applications to overcharge consumers. Also, Goldman Sachs analyst Rod Hall cautioned that App Store expansion had “slowed markedly” in May and June, weighing on the narrative that Services will continue growing like a weed.

Apple Watch

When the Apple Watch was first released in 2015, some experts pegged it as a real contender to be the next iPhone. And that was when iPhone sales still were growing at a rapid clip. Analysts’ guesses for first-year sales mostly ranged between 8 million and 41 million units, though one predicted Apple could sell 50 million units – if it could churn out enough supply to meet demand.

Reality was a little disappointing. Apple sold an estimated 12 million units in 2015 – though that is better than the 3.7 million iPhones sold in the smartphone’s first year of availability.

The company has steadily improved on the original, while pivoting to make fitness and health the primary focus of the Apple Watch. That move — which saw the device gain an electrocardiography function and fall detection last year — helped Apple to move an estimated 22.5 million units in 2018. However, even with declining sales, Apple sold an estimated 209 million iPhones last year – at a sale price more than double the Apple Watch.

There’s plenty of potential, sure. In a January interview, Apple CEO Tim Cook said health technology will turn out to be the company’s “greatest contribution to mankind.” And it’s possible that the Apple Watch could lead that charge. Apple has long been rumored to be working on additional health capabilities for its smartwatch, including blood sugar monitoring. The market for blood sugar monitors for diabetics is expected to grow from $21.9 billion last year to $38.5 billion in 2026. The global market for wearable medical monitoring devices that track metrics such as heart rate is growing, too, from $22.6 billion in 2017 to an estimated $37.2 billion by 2025.

The real prize may be health insurance companies. Apple and Fitbit (FIT) are both actively courting this market and making headway. For insurance companies, giving a free smartwatch to customers could pay off by encouraging them to be more active, and providing proactive alerts to potential health issues (which are much less costly to address than a full-blown health crisis) — an advantage that becomes more important with an increasingly aging population.

Project Titan

The global smartphone market was worth an estimated $522 billion in 2018. Impressive as it sounds, that revenue is dwarfed by the automotive industry. And the auto industry is ripe for technological disruption — as companies such as Tesla Motors (TSLA) are doing through advances like electric cars and autonomous capabilities. UBS estimates the global market for self-driving taxis alone could be worth $2 trillion by 2030.

It’s one of Silicon Valley’s most poorly kept secrets that Apple is interested in leveraging its tech know-how and name recognition to grab a piece of that automotive market. “Project Titan” is the code name of the Apple car project that is estimated to currently involve 5,000 staff, including prominent hires from Tesla.

Apple self-driving cars are on the roads in California, but at this point it’s unclear whether the company is working on an electric car, an autonomous car or technology that can be licensed to traditional car manufacturers. Analyst Ming-Chi Kuo, for instance, says he thinks Apple is indeed working on a physical car – one that could go live between 2023 and 2025.

However, Gullane Capital Partners’ Trip Miller is skeptical that Apple will ever produce an actual vehicle, seeing it far more likely that Apple is working on an “operating system for automotive companies.” He sees any payoff for Project Titan being a long way out, and not a revenue driver for Apple for at least 36 months But even if Apple isn’t planning to release its own automobile, licensing software and/or technology to the other automakers still could turn into big business.

The potential here is sky-high … but the amount of concrete information is discouragingly low.

Augmented Reality Glasses

In some ways, augmented reality (AR) resembles the smartphone market when Apple came out of nowhere and disrupted it with the iPhone. There are established players, with Alphabet’s (GOOGL) Google and Microsoft (MSFT) both trying to crack the AR market for the past several years. Google Glass AR eyeglasses became an expensive tech status symbol before quickly becoming the object of public ridicule and generating a new term of derision for those who paid $1,500 for a pair.

Discontinued in 2015, Google Glass recently came back as an enterprise edition aimed at business. Microsoft has stuck to business applications for its HoloLens AR headset.

Today, augmented reality is primarily consumer-focused and accessed via smartphones, but it’s proven to be popular — despite limitations in the technology. Games such as Pokemon Go demonstrated the potential early on. Retailers including Ikea have adopted AR in their mobile apps to help consumers visualize how products will look in their homes.

Apple has been laying the groundwork for a charge at consumer-level AR via its ARKit framework for software developers. There have been credible rumors for several years that the company is working on AR glasses and had assembled a sizeable team for the project. Apple even made several attempts to buy AR startup Leap Motion.

If Apple was to make a breakthrough and release the consumer AR glasses that are a revolutionary smash hit where Google Glass face-planted, what is the potential upside? A recent report pegged the global AR market as being worth $85 billion by 2025 (up from $4.2 billion in 2017).

That’s lucrative, but most demand is currently being driven by enterprise, medical and industrial applications. Unless Apple stimulates consumer demand – turning AR glasses into the next must-have device – the prospect of hitting iPhone levels of revenue seem slim. Slimmer still, if a July rumor from Digitimes proves true. The publication claims Apple has either walked away from its AR project or delayed it while it waits for technology to catch up to its ambitions.

Either way, it seems unlikely that Apple AR glasses will be the next iPhone, and certainly not anytime soon.

A Folding iPhone

What if the “next iPhone” is … another iPhone?

Folding smartphones – essentially a hybrid between a smartphone and a small tablet – have made headlines over the past year. At first it was simply the futuristic cool factor, then it was the jaw-dropping prices that manufacturers were charging. Then it was the embarrassing delayed launch of Samsung’s Galaxy Fold, after multiple review units failed.

But the folding smartphone might still be different, useful and desirable enough that the new form factor could kick off the massive wave of upgrades that has eluded premium smartphone makers for the past several years. (Think of how smartphones left flip phones and feature phones in the dust once consumers got hooked.) With Huawei and Samsung charging $1,980 and $2,600, respectively, for their new folding flagships, the potential is there for a big revenue leap as well – if the devices catch on.

Apple has been absent from the nascent folding smartphone market to date, but it has filed folding smartphone patents of its own. If Apple followed its iPhone playbook and released a killer version of a folding phone that significantly improved on the designs pioneered by early releases such as the Samsung Galaxy Fold and Huawei Mate X, it theoretically could kickstart a new iPhone cycle.

Maybe There Is No Single iPhone Replacement

As you can see so far, there’s an uphill climb for even the most successful Apple division or most promising future product to replace the iPhone as the device that carries Apple on its back.

But maybe Apple doesn’t need a “next iPhone.”

The plateauing of the actual iPhone is forcing Apple to address a weakness that most anyone outside the analyst community didn’t care much about while iPhone sales were going ga-ga: Apple is/was too reliant on a single product.

Over the past few years, however, Apple has put more of its focus into improving its current products, widening its services and developing new technologies. Apple now has a stable of offerings that, when lumped together, may eventually boost revenues and profits past where they were at peak iPhone, all while insulating the company from weakness in any one division. Indeed, while analysts expect Apple’s sales to decline more than 3% this year, they expect a rebound in 2020 to $267.5 billion – what would be an all-time high.

Services, the Apple Watch, and still-secret developments like Project Titan have the potential to make up significant chunks of that revenue. And their growth – combined with contributions from other Apple products, as well as future initiatives – can create a halo effect that keeps people buying Apple gear, software and other services.

Keep reading, then, to examine some products that certainly won’t be the next iPhone, but can help carry the load in some significant way.

AirPods

A classic example of a product that will always be dwarfed by the iPhone, but still is an important success in its own right, is the AirPod. Apple’s wireless earbuds caught everyone off guard. They were priced lower than many true wireless earbuds – a rarity for Apple. But more importantly, they looked odd and were immediately the subject of ridicule.

The ugly duckling became wildly popular regardless. Apple couldn’t keep up with demand when they were released in 2017. By December of that year, AirPods accounted for 85% of America’s wireless headphone revenues. By the end of 2018, they had captured 60% of the global market share. The, ahem, distinctive look of AirPods has become instantly recognizable – a status symbol. The earbuds’ popularity earned them a second-generation version that launched earlier this year with a price hike, to $199 a pair.

AirPods will never be the iPhone. The wireless headphone market is expected to grow to around $34 billion by 2024, so even if Apple put every other wireless-headphone provider out of business, AirPods would generate half as much in a year as iPhones did in a quarter at their peak.

But no one should sneeze at a few billion dollars of revenue a year – especially when they come from a high-quality product that builds loyalty to Apple hardware.

Mac

Apple started out as a computer company, and its Mac computers remain a popular choice among consumers and professionals.

Speaking of professionals, the company is on the verge of releasing an all-new Mac Pro for that market. It also is rumored to have a new, super-sized (and presumable super-priced) 16-inch MacBook Pro in the wings.

Unfortunately, Apple’s Mac division just doesn’t have the steam to produce the next iPhone – even if it can convince a whole lot of professionals to spend $11,000 to buy a new Mac Pro and accompanying Pro Display XDR. Worldwide PC sales at least seem to be stabilizing of late, but overall, the market has been in decline since peaking in 2011. Even with an uptick in global PC sales in Q2, Apple’s Mac sales still experienced a roughly 5% year-over-year decline.

That said, while Apple can’t look to a resurgence in its original business to make up for the iPhone’s revenue decline, Mac sales still provide a decent base. The division brought in $5.5 billion in revenue despite its difficulties.

Apple TV

Tim Cook said its Apple TV box generated more than $1 billion in revenues in 2014. Apple doesn’t explicitly break out Apple TV revenue in its reports, however, so it’s difficult to tell what that figure is today – but the safe assumption is that while today’s number is greater, it’s not considerably so.

While many companies would kill for $1 billion in annual revenue, Apple TV hardware sales are a rounding error for a company that did $266 billion in sales in 2018, and a drop in the bucket compared to the $167 billion in revenues that the iPhone delivered last year.

Despite an early lead in the streaming video space (the first Apple TV was released in 2007), Apple is dominated by multiple competitors in a market that is becoming saturated. In the U.S., Roku (ROKU) and Amazon.com’s (AMZN) Fire TV are the most popular streaming devices, now accounting for roughly 70% of the U.S. installed user base between them. And with streaming media player growth in the U.S. stalled at just 1% annual growth, there’s little chance the Apple TV is suddenly going to become a breakout product.

What the Apple TV does do for the company, is to keep it in the game and provide the best platform for its customers to access the company’s upcoming new Apple TV+ video streaming service. That’s a service, by the way, that Wedbush analyst Dan Ives said could generate between $7 billion to $10 billion annually once it’s up and running.

iPad

What about Apple’s tablet business?

After peaking in 2014 – just four years after the product’s launch – iPad sales went into a slide that lasted for 13 straight quarters.

However, the company shifted gears and went after the “prosumer” market by introducing the iPad Pro – an ultralight laptop replacement with an optional keyboard cover and stylus (a la Microsoft’s Surface Pro). It followed that up with updates to the consumer iPad, along with a significant price cut. As a result of these efforts, Apple breathed new life into iPad sales. In the most recent quarter, iPad revenues jumped 22% year-over-year to $4.9 billion.

Sure, that’s less than half the $11.5 billion in revenues that the iPad generated at its popularity peak in Q1 2014. But it smacks in the face of an overall global tablet market that remains in decline as consumers gravitate more heavily toward smartphones. But it’s an underrated turnaround story that could have more room for upside if Apple’s iPad continues to make consumers reconsider their thoughts about tablets.

HomePod

Lastly, we’ll look at a product that in theory could be a game changer, but will need a lot of work – or more likely, a big change in strategy.

The HomePod should have been a hit. The smart speaker market has been the hottest product category over the past several years, and by sitting it out while Amazon and Google fought, Apple had the opportunity to study what the competition did wrong and did right, then build something superior.

It’s the classic Apple strategy.

On top of that, Apple owns one of the best-known names in premium audio (Beats by Dre), and Apple Music is the world’s second most popular streaming music service. So when Apple announced the HomePod in 2017, all the pieces were in place for a home-run launch.

But Apple bumbled things big-time. Its smart speaker entered the market late, which would have been fine, but then it was delayed and missed its own launch date, and arrived in the doldrums after the 2017 holiday shopping season had ended. Amazon and Google had been discounting the Echo Dot and Google Home Mini smart speakers to $25 just to gobble up market share and rush their products into homes. Apple arrogantly had full faith that its disciples would rush in at $349.

A subsequent price cut to $299 has unsurprisingly failed to boost HomePod sales to a significant degree. Over the 2018 holiday shopping season, manufacturers shipped almost double the number of smart speakers (38.5 million) that they shipped the year before. But during the holiday fourth quarter, HomePod captured just 4.1% of the global market.

Is HomePod doomed? No. Smart speakers could be a lucrative opportunity if it becomes the every-household-must-have one product they’re shaping up to be. But Apple might need to rethink the way it thinks about smart speakers before Amazon and Google maintain too large of a lead to overcome.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Brad Moon is a tech industry veteran who contributes to a range of publications including Forbes, InvestorPlace and MSN Money and is an original member of the award-winning GeekDad blog. Over the past decade, he has also written about technology for Wired, Gizmodo, Shaw Media, About.com, The Winnipeg Free Press and others.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

I want to sell our beach house to retire now, but my wife wants to keep it.

I want to sell our beach house to retire now, but my wife wants to keep it.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

How to Add a Pet Trust to Your Estate Plan

How to Add a Pet Trust to Your Estate PlanAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

Dow Dives 870 Points on Overseas Affairs: Stock Market Today

Dow Dives 870 Points on Overseas Affairs: Stock Market TodayFiscal policy in the Far East and foreign policy in the near west send markets all over the world into a selling frenzy.

-

Small Caps Can Only Lead Stocks So High: Stock Market Today

Small Caps Can Only Lead Stocks So High: Stock Market TodayThe main U.S. equity indexes were down for the week, but small-cap stocks look as healthy as they ever have.